Gold has two winning streaks, how to trade in the short term?The 1-hour moving average of gold has begun to turn gradually, and the strength of gold bulls has begun to weaken. Gold may continue to adjust in the short term. The 1-hour short-term double top structure of gold. Gold subsequently rebounded but did not continue to set a new high. Today, the rebound was under pressure at 3232 and began to fall back.Gold still has the opportunity to adjust, and gold will continue to watch the adjustment market in the short term.

Trading ideas: Short gold near 3230, stop loss 3240, target 3200

Xauusdtrend

XAU/USD "The Gold" Metals Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (3260) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (3150) Swing/Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 3470 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XAU/USD "The Gold" Metals Market Heist Plan (Day / Swing Trade) is currently experiencing a Neutral trend (there is a chance to move bullishness).., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Gold Maintains Weekly Bullish Structure Amid PullbackGold Weekly Technical Outlook

Gold (XAU/USD) remains in a clear bullish trend on the weekly chart, currently trading around $3,230. After marking a new high, price action suggests a potential pullback—a healthy retracement that could set the stage for further gains.

Key Levels to Watch:

Current Price: $3,230

Retracement Zone:

First support at $3,100, a recent consolidation level

Deeper support between $2,950 – $2,900, aligned with prior breakout structure and strong demand from earlier in the trend

These levels are key for a potential bounce, as they mark high-probability zones for buyers to re-enter the market.

Upside Targets:

Short-term resistance: $3,280

Primary target (by mid-May): $3,400

This level aligns with the projected extension of the ascending structure and continuation of bullish momentum

Technical Outlook:

As long as gold holds above $2,900, the weekly bullish trend remains intact. A rebound from the retracement zone would likely lead to a renewed rally targeting the $3,400 region.

XAUUSD Daily Analysis📈 XAUUSD Daily Analysis – 12/04/2025

🔥 Strong bullish move after a clear Market Structure Shift (MSS) and liquidity grab below the Previous Daily Low.

📉 A significant Fair Value Gap (FVG) remains between 3,100,000 and 3,175,000 – a potential pullback zone.

📍 Price could revisit this FVG before continuing the bullish momentum towards 3,300,000+.

🔹 PDL = Previous Daily Low

🔴 BAG = Breakaway Gap

🧠 Patience is key – wait for price reaction in the zone of interest.

📌 For educational purposes only – not financial advice.

💬 Drop your thoughts in the comments ⬇️

🔁 Like if you found this helpful!

XAUUSD Weekly Forecast: Probable Price Range and Trade PlanAs of April 12, 2025, gold (XAU/USD) has experienced significant volatility, reaching record highs amid global economic uncertainties. Here's an analysis based on the latest data:

📅 Economic Calendar Highlights (April 2025)

Key upcoming events that could influence gold prices include:

April 15: U.S. Consumer Price Index (CPI) release

April 17: U.S. Initial Jobless Claims

April 18: University of Michigan Consumer Sentiment Index

📈 XAU/USD Technical Overview

Trend & Momentum: Current Price: Approximately $3,236.21 per ounce.

Trend: Strong uptrend, with prices surging past the critical $3,200 mark.

RSI (14): 64.826 – approaching overbought territory, suggesting strong buying pressure.

MACD (12,26): Positive value of 21.21 – indicating bullish momentum.

ADX (14): 33.482 – confirming a strong trend.

Moving Averages: All major moving averages (MA5 to MA200) are signaling a 'Buy,' reinforcing the bullish outlook.

Support & Resistance Levels:

Immediate Resistance: $3,245.69 – recent intraday high.

Next Resistance Target: $3,300 – as projected by analysts amid ongoing market dynamics.

Immediate Support: $3,174.14 – recent intraday low.

Key Support Levels: $3,048 and $2,953 – potential pullback zones if a correction occurs.

Candlestick Patterns:

A “shooting star” pattern has emerged, which may signal a short-term reversal or consolidation phase.

Price Projection for April 14–18, 2025

Considering the current technical indicators and market conditions:

Projected Minimum Price: $3,180 – accounting for potential short-term corrections.

Projected Maximum Price: $3,280 – if bullish momentum continues without significant resistance.

XAUUSD Daily Trading Plan - Sniper EntriesXAUUSD Daily Trading Plan - Sniper Entries 🚀

🔹 Price Action Overview:

Trend: Bullish (H1, H4, M15)

Current Price: ~3,217

Market Sentiment: Positive, with strong bullish momentum, consolidating after breaking recent highs.

Key News: Core PPI (m/m) and Prelim UoM Consumer Sentiment due today, watch for volatility during the New York session.

🚨 Potential Sniper Entry Zones:

1st Buy Entry Zone 📈

Price Range: 3,172 – 3,175

Why: Strong Order Block (OB) on M15 & M5, CHoCH confirming trend reversal with a clear liquidity grab.

Confirmation: Expect a bounce from support as price retraces into the zone, offering favorable risk/reward for a buy continuation.

Stop Loss (SL): 3,160 (tight risk management)

Take Profit (TP):

TP1: 3,200

TP2: 3,220

TP3: 3,240

2nd Buy Entry Zone 🛒

Price Range: 3,200 – 3,205

Why: Minor support with the market showing consistent bullish action around this zone.

Confirmation: Watch for market structure to hold; this will be a second-tier entry in case of shallow retracements.

Stop Loss (SL): 3,190

Take Profit (TP):

TP1: 3,220

TP2: 3,240

TP3: 3,260

1st Sell Entry Zone 🔻

Price Range: 3,220 – 3,230

Why: Possible Premium zone as the price tests recent highs, near overbought conditions. Look for rejections here.

Confirmation: Watch for FVG & Price Action rejection signals.

Stop Loss (SL): 3,240

Take Profit (TP):

TP1: 3,200

TP2: 3,180

TP3: 3,150

2nd Sell Entry Zone 🔻

Price Range: 3,240 – 3,250

Why: Testing the Premium area near previous highs; watch for signs of a strong reversal.

Confirmation: Look for Bearish Divergence or Order Block Rejections.

Stop Loss (SL): 3,260

Take Profit (TP):

TP1: 3,220

TP2: 3,200

TP3: 3,180

⏰ Key Trading Hours:

New York Session (14:30 – 22:00 UTC+2): Pay attention to Core PPI data and Prelim UoM Consumer Sentiment for volatility. Watch for price reaction during these times to align with the entry zones.

🔑 Summary & Final Notes:

Buy Bias is dominant in this market given the recent strong bullish momentum. However, be mindful of resistance zones as price approaches key levels.

Ensure Risk-to-Reward is always favorable before entering.

Monitor key news events around 3:30 PM UTC for potential market reactions.

💬 Let's trade smart! Drop a comment below if you like the setup! 🔥 Follow and subscribe for more analysis!

Gold bulls are rising higherGold's 1-hour moving average continues to spread upwards and bulls are spreading. Gold bulls are full of strength. Gold still has upward momentum. The pullback will continue to give opportunities to go long.

Trading idea: Go long near gold 3175, stop loss 3165, target 3210

The above is only a sharing of trading ideas and does not constitute investment advice. You need to be responsible for your own profits and losses.

Gold Price Surpasses $3,200 for the First Time in HistoryGold Price Surpasses $3,200 for the First Time in History

According to the XAU/USD chart today, the price of an ounce of gold is fluctuating above the $3,200 level on global exchanges — a level never reached before.

Since the beginning of 2025, gold has gained approximately 22%.

Why Is Gold Rising Today?

Today’s bullish momentum in the gold market is driven by two key factors.

First, inflation data. Figures released yesterday for the CPI (Consumer Price Index) revealed a slowdown in inflation in the United States. This suggests a greater likelihood of monetary policy easing by the Federal Reserve. According to Reuters, gold prices now reflect expectations of three interest rate cuts by the end of 2025 — and lower rates typically support a stronger XAU/USD.

Second, fears of a global recession. Although US President Donald Trump has introduced a 90-day delay on the implementation of international trade tariffs, this does not apply to China, where tariffs have been increased to a striking 145%. Traders fear that Beijing could retaliate by raising tariffs on US goods beyond the current 84%.

Technical Analysis of XAU/USD

At present, the gold market is showing strong upward momentum, which began in early March (as illustrated by the blue trend channel). Key points include:

→ A breakout above the upper boundary of the channel;

→ The RSI indicator suggests a potential bearish divergence forming.

This points to the possibility of a short-term pullback into the blue channel, which would be a natural correction — especially considering the rapid $200 surge from $3,000 to $3,200 over just two days. However, given the current news backdrop, it seems unlikely that the bulls will relinquish control anytime soon.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Gold: Sell@3188-3200Gold has continued its strong rally, hitting a new all-time high, with bullish sentiment running extremely hot.

However, we must approach this rationally — every new high is usually followed by a technical pullback.

Currently, the 3200 level is a significant psychological resistance, as well as a key threshold for short-term bullish momentum.

From a technical perspective, the sharp recent rally has shown signs of momentum exhaustion, with clear overbought signals emerging.

📌 Strategy Suggestion:

Consider building short positions around the 3188–3200 zone

If 3137 is broken, further downside could extend to 3112–3090

⚠️ Risk Management Notes:

The larger the rally, the stronger the pullback potential

Avoid chasing long positions at these levels to prevent getting trapped at the top

Keep position sizes under control and set stop-losses to guard against sudden volatility

Wishing everyone smooth trades and solid profits!

4/11 Gold Trading StrategyFresh High Above 3170 – Momentum Continues, but Chasing Longs Is Risky

Gold delivered a strong one-sided rally yesterday, rising from around 3078 to above 3170, setting a fresh short-term high. While CPI and jobless claims data were modestly bullish, most of the rally occurred before the data release, suggesting that the move was primarily technically driven rather than fundamentally triggered.

As we anticipated yesterday, the price did reach above 3170 , and as clearly stated, we did not recommend chasing long positions at those highs. This view remains unchanged today.

🔍【Technical Insights】

The recovery from 2955 back to 3160+ took just 2 sessions, versus 4 sessions for the prior drop from 3167 — a clear sign of momentum dominance.

The daily chart shows two strong bullish candles, typically a sign of follow-through potential.

However, new highs reached under this structure tend to attract profit-taking and possible pullbacks.

If a technical correction occurs, look to 3143–3128 as a meaningful support zone for long opportunities.

🎯【Today's Gold Trade Setup】

🔻Sell Zone: 3188 – 3215

Look for short entries near resistance after overextension

🔺Buy Zone: 3134 – 3112

Wait for a healthy pullback to consider long positions

🔄Range Zone: 3178 – 3143

Flexible trading range — favor quick in/out trades in the zone

Risk aversion continues to escalate, go long after gold retreats

Gold has two effective support positions. The first one is near 3048, and gold rises rapidly after hitting the bottom of 3048. The second one is near 3070. If gold does not break through 3070, it will continue its strong bull market. If gold falls back near 3048, then gold may start to maintain a large range of shocks.

Trading idea: Go long near gold 3070, stop loss 3060, target 3100

After a brief rebound, gold continues to be short-sellingThe gold 1-hour moving average is still in a downward dead cross short arrangement, and the gold short strength is still there. The gold moving average resistance has now moved down to around 3002. After gold fell below 3000, gold accelerated its decline again, indicating that gold is still at an important level around 3000. The volatility of gold has only increased recently, so don't think that the market has reversed because it seems to have rebounded a lot. The recent fluctuations of tens of dollars in the gold market are normal.

Trading ideas: short gold around 3000, stop loss 3010, target 2970

Gold is still weak, rebound can still be shortedThe 1-hour moving average of gold still continues to cross downwards, and the strength of gold shorts has not weakened; gold rebounds are still mainly short selling. Although gold rose after covering the gap for one hour, the upper shadow line soon fell. Gold is still weak overall, and gold is under pressure near 3050 in the short term.

Trading idea: short gold near 3042, stop loss 3052, target 3022

The above is purely a sharing of personal opinions and does not constitute trading advice. Investments are risky and you are responsible for your profits and losses.

GOLD Price Analysis: Key Insights for Next Week Trading DecisionThe price of gold (XAUUSD) surged to a new all-time high last week following former President Trump’s announcement of reciprocal tariffs, only to face a strong retracement that plunged it to a 7-day low of around $3,015. The market then saw a recovery after Fed Chair Jerome Powell hinted that inflation could reaccelerate due to the economic impact of tariffs.

In this video, I break down:

✨ Gold price action and how markets are reacting to significant headlines

📉 A complete technical analysis of XAUUSD

📍 Key price levels, the current trend, and market structure

💡 Potential trade setups for the week ahead

We’re standing at a critical juncture in the gold market—and how traders respond could shape the next major move.

#XAUUSD #GoldAnalysis #GoldPrice #TechnicalAnalysis #ForexTrading #GoldForecast #FOMC #JeromePowell #TrumpTariffs #InflationData #MarketUpdate

Disclaimer:

Forex and other market trading involve high risk and may not be for everyone. This content is educational only—not financial advice. Always assess your situation and consult a professional before investing. Past performance doesn’t guarantee future results.

Gold continues to fall, what will happen next week?After the gold price fluctuated sharply at the high level in the past two days, gold finally broke down on Friday. In fact, the market was too active in the past two days, and the overall volatility was very large. In fact, it was still a little difficult to trade. Although the overall outlook is bearish, the rebound amplitude is actually not small each time. Now sometimes it rebounds more than 20 US dollars in a few minutes, so it may continue to fall after a loss. Now that the gold daily high is covered by dark clouds, how should we trade next week?

The gold 1-hour moving average has formed a death cross downward, so the gold shorts still have power, and the short-term gold can only rebound. After the rebound, the shorts will continue, and then the gold will enter a shock. After the high-level plunge of gold, the shorts will be more dominant in the short term. Unless there is a big positive news, it is difficult for gold to rise directly. The resistance for gold's rebound is 3076. If it is under pressure, then gold's rebound will mainly continue to be short on highs.

Perfect ending, gold trend analysis and layout for next weekEarly layout plan for gold: 3.31-4.4 Reviewing this week, a total of 20 layouts were arranged, and the overall harvest was 1245pips! This week can be called a super week. After the tariff fundamentals were implemented, the market started the callback mode, and there was a big sweep in the middle. It is unrealistic to say that we can win all the games. The number of mistakes we made this week has also increased. This is normal, but our eye-catching operations are even more dazzling, and we have gained more. Overall, I am quite satisfied. I will continue to work hard next week.

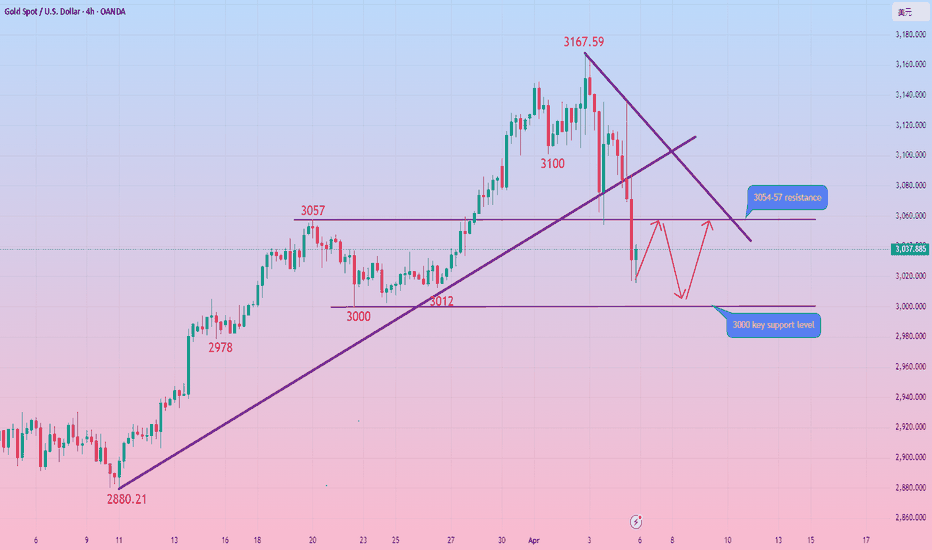

Analysis of gold market trends next Monday: Technical analysis of gold: The gold market on Thursday and Friday this week can be described as thrilling, with a rise and fall of more than 100 points in two days! The gold market suddenly changed, and there was an extremely violent sweep. First, it rose rapidly to 3136 without any signs, and then fell back quickly at lightning speed, and fell below the intraday low. After a series of big negative declines, the current short-term trend of gold is bearish. The daily line has a big negative downward trend, breaking the short-term moving average and piercing the middle track, leaving a lower shadow below. The pattern shows a bearish signal of Yin engulfing Yang. In the short term, it may rely on the support of the middle track to confirm the 10ma resistance and fall again. The 4-hour Bollinger band opens and extends downward. The K-line continues to decline, and the trend is bearish and downward. The callback space is larger than the rising space. Falling below the previous day's starting low of 3054 is a short-term empty point, and the lowest retracement is around 3015. The daily line is in a partial adjustment in the short term.

Combined with the falling wave space of the 4-hour chart. The 3000 integer mark is the support position of the golden section point 0.5. The 4-hour Bollinger Bands open downward, and the K-line continues to decline. The downward trend is obvious. The focus below is on the break of the 3000 mark. As long as the 3000 mark is held, the short-term bullish structure will not change. The market will continue to rise to new highs. If the 3000 mark is broken, the market will form a large-level adjustment structure. The short-term operation is mainly to buy on dips above 3000, and to sell at high altitudes. The upper resistance is around 3054-3057-3072, and the lower support is 3015-3000. On the whole, the short-term operation of gold next Monday is mainly to buy on rebounds, and to buy on callbacks. The upper short-term focus is on the 3054-3057 resistance line, and the lower short-term focus is on the 3000-3015 support line. Friends must keep up with the rhythm. It is necessary to control the position and stop loss, set the stop loss strictly, and do not resist the single operation. The specific points are mainly based on real-time intraday trading. Welcome to experience and exchange real-time market information ☎️, enter ✈️✈️ to follow real-time orders.

Reference for gold operation strategies on Monday:

Short order strategy: Strategy 1: Short gold rebounds near 3045-3055, stop loss 10 points, target near 3030-3015, break to see 3000 line.

Long order strategy: Strategy 2: Long gold pullback near 3015-3005, stop loss 10 points, target near 3030-3040, break to see 3050 line.

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S.Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (3095) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (3140) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 3030 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

4/4 Gold Trading StrategiesAfter yesterday’s sharp drop, gold quickly rebounded, and by the end of the session, prices had returned close to the opening level. I’m not sure if anyone is currently stuck in unfavorable positions. Under normal circumstances, if your account has sufficient margin and risk tolerance, such volatility shouldn’t cause major damage. However, for those with weak positions or who bought at the top or sold at the bottom, losses may have occurred—especially common among newer traders who are often influenced by emotions.

If you are currently holding short positions and hoping to wait for a price pullback, you'll need both time and sufficient margin. Based on current candlestick patterns, gold may attempt to test the 3128–3136 resistance zone again. Whether it moves higher will depend on the strength of the bulls.

Importantly, there are several key U.S. economic data releases during the New York session today. Based on preliminary expectations, the data appears to favor the bears, which could put additional pressure on gold prices.

📉 Today’s Trading Strategy:

Sell within the 3133–3152 zone

Buy within the 3065–3032 zone

📊 Scalping/Short-Term Trades:

Be flexible in the 3128–3088 range

The bearish trend is just beginning: Short Gold!Good morning, bros! With the gold price falling by LSE:100H yesterday, there is no doubt that the market is currently dominated by bears! As the gold high gradually moves down, it is difficult to hold even 3100, further weakening the bullish momentum and exacerbating panic selling to a certain extent!

Obviously, as gold completes the regional conversion, the previous support has been transformed into an important resistance area in the short term, and the short-term resistance effect of the 3115-3125 zone is very obvious; and the current area near 3090 does not play a structural support role, so the area near 3090 is easy to be broken, and the short-term support below is in the 3075-3065 zone.

So in terms of short-term trading, before the NFP market, we can still short gold with the resistance of the 3115-3125 zone, with the first target pointing to the 3075-3065 zone, followed by the 3055-3045 zone.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

What reason do we have to go short?Gold hit a high and then fell back to meet the support of the moving average. Can you make money by going long on gold above 3130? In a bullish trend, just do what bulls should do and don’t worry too much about gold peaking. The market will give a signal when gold peaks. At present, we continue to do more in the trend.

XAUUSD Weekly Trading Plan (W1 Outlook)Bias: 📈 Bullish (Strong Momentum)

Structure: Higher Highs / Higher Lows (Weekly)

Current Price: ~$3,084

Market Phase: Price Discovery / Momentum Phase

🔍 1. Weekly Market Structure

Clear bullish structure with strong continuation.

Recent Higher Low (HL): ~1985–2000 zone.

Current Weekly Candle: Strong bullish with little to no upper wick → sign of aggressive buying.

🧠 2. Smart Money Concepts (SMC)

✅ Liquidity Grab: Buy-side liquidity above 2080–2150 has been swept → cleared space for new highs.

📏 Fair Value Gap (FVG): Estimated FVG between 3000 – 3080, possible retest area.

🧱 Valid Bullish OBs: Below, around 1985–2000 (HL origin).

⛔ No resistance above – price is now in price discovery mode.

📊 3. EMA Alignment (Estimated)

EMA 5/21/50/200 are all bullishly stacked.

Price is significantly extended above EMA 21 → potential for short-term pullback.

Trend remains intact and strong.

🧱 4. Key Zones (Weekly)

Support Zones:

3000 – 2960 → recent impulse base.

2900 – 2880 → minor structure zone.

2080 – 2100 → breakout + consolidation area.

No historical resistance above current levels. Watch for round number reactions (e.g. 3100, 3150, 3200).

🔢 5. Fibonacci Levels (Swing Low: ~1985 → High: ~3084)

0.382: ~2660

0.5: ~2535

0.618: ~2410

→ These levels are relevant only if price enters deeper retracement later.

📅 6. Weekly Scenarios

✅ Bullish Continuation (Main Bias)

Hold above 3000 → target extensions toward:

🎯 3120 / 3180 / 3250+

Strong momentum candle suggests interest remains to the upside.

⚠️ Pullback Scenario

Rejection from 3085 area → potential drop toward:

3000 (minor FVG fill)

2960–2900 (stronger structure + potential re-entry area)

Bullish bias remains intact unless we break below 2900 weekly close.

🧭 Summary

XAUUSD is in price discovery after sweeping key liquidity.

Momentum is strong, but price is overextended → short-term pullbacks are healthy.

All signs point toward higher targets unless major structure breaks.

Last Friday, 3085 was shorted to make a profit, next week?Gold fell back on Friday after rising higher, and gold encountered resistance at 3085. However, gold is still just adjusting for the time being. Gold rebounded after the adjustment, and gold bulls are still relatively strong. You can continue to buy gold after it falls next week. After all, gold bulls are strong now, but don't chase it at high levels, and wait for it to fall before buying more.

The 1-hour chart of gold still shows a golden cross with upward bullish divergence. After the adjustment, the gold bulls did not weaken, but continued to be strong. Therefore, the decline of gold is just an adjustment. Gold can continue to go long after the adjustment next week. Gold rose again after bottoming near 3067 on Friday. The gold moving average support has now moved up to a line near 3072. Therefore, gold is still a support area in this range. Then if gold falls back to support near 3070 next week, it will still be long on dips.