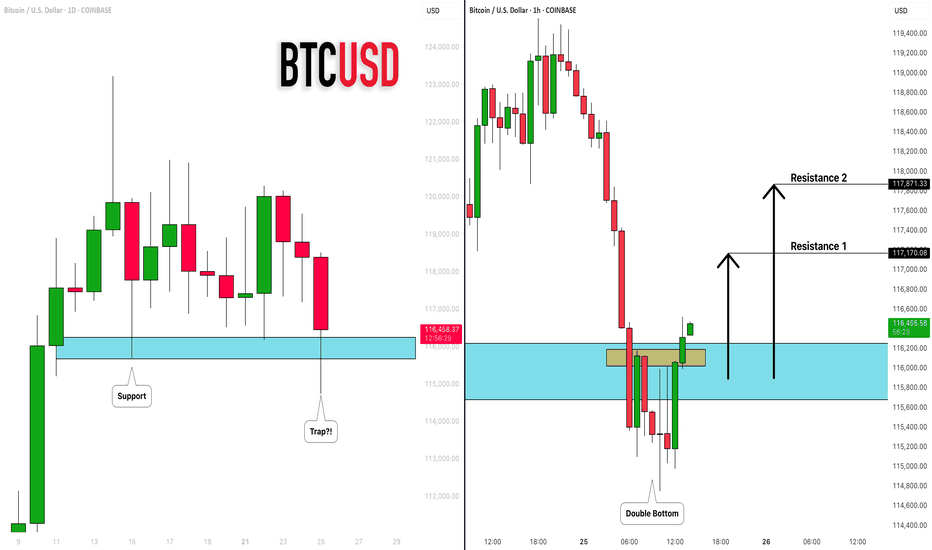

BITCOIN (BTCUSD): Recovery Starts

Bitcoin is going to rise from a key daily support.

After a liquidity grab, the market shows a clear strength,

forming a double bottom on an hourly time frame.

I expect a bullish movement at least to 117100

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XBTUSD

Bitcoin - Flag pattern is brokenBitcoin had been consolidating within a flag pattern for the past three months. That pattern has now officially broken to the upside, with the price surging to $109K — a strong bullish signal fueled by encouraging news around institutional adoption.

Based on both the technical flag breakout and ongoing fundamental momentum, the next target for Bitcoin is $145K. Any move beyond that would be considered a bonus in this current bull cycle.

Stay tuned for more updates.

Cheers,

GreenCrypto

BTCUSDOKAY DEGENS

BTC is on a growth cycle not an innovation cycle which means slower growth, extended top, hypercycle on the backside and no double top BS like last time. The market will act like it did in 2017 going parabolic in LATE OCT/EARLY NOV. My low end target is 140k but it works on a time fractal for a November exit, so if we ain't at 140k by AUG that will probably be the top in NOV. So readjust, but I am a degen so I will shoot for 180k unlike the tards going for 240k thinking this is 2017 expect 1000% gains, we are at the top of the stock to flow model... This means adoption is slower and at the price action we are at now it is more difficult to "make number go up." Muhammad can't through a 60$ 100x trade anymore on swaps to push the price. Imagine that 240k for fake internet money, WILD, anyway don't make your greed translate into stupidity. Trust me I know, alright then... going to hang out with my second ex-wife's boyfriend Tyrone, see ya fellas.

I would be happy to share my thoughts on growth models vs innovation models in the BTC market.

"Where are my kids?"

-KewlKat

BITCOIN (BTCUSD): The Next Resistances

As Bitcoin is trading in the no man's land again,

violating a resistance cluster based on a previous ATH,

here are the next potentially strong resistance to watch.

Resistance 1: Narrow area based on 115000 level - the closest strong

psychological level.

Resistance 2: Narrow area based on 120000 level - the next

psychological level.

Resistance 1 is going to be the next goal for the buyers

and will most likely reached soon.

Its breakout will push the prices to Resistance 2.

❤️Please, support my work with like, thank you!❤️

Bitcoin: Next Stop is at 144,000Looking at historical data, Bitcoin has experienced similar price growth following the last two MACD crossovers on the weekly chart. We’re now witnessing a third MACD crossover, and if history repeats itself, this could project Bitcoin’s price to around $144,000.

This is a conservative estimate, based on past performance during the middle of previous bull runs. Currently, we appear to be in the final leg of this cycle — which could mean even more upside compared to the previous two MACD crossovers.

What’s your Bitcoin target? Drop your predictions in the comments!

Cheers,

GreenCrypto

Bitcoin - CME Gap fill before going up ?Bitcoin CME Futures have formed a clear CME Gap in the $91,600 – $93,400 zone (highlighted in blue). Historically, these gaps tend to get filled before the price resumes its trend.

Price may dip into the gap zone (91,800–93,400) to fill the imbalance.

We have a entry around the lower part of the gap ($91,800–$92,200).

Stop loss: Below $91,500 to invalidate the setup.

After the gap fill, we can expected strong bullish continuation

Entry: 91600

TP1: 92800

TP2: 93500

TP3: 94500

SL Below 90500

Like and support for more ideas.

Cheers

GreenCrypto

Bitcoin - Trading below 50 and 200 EMACurrently bitcoin is trading below 50 and 200 EMA after multiple failed attempt to breach the these EMA levels. 1D candle closed above 200 EMA however, failed to close above 50 EMA

Additionally price is around the trendline which is acting as resistance, a strong breakout from this resistance is needed for bullish momentum to continue.

In the next couple of days we will get to know if price will break the resistance or gets rejected.

Stay tuned for more updates

Cheers

GreenCrypto

1050 days of bull, 380 days of bearPlanning for the afterlife already. Each cycle fits quite neatly into ca. 1050 days of bull market and 375 days of bear. The big bounce should happen just before the summer, then consolidate, and the last leg up should come after, and we peak in late October. Let's try this

Bitcoin is at the crucial stage BINANCE:BTCUSDT (1D CHART) Technical Analysis Update

Bitcoin is currently trading inside the triangle on 1H chart and price is heading towards the support zone. Its crucial that bitcoin holds the support zone around 91K.

if price breaks below 91K then we are headed for a bearish trend. If price holds above 91K then we can expect the current bullish trend to continue.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

Crossing the RubiconJumping across the creek would confirm wyckoff-reaccumulation and trigger an all-in scenario, causing disruption in financial markets everywhere. Housing market is cooked, and people will begin to sell their homes in exchange for a fraction of a coin, leading to inflationary pressures that the US Administration was never equipped to handle. Evidence of their incompetence is found in their handling of the trump meme coin, which exposes more corruption than any optimistic man is willing to admit.

God have mercy on us all. Bullish on xbt. Bearish on political and socio-economic stability.

Bitcoin could rise againBitcoin Price Analysis: Navigating the Market's Fluctuations

As of today, Bitcoin's price has shown a mix of volatility and resilience. Over the past few weeks, it has been trading within a range, testing both support and resistance levels that reflect market sentiment and external factors such as global economic conditions and investor behavior.

At the moment, Bitcoin is hovering around , maintaining its position as the leading cryptocurrency in market capitalization. While the overall trend seems to be consolidating, Bitcoin has displayed remarkable resilience in the face of potential market corrections. The digital asset continues to attract attention, both from institutional investors and retail traders, who see Bitcoin as a hedge against inflation and a store of value in times of economic uncertainty.

Key support levels are being watched closely by traders, with many viewing the $ mark as a crucial point for potential rebound or further declines. Conversely, the next resistance level sits around $ , which could determine if the current consolidation phase is followed by an upward breakout or a shift in market dynamics.

Technically, the Relative Strength Index (RSI) is hovering near neutral territory, indicating a balance between buying and selling pressure. The Moving Averages suggest that Bitcoin is at a critical juncture, with short-term fluctuations creating uncertainty. However, its long-term trajectory remains positive, with fundamental factors like growing adoption and institutional interest continuing to bolster Bitcoin’s value proposition.

While the market is still in a state of flux, Bitcoin has proven time and again its ability to recover from downward movements and rise to new highs. The current price levels offer both opportunities and risks, and for anyone looking to invest, a cautious yet optimistic approach is recommended.

In summary, Bitcoin’s current price presents an interesting crossroads for the market. With bullish long-term prospects and short-term uncertainties, it's a dynamic environment for traders and investors alike.

CRYPTOCAP:BTC BYBIT:BTCUSDT.P BINANCE:BTCUSD

Bitcoin will fall sharpely!Beware, there is a high risk of Bitcoin dump in the next few days. Of course, I could be wrong, as I'm no soothsayer and I've made mistakes in the past, but I'm relying on a predictive model I've been developing for the past three years, which has become very reliable in recent months. To sum up, my model gives me a cycle top below $100K, a 30 to 40% dump this week, followed by a downtrend punctuated by rebounds over several months towards $31K. Do your own research, as I'm only expressing my opinion, which is not a financial advice.

BTCUSD path to 200 000 USD weekly chart overview🔸Hello traders, today let's review weekly price chart for BTCUSD .

going into BTC halving event later in April bulls still maintain control,

having said that, we are closing on on the danger zone, which is

defined by 75 000 - 100 000 usd, so let's review the primary scenarios

for bitcoin prices going forward. No nonsense overview, no dinosaurs,

NFTs, super mario patterns, etc, just pure price action. Let's dive into it!

🔸Looking at the weekly price chart (log scale), bitcoin is trading

in well-defined bullish channel since 2018 on weekly timeframe.

We got a confirmed/strong sequence of higher lows / higher highs,

which is a clear definition of an ongoing uptrend. Prices are projected

to appreciate further, however there are two possible outcomes/scenarios

going forward, so let's review them.

🔸SCENARIO1: uptrend resumes without any reasonable pullbacks,

which will catch a lot of traders off guard, generate strong momentum

and FOMO and BTC then will be projected to hit a final target near

200 000 USD by end of 2024. This is one of the options, definitely, however

traders should be aware of the high danger zone, we are closing in

on it right now - 75 000 - 100 000 usd - high risk of pullback/reversal.

🔸SCENARIO2: after halving initially we get solid gains / BTC pumps

into high danger zone on decent / strong volume, however once we

hit near 75 000 - 100 000 usd momentum fades / dies off and we start

to top out on weekly price chart with heavy sell-side wicks and

bulls eventually lose control near 100 000 usd and then we proceed

into pullback/correction mode. It's possible that we lose up to 50%

of the recent gains in the ongoing correction, based on the weekly

price chart logical/next higher low might be printed near 35/40K.

🔸Bottom-line/recommended trade setups: if you are already

a long-term holder and bought low near 20 000 usd, you should

definitely keep holding and ride out the volatility, as the price

target at 200 000 USD is still very reasonable / possible within

12-24 months. If you bought recently anticipating massive gains

post BTC halving you should be very careful and watch out for

potential reversal near Danger Zone. good luck traders!

🎁Please hit the like button and

🎁Leave a comment to support our team!

RISK DISCLAIMER:

Trading Futures , Forex, CFDs and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use tight stop loss.

BITCOIN (BTCUSD): Test of ATH Soon! ₿

It looks like Bitcoin is preparing to retest the ATH soon.

I see very bullish technicals: after a test of a strong rising trend line

the price went up and violated a resistance line of a bullish flag pattern.

After the test of the ATH, with a high probability,

we may see its violation and a formation of a new one.

❤️Please, support my work with like, thank you!❤️