XLF

Blackrock ShortI have highlighted the XLF representing the broader financial sector in purple and the S&P 500 index in gray. As you can see it has outperformed the financial sector by a longshot and outperformed the S&P 500 index.

Since Blackrock’s bread and butter is asset management with nearly 8 trillion AUM, the overall concern with overvaluations in the markets combined with BLK’s significant outperformance to its peers and to the broader market in which it invests; I’d say it is time for a pullback.

I would expect it to correct to its previous highs as seen with the green line. I do not expect it to head down towards the XLF, but it is possible it could correct all the way to where the S&P is. It is trading at about 21x earnings.

Sector Winners and Losers week ending 11/27Energy (XLE) put in a third week of huge gains and topped the other sectors. The sector is up over 40% in the last three weeks. It did pull back a bit on Wed and Fri.

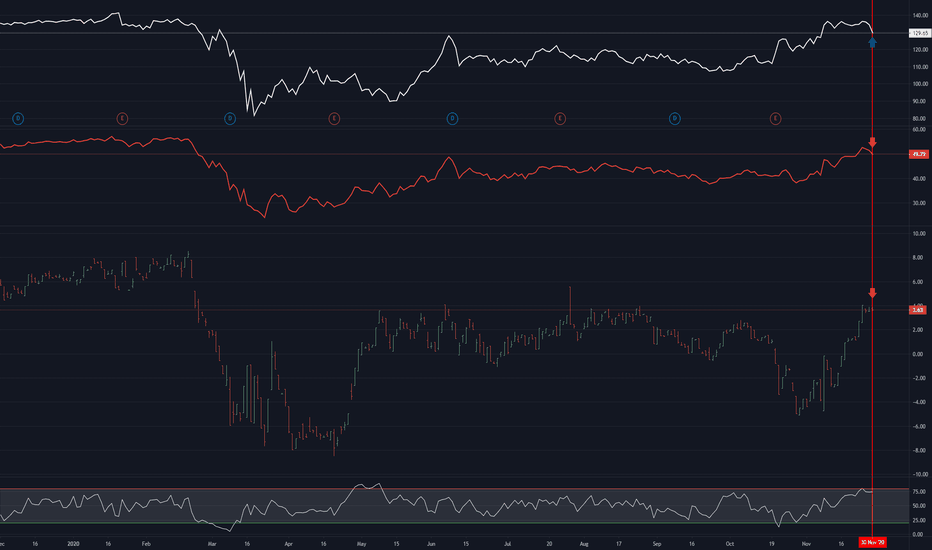

Financials (XLF) also sticks out as a winner for the week, far above the rest of the sectors.

The worst performing sectors were Real Estate (XLRE) and Utilities (XLU). Utilities briefly emerged as a leader for Wednesday afternoon as investors parked money in the safe haven sector for the holiday.

Technology (XLK) underperformed the index for a third week.

Sector Winners and Losers week ending 11/13Energy (XLE +17.11% WoW) was the clear winner of the week. Straight out of the gait, Energy benefited from the news that an effective vaccine could be available soon. The Energy sector would benefit from the economic recovery of several of sectors including Transportation, Travel and Leisure.

Financials (XLF +8.29% WoW) followed in a distance second. Banks have a lot to benefit from an economic recovery including higher yields in bonds as investors move back into equities.

Those two sectors stood tall above the rest who all performed more closely to the S&P 500 performance.

Technology (XLK -0.31% WoW) was the only sector to end the week with losses. A clear metric of what we already knew - that investors rotated out of popular technology stocks that benefited from the pandemic lockdowns.

Tech sector showing weakness despite gains on election dayWhen comparing tech focused ETFs/indexes, namely $NDAQ and $XLK, we can see that $SPY has recently been outperforming them. My theory is that this is an unusual case and a sign that tech stocks are near tops.

Given that I did not receive the dip I wanted, I have difficulty putting on a short position on tech. There is also the factor that the highs have not been truly swept yet.

Just something to keep an eye on.

$NDAQ/$SPY

$XLK/$SPY

For options plays, it would appear leaps for $NDAQ would be ideal, while short term plays on $XLK would work out. $NDAQ is quite illiquid.

Sector Winners and Losers week ending 10/23This week it was all about Communication Services (XLC) with the positive earnings beat from Snap (SNAP) driving growth in many of the social platform company stock prices.

Utilities (XLU) continues to be a safe bet for investors as a sector that is consistently performing well over the past few weeks.

Financials (XLF) also had a great week as bond yields are increasing which is usually a good sign for performance of banking stocks.

Consumer Discretionary (XLY) started the week on top but backed off a bit before coming back with some good gains on Friday.

Energy (XLE) had a huge Thursday that put it at the top of the the sectors, but it could not hold the lead, backing off a bit on Friday.

It's not often that we find Technology (XLK) at the bottom of the list for weekly sector performance. Keep an eye on it as many technology companies will have earnings in the next two weeks.

Energy and Financials Adding To SPX Strength In ATH RunSPX with a key back test of the 3389 level overnight as it's trying to break up over the 3411 level. If it can over 3411 it should trigger a test of the key 3425 level. This is a key level from our double top back in September.

SPX is opening stronger than NAS and this is mainly because of energy and financials. If energy and financials are able to join this rally, SPX will run to ATH's and beyond. October is shaping up to be a very bullish month with the potential for a very large rally.