XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Xauusdidea

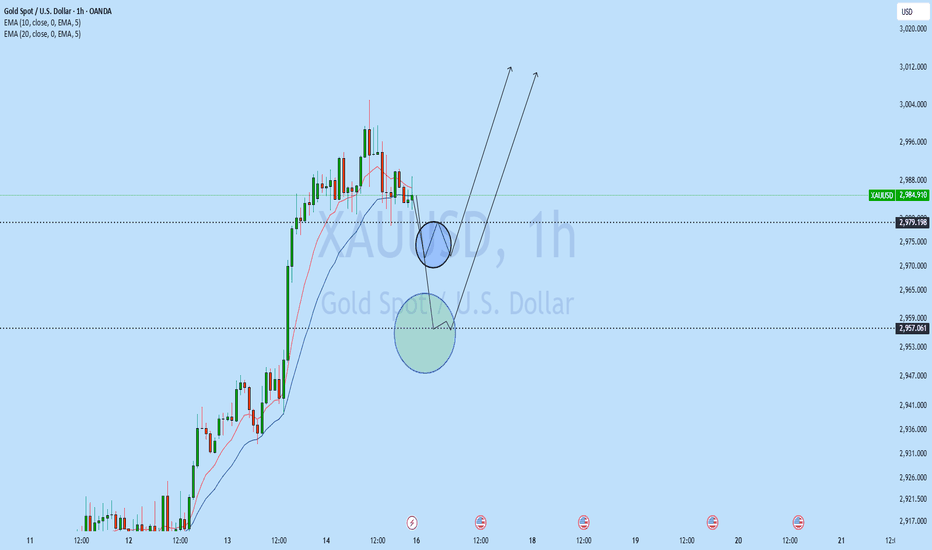

XAUUSD:Trading Strategy for Next WeekAfter a significant rally, it is reasonable for the gold price to experience a short-term pullback and adjustment. In the short term, the bullish trend of gold has not been reversed.

diverging upwards in a bullish manner, indicating that the bullish momentum of gold remains intact. Unless the moving averages start to turn downwards next week, the bullish momentum of gold may be affected.

The support level of the gold moving averages has now shifted up to around $2,968. Next week, one can continue to go long on gold at dips above $2,968. Continue to pay attention to the resistance near the high of around $3,005.

Suggestions for gold trading operations next week:

buy@2970-2975

SL:2963

TP:2998

I always firmly believe that profit is the sole criterion for measuring strength. I will share accurate trading signals every day. Follow my lead and wealth will surely come rolling in. Click on my profile for your guide.

XAU/USD "The Gold vs U.S Dollar" Metals Market Robbery Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🚀

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold vs U.S Dollar" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2830.00) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (2830.00) swing Trade Basis Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 2780.00 (or) Escape Before the Target

Secondary Target - 2710.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Global Market Analysis, Sentimental Outlook, Intermarket Analysis, Quantitative Analysis, Positioning:

XAU/USD "The Gold vs U.S Dollar" Metals Market is currently experiencing a Neutral trend., driven by several key factors.

⭐☀🌟Fundamental Analysis

Gold prices are influenced by various fundamental factors, including:

- Inflation: Rising inflation can lead to increased demand for gold as a hedge against inflation.

- Interest Rates: Lower interest rates can make gold more attractive to investors, while higher interest rates can reduce demand.

- Central Bank Policies: Central banks' decisions on gold reserves and monetary policies can impact gold prices.

- Global Economic Conditions: Economic downturns or crises can increase demand for gold as a safe-haven asset.

⭐☀🌟Macro Economics

Macroeconomic factors that can impact gold prices include:

- GDP Growth: Slowing GDP growth can lead to increased demand for gold.

- Unemployment Rates: Rising unemployment can increase demand for gold.

- Inflation Rates: Rising inflation can lead to increased demand for gold.

⭐☀🌟Global Market Analysis

Global market trends can also impact gold prices:

- Stock Market Performance: Weakness in the stock market can lead to increased demand for gold.

- Currency Fluctuations: A weaker US dollar can make gold more attractive to investors.

⭐☀🌟COT Data

Commitment of Traders (COT) data can provide insights into market sentiment:

- Non-Commercial Traders: An increase in long positions by non-commercial traders can indicate bullish sentiment.

- Commercial Traders: An increase in short positions by commercial traders can indicate bearish sentiment.

⭐☀🌟Intermarket Analysis

Intermarket analysis involves analyzing the relationships between different markets:

- Correlation with Other Assets: Gold's correlation with other assets, such as stocks and bonds, can impact its price.

- Commodity Prices: Changes in commodity prices, such as oil and copper, can impact gold prices.

⭐☀🌟Quantitative Analysis

Quantitative analysis involves using mathematical models to analyze gold prices:

- Technical Indicators: Technical indicators, such as moving averages and relative strength index (RSI), can provide insights into gold's trend.

- Statistical Models: Statistical models, such as regression analysis, can help identify relationships between gold prices and other variables.

⭐☀🌟Market Sentimental Analysis

Market sentimental analysis involves analyzing investor attitudes and sentiment:

- Bullish Sentiment: Increased bullish sentiment can lead to higher gold prices.

- Bearish Sentiment: Increased bearish sentiment can lead to lower gold prices.

⭐☀🌟Positioning

Positioning involves analyzing the current market position:

- Long Positions: An increase in long positions can indicate bullish sentiment.

- Short Positions: An increase in short positions can indicate bearish sentiment.

⭐☀🌟Next Trend Move

Based on the analysis, the next trend move for XAU/USD is uncertain. However, if inflation concerns rise, or if there's a significant increase in bullish sentiment, gold prices could move higher.

Short-Term: Bullish: $2,900-$3,000, Bearish: $2,700-$2,600

Medium-Term: Bullish: $3,200-$3,500, Bearish: $2,400-$2,200

Long-Term: Bullish: $3,800-$4,000, Bearish: $2,000-$1,800

⭐☀🌟Overall Summary Outlook

The overall summary outlook for XAU/USD is neutral. Gold prices are influenced by a complex array of factors, and the current market position is uncertain. Investors should monitor inflation concerns, interest rates, and global economic conditions to make informed decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Analysis of the Gold Price Trend Next WeekThis week, the spot gold price witnessed a breakthrough market trend. Influenced by the continuous gold purchases by central banks of multiple countries, the heightened global economic uncertainties, and the expectations of trade frictions, the gold price soared to as high as US$3,005 per ounce at one point, reaching a historical high. Although the short-term overbought signals and the pressure of profit-taking may trigger market volatility, the long-term bullish pattern has already been established.

The key resistance level on the daily chart is at 3025, which is the combination of the previous high and the 2.618 Fibonacci retracement level. The support level below is at 2956, which is the recent level where the top has transformed into the bottom. The hourly chart shows that during the U.S. trading session, the price correction only reached 2978 before gaining support. If the price stabilizes within the range of 2970 - 2975, there will still be short-term upward momentum.

Suggestions for gold trading operations next week:

buy@2970-2975

SL@2963

TP:2998

XAU/USD "Gold vs US.Dollar" Metal Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "Gold vs US.Dollar" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 2950.00

Sell Entry below 2870.00

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

-Thief SL placed at 2900.00 (swing Trade Basis) for Bullish Trade

-Thief SL placed at 2920.00 (swing Trade Basis) for Bearish Trade

Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 3070.00 (or) Escape Before the Target

-Bearish Robbers TP 2770.00 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

XAU/USD "Gold vs US.Dollar" Metal market is currently experiencing a Neutral trend (there is a higher chance for Bullishness)., driven by several key factors.

🚩Fundamental Analysis

Gold Demand: Gold demand is expected to increase, driven by growing central bank purchases and investor demand for safe-haven assets.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for gold as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for gold.

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for gold, driven by increasing investor confidence.

🚩Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for gold, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for gold as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for gold.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

🚩COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 70%

Open Interest: 250,000 contracts

Commercial Traders (Companies):

Net Short Positions: 20%

Open Interest: 120,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 25,000 contracts

COT Ratio: 3.0 (indicating a strong bullish trend)

🚩Sentimental Outlook

Institutional Sentiment: 75% bullish, 25% bearish.

Retail Sentiment: 70% bullish, 30% bearish.

Market Mood: The overall market mood is bullish, with a sentiment score of +65.

🚩Next Move Prediction

Bullish Move: Potential upside to 3070.00-3200.00.

Target: 3200.00 (primary target), 3300.00 (secondary target)

Next Swing Target: 3400.00 (potential swing high)

Stop Loss: 2700.00 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 300.00 vs potential loss of 150.00)

🚩Overall Outlook

The overall outlook for XAU/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in gold demand, growing central bank purchases, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAU/USD "The Gold vs U.S Dollar" Metal Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold vs U.S Dollar" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 2960.00

Sell Entry below 2925.00

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

-Thief SL placed at 2920.00 for Bullish Trade

-Thief SL placed at 2955.00 for Bearish Trade

Using the 30min period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 3030.00 (or) Escape Before the Target

-Bearish Robbers TP 2880.00 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

XAU/USD "The Gold vs U.S Dollar" Metal market is currently experiencing a Neutral trend (there is a higher chance for Bullishness)., driven by several key factors.

⭐Fundamental Analysis

The current price of XAU/USD is 2940.00, indicating a strong bullish trend. The gold market is driven by various fundamental factors, including:

Inflation concerns: Rising inflation expectations and a potential decline in the US dollar may boost gold prices.

Interest rate policies: The US Federal Reserve's interest rate decisions may impact gold prices.

Global economic uncertainty: Ongoing trade tensions, Brexit uncertainty, and geopolitical risks may drive safe-haven demand for gold.

⭐Macro Economics

The global economic outlook is uncertain, with:

Recession concerns: Weak economic data and trade tensions have raised concerns about a potential global recession.

Central bank rate hikes: The US Federal Reserve and other central banks may continue to raise interest rates, impacting currency markets.

Inflation expectations: Rising inflation expectations may boost gold prices.

⭐COT Data

Commercial Traders: Net short 143,000 contracts (a decrease of 11,000 contracts from the previous week)

Non-Commercial Traders: Net long 104,000 contracts (an increase of 8,000 contracts from the previous week)

Non-Reportable Positions: Net long 39,000 contracts (an increase of 3,000 contracts from the previous week)

Open Interest: 544,000 contracts (a decrease of 10,000 contracts from the previous week)

⭐Market Sentimental Analysis

Market sentiment for XAU/USD is:

Bullish: 62% of investors expect gold prices to rise, driven by inflation concerns and global economic uncertainty.

Bearish: 21% of investors expect gold prices to fall, driven by potential US dollar strength and interest rate hikes.

Neutral: 17% of investors remain neutral, awaiting further market developments.

⭐Intermarket Analysis

The XAU/USD pair is highly correlated with:

USD Index: A weaker US dollar may boost gold prices.

10-Year Treasury Yield: Lower yields may increase demand for gold.

S&P 500: A decline in the S&P 500 may drive safe-haven demand for gold.

⭐News and Events

Upcoming events that may impact the XAU/USD pair include:

US Federal Reserve Interest Rate Decision: March 15, 2025

US GDP Growth Rate: March 25, 2025

US Inflation Rate: March 29, 2025

⭐Seasonality

Gold prices tend to be:

Stronger during the winter months: Due to increased demand for jewelry and coins.

Weaker during the summer months: Due to decreased demand for jewelry and coins.

⭐Positioning Analysis

Traders are advised to:

Consider long-term investments: As gold prices are expected to rise due to inflation concerns and global economic uncertainty.

Monitor market volatility: As interest rate hikes and US dollar strength may impact gold prices.

Diversify portfolios: By investing in other assets, such as currencies, stocks, or bonds.

⭐Next Trend Move

The XAU/USD pair may experience a:

Bullish move: Driven by inflation concerns and the US Federal Reserve's potential interest rate hikes.

Bearish move: If the US dollar strengthens or global economic uncertainty increases.

⭐Overall Summary Outlook

The XAU/USD pair is expected to experience volatility due to:

Global economic uncertainty: Ongoing trade tensions, Brexit uncertainty, and geopolitical risks.

Inflation concerns: Rising inflation expectations and a potential decline in the US dollar.

Central bank rate hikes: The US Federal Reserve and other central banks may continue to raise interest rates.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAU/USD "The Gold vs U.S Dollar" Metal Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold vs U.S Dollar" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2890) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 2930 (swing Trade Basis) Using the 1H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2830 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental, Positioning, Overall Outlook:

╰┈➤XAU/USD "The Gold vs U.S Dollar" Metal Market is currently experiencing a bearish trend,., driven by several key factors.

╰┈➤Fundamental Analysis

Rates: Fed at 3-3.5%, ECB/BoJ lower—neutral to bearish.

Inflation: U.S. PCE 2.6%, global 2.5-3%—bullish.

Demand: Central banks, ETFs strong—bullish.

Geopolitics: Tariffs, Russia-Ukraine—bullish.

USD: DXY 106.00, slight softness—mildly bullish.

╰┈➤Macroeconomic Factors

U.S.: Weak PMI (50.4), jobless claims up—bullish.

Global: China 4.5%, Eurozone 1.2%—safe-haven lift.

Commodities: Oil $70.44—supports gold premium.

Trump: Tariffs inflate costs—bullish.

╰┈➤COT Data

Speculators: Net long 55,000—cooling but bullish.

Hedgers: Net short 65,000—stable.

Open Interest: 125,000—sustained interest.

Market Sentiment Analysis

Retail: 59% short—contrarian upside risk.

Institutional: Bullish to $3000, short-term caution.

Corporate: Miners hedge 2920-2940—neutral.

Social Media : Mixed, bearish near-term (2880-2906).

Broker: 60% long—crowded.

╰┈➤Positioning Analysis

Speculative: Longs to 2949, shorts to 2880.

Retail: Shorts at 2918-2924—squeeze risk.

Institutional: Balanced, inflation bets.

Corporate: Hedging stabilizes.

╰┈➤Quantitative Analysis

SMAs: 50-day 2850, 200-day 2650—bullish.

RSI: 48—neutral.

Bollinger: 2890-2930—consolidation.

Fibonacci: 50% at 2909.47—pivot.

Volatility: 12%, ±35 points daily.

╰┈➤Intermarket Analysis

DXY: 106.00, soft—bullish.

EUR/USD: <1.0500—caps gains.

Gold: Aligns with CHF/JPY—safe-haven.

Equities: S&P 5960-6120—neutral.

Bonds: U.S. 3.8% yield—pressures gold.

╰┈➤News and Events Analysis

Recent: Tariffs, weak U.S. data—bullish.

Upcoming: PCE (Feb 28)—key USD driver.

Impact: Bullish short-term, bearish risk if PCE hot.

╰┈➤Next Trend Move

Technical: Support 2906-2891, resistance 2949-2955.

Short-Term: Dip to 2906-2880, rebound to 2949.

Medium-Term: Range 2850-3000.

Triggers: Bullish—soft PCE; Bearish—hot PCE.

╰┈➤Overall Summary Outlook

XAU/USD at 2910.00: Bullish fundamentals (inflation, tariffs) vs. bearish USD strength. Short-term dip to 2880, medium-term to 3000 if catalysts hit.

╰┈➤Future Prediction

Bullish: 2980-3000 by Q2 2025 (soft USD, tariffs).

Bearish: 2850-2864 (hot PCE, Fed hawkish).

Prediction: Bearish to 2880 short-term, bullish to 2980 mid-2025.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Gold is on a relentless hunt for the $2,720 levelGold is on a relentless hunt for the $2,720 level, navigating through a well-defined ascending channel where the upper boundary has acted as long-term resistance and the lower boundary as dynamic support. The price has respected this structure, with multiple touches reinforcing its integrity. However, a recent double top near the upper boundary signals potential bullish exhaustion, increasing the probability of a downside move. If the price remains below this key level, further declines are likely, with $2,720 emerging as a crucial support zone—aligned with the golden pocket on the Fibonacci retracement, making it a prime area for a reaction.

The Alternative Scenario: The New Economy's Bullish Case

Despite the bearish structure, gold in the new economy presents an alternative bullish outlook. A smaller bullish channel has formed between $2,789 and $2,855, suggesting that buyers are still in control within this range. If this mini uptrend holds, it could fuel another breakout attempt above recent highs, invalidating the bearish scenario and positioning gold for a renewed push toward higher levels.

For now, gold is at a crossroads, with $2,720 as the primary target on the downside—but if buyers defend this level or sustain the new bullish channel, the uptrend may persist in the evolving economic landscape.

XAUUSD Analysis StrategyAs of now, gold has already broken through the 3000 level. It reached a peak of 3005 at its highest point and then pulled back for adjustment.

From the analysis of the 4-hour gold trend, we should focus on the support level at 2956-2965 below, and the resistance level at 3005-3010 above. In terms of operation, we can mainly go long when there is a pullback following the trend. In the middle price range, it is advisable to observe more and act less, and be cautious when chasing orders. We should patiently wait for entry at key price levels. I will provide specific trading strategies during the trading session. Please pay attention in a timely manner.

Gold trading strategy:

buy @ 2956-2960

tp 2990-3000

If you're not satisfied with your current gold trading performance, and if you also need to get accurate trading signals every day, you can focus me. I hope I can be of some help to you.

Gold Bulls Mid Term, Long Term Trade Direction (Buy/long)Gold is trading around 2857.xx

The bullish momentum continued with trump unexpected policy shift of trade and war and technically if this momentum continued, we could see bullish continuation towards 3000 - 3085 by May 2025.

Mid to long term stance is buy on dips.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Showing Strength on the 4H Chart📈 XAUUSD Gold 🟡 has been demonstrating strong resilience, maintaining a clear bullish trend on this 4H timeframe. Price action continues to align with an upward trajectory, with my target set at the previous high marked on the chart 🎯.

A pullback is expected, potentially offering an opportunity to enter at a discount before a continuation toward the target zone 🚀.

⚠️ Not financial advice—always manage risk appropriately!

Short positions are in trouble, how to get out of trouble?Bros, gold accelerated to above 2980 today under the stimulation of news. If you hold a short position in gold, you must be in a trading dilemma, so how to get rid of the trading dilemma has become the current primary goal.

First remember the key node, Thursday. Under normal circumstances, Thursday and Friday are the nodes most likely to cause market changes! And from the candle chart, it is just pulled back to the high area with the stimulation of news. From the regional conversion, we can clearly see that according to the current momentum of gold, it will only reach the area around 2980-2982 (there may be a technical false breakthrough). It is difficult to rise to the vicinity of the 3000 mark in one fell swoop.

If you still have sufficient margin levels to help you get out of trouble, you might as well consider adding more positions near 2980 to continue shorting gold, effectively raising your average cost price. After gold falls back, you can choose to close all short positions and turn losses into profits. However, because gold has risen sharply, we must lower our expectations for the extent of gold's retracement. If gold retraces to the 2940-2930 area, we can consider closing our positions, so that we can turn losses into profits! And I predict that gold will enter a correction market tomorrow at the latest!

Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

XAUUSD buy-and-profit trading signalGold news analysis: The latest data released on Thursday (March 13) showed that the US producer price index stagnated due to falling service costs, and the number of initial claims in the United States fell slightly, still close to pre-epidemic levels. At the same time, driven by demand for safe-haven assets due to tariff concerns and US inflation reports that reinforced expectations of future rate cuts, gold prices approached historical highs but failed to break through. As of press time, spot gold rose 0.5% to $2,946.68 per ounce. The number of initial jobless claims in the United States fell last week, but the government's sharp spending cuts and escalating trade wars threaten the stability of the labor market. The U.S. Department of Labor reported on Thursday that the number of initial jobless claims fell by 2,000 to 220,000 after seasonal adjustment in the week ending March 8. Economists surveyed by the agency had previously expected the number of initial jobless claims to be 225,000 last week. In late February, the number of applications for unemployment benefits soared due to seasonal fluctuations around the winter blizzard and the President's Day holiday, which made it difficult to adjust the data. Although the labor market remains solid, the Trump administration's policies pose downside risks.

Gold's 1-hour moving average is still a golden cross with upward bullish divergence. After breaking through the box and oscillating, gold continued to rise in the morning today and has basically stabilized at the 2930 line. Gold's retracement to 2930 is an opportunity to buy on dips. Gold can buy more first when it retraces to 2933 in the afternoon. If gold does not fall below 2930 again, then gold bulls will have further momentum to rise. Gold bulls are now ready to go and are expected to be even better. In the end, gold bulls have the upper hand in the oscillation, so follow the pace of the bulls. Whether gold can break through the historical high again, we will wait and see! Overall, recommends that the short-term operation of gold today is mainly long on pullbacks and short on rebounds. The short-term focus on the upper side is the resistance of 2985-2990, and the short-term focus on the lower side is the support of 2938-2928.

Trading is risky, so control your position reasonably. If you don't know when to enter the market, please follow the real-time signal announcement of my trading center or leave me a message, so that you can get rid of trading problems and realize profits as soon as possible. PEPPERSTONE:XAUUSD OANDA:XAUUSD CAPITALCOM:GOLD TVC:GOLD FOREXCOM:XAUUSD

XAUUSD SHORT CHART MAPPING IN 1-H ATHello Guys Here Is Chart Of XAUUSD in 1-H AT

Sell Entry: Below 2886

Resistance: 2886 - 2890

Target: 2866 - 2860

Break-even: Your entry price (likely around 2880)

If price breaks below 2860, expect it to hit 2840 for support. If it moves above 2900, the setup may be invalid.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

How to continue to short (2)As in my last analysis, currently XAUUSDXAUUSD is about to hit that 2945-2948

Operation policy reference:

Short Position Strategy

1:XAUUSD sell@2945-2948 20%Transaction of funds , tp:2930-2920-2910

2:XAUUSD Buy@2910-2915 20%Transaction of funds , tp:2930-2945-2955

The Signals have timeliness , if you also need to get accurate signals every day,follow the link below to get my daily strategy updates

If your account is still in the red, you need to pay attention to whether the resistance is valid. If the resistance is valid, there may be a decline. You can close your order on the decline and trade in the right direction again

Gold (XAU/USD) Technical Analysis – March 11, 2025Gold is currently trading near 2920 , showing bullish momentum after a strong recovery from recent lows. Price action suggests buyers are in control, but key levels must hold for continued upside.

🔍 Key Observations:

✅ Bullish Structure: The price has formed a bullish flag , signaling potential continuation toward liquidity above 2930.3 (swing high).

✅ Fair Value Gap (FVG) 2907 - 2900: This zone should act as support. If price stays above it, we could see bullish continuation.

✅ Bullish Order Block (OB) 2891 - 2880: If price retraces, this area could serve as a high-probability buy zone for another push higher.

📈 Key Levels to Watch:

🔹 Support Zones:

2907 - 2900 (FVG, 4H) – Ideal for bullish continuation.

2891 - 2880 (OB, 4H) – Stronger demand zone if a pullback occurs.

🔹 Resistance & Targets:

2930.3 (Swing High) – Liquidity target for buyers.

A breakout above 2930 could trigger further bullish momentum.

⚠️ Possible Scenarios:

📌 Bullish: A break above 2920-2925 could send price toward 2930+ liquidity.

📌 Bearish Pullback: A drop into 2907-2900 may present a buying opportunity before moving higher.

🛑 Final Thoughts:

The trend remains bullish , and as long as price stays above key FVG and OB zones, further upside is likely. Keep an eye on these levels for potential trade setups!

xauusd Next 28% profit signal opportunity

Short-term XAUUSD trading signal analysis shows 2882 support for long positions, with tp reaching the target of 28%.

If you don’t know when to buy or sell, please pay close attention to the real-time signal release of the trading center or leave me a message, so that you can quickly realize the joy of profit. TVC:GOLD ICMARKETS:XAUUSD FOREXCOM:XAUUSD OANDA:XAUUSD

XAUUSD Strategy AnalysisCurrently, the overall gold market is on the weaker side. However, we should by no means chase short positions at low levels. Instead, we should wait for a rebound and look for opportunities to trade.

Resistance levels: 2925

Support levels: 2886

I will share accurate trading strategies every day, and the accuracy rate of the trading signals reaches 90%. Click on the link below the article to obtain the accurate signals.