Gold surged higher but encountered resistance and pulled back.Spot gold edged higher, with the highest level reaching $3,374.71 per ounce, the highest since June 23. Over the weekend, Trump announced that a 30% tariff would be imposed on goods imported from the European Union starting from August 1, which further intensified market concerns about international trade and provided upward momentum for gold prices.

Gold prices rose 1% last Friday, closing at $3,357.39 per ounce, as investors turned to safe-haven assets after U.S. President Trump announced a series of tariff measures. Analysts said that the uncertainty premium has returned to the market again.

U.S. President Trump threatened on Saturday (July 12) to impose a 30% tariff on goods imported from Mexico and the European Union starting from August 1. Prior to this, he had engaged in weeks of negotiations with these two largest U.S. trading partners but failed to reach a comprehensive trade agreement. The escalation of the trade war has angered U.S. allies and unsettled investors.

It is worth noting that U.S. President Trump plans to make a "major announcement" on the Russia issue on Monday, which also requires attention from investors.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Xauusdlong

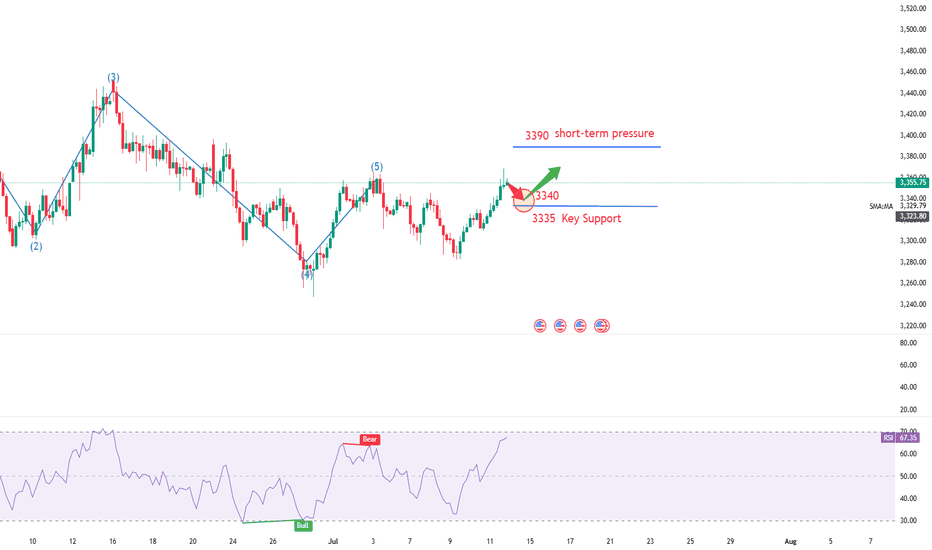

XAUUSD Long OpportunityXAUUSD is bullish per the 4 hour and 1 hour timeframe with continued bullish momentum coming out of the fundamentals around tariff uncertainty. There is clear bullish market structure.

XAUUSD is currently sitting on the pivot level of $3350 (Resistance turned support) after a retracement prior for the NY opening bell which gives rise for a long opportunity from this level towards the next Pivot point at $3391.

On the hour timeframe, price is trading above the 50 and 200 SMA and is currently sitting upon the 21 SMA which XAUUSD has used push point from in the past trending markets. RSI is currently sitting in a sweet spot region of the RSI between 45-55 indicating this is a valid retracement and price is looking to turn bullish again soon.

This provides 4 points of Bullish confluence within the momentum in favour of further bullish movements

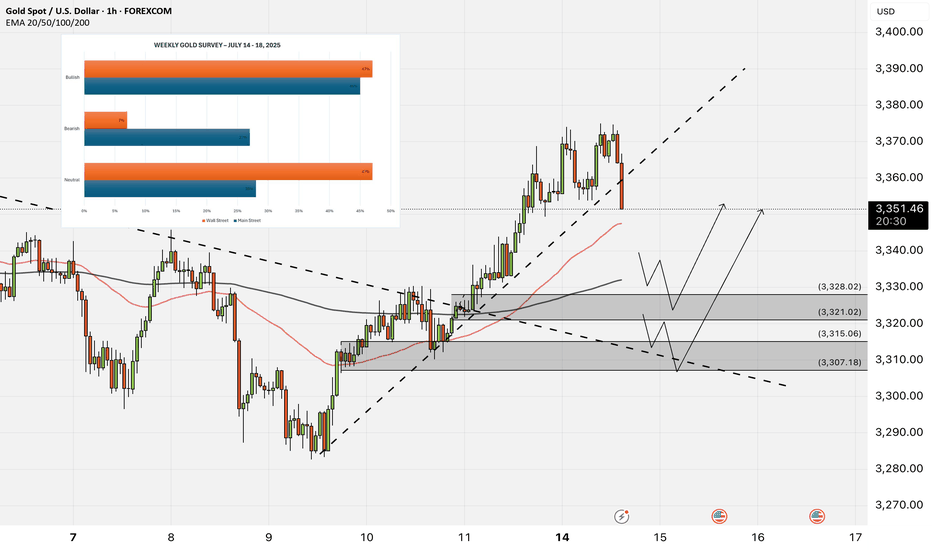

XAUUSD - Gold Awaits Tariff News?!Gold is trading above the EMA200 and EMA50 on the hourly chart and is trading in its medium-term ascending channel. We remain bullish on the commodity and can expect to see $3,400. A correction towards the demand zones would provide us with a better risk-reward buying opportunity.

Gold markets experienced significant volatility this past week, largely driven by global trade developments and speculation over future Federal Reserve actions. Although gold posted a positive weekly performance, it remained confined within its recent trading range and continued to trade cautiously.

Marc Chandler, CEO of Bannockburn Global Forex, noted, “Gold saw declines on Monday and Tuesday, but a three-day rally brought the week to a positive close. It appears that the announcement of new U.S. tariffs played a major role in this rebound. However, it remains uncertain whether the consolidation phase following the historic high near $3,500 has concluded.”

Adam Button, head of currency strategy at Forexlive.com, said that since the passage of the “Big, Beautiful Bill” last week, markets have split into two opposing camps. “The optimists are enthusiastically buying equities, while the pessimists are flocking to precious metals. The bulls believe the budget deficit could stimulate growth, but the bears are concerned about the long-term burden of repaying it.”

He continued: “This divide is evident across the market. Bearish capital is flowing into bitcoin, silver, and gold. While retail traders are largely focused on bitcoin and silver, gold remains the preferred safe haven for central banks and global reserve managers. These institutions are likely observing Trump’s policies and the political landscape carefully before reducing reliance on the U.S. dollar and reallocating reserves toward gold.” He added, “Among retail traders, patience seems to have worn thin, and many are ready to enter the market aggressively.”

Button also stated that the markets are no longer reacting seriously to Trump’s tariff rhetoric. “The reaction of the Canadian dollar after the 35% tariff announcement on Thursday clearly reflected this indifference. Even the Brazilian real barely moved despite facing unexpected tariffs. Now all eyes are on the potential tariffs on Europe—an announcement that could come at any moment and serve as a key test. Still, I expect the market will shrug it off. The only question is whether that indifference lasts an hour or even less.”

Meanwhile, Deutsche Bank has issued a warning that financial markets may be underestimating the risk of Federal Reserve Chair Jerome Powell being dismissed by Trump. According to Bloomberg, George Saravelos, the bank’s senior strategist, said that such a move could result in a 3–4% drop in the U.S. dollar and a 30–40 basis point surge in Treasury yields within a single day.

He emphasized that removing Powell would be a significant blow to the Fed’s independence and would raise concerns about direct political interference in monetary policymaking. The market’s long-term response would depend on Trump’s nominee to replace Powell, how other Fed officials react, and the overall state of the economy. Deutsche Bank also warned that the U.S.’s weak external financing position could amplify market volatility well beyond the initial shock.

Looking ahead to next week, investors will be closely watching developments around trade tariffs, but special attention will also be paid to the U.S. Consumer Price Index (CPI) for June. According to the ISM Purchasing Managers Index (PMI), prices in the manufacturing sector have slightly accelerated, while price components in the non-manufacturing sector have dropped notably. Since manufacturing only accounts for 10% of U.S.GDP, the risks to CPI appear skewed to the downside. A slowdown in inflation may lead some market participants to reassess the likelihood of a July rate cut—potentially halting the recent upward momentum of the U.S. dollar.

On Wednesday, June’s Producer Price Index (PPI) data will be released, followed by June retail sales figures on Thursday. Additionally, Friday will see the preliminary results of the University of Michigan’s consumer sentiment survey for July. This report is closely watched for its one-year inflation expectations. The annual rate surged to 6.6% in May before dropping to 5% in June. If this downward trend continues, it could reinforce the view that inflation risks are easing, potentially leading to a modest pullback in the dollar.

Gold Eyes CPI as Tariffs BiteGold (XAU/USD) continues to push higher, recently hitting $3,360. The latest catalyst: escalating trade tensions, as President Trump imposes a fresh round of 30% tariffs on EU and Mexican goods. This is boosting safe-haven demand and weighing on the dollar, albeit modestly. Still, with the Federal Reserve signalling a cautious stance on rate cuts, gold may need an additional spark to clear long-term resistance.

Chart Setup:

• Current Resistance: Gold is trading just below $3,365, a multi-session ceiling.

• Indicators: The RSI remains above 50, reflecting bullish momentum.

• Breakout Potential: A strong CPI print tomorrow could challenge this uptrend. But if CPI cools, gold could test the $3,400 psychological barrier.

• Pullback Risk: A drop below $3,350 (23.6% Fibonacci) could bring us back to the $3,340–$3,320 support zone.

Markets are on edge ahead of Tuesday's U.S. CPI report, which may significantly influence inflation expectations, Fed policy, and safe-haven demand.

Adjust after shock and then go longNews: In the early Asian session, spot gold rose slightly, reaching a high of $3,372.65/ounce, the highest since June 23. Trump announced last weekend that he would impose a 30% tariff on goods imported from the EU from August 1, which further heated up the market's concerns about international trade and provided momentum for gold prices to rise. In the early Asian session, spot gold rose slightly, reaching a high of $3,373.99/ounce so far, the highest since June 23. Trump announced last weekend that he would impose a 30% tariff on goods imported from the EU from August 1, which further heated up the market's concerns about international trade and provided momentum for gold prices to rise.

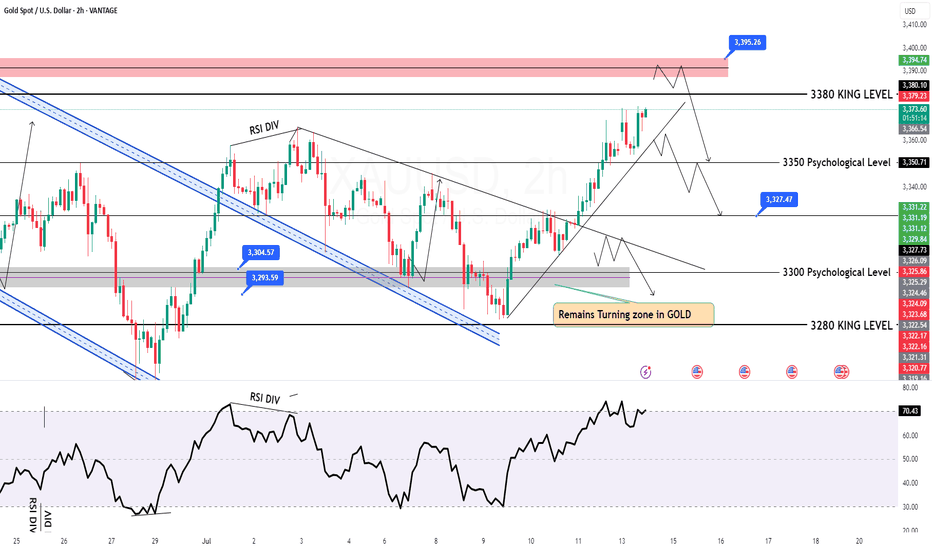

Analysis of gold trend: Today it hit a new high at around 3373. From the daily chart, gold has closed three consecutive positive days. The K-line pattern is a bullish signal. From the indicators, the RSI turned upward from a low level, and the Stoch indicator formed a golden cross at a low level. It is currently running in the middle. The indicators show that gold is still likely to rise in the short term. At the same time, we should also pay attention to the suppression of the 3400 area on the upper track of the daily Bollinger band. In the short term, pay attention to the breakthrough of this level. Once 3400 is not broken through for multiple times, gold will still fall back to test the 3280 support in the future. Once it breaks through 3400, gold will test the 3450 area. In the short term, it is still likely to rise. The operation strategy remains unchanged.

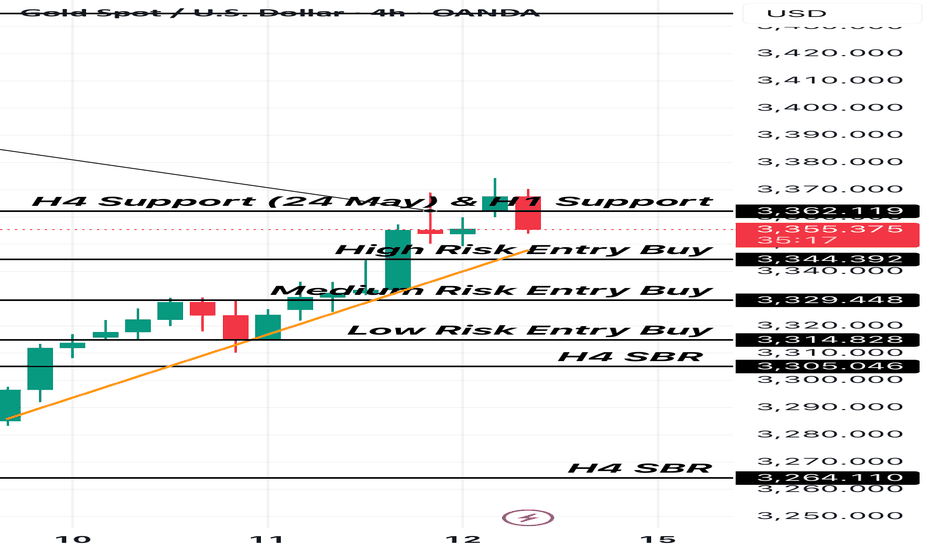

XAU/USD Setup THIS WEEK

Expecting a drop into the 3300–3310 zone, where we have:

4H Fair Value Gap

Trendline confluence

Liquidity below New York Low

From there, looking for a potential bullish reaction targeting:

📈 3405 – area with resting liquidity above recent highs.

📍 No confirmed bullish structure yet — waiting for a shift on the 5M/15M timeframe to confirm entry.

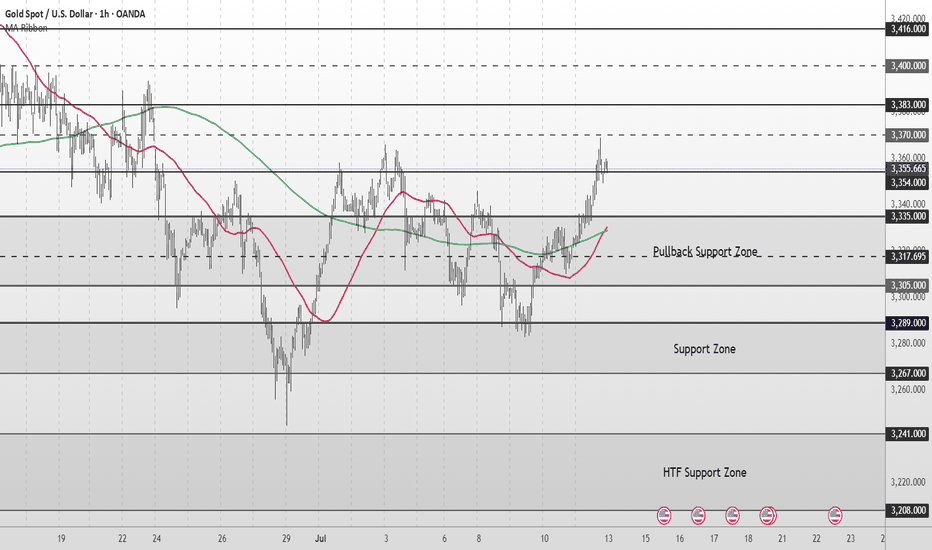

Gold Medium to Short Term Outlook Gold has shifted into a bullish structure after reclaiming key technical levels.

The strong impulsive move from below $3,300 into the $3,354–$3,370 resistance area reflects renewed buying interest, likely driven by improving sentiment and shifting macroeconomic expectations.

If bulls maintain control and price breaks and holds above $3,354, we could see continuation toward $3,383 and $3,400, with $3,416 marking the next major higher-timeframe resistance. These levels will be critical in determining whether gold resumes a broader bullish trend or begins to stall into a deeper correction.

On the flip side, if gold begins to fade below $3,354, then the $3,335–$3,305 pullback support zone will be key for potential bullish re-entry attempts.

A sustained break below this area would invalidate the current bullish leg and expose the market to a deeper retracement toward $3,289–$3,267, with $3,241–$3,208 acting as the higher-timeframe support floor.

📌 Key Levels to Watch

Resistance

‣ $3,370

‣ $3,383

‣ $3,400

‣ $3,416

Support

‣ $3,335

‣ $3,305

‣ $3,289

‣ $3,267

‣ $3,241

‣ $3,208

🔎 Fundamental Focus

Multiple high-impact U.S. data releases this week, including CPI, PPI, Retail Sales, and Unemployment Claims.

Expect elevated volatility across sessions.

⚠️ Manage your risk around news times. Stay sharp.

"Gold at a Crossroads! Bullish or Bearish? (Trade Plan)"🦹♂️💰 "Gold Heist Alert: XAU/USD Bullish Raid or Bearish Ambush?" 💰🦹♂️

🌍 Greetings, Market Pirates & Profit Raiders! 🌍

(Hola! Oi! Bonjour! Hallo! Marhaba!)

Based on the 🔥Thief Trading Method🔥, here’s our strategic heist plan for XAU/USD (Gold vs. Dollar). Follow the chart markings for high-probability loot zones—whether you're a bullish bandit or a bearish burglar! 🏴☠️💸

🎯 Entry Strategy (Where to Strike)

"The treasure is ripe for taking! Breakout = GO TIME!"

✅ Long Entry (Bullish Raid): Jump in at current levels if the uptrend holds.

✅ Short Entry (Bearish Ambush): Wait for a break & close below 3280.00 (confirms downtrend).

🛑 Stop Loss (Escape Route)

🚨 For Bulls: Bail out if price hits 3240.00 (SL tightens if trend strengthens).

🚨 For Bears: Retreat if price surges past 3360.00 (only activate SL post-breakout!).

🎯 Take Profit (Loot & Scoot!)

💰 Bullish Thieves: Aim for 3600.00 (or exit early if momentum fades).

💰 Bearish Bandits: Target 3125.00 (or escape before the cops—err, reversal—arrives).

📡 Market Intel (Why This Heist?)

Gold’s in a neutral zone (but bulls have the edge! 🐂📈). Key factors:

Macroeconomic shifts

COT data clues

Sentiment & seasonal trends

(Full breakdown in the chart notes—klick the 🔗! 🔍🌐)

⚠️ Danger Zones (News & Risk Control)

🚨 High-Impact News = NO NEW TRADES!

🚨 Protect open positions: Use trailing stops to lock in profits.

🚨 Adjust SLs if volatility spikes!

💥 Boost the Heist! 💥

Like & Share to fuel our next market robbery! 🚀💰

Follow for more lucrative trade setups—coming soon! 👀🔥

🎯 Trade Smart, Steal Smarter! 🦹♂️💎

GOLD Breakout or Fakeout? Thief’s Guide to Safely Rob the Move!🏆 XAU/USD Master Plan: Loot the Bullish Rally Before the Bearish Trap!💨💰

🌟 Hola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💸

🔥 Thief Trading Strategy Alert 🔥

Time to execute our gold heist on XAU/USD! Based on technical + fundamental looting tactics, here’s the play:

📈 ENTRY ZONES (4H TIMEFRAME)

BUY: Sneak in at Market Maker’s Buy Zone (Pullback Entries Only!).

SELL: "The vault’s wide open!"—Ambush bearish traps at risky highs (Red Zone).

🛑 STOP-LOSS (THIEF RULES)

Hide your SL at:

Past key lows OR nearest swing low (4H).

Adjust based on your risk, lot size, & robbery multiplier.

🎯 TARGET: 3525.00 (OR ESCAPE EARTHER!)

Scalpers: Long-side only! Trail your SL to lock loot.

Swing Thieves: Join forces—big pockets or small, execute the plan!

⚠️ WARNING: NEWS = VOLATILITY TRAPS!

Avoid new trades during news.

Use trailing SL to protect stolen profits.

📰 FUNDAMENTAL LOOT LIST (READ BEFORE HEIST!)

COT Report, Macro Data, Sentiment Outlook—Link in bi0! 🔗🤙🏻👉🏻👉🏻

Gold’s bullish now… but robbers adapt fast!

💥 BOOST THIS PLAN = STRONGER GANG!

Hit 👍 & Share—More boosts = More gold stolen daily!

Stay tuned… Next heist drops soon! 🚀🐱👤

GOLD UPDATE Hello friends🙌

📉Regarding the decline we had, which we also analyzed for you and said that the price is falling...

✔Now, with the support hunt identified, you can see that the price has returned strongly and broken the identified resistance and managed to reach higher ceilings, which also created a QM pattern, which increases the likelihood of the upward trend continuing.

Now with capital and risk management you can move towards your specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

XAUUSD Support & Resistance Levels🚀 Here are some key zones I've identified on the 15m timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!

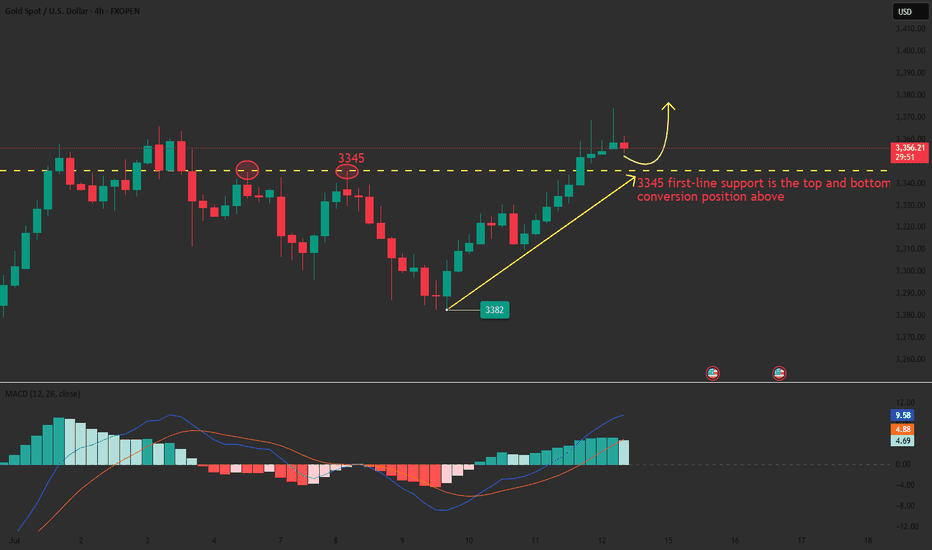

Analysis of Gold's Trend Next WeekThe current uptrend for gold is clear. If there is a pullback at the opening next week, still recommends prioritizing long positions.

From a technical perspective, the 1-hour moving average has formed a golden cross, indicating strong bullish momentum. After breaking through in the afternoon, gold prices pulled back to test the 3330 support level, and the confirmation of its effectiveness has led to the formation of a short-term support structure.

It should be noted that although the 1-hour chart shows a relatively strong trend with a small pullback range, the risk of a deep correction remains a concern.

The operational suggestions for next week focus on the following support levels:

The first support level is 3345 (the bull-bear watershed).

The second support level is 3330 (a key support).

If prices pull back to around 3345 and stabilize, light positions can be taken to test long positions. If 3330 is broken down, the trend needs to be reassessed.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Is Gold (XAU/USD) Ready to Bounce? Bullish Setup on Key TrendlinHi traders! , Analyzing XAU/USD on the 1H timeframe, price is currently bouncing off a long-term ascending trendline, showing signs of a potential bullish continuation:

🔹 Entry: 3318

🔹 Take Profit (TP): 3424

🔹 Stop Loss (SL): 3207

After testing the ascending trendline multiple times, gold is once again showing bullish rejection near support. Price remains above the key trendline and is attempting to form a higher low within the broader uptrend.

The RSI is recovering from oversold territory (currently around 49), which suggests weakening selling pressure and possible buildup of bullish momentum.

If the structure holds, the target at 3424 aligns with a previous resistance area and a natural extension of the upward channel. The risk-reward is favorable with a strong technical confluence backing the setup.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for managing their own risk and strategy.

The rebound is under pressure and the retracement is furtherFrom the 4-hour analysis, the support below today is around 3309-16.

The short-term bullish strong dividing line is around 3295-3301. The overall bullish rhythm of high-altitude and low-multiple continues to remain unchanged.

Before the daily level falls below the 3300 mark, any retracement is a long opportunity, and short positions against the trend should be cautious.

THE LONG SHOT 〉POTENTIAL OUTLOOKAs illustrated, I'm trying to visualize how a potential continuation impulse could look like during " Bullish July " and toward the end of the year (depending on how aggressive buyers step in; specially central banks and institutions).

As you can see on this Daily chart, price respected a long term trend line + is forming higher lows, funneling into a shorter and shorter range of accumulation.

This is a very strong bullish behavior; when price gets tighter and tighter respecting a resistance level, but making higher lows. It tends to indicate that price is accumulating and "loading" (sort of speak).

Now, analyzing gold from the fundamental aspect, one MUST align those factors with price. In other words: DOES IT MAKE SENSE TO BE BULLISH OR "THINK" PRICE COULD RISE?

Well, ask yourself and do the research on the following (but not limited to) questions:

1. How is the US dollar doing? (Since it is the world's "reserve" currency)

2. Are the interest rates in the USA favoring the economy?

3. How is the world economy as a whole doing?

- inflation in the top world powers and important economies?

4. How is international trade policy looking like for the world?

- Positive or negative? Are countries happy with each other currently, trading without any issues? (Or maybe... there's a tariff war and a trade war goin on?...)

5. Politically speaking, is the general public UNITED or POLARIZED? (politics is a key fundamental aspect for the price of gold, as it either adds to uncertainty and tensions, or it calms things down).

6. Geopolitically speaking (and most importantly); is the "conflict" (war) ending, getting better, resolving? ...

7. Where is the money going and flowing? Black rock, vanguard, and other top hedge funds; where are they investing their money? ( because central banks keep BUYING gold... )

Those are some of many many questions one must study and understand, in order to align the technical aspects of the price of the yellow metal.

If any question/factor DOES NOT POINT to bullishness in price, then the technical and price projection of any analysis starts to have weakness.

On the other hand, if the fundamental factors and questions in play INDEED POINT toward an uncertain situation, adding bullishness to the price, any analysis and bullish projection simply has those aspects to its favor.

--

GOOD LUCK!

persaxu

IMPORTANT BREAKOUT 〉BULLS ARE BACKAs illustrated, price has broken out of an important 4H and 1D trend line that had kept price bearish since the beginning of the month.

Yesterday, gold made its way to a ket resistance level and broke it, CLOSING above it in the 4H timeframe, which is a key sign that bulls are back.

An interesting sign is that price bounced from the 61.8 - 67% retracement of the last bullish impulse that had an extended correction.

Should price manage to stay above 3250-3300 next week, , (a very strong psychological and algorithmic price range), the path to a new ATH is well opened and the probabilities arise on its favor.

I try to visualize a potential buy area shown in green, and the invalidation of this idea would be the level from which price has bounced.

--

I have been bullish on gold since 2023, ignoring any correction to be a "bearish market" and rather accumulation phases of longer term potential for growth.

The world economy and geopolitical conflict along many other financial macroeconomic data and circumstances, are simply NOT pointing toward a better future, and gold is screaming so by continuing to rise, and central banks back this up by continuing to buy it physically.

--

GOOD LUCK

Uptrend at the end of the week 3367, maintain the upward force⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) are on track to notch a third straight day of gains on Friday, climbing toward the upper boundary of this week’s trading range as escalating trade tensions fuel safe-haven demand. In a significant intensification of global trade disputes, US President Donald Trump issued formal notices this week to multiple trading partners, detailing individual tariff rates set to take effect on August 1 should no agreements be reached. This has rattled investor sentiment and weighed on risk assets, offering solid support to Gold.

Meanwhile, expectations for an imminent interest rate cut by the Federal Reserve (Fed) have cooled following last week’s strong US jobs data. As a result, the US Dollar (USD) remains firm, holding near a more than two-week high reached on Thursday. This USD strength could limit the upside for the non-yielding yellow metal in the near term. Therefore, traders may look for a sustained breakout before committing to further bullish positions in the XAU/USD pair.

⭐️Personal comments NOVA:

Gold price breaks 3330, maintaining good buying pressure, recovering at the end of the week

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3367- 3369 SL 3374

TP1: $3355

TP2: $3342

TP3: $3325

🔥BUY GOLD zone: $3306-$3308 SL $3301

TP1: $3315

TP2: $3325

TP3: $3338

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account