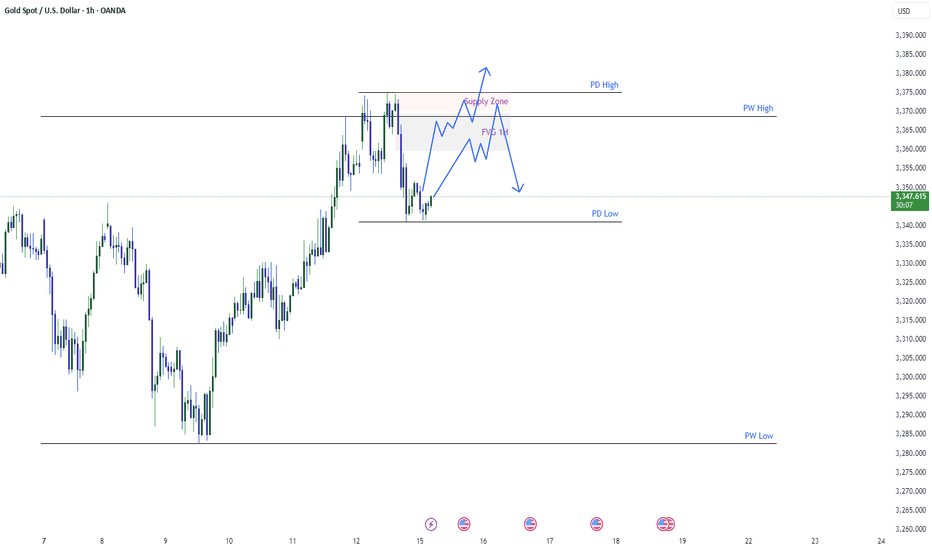

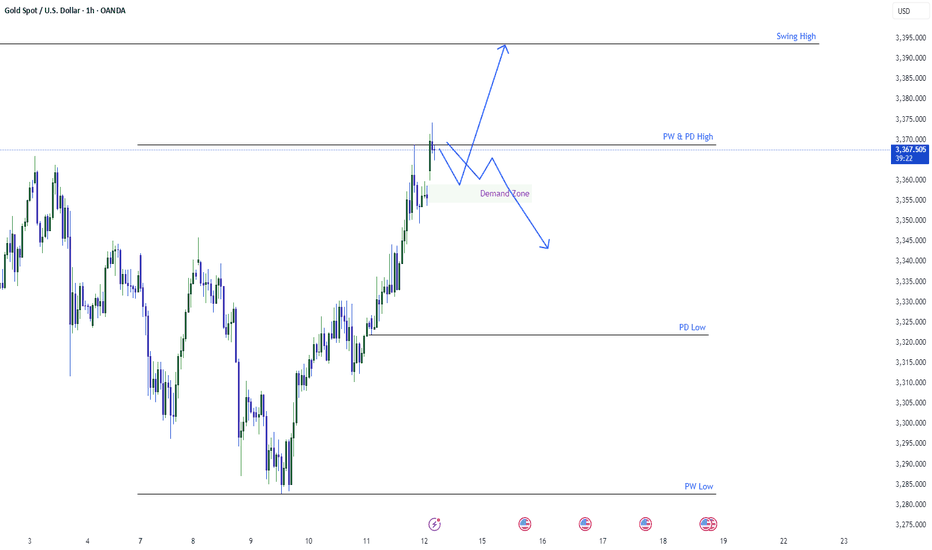

Gold OutlookGold took previous week high and gave bearish move. The gold overall scenario shows it is bullish. The possible move for the gold will be to touch FVG retrace and go towards supply zone and again retrace back. Or if buyers step in we may see good bullish move gold might touch supply zone retrace a little bit follow the bullish path.

Xauusdoutlook

Gold trying to cross 3400Gold has show bullish momentum by crossing the previous week high which was residing around 3369. Filed the previous gap available. We expect gold to go higher and touch the 2293 level which is a swing high. Another possibility would the to after taking previous week liquidly may give us a deeper pullback. The possibilities for the gold are shown in the graph accordingly.

Gold Price Surpasses $3,200 for the First Time in HistoryGold Price Surpasses $3,200 for the First Time in History

According to the XAU/USD chart today, the price of an ounce of gold is fluctuating above the $3,200 level on global exchanges — a level never reached before.

Since the beginning of 2025, gold has gained approximately 22%.

Why Is Gold Rising Today?

Today’s bullish momentum in the gold market is driven by two key factors.

First, inflation data. Figures released yesterday for the CPI (Consumer Price Index) revealed a slowdown in inflation in the United States. This suggests a greater likelihood of monetary policy easing by the Federal Reserve. According to Reuters, gold prices now reflect expectations of three interest rate cuts by the end of 2025 — and lower rates typically support a stronger XAU/USD.

Second, fears of a global recession. Although US President Donald Trump has introduced a 90-day delay on the implementation of international trade tariffs, this does not apply to China, where tariffs have been increased to a striking 145%. Traders fear that Beijing could retaliate by raising tariffs on US goods beyond the current 84%.

Technical Analysis of XAU/USD

At present, the gold market is showing strong upward momentum, which began in early March (as illustrated by the blue trend channel). Key points include:

→ A breakout above the upper boundary of the channel;

→ The RSI indicator suggests a potential bearish divergence forming.

This points to the possibility of a short-term pullback into the blue channel, which would be a natural correction — especially considering the rapid $200 surge from $3,000 to $3,200 over just two days. However, given the current news backdrop, it seems unlikely that the bulls will relinquish control anytime soon.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Is Gold's correction over?In my recent analyses, I warned that a significant correction in Gold prices was inevitable.

True to this prediction, the election of Donald Trump triggered a sharp 1,000-pip drop in Gold's value.

However, yesterday, the market rebounded strongly, recovering 700 pips from that initial decline.

The big question now is whether this correction has run its course.

In my view, we may have reached a bottom, and Gold could be poised to resume its overall uptrend.

I’m currently looking for buying opportunities on dips.

Uncertainty in Gold: Is a New Leg of Correction on the Horizon?Yesterday, OANDA:XAUUSD exhibited significant volatility, with sharp fluctuations both upward and downward. However, by the close of the session, the price remained relatively unchanged, lacking a clear directional trend. The current price movement suggests a phase of consolidation, indicating that a more definitive direction may emerge soon.

Traders are now observing key levels that could guide future moves. On the upside, the 2663-2665 zone is seen as a resistance level, which could signal a bullish breakout if breached. Conversely, the 2645-2650 range serves as a support zone, indicating a potential bearish move if the price falls below this level.

From a personal perspective, I anticipate that gold might break to the downside, leading to a new corrective phase that could potentially drive the price toward the 2600 level.

That said, this is merely my view, and there is always the possibility of being wrong. Therefore, my invalidation point for this bearish scenario would be a break above the established resistance zone, which would signal the need to reassess the situation.

In conclusion, while the market remains in a state of indecision, these key levels provide traders with important reference points to monitor for potential breakouts or reversals in the near future.

XAU/USD: Is the 2650 Break Sustainable or Driven by Emotion?Yesterday, OANDA:XAUUSD (Gold) broke back above the 2650 level, a point of significant psychological and technical importance. This level is critical due to the confluence of a horizontal support line and the falling trendline of the down-channel pattern.

While this upward break may seem promising, I believe it is not likely to be a sustainable move.

In my view, this breakout appears to be driven more by emotional reactions rather than genuine market demand.

As a result, I believe the current correction for Gold is not yet complete, and we could see another downward move in the near future.

From a technical perspective, the 2650 level acts as a critical "line in the sand." Should the price drop back below this level, the first target would likely be the recent low, with the potential for an extended decline towards the next major support zone around 2590. This area marks an important technical level that could offer stronger support if the downtrend continues.

At the time of writing, I am currently out of the market, and waiting for further clarification.

I am particularly looking for a decisive drop back below 2650, which would reinforce my bearish outlook and provide confirmation for a potential short trade.

XAUUSD: Fed Chair Powell Speaks!Late on Tuesday, US President Joe Biden expressed concerns about China's significant challenges, sparking fears about the global economy and a potential conflict between the US and China. These apprehensions have also prompted gold buyers to take action. Adding to this, the Wall Street Journal (WSJ) reported that the Biden administration is contemplating imposing additional limitations on the export of artificial intelligence chips to China. This move is driven by mounting concerns over the potential technological advantage that US adversaries could gain.

Support levels: 1,903.80 1,888.10 1,870.15

Resistance levels: 1,924.05 1,933.50 1,941.90

XAUUSD DETAILED Video Analysis, with a trading plan👉I believe that "right or wrong" mentality is a fundamental flaw of any beginner. In reality, a trader is right only when he executes the system and follows his rules, and he's wrong only when he's taking random setups. A trader should find a system he's willing to work with long-term, hindsight test, backtest and then execute live, then refine until perfection.

🚀Thanks for your BOOSTS and support🚀

💬Send your comments and questions below, share your ideas and charts, I'll be glad to talk to you💬

XAUUSD WEEKLY, AT CRITICAL LEVEL, BELOW 1877 TESTING 1835XAUUSD formed candlestick pattern: Long Upper Shadow, Bearish Signal.

Break & Hold Below 1877, Cancel Bullish Medium Term Outlook. Turned to Neutral. Potentially Testing 1835 (MA 50 & 100 W) & 1785.

As a reference, You can also see my XAUUSD H1 bearish outlook www.tradingview.com

ABOVE 1660, BUY ON WEAKNESS.

Break & Hold Above 1998, Bullish Medium Term Outlook Resume.

Break & Hold Below 1660, Bearish Medium Term Outlook. But,

LONG TERM OUTLOOK STILL BULLISH !

XAUUSD, WHILE BELOW 1915 STILL BEARISH TO TARGET 1889 & 1877XAUUSD reversed and turned to neutral after broke 1948.

Then, quickly turned to bearish after broke 1915.

As I said in the previous idea,

"But, if Break below 1915, outlook bearish , open the way to target 1889 & 1877."

Now, XAUUSD still heading to 1889 & 1877.

Strong Support 1877, if break then cancel medium term bullish: medium term outlook neutral.

Break Below 1877, could open the way to target 1853 & 1818.

Resistance at 1915 & 1948.