SHORT ON GOLD (XAU/USD)Gold has found a ceiling and has given a bit of a double top with a change of market structure from up to down.

Its currently retesting the supply area that provided the choc (change of character)

I will be selling gold to the next support level looking to make a $50 move which is 500 pips.

Xauusdsell

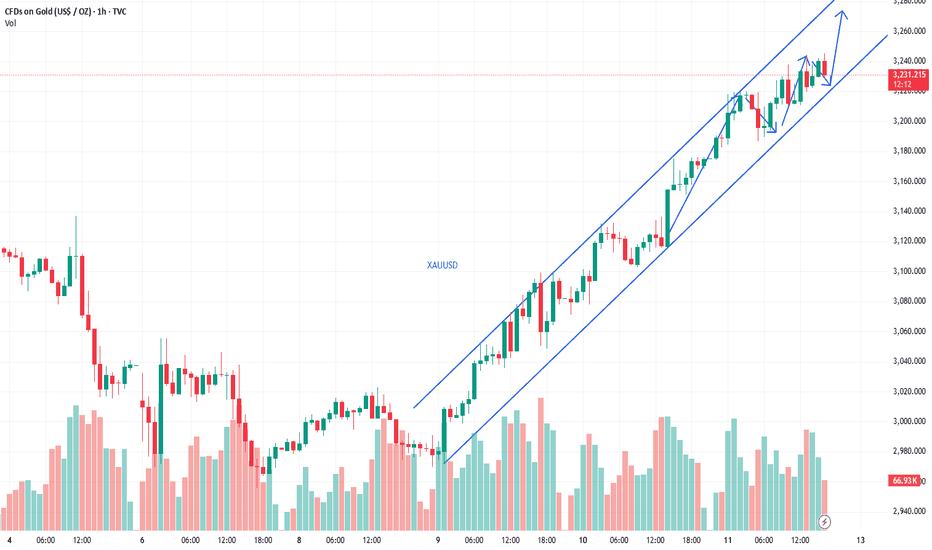

GOLD 2 Excepted Scenarios Very Clear , Which One You Prefer ? Here is my opinion on GOLD Chart , the price broke the highest Res , and continue to upside , so i think we have 2 ways in this pair right now , if the price go back to retest the broken res area and give us a good bullish Price Action we can enter a buy trade with smal lot size cuz the price at very high price , and if we have a clear closure below it , we can enter a sell trade with 500 pips target .

Gold's main rise is not over yet, long is still the core strategHeading into next week, we maintain a bullish medium-term outlook on gold, with a continued preference for trend-following long positions.

Although short-term bearish attempts persist, the broader upward structure remains intact, with pullbacks presenting tactical buying opportunities.

Key support is observed around $3,200/oz, which serves as a strategic level for initiating low-risk long entries within the ongoing uptrend.

XAU/USD is about to reach the 3300 - point level.The long-term upward trend remains unchanged. Tariffs are still a major variable causing significant fluctuations in gold.

U.S. Tariff Policies

Since April 9th, the United States has imposed tariffs ranging from 10% to 25% on goods from China, the European Union, Canada, and other regions, covering key sectors such as automobiles, steel, and semiconductors.😒

Countermeasures of Various Countries

China: On April 4th, China announced that it would impose a 34% tariff on U.S. goods starting from April 10th. On April 9th, the tariff rate was further increased to 84%, covering all U.S. goods.😠

The European Union: Announced that it would impose a 25% tariff on U.S. motorcycles, diamonds, and other goods starting from May 16th.😤

Canada: Imposed a 25% retaliatory tariff on U.S. automobiles on April 9th, but exempted auto parts.😏

At present, the rise of gold is still driven by the demand for a safe haven. It remains uncertain whether the 104% tariff will actually be implemented. Once relations deteriorate, it will truly be bullish for gold again. In the short term, this is definitely something that needs to be closely monitored.🤔

This upward movement has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟.

💰💰💰 XAUUSD 💰💰💰

🎯 Buy@3220 - 3230

🎯 TP 3270 - 3300

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

Gold Shows Downward Correction, Short Strategy Timely EnteredIn the previous trading signal, it was advised to take profits around $3235. Based on the latest market analysis, gold prices are expected to experience a downward correction. Therefore, it is recommended to open short positions around $3230. Investors should closely monitor market trends and adjust stop-profit levels in response to price fluctuations to secure profits. Please remain flexible and responsive to market changes, capturing every trading opportunity with precision.

Gold Prices Decline, Short Strategy Successfully Captures ProfitCurrently, gold prices are showing a clear bearish trend, previously fluctuating around $3240. Based on market predictions, there is a potential for further downward movement in gold. A short position was suggested around the $3240 level, and as the market corrected, gold prices have indeed dropped, allowing short-positioned investors to lock in profits. Congratulations to those who successfully capitalized on this short opportunity and secured gains. Stay alert to market developments and carefully adjust your stop-profit levels to ensure the stability of your returns.

Gold's safe-haven demand surgesThis week, concerns over a global economic slowdown have swept across Wall Street, becoming the dominant market sentiment. In this context, U.S. President Trump's erratic messaging on tariff policies has triggered a panic sell-off in U.S. stocks, bonds, and the dollar, highlighting gold's position as a safe-haven asset. Gold prices have surged sharply, breaking through all previous resistance levels and maintaining an upward trend. Given the ongoing risk-off sentiment, the bullish momentum in gold remains strong, and the market may continue to trend higher in the near term.

In this market environment, it is recommended that investors take long positions near $3220 and consider taking profits around $3230 to fully capitalize on the current uptrend in gold. For additional trading signals, Please stay tuned.

Gold Breaks $3240, Shorting Opportunity EmergesGold prices have now surged to around $3240, continuing the recent strong upward momentum. Based on the previous trading signal, a long position at $3220 was suggested; however, due to the high volatility, many investors may have missed the opportunity to go long at that level. At this point, with prices approaching $3240, it may be an opportune time to establish short positions, with a target profit around $3225. Please note that this is just personal advice, and actual trading decisions should be made with attention to changes in key price levels.

4/11 Gold Trading StrategyFresh High Above 3170 – Momentum Continues, but Chasing Longs Is Risky

Gold delivered a strong one-sided rally yesterday, rising from around 3078 to above 3170, setting a fresh short-term high. While CPI and jobless claims data were modestly bullish, most of the rally occurred before the data release, suggesting that the move was primarily technically driven rather than fundamentally triggered.

As we anticipated yesterday, the price did reach above 3170 , and as clearly stated, we did not recommend chasing long positions at those highs. This view remains unchanged today.

🔍【Technical Insights】

The recovery from 2955 back to 3160+ took just 2 sessions, versus 4 sessions for the prior drop from 3167 — a clear sign of momentum dominance.

The daily chart shows two strong bullish candles, typically a sign of follow-through potential.

However, new highs reached under this structure tend to attract profit-taking and possible pullbacks.

If a technical correction occurs, look to 3143–3128 as a meaningful support zone for long opportunities.

🎯【Today's Gold Trade Setup】

🔻Sell Zone: 3188 – 3215

Look for short entries near resistance after overextension

🔺Buy Zone: 3134 – 3112

Wait for a healthy pullback to consider long positions

🔄Range Zone: 3178 – 3143

Flexible trading range — favor quick in/out trades in the zone

XAUUSD hit a new record high!calm downDue to the influence of various factors, the price of gold has reached a new high and has already set a new historical record. Will it make an attempt to break through the 3200 mark?

Perhaps we should step out of the madness of the gold price and observe the market calmly. I think it will fluctuate within a certain range in the short term, and we can make a profit by choosing to go long or short at the appropriate price points.

XAUUSD trading strategy

sell @ 3165-3170

sl 3180

tp 3155-3160

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

GOLD At Interesting Res Area , Should We Sell Now Or Wait ?Here is my GOLD Chart and this si 1H Time Frame , i`m looking to sell it if i have a bearish price action to confirm that the price will go down , i think the price will go up a little to make some wicks and take all stop losses before going down again maybe tomorrow, so i think we will see some stop hunts before the price going going down for 500 pips and then move again to upside very hard .

Gold: CPI Data Trading ViewsToday's signals for XAUUSD / BTCUSD / GBPUSD all hit their targets!

Congrats to everyone who followed—great profits all around!

🕒 Reminder: CPI data will be released in 1.5 hours.

Before that, we may see:

A quiet, ranging market, or

A pre-release pricing-in scenario that leads to sharp volatility ⚠️

Trading Suggestions:

✅ If you want to avoid unnecessary risk, it’s better to pause trading and wait for the data release

✅ If you're holding positions, please:

Manage your risk carefully

For large positions, consider partial closing or adding SL

Post-CPI Strategy Outlook:

Price has reached key resistance zones

If the data is bullish, further upside may be limited due to:

Proximity to recent highs

Remaining selling pressure in the market

Therefore, focus on:

High-level short entries or low-level long entries

Avoid blindly chasing the market—don’t go long at the top or short at the bottom

To sum it up:

Control your emotions, manage your positions wisely.

The 30 minutes after the CPI release will separate winners from losers!

Gold's Downtrend PersistsGold's Bearish Outlook Continues Despite Temporary Upside Spike

Market Overview:

The overall outlook for gold remains bearish, even though the market recently experienced a surprising and sharp upward movement. While a deep correction was anticipated and in line with prior expectations, the nature and timing of the recent surge raised some eyebrows among analysts and traders alike.

The unexpected bullish reaction came shortly after former U.S. President Donald Trump announced a 90-day suspension on reciprocal tariffs—a development that typically would not warrant such a dramatic price rally in gold. Normally, easing geopolitical or economic tensions would dampen safe-haven demand, causing gold to retreat. In this case, however, the opposite occurred, which suggests the possibility of non-fundamental drivers at play, potentially even artificial market influence or manipulation.

Technical Outlook:

Despite the sudden upward movement, gold’s larger technical structure has not changed significantly. The overall trend remains bearish unless we see a sustained breakout above the 3167 resistance level. A clean breach above that threshold would be uncharacteristic based on current fundamentals and could indicate external interference or speculative overreaction rather than a genuine shift in sentiment or macroeconomic conditions.

The price action continues to favor the bears, with lower highs and lower lows still forming on the larger timeframes. Until there’s clear evidence to the contrary, any rallies should be viewed with skepticism and treated as potential selling opportunities rather than the start of a new bullish trend.

Key Support Zones:

Looking at potential areas where gold may find some temporary footing, the following support levels should be closely monitored:

3054 – Minor support; could serve as a short-term pause point.

3000 – A psychological level and round number that often acts as a magnet for price action.

2925 – More significant historical support zone with prior buying interest.

2840 – Deeper support, aligning with the longer-term bearish trajectory.

Conclusion:

In summary, while gold has shown a sudden upward burst, the broader picture remains cautious. The technical indicators, market context, and recent price behavior all point toward a continuation of the downtrend unless key resistance levels are convincingly breached. Traders are advised to remain vigilant, avoid emotional reactions to short-term volatility, and refer closely to technical signals when making decisions.

The chart provides further clarity on this setup—feel free to review it for a more visual representation of the analysis.

Thank you for reading, and best of luck in the markets!

4/10 Gold Trading StrategiesGold maintained a bullish tone yesterday, with prices recovering steadily toward the 3100 level, offering smooth trade opportunities and favorable returns.

However, today presents a significantly more complex trading environment due to several high-impact events:

🇺🇸 US CPI (MoM + Core CPI)

📝 Initial Jobless Claims

🗣️ Fed speakers including Barkin and Schmid

Technically, gold is now at a crucial inflection point , where market interpretation diverges:

If this is merely a corrective rebound in a broader downtrend , the move may be near completion.

If instead it's a healthy retracement in an ongoing uptrend, we could be in the middle phase of a continued climb.

Given the mix of technical ambiguity and fundamental uncertainty, a neutral and reactive trading stance is essential today.

🎯【Recommended Strategy & Positioning】

Trade Against Emotional Swings

Avoid chasing price during high-volatility news. Look to sell after sharp rallies and buy after sharp dips , minimizing exposure to emotional trades.

Key Zone Analysis – Watch the Trapped Orders

3128–3158: Zone where many long positions may be trapped — watch for selling pressure.

3016–2978: Former short-entry zone — potential area for long-side reactivation if retested.

📌【Today's Key Trade Zones】

🔻 Sell Zone: 3143 – 3168

🔺 Buy Zone: 3013 – 2979

🔄 Flexible Zone 1: 3109 – 3058

🔄 Flexible Zone 2: 3045 – 3013

❗ Above 3170, focus only on short positions — avoid chasing long trades at elevated levels.

Gold: Watch for Selling OpportunitiesGold remains under pressure around the 3100 level, where previous trapped buyers are creating significant selling pressure. The heavier resistance zone lies between 3127–3146, so if you’re holding long positions, don’t be greedy — this is a crucial area to watch!

Tomorrow during the U.S. session, we’re expecting major economic data and headlines. The market will likely see high volatility, and instead of a clear one-way trend, there’s a higher chance of a two-way sweep (both up and down).

Trading Advice for Tomorrow:

Avoid chasing price or getting caught in emotional trades.

Control your position size — even if you end up holding during turbulence, a small and managed position won’t hurt you. You might even come out profitable.

But if you enter with full margin and no risk control, the result could be heavy losses or even blowing your account. This is my honest advice!

During the Asian and European sessions, the technical outlook favors short positions. Consider selling around the 3103–3123 zone, with support levels at:

3078 / 3066 / 3051 / 3027 / 3011

I will release updated strategies for the U.S. session tomorrow based on key data releases. Stay tuned and feel free to reach out if you have any questions.

Good luck and trade safe!

4/9 Gold Trading Strategies

Gold opened with a mild bullish tone yesterday but faced resistance near 3018 , pulling back briefly before attempting a second push toward 3023 . However, the rally failed to sustain, and price returned near the opening level. Compared to recent sessions, yesterday marked a clear contraction in volatility, suggesting either a bottoming formation or a setup for a directional breakout.

From both candlestick structure and indicator alignment, the market appears primed for a potential bullish push today. If momentum builds as expected, a test of the 3037–3043 resistance zone is highly probable.

On the downside, 2976 remains the key initial support , followed by 2952 , which was the previous local low.

On the fundamental side, no major data releases are scheduled today. However, updates related to tariff policies will likely be the main market driver, and could trigger intraday volatility.

🎯 【Trade Setup for Today】

🔻Sell Zone: 3047–3066

🔺Buy Zone: 2968–2942

🔄Flexible/Scalping Zone: 2978–3023

4/8 Gold Trading StrategyYesterday, gold dipped to the 2950 support zone, still under bearish pressure. However, the market did not enter into an extreme one-sided sell-off. Instead, an intraday rebound suggested that short-term buying interest is beginning to emerge.

Following last week's and yesterday’s sharp correction, the 1-hour technical structure has started to show early signs of a potential bottom. While a retest of the 2960–2950 area in the near term cannot be ruled out, the broader price action now supports the technical conditions for a medium- to short-term rebound.

Currently, gold is stabilizing around the 2980-2960 level. Even if additional bearish pressure emerges, the maximum downside support is expected in the 2919–2888 range. This suggests a likely transition into a low-level consolidation and base-building phase, rather than a continued steep decline.

From a technical perspective, the 3100 zone is a key corrective target for this pullback. The market may gradually move higher to complete a structure recovery, offering a limited-risk, clearly defined opportunity for the bulls.

📌 Key intraday resistance levels:

3018 → 3037 → 3058 → 3079

📌 Trading Strategy for Today:

🟢 Buy Zone: 2976 – 2948

🔴 Sell Zone: 3048 – 3062

🔁 Scalp/Range Zone: 3032 – 2998

Gold: Economic Risks May Drive Prices UpGold Surges Amid Global Uncertainty, Testing Key Resistance

Gold has continued its impressive rebound, climbing steadily from its recent trough at $2,957 to reclaim territory above the psychological $3,000 mark. This upward momentum is being driven by a confluence of macroeconomic factors, including a softening US dollar and a pause in the previously relentless climb of US Treasury yields. With markets recalibrating their expectations around interest rate cuts by the Federal Reserve, investor appetite for safe-haven assets like gold has gained renewed strength.

At the heart of the current rally lies mounting geopolitical tension, particularly the intensifying trade standoff between the United States and China. Washington's proposal to impose 50% tariffs on a broad array of Chinese goods has rattled global markets. In response, Beijing is signaling potential retaliatory measures, further stoking fears of a prolonged economic conflict between the world's two largest economies. These developments are injecting volatility into risk assets and increasing demand for traditional hedges such as gold.

From a technical standpoint, the precious metal is currently grappling with a significant resistance level near $3,013. If the price manages to consolidate above this threshold following the current retracement, it could pave the way for a continued upward drive toward the next resistance zones at $3,033 and $3,057. These levels represent key pivot points that could dictate the short- to medium-term trajectory of gold.

On the downside, immediate support lies at $2,996, with stronger backing at $2,981. These levels may provide a cushion for any near-term pullbacks, especially as traders look for opportunities to re-enter the market during dips.

The broader narrative remains highly fluid, shaped by the ever-changing dynamics of global trade policy and monetary strategy. As the tug-of-war between Washington and Beijing intensifies, markets are left navigating a highly politicized and uncertain environment. With neither side showing signs of capitulation—China maintaining its firm stance, and the US administration likely to resist backing down—the potential for further escalation remains high.

In this context, gold’s appeal as a strategic asset grows stronger. The current setup suggests that the metal may gain additional bullish traction if it finds support around the 0.5 Fibonacci retracement level or holds above $3,013. Investors are keenly watching these technical and fundamental cues, weighing the growing economic risks that could propel gold into a sustained rally.

"Gold Price Rejection Setup – Trendline + Resistance Combo"XAU/USD 1H Chart Analysis 🪙📉

🔹 Trendline 📐

* Descending trendline marked by 3 touches

* Shows consistent bearish pressure

* Price is respecting it—watch for rejections

🔹 Resistance Area ⛔

* Blue zone between $3,014 - $3,025

* Strong supply zone—price failed to break it before

* Potential reversal zone if price touches again

🔹 Entry Point 🎯

* Suggested short entry at $3,014.29

* Just under resistance + near trendline

* Great spot for catching a downward move

🔹 Stop Loss ⚠️

* Placed at $3,025.13

* Above resistance = smart protection

* Keeps risk under control if breakout happens

🔹 Target Point 💰

* Take-profit marked around $2,964.45

* Down at a key support level

* Clean risk-to-reward around 1:5 (sweet setup!)

🔹 Moving Average (DEMA 9) 📈

* Dynamic resistance (line hugging candles)

* If price closes below, confirms bearish move

Summary ✅

This setup is a classic trendline + resistance short. You're betting on price respecting resistance and heading lower.

Bias: Bearish 🔻

Entry: $3,014.29

SL: $3,025.13 🛑

TP: $2,964.45 ✅

Gold: Buy, Target 3004-3028On the 1H chart, the MACD is showing a bullish divergence, signaling a potential bottom. If gold can build a base around 2960-2980, bulls will have the upper hand from a technical standpoint.

While today's major macro news will hit during the U.S. session, technical analysis dominates the Asian and European sessions — which favors a buy-on-dip strategy.

The 3030 resistance, which wasn’t tested yesterday, may be reached today.

If the price drops unexpectedly, watch the 2946-2928-2916 zone for new buying opportunities — especially 2928-2916, which is a strong support zone.

Buy:2960 - 2980

TP:3004 - 3028

After a brief rebound, gold continues to be short-sellingThe gold 1-hour moving average is still in a downward dead cross short arrangement, and the gold short strength is still there. The gold moving average resistance has now moved down to around 3002. After gold fell below 3000, gold accelerated its decline again, indicating that gold is still at an important level around 3000. The volatility of gold has only increased recently, so don't think that the market has reversed because it seems to have rebounded a lot. The recent fluctuations of tens of dollars in the gold market are normal.

Trading ideas: short gold around 3000, stop loss 3010, target 2970

XAUUSD Breakdown Setup – Gold Bears Eye $2,845 Support ZoneGold (XAUUSD) has broken below its rising channel structure, signaling a shift from bullish momentum to potential bearish continuation. After a sharp rejection from the $3,167 high, price is currently consolidating just below the psychological $3,000 level, which now acts as resistance.

Key Technical Zones:

Current Price: $2,985

Resistance Zone: $3,000 – $3,005 (key rejection area)

Support Targets:

TP1: $2,923

TP2: $2,844

TP3: $2,832 (swing low)

Bearish Trade Setup:

📉 Entry Zone: If price retests and rejects the $3,000 resistance

📈 Invalidation Level: Break above $3,005

📉 Target Zones:

$2,923 – Previous structure support

$2,844 – $2,832 – Deeper support and channel base

Technical Confluence:

✅ Bearish flag formation following strong impulsive sell-off

✅ Channel break confirms shift in trend

✅ Lower highs and bearish momentum building beneath $3,000

✅ Strong psychological resistance at $3,000

XAUUSD - 2950 As the market is continuing its bearish order flow, I'm expecting it to react from the current supply range. Which is 1H supply zone and 15 refined supply zone.

Here’s the expected sequence of movement:

1. It gave a fake out from the channel pattern.

2. I expect a push higher to take out the previous LTF swing high, resulting in an iBoS.

3. Following that, I need market to give CHoCH and tap in the supply zone which caused the

CHoCH and continue to fall until it reaches the price lvl of 2950 range.

Even if the price starts to fall from the current trading price the plan is still the same 📉.

This is my current plan for now. If there's any changes arise, I will update the outlook accordingly.

Thanks you for your time..