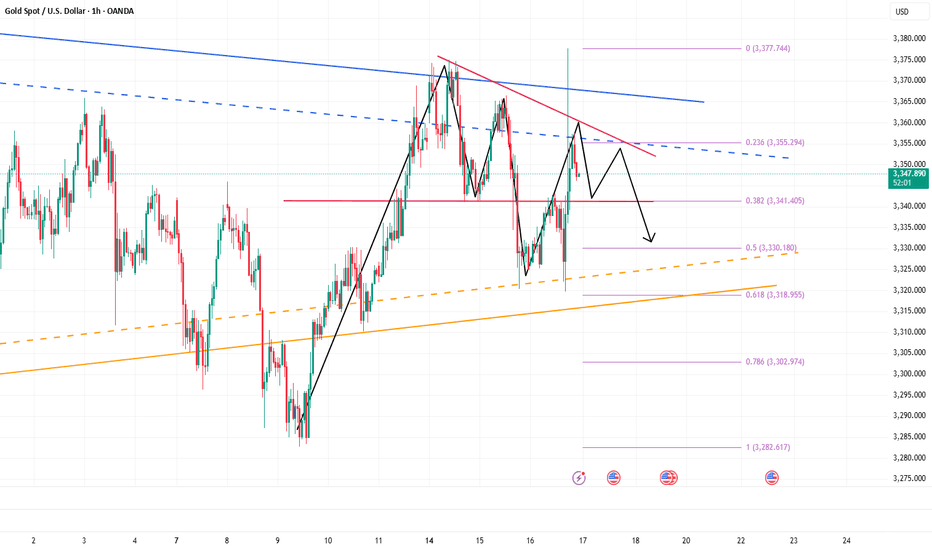

False breakout? Gold reverses sharply after news surgeBecause of the news that Trump hinted at firing Powell, gold surged strongly in the short term and passed to 3377, recovering the recent decline in one fell swoop. We went long on gold near 3323 in advance, and went long on gold near 3340 again after gold retreated, hitting TP: 3345 and 3355 respectively. The two long trades successfully made a profit of 370pips, with a profit of more than $18K.

Although gold has risen sharply in the short term and effectively destroyed the downward structure, it is mainly news that drives the market. After Trump denied firing Powell, gold rose fast and fell fast. So we can't chase long gold too much. First, the sustainability of the news-driven market needs to be examined, and second, the certainty of Trump's news is still unreliable. He always denies himself the next day.

After the gold price retreated quickly, a long upper shadow appeared in the candlestick chart, indicating that the upper resistance should not be underestimated. Therefore, we should not rush to buy gold. We can still consider shorting gold in the 3355-3365 area. We should first focus on the area around 3340. If gold falls below this area during the retreat, gold will return to the short trend and test the area around 3320 again, or even fall below this area after multiple tests and continue to the 3310-3300 area.

Xauuusdshort

Below 3360, short sellers still have profit potential!Although gold has steadily rebounded to around 3345, compared with yesterday's gold falling below 3330 again, the rebound in the short term is not strong; overall, gold is still in a weak and volatile pattern, with pressure from the upper side at 3350-3360; and there is technical buying support in the lower 3300-3290 area. It is under the influence of the resistance area and the support area that gold lacks continuity.

So before gold breaks through effectively, I think both the long and short sides of gold have profit potential, so for the current short-term trading, we can temporarily maintain the high-sell-low-dregs trading within the range.

1. Consider shorting gold in batches with 3345-3365 as resistance, TP: 3330-3320-3310;

2. Consider going long gold in batches with 3325-3305 as support, TP: 3345-3355-3365

I hold on to my short position and wait patiently.Currently, gold continues to rebound to around 3358, and there has been no decent retracement during the rebound, so during the trading period, apart from chasing the rise, there are almost no opportunities to go long on gold; so is the steady rise in gold during the day brewing a bigger rally?

I think there are three reasons for the continued rise of gold:

1. The continued weakness of the US dollar provides support for the strong rise of gold;

2. The trapped long chips have recently shown self-rescue behavior, and strong buying funds have driven gold up;

3. The market intends to eliminate and kill a large number of shorts in recent times;

Based on the above reasons, I think it is not a wise decision to chase gold at present; on the contrary, I still prefer to short gold in the short term, and I still hold a short position now; the following are the reasons to support my insistence on shorting gold:

1. The US dollar has a technical rebound demand after a sharp drop, which will limit the rebound space of gold and suppress gold;

2. After the recent trapped long chips successfully rescue themselves, they may cash out in large quantities, thereby stimulating gold to fall again;

3. While killing the shorts, the market has also lured a large number of long funds to a certain extent. Based on the above reasons, I currently still hold short positions near 3345 and 3355, and hope that gold can retreat to the 3335-3325 area.

Seize the opportunity to short gold after the reboundBecause gold fell back to the expected support area of 3375-3365 first, I just took the opportunity to go long on gold near 3372 and set TP: 3390. Obviously, our long position ended the transaction by hitting TP, and we made a profit of 180pips.

At present, gold continues to rebound to around 3396, and is facing the short-term resistance area of 3395-3405, and the upside may be limited. And I think before the Fed's interest rate decision and Powell's monetary policy conference, gold is likely to maintain a range of fluctuations, and the willingness of both long and short parties to break through may not be strong in the short term. And from the current structure, gold tends to fluctuate downward as a whole.

So for short-term trading, we might as well try to short gold in the resistance area. I think it is still very likely to retreat to at least the 3385-3380 area.

Gold rises as a safe haven, how to plan the market outlook

📌 Gold Drivers

Gold prices rose more than 2% on Monday, benefiting from a weaker dollar and safe-haven inflows as U.S. President Donald Trump's new tariffs reignited concerns about the impact of a global trade war. Spot gold rose by more than 2.3%, US gold futures rose by 2.4%, and the US dollar index fell by 0.4%. On Sunday, Trump wrote on his social platform Truth Social: "I authorize the Department of Commerce and the United States Trade Representative to immediately initiate procedures to impose a 100% tariff on all films produced abroad entering the United States. We want to make movies in the United States again!" But he did not specify how these tariffs will be implemented.

📊Comment analysis

Gold prices continue to accumulate and have broken through 3330 points. It can be found that gold is now completely above the trend line.

💰Strategy package

The only suppression position above is currently around 3350.

The support below is currently at 3275-85.

If gold does not retreat, then the upper side will directly test the suppression near 3350.

On the contrary, if gold chooses to retreat next, then pay attention to 3275-85.

As long as gold retreats and stabilizes in the 3275-85 range, you can directly enter the market to do more.

Continue to look at 3350 above. If it breaks through and stabilizes above 3350 in the future, you will see the 3380-3420 range.

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

GOLD TRADING POINT UPDADE > READ THE CAPTAINBuddy'S dear friend 👋

Gold trading analysis map 🗾 update Gold already breakout bullish trend. 2721 -2605 Sellers closed trade. gold recover quickly ✔️ 2658 rejected again test diamond zone 2621 again recover quickly ✔️ Bullish trend 📈. Gold ready for short trade 😀 closed below 👇 Trend 📉 2605 - 2548 don't forget back up trand 😱 if blackout 2648 Next target 2680 ?!!!

Support ✨ My hard analysis Setup like And Following Me 🤝 that star ✨ game 🎮

Gold fell as expected, making a huge profit of 500pipsThe magic was successfully demonstrated, and we finally met at 2430-2420! In the past two days, I have been emphasizing shorting gold and setting a target: 2430-2420. And the day before yesterday, I also emphasized in the article that shorting gold in batches in the 2470-2480 area, the target is 2430-2420. Today, gold continued to fall, and the lowest has reached around 2404. Perfectly hit our target area, we successfully made a profit of 500pips, a great deal!

At present, gold has fallen sharply and has continuously broken through multiple short-term supports. Now it is not just a correction, but the market sentiment venting and the selling of chips have formed a combined force to stimulate gold to form a new downward trend. At present, gold has fallen below the support near 2410, and the short-selling counterattack has strong potential. At present, there is no technical structure to support the rebound of gold, so I think gold will definitely test the 2400 integer mark. If gold falls below 2400, then gold may accelerate its decline to the 2385-2360 area in the future.

So in terms of trading, don't go long on gold for now; but the market won't give us a good position to go short easily. So what we have to do now is to wait and see! Of course, if gold has a chance to rebound to 2420, we can go short on gold.

I share detailed trading strategies and trading signals every day. You can follow the channel at the bottom of the article to get detailed trading signals and learn trading logic. People who are already in it have already made a lot of money. Let us enjoy the journey of making money together. !

suitable entry to trade XAUUSD for the first day of DecemberXAUUSD

Today, XAUUSD is making its intentions even clearer. First, let's talk about the D1 candle that ended yesterday. After H4 retreated and created consecutive bearish pin bars, + XAUUSD experiences recovery (not decline) due to previous analysis (overall trend is still up, no strong downside force) more likely. waste ). D1 closes the candle according to the above meaning. This is a bearish candlestick, but not bearish. It swallows the previous candlestick and shows the price reaction to the D resistance zone. There may be an imminent decline, but there will be no reversal. H1 – H4 currently have very good increasing power. If the market does not generate a bearish signal in his 2045 price area, H4 will show a significant bullish signal (see below). This 2045 area is the wall of his H1 price channel above, which combines with the H4 pin bar area and sits in the newly created D1 supply zone. A price reaction is likely in this area. But whether there is a reversal or not, we need to see how the market reacts here. In the absence of bearish signals, the bullish force is confirmed and from 2052 he goes directly to the period 2060. ACE can refer to the trading plan on the chart for more details.

Gold crude oil operation sharing

After gold fell from 1965 to 1932, it needed a rebound with a wave structure. The target range for the rebound is the 1945-1950 area. 1950 is also the central axis position of this wave of adjustment. For today's idea, we will first rely on the 1950 position to be bearish. Below, the vicinity of 1932 and 1931 is the weekly support. This position is expected to be a game.

The support is 1932, the pressure is 1945, 1950, and the strength of the market is 1941.

Silver market analysis

Recently, silver has also entered a short position. Silver has plunged immediately. Currently, silver still has room to fall. Today’s thinking is based on the bearish trend of 22.10. Silver is currently weaker than gold, and there will be a need to make up for the decline later.

Crude oil market analysis

Crude oil cannot see a bottom signal, and the weekly line is still very short. The appearance of a cross star and a small positive line on the daily line is a sign of weakness, and it is also a signal of repair. It indicates that crude oil will need to rebound and repair later. The first pressure is to pay attention Near 77.80, go short near this position. The super pressure of this wave is near 80.00.

Operation suggestions

Gold——Short around 1950, target 1940-1931,

Silver——Short around 22.10, target 21.50-21.00

Crude oil——Short around 77.80, target 76.50-76.00

XAUUSDDear Traders,

Today we will be looking at the factors that affect the gold, however, let’s focus on what we are expecting price to do next week. Gold traded in a range of 1920-1928 on friday indicating a low level of interest from buyers and same goes for sellers. In most cases, prices tends to fell more as we will sellers dominance on MONDAY. Once prices drops, it is very likely that it will reach the 1900 region.

Factors that affect GOLD prices:

First one is ‘USD as CURRENCY VALUE’: Gold is typically priced in US DOLLAR, so changes in the value of the dollar can affect gold prices. When the dollar is strong, gold is more expensive for buyers using other currencies, which can decrease the demand and lower the price. Likewise, when the dollar is weak, gold is cheaper for buyers using other currencies which can increase demand and raise prices.

Secondly, Geopolitical events can create uncertainty, leading investors to seek out "safe haven" investments like gold. This can increase demand and drive up prices. Especially, in counties like India where on festive season gold demand increases sharply which clearly out rank the supply.

XAUUSD: Gold operation idea

Gold operation ideas and suggestions: this week's short term, the US data this month basically meet expectations, inflation has declined, the market did not give a lot of feedback after the Federal Reserve rate hike landing, after the release of GDP data, gold fell sharply in the short term, and then rebounded near 1942. From the fundamental point of view, the current data announcement is basically in line with expectations, the market has gradually recovered, and short-term gold is bearish.

From the technical point of view, after the short-term decline in gold, the market did not show signs of changing hands, and quickly rose to near 1961 near 1942, and the single did not break 1961, and first went down to near 1953 after the market opened on Monday, and then began to rise; It is judged that this week will be a range move between 1960 and 1942, consolidating the previous period of rapid decline in volume.

GOLD:sell@1960-1965 tp 1953

Join me and don't let procrastination and hesitation stop you from making money quickly

XAUUSD: Sell

Folks, we're back to feeling the NFP thrill this week!

I'll be posting my views ahead of the data, remember to check, for now, let's trade today's market first.

In the 30m chart, its form is a double top, I like to call it M top, its first decline has ended, and a small rebound to test the resistance near 1915, it did not break through, indicating that the resistance is a bit strong.

Now, it is going to test the support of 1910-1907. If it breaks, congratulations bear friends, you will get very good profits. If the support is effective, then congratulations bulls friends, you will get very good profits!

Because today Monday, the U.S. market will not have particularly large fluctuations, but it should be larger than the Asian and European markets. I will give you a few important points, and you can trade based on them.

Support: 1907, 1902, 1896

Resistance: 1916, 1923, 1929

Good luck guys!

XAUUSD-1920 IS THE NEXT TARGETHey Everyone, following our last setup on gold, as we had pointed out that price will come to area of 1970-75 and will reverse from there, price just did that. We now have gap to be filled, however, price have shown no strong bullish intent since the London Session. Strong bearish presence is there as we look in to the price movement and behaviour.

-Either you can sell now with a greater stop loss or wait until New Session Begins. The target will be 1920.

Good Luck and Trade Safe

20 reason for sell XAUUSD🔆MULTI-TIME FRAME TOP-DOWN ANALYSIS OVERVIEW☀️

1 ✨Eagle eye: most significant time frame yearly base on yearly gold is in a bull trend but currently in a corrective phase

2 📆Monthly: higher low /lower low formatted bear trend current candle is a retracement candle and also filled out discounted area of monthly time frame

3 📅Weekly: extremely bearish in weekly now in a corrective phase and also fill out extreme Imbalance area or FVG gap take a resistance here and also formed and key reversal weekly candle bear trigger event also occurred everything favour of bear right now even no volume on the weekly chart

4 🕛Daily: a bull trend but a strong resistance at weekly and daily ob after its price also gives us a country reversal with the lowest volume and a vital reversal sign

😇7 Dimension analysis

🟢 analysis time frame: Daily

5: 1 Price Structure: bullish

6: 2 Pattern Candle Chart: Counter trend with low volume

7: 3 Volume: dried no volume

8: 4 Momentum UNCONVENTIONAL Rsi: At a decision area around 60

9: 5 Volatility measure Bollinger bands: double top m pattern with a most substantial volatility divergence

10: 6 Strength ADX: Dmi cross over excepted for bears

11: 7 Sentiment ROC: equal

✔️ Entry Time Frame: H4

12: Entry TF Structure: Established bear

13: entry move: a considerable doji wait for an impulse move

14: Support resistance base: 1801 to 20 is a substantial resistance price already rejected

15: FIB: trigger event

☑️ final comments: if the price break the 1751 area, we go with bear

16: 💡decision: sell

17: 🚀Entry: 1790.5

18: ✋Stop losel:1801/1810

19: 🎯Take profit:1715

20: 😊Risk to reward Ratio:1:5

🕛 Excepted Duration :7 day

GOLD GOING DOWN TODAYThe XAUUSD entered a correction phase while being on a downtrend, it bounced on the descendant triangle, and the MA50, and also a key level!!

What to predict?

By the opening of the NY session, the market will break the parallel channel, and go all the way down to the next level to continue the downtrend!

(i've took my position earlier today, but it not too late to make your entry!)