Gold Rejected at 3315 – But Bulls Might Not Be Done Yet📌 What happened yesterday?

During the Asian session, Gold printed a fresh local low at 3268, continuing the downtrend that already dropped over 1700 pips in just one week. However, that move quickly reversed, and we saw a natural corrective bounce.

📈 Resistance holds firm

The correction took price back up into the 3310 zone, which acted as confluence resistance. After two taps into that area, price failed to sustain above 3300, indicating sellers are still active there.

❓ Is the upside correction over?

I don't think so. The recent drop has been choppy, lacking the strong momentum of previous legs. This type of price action often signals that we are still within a correction, not in a clean continuation.

📊 What am I watching?

I’m actively monitoring for:

• Exhaustion signs on the downside

• Upside reversal signals

My plan is to open long trades only when I see confirmation, aiming for a move back toward the 3330 zone, which could act as resistance.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Xauusdsignal

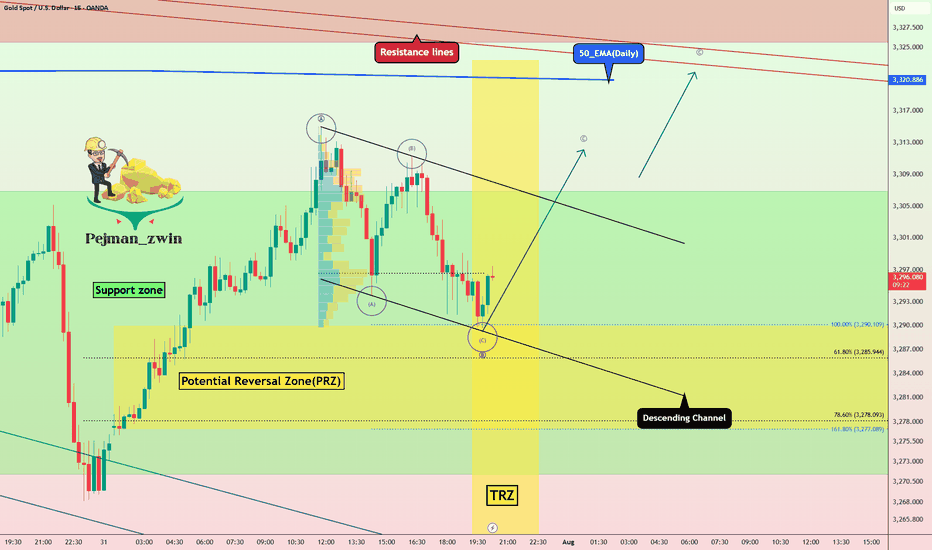

Gold in PRZ + TRZ: Is a Bullish Reversal Brewing(Short-term)?Gold , as I expected in yesterday's idea , fell to the Potential Reversal Zone(PRZ) and started to rise again .

Today's Gold analysis is on the 15-minute time frame and is considered short-term , so please pay attention .

Gold is currently trading in the Support zone($3,307-$3,275) and near the Potential Reversal Zone(PRZ) and Time Reversal Zone(TRZ) .

In terms of Elliott Wave theory , it seems that Gold can complete the microwave C of wave B at the lower line of the descending channel.

I expect Gold to trend higher in the coming hours and rise to at least $3,311 .

Note: Stop Loss (SL) = $3,267

Gold Analyze (XAUUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Gold Surges on Non-Farm Data; 3330 Key Next WeekGold was strongly boosted by the significantly bullish non-farm payroll data, surging sharply like a rocket 🚀, with gains that completely "wiped out" all the weekly losses. The current gold trend, as if injected with super momentum, has completely broken the previous long-short stalemate. Starting from the 3300 level, it has been breaking through obstacles all the way up to 3350. At present, 3330 is like a critical "battleground" ⚔️ fiercely contested by both long and short sides.

This week, when gold was still "lingering" below 3300, I emphasized repeatedly that a rebound was inevitable – we just needed to stay calm and wait for the opportunity. As it turns out, our judgment was spot on, and we successfully took profits around 3340, reaping good gains 💴. Now, gold prices are oscillating back and forth in the 3340-3350 range. Based on a comprehensive analysis of the current trend, I boldly predict that gold is likely to pull back to around 3330 next week, so everyone can prepare in advance 🤗

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Sell@ 3350

🚀 TP 3330 - 3320 - 3310

🚀 Buy@ 3300 -3310

🚀 TP 3320 - 3330 - 3340

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

GOLD TRADING PLAN – Triangle Squeeze, All Eyes on NFP【XAU/USD】GOLD TRADING PLAN – Triangle Squeeze, All Eyes on NFP

Gold continues to trade within a large symmetrical triangle, tightening toward the end of its range. However, current candle structure shows clear bullish momentum, indicating the potential for a strong upside breakout.

🔍 Today’s Key Focus: Non-Farm Payrolls (NFP)

Market expectations are pointing to weaker-than-expected US economic data, which could trigger strong FOMO-buying for gold if confirmed. A poor NFP report would likely weaken the USD, supporting bullish continuation.

🔑 Strategy and Key Technical Levels:

Watch for a confirmed breakout above the descending trendline to trigger Wave 3 of the bullish structure.

CP ZONE + OBS BUY ZONE triggered yesterday already yielded 160+ pips profit.

Strategy: Prefer buy-the-dip entries. SELL setups only valid on strong resistance rejection. Avoid counter-trend trades near breakout zones.

🟩 BUY ZONE:

Entry: 3276 – 3274

Stop Loss: 3270

Take Profits:

3280, 3284, 3290, 3294, 3300, 3305, 3310, 3320, 3330, 3340, 3350

🟥 SELL ZONE:

Entry: 3339 – 3341

Stop Loss: 3345

Take Profits:

3335, 3330, 3325, 3320, 3315, 3310, 3305

How to seize the key turning points in the gold market?The market is ever-changing, and following the trend is the best strategy. When the trend emerges, jump in; don't buy against it, or you'll suffer. Remember not to act on impulse when trading. The market is a haven for all kinds of resistance, so don't hold onto positions. I'm sure many people have experienced this: the more you hold onto positions, the more panic you become, leading to ever-increasing losses, poor sleep, and missed opportunities. If you share these concerns, why not try following Tian Haoyang's lead and see if it can open your eyes? I'm always here for you if you need help, but how can I help you if you don't even offer a hand?

Gold did not fall below 3280 during the day on Friday and started to fluctuate in the range of 3280-3300. The non-farm payroll data was bullish, and it directly broke through the pressure of 3315, and then broke through the important pressure of 3335 again. As of now, it has reached a high near 3355. The non-farm payroll data market has almost been exhausted. Next, we will focus on the technical form adjustment. At present, you can consider light shorting in the area near 3355-3370. After all, chasing long is risky, and the technical side needs to be adjusted. If your current operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with me.

Based on the 4-hour chart, short-term resistance is near 3355-3365, with a focus on the key resistance level of 3370-3375. Short-term buy orders should be taken if a rebound continues. I'll provide detailed trading strategies at the bottom of the page, so stay tuned.

Gold operation strategy: Short gold in batches when gold rebounds to 3355-3370, with the target being the area around 3340-3335. Continue to hold if it breaks through.

DAILY SCALPING PLAN | CLINTON SMC STYLE✅ XAU/USD - DAILY SCALPING PLAN | CLINTON SMC STYLE

📆 Date: August 1st, 2025

📍 Strategy: Smart Money Concepts (SMC)

🔑 Focus: Liquidity Sweep | Order Block | BOS | Premium/Discount Model

🔍 Market Overview

Gold (XAU/USD) is currently in a manipulation phase after a strong move down from a premium supply zone. The market has swept key liquidity and is preparing for a high-probability move in both directions based on Smart Money footprints.

Current structure suggests:

Bullish intent forming from a discount demand zone.

Liquidity resting above recent highs – perfect for short-term scalps and intraday swings.

🟢 BUY SETUP – DISCOUNT DEMAND REACTION

🎯 Entry: 3275

🛡️ Stop Loss: 3268

🎯 Take Profits:

TP1: 3285

TP2: 3295

TP3: 3305

TP4: 3315

TP5: 3325

TP6: 3335

Reasoning:

This is a clean bullish OB resting beneath a CHoCH and BOS zone. Price may wick into this area as Smart Money reloads after sweeping early long positions. If held, expect sharp upside expansion toward previous liquidity highs.

🔴 SELL SETUP – PREMIUM SUPPLY REJECTION

🎯 Entry: 3356

🛡️ Stop Loss: 3362

🎯 Take Profits:

TP1: 3350

TP2: 3345

TP3: 3340

TP4: 3330

TP5: 3320

Reasoning:

This level is a key supply block where price previously distributed. If price expands into this zone, it’s likely to act as a liquidity magnet for Smart Money to offload longs and enter short-term shorts. Expect reaction.

🧠 SMC Insights

Internal BOS & CHoCH signal early signs of accumulation.

Price respects the premium vs. discount framework with clear liquidity targets.

SMC traders understand that price doesn’t move randomly – it targets liquidity, mitigates OBs, and respects structure.

🔔 Note:

Always wait for clear confirmation (rejection wick, engulfing pattern, or M15 structure shift) before execution. Entries without confirmation are riskier in current volatility.

📌 Follow @ClintonScalper for daily SMC scalping plans & deep institutional insight.

🔁 Like, comment & share if you find this helpful!

Gold is significantly bullish, where can we short?The positive non-farm payroll report pushed the market from 3300 directly above 3330, demonstrating overall bullish momentum. Congratulations again, everyone. Real-time strategies are like a beacon guiding your investment journey. The market will never disappoint those who persevere and explore wisely. Charlie advises against blindly chasing highs. Trading advice (first hit is valid): Focus on key support levels: 3300 and 3310. Go long if these levels are reached.

~For those who want to go short above 3350-55, only use a stop-loss and feel free to try~ PEPPERSTONE:XAUUSD FXOPEN:XAUUSD ACTIVTRADES:GOLD FXOPEN:XAUUSD CMCMARKETS:GOLD VANTAGE:XAUUSD VELOCITY:GOLD

Is the uptrend complete? Will there be a pullback?On the last trading day of this week, gold prices soared, rising nearly $56, driven by the non-farm payroll data. The rally began at 3300 and peaked near 3356. The price has now retreated slightly, fluctuating around 3345.

The current uptrend has repeatedly tested the resistance level near 3355 but has failed to break through. The RSI indicator hovered around 76.8, indicating a gradual flattening of the upward trend. The 3355 high is likely the end of this uptrend.

As this is the last day of a major data week, Quaid believes the current uptrend is complete. Consider a light short position around 3350-3355. The current low has yet to be confirmed, and the pullback is likely to end around 3335.

However, we cannot rule out the possibility that the price will remain within the upward channel with slight fluctuations on the last trading day of the week.

NFP data is positive, the bullish trend remains unchanged#XAUUSD

The current market, influenced by data such as NFP, remains bullish, even briefly pushing towards the 4H upper limit of 3350, reaching a high near 3354.📈

In the short term, gold still has upward momentum and could even reach the previous high resistance level near 3375.🐂

Currently, gold is undergoing a technical correction and needs to begin a pullback to accumulate more bullish momentum, giving traders who previously missed the opportunity to get on board.🚀

As resistance continues to rise, support below will also rise. 📊If gold retreats below 3335-3315, consider going long.📈

🚀 SELL 3335-3315

🚀 TP 3350-3375

XAUUSD – Demand Zone Reaction & Potential Markup (VSA Analysis)💡 Idea:

Gold is testing a major 4H demand zone with early signs of smart money accumulation. VSA signals show supply exhaustion and potential for a bullish reversal toward upper resistance.

📍 Trade Setup:

Entry Zone: 3,265 – 3,285 (current demand zone)

Target 1: 3,380 – 3,400 (mid supply zone)

Target 2: 3,440 – 3,460 (major supply zone)

Stop Loss: Below 3,240 (to avoid false breakouts)

R:R Potential: ~3:1

📊 Technical Reasoning (VSA)

Stopping Volume Detected

On the recent drop into the demand zone, a wide spread down-bar on ultra-high volume appeared, followed by no further downside progress.

This is a classic stopping volume pattern where professional money absorbs selling pressure.

No Supply Confirmation

Subsequent candles inside the zone show narrow spreads on decreasing volume, indicating a lack of genuine selling interest.

Demand vs Supply Shift

Multiple attempts to break below 3,265 have failed, showing absorption of supply and positioning for markup.

If price rallies from here on increasing volume and wider spreads up, it would confirm demand dominance.

Structure Context

This demand zone has historically produced strong rallies.

Break above the minor resistance inside the zone could trigger a swift move toward Target 1, with momentum possibly extending to Target 2.

📌 Trading Plan:

Look for bullish confirmation bars with high volume before entry.

If price breaks below 3,240 on high volume, invalidate the long setup and watch for the next demand level around 3,140.

Partial profits can be taken at Target 1, and the remainder trailed toward Target 2.

XAUUSD Update – Down Continuation to 3250?1. What Happened Yesterday

After an anemic correction that formed a bearish flag, Gold finally broke below 3300 and even dipped under the 3280 support zone — which was my primary downside target. While the move during the day didn’t have enough momentum to reach my second sell limit, I was already in a low-volume short position, so I didn’t miss the move entirely.

2. The Key Question

Has the drop ended, or are we looking at further downside?

3. Why I Expect More Downside

• The overall structure remains bearish.

• The newly formed resistance (previous support) is now the new sell zone.

• If the price drops towards 3280 again, continuation to 3250 becomes very probable.

4. Trading Plan

Selling rallies remains the preferred strategy, especially on spikes into resistance. As long as the price stays below 3335-3340 zone, the bearish outlook remains intact.

5. Conclusion

Sell the rallies. The technical picture still favors downside continuation — no need to overcomplicate it. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Bounce From Final Liquidity or Start of a Bullish Move? Bounce From Final Liquidity or Start of a Bullish Move?

After the FOMC event, gold completed a sweep of the final liquidity zone at 3269–3271 and rebounded strongly, in line with the broader bullish trend. The price has now recovered sharply and is gradually returning to the liquidity zones left behind after yesterday’s sharp drop.

📍 At the moment, gold is reacting around 3295, which aligns with a CP (Compression Point) Zone on the M30 chart. We're seeing a slight pullback here, and another retracement could occur before a strong upward continuation — potentially breaking out of the descending trendline that’s formed over recent days.

📊 Trading Plan & Key Levels

✅ BUY ZONE – Trend Continuation Setup

Entry: 3286–3284

Stop Loss: 3278

Take Profits:

3290 → 3294 → 3298 → 3304 → 3308 → 3312 → 3316 → 3320 → 3330 → …

💡 This is a prime area to look for re-entries into the dominant bullish move. Price action left a clean liquidity zone below after the aggressive upside reaction — ideal for riding the next wave.

❌ SELL ZONE – Only Valid Below VPOC

Entry: 3328–3330 (Volume Point of Control)

Stop Loss: 3335

Take Profits:

3324 → 3320 → 3315 → 3310 → 3305 → 3300

🔻 This is a high-probability short only if price stays below 3330. If gold closes above this VPOC region, the structure shifts to bullish and we should look for sells higher up — around 335x–337x zones.

📅 Monthly Candle Close – Watch for Indecision

As it’s the last trading day of the month, note that the past two monthly candles have printed doji-like wicks, signalling indecision and liquidity grabs. The market is still waiting for a clearer signal from the Fed on the first potential rate cut of the year.

🚫 Avoid emotional trading. This is a highly reactive environment, so careful risk management is key.

🧭 Final Thoughts

Gold continues to respect market structure and liquidity theory. The first major test lies at the 3313 resistance level — if broken, it opens the door to stronger bullish momentum toward the broader VPOC zone.

⏳ Be patient and only act when price confirms your bias.

The idea of shorting on rallies below 3315 remains unchanged.Gold remains generally weak, with multiple rebounds showing signs of fatigue. The upward moving average continues to suppress prices, indicating that the bearish trend remains intact, and the short-term market outlook remains bearish. Trading strategies remain bearish today, with a key focus on the 3300-3315 area, a key short-term resistance zone. If the market rebounds before the US market opens and approaches this area, or if a clear topping signal appears near this range, consider entering a short position. Today will see the release of the non-farm payroll data, which may influence the market's trajectory. We recommend prioritizing short-term trading before the release, and reconsidering the market's direction based on market feedback after the release. Structurally, gold continues to exhibit a volatile downward trend, with lower highs and lower lows. Today's low is expected to be lower than yesterday's. Short-term short positions are focused on 3285-3280, with a break below this level potentially allowing for further declines. Please carefully time your entry, strictly implement risk management, and avoid emotional trading.

How to maintain stable operations before NFP dataYesterday, gold closed the month with a long upper shadow doji candlestick, indicating strong upward pressure, with monthly resistance at 3439-3451. Today marks the beginning of the month, and with the release of numerous data indicators such as NFP, unemployment benefits, and PMI, there is considerable uncertainty, so intraday trading should proceed with caution.

Judging from the daily chart, the current MACD indicator is dead cross with large volume, and the smart indicator is running oversold, indicating a low-level fluctuation trend during the day. At present, we need to pay attention to the SMA60 moving average and the daily middle track corresponding to 3327-3337 on the upper side, and pay attention to the intraday low around 3280 on the lower side. The lows of the previous two days at 3275-3268 cannot be ignored. There is a possibility that the low-level oscillation will touch the previous low again.

From the 4H chart, technical indicators are currently flat, with no significant short-term fluctuations expected. Low-level volatility is expected to persist within the day. Then just focus on the support near 3275 below and the middle track pressure near 3307 above. Looking at the hourly chart, gold is currently oscillating below the mid-range band, with resistance at 3295-3307 to watch in the short term.

Overall, the market is expected to remain volatile before the release of today's data. Based on Wednesday's ADP data, this round of data is also expected to be around $100,000. The contrast between ADP and NFP last time deserves our caution. The current market is basically optimistic about the short-selling situation, which is exactly what I am most worried about. If the gold price can stabilize above 3,300 before the NY data, the possibility of NFP data being bullish cannot be ruled out.

Intraday European trading suggestion: if the current gold price falls back to 3285-3280 and stabilizes, you can consider short-term long positions, with the target at 3295-3305. If the gold price tests the low of 3275-3268 again and does not break through, you can consider a second chance to go long. After making a profit of $10-20, you can consider exiting the market with profits. The market is volatile and unstable, so be sure to bring SL with you and pay close attention to the impact of the NFP data. Conservative investors can enter the market after the data is released.

Gold Technical Outlook

Gold is currently consolidating inside a triangle pattern. After a recent bullish rally, price retraced between the 61.8% – 76.4% Fibonacci levels, finding support and bouncing upward. At present, gold is facing resistance at both the falling trendline and the 3298–3300 zone.

Bullish Scenario:

A breakout above the resistance trendline and the 3298–3300 zone could trigger a strong bullish move toward 3311, 3322, and 3333. A sustained break above 3333 would confirm a short-term bullish trend, opening the way for higher targets at 3360 and 3400.

Bearish Scenario:

If price faces rejection from the 3300 resistance and the falling trendline, gold is expected to move lower, retesting 3270. A decisive break below 3270 may extend the decline toward 3250. If 3250 is broken, gold could enter strong bearish momentum, potentially shifting the long-term trend to the downside with targets at 3000 and 2850.

OANDA:XAUUSD Gold Technical Outlook

Impact of the Non-Farm Payrolls? Latest Analysis.Information Summary:

Most traders are turning their attention to the crucial US labor market report, which is being closely watched as the market actively searches for new clues regarding the timing of the next interest rate cut this year.

The July non-farm payrolls report will be released at 8:30 AM US time. US non-farm payrolls increased by 110,000 in July, seasonally adjusted, lower than the 147,000 increase in June. The US unemployment rate is expected to rise from 4.1% to 4.2% in July.

If the non-farm payrolls figure falls below 100,000 and the unemployment rate rises, it could signal a weakening job market, undermining the Fed's rekindled hawkish outlook and dampening the dollar's upward momentum. In this scenario, gold prices could re-cross the 3,400 mark. However, if the non-farm payrolls unexpectedly exceed 150,000, it could support the dollar's continued rise and hurt gold. Strong US employment data could rule out two rate cuts from the Fed this year.

Market Analysis:

Quaid believes that the current moving average crossover is trending downward, and downward momentum is still in play. The RSI remains at 42.7, hovering below the midline, indicating that gold's downward trend remains intact. The 20-day moving average fell below the 50-day moving average on Wednesday, confirming the bearish momentum.

Therefore, if gold closes below the key support level of the 100-day moving average at $3,270 on a weekly basis, a new downtrend could begin, potentially leading to a drop towards the June 30 low of $3,248.

Quaid believes that the current bull-bear watershed needs to focus on around 3315, which is the previous intensive trading area and is also the first resistance position for short-term upward movement.

On the last trading day of Super Data Week, Quaid hopes that everyone has gained something and has a happy weekend; I wish you all good luck.

How to correctly grasp the gold trading opportunities?Yesterday, gold prices saw a technical rally amidst volatile trading, followed by a downward trend under pressure. Bulls strongly supported a rebound at 3280 in the Asian session. The European session saw an accelerated upward move, breaking through 3314 before retreating under pressure. We also precisely positioned short positions below 3315, achieving a perfect target of 3290-3295. During the US session, the market again faced pressure at 3311, weakening in a volatile trend before breaking through 3300. The daily chart ultimately closed with a medium-sized bullish candlestick pattern, followed by a pullback and then a decline.

Overall, after yesterday's rebound, gold prices remain under pressure at the key resistance level of 3314. The short-term bearish weakness line has moved down to this level. If pressure continues in this area in the short term, gold will maintain a weak and volatile structure, with intraday trading remaining focused on rebounds and upward moves. If you are currently experiencing confusion or unsatisfactory trading strategies, please feel free to discuss your options and help avoid investment pitfalls.

From a 4-hour analysis perspective, focus on resistance at 3305-3315 on the upside. A rebound to this level is a good opportunity to short against resistance. Focus on support at 3280-3270 on the downside. Unless the price stabilizes strongly, consider not entering long positions below this level. The overall strategy remains to short on rebounds, with the same rhythm. I will provide timely notifications of specific levels from the bottom, so keep an eye on them.

Gold Trading Strategy: Short on rebounds near 3305-3315, with targets at 3290-3280-3270.

Gold Crashing After Hot U.S. Data – More Pain Ahead?Minutes ago, important indices were released from the US , which catalyzed the continuation of gold's downward trend .

Key U.S. Economic Data Just Dropped!

ADP Employment: 104K

GDP q/q: 3.0%

Both came in stronger than expected , signaling that the U.S. economy is holding up better than many thought!

Strong job growth

Solid economic expansion

The result? A stronger U.S. dollar ( TVC:DXY ) and potential downward pressure on Gold .

All eyes are now on FOMC meeting .

Will the Fed still hint at future rate cuts despite the solid data? Or is the easing cycle officially on hold? What is your idea!?

----------------------

Gold ( OANDA:XAUUSD ) has already managed to break the Support zone($3,350-$3,326) , Monthly Pivot Point , 50_EMA(Daily) , Support lines , and the lower line of the ascending channel . Also, Gold trading below $3,333 plays an important role for me, which can increase the possibility of a continuation of the downtrend .

I expect Gold to drop to at least the Potential Reversal Zone(PRZ) before the FOMO meeting and if the Support zone($3,307-$3,272) is broken, we can expect further declines to $3,253(Second Target) .

--------------------------------

Information we need to know:

How should the Federal Funds Rate be announced to cause a deeper drop in Gold ?

The Fed needs to take a hawkish stance — meaning:

They keep rates unchanged, but make it clear they intend to keep them elevated for a prolonged period.

They emphasize strong economic data like today's solid ADP and GDP numbers .

They express concern that inflationary risks remain, and cutting rates isn’t on the table anytime soon.

In this case, markets get disappointed, rate cut hopes fade, and gold drops as real yields( TVC:US10Y ) rise and the U.S. dollar strengthens.

--------------------------------

Note: Stop Loss (SL) = $3,340

Gold Analyze (XAUUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.