XLMUSDT, We are near buy zone areaHello everyone

According to the chart that you can see , the price is in correction wave and we think the price should come and do the end of corretion in buy zone area and after that is ready to move up , you can buy in 2 part in each of the buy zone area and after that at least 50% percent profit is near to us.

Be lucky

AA

XLM

XLM in coming days ...Currently, XLM is forming an ascending triangle, indicating a potential price increase. It is anticipated that the price could rise, aligning with the projected price movement (AB=CD).

However, it is crucial to wait for the triangle to break before taking any action.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

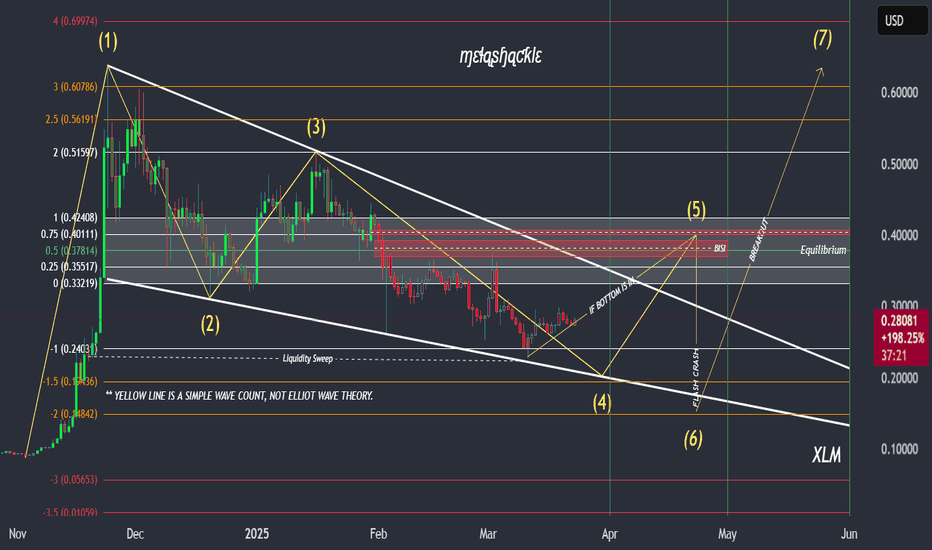

XLM charts with April 'flash crash' thesis zones.Here's my latest XLM chart, which includes potential levels that could be hit, along with an alternative path for the 5th wave, assuming the bottom is already in on the chart.

- If wave 4 is already complete, then the wave 6 "flash crash" low would likely be higher than the chart shows.

- If wave 4 isn't complete, then the wave 6 "flash crash" would likely sweep that low, prior moving into the real breakout beginning in the month of May.

- The real breakout, the 7th wave, would likely take out the previous pattern high making a run for what could potentially become a new all-time high in XLM.

Keep in mind that the "flash crash" in April is a theory and may not come to fruition or could be off in timing. However, I do believe that the breakout will begin in May, even if the "flash crash" does not occur in mid to late April as I've theorized.

Good luck, and always use a stop loss!

#XLM #XLMUSDT #Stellar #Analysis #Eddy#XLM #XLMUSDT #Stellar #Analysis #Eddy

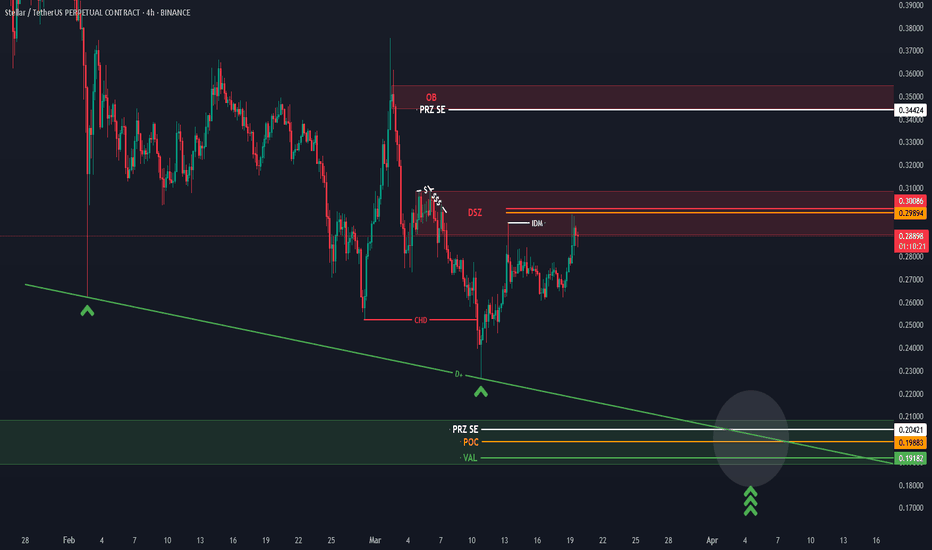

Everything is clear on the chart, I didn't have enough time to explain further. From the supply area, with or without the area hunt, it can fall to the demand area. Then you can invest in your style by getting the necessary confirmations when the high-time divergence is completed, which is probably the third collision on the lines marked in the demand area.

This analysis is only to show important areas.

It is never too late to buy and invest. Do not rush and do not be fooled by the positive movements and reactions of the market. Wait for the price to reach its valuable areas. In the analysis of the Atom currency, as you can see, there is a strong demand area that is intact. Be patient until the price falls from the decision or extreme flips to the green area of the important demand area. Be sure to check this currency in your monthly time frame and draw the areas. Then refer to the weekly, daily and four-hour time frames and draw the lower time areas and look for confirmation for volatility.

Do not rush to invest and buy spot and let the price reach the support area.

Important areas are drawn and labeled so you can make informed decisions.

Good luck.

Lets Make Life Changing Money TogetherMartyBoots here , I have been trading for 17 years and sharing my thoughts on CRYPTOCAP:OTHERS .

.

CRYPTOCAP:OTHERS is looking beautiful , absolutely beautiful and a very interesting chart for more upside, it is now getting into support. Just like NASDAQ:AMZN did back in 2008.

Do not miss out on CRYPTOCAP:OTHERS as this is a great opportunity to make life changing money on ALT Coins.

Regulation is going to moon this market

Be Ready

Watch video for more details

XLMUSDT - JUST ANOTHER IDEA OKAY!Crypto trends been down for awhile after all those uptrend euphoria failed badly..

The more you see those influencers on youtube hyping some coins, of course it crashed at some points, after all that is what those big power institutes wanted to suck all the money inflow, and especially they killed off people who wanna get rich quick who went for high leverage trades.. even with just 2X you will get liquidized with 50% drop for altcoins..

So enough said, if another crash is expected, probably it s going to be the bottom,.. so we can expect great recovery.. I am not an expert, but as XLM being down beautifully as it seems like a flag pattern, so we can expect rebound for XLM some where @0.191.. and expecting higher-high at bigger time frame..

How high? for now no body knows..

So, trade wisely and don't forget your stoploss..

Have a nice day & Happy trading guys!~

Stellar XLM price analysisWhile CRYPTOCAP:XRP price has already firmly established itself above the 2021 highs, the junior "padawane" CRYPTOCAP:XLM has not yet succeeded.

But compared to other alts, the price of #XLMUSDT is still very well held and moves from level to level.

There was a nice rebound from $0.226 to the current $0.27

Of course, it would be nice to test $0.19-0.20 as a courtesy gesture according to TA canons, but if it doesn't, it will only confirm the strength and serious intentions of buyers.

⁉️ Who knows, maybe this year the alt-season will come, and the #Stellar price will reach the current #Ripple levels around $2.30

How much will CRYPTOCAP:XRP cost then?)

XLM Looks Bearish (1D)It seems to be pulling back within the internal structure. From the supply zone, it may move toward the green zone. The green zone is a strong area where we can consider rebuying.

A daily candle closing above the invalidation level will nullify this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

XLM short termHello

this time I am posting a short term idea (few days to few weeks).

After explosion in Q4 of 2024 XLM has formed a downtrending channel which can potentially turn into a bull flag.

Currently XLM price is sitting at a bottom of this channel.

Short term traders can look to purchase some XLM now and wait till it comes towards the top of the channel to sell and get some profit. If it reaches top of the channel potential is 50% price increase.

If the market turns bullish in next few days to weeks XLM might even break upwards out of this bull flag but do not count on it just yet.

This idea is somewhat risky so proceed with extreme caution and with tight stop-loss below the channel.

Good luck.

XLM Crashes Below Key Support – Is a Reversal Near?XLM has broken its previous low, raising the question: where is the next major support zone? To determine this, we will focus on fibonacci, moving averages, and order blocks to find a high-probability bounce area for a potential long position.

🔍 Fibonacci Retracement – Locating the Next Support Level

Using the Fibonacci retracement tool from the low at $0.0757 to the high at $0.6374:

0.618 Fib Retracement → $0.2903 (Already Lost) ❌ Current Price: $0.248

Next Major Fib Level – 0.786 Retracement at $0.1959

Since the 0.786 Fib level is a key retracement point, we need further confluence factors to confirm its strength as a potential support zone.

🔗 Confluence Factors Strengthening the Support Zone ($0.1959 – $0.17179)

1:1 Trend-Based Fibonacci Extension

High: $0.6374

A: $0.3179

B: $0.515

1:1 extension aligns at $0.1902 → Strong confirmation near 0.786 Fib retracement ✅

Wave A-B Fibonacci Extension

1.618 Fib extension from wave A to B is at $0.1875 → Aligns with the 1:1 trend-based extension ✅

Daily Support Level at $0.1962

Sits almost exactly at the 0.786 retracement ($0.1959) ✅

21 EMA & 21 SMA for Moving Average Support

21 EMA at $0.20338

21 SMA at $0.17187

Order Block Between $0.2208 – $0.1964

Demand area aligns with the major support zone ✅

Key Takeaway:

A high-probability support zone is now identified between $0.1959 and $0.17179, with multiple confluences suggesting a strong potential bounce.

Trade Plan – Scaling Into a Long Position

Given the strong confluence at the support zone, the best approach is scaling into a long trade.

DCA Entry Strategy:

Start scaling in at $0.22, as an order block exists between $0.2208 – $0.1964

Main focus remains on the support zone ($0.1959 – $0.17179)

Stop Loss:

Below the 21 SMA ($0.17187) for invalidation

Take Profit Levels for Optimal R:R:

First TP at $0.25 → Resistance area

Next TP at $0.30 → Strong psychological & resistance level

R:R Approximation:

2:1 R:R for first TP ($0.25)

3:1+ R:R if targeting $0.30

High-Probability Support Zone Identified

✔ Multiple confluences confirm a strong support zone at $0.1959 – $0.17179

✔ Scaling into a long from $0.22 to $0.17179, with stop loss below the 21 SMA ($0.17187)

✔ Take profit levels set at $0.25 & $0.30 for a solid R:R trade

Alternative bullish scenario: A reclaim of lost key low at $2526 with rising volume could signal a long opportunity, only on confirmation.

💬 Will XLM bounce from this key support? Let me know your thoughts in the comments! 🚀🔥

(xlm) STELLAR "LOOP"This chart looks like there is no real volume and only someone very rich controlling the price of XLM. If I missed the top to sell and the price of XLM never went higher than previous ATH the price of most cryptocurrency is what would otherwise be stuck in a loop with very little interest from real investors. How is it possible for the chart to be like this?

XLM is going to put some smiles on people's faces very soon!The XLM chart appears to be showing some serious potential for growth. Currently trading within a descending wedge pattern and displaying a 5th wave internal wave count, XLM could outperform many people's expectations if the 5th wave plays out. Although many people tend to prefer XRP over XLM, I wouldn't count it out just yet, as—with recent price increases—it has potentially become more desirable compared to XRP due to its lower entry price range. As we know, many people don’t have a lot of extra cash just lying around nowadays.

Good luck, and always use a stop loss!

TradeCityPro | XLM: Key Levels and Market Analysis👋 Welcome to TradeCity Pro!

In this analysis, I want to review XLM for you. This coin is one of the U.S.-based crypto projects, and given the recent surge in news regarding crypto and the U.S., it could experience significant volatility, making it suitable for trading.

📅 Daily Timeframe

On the daily timeframe, we can see a strong bullish leg that extended up to $0.5781 before entering a correction phase, forming a descending wedge.

🔍 At the moment, there is a very important support level close to the price. If $0.2827 is broken, we can expect a further correction toward the 0.5 or 0.618 Fibonacci retracement levels. Another key support level is at $0.1566.

⚡️ The $0.2827 zone is highly significant, as it overlaps with the 0.382 Fibonacci retracement, making it a crucial level. If the price finds support at this zone, we could see the next bullish leg begin. However, if this support is lost, the price could experience sharp downward movements.

🔼 For spot buying, the $0.3522 resistance has turned into a solid level, where the price has tested and rejected multiple times. If the wedge pattern and resistance break, you can enter a long position or consider spot buying.

🚀 The next resistance levels are $0.4896 and $0.5781. The ATH at $0.7791 is a major supply zone.

📊 In the next few days, pay close attention to volume. A rise in volume before a breakout could indicate an imminent move.

⏳ 4-Hour Timeframe

On the 4-hour timeframe, we can observe price action in more detail. There is strong resistance at $0.3522, where the price was rejected, leading to significant bearish momentum.

✅ Currently, the price is reacting to the $0.2817 zone, and after seven consecutive red candles, a green candle has formed. Previously, the price faked a breakout at this level, and now it has retested this zone again.

🔽 If $0.2817 is broken, a short position can be opened, with the next support at $0.2368. For long positions, wait until the price forms a structure and the $0.3102 trigger level is confirmed. The main long trigger will be a breakout above $0.3522.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Trading Genius Reveals How To Succeed In 2025 (Must Watch!)Let me explain. The market won't start growing in a matter of days. It is true that long-term support has been hit, activated, but the next bullish wave will take time to develop. Between each wave, there is always a period of sideways, consolidation.

It is the first time that MA200 is tested as support coming off a major high —since September 2023. XLMUSDT daily.

Now, a period of sideways action will start (consolidation), after this period is over we will experience massive growth. Sideways is sideways, just so you know. This period can last anywhere between 1-3 months. The action will vary between pairs, some will move first while others will take longer.

Patience is key.

Start accumulating and whatever you do, focus on the long-term.

The waiting can be boring and troublesome for a few, this will be your test. If you try to move from pair to pair trying to catch the next bullish wave, you will fail. The exchanges will only buy those pairs that nobody is buying to create the illusion of massive growth. The truth is that most of the market will be sideways and the gamblers will be getting whipsawed. That's how it all works.

When you see a pair growing 600% in a single day, just know that nobody is holding it other than the exchange. It is an illusion. To succeed, create and follow a strategy, focus on the long-term.

Any easy and quick money mentality will result in a great opportunity being lost. It will be hard to lose in a bull-market, but you can lose by ending up with 2-3X "trading" when you can end up with 10-20X with a simple strategy of buy and hold.

Namaste.

$3.00 + XLM by September is very likely! It's no mystery that XLM and XRP often trade like they are family. Much like an older brother, XRP generally paves the way for XLM—the younger sibling—and the two share a similar charting structure. However, since the "Trump election pump," although both have broken out, XLM has yet to break above the upper trendline of the current wedge pattern. This leads me to believe that we may soon see XLM surprise everyone. Instead of following, it may take the lead this time by breaking out of the wedge pattern, setting a new all-time high, and then entering price discovery along with its older brother, XRP. Together, they will likely lead the entire crypto market, as they are two of the ISO 20022-compliant tokens with the most potential for widespread adoption.

Keep an eye on XLM—I believe it will not only play catch-up but may even lead XRP and the broader crypto market in the next leg up.

Good luck, and always use a stop-loss!

XLMUSD - SHORT SETUPCoin: #XLM/USDT

Short Set-Up

Leverage: 5-10x

#XLM already breaked down the symmetrical triangle and looking bearish.

Entry: 0.278 - 0.284$(Enter partially)

Targets: 0.272 - 0.266 - 0.260 - 0.254 - 0.242 - 0.230$(Short term)

Stop-loss: 0.290$

Please support with a like/boost and follow for more useful crypto updates!

XLM stellar Stellar down -60% since hitting a recent peak last November. The length of time following the mega candle in regards to the label and standing of XLM is a bit reductive when the price should be capable of doing better than losing so much. How is Stellar still this weak and lacking a great deal of support,. When is the $1.00 XLM coming,.

Will there be one more liquidation candle for XLM?XLM closely follows XRP's price action. Many investors, traders, and speculators understand that this relationship can provide distinct advantages at times, depending on market circumstances. However, it appears that XLM may have one more liquidation event in mind before the next leg up. Although there is no guarantee that this will occur, I believe it is very likely, as the weak doji candle—currently at the $0.23 cent level—would allow another liquidation event to clear the last remaining remnants of sell-side liquidity currently resting below the previous liquidation candle. I could be wrong, but this is an area to keep your eyes on in the event that the price continues to move downward.

Good luck, and always use a stop-loss!

(XLM) STELLARBefore large businesses finally consume the market of defi to become well established payment systems, small businesses can do so sooner than later. Even if large businesses are not using cryptocurrency to receive and transaction payments, there is no reason small businesses and freelancers cannot offer a way to receive and send payments through decentralized means. If most people used defi payment systems of some type (Preferred by the user) the need to care about whether the largest banks connected the two points as a bridge would not be necessary or important. In a way, it is as if society expects the banks, instead of the businesses (large, med, small) to make it possible to connect with payment crypto systems. If the business uses or even requires crypto payment transactions the bank is the one that will need to keep up and not the other way around. Why are we living in a world where we let the people that do the least amount of future thinking decisions control the way the future will be shaped. Banks have power through the people. Power to the people, not the banks. Banks collect all the money and use the collective bargaining chip to control people. From an individual standpoint people are more important than banks and as a network of individuals the movement of money is free flowing only if people choose to control their future and money. It is the end of the world, we're all going to die, this is the end, oh no. Investing in risky assets was never a safe bet as much as a risk worth taking. Keep that in mind. Using a feeless service like XLM for transactions that happen instantaneously would not be subject to issues of volatility in price. If there was a way to buy a crypto at the same time as transacting the cryptocurrency for the purpose of a transaction, now that would be revolutionary; so as to avoid the idea of holding the cryptocurrency to make the transaction.