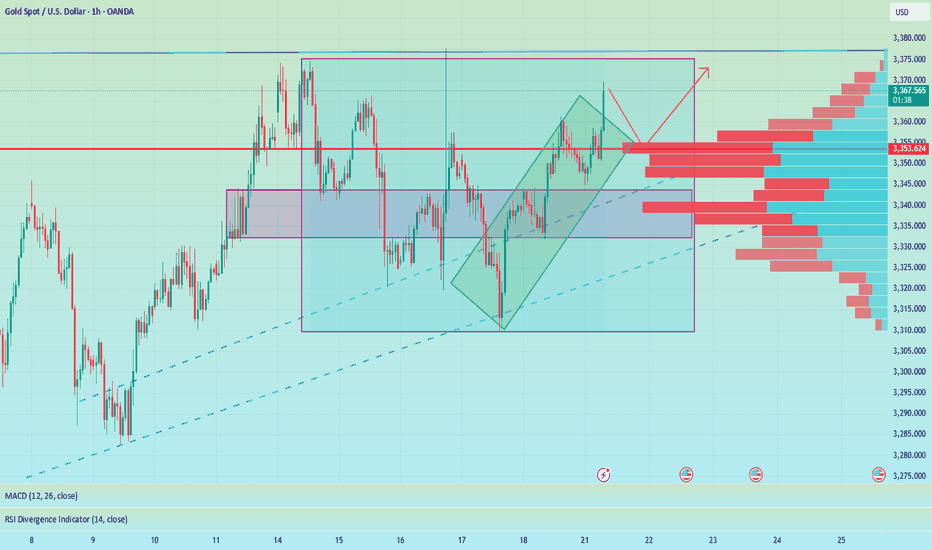

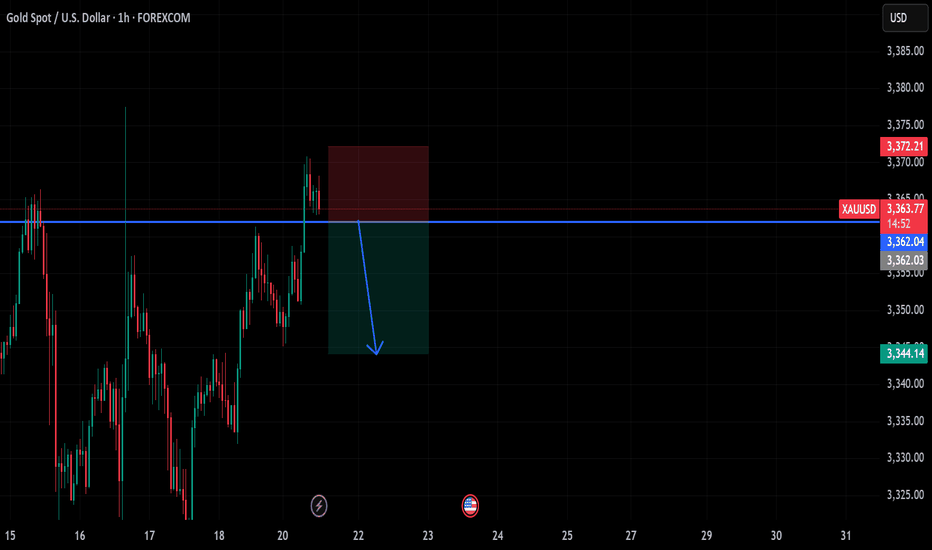

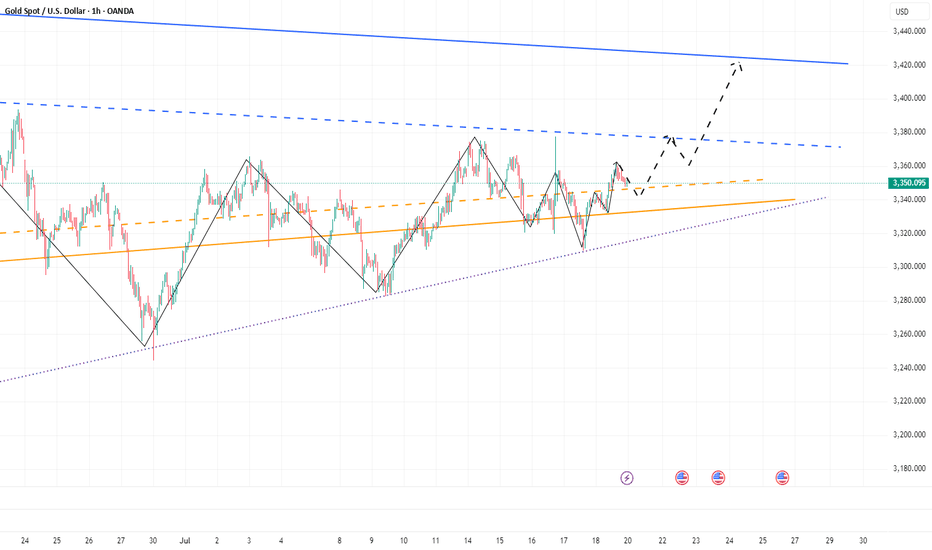

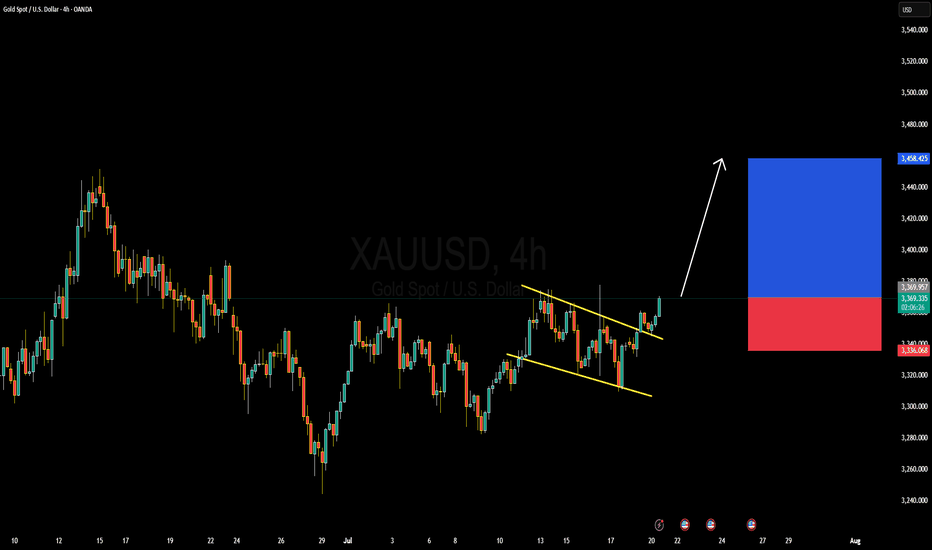

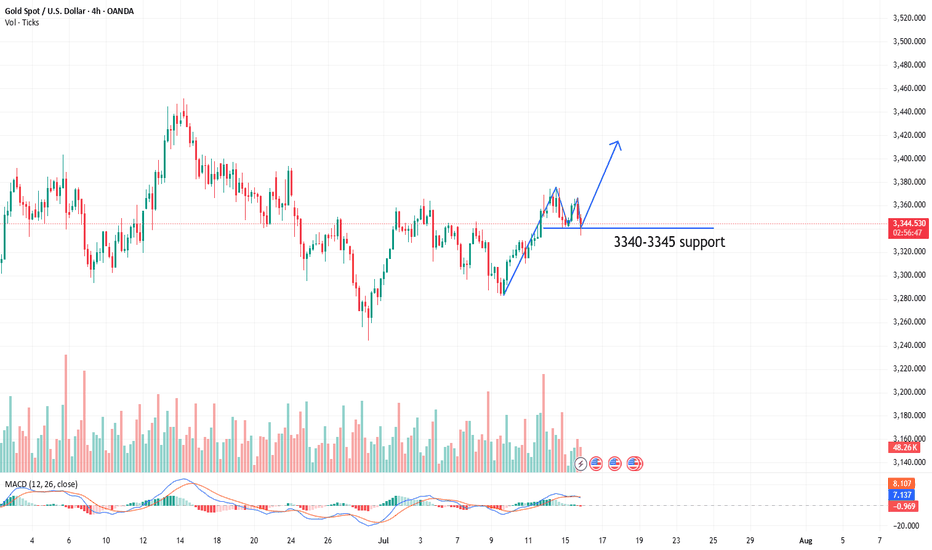

XAUUSD 1 HOUR CHART PATTERN(XAU/USD 1H timeframe), there are two target points clearly marked on the screen:

1. First Target Point:

~3,380,000 (as shown on the chart).

2. Second Target Point:

~3,420,000 (higher target marked at the top).

The chart shows a breakout above a descending trendline, with price retesting the breakout zone (light blue area). The arrows suggest an expected bullish continuation towards these targets.

Suggest stop loss zones.

Analyze further timeframes.

Xauusdupdates

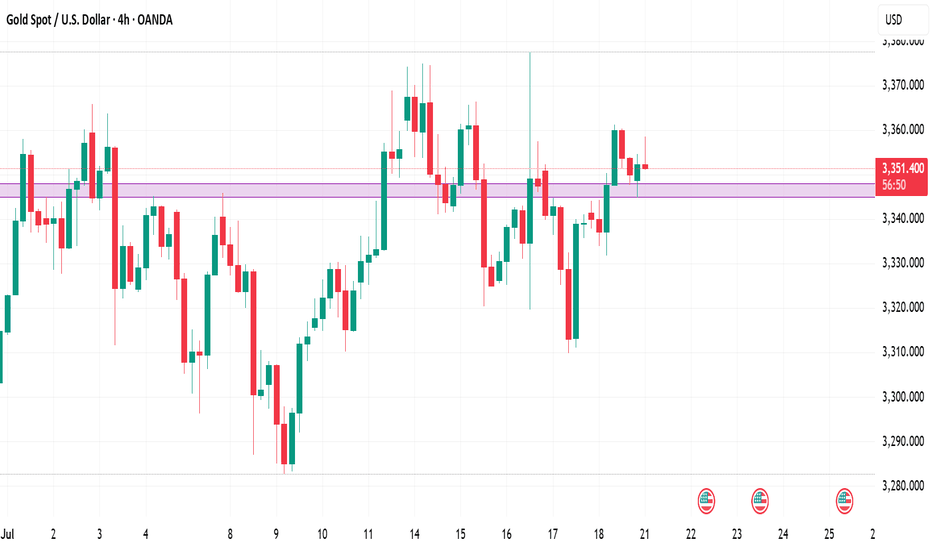

Accurate prediction, continue to buy after retracement to 3353📰 News information:

1. The Trump administration puts pressure on the Federal Reserve to cut interest rates

2. The continued impact of tariffs and the responses of various countries

📈 Technical Analysis:

Gold is currently rising rapidly, reaching a high near 3368, and the overall bullish trend has not changed yet. It is not recommended to continue chasing the highs at present. Those who are long at 3345 can consider exiting the market with profits. The technical indicators are close to the overbought area and there is a certain risk of a correction. Be patient and wait for the pullback to provide an opportunity. At the same time, 3353 has become the position with relatively large trading volume at present, and the top and bottom conversion in the short term provides certain support for gold longs. If it retreats to 3355-3345, you can consider going long again, with the target at 3375-3385. If it falls below 3345, look to 3333, a second trading opportunity within the day. If it falls below again, it means that the market has changed, and you can no longer easily chase long positions.

🎯 Trading Points:

BUY 3355-3345

TP 3375-3385

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD TVC:GOLD

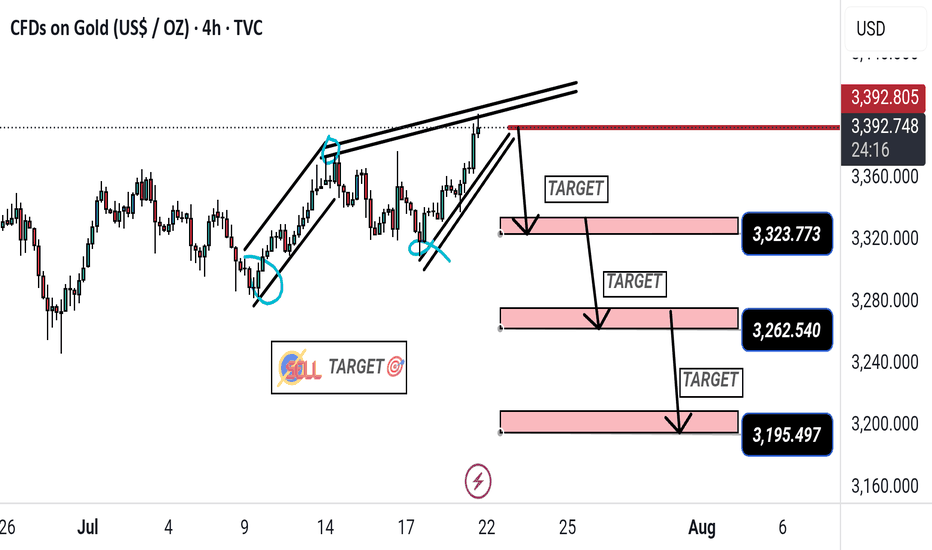

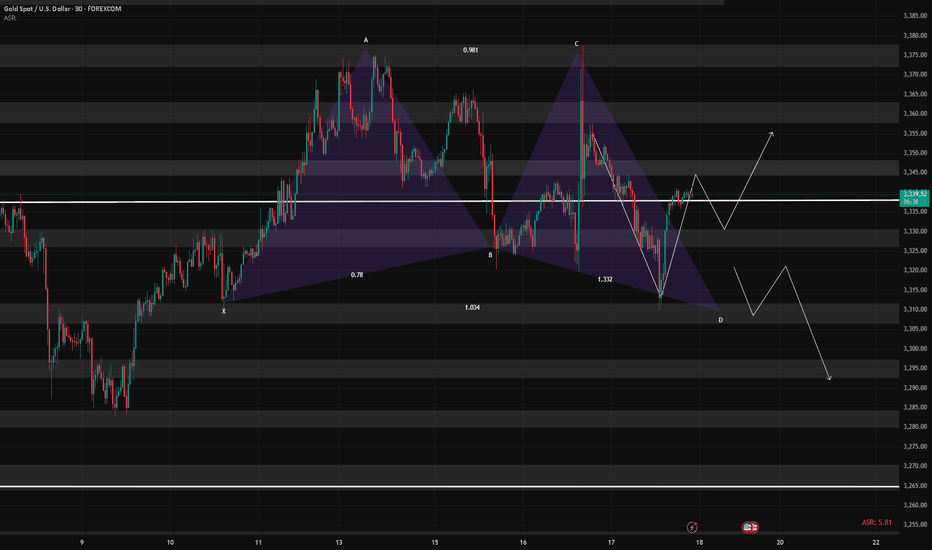

"Gold Price Bearish Reversal: Key Sell Targets Identified"This 4-hour chart of Gold (XAU/USD) shows a potential bearish reversal pattern forming after a rising wedge breakout. The chart indicates a SELL signal near the $3,392 resistance zone, with three downside targets at:

1. $3,323.773

2. $3,262.540

3. $3,195.497

Highlighted support zones suggest possible price retracements to these levels.

XAUUSD:The next target is 3430.The market is developing completely in accordance with the expectations of the band trading center. Today is a day of sharp rise. As Monday, this increase is quite considerable.

The three reminders to buy are all at a lower position. The post clearly points out that the market has reached 3400. 3400 is a controversial position. It needs to fluctuate in the New York market, and then there will be some breakthroughs. If it is stronger, it will directly break through the New York market. In the short term, you can pay a little attention to the retracement position of 3390-3395. Then continue to buy. The next target is 3430.

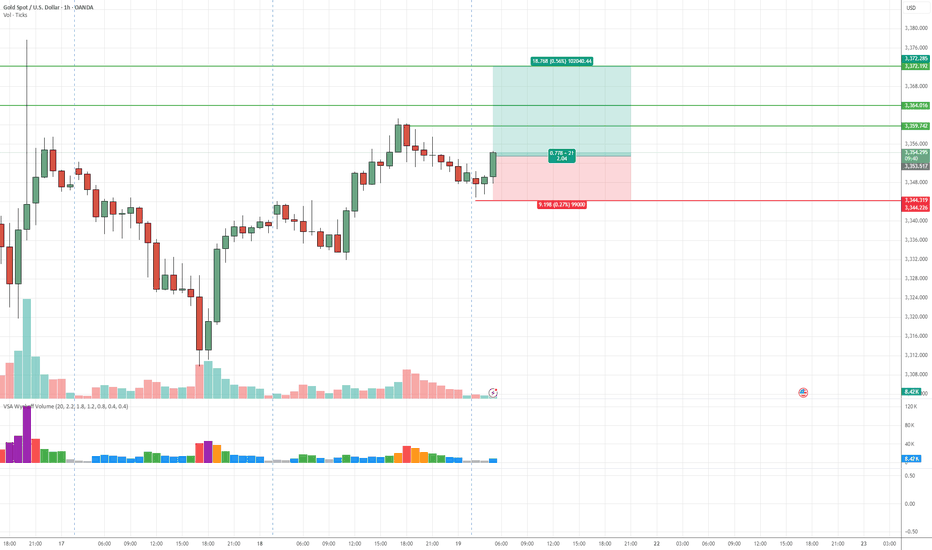

Gold (XAUUSD) Bullish SetupGold is maintaining its bullish momentum, with price action respecting key support levels. The chart highlights three target levels (TP1, TP2, TP3) marked with green lines, indicating potential zones for profit-taking as the uptrend progresses. A stop-loss is defined below the recent swing low, marked with a red line, to manage downside risk. This setup aligns with the prevailing trend and favors continuation traders.

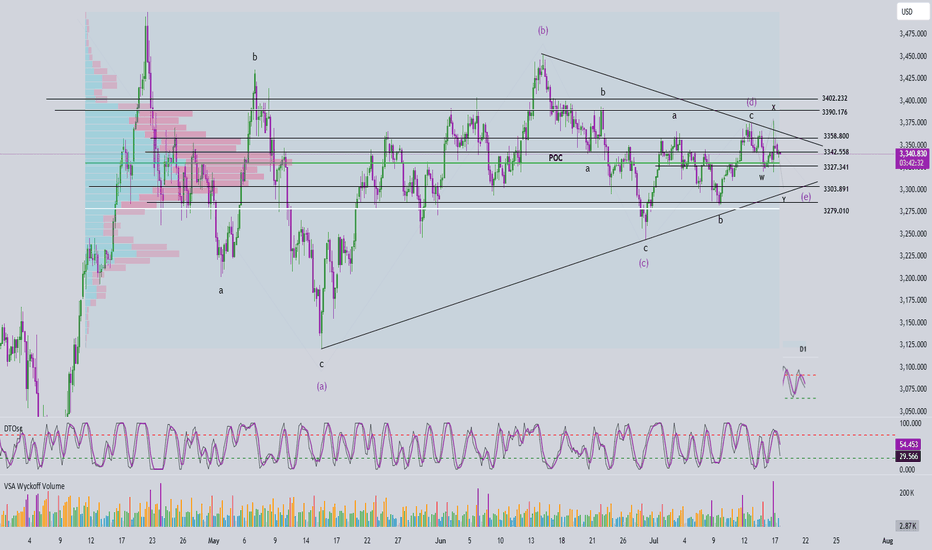

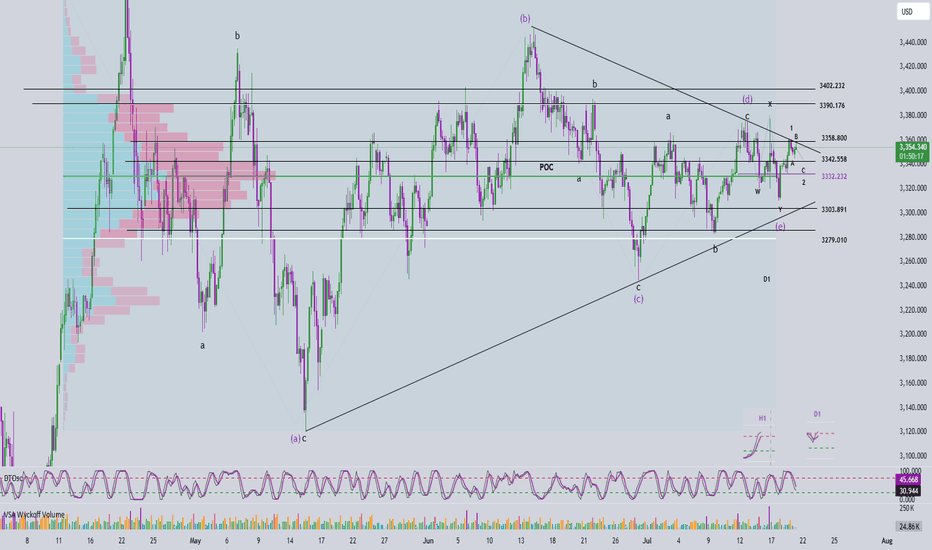

Elliott Wave Analysis – XAUUSD July 17, 2025

🔍 Momentum Analysis

D1 timeframe: Momentum is still trending downward, but we’re starting to see signs of convergence between the indicator lines. Normally, we would expect another two daily candles to reach the oversold zone and trigger a potential reversal. However, with the current narrowing pattern, we cannot rule out the possibility of an earlier reversal. Today’s daily close will be crucial for confirmation.

H4 timeframe: Momentum is clearly declining, suggesting that the market may either continue downwards or consolidate sideways throughout the day.

🌀 Elliott Wave Structure

On the H4 chart, price action is compressing tightly at the end of a symmetrical triangle pattern – a classic setup in Elliott Wave theory. Notably, this final point of compression coincides with the POC (Point of Control), indicating a key price level where high volume has accumulated.

Wave W (in black) follows a 3-wave structure. Yesterday, price surged to the beginning of wave W and then sharply reversed, forming the basis for two potential scenarios:

Scenario 1 – WXY structure with current price completing wave Y within wave e (green):

+ Target 1: 3327

+ Target 2: 3303

Scenario 2 – Wave e (green) evolves into a triangle:

+ In this case, price may consolidate sideways above the 3327 zone.

🔗 Combining Wave and Momentum Analysis

Both D1 and H4 momentum indicators are still pointing downward. However, the price candles appear overlapping and lack clear directional strength – a common trait of compression near the triangle’s apex. With price sitting right on the POC, there’s a high chance of continued tightening before a breakout. At this stage, the recommended strategy is to wait for a strong bullish candle at one of the target zones before entering a BUY position.

📈 Trade Setup

✅ Scenario 1 – BUY at 3327 – 3326

+ Stop Loss: 3317

+ Take Profit 1: 3342

+ Take Profit 2: 3358

+ Take Profit 3: 3402

✅ Scenario 2 – BUY at 3305 – 3302

+ Stop Loss: 3295

+ Take Profit 1: 3327

+ Take Profit 2: 3358

+ Take Profit 3: 3402

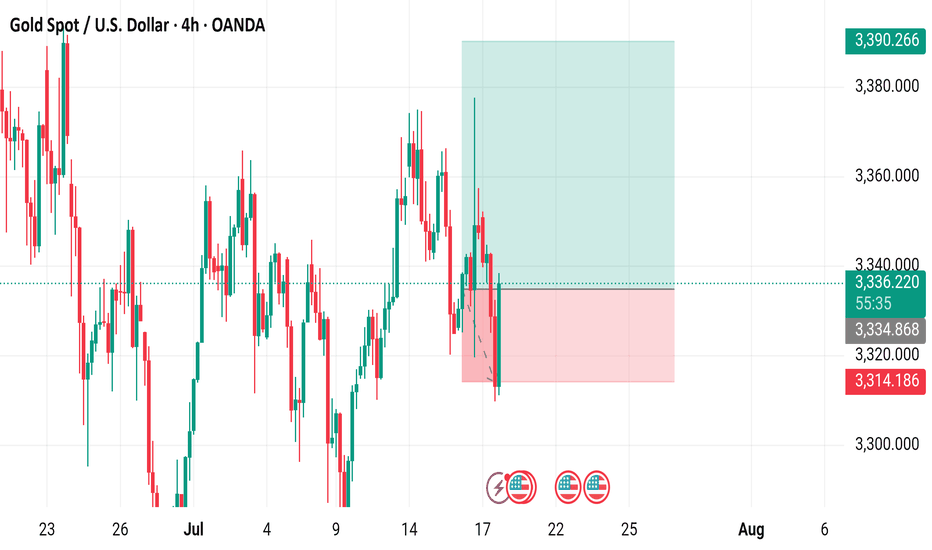

Gold Spot / U.S. Dollar (XAU/USD) 4-Hour Chart - OANDA4-hour chart displays the price movement of Gold Spot (XAU) against the U.S. Dollar (USD) from late July to early August 2025. The current price is 3,390.266, with a recent decrease of 10.870 (-0.32%). Key levels include a sell price of 3,336.420 and a buy price of 3,337.020, with a resistance zone highlighted between 3,340.720 and 3,380.000, and a support zone around 3,314.186. The chart includes candlestick patterns and trading indicators.

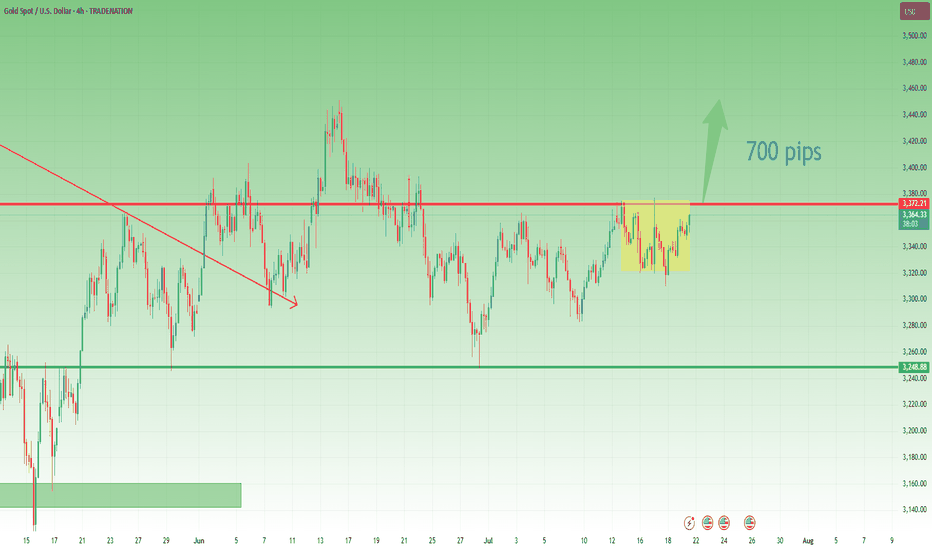

Gold Outlook – The Range Holds, Direction Still Pending📆 What happened recently?

Since the middle of last week, I’ve been repeating the same core idea like a broken record:

👉 “Gold needs to break out of the range to define its next real move.”

And once again, on Friday, TRADENATION:XAUUSD respected the structure, fluctuating quietly and closing the week right in the middle of the range — no breakout, no confirmation.

📈 Current status:

The new week opened with some bullish interest, and at the time of writing, Gold trades around 3363. Still inside the box.

So far, no technical change, and certainly no resolution.

❓ What am I watching for?

A clear break above 3375 → confirms bullish continuation

A decisive break below 3320 → confirms reversal potential

Until then, everything in between is noise and chop.

🧭 Trading plan:

My stance remains unchanged:

⏳ No position. No bias. Just waiting.

Once we get confirmation in either direction, I’ll take action.

📌 Conclusion:

Gold is still locked inside the range. The market is coiling, but no side is winning yet.

Patience here is a weapon — and I’m keeping it loaded. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold is waiting for a pullback to break through 3400In the short term, gold is stuck in a sideways trend near 3365. It is not recommended to enter this point regardless of long or short positions. It is expected that there will be certain variables in the NY period. If gold retreats and falls in the short term as we expect, it may first touch around 3361. If it falls below 3361, it is expected to touch around 3353, which is also the point I gave this morning to see support.

Judging from the market, our focus on the upper side is still the 3375-3385 resistance area. If it can be effectively broken through, it is expected to hit the 3400-3420 mark. Although the daily MACD is oscillating near the zero axis, the 4H market shows that the oscillation is strong. Our trading strategy remains unchanged in the short term. The pullback in the NY period provides an opportunity, and we can consider going long. If there is new news during the day that requires adjustment, I will notify you immediately. Bros, please be patient and wait for trading opportunities.

OANDA:XAUUSD

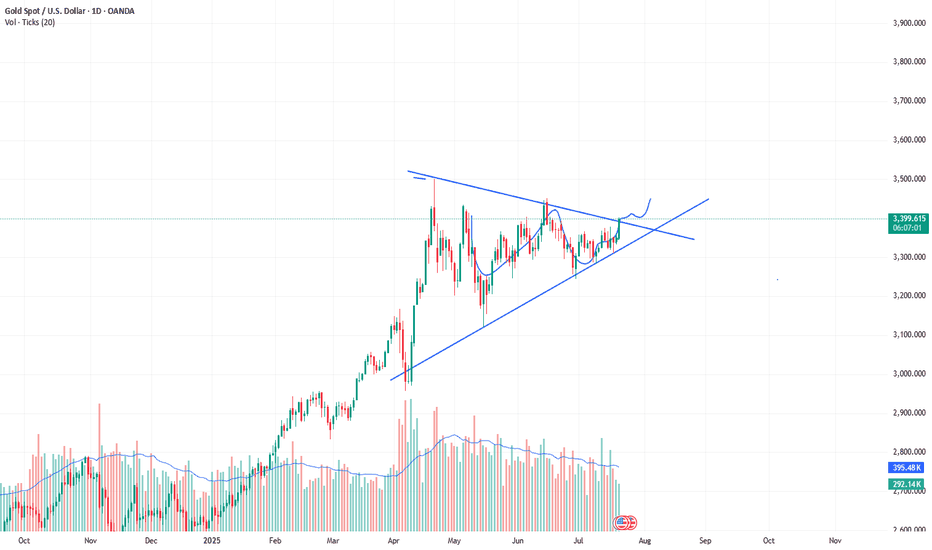

Gold returns to its original nature. Price increase towards 3400✏️ OANDA:XAUUSD is back to its inherent uptrend. Currently trading in a wide range. Shaped by CPI news last week. Trendline is still supporting Gold price towards 3400 next week. Pay attention to the important zone 3373 to DCA BUY and do not SELL when breaking this important zone 3373. Effective trading strategy is to wait for Gold to correct and buy.

📉 Key Levels

Support: 3343 - 3322

Resistance: 3373-3400

Buy Trigger: Rejects the support zone 3343 and reacts to the upside

Buy Trigger: Rebound from 3322

Target 3400

Leave your comments on the idea. I am happy to read your views.

XAUUSD Analysis Today Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

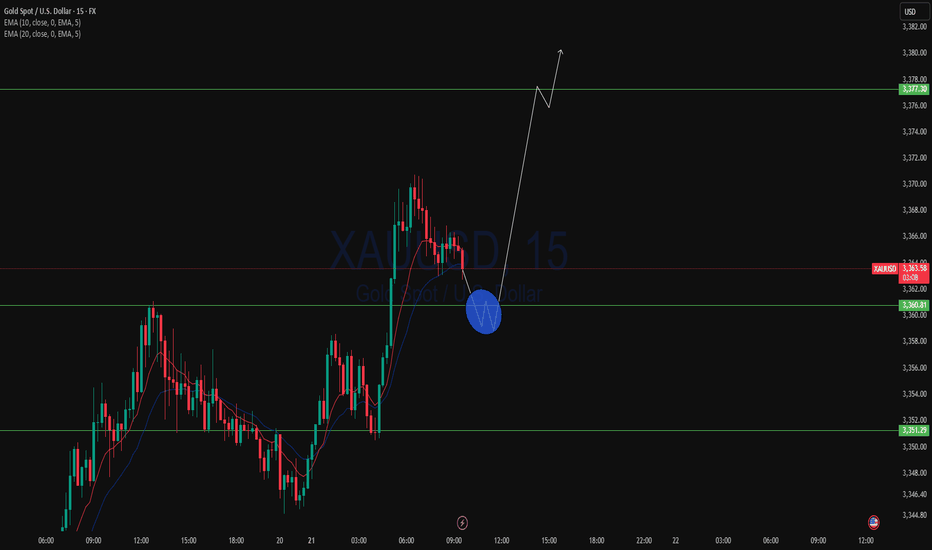

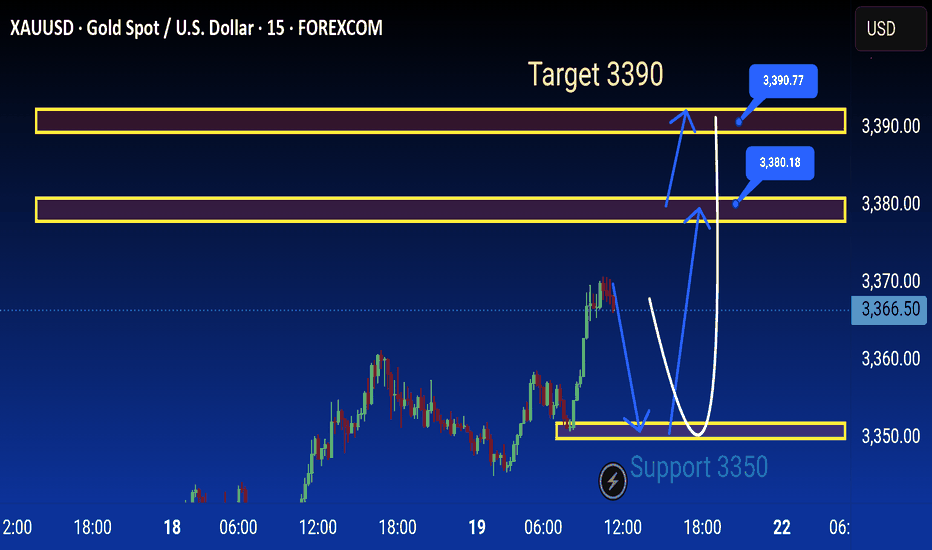

Xauusd Analysis is Ready technical analysis of XAUUSD (Gold Spot vs. US Dollar) on the 15-minute timeframe using support and resistance levels, with projected price movements annotated.

Key Levels:

Support Zone: Around 3350 USD (labeled as "Support 3350")

Resistance Zones:

Minor resistance: Around 3380.18 USD

Major resistance: Around 3390.77 USD

Target: 3390 USD, highlighted as the ultimate bullish goal.

Current Price:

Price at the time of analysis: ~3368.30 USD

Analysis Summary:

1. Support Retest Scenario:

Price may pull back to the 3350 support zone.

If this support holds, a bullish reversal is expected.

The anticipated move is a rebound back toward the resistance zone at 3380, and possibly to the target at 3390.

2. Immediate Bullish Continuation:

Alternatively, price could continue upwards from the current level without revisiting support.

Resistance around 3380 may act as a minor barrier.

If broken, the price could reach the target at 3390.

3. Bearish Risk:

If 3350 fails to hold as support, further downside may occur, invalidating the bullish setup.

Strategy Implication:

Buy positions could be considered on a successful retest and bounce at 3350.

Take-profits might be set near 3380 and 3390.

Traders should watch for price action confirmation at key levels before entering trades.

This is a classic support-resistance trading setup with short-term bullish bias aiming for a breakout toward higher resistance levels

Is This the Start of a New Gold Bull Run?News that must be paid attention to:

1. The Middle East region is in constant conflict and the situation is unstable, which may re-stimulate the market's risk aversion sentiment;

2. Trump strongly called for a rate cut, and many Fed directors agreed to the rate cut. Under the situation of internal and external troubles, can Powell withstand the pressure of rate cuts? In addition, the tense relationship between Trump and Powell, as well as the development of Powell's dismissal storm, have increased the market's risk aversion demand and enhanced the market's bullish sentiment;

3. The uncertainty brought about by the tariff issue may disrupt the market.

Technical aspects:

This week, the gold market is roughly a bottoming out and rebounding trend. We can clearly see from the recent candle chart that the recent trend line suppression is located near 3380, and this week gold has repeatedly encountered resistance and fallen in the 3375-3380 area, which has strengthened the suppression effect of resistance in this area to a certain extent; and gold has repeatedly tested the 3320-3310 area support during the retracement process. Gold has not fallen below the support of this area during multiple retracements, giving the market bulls great confidence.

On Friday, gold hit 3360 during the rebound and closed above 3350, which is strong in the short term. As gold continues to rebound, the current bull-bear dividing line is in the 3345-3335 area. If gold cannot even fall below the 3345-3335 area during the retracement next week, it will greatly boost buying power and is expected to hit the 3380 area again. Once gold breaks through the 3380 area during the rise, there will be a chance to further continue the rise and test 3400, or even the 3420 area.

Therefore, at the beginning of next week, if gold retreats to the 3345-3335 area for the first time, I think we must make an attempt to buy gold, first focusing on the target 3370-3380 area, and then bullish to the 3400-3420 area after a strong breakthrough.

XAUUSD Forming descending ChannelXAUUSD Gold has just broken out of a descending wedge formation and is now building bullish momentum. The daily chart shows a clear breakout above the upper channel line, confirming that buyers have taken control. Across the 4‑hour and daily charts, price is holding above key moving averages (20/50/100) and recently formed a bullish hammer—classic signals of fresh upside potential. A fib retracement off the wedge low would likely find support around $3,300–3,320, which already held strong. With immediate resistance in the $3,342–3,350 range, I'm expecting a firm push toward the $3,400 zone next, positioning for a possible continuation to $3,450+.

Fundamentals continue to steer price in our favor. In Q3 2025, gold remains elevated as the U.S. dollar loses steam and rate‑cut expectations rise. The market is pricing in a possible Fed move as early as next month, while tariff and trade uncertainty continues to dominate headlines. Central bank gold purchases remain strong, and investors are seeking safe‑haven shelter amid economic jitters—supporting gold’s role as a defensive asset. With YTD gains nearing 26%, momentum remains firmly bullish.

Looking ahead over the next couple of weeks, the risk/reward remains favorable. If gold holds above the $3,330–3,340 zone, we can remain bullish toward targets $3,400–$3,450. A dip toward that zone would present an attractive long entry, reinforcing our position. However, a breakdown below $3,300 would warrant caution and could introduce a deeper correction.

Given current technicals, fundamentals, and macro backdrop, this setup offers a strong opportunity. With proper risk management and support confirmation, another significant bullish leg toward $3,450–$3,500 is well within reach. Have a profitable trade.

Gold (XAU/USD) Technical Outlook — 21 July 20251. Market Overview & Live Price Confirmation

Gold is currently trading around $3,354, with a daily range of approximately $3,345–$3,359. This places it firmly within its broader uptrend, showing resilience amid recent macro uncertainties and consolidating its position above key support zones.

2. Four-Hour Technical Breakdown

Trend & Structure

The 4-hour chart reveals a strong bullish structure, marked by consistent higher highs and lows. A recent Break of Structure occurred near $3,324, reinforcing the upward bias. A minor Change of Character around $3,360–$3,358 reflects a healthy retracement, but the bigger picture remains strong.

Key SMC & ICT Zones

Supply Zone: $3,360–$3,362 — recent peak area likely to attract sellers and sweep above liquidity.

Demand Zone: $3,340–$3,344 — aligns perfectly with the 38.2% Fib from the $3,308–$3,362 swing, forming a prime area to buy from.

Order Block / FVG Zone: $3,336–$3,342 — open imbalance suggesting price may revisit for efficient entry.

Liquidity Context: Order flow patterns indicate stop hunts around established zones — part of classic Smart Money Concepts.

Fibonacci Levels

38.2% retrace at $3,340, offering medium-term confluence support.

Upside projections via Fibonacci:

1.272 extension: $3,378

1.618 extension: $3,389

3. One-Hour Intraday Trading Setups

Aligned with the 4-hour bullish bias, these setups offer scalable, structured entry opportunities.

Strategy Entry Zone Stop-Loss Take-Profit Risk:Reward

Aggressive Long $3,344 $3,338 $3,358 → $3,362 ~2:1

Conservative Long $3,340 $3,330 $3,362 → $3,378 ~2.5:1

Short Opportunity Rejection @ $3,362 $3,368 $3,344 ~2:1

🌟 The Golden Setup

Buy within $3,340–$3,344 (4H demand + Fib zone + FVG)

Stop-Loss: $3,330

Take-Profit 1: $3,362 (range high)

Take-Profit 2: $3,378 (Fib 1.272)

Why It Works: A confluence of structural support, liquidity zones, and retracement levels gives this setup high predictive quality.

4. Analyst Consensus Snapshot

Market commentary from professional analysts shows alignment with dip-buy strategies. Most recognize the $3,340 region as key support and express caution entering $3,360–$3,375 resistance. Weekly forecasts describe tight trading with potential for breakouts or retracements depending on economic data and Fed commentary, but the medium-term trend remains bullish.

5. Summary & Trading Blueprint

Price Range: $3,345–$3,359 (daily); $3,338–$3,378 (targets)

4-Hour Bias: Bullish, with defined demand and supply zones

Golden Trade: Buy $3,340–3,344 → SL $3,330 → TP1 $3,362 / TP2 $3,378

Catalysts to Watch: Federal Reserve speech, tariff developments, USD movements.

6. Final Thoughts

Gold continues to demonstrate bullish resilience, supported by both technical structure and macro tailwinds. The $3,340–3,344 zone offers a clear, high-probability entry confluence, while stop placement and profit targets are well-defined. Profit management around $3,360 ensures disciplined scaling or early exits if risk factors emerge.

By blending price action, Smart Money frameworks, ICT concepts, and Fibonacci confluence—all structured into actionable trade setups—you have a professional-grade playbook ready for deployment.

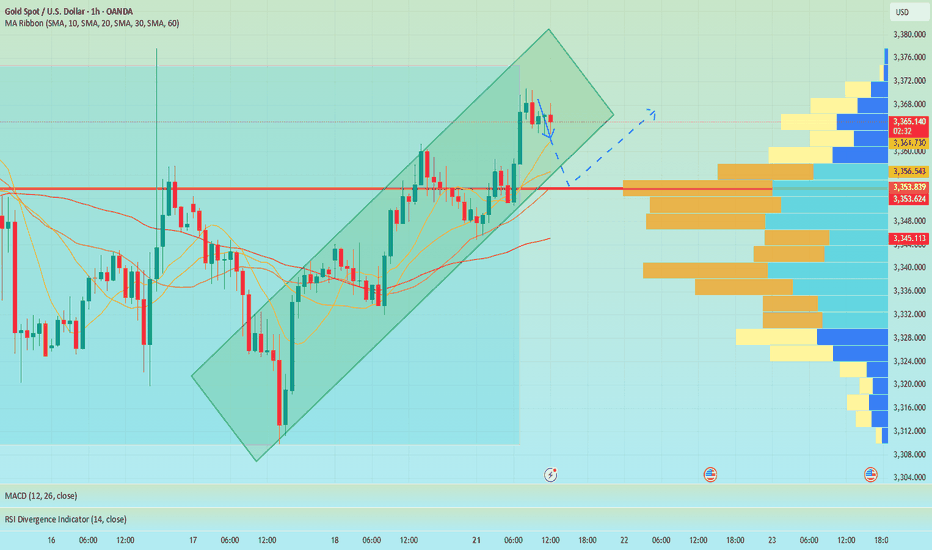

Elliott Wave Analysis – XAUUSD | July 21, 2025

🔍 Momentum Analysis

- D1 Timeframe: Momentum is currently rising → the dominant trend over the next 3 days is likely to remain bullish.

- H4 Timeframe: Momentum is approaching the oversold area → just one more bearish H4 candle could complete the entry into oversold territory.

- H1 Timeframe: Momentum is about to reverse downward → suggesting a short-term corrective pullback in the current session.

🌀 Elliott Wave Structure Update

On the H4 chart, price continues to consolidate within a corrective triangle structure. According to our previous plan, price approached the 3358 zone, and we expect:

- Wave 1 (black) may have completed at the 3358 high.

- Currently, Wave 2 (black) is likely unfolding:

+ Wave A appears to have completed.

+ The current upward leg is part of Wave B.

+ A final drop in Wave C is expected, with two key target zones:

- Target 1: 3342

- Target 2: 3332

🔎 Combining Momentum & Wave Structure

- If price breaks above 3358, we want to see a sharp, impulsive, and steep rally to confirm the beginning of Wave 3.

- If price movement remains choppy or overlapping, the market is likely still in a corrective phase.

- Key resistance zone to monitor: 3390–3402 – a clean breakout above this range would significantly strengthen the Wave 3 scenario.

📌 Trade Plan

1️⃣ BUY Setup #1

Entry Zone: 3343 – 3341

Stop Loss: 3337

Take Profit 1: 3358

Take Profit 2: 3390

2️⃣ BUY Setup #2

Entry Zone: 3333 – 3331

Stop Loss: 3323

Take Profit 1: 3358

Take Profit 2: 3390

📎 Note: Prioritize entries that come with clear confirmation signals from price action and momentum. Avoid buying during choppy or indecisive market conditions.

7/18: Watch 3343 Resistance, Guard Against Break Below 3323Good morning, everyone!

Yesterday, gold broke below the 3337 support after consolidating there, driven lower by bearish data, and eventually reached the 3323–3312 support zone. A rebound followed, and price has now returned above 3323, which also aligns with the daily MA60.

📌 Key Levels to Watch Today:

Resistance: 3343 / 3352–3358

→ A sustained break above 3343 opens the door for a potential move toward 3366 / 3372–3378;

Support: 3323 / 3312

→ If price remains capped below resistance and weekly close is under 3323, it will signal bearish structural pressure for the medium term.

📌 Trading Strategy:

Trade flexibly within the range of 3358–3343–3332–3323–3312

📌 Important Reminder:

If today’s closing price is below 3323, and you're planning to hold positions over the weekend, it’s safer to lean short. While we can’t predict weekend news, technically, bears have the upper hand, so risk control is essential.

The range breakthrough is waiting for CPI to take effectIn the early stage, it was mainly volatile, and the lowest level in the morning reached 3334, which was also the position we went long last night. Today, we continue to focus on the 3340-45 line and go long, focusing on the release of CPI data. If CPI rises as expected, it means that inflation is rising, and the Fed's annual interest rate cut expectations will be further reduced, and gold prices may be under pressure to fall again; on the contrary, if CPI is lower than expected or even performs well, it means that Trump's tariff war has not had such a big impact on the market, and the Fed's interest rate cut expectations have increased significantly. After breaking through 3375, gold prices may accelerate to rebound to 3385-90 or even 3400. We focus on the release of data. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with us!

From the 4-hour analysis, the bullish strong dividing line below is 3325-30. Below, we pay attention to the short-term support of 3340-45. The daily level stabilizes at this position and continues to maintain the bullish rhythm of stepping back and falling. The short-term pressure focuses on the vicinity of 3370-75. The overall high-altitude low-multiple cycle participation in this range remains unchanged. I will prompt the specific operation strategy in the link, so please pay attention to it in time.

Gold operation strategy:

1. Go long when gold falls back to 3340-45, and add more when it falls back to 3325-30. Stop loss 3317, target 3365-70, and continue to hold if it breaks;

Monday market forecast, pay attention to the 3339 retracement📰 News information:

1. The Trump administration puts pressure on the Federal Reserve to cut interest rates

2. The continued impact of tariffs and the responses of various countries

📈 Technical Analysis:

This week's basic judgment and forecast on the gold market trend were consistent, but on Friday, the overall gold fluctuations were not large. The overall trend of the daily line fluctuated around 3345, and the 3345 line also became a short-term long-short watershed. Although prices are likely to rise more easily than fall in the short term, it should be noted that the three-month adjustment cycle is coming to an end while the fundamentals of the bull market have not changed. It is recommended that you focus on preventing risks from short position operations next week. At the same time, the overall strong shock pattern, the anti-pulling momentum has not reached the top suppression position, and the area around 3339 below is the previous intensive trading area, which constitutes a certain support in the short term. If the market fails to effectively break below next week, it will greatly boost the bullish momentum, and it is not ruled out that there will be a possibility of refreshing the high point near 3380 next week.

On the whole, the short-term focus next week is the 3345-3335 area below. If it falls back to this point, you can consider arranging long orders. The short-term target is 3355-3365, and the strong trend is expected to continue to touch 3375-3385.

🎯 Trading Points:

BUY 3345-3335

TP 3355-3365-3375-3385

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

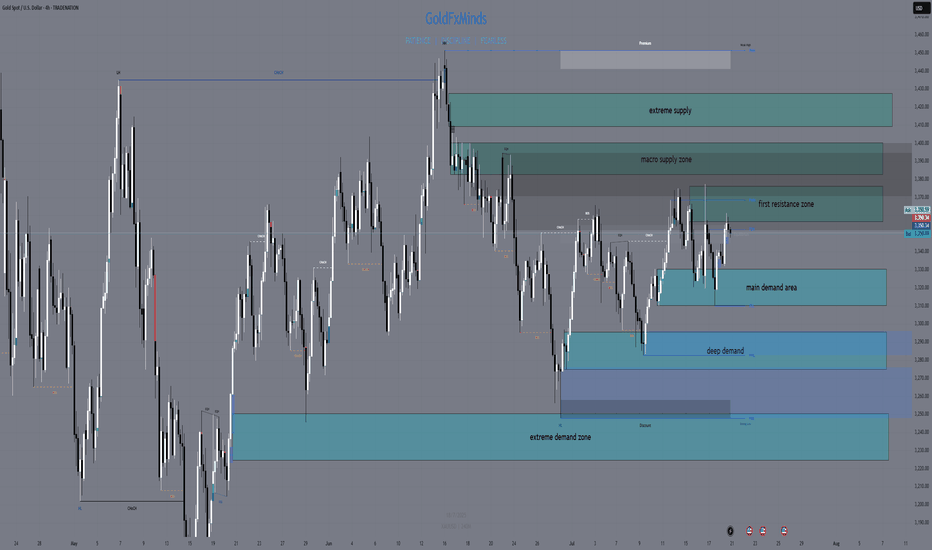

XAUUSD H4 Outlook – Full Structure & Macro | July 21, 2025Hello, GoldMinds! 💙

After a volatile week, gold remains caught in a wide H4 range, ping-ponging between structural supply and demand. Let’s break down the current picture so you can navigate the next big moves with confidence.

🌍 Macro & Bias

Macro context:

Last week’s US CPI print triggered a temporary rally, but gold failed to hold above resistance and quickly reversed as the dollar strengthened. Next week brings Fed Chair Powell’s testimony, global PMI numbers, and jobless claims—all catalysts for new volatility.

Bias:

Neutral on H4:

Gold is consolidating inside a broad sideways range.

The market is waiting for a catalyst to break above 3375 or below 3310 before showing a real trend.

🔸 Structural Key Supply Zones (Above Price)

1️⃣ 3357–3375 | Main H4 Supply

Why it matters:

Aggressive NY and CPI rallies have been sold off here; price rejected every attempt to close above 3375. OB, liquidity cluster, inducement—this is the first real ceiling above price.

Trade logic:

Watch for M15/H1 reversal or exhaustion. No clean break = supply remains active.

2️⃣ 3384–3400 | Macro Supply

Why it matters:

All failed breakouts from early summer were stopped in this block. Liquidity pool and macro OB; every test led to sharp pullbacks.

Trade logic:

Avoid FOMO—only short with confirmation of rejection.

3️⃣ 3410–3425 | Extreme Supply

Why it matters:

The final upper ceiling for now. Any spike here is likely to see big profit-taking and volatility.

🔹 Structural Key Demand Zones (Below Price)

1️⃣ 3330–3310 | Main H4 Demand

Why it matters:

All major dips last week bounced here—bulls are active in this OB. It’s the base of the current “micro-range,” with clear LTF inducement and high volume.

Trade logic:

Look for bullish reversal (M15/H1) before trusting any long from here.

2️⃣ 3295–3275 | Swing Demand / Discount Zone

Why it matters:

The main structure support for July. Strong OB, historic liquidity sweeps—each deep flush has brought responsive buyers.

Trade logic:

Watch for reaction, but don’t knife-catch without a clear structure break.

3️⃣ 3250–3225 | Extreme Demand / HTF Liquidity Pool

Why it matters:

The “final line” for bulls. This zone has absorbed all major liquidations and created swing reversals since early spring.

📊 H4 Structure Logic

Current play:

Gold is stuck in a structural cage between 3375 and 3310.

Until price closes outside these edges, every spike is likely a liquidity hunt.

Pro move:

Only react to confirmation in these zones—don’t force trades in the mid-range!

🧠 Game Plan

Set alerts at each supply & demand zone.

Wait for confirmation: M15/H1 CHoCH, BOS, wicks, or volume.

Let the news come to you: Powell & PMI will likely force a test of an edge; be patient.

💬 What’s your bias for the week? Drop it below and tag a friend!

🚀🚀🚀 and Follow GoldFxMinds for sniper-level gold planning and deep-dive SMC education.

Posted using the Trade Nation broker feed as part of their influencer program for using their TradingView charts in educational content.

— GoldFxMinds 💙

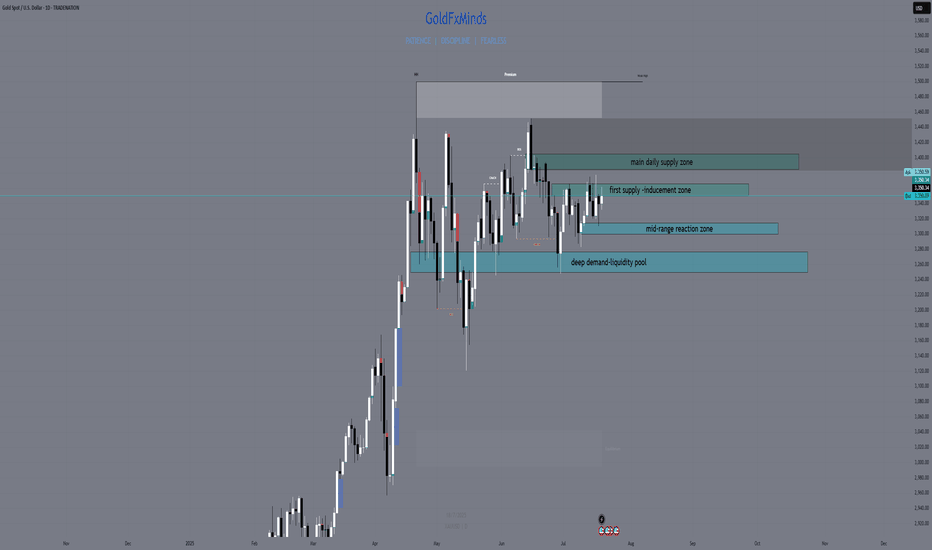

XAUUSD Daily Outlook – July 21, 2025Hey traders 💙

Gold continues to move inside a high timeframe range, with both bulls and bears defending structure at the edges. Price remains stuck between supply and demand — and only the strongest levels matter now. Here’s how the chart truly looks:

🔸 Key Supply Zones

1. 3380–3405: Main Daily Supply / Liquidity Pool Above

This is the top wall of the current range and the zone with the highest supply. Multiple failed breakouts, long upper wicks, and a clear cluster of liquidity just above. Unless we get a solid daily close above 3405, this area remains a trap for late buyers and a magnet for liquidity grabs.

2. 3355–3375: Internal Supply / Inducement Block

This zone has acted as an internal ceiling since the last CPI event. Here, price repeatedly failed to close above, and every return has produced quick rejections or fake breakouts. It often works as an inducement, catching breakout buyers and flipping the market lower.

🔹 Key Demand Zones

1. 3312–3300: Internal Demand / Mid-range Reaction

Here we see a clear reaction point where buyers have defended aggressively after CPI and NY session moves. It’s an internal demand area, often working as a temporary bounce or a place for stop hunts before larger moves.

2. 3275–3250: Main Daily Demand / Liquidity Pool Below

This is the base of the range, holding as support multiple times this month. Every dip into this zone has triggered large bounces, but the liquidity sitting below is also a key magnet for potential sweeps. Only a full daily breakdown here would flip the higher timeframe bias bearish.

📊 Technical Structure & Strategy

We are stuck between Main Supply (3380–3405) and Main Demand (3275–3250).

Every “middle” move is either inducement or a set-up for liquidity collection — not a real trend.

No daily close above 3405 → no bullish continuation.

No breakdown below 3250 → no clean bearish momentum.

Your edge: Only act when price confirms a reaction at a major zone with CHoCH/BOS, strong OB, or a liquidity sweep.

🧠 Takeaway:

This is not the time to guess direction — let the market show its intent at the edges. Use TradingView alerts on your key levels, be ready for volatility from macro news, and don’t get trapped in the mid-range games.

💬 Comment your bias or questions below.

Follow GoldFxMinds for more advanced XAUUSD updates and sniper-level education.

Stay patient, stay precise, and let structure work for you!

Posted using Trade Nation broker feed. As a participant in the Trade Nation Influencer program, I receive a monthly fee for using their TradingView charts in my educational content.

— GoldFxMinds 💙