Xauusdidea

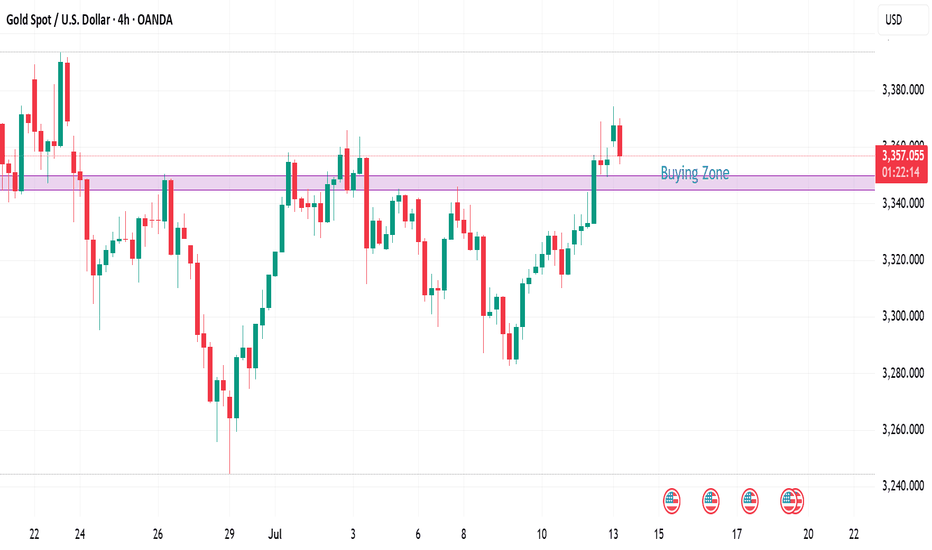

Short position profit, focus on 3355-3345 support📰 News information:

1. Focus on tomorrow's CPI data

2. Bowman's speech at the Federal Reserve

3. Tariff information outflows and countries' responses to tariff issues

📈 Technical Analysis:

The short-term bears have successfully hit the TP to realize profits, and the trading strategy is still valid. Continue to pay attention to the 3355-3345 support during the day. If effective support is obtained here, you can consider going long. For the rebound, the first TP can focus on the 3365 line. If the gold price breaks through 3380 in the future, it will not be far from 3400. If it falls below, pay attention to the support of 3330-3320 below. It is expected that this is the limit position of short-term bearishness. The impact of tariffs is still there, and the bullish trend remains optimistic in the short term, unless Europe, Japan and other countries have a new solution to tariffs.

🎯 Trading Points:

BUY 3355-3345

TP 3365-3380-3400

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

OANDA:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD TVC:GOLD FXOPEN:XAUUSD

Market Analysis: Gold Climbs Higher Amid Market OptimismMarket Analysis: Gold Climbs Higher Amid Market Optimism

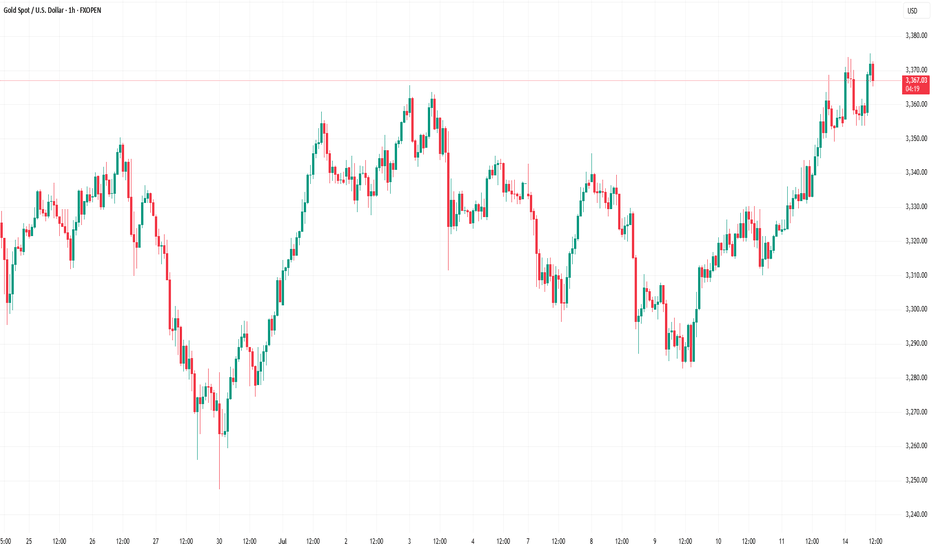

Gold price started a fresh increase above the $3,350 resistance level.

Important Takeaways for Gold Price Analysis Today

- The gold price started a fresh surge and traded above $3,330.

- A key bullish trend line is forming with support at $3,350 on the hourly chart of gold at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price formed a base near the $3,280 zone. The price started a steady increase above the $3,330 and $3,350 resistance levels.

There was a decent move above the 50-hour simple moving average and $3,360. The bulls pushed the price above the $3,365 resistance zone. A high was formed near $3,373 and the price is now consolidating.

On the downside, immediate support is near the $3,350 level and the 23.6% Fib retracement level of the upward move from the $3,282 swing low to the $3,373 high.

Besides, there is a key bullish trend line forming with support at $3,350. The next major support sits at $3,330 and the 50% Fib retracement level.

A downside break below the $3,330 support might send the price toward $3,300. Any more losses might send the price toward the $3,280 support zone.

Immediate resistance is near the $3,370 level. The next major resistance is near $3,380. An upside break above $3,380 could send Gold price toward $3,400. Any more gains may perhaps set the pace for an increase toward the $3,420 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Structure & Technical Context 14 July 20241. Price Action & Market Structure

Gold has broken recent swing highs above ~$3,360, marking a bullish Break of Structure (BOS) and signaling upward momentum continuity

Recent pullback zones around $3,350–$3,340 formed a clear Higher Low (Change of Character) — textbook price action confirmation.

2. Fibonacci Retracement / Extension

Measuring from the last swing low near ~$3,326 to swing high ~3,374:

38.2% retracement at ~$3,352 coincides with the current bounce zone.

50% retracement at ~$3,350 aligns with key structure support.

Upside extension targets: 1.272 at ~$3,396, 1.618 at ~$3,425 — overlapping major resistance zones

3. ICT & Smart Money Concepts (SMC)

Order Blocks (OBs) identified near $3,340–$3,342 (prior resistance turned support) — ideal demand zone.

A recent Buy-side liquidity grab eclipsed above $3,360, sweeping stops and gathering liquidity before the breakout — classic ICT setup .

A Fair Value Gap (imbalance) lies around $3,345–$3,350 — zone to expect value-driven retracement.

Higher timeframe has clear SMC alignment: BOS above 3,360 with CHoCH already formed.

4. Major Supply / Demand & Support / Resistance Zones

Demand: $3,340–$3,352 (OB + Fib + BOS confluence).

Supply: $3,380–$3,385 (intraday swing high resistance), followed by zone at $3,396–$3,400.

Key resistance at $3,360–$3,362 — confirmed supply pocket that needs to be reclaimed

5. Moving Average Confirmation

The 4‑hour SMA/EMA 100–200 band is sloping up just below current price (~$3,340–$3,350), reinforcing the bullish context .

1‑Hour Intraday Setups (Aligned with HTF Bullish Bias)

Setup A: Pullback into 4‑Hour OB / Fair Value Gap

Entry: Limit buy at $3,345–$3,350.

Stop: Below $3,335 (below imbalance & BOS).

TP1: $3,362 (former resistance).

TP2: $3,380 (next supply block).

Setup B: Breakout Retest of 3,360

Entry: Buy on retest of broken resistance at $3,360.

Stop: Below $3,356.

TP1: $3,380.

TP2: $3,396 (Fib extension confluence).

Setup C: Momentum Continuation Fresh Breakout

Entry: Market buy on clear H1 BOS above $3,365.

Stop: Below breakout candle low (~$3,360).

TP: $3,396 (1.272 Fib) – extend to $3,425 if momentum strong.

The Golden Setup:

Setup A—buy from $3,345–$3,350—has strong confluences:

4‑hour demand OB + fair value gap,

38.2–50% Fib retracement,

SMC BOS/imbalance alignment,

ICT-style order block zone.

This offers high edge with confluence clusters.

✔ Summary Report: Direction & Key Zones

Directional Bias:

Medium-term (4H): Bullish, confirmed by BOS above 3,360, higher lows, OB and Fibonacci alignment.

🔹 Primary Buy Zones:

$3,345–$3,350 — 4H OB + fair value gap + Fib.

$3,360 on retention — breakout retest zone.

Momentum entry >$3,365.

🔹 Key Target Zones:

First resistance: $3,360–$3,362.

Next supply: $3,380–$3,385.

Extension target: $3,396 (1.272 Fib), then $3,425 (1.618 Fib).

🔻 Watchdownside Risk:

Daily invalidation if drop below $3,335 (4H OB break).

Next support at $3,326–$3,330.

📋 Consolidated Table: Setups at a Glance

Setup Entry Zone Stop Targets

Golden $3,345–$3,350 $3,335 TP1: $3,362 / TP2: $3,380

Breakout Pullback $3,360 retest $3,356 $3,380 → $3,396

Momentum BOS >$3,365 (H1 BOS) < $3,360 $3,396 → $3,425

Final Thoughts

On the 4‑hour chart, price is firmly in a bullish regime, supported by price structure, SMC, ICT concepts, and Fibonacci confluence. The $3,345–$3,350 zone is the highest‑probability entry for buyers, offering excellent risk/reward. The Golden Setup targets ~$3,380 and beyond, combining structure, gap fill, and liquidity strategy.

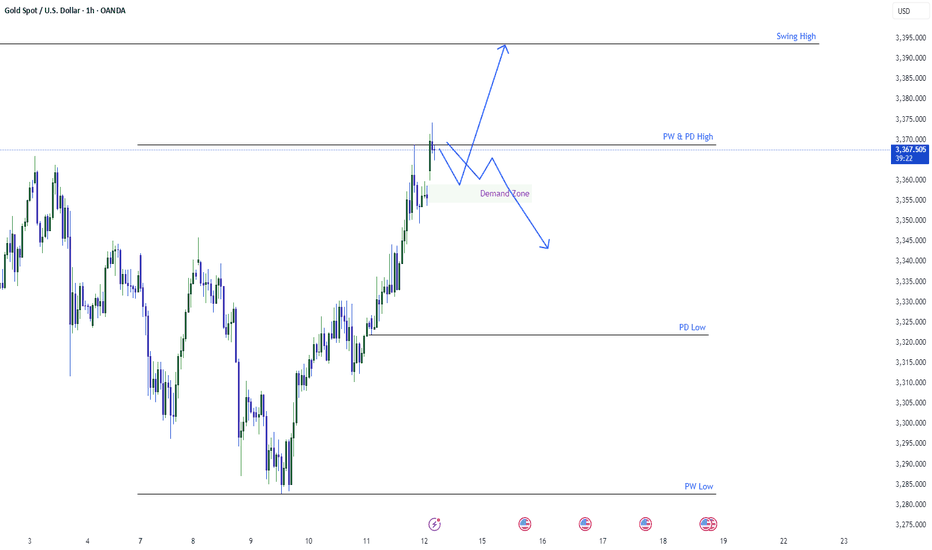

Gold trying to cross 3400Gold has show bullish momentum by crossing the previous week high which was residing around 3369. Filed the previous gap available. We expect gold to go higher and touch the 2293 level which is a swing high. Another possibility would the to after taking previous week liquidly may give us a deeper pullback. The possibilities for the gold are shown in the graph accordingly.

GOLD Remains BullishPrice made a HH at 3365, confirming structure shift back to bullish. The last HL is at 3305, making it the protected level for bulls.

H4 OB: 3305–3322 (origin of the recent impulsive leg — ideal pullback zone)

Supply Zone: 3432–3445 (next unmitigated supply target)

Bullish if price pulls into demand zone and holds, expect continuation to 3432+

H1 OB: 3325– 3335 (potential re-entry zone)

Watch for reaction on pull back

M15 Micro bullish flow is intact; price is consolidating around 3360

Breakout Buy: M15 BOS above 3365 with retest = entry trigger

🟢Entry Zone: 3325– 3335

SL: Below 3305

TP1: 3365

TP2: 3432

TP3: 3445

"GOLD Bandit Strategy: Loot Pips Like a Pro!🏆 GOLD HEIST ALERT! 🏆 XAU/USD Bandit Strategy (Swing/Day Trade)

Steal Pips Like a Pro! 💰🔓 Bull vs. Bear Raid Plan

🌟 Greetings, Market Pirates! 🌟

"The trend is your accomplice—time to loot!"

🔮 Thief’s Technical & Fundamental Intel:

XAU/USD (The Gold Vault) is flashing BEARISH signals, but we’re ready to raid both sides! Follow the heist blueprint below 👇

🎯 ENRY POINTS (Where to Strike!)

🏴☠️ LONG RAID (Bullish Thieves):

Break & Grab: Enter above 3450.00 (Pullback Zone)

"Wait for the breakout, then ambush!"

🐻 SHORT RAID (Bearish Bandits):

Sneak Attack 1: Sell below 3300.00

Sneak Attack 2: Sell below 3260.00 (Support Wall Cracked!)

🛑 STOP-LOSS (Escape Routes)

Bullish Trade: SL at 3230.00 (Guard your loot!)

Bearish Trade 1: SL at 3360.00 (Don’t get caught!)

Bearish Trade 2: SL at 3280.00 (Risk = Reward!)

(Adjust SL based on your risk appetite & lot size!)

💰 TAKE-PROFIT (Cash Out & Flee!)

Bullish Thieves: TP at 3270.00 (Or escape early!)

Bearish Bandits (1): TP at 3270.00

Bearish Bandits (2): TP at 3210.00 (Big score!)

⚠️ WARNING: Market Traps Ahead!

News = Danger Zone! 📢 Avoid new trades during high-impact news.

Trailing SL = Your Getaway Car! Lock profits & evade reversals.

📰 FUNDAMENTAL BACKUP (Why This Heist Works)

Bearish momentum fueled by macro trends, COT data, & sentiment.

Stay sharp—markets shift fast!

💥 BOOST THIS HEIST! 💥

Like & Share to strengthen our pirate crew! 🚀 More alerts = More profits!

🚨 Next Heist Coming Soon… Stay Tuned! 🚨

"Gold at a Crossroads! Bullish or Bearish? (Trade Plan)"🦹♂️💰 "Gold Heist Alert: XAU/USD Bullish Raid or Bearish Ambush?" 💰🦹♂️

🌍 Greetings, Market Pirates & Profit Raiders! 🌍

(Hola! Oi! Bonjour! Hallo! Marhaba!)

Based on the 🔥Thief Trading Method🔥, here’s our strategic heist plan for XAU/USD (Gold vs. Dollar). Follow the chart markings for high-probability loot zones—whether you're a bullish bandit or a bearish burglar! 🏴☠️💸

🎯 Entry Strategy (Where to Strike)

"The treasure is ripe for taking! Breakout = GO TIME!"

✅ Long Entry (Bullish Raid): Jump in at current levels if the uptrend holds.

✅ Short Entry (Bearish Ambush): Wait for a break & close below 3280.00 (confirms downtrend).

🛑 Stop Loss (Escape Route)

🚨 For Bulls: Bail out if price hits 3240.00 (SL tightens if trend strengthens).

🚨 For Bears: Retreat if price surges past 3360.00 (only activate SL post-breakout!).

🎯 Take Profit (Loot & Scoot!)

💰 Bullish Thieves: Aim for 3600.00 (or exit early if momentum fades).

💰 Bearish Bandits: Target 3125.00 (or escape before the cops—err, reversal—arrives).

📡 Market Intel (Why This Heist?)

Gold’s in a neutral zone (but bulls have the edge! 🐂📈). Key factors:

Macroeconomic shifts

COT data clues

Sentiment & seasonal trends

(Full breakdown in the chart notes—klick the 🔗! 🔍🌐)

⚠️ Danger Zones (News & Risk Control)

🚨 High-Impact News = NO NEW TRADES!

🚨 Protect open positions: Use trailing stops to lock in profits.

🚨 Adjust SLs if volatility spikes!

💥 Boost the Heist! 💥

Like & Share to fuel our next market robbery! 🚀💰

Follow for more lucrative trade setups—coming soon! 👀🔥

🎯 Trade Smart, Steal Smarter! 🦹♂️💎

GOLD Breakout or Fakeout? Thief’s Guide to Safely Rob the Move!🏆 XAU/USD Master Plan: Loot the Bullish Rally Before the Bearish Trap!💨💰

🌟 Hola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💸

🔥 Thief Trading Strategy Alert 🔥

Time to execute our gold heist on XAU/USD! Based on technical + fundamental looting tactics, here’s the play:

📈 ENTRY ZONES (4H TIMEFRAME)

BUY: Sneak in at Market Maker’s Buy Zone (Pullback Entries Only!).

SELL: "The vault’s wide open!"—Ambush bearish traps at risky highs (Red Zone).

🛑 STOP-LOSS (THIEF RULES)

Hide your SL at:

Past key lows OR nearest swing low (4H).

Adjust based on your risk, lot size, & robbery multiplier.

🎯 TARGET: 3525.00 (OR ESCAPE EARTHER!)

Scalpers: Long-side only! Trail your SL to lock loot.

Swing Thieves: Join forces—big pockets or small, execute the plan!

⚠️ WARNING: NEWS = VOLATILITY TRAPS!

Avoid new trades during news.

Use trailing SL to protect stolen profits.

📰 FUNDAMENTAL LOOT LIST (READ BEFORE HEIST!)

COT Report, Macro Data, Sentiment Outlook—Link in bi0! 🔗🤙🏻👉🏻👉🏻

Gold’s bullish now… but robbers adapt fast!

💥 BOOST THIS PLAN = STRONGER GANG!

Hit 👍 & Share—More boosts = More gold stolen daily!

Stay tuned… Next heist drops soon! 🚀🐱👤

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

The idea remains unchanged, NY3360-3365 is emptyThe idea remains unchanged during the NY period. Although gold has currently reached a high of around 3348, it has not stabilized above it. If gold successfully breaks through 3350 in the short term, it may reach 3360 or 3365. In the 4H cycle, it presents a step-by-step upward pattern. The K-line is temporarily fluctuating sideways near the upper track. At the same time, 3345 has formed a double top pattern. Combined with Thursday's low of 3310, an inverted triangle oscillation range of 3345-3310 is formed in the short term. This week's trend needs to pay close attention to the breakthrough direction of this range. Short-term long positions can be taken after the trend is confirmed.

XAUUSD@3330-3320 long TP 3345-3365

OANDA:XAUUSD

Bulls rise, beware of Friday's black swan📰 News information:

1. Pay attention to the impact of Trump administration tariffs

📈 Technical Analysis:

Gold rose as expected and touched around 3344, which was in line with our judgment last night. However, from the market point of view, the K-line entity did not stand firmly above 3335. There are only two possible scenarios for the subsequent trend of gold. One is to stand directly above and test the 3345 resistance again, and the other is to fall in the European and American markets due to timeliness and retest the key support of 3310. At present, the upper positions are 3345 and 3365 respectively. If 3345 is repeatedly not broken and the European market falls with acceleration, then the 3310 area will still need to take back the long positions, which can be defined as a long wide-range wash. 3330-3320 is a very critical support position, and 3310 is a strong support. Therefore, the best position for shorting during the day is around 3335-3345, with the target at 3330-3320. Consider long positions after falling back and getting support here.

🎯 Trading Points:

SELL 3335-3345

TP 3330-3320

BUY 3330-3320

TP 3345-3365

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

OANDA:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD FXOPEN:XAUUSD TVC:GOLD

Gold Spot / U.S. Dollar (XAUUSD) 4-Hour Chart4-hour chart from OANDA shows the price movement of Gold Spot (XAUUSD) with a current value of $3,325.625, reflecting a $11.925 increase (+0.36%). The chart highlights key levels including a sell price of $3,325.290 and a buy price of $3,325.960, with a spread of 67 points. Technical analysis includes a resistance zone around $3,359.388 and a support zone near $3,317.966, with recent price action showing a potential upward trend from a low point. The chart spans from June to early August 2025.

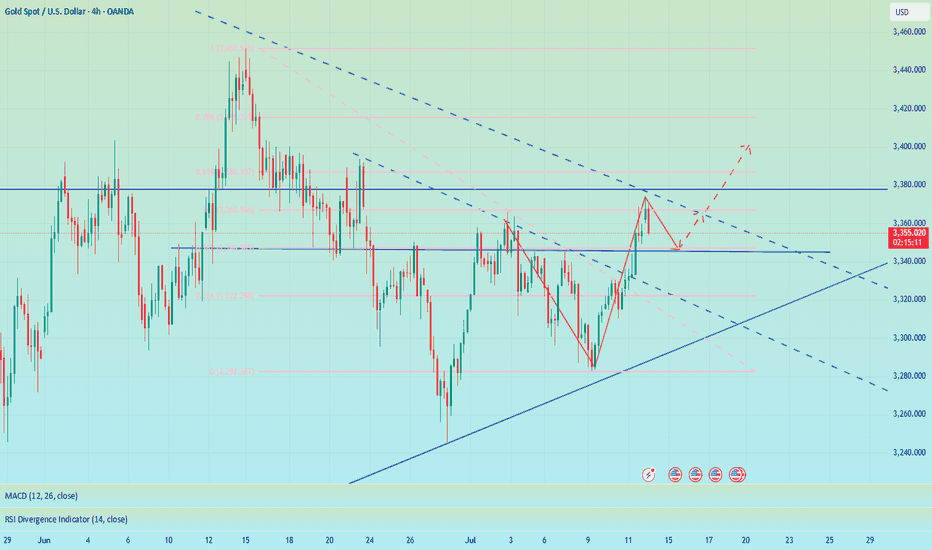

Elliott Wave Analysis – XAUUSD July 11, 2025

🔍 Momentum:

D1 timeframe: Momentum is currently rising, suggesting that the bullish trend is likely to continue for the next few days.

H4 timeframe: Momentum is also bullish, indicating that the uptrend is likely to dominate today.

🌀 Elliott Wave Pattern:

On the H4 chart, price action is in the final stage of a contracting triangle correction.

Price is now approaching the upper boundary of the triangle. With both D1 and H4 momentum in alignment, the probability of a breakout to the upside is high.

If this breakout occurs, we can expect a move toward the 3393 area, which is a key level to confirm whether the corrective phase has truly ended.

🎯 Price Targets:

Current area (3330–3332): A potential opportunity for a scalp BUY, supported by bullish momentum on H4.

Next support zone: 3315–3317 – a solid area for a mid-term BUY entry if there’s a pullback.

⚠️ If price breaks below 3279, the current wave count becomes invalid and a new analysis will be provided.

✅ Trade Plan:

🔹 SCALP BUY

Entry: 3332 – 3330

SL: 3327

TP1: 3363

TP2: 3390

🔹 MID-TERM BUY ZONE

Entry: 3317 – 3315

SL: 3307

TP1: 3342

TP2: 3363

TP3: 3390

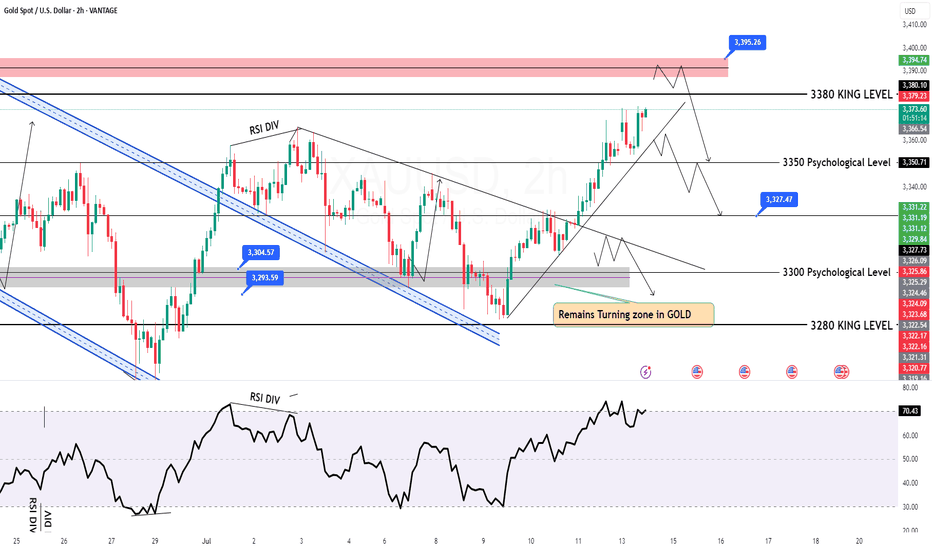

GOLD H2 Intraday Chart Update For 11 July 2025Hello Traders

Today we have weekly closing & all eyes on weekly closing initially

2nd 3350 Psychological level remains watchable if GOLD break 3360 level successfully today then it will move towards 3390 else we have remains selling opportunities from TOP

below 3360 level market will move towards 3315

Disclaimer: Forex is Risky

Gold fluctuates, consolidation in the 3330-3310 range📰 News information:

1. Waller meeting on interest rate cuts

2. Trump tariff issues

📈 Technical Analysis:

Waller will participate in the meeting in more than two hours and pay attention to whether there is any news of interest rate cut. The key is to operate around the 3330-3310 range. Continue to pay attention to the support of 3310-3305 at night. If gold falls below 3310,-3305 again, the downward trend will continue, and it is expected to touch 3280 again, or even 3250. If it rebounds above 3330, it is likely to continue to rise.

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD FXOPEN:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD OANDA:XAUUSD

Go long when the trend reverses, beware of black swansYesterday's pullback to 3313-3310 confirmed the upward trend of gold. As I expected, it broke through the resistance of 3330 and touched around 3345. Currently, the short-term strong resistance is at 3345. Only by breaking through this resistance can gold maintain its upward trend. If it is blocked near the 3345 line in the short term, there is a possibility of a pullback. If 3345 breaks, there will be 3365 and 3400 above. Once the direction is clear, it will be easier to act. If there is a pullback during the day, it will give us a trading opportunity to enter the long position.

OANDA:XAUUSD

XAU/USD 1H Outlook

FVG Fill (3320–3318)

Price is expected to drop into the unfilled Fair Value Gap between 3320 and 3318.

London/NY Liquidity Hunt

After filling the FVG, look for a swift bullish impulse during the London and New York sessions to trigger stop-runs and collect liquidity.

Downward Correction to 3305 & 3298

Once the liquidity grab completes, expect a retracement:

First target: 3305

On a break below 3305, next target is the unfilled FVG at 3298

Summary:

Drop → FVG fill (3320–3318) → Bullish liquidity hunt (London/NY) → Retracement toward 3305 (then 3298)

XAUUSD - Intraday SMC Bearish Setup | 15m ChartGold is currently reacting to a visible 15m supply zone after a bullish retracement. Price failed to break above the short-term supply (highlighted in red), showing signs of potential short-term reversal.

🔍 Key SMC Insights:

Supply Zone at 3318.47 – 3320 area is holding firm, with price showing clear rejection and lower highs forming.

Internal CHoCH already confirmed — suggesting short-term bearish order flow is active.

Liquidity Grab and rejection around the supply confirms smart money may be offloading positions.

Imbalance Below near 3303.96, with further inefficiency down to 3272.64.

📍Trade Idea:

Sell Entry: After a retest or failure to break above the 3318.47 zone.

Target 1: 3303.96 (near-term support and minor liquidity)

Target 2: 3272.64 (major liquidity zone + possible demand area)

Invalidation: Bullish break and close above 3320 would shift intraday bias.

⚠️ Monitor lower timeframes (1m–5m) for confirmation before executing trades. This setup aligns with the 4H bearish structure, enhancing confluence.

Gold fluctuates, continue to short at 3345 during the dayTrump's trade policy continues to stimulate risk aversion. Although the Federal Reserve's meeting minutes are neutral, they can potentially provide support for gold. Yesterday we gave the short positions of 3321 and 3333, which have generated profits so far. At the same time, it should be noted that the 4H MACD indicator has the potential demand to form a golden cross. In the short term, there is a certain suppression force at 3330-3335. If the Asian and European sessions repeatedly test this position but fail to break through effectively, you can go short without hesitation. If you want to go short again during the day, you can consider 3340-3345 and defend 3350. The lower 3310-3305 is a relatively strong support area during the day. If the Asian session retreats to this point, you can consider going long, with the target looking at 3330-3335.

OANDA:XAUUSD