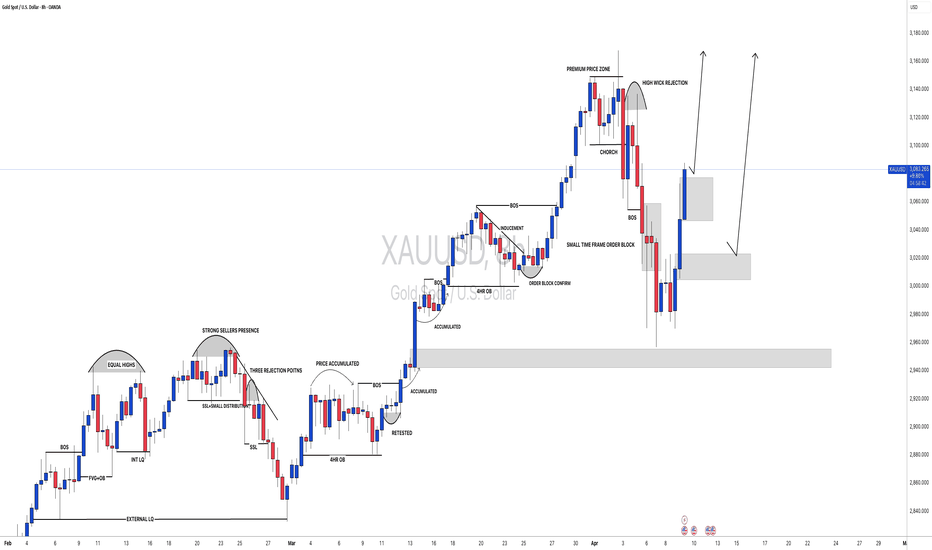

Xauusdsetup

Gold's main rise is not over yet, long is still the core strategHeading into next week, we maintain a bullish medium-term outlook on gold, with a continued preference for trend-following long positions.

Although short-term bearish attempts persist, the broader upward structure remains intact, with pullbacks presenting tactical buying opportunities.

Key support is observed around $3,200/oz, which serves as a strategic level for initiating low-risk long entries within the ongoing uptrend.

Gold (XAU/USD)Trade Setup – Bullish RBR Zone & High Reward Poten🔹 Key Levels:

📍 Entry Point: 3211 🔵

📍 Stop Loss: 3185.109 🔴

📍 Target Point: 3300 🟢

🔹 Market Structure:

📈 The price has formed a Rally-Base-Rally (RBR) zone 📊, which is a bullish continuation pattern 🚀.

🔄 The market surged and is now consolidating within the RBR zone 📦 before potentially resuming its uptrend 📢.

🔹 Trading Plan:

✅ Buy Entry: If price retraces into the RBR zone (around 3211), consider a buy position. 🛒📊

🔻 Stop Loss: Set below the base at 3185.109 to limit risk. ⚠️🚫

🎯 Take Profit: Aiming for 3300, a major resistance level. 🎯📈

🔹 Indicators & Confluence:

📏 DEMA (9): 3223.297 (Currently acting as resistance 🛑)

💰 Risk-Reward Ratio: Favorable setup (High Reward Potential ✅)

🔹 Potential Risks:

⚠️ If price drops below 3185, it could indicate a trend reversal 🔄⛔.

🌎 Economic News & Geopolitical Factors may impact Gold prices significantly. 📰📉

🔹 Conclusion:

📊 Bullish Opportunity 🦅📈 – If the price respects the RBR zone, it may continue upwards towards 3300! 🚀💰

XAU/USD 11 April 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed as per my analysis dated 04 April 2025 by targeting weak internal high and printing bullish iBOS.

We currently do not have an indication of bearish pullback phase initiation. Current CHoCH positioning is denoted with a blue dotted line.

Intraday Expectation:

Price to indicate bearish pullback phase initiation by printing bearish CHoCH.

It is possible for price to potentially print higher highs in order to reposition CHoCH closer to current price action.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

As mentioned in yesterday's analysis that I will continue to monitor internal structure following the printing of a bearish CHoCH.

Price has continued higher without a meaningful pullback, therefore, I will not classify previous iBOS, which is marked in red, as a bullish iBOS.

Intraday Expectation:

Price to indicate bearish pullback phase initiation by printing bearish CHoCH. Current CHoCH positioning is denoted with a blue dotted line.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

Trump's tariff announcement will most likely cause considerably increased volatility and whipsaws.

M15 Chart:

"Gold on Fire: Demand Zone Bounce with Bullish Target Ahead! "Key Zones & Levels:

Demand Zone 🔵

Area: 3099.36 – 3110

This is where buyers stepped in strongly before – price bounced up from here twice!

Strong support zone!

Resistance / Mini Consolidation ⚠️

Around 3125 – 3135

Price is hesitating here – needs to break this box for continuation.

Target Point 🎯

Level: 3168.17

Based on previous highs – this is the bullish target zone!

Stop Loss ❌

Level: 3099.36

Placed just below the demand zone to limit losses if price breaks down.

Trade Idea Summary:

Entry Zone: ✍️ 3110–3125

Stop Loss: ❌ 3099.36

Target: 🎯 3168.17

Risk-Reward Ratio: 5:1 ⭐️ (Great setup!)

What to Watch For:

✅ If price holds above demand and breaks the mini consolidation, expect bullish continuation.

❌ If price drops below the demand zone, setup is invalid – risk of further decline.

Gold bulls are rising higherGold's 1-hour moving average continues to spread upwards and bulls are spreading. Gold bulls are full of strength. Gold still has upward momentum. The pullback will continue to give opportunities to go long.

Trading idea: Go long near gold 3175, stop loss 3165, target 3210

The above is only a sharing of trading ideas and does not constitute investment advice. You need to be responsible for your own profits and losses.

XAUUSD: Investors are more interested in Gold than ever! Gold reversed successfully after touching our entry point, moving to over 1400 pips. We previously advised closing the idea, but now we see a strong bullish market likely to create another record high. The ongoing tariff war between China and the US will likely create more fear in the global market.

Like, comment, and support us.

Team Setupsfx_

GOLD At Interesting Res Area , Should We Sell Now Or Wait ?Here is my GOLD Chart and this si 1H Time Frame , i`m looking to sell it if i have a bearish price action to confirm that the price will go down , i think the price will go up a little to make some wicks and take all stop losses before going down again maybe tomorrow, so i think we will see some stop hunts before the price going going down for 500 pips and then move again to upside very hard .

Gold's Downtrend PersistsGold's Bearish Outlook Continues Despite Temporary Upside Spike

Market Overview:

The overall outlook for gold remains bearish, even though the market recently experienced a surprising and sharp upward movement. While a deep correction was anticipated and in line with prior expectations, the nature and timing of the recent surge raised some eyebrows among analysts and traders alike.

The unexpected bullish reaction came shortly after former U.S. President Donald Trump announced a 90-day suspension on reciprocal tariffs—a development that typically would not warrant such a dramatic price rally in gold. Normally, easing geopolitical or economic tensions would dampen safe-haven demand, causing gold to retreat. In this case, however, the opposite occurred, which suggests the possibility of non-fundamental drivers at play, potentially even artificial market influence or manipulation.

Technical Outlook:

Despite the sudden upward movement, gold’s larger technical structure has not changed significantly. The overall trend remains bearish unless we see a sustained breakout above the 3167 resistance level. A clean breach above that threshold would be uncharacteristic based on current fundamentals and could indicate external interference or speculative overreaction rather than a genuine shift in sentiment or macroeconomic conditions.

The price action continues to favor the bears, with lower highs and lower lows still forming on the larger timeframes. Until there’s clear evidence to the contrary, any rallies should be viewed with skepticism and treated as potential selling opportunities rather than the start of a new bullish trend.

Key Support Zones:

Looking at potential areas where gold may find some temporary footing, the following support levels should be closely monitored:

3054 – Minor support; could serve as a short-term pause point.

3000 – A psychological level and round number that often acts as a magnet for price action.

2925 – More significant historical support zone with prior buying interest.

2840 – Deeper support, aligning with the longer-term bearish trajectory.

Conclusion:

In summary, while gold has shown a sudden upward burst, the broader picture remains cautious. The technical indicators, market context, and recent price behavior all point toward a continuation of the downtrend unless key resistance levels are convincingly breached. Traders are advised to remain vigilant, avoid emotional reactions to short-term volatility, and refer closely to technical signals when making decisions.

The chart provides further clarity on this setup—feel free to review it for a more visual representation of the analysis.

Thank you for reading, and best of luck in the markets!

Gold (XAU/USD) Breakout Setup – Bullish Reversal from RBR Zone!🔹 Trade Idea: Long (Buy) Setup

📈 Targeting a price rally from a demand zone!

---

🔵 .ENTRY ZONE (Buy Area)

🟦 Marked between 3,039.773 – 3,043.052

📍 Located in the RBS + RBR zone (Resistance becomes Support + Rally-Base-Rally)

💡 Price dipped here and bounced — showing bullish intent

🔻 .STOP LOSS

🚨 Placed at 3,014.537

🛡️ Protects you in case the price drops below the zone

✋ Risk is clearly defined here

🎯 .TARGET POINT (Take Profit)

🚀 Aiming for 3,115.910

💸 A high reward area if momentum continues

🔥 Great R:R ratio (~1:3) — solid risk/reward

📊 .Technical Confirmation

📌 Price has moved above the 9-period DEMA (3,043.052)

⚡ Signals bullish momentum

🕯️ Strong bullish candles forming after the bounce — confirming entry.

🔍 .Market Structure Notes

⬇️ Previous trend was down

🔄 Now forming a potential reversal

🧱 Support holding strong near 3,014–3,030

✅ Summary: 💥 Buy idea from demand zone

🔝 Targeting new highs

🛑 Stop loss tightly managed

⚖️ Clean setup with momentum on your side

"Gold Price Rejection Setup – Trendline + Resistance Combo"XAU/USD 1H Chart Analysis 🪙📉

🔹 Trendline 📐

* Descending trendline marked by 3 touches

* Shows consistent bearish pressure

* Price is respecting it—watch for rejections

🔹 Resistance Area ⛔

* Blue zone between $3,014 - $3,025

* Strong supply zone—price failed to break it before

* Potential reversal zone if price touches again

🔹 Entry Point 🎯

* Suggested short entry at $3,014.29

* Just under resistance + near trendline

* Great spot for catching a downward move

🔹 Stop Loss ⚠️

* Placed at $3,025.13

* Above resistance = smart protection

* Keeps risk under control if breakout happens

🔹 Target Point 💰

* Take-profit marked around $2,964.45

* Down at a key support level

* Clean risk-to-reward around 1:5 (sweet setup!)

🔹 Moving Average (DEMA 9) 📈

* Dynamic resistance (line hugging candles)

* If price closes below, confirms bearish move

Summary ✅

This setup is a classic trendline + resistance short. You're betting on price respecting resistance and heading lower.

Bias: Bearish 🔻

Entry: $3,014.29

SL: $3,025.13 🛑

TP: $2,964.45 ✅

Gold has won two consecutive games, continue to short?Gold continued to be in a dead cross downward short position at 1 hour. The strength of gold short positions has not diminished. Gold fell near the resistance of 3017, and the gold moving average resistance has now moved down to near 3021. After gold rebounds, it is still mainly short selling.

Trading ideas: short gold near 3015, stop loss 3025, target 2990

The above is only a sharing of personal opinions and does not constitute investment advice. Investment is risky and you are responsible for your profits and losses.

Gold is Bullish, Target 3030-3060At the market open today, we signaled a buy opportunity near the 2980 level for gold. Since then, the price has surged over $30, and those who followed the strategy have already secured solid profits.

Gold is now approaching a short-term resistance, so a minor pullback may occur. However, the overall uptrend for the day remains intact, and our strategy continues to favor buying on dips.

Based on the current chart pattern, there's potential for the price to rise toward the 3030–3060 zone later today.

Stay alert for retracement opportunities, manage your position size wisely, and trade with discipline.

If you missed this entry, don’t worry — the next opportunity is just around the corner!

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Blue MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (3000) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (3050) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2960

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Gold is still weak, rebound can still be shortedThe 1-hour moving average of gold still continues to cross downwards, and the strength of gold shorts has not weakened; gold rebounds are still mainly short selling. Although gold rose after covering the gap for one hour, the upper shadow line soon fell. Gold is still weak overall, and gold is under pressure near 3050 in the short term.

Trading idea: short gold near 3042, stop loss 3052, target 3022

The above is purely a sharing of personal opinions and does not constitute trading advice. Investments are risky and you are responsible for your profits and losses.

"Gold Spot (XAU/USD) -Trend Reversal or Continuation? tradesetup📊 Key Levels & Zones

🔵 Target Point: 📈 3,055.65 (Upper blue box) – The expected bullish target.

🟠 Demand Zone: 📉 3,009 - 3,019 (Orange box) – A strong support area where buyers might step in.

🔴 Stop Loss: ⛔ 3,009.47 – Safety exit if the price drops below this level.

📉 Trend Analysis

📍 Trend Line (🔽 Downward Sloping): Indicates a declining price movement.

📍 Potential Breakout (📈): If price breaks above the trend line, it may trigger an upward move toward the target point.

🛠️ Strategy

🔹 Wait for confirmation – A bullish candle above the trend line can signal a buy entry.

🔹 Watch demand zone – If price holds above this area, it could support the bullish move.

🔹 Manage risk – SL (⛔) ensures minimal losses in case of a breakdown.

XAU/USD 07 April 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 04 April 2025.

Since last analysis price has printed a bearish CHoCH which is the first indication, but not confirmation of bearish pullback phase initiation.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,187,835

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Price has printed as per last Friday's analysis by targeting weak internal low and printing a bearish iBOS.

Price has subsequently printed a bullish iBOS indicating bullish phase initiation.

Price is now trading within an established internal range.

Intraday Expectation:

Price to continue bullish, react at either premium of internal 50% EQ, or M15/H4 nested supply zone before targeting weak internal low priced at 2,970.215

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

Trump's tariff announcement will most likely cause considerably increased volatility and whipsaws.

M15 Chart:

GOLD Price Analysis: Key Insights for Next Week Trading DecisionThe price of gold (XAUUSD) surged to a new all-time high last week following former President Trump’s announcement of reciprocal tariffs, only to face a strong retracement that plunged it to a 7-day low of around $3,015. The market then saw a recovery after Fed Chair Jerome Powell hinted that inflation could reaccelerate due to the economic impact of tariffs.

In this video, I break down:

✨ Gold price action and how markets are reacting to significant headlines

📉 A complete technical analysis of XAUUSD

📍 Key price levels, the current trend, and market structure

💡 Potential trade setups for the week ahead

We’re standing at a critical juncture in the gold market—and how traders respond could shape the next major move.

#XAUUSD #GoldAnalysis #GoldPrice #TechnicalAnalysis #ForexTrading #GoldForecast #FOMC #JeromePowell #TrumpTariffs #InflationData #MarketUpdate

Disclaimer:

Forex and other market trading involve high risk and may not be for everyone. This content is educational only—not financial advice. Always assess your situation and consult a professional before investing. Past performance doesn’t guarantee future results.

Gold opens lower and moves lower, the rebound continues to be beThe gold 1-hour moving average crosses downwards and the short positions are arranged, and it continues to open downwards. So gold is now the home of the shorts. Gold rebounds or continues to be short. Gold is now in a short trend under the gap. Gold rebounds around 3050 and continues to be short.

Trading ideas: short gold near 3050, stop loss 3060, target 3030

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S.Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (3095) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (3140) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 3030 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Gold Price Drops on Tariff Selloff

Gold, long considered a safe-haven asset during times of economic uncertainty, experienced a sharp reversal of fortune this Friday, tumbling as much as 2.4% and extending losses from the previous session. This significant decline came as a surprise to many who had witnessed the precious metal steadily climb to record highs in recent weeks, fueled by persistent inflation concerns, geopolitical instability, and expectations of easing monetary policy. However, the resurgence of tariff anxieties has triggered a broad selloff across various asset classes, including gold, as investors recalibrate their risk exposure in the face of heightened economic uncertainty.1

The catalyst for this sudden shift in market sentiment has been the renewed threat of escalating trade tensions.2 While the specifics of the "tariff shock" are crucial in understanding the market reaction, the general principle is that the imposition or threat of tariffs can disrupt global supply chains, increase costs for businesses and consumers, and ultimately dampen economic growth.3 This increased uncertainty and the potential for negative economic consequences have prompted investors to reassess their portfolios and, in many cases, reduce their exposure to assets perceived as riskier or less liquid, even those traditionally considered safe havens.4

Gold's traditional role as a safe haven stems from its historical use as a store of value, its limited supply, and its lack of correlation with traditional financial assets during periods of stress.5 In times of economic turmoil, investors often flock to gold as a hedge against inflation, currency devaluation, and market volatility.6 This flight to safety typically drives up the price of bullion.7

However, the current market reaction suggests a more nuanced dynamic at play. The tariff shock appears to have triggered a broader reassessment of risk, leading to a selloff that encompasses not only equities and other riskier assets but also traditional safe havens like gold. Several factors could be contributing to this phenomenon.

Firstly, the prospect of tariffs can lead to concerns about slower global growth.8 If economic activity contracts, it could reduce overall demand, potentially impacting even safe-haven assets like gold, particularly if investors anticipate lower inflation in the long run. While gold is often seen as an inflation hedge, a significant deflationary shock could negatively affect its price.

Secondly, the imposition of tariffs can create uncertainty about future economic policies and international relations.9 This uncertainty can lead to increased volatility across all asset classes, prompting investors to reduce overall exposure and move towards cash or other highly liquid assets. In such scenarios, even assets perceived as safe havens might be sold off as part of a broader de-risking strategy.

Thirdly, the recent run-up in gold prices to record highs might have made it a target for profit-taking. After a significant rally, any negative news or shift in market sentiment can trigger a wave of selling as investors look to lock in gains. The tariff shock could have provided the catalyst for such profit-taking, exacerbating the downward pressure on gold prices.

Furthermore, the interconnectedness of global financial markets means that negative sentiment in one area can quickly spread to others.10 The fear of a trade war can impact equity markets, leading to margin calls or a general desire to reduce risk across portfolios, which could include selling gold holdings.

The extent of the gold selloff – a 2.4% drop in a single day is significant for a traditionally stable asset – underscores the severity of the market's reaction to the tariff news. This move also highlights the fact that even safe-haven assets are not immune to broad market dislocations and shifts in investor sentiment.

Looking ahead, the trajectory of gold prices will likely depend heavily on how the tariff situation unfolds and its actual impact on the global economy. If the tariff threats escalate into a full-blown trade war with significant negative consequences for growth and corporate earnings, we could see further volatility across all asset classes. In such a scenario, the initial reaction might be continued selling pressure on gold as investors prioritize liquidity and de-risking.

However, if the economic fallout from tariffs becomes more apparent and concerns about stagflation (slow growth with high inflation) resurface, gold's traditional safe-haven appeal could reassert itself. In a stagflationary environment, gold could once again become an attractive asset as a hedge against both economic stagnation and the erosion of purchasing power.

Moreover, any signs of easing monetary policy by central banks in response to slowing economic growth could also provide support for gold prices. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold and can also be inflationary in the long run.

In conclusion, the recent tumble in gold prices following the tariff shock demonstrates that even traditional safe-haven assets are susceptible to broad market selloffs triggered by significant economic uncertainties. The initial reaction appears to be driven by a general de-risking across asset classes and potential profit-taking after gold's recent record highs. However, the future performance of gold will depend on the evolving economic landscape, the actual impact of tariffs, and the response of monetary policy. While the immediate reaction has been negative, gold's role as a potential hedge against economic turmoil and inflation could see it regain its footing if the negative consequences of the tariff shock become more pronounced. Investors should closely monitor developments in trade policies and their broader economic implications to gauge the future direction of gold prices. The current volatility serves as a reminder that even in the realm of safe havens, market dynamics can shift rapidly and unexpectedly.