Xauusdsignal

BTC's latest trading strategy and analysis layout#BTCUSD

BTC's current technical signals show a bull-bear tug-of-war situation.If a golden cross is formed near the zero axis, it may indicate a new wave of rise; if it falls below the zero axis, we need to be wary of a deep correction.

There are certain opportunities for both bulls and bears in the current market, but global regulatory policies have not yet been unified. Policies such as the US "GENIUS Act" may affect BTC and require continued attention. BTC is currently facing significant buying support around 117,500, but the hourly chart shows that there is still potential for a continued pullback. The current trend has not yet finished. Pay attention to the support level of 116,000 below. If it falls below, it may fall into the consolidation range of 116,000-114,000. For aggressive traders, consider going long at 117,500-116,500, with a target of 118,500-119,500. A break above this level could lead to 120,000.

🚀 117500-116500

🚀 118500-119500

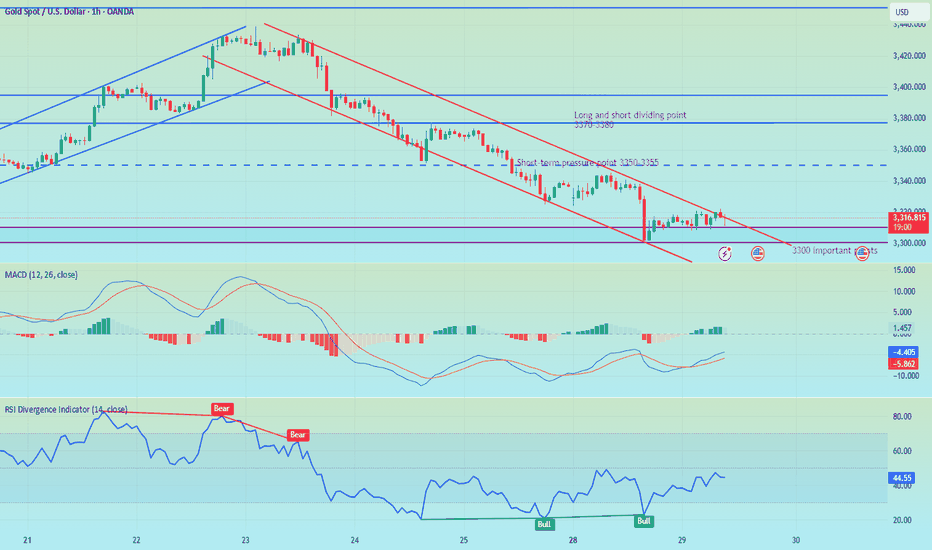

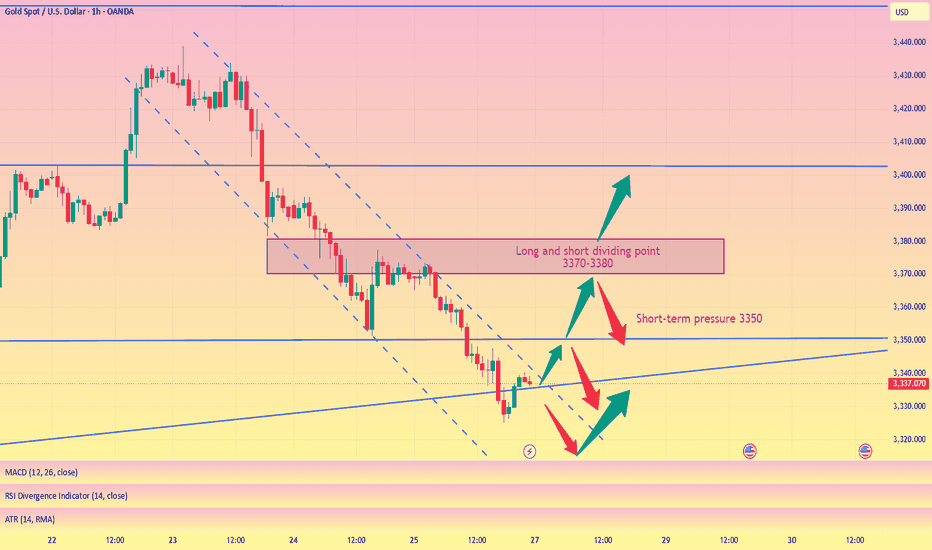

Bottoming out? Be wary of the market.After a sharp drop to around 3300 on Monday, gold rebounded, reaching a high of around 3330 so far.

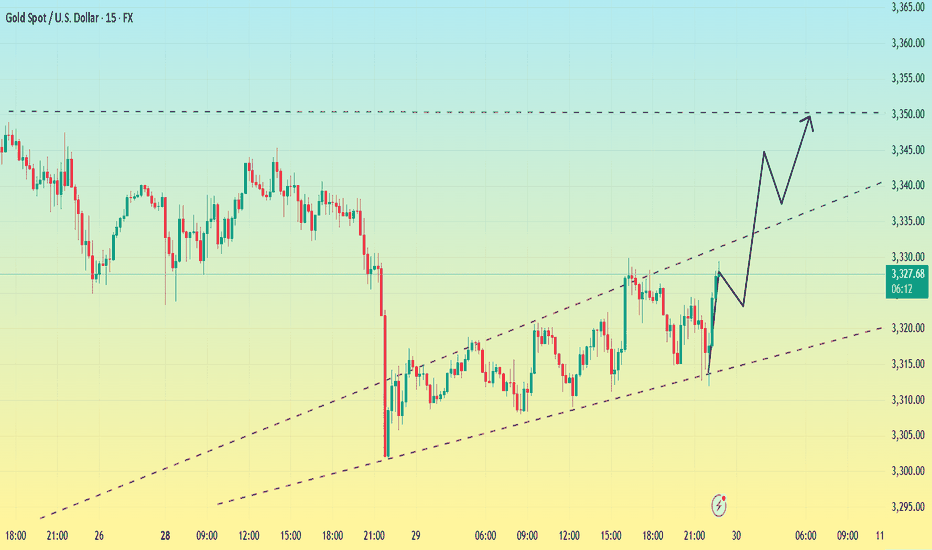

From the 1-hour chart,Gold has now broken out and stabilized within the hourly chart's downward trend channel. The key upward level is currently around 3330. If it breaks above 3330 again, caution is advised; it may test 3345-3350. Conversely, if it fails to break above 3330, gold may consolidate between 3300-3330 before the non-farm payrolls release.

From a short-term 15-minute perspective, the current 15-minute range has been broken out and stabilized. The current situation is unfavorable for bears. Based on the trend, a breakout above the 15-minute range would indicate a rebound. However, until 3330 holds, the 3320-3330 range is the only option. However, the current trend favors a bullish pullback, so I'm not too keen on shorting. Therefore, focus on support at 3320.

If it fails to break below 3320, enter a long position near 3320. The upper target is the top of the 3345-3350 range.

European session under pressure 3321 continue to shortI reminded everyone last night that if gold holds the 3300 mark, it will consolidate in the 3300-3345 range in the short term. The current gold price basically fluctuates narrowly between 3320-3310. Judging from the daily chart, the short-term upper pressure is at 3330. Only if the daily line stands firmly above 3330, there is a possibility of a rebound upward in the short term. Judging from the hourly chart, gold is still in a downward trend, and the hourly line is blocked near 3321. In the short term, if it cannot break through 3320-3330, gold will continue to fall. You can consider shorting, with the target at 3310-3300. If the European session is still volatile, maintain high shorts and low longs to participate in the cycle.

My premium privileges are about to expire, and subsequent trading strategies and analysis will be published in the group.

XAUUSD – Bears in Control, but Watch for a Rebound FirstYesterday, after a small bounce from the ascending trendline, Gold broke down and printed an intraday low around $3300.

Right now, the market appears bear-dominated, and further downside continuation is likely in the coming days.

________________________________________

📉 But there’s a catch:

From last week's top, Gold has dropped over 1400 pips without any meaningful correction.

That opens the door for a possible short-term rebound, which could be just a setup for new short entries.

________________________________________

📌 Key levels to watch:

• First resistance: $3350

• Major resistance: $3375 – Only a daily close above this level would shift control back to the bulls

🎯 Until then, any bounce is an opportunity to sell into strength.

A break below $3300 opens the path to $3280, with a likely extension toward $3250.

________________________________________

Conclusion:

The trend is bearish, but don’t chase.

Wait for a corrective rally, then look to sell the rip—unless bulls reclaim $3375, it’s still a bear market.

Let’s see if Gold gives us the setup. 🎯

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

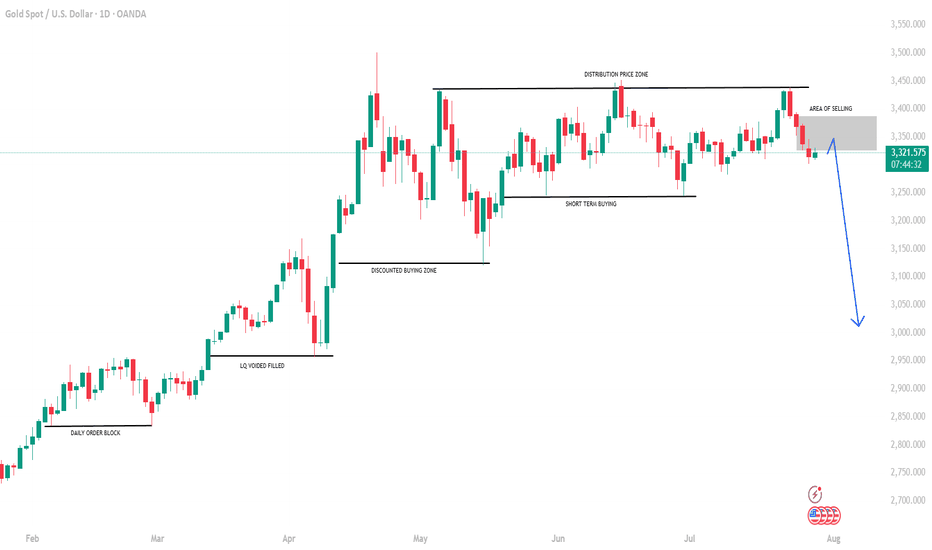

GOLD: Time for massive drop? +3000 pips move! Gold has failed to breakthrough the previous resistance indicating a strong sellers hold around $3440 region. Now since the price has stared dropping we can see it dropping around $2800 in long term. In order for this to happen we need strong confirmation, which will help us understand the possible volume.

Agree with our idea?

Like and comment!

GOLD: Bottoming Out or Just the Calm Before the Storm? – GOLD: Bottoming Out or Just the Calm Before the Storm?

Gold has dropped nearly $50 over the last 4 sessions, showing clear bearish momentum. But is this just a liquidity grab before a reversal — or are we simply pausing before another leg down?

🔍 Market Context:

Recent US–EU defence and trade agreements may have weakened gold’s short-term appeal as a safe haven.

The US dollar and equities have both gained on strong macroeconomic data, redirecting capital flows away from metals.

Overall market sentiment has tilted risk-on, putting additional pressure on gold prices.

📊 Technical Overview (12H Chart):

Price has broken below the 3342 key support zone and rejected the retest — turning it into short-term resistance.

Current range sits between:

Sell-side liquidity zone: 3301–3292

Major demand/FVG zone: 3272–3270

Above price:

Resistance at 3342, and a broader sell zone at 3370–3388 (OB + FVG + Fib 0.5–0.618)

🔧 Trade Plan (Reaction-Based — Not Predictive):

🟢 Scenario 1 – Buy (Scalp Reaction)

Entry: 3292 – 3290

Stop Loss: 3285

Targets: 3296 → 3300 → 3305 → 3310 → 3315 → 3320 → 3325 → 3330

📍 Intraday bounce play from a high-liquidity zone

🟢 Scenario 2 – Buy (Deeper Reversal Swing)

Entry: 3272 – 3270

Stop Loss: 3265

Targets: 3276 → 3280 → 3284 → 3288 → 3292 → 3294 → 3300 → Trail

📍 Potential mid-term bottom setup if liquidity is fully swept

🔴 Scenario 3 – Sell (Short-Term Rejection)

Entry: 3340 – 3342

Stop Loss: 3346

Targets: 3335 → 3330 → 3325 → 3320 → 3310

📍 Clean rejection setup if price fails to reclaim key resistance

🔴 Scenario 4 – Sell (Higher Supply Zone)

Entry: 3370 – 3372

Stop Loss: 3376

Targets: 3365 → 3360 → 3355 → 3350 → 3345 → 3340 → 3330 → 3320

⚠️ Higher risk; only valid with strong confirmation

⚠️ Risk Notes:

Be mindful of fakeouts around London and NY opens, as liquidity sweeps are common.

Wait for price to enter your zone, then react — don’t anticipate.

Strict risk management is key in a volatile environment like this.

🧭 I’ll continue monitoring how price reacts around these zones.

If this kind of structured planning resonates with your approach,

feel free to stay connected — or share your perspective in the comments.

GOLD H2 Intraday Chart Update For 29 July 2025Hello Traders, Welcome to new day

we have US JOLTS high impact news today, for market sustains above 3300 psychological level

if market successfully break 3280 level then it will move towards 3280 or even 3270

if market crosses 3330 level successfully then it will move towards 3345 or even 3360

All eyes on FOMC & NFP news for the week

Disclaimer: Forex is Risky

Gold Spot / U.S. Dollar (XAUUSD) 4-Hour Chart4-hour chart from OANDA shows the price movement of Gold Spot (XAUUSD) from mid-July to late August 2025. The current price is 3,425.000, with a slight increase of +0.03% (0.880) to 3,315.325. Key levels include a sell price of 3,315.070 and a buy price of 3,315.590. The chart highlights a recent downward trend with a support zone around 3,313.855 and resistance near 3,350.823, as indicated by the shaded areas.

Gold: This Week's Analysis & StrategyThis week, the fluctuations have clearly moderated📉. Focus on a strategy of buying at lows and selling at highs as much as possible📈. Currently, the resistance around 3350 is prominent🚧, and 3300 acts as support below🛡️. If the decline continues, it may reach around 3285👇

We successfully took short positions last week 📉, and this week I recommend going long at lower levels 📈. Over the long term, gold remains in a bull market 🐂, but it will not repeat the frenzy seen in April; instead, it will maintain a steady upward pace ⬆️.

Market expectations for Fed rate cuts have been volatile so far this year 📊. At the start of the year, as Trump-related developments unfolded, market optimism faded 😐. Meanwhile, the de-dollarization trend fueled growing expectations of Fed rate cuts 💹. By early April, Trump’s reciprocal tariff measures—far more aggressive than expected—roiled global financial markets 🌍, triggering a surge in concerns about a U.S. recession ⚠️. Markets thus anticipated that the Fed would cut rates quickly to shore up the economy, with expectations for rate cuts within the year once exceeding 100 basis points 📉. However, shortly after, Trump announced a 90-day extension of the reciprocal tariffs, easing market pessimism 😌 and driving a strong rebound in U.S. stocks 📈. At this point, markets began worrying that his tariff policies could spark an inflation rebound 🔥, leading to a steady decline in rate cut expectations—currently, expectations for rate cuts this year have dropped to fewer than two 🔄.

Risk Warning ⚠️

Event Sensitivity: Outcomes of China-U.S. trade talks 🤝, the Fed’s statements , and nonfarm payroll data 📊 may trigger one-sided volatility. Positions should be adjusted promptly to avoid risks 🛡️

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Buy@ 3300 -3310

🚀 TP 3320 - 3330 - 3340

🚀 Sell@ 3350 -3340

🚀 TP 3330 - 3320 - 3310

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

Gold repeatedly tested lows. Will it break through?On Monday, the Asian market opened low and rose in the early trading. In the European trading, it rose to around 3345. The European trading was under pressure and fluctuated. The US trading began to accelerate its decline, and the lowest point reached around 3302. Then it continued to fluctuate in the range of 3300-3320.

On July 27, the United States and the European Union reached a framework trade agreement; the agreement reduced market concerns about the global economic recession, promoted the attractiveness of risky assets, and boosted the stock market and the US dollar. Although Trump has repeatedly pressured for a substantial interest rate cut, the market has strong expectations for a September interest rate cut. The current expectation of maintaining a stable interest rate dominates the market, coupled with the strength of the US dollar, which puts gold prices under downward pressure in the short term.

Gold opened low in the early trading on Monday and then rebounded to recover the losses, but then fell below the low again, and the daily line closed in the negative, and now it has formed a four-day negative decline. MA5 and 10-day moving averages form a dead cross, and there is a downward turn.

The focus on the upper side is around Monday's high of 3345, which is also near the current position of MA5, 20, and 30-day moving averages. Below this position, gold is weak; if it breaks upward, it is necessary to prevent the possibility of a rebound correction.

The lower support first focuses on the 3300 integer mark; secondly, focus on the area around 3285-3275.

Operation strategy:

Short near 3340, stop loss 3350, profit range 3320-3300;

Long near 3300, stop loss 3290, profit range 3320-3340.

Before the release of US data on Tuesday, you can maintain this operation strategy; after the data is released, adjust the strategy based on the impact of the data.

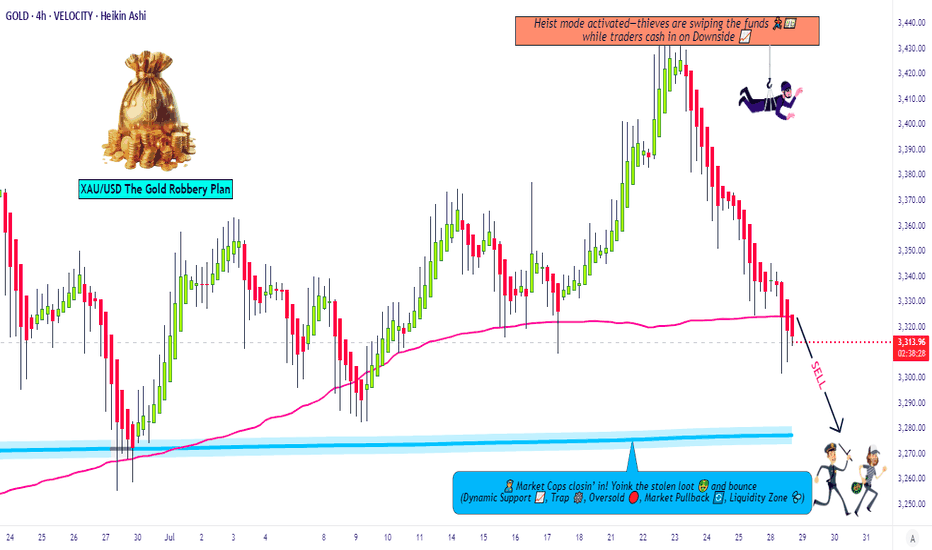

Gold Robbery Blueprint: Smart Bears on the Move Now!💣 XAU/USD GOLD HEIST PLAN: Robbery Begins at Resistance Zone! 🔐💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Market Robbers, 🕵️♂️💸🚀

Welcome to another strategic strike by Thief Trading Style™—where smart analysis meets bold execution. We're targeting XAU/USD (Gold) in this scalping/day-trade opportunity, primed with fundamentals, technicals, and pure robbery logic.

🔍 THE GAME PLAN

We're looking at a neutral zone turning bearish, and here’s how the robbery unfolds:

🔑 ENTRY POINTS

🎯 “Vault wide open” signal!

Initiate short orders at current price zones or set layered SELL LIMITS near swing highs on 15M/30M charts. We're running a DCA-style pullback entry for max loot.

🕵️♀️ Entry isn't about one shot—it's about precision raids.

🛑 STOP LOSS: THE ALARM SYSTEM

Set SL just above the nearest swing high (4H timeframe preferred).

Use candle wick tips as your defense line (Example: 3350.00).

Adjust SL based on risk appetite and number of orders stacked.

🎯 TARGET: THE GETAWAY PLAN

💸 First Vault: 3280.00

💨 Or escape earlier if price action signals reversal. Protect your gains. Professional thieves don't get greedy.

📊 WHY WE’RE ROBBING HERE

This level is a high-risk barricade zone—police aka "market makers" are strong here.

We spotted consolidation, oversold signals, trend reversal setups, and a bullish trap disguised as support. A perfect time to strike. 🧠🔍

📰 FUNDAMENTAL & SENTIMENTAL CHECKPOINTS

🔎 Stay updated with:

Global news drivers

Macro & Intermarket analysis

COT reports & future trend targets

👉 Check the 🔗🔗🔗

⚠️ TRADING ALERT - STAY SAFE DURING NEWS BOMBS!

Avoid entries during major economic data releases.

Use trailing SL to protect running profits.

Monitor volatility spikes & price anomalies.

💖 JOIN THE CREW, BOOST THE HEIST!

If this plan adds value to your trades, hit that Boost Button 💥

Support the Robberhood and help grow the gang of smart money snipers 🕶️💼💣

Every boost = more ammo for next mission. Let's rob the market—not each other. 🚀🤑

📌 Remember: Market is fluid. Stay sharp, adapt quick, and trade like a shadow.

Catch you soon in the next grand heist 🎭💼

#XAUUSD #GoldTrade #ScalpingStrategy #DayTrading #ThiefTrader #RobTheMarket #BoostForMore #NoChaseNoCase

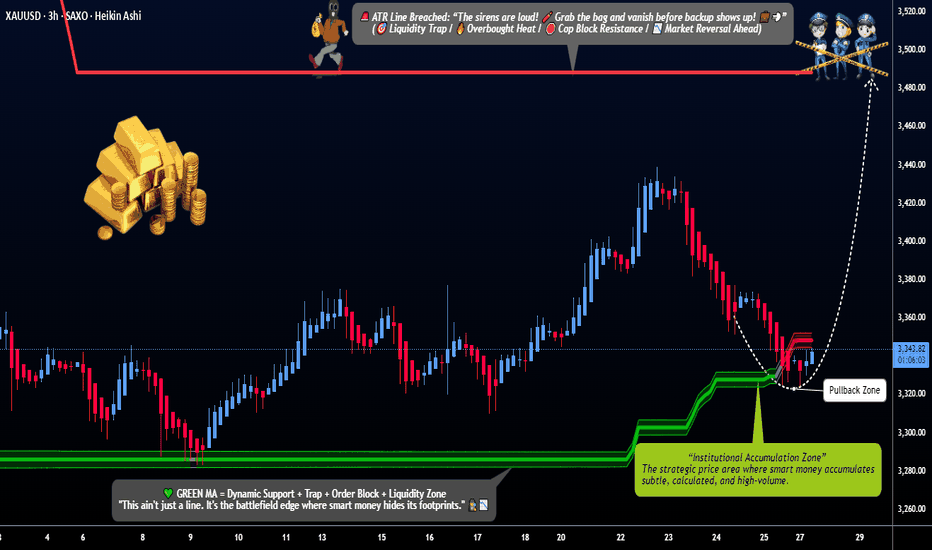

"XAU/USD Gold Heist Plan | Pullback Entry for Big Bullish Move"🔐💰“GOLD HEIST PLAN UNLOCKED: Thief Trader’s XAU/USD Breakout Blueprint”💰🔐

by The Market Robber a.k.a. Thief Trader – Stealing Pips, One Candle at a Time!

🌍 Hey Money Makers, Market Hustlers, Robbers, & Chart Crackers! 🌍

Bonjour! Hola! Marhaba! Hallo! Ola! What's poppin'?

Welcome to another exclusive robbery plan crafted in pure Thief Trading style—built off technicals, fundamentals, market psychology, and a bit of outlaw intuition. 💸⚔️

This one’s for the GOLD DIGGERS – literally. We’re targeting XAU/USD for a high-voltage bullish heist 🎯💥. Stick to the plan, follow the chart, and you might just make it out with a sack full of pips 💰🔥.

🔓 THE SETUP: GET READY TO ROB THE GOLD MARKET

We're eyeing a LONG ENTRY, with clear intent to break past the consolidation zone and avoid the trap laid by the "market police" at the ATR barricade zone 🚨. This level is where overbought drama and bear claws are strongest – we slip in, grab the profits, and bounce before they know what hit ‘em.

🧠 Use caution: This level is filled with liquidity traps, reversals, fakeouts and retail bait zones. Classic Thief style means we know where the guards are sleeping and where the cameras don't reach. 🎥🔕

💸 ENTRY PLAN:

🟢 Entry Zone: Watch for a pullback to 3320.00 or above. Don’t jump early.

💡 Tactics:

Use Buy Limit Orders (DCA / Layered Entry Style)

Drop them in on 15min/30min swing levels – catch price slipping into liquidity

Confirm with minor structure breaks / order block retests

🔔 Set those alerts – the real move happens when the breakout candle hits.

🛑 STOP LOSS STRATEGY:

🧠 Pro Rule: No stop-loss before breakout.

Once breakout confirms:

🔴 SL Zone: Recent swing low (approx. 3280.00) on the 4H chart

🎯 Adjust SL based on:

Lot size

Order count

Risk appetite

You know the game: manage your risk like a pro thief—quiet, calculated, and fast on the getaway. 💨

🎯 TARGET ZONE:

🏁 TP Zone: 3490.00

⚠️ Escape earlier if the pressure gets heavy – smart thieves never overstay the job.

🧲 SCALP MODE:

Only scalp LONG SIDE – don’t get caught chasing shorts unless you're rich enough to burn your drawdown 🔥

🔐 Use trailing SL to secure bags while climbing the ladder.

🧠 FUNDAMENTALS & MACRO EDGE:

The Gold market is currently in a BEAR structure with hints of bullish reversal potential. This heist isn’t just technical – it’s backed by:

🌍 Global Macro Flows

💼 COT Reports

📰 Sentiment & News Risk

💣 Geo-political Heat

📊 Intermarket Analysis (Dollar, Yields, Risk-On/Off correlations)

Dig deep for the full macro breakdown. Knowledge is leverage.

(Find full reports on reputable sources — you know where to look 👀)

🚨 RISK ALERT:

Before, During & After News Releases:

Avoid fresh entries 🔕

Use Trailing SLs to protect live trades

Watch spread spikes & low-liquidity traps

👉 Don't trade when the market's drunk.

💖 SHOW LOVE – BOOST THE PLAN:

💥Smash that Boost Button💥 if you want more precision heist strategies like this. Support the Thief Trading Style, and we’ll keep robbing the markets clean and teaching the crew how to get in & get out profit-heavy. 🏴☠️📈💰

🎭 I’ll be back with another chart crime scene soon. Until then, stay sneaky, stay profitable, and always move like the market’s watching (because it is). 😎

🔐 Thief Trader Out. Rob. Exit. Repeat. 🔁💸

Gold fell below support. What will be the subsequent trend?The 1-hour moving average of gold continues to show a downward short position, indicating that the downward momentum is still sufficient; the wave pattern of gold's current decline remains intact, but the rebound strength is very weak, showing an obvious short trend of gold. Moreover, when gold rebounded in the short term, obvious resistance began to form above 3320, and the upward momentum was slightly insufficient.

From the daily chart, before 3300 fails to fall, it is likely to fluctuate around 3300-3350. On the contrary, if it falls below 3300, it is likely to reach the bottom of the 3385-3375 range.

This week is a super data week. The data of each day may affect the trend of gold on that day, but it will not form a unilateral strong trend. Therefore, the volatility before and after the data is released is likely to be large, so traders should focus on the following data:

1. US ADP employment report, US second quarter GDP preliminary value;

2. Federal Reserve interest rate decision;

3. US PCE annual rate, monthly rate;

4. The last trading day of this week will usher in non-agricultural data.

How to plan for the evening, pay attention to the 3300 markAfter the shorts took profits, gold consolidated in the 3310-3300 area. Judging from the daily chart, the decline in gold seems to have just begun, with the middle track of the Bollinger Band at around 3345 and the lower track at 3285. The possibility of falling below the 3300 mark cannot be ruled out in the evening. If gold falls below the 3300 mark, it may first hit 3295. If the decline continues, it may even hit the low of 3285-3275 below. However, if the 3300 mark can be effectively defended, then the possibility of maintaining the consolidation of 3300-3345 in the evening may be maintained. Therefore, it is not recommended to easily participate in transactions at the current position in the evening. It is mainly advisable to wait and see and pay attention to the breakthrough of the 3300 mark.

My premium privileges are about to expire, and subsequent trading strategies and analysis will be published in the group.

Monday market forecast and analysis ideas#XAUUSD

There will be a lot of data next week, such as the 8.1 tariff deadline that I have repeatedly emphasized, the Federal Reserve decision, NFP data, etc. It can be said that it is relatively difficult to analyze purely from a technical perspective, because there is uncertainty in many data, the data results are often non-linearly correlated with market reactions (good news does not necessarily lead to a rise, and bad news does not necessarily lead to a fall), and large fluctuations can easily form oscillating K-lines with long upper and lower shadows. Therefore, the first arrangement for next week is to participate in trading with a light position and avoid letting emotions control your thinking.

The closing price on Friday was near 3337, proving that the short-term judgment on the rebound momentum of gold is correct, so there are two possible situations on Monday.

1. The first thing we need to pay attention to is 3345-3350 to determine whether it constitutes a short-term pressure level. The weekly line closed with a negative cross star. Combined with the monthly line trend, in terms of support, focus on the trend line support near this week's low of 3325. If this position is not broken, the market is expected to usher in a wave of rebound; if it falls below 3325, the bottom may look to 3310 or even 3295 for support.

2. The rebound momentum of Friday continued on Monday, breaking through 3350 first, and then it is possible to reach the previous high resistance area of 3370-3380. If it encounters resistance here, gold will continue to fall and fluctuate, and the target may even be 3310. If the price remains strong and issues such as interest rate cuts and tariffs are imminent, it means that the short-term downward trend has ended and may even set a new high.

The above content is only a forecast for Monday’s market. It will be greatly affected by data and news, and may be adjusted in real time next week based on intraday trends. You can refer to this, but remember not to be swayed by emotions. We will participate with a light position, and the specific trading strategy can wait for my trading signal.

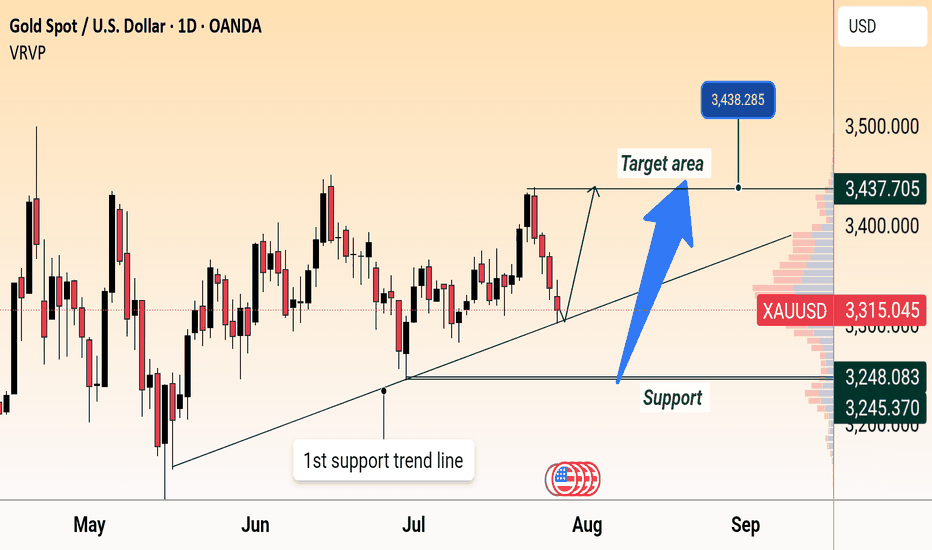

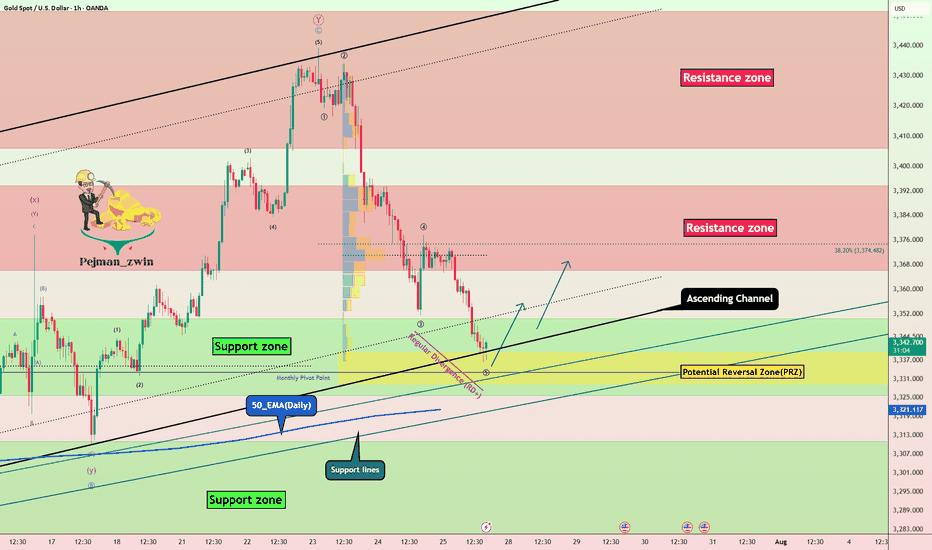

Gold Recovery Setup = Divergence + Support ClusterGold ( OANDA:XAUUSD ) fell to the lower line of the ascending channel and the Support zone($3,350-$3,326) , as I expected in my previous idea .

Gold is currently near a set of Supports .

Supports:

Support zone: $3,350-$3,326

Monthly Pivot Point: $3,333

Potential Reversal Zone(PRZ): $3,339-$3,329

Lower line of the ascending Channel

50_EMA(Daily)

Support lines

In terms of Elliott Wave theory , Gold appears to be completing a bearish wave 5 .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect Gold to rise to at least $3,359 .

Second target: $3,367

Note: Stop Loss (SL) = $3,319

Do you think Gold can break the Support cluster by the end of trading hours?

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

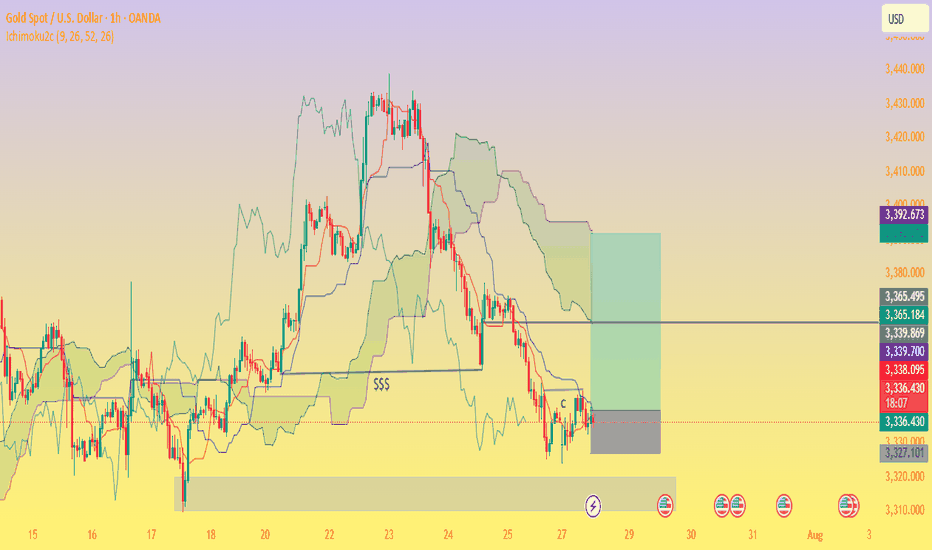

XAU/USD 1H – Range Consolidation Below Ichimoku Cloud. Chart Review & Technical Insight

1. Ichimoku Cloud & Overall Structure

Price is below the Ichimoku Cloud, with the cloud ahead sloping downward—indicative of bearish short‑term momentum and resistance overhead as long as the cloud holds above price.

The Kijun-sen (blue) line is above the Tenkan-sen (red), reinforcing the bearish bias on this timeframe.

2. Price Action & Key Zones

A support zone around 3,327–3,330 USD/oz is visible, underpinned by multiple rejection taps and price consolidation (“$$$” zone). A clean break below could open the path toward the 3,320’s or lower imbalance region.

On the upside, resistance lies near 3,339–3,340, backed by the cloud’s lower boundary and the Kijun-sen level.

The highlighted green rectangle appears to signal a potential bullish breakout target zone toward 3,365–3,392, contingent on recovery above the cloud.

3. Momentum & Trade Considerations

Momentum is weak, with price moving sideways inside a low‑volatility rectangle on diminishing volume and few directional impulses.

Possible ABC corrective structure is forming as marked, suggesting price may oscillate sideways or continue correcting within established bounds.

A bullish scenario would require clearing the Ichimoku Cloud and resistance at 3,340–3,360 USD.

Conversely, a bearish breakdown below ~3,327 could confirm continuation deeper into the 3,320s or toward the next significant demand zone near 3,300 USD.

.

✅ Summary

Bias: Slightly bearish to neutral until price can clear the Ichimoku Cloud.

Key Levels to Watch:

Support: 3,327–3,330 (immediate), then 3,320–3,300.

Resistance: 3,339–3,365, cloud top near 3,365, further target zone 3,392.

Scenarios:

Bullish breakout: Close above cloud → potential rally toward 3,365–3,392.

Bearish breakdown: Close below 3,327 → deeper correction toward 3,320 and lower imbalance areas.

[XAUUSD] Reversal Signals from Key Support As of the July 28–29 trading sessions, the XAUUSD 15-minute chart is showing early signs of a bullish reversal, with price reacting strongly at a key Fibonacci support zone and breaking through a descending trendline.

1. Price Action and Technical Structure

After a prolonged downtrend from the 3,430 zone, gold found support at the 0.618 Fibonacci retracement (3,327.85), aligning closely with the horizontal support at 3,324 – 3,327.

A descending trendline has been breached, signaling a potential breakout setup.

A potential ZigZag corrective wave structure is forming, hinting at the beginning of a new bullish swing.

2. Fibonacci Extension & Upside Targets

The Fibonacci extension tool suggests a possible rally toward the 3.618 extension at 3,425.

This level marks the next major upside target if the breakout holds.

3. Key Price Levels

Price Zone

Technical Significance: 3,327 – 3,324 Major support zone (Fib 0.618 + horizontal support)

3,350 – 3,355 First reaction zone / interim resistance

3,380 – 3,400 Strong resistance zone

3,425 Final target – 3.618 Fib extension

4. Suggested Trading Strategy

Long Setup – Breakout & Reversal Confirmation

Entry: 3,328 – 3,332 (after bullish confirmation above trendline and support)

Stop Loss: Below 3,320 (beneath local swing low)

Take Profit: 3,355 → 3,380 → 3,425 (scaling out by zone)

Bearish Continuation Scenario

If price drops below 3,320 and breaks 3,307 support, the bullish outlook is invalidated, and a retest of deeper levels is likely.

5. Volume and Confirmation Cues

Volume has started to pick up as price tests the breakout zone – indicating that buying pressure may be returning.

Wait for a strong bullish candle with volume above average before committing to the trade.

Gold is approaching a critical inflection point, and bulls may regain control from this confluence support zone. Stay alert for a breakout confirmation. Save this idea if you find it helpful and follow for more high-probability strategies!

The US and Europe reached an agreement. Gold rebounded.At the current node, the EU and the US reached a tariff cooperation, 15% tariff + 600 billion US dollars for investment in the United States. The additional tariffs are considered a big deal, and the US has become the winner again this time.

Of course, this is a small negative for the current gold market.

From a multi-period analysis, the monthly chart price is still in a reverse K state. For the current situation, we need to pay attention to the gains and losses of the monthly highs and lows. The weekly chart shows that the price has continued to fluctuate at a high level recently. As time goes by, the weekly watershed is temporarily at 3320. After last week's high and fall, there is currently a further downward performance.

The four-hour chart shows that the price has continued to be suppressed after breaking through the four-hour support last Wednesday. The four-hour level resistance is currently around 3355, and the resistance level has moved up compared with the early Asian market. Therefore, we will pay attention to the pressure at this position in the future. If it fails to break through for a long time, it is likely to fall directly under pressure; pay attention to the support range of 3320-3310 below.

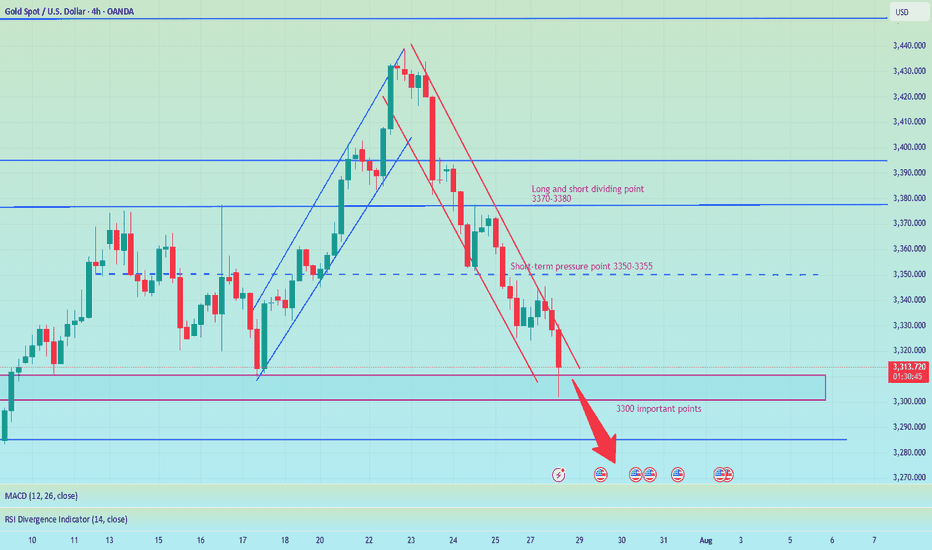

Gold Breakout Failed – Bearish Reversal in Play?Last week was both interesting and revealing for Gold.

After breaking above the key $3375 resistance—which also marked the upper boundary of a large triangle—price quickly accelerated higher, reaching the $3440 resistance zone.

However, instead of a bullish continuation, we witnessed a false breakout and sharp reversal. What initially looked like a healthy pullback turned into a full bearish rejection by week’s end.

________________________________________

📉 Current Technical Picture:

• On the daily chart, we now see a clear Three Black Crows formation

• On the weekly chart, a strong bearish Pin Bar confirms rejection

• And if we add the failed breakout above 3375, the bias tilts decisively bearish

________________________________________

📌 Key Zones and Trading Plan:

• Gold is currently bouncing from the ascending trendline zone, which is natural after dropping more than 1,000 pips in just 3 days

• The $3375–3380 area has regained importance as a key resistance zone, and that’s where I’ll be looking to sell rallies

• A bullish invalidation would only come if price manages to stabilize above $3400

Until then, this remains a bear-dominated market, and a drop below $3300 is on the table.

________________________________________

🧭 Support levels to watch:

• First support: $3280

• Major support: $3250 zone

________________________________________

📉 Conclusion:

The failed breakout, bearish candle formations, and current price structure all point to a market that's shifting in favor of sellers.

I’m looking to sell spikes into resistance, with a clear invalidation above $3400.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.