Xauusdsell

Gold: Safe - Haven Drop, Short - Term BetsGold remains buoyed by safe - haven sentiment. Nevertheless, subsequent to a substantial rally to a high, gold underwent a swift retracement. In truth, the support for gold emanating from safe - haven requirements is a rather commonplace occurrence. Given that the bullish impetus in the gold market failed to persist, this implies that the upside potential for gold bulls is circumscribed. During the US trading session in the gold market, gold initially rallied and then declined. We directly initiated a short position on gold at $3032. As projected, gold declined, enabling us to realize profits. Should gold rebound to an elevated level during the US trading session, a short position should still be contemplated.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

XAU/USD Continue to shortToday, the gold short trading strategy has been profitable, although the brief spike back to test the 3035-3040 resistance zone, but we continue to choose to short.

Keep an eye on the resistance zone until it breaks through.

This week, the gold trading strategy was completely correct and the account made more than 200% profit in two weeks

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income,You can follow the link below this article

Buy or SellRecently, XAUUSD shows box - range oscillation between 3000 - 3040.

3000 serves as support and 3040 as resistance. Notably, 3000 demonstrated its strong support level yesterday. Keep a close eye on the 3000 support level. If it is broken, then it will likely trigger a downward trend, with prices potentially heading towards the next significant support area.

💎💎💎 XAUUSD 💎💎💎

🎁 Sell@3040 - 3030

🎁 TP 3010 3000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Analysis of Today's Gold Short - Selling StrategyYesterday, towards the end of the trading session, the gold price tested the vicinity of the $3,000 level again. Subsequently, it oscillated higher in the late trading, and continued to surge upward today. The Bollinger Bands are opening downward, indicating a distinctly bearish trend. However, there has been some support near the $3,000 mark, with signs of a short - term rebound. Pay attention to the resistance levels near $3,020 and $3,030. If the rebound fails to break through these resistance levels, the gold price is likely to decline again

XAUUSD

sell@3025-3035

tp:3010

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

The rebound presents a perfect opportunity to short gold.📍Gold has once again rebounded to the 3020-3025 range in the short term. You might think the bulls have regained control, but I see this rebound as a prime opportunity to short gold.

📍Currently, a new descending channel has formed within gold’s short-term structure. Despite multiple rebound attempts, the price has failed to break above this channel, further reinforcing its downward pressure. Additionally, on the daily chart, gold has printed three consecutive bearish candlesticks, undermining bullish sentiment and weakening confidence. This has also diminished the effectiveness of the 3000 support level, increasing the likelihood of further downside.

🔎Trade Idea:

Xauusd: Sell at 3015-3025

TP:3005-2995

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

The downward channel appears, or there will be a deep callback📍Gold's current upward momentum appears weak, with signs of a descending channel forming in the short-term technical structure. If gold fails to decisively break through the 3015-3025 resistance zone, it will confirm and reinforce the descending channel pattern, exerting further technical pressure on the metal.

📍Moreover, if gold breaks below the critical 3000 level during its decline, it would severely undermine bullish confidence, triggering further downside. In this scenario, the downside potential would expand, with gold likely extending its decline toward the 2990-2980 support zone.

🔎Trade Idea:

Xauusd: Sell at 3015-3025

TP:3005-2995

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

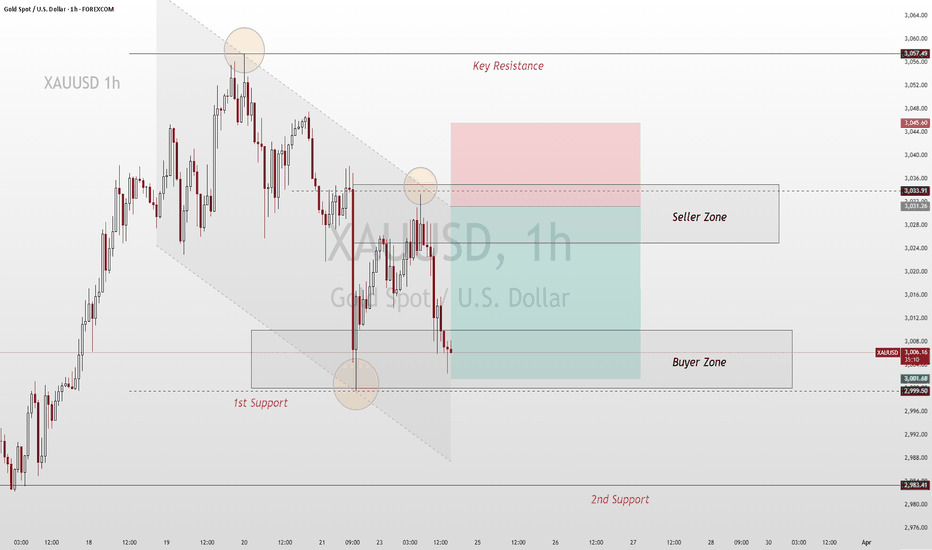

Current Analysis and Forecast of Gold PriceOn Monday, the price of gold exhibited relatively subdued behavior, largely oscillating within a narrow trading band.

During the European trading session, the yellow metal briefly ascended to test the $3,033 resistance level. Subsequently, in the US trading session, it encountered a significant pullback, with prices temporarily dipping to a low of $3,002.

Despite the emergence of a rebound, the momentum behind it appears lackluster. Looking ahead, in the subsequent trading, gold is anticipated to consolidate within the range of $3,000 - $3,030.

XAUUSD

sell@3025-3035

tp:3010

buy@3000-3010

tp:3030

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

XAU/USD Symmetrical Triangle Pattern Breakdown – Trading Setup📌 Chart Overview

The chart represents the Gold Spot (XAU/USD) on a 1-hour timeframe, where the price is currently consolidating within a symmetrical triangle pattern. This pattern consists of a series of lower highs and higher lows, indicating market indecision. However, as price approaches the apex of the triangle, a breakout is imminent, making this a high-probability trading opportunity.

The analysis suggests a potential bearish breakdown, with price action likely to drop toward key support levels if the lower boundary of the triangle is breached.

📊 Breakdown of Key Chart Elements

1. Symmetrical Triangle Formation

The symmetrical triangle is a well-known technical pattern that signals a period of consolidation before a significant move. It forms when:

Buyers and sellers struggle for control, resulting in a narrowing price range.

A breakout occurs when one side gains dominance, leading to an expansion in volatility.

In this chart, the price is trapped within the triangle, gradually forming a squeeze, and a breakout is highly likely.

2. Resistance & Support Levels

Understanding key support and resistance zones is crucial in determining the next price direction.

🟧 Resistance Zone (~3,030 – 3,058 USD)

Marked in yellow, this area has acted as a strong resistance.

Multiple rejection points suggest that bulls are struggling to push prices higher.

If price breaks above this zone, it could trigger a bullish rally.

🟦 Support Level (~2,990 USD)

This is a critical support zone that has been tested multiple times.

The lower boundary of the triangle aligns with this level.

A clean breakdown will likely trigger stop losses and aggressive selling pressure.

📉 Expected Breakdown & Price Projection

The price is currently trading near the lower boundary of the symmetrical triangle. Based on technical probabilities, the higher likelihood is a breakdown, which is why the trade setup leans towards a short-selling opportunity.

3. Retesting Area (~3,015 – 3,020 USD)

If price breaks below the triangle, it may retest the broken support before continuing downward.

The retesting area is a critical zone where sellers may re-enter to drive prices lower.

A failed retest (bounce back inside the triangle) would invalidate the bearish setup.

📈 Trading Strategy & Execution Plan

This setup presents a well-structured short-selling opportunity based on the expected breakdown scenario.

🔽 Short Entry Strategy

Entry Confirmation: Short position can be taken once price breaks and closes below 2,990 USD (triangle support).

Retest Entry: If price retests the breakdown zone (around 3,015 – 3,020 USD) and rejects, it confirms the bearish bias.

Aggressive Entry: Traders who take early positions can enter a short once price approaches the lower triangle boundary with a tight stop-loss.

🎯 Target Levels

Upon confirmation of a breakdown, price action is likely to follow a measured move toward the following downside targets:

Target 1: 2,942 USD (first major support level)

Target 2: 2,920 USD (next key demand zone)

These levels are determined by previous price reactions and historical support zones.

🛑 Stop-Loss Placement

To manage risk, a stop-loss should be placed above the recent swing high to protect against a fake breakout.

Safe Stop Loss: Above 3,058 USD (strong resistance zone).

Aggressive Stop Loss: Just above the breakout retest zone (~3,030 USD).

📌 Market Psychology & Risk Management

Traders should consider the psychological aspects behind this setup:

Bullish traders may attempt to defend the support zone, but a failure will lead to panic selling.

Smart money (institutional traders) often use fake breakouts to trap early sellers before driving the price lower.

Wait for confirmation before entering trades to avoid being caught in false moves.

Risk-Reward Ratio (RRR)

Entry: ~2,990 USD

Target 1: 2,942 USD

Target 2: 2,920 USD

Stop Loss: 3,058 USD

This setup offers an excellent risk-to-reward ratio (RRR), making it a high-probability trade.

🔎 Conclusion & Final Thoughts

The symmetrical triangle is at its final stage, and a breakout is imminent.

A break below 2,990 USD will likely confirm a bearish move.

Retesting the breakdown zone (3,015 – 3,020 USD) is crucial for short entries.

Downside targets are 2,942 USD and 2,920 USD based on historical support zones.

Proper risk management is essential—always use stop-losses to mitigate potential losses.

This setup presents a strong opportunity for short traders, but patience is key. Traders should wait for confirmation before committing to a position.

3/25 Gold Signal: 3009-3023 short, 2996-2982 longThe gold price rose above 3012. The long orders entered near 3004-2996 before the closing are currently profitable. From the trend pattern, there is still room for rebound, but it will take some time. During this process, the price may fluctuate. For friends who have already made profits, it is not worthwhile to bear the risk of profit taking, so this order can be closed first. Of course, if you don’t mind this risk, you can continue to hold it. I expect the rebound resistance to be around 3018.

In terms of the current big trend, the better long opportunities may be more inclined to the 2996-2982 area, because this is the starting point of the previous rise, and it can be regarded as a strong support platform. Usually in this case, the probability and amplitude of the rebound will be higher. Of course, if there is a reverse impact from news, asymmetric fluctuations are also possible.

Today’s main focus is the integer support of 3000. If it falls below, consider the support of the large range of 2996-2982, and the second is the resistance of the range of 3015-3023 during the current rebound.

The overall trading plan is that if the price falls below 3000, long positions will be opened in batches in the 2998-2986 range. If the rebound cannot break through 3023, short positions will be traded in batches in the 3009-3021 range.

I will update the specific transaction details in real time, so you can check them in time. If you have any questions, please leave a message at any time.

Gold focuses on suppression near 3038 aboveThe hourly chart suppression point of gold is around 3038. As long as the trend line is not stable, gold may still retreat. At present, we need to pay attention to whether 3038 can be stabilized. As long as you do not stand firmly above this position, you can rely on the 3030-40 range to go short.

XAUUSD:Continue short - selling at night.As long as gold doesn't stage a strong rally this week, the hourly moving averages of gold may continue to head downward. Eventually, if a bearish death cross and a short - biased arrangement are formed, the downside potential of gold can be truly unlocked. The resistance of the gold moving averages has now shifted down to around 3036. Therefore, there is still some resistance within this range.

Continue to engage in short - selling at high levels around the resistance of 3033. As long as this level remains unbroken, the strategy of shorting at highs between 3030 - 3033 remains unchanged. Set a stop - loss at 3040 and a take - profit at 3010. Be cautious of risks.

XAUUSD Trading Strategy:

sell@3030-3035

TP:3010

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

XAU/USD: Next Week's Short - Selling Tactic on BounceThe closing price of XAU/USD on Friday was 3,022.790.

Indeed, gold prices have broken through that key $3,000 support level, just as we anticipated.

Although the $3,000 support level was quite strong—it's always been a tough nut to crack—it still failed to hold firm.

Given the current market conditions, gold prices are set to continue their downward trend next week, no doubt about it.

Now, for the trading strategy: when the price rebounds to the $3,030 - $3,040 range, that's when you might want to consider short - selling.

Make sure to set the stop - loss slightly above $3,057 and the target price at $2,980. Simple as that, isn't it?

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

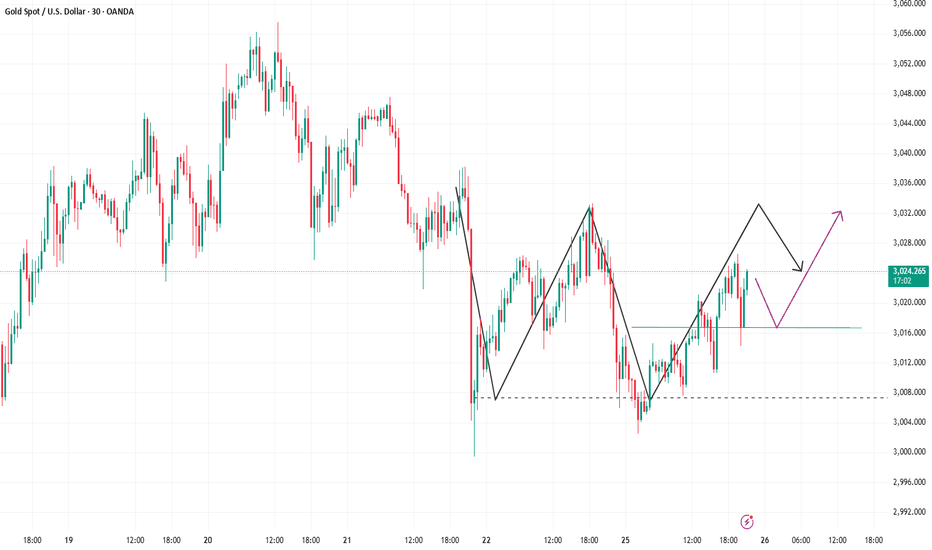

Gold: Trading signals during the European sessionGold is now making its first attempt at resistance. In this process, we can use the black trend line below and the purple trend line as reference support.

If the price does not actually fall below the test, there is a high probability that it will reach the 3037-3044 area. Therefore, during the European trading period, the 3037-3044 area can be used as an opportunity to enter the short position.

At the same time, pay attention to the long opportunities brought by the support area. For conservative trading, the area near 3025 can be used as an entry time.

XAU/USD – Triple Top Formation & Bearish Breakdown Potential📌 Overview of the Chart

This chart presents the XAU/USD (Gold Spot vs. USD) price action on a 15-minute timeframe, highlighting a classic Triple Top pattern. The Triple Top is a well-known bearish reversal pattern that forms after an extended uptrend. It signals that buyers have attempted to push the price higher multiple times but failed, indicating weakening bullish momentum.

This pattern is crucial for traders as it often precedes a trend reversal. The breakdown below the neckline (support level) confirms that selling pressure is taking over, leading to a potential decline.

📊 Identifying the Triple Top Formation

A Triple Top pattern consists of three peaks (Top 1, Top 2, and Top 3) at nearly the same resistance level. Here’s a detailed breakdown of its formation:

🔹 Step 1: Price Uptrend Leading to Resistance

Before the pattern develops, the price follows a strong uptrend with buyers dominating.

The price reaches a key resistance level and faces rejection (Top 1), signaling initial weakness.

🔹 Step 2: Repeated Attempts to Break Resistance

After pulling back slightly, buyers make another attempt to break through resistance (Top 2), but fail again.

This signals that sellers are actively defending this price zone.

🔹 Step 3: Final Rejection & Breakdown Setup

The third attempt (Top 3) fails to break resistance once more.

This repeated rejection confirms a Triple Top formation.

The price then moves toward the neckline (support level), which is a critical area for the bearish breakdown.

📉 Trading Setup & Execution Strategy

✅ Entry Point – When to Open a Short Position?

A short position is confirmed when the price breaks below the neckline with a strong bearish candlestick.

A breakdown with high volume strengthens the bearish confirmation.

Conservative traders may wait for a retest of the broken neckline before entering.

❌ Stop Loss Placement – Managing Risk

The stop loss should be placed above the highest peak ($3,039.076), ensuring protection against false breakouts.

If the price moves above this level, the Triple Top pattern fails, and the bearish setup is invalidated.

🎯 Profit Targets – Where to Exit?

After the breakdown, price action usually follows a measured move based on the height of the pattern. The following target levels are identified:

1️⃣ First Target: $3,000.962 → A key support level where price may pause.

2️⃣ Second Target: $2,991.766 → A deeper support area that aligns with the price projection from the pattern.

Risk-Reward Ratio: The trade setup offers a favorable risk-to-reward ratio, making it an attractive opportunity for short sellers.

📈 Confirmation Signals to Strengthen the Setup

To increase the probability of a successful trade, look for additional confirmations:

🔸 Volume Analysis:

A spike in selling volume at the neckline breakdown suggests strong bearish conviction.

Low volume breakdowns may indicate a false move, requiring extra caution.

🔸 Retest of the Neckline:

Sometimes, after breaking below the neckline, the price retests the level before continuing downward.

This provides a secondary entry opportunity for traders who missed the initial breakdown.

🔸 RSI & Momentum Indicators:

If RSI (Relative Strength Index) shows bearish divergence, it adds confidence to the downside move.

Momentum indicators like MACD crossing bearish further confirm selling pressure.

📍 Key Considerations & Risk Management

🔹 False Breakout Risk: If price bounces back above the neckline after the breakdown, it could be a false move. Waiting for confirmation reduces this risk.

🔹 Macro Fundamentals: Gold prices are sensitive to economic news, interest rates, and geopolitical events. Unexpected fundamental shifts can impact the pattern’s reliability.

🔹 Trailing Stop Strategy: To protect profits, traders can use a trailing stop-loss, adjusting as the price moves toward targets.

🔍 Summary & Trading Plan

📊 Pattern: Triple Top (Bearish Reversal)

📉 Bias: Bearish (Short Setup)

🛠️ Entry: Sell below neckline confirmation

🎯 Targets:

Target 1: $3,000.96

Target 2: $2,991.76

🚨 Stop Loss: Above $3,039

💡 Final Thoughts

The Triple Top pattern on XAU/USD suggests a high-probability bearish setup. A confirmed neckline breakdown signals selling pressure, with price targets well-aligned with historical support zones. Patience and confirmation are key—watch for a clean breakdown or a potential retest before entering.

Would you like any modifications or additional insights? 🚀

Golden Signal: Go Short in the 3027-3037 AreaLast Friday, gold rebounded to near resistance. Although the indicator in the 30M level chart shows that there is still some rebound momentum, the space is not very large, because the head and shoulders pattern has appeared in the early stage, and the pressure on the bulls is still very large.

Therefore, in the intraday trading on Monday, we can focus on short trading around the resistance area of 3027-3040. The single needle bottoming provides good support, so TP does not need to be set too large for the time being. The previous rising point of 3007 is used as a reference support, and TP is controlled in the range of $10-$16. Personally, it is expected to be in the 3018-3011 area.

I will update the specific trading information during the intraday, please pay attention to the content of the intraday update. If you have any questions, you can leave me a message, and I will reply to you in time when I see it.

I wish you all a prosperous new week!

3/24 Gold Trading Signal: 3027-3037 Range ShortThe market has opened. As mentioned in the previous article, gold still has a rebound. Under the current circumstances, our main focus is the resistance area of 3027-3037. I personally think that the probability of a direct breakthrough is not high, so we maintain the trading idea of shorting in this range.

During the decline, 3018/3015/3011/3007 are the support levels that need to be paid attention to.

If you have any questions, you can leave me a message. I will reply in time after I see it. In the new week, I wish you all a lot of money!

Analysis and Forecast of Gold Price Next WeekOn Friday evening, the spot gold price broke below the key support level of $3,000, which was in line with previous expectations. After reaching a phased high of $3,057, the market witnessed a rather significant downward movement.

However, the support at the $3,000 level was relatively strong. Although the price briefly fell below this level, it failed to stabilize effectively.

During the late trading session, the gold price rebounded technically and recovered to around $3,020.

Based on the current technical analysis and market sentiment, it is expected that the gold price will continue its weak downward trend next week, accompanied by certain corrective retracement.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Next week's analysis has been written, please check itOn Mar 21, 2025, XAUUSD closed at 3023, with the lowest 2999.32 and the highest 3047.43. Previous support was 3000 and resistance was 3060. Now let's analyze new levels and the trend.

New Support and Resistance

Pivot Point Theory: From Huicong Finance data on Mar 21, 2025, the pivot point for XAUUSD is 3042.41, with support at 2995.85 and resistance at 3090.92.

Technical Analysis: On the 4 - hour chart, support is near 3027.26 (20 - day MA) and in 3011 - 2996.90 range. Resistance is around 3056.20 - 3057.25 (previous high) and 3070 - 3085.

Trend Analysis

Technical: The 5 - day MA (around 3030) and 20 - day MA (2950 - 2942) are in a bullish arrangement, but the price has deviated. The 4 - hour chart shows a possible completed correction, yet there are divergence signs, indicating potential profit - taking pressure.

Fundamental: Geopolitical tension in the Middle East persists, supporting gold. US economic data is weak, fueling recession concerns and safe - haven demand for gold. The market still anticipates Fed rate cuts, which would benefit gold.

In short, XAUUSD may range - trade between 3000 - 3060 in the short - term. A break above 3060 could lead to higher prices, while a break below 2995.85 may open up downward space.

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

XAU/USD: Weekly Recap and Key Levels for Next WeekLast week, XAU/USD showed a pattern of high-level consolidation. After reaching the key psychological level of 3000 USD on March 17th, gold prices entered a sideways phase. On March 20th, gold hit a new all-time high of 3057 USD per ounce before pulling back. By March 22nd, gold prices had fallen for two straight trading days, briefly touching 2999 USD per ounce. However, dip-buying activity helped recover some of the losses.

From a technical perspective, the 5-day and 20-day moving averages remain in a bullish alignment. However, the price has deviated significantly from these averages, indicating a need for a technical correction.

Gold may continue its adjustment early next week, with support levels to watch in the 3000-3030 USD range. If geopolitical tensions do not escalate significantly, spot gold prices could test support near 2993 USD, though the likelihood of breaking below 3000 USD is low.

If gold prices fall below the 5-day moving average, they may further test the 20-day moving average support (2950.00-2942.00 USD). If the recent consolidation range is broken, the resistance levels to watch are the previous high of 3057 USD and beyond.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.