Xlflong

9/18/22 GSGoldman Sachs Group, Inc. ( NYSE:GS )

Sector: Finance (Investment Banks/Brokers)

Market Capitalization: $112.036B

Current Price: $326.21

Breakout Price: $335.15

Buy Zone (Top/Bottom Range): $325.35-$306.65

Price Target: $361.40-$363.50

Estimated Duration to Target: 60-63d

Contract of Interest: $GS 11/18/22 330c

Trade price as of publish date: $15.45/contract

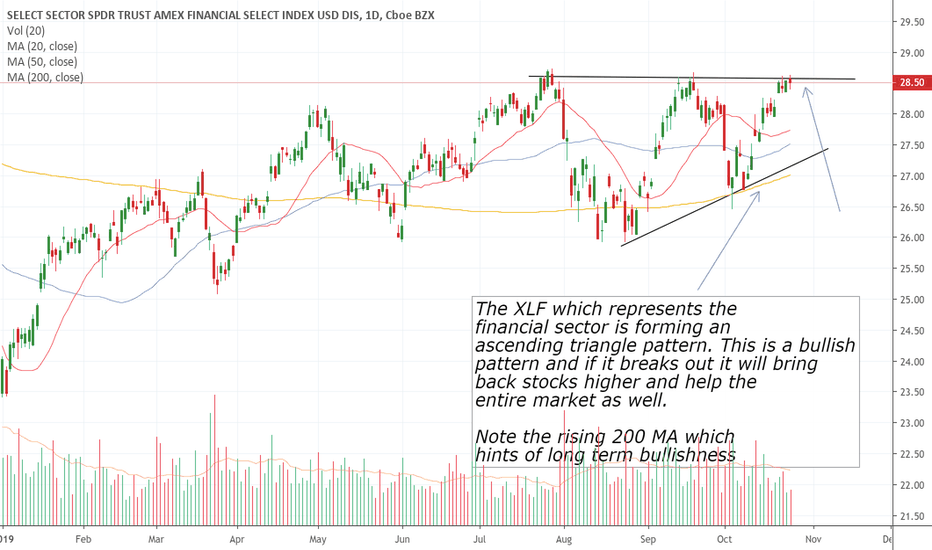

XLF $XLF Initial LongXLF $XLF Initial Long. This is a pure momentum signal just as are every other signal I post. ZERO other factors are considered in producing this signal.

Entry reasons: XLF is showing momentum and confluence of mean reversion crossing up the 70 day price mean.

Exits and SL: TP and SL on chart. Move SL on TP. After TP2, trail with 0.5xATR step and 1.5xATR offset.

XLF (Financial Sector ETF) - Support Bounce Hammer Candle - 1DXLF (SPDR Financial Sector ETF) price has bounced up from 0.618 fibonacci support on the daily chart.

Entry (long): $37.53

Take Profit +3% (exit): $38.66

Stop Loss -1.5% (exit): $36.95

Note: Many Finance related stocks have a similar pattern on either the Daily or 4-Hour charts. Could see an industry-wide bounce up if fibonacci support levels hold this month.

-BAC (Bank of America)

-WFC (Wells Fargo)

-C (Citi Group)

-JPM (JP Morgan Chase)

-MS (Morgan Stanley)

All content is Not financial advice. Trade at your own risk.

4/3/22 BXBlackstone Inc. ( NYSE:BX )

Sector: Finance (Investment Managers)

Market Capitalization: $153.312B

Current Price: $128.13

Breakout Price: $135.00

Buy Zone (Top/Bottom Range): $127.15-$117.00

Price Target: $139.35-$140.80 (1st), $149.60-$151.00 (2nd)

Estimated Duration to Target: 74-77d (1st), 147-150d (2nd)

Contract of Interest: $BX 6/17/22 130c, $BX 9/16/22 130c

Trade price as of publish date: $6.65/contract, $9.50/contract

XLF- Mac-D serving as an early buy signal.AMEX:XLF has seen some channel trading from 2018 too early this year. Finding its range peak in February of 2020 it crashed hard and has been working it's way up since. In red and green (A-D) are the main support and resistance levels and I have noted on the MAC-D where price has reversed, and also accounted for some major financial events such as the Chinese trade war and COVID-19 pandemic. XLF seems to have found its new channel and will either retest its support on the downside and hold the channel or test the SMAs as resistance on the upside and possibly find its way into the former price range leading up to the election. I am going to use MAC-D as my signal to buy as we near a cross.

XLF - Financial sector SPDR S/R zonesHello traders,

Description of the analysis:

The financial sector is showing an attempt at stabilization, but so far there is no talk of stabilization. We see gaps up and down. It is necessary to wait for a clearly defined volume distribution. Gaps tend to fill sooner or later. The way up again will be hampered by marked resistances. At the moment, I would be very careful to invest in this sector.

About me:

Hi, my name is Jacob Kovarik and I´m trading on stock exchange since 2008. I started with a capital of 3000 USD. My first strategy was based on OTM options. (American stock index and their ETF ). I´ve learnt on my path that professional trading is based on two main fundaments which have to complement each other, to make a bussiness attitude profitable. I´ve tried a lot of techniques and many manners how to analyze the market. From basic technical analysis to fundamental analysis of single title. My analytics gradually changed into professional attitude. I work with logical advantages of stock exchange (return of value back to average, volume , expected volatility , advantage of high stop-loss, the breakdown of time in options, statistics and cosistent thorough control of risk). At the moment, my main target is ITM on SPM index. Biggest part of my current bussiness activity comes from e mini futures (NQ, ES). I´m trader of positions. I´m from Czech republic and I take care of a private fund (4 000 000 USD). During my career I´ve earned a lot of valuable experience, such as functionality of strategies and what is more important, control of emotions. Professional trading is, in my opinion, certain kind of mental training and if we are able to control our emotions, accomplishment will show up. I will share with you my analysis and trades on my profile. I wish to all of you successul trades.

Jacob

XLF Has Its Pre Financial Crisis High In SightsThe popular ETF, XLF follows the financial sector and after weeks of selling, it looks to have found support and be gearing up for a big move indicated by the Weekly Squeeze coiling for the past 8 weeks, with the momentum shifting to bullish this week. If you take a look at C (Citigroup), it too has a Weekly Squeeze. If you take a look at it on a Daily it also has a Squeeze which looks like it will fire long. If this move for the financial sector plays out long, I would expect a retest of its high back from January (30.33) then a retest of it's high of 30.84. This high (30.84 - May 28, 2007 - 11+ year ago) is an important one because this was the peak of the financial sector ETF ( XLF ) before the financial crisis of 2008.

XLF gonna hit new high XLF sees strong momentum on Tuesday trading and there's support @22.85. Trump's policy will benefit the financial sector anyway and we are expecting to see a pullback+bounce back to previous highest level and break through into a new territory!! Wait for the pullback to build the portfolio.

New Area for XLF @ > 25 USD at least (historical context)What a rollercoaster the financilas got - no doubt :)

How ever, based on some strategic facts (point of views) i realized that the financial sector still got time and room to prices above 25 at least. Why ??? The Sentiment changed !!! And not only this - of course politics in the US too. And this is probably the most inflous - the most bullish factor !? CNBC Joe (Squaqck Box) said an interesting set which not tasted good at first, but as longer i am thinking about it, it`s sounding plausible: "Maybe we don`t see a Trump Rally !? Maybe it`s an Obama recreation" (he said this set not word by word - in context of course - don`t nail me for this quote). And thats what i am also starting to believe. It`s much more an recovery of the last 8 years - even under Obama (and his policy in context to the financial markets) - even in relations to the US Equities (Financials & Energy Sector).

I am not an political analysis or even political expert,

but this hypothesis makes sense in historical context of the chart!

And that`s the reason why i am so pretty optimistic - kosher confident (self-disciplined) not euphoric bullish. `Cause i can`t feel maniac future optimism around me - not here in chats, not on other intenet sites, not on CNBC or BloombergTv and by no one of my trading buddies.

2400 at least for the SPX are in (over Christmas into Trumpe Presidency start)

25 at least for the XLF are in (over Christmas into Trumpe Presidency start)

Take care

& analyzed it again

- it`s always your decission ...

(for a bigger picture zoom the chart)

Best regards

Aaron