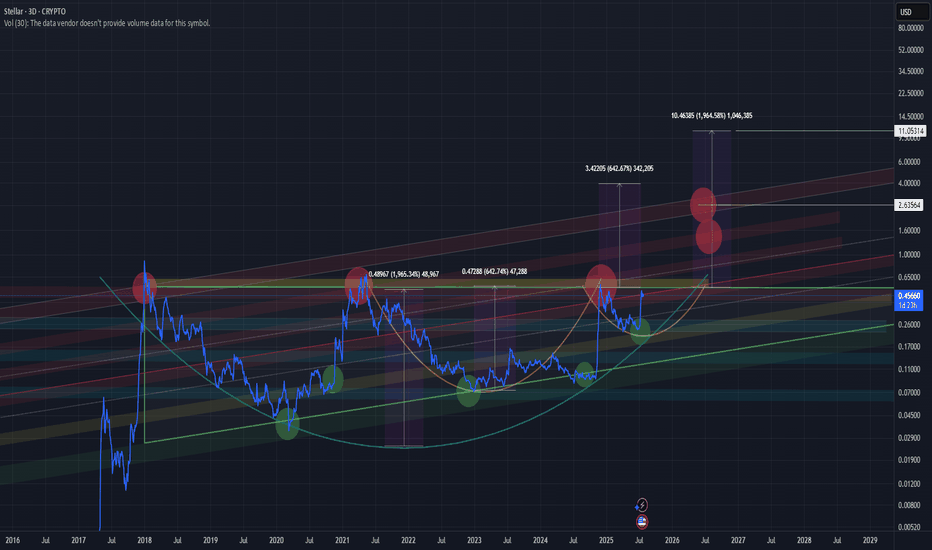

XLM/USD XLM is showing one of the strongest bullish setups right now.

A macro “Cup”, with a smaller “Cup with Handle” forming inside it — a powerful setup often leading to parabolic breakouts.

Before a true breakout, price may fake out to the downside, trapping longs.

This is classic market maker behavior — shakeouts followed by strong reversal and breakout. Stay focused on the reaction around yellow zone.

Currently in the final stages of the “handle” formation.

A breakout may confirm a move toward $4

Xlmanalysis

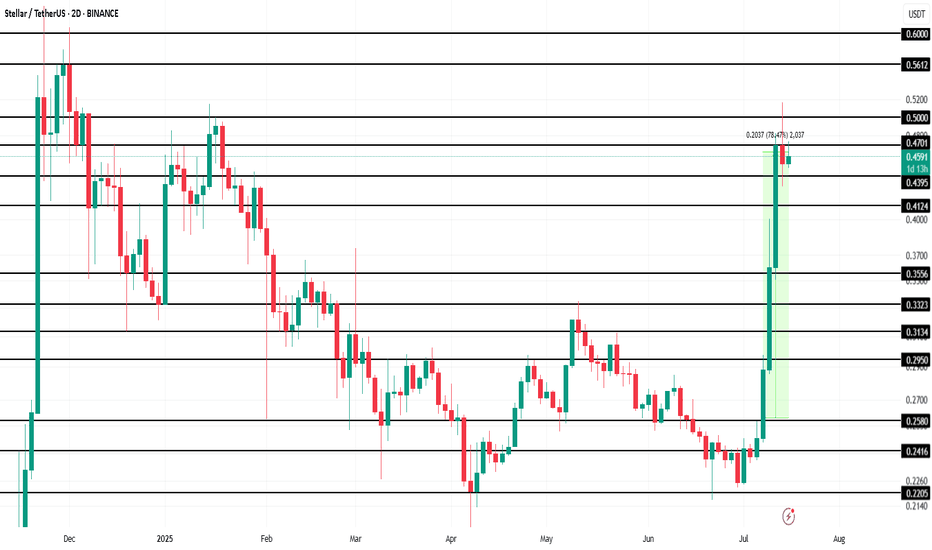

Stellar (XLM) Makes History Amid 78% Price Surge This WeekBINANCE:XLMUSDT is currently trading at $0.46, up 78.5% over the past week . However, the altcoin faces resistance at $0.47, a level it has struggled to breach in recent days. The ability to break this resistance is crucial for continued growth, as it will determine whether XLM can push higher.

BINANCE:XLMUSDT futures market activity has also surged, with Futures Open Interest hitting an all-time high of $520 million in the last 24 hours. This indicates that traders are increasingly interested in the asset's derivatives, which are capitalizing on its rise.

Given the strong sentiment from futures traders and the technical indicators, it is likely that BINANCE:XLMUSDT will push past the $0.47 resistance and target $0.50 in the coming days . A successful breakthrough could lead XLM toward its next target at $0.56, marking an eight-month high. This would signify continued strength for the asset.

However, if the broader market sentiment shifts or investors begin to sell their holdings, BINANCE:XLMUSDT could face a significant pullback. If the price falls below the key support levels of $0.43 and $0.41 , it could slide further to $0.35, which would invalidate the current bullish outlook.

XLMUSDT Eyes on $0.3109: Breakout Zone Could Ignite Rapid ClimbXLMUSDT is currently forming a bullish reversal structure on the 4-hour chart. After a prolonged downtrend, price has established a support base around the $0.2570 level. This zone has acted as a key support, rejecting downside attempts multiple times, and creating a potential accumulation floor.

The price is now pushing above short-term consolidation, hinting at a possible breakout from the recent range. This range behavior, followed by an early higher low formation, indicates that buyers may be stepping in more aggressively.

Support Zone

The support zone around $0.2570 to $0.2585 is structurally significant. Price dipped into this level twice and was strongly rejected both times. The most recent low around this zone created a long wick, suggesting liquidity grab and potential trend reversal.

This zone now serves as a clear invalidation point for the bullish setup. A break below would likely invalidate the long bias and open the door for a deeper retracement.

Resistance Levels and Take-Profit Targets

The chart identifies two major resistance levels.

The first resistance is around $0.2902, marking Take Profit 1 (TP1). This level acted as resistance multiple times in the past and should be the first area where selling pressure could return.

The second resistance, marked at $0.3109 (TP2), is a higher timeframe resistance zone. It was previously a strong ceiling before the drop in early June. If the momentum is sustained, this area becomes a logical final target for the current bullish swing.

Supertrend Confirmation

The Supertrend indicator has recently flipped green, supporting the bullish bias. The flip occurred after price reclaimed the mid-range, and the price is now consolidating just above the Supertrend baseline.

This is a classic bullish signal on the 4H chart, particularly when it aligns with a structural bottoming pattern and a clean risk-reward setup.

Risk–Reward Setup

The current setup offers a favorable risk-to-reward ratio of 2.49. Entry is positioned near $0.2723, with the stop-loss placed just below the support zone at $0.2570. This limits downside risk to approximately 5.6%.

The upside, on the other hand, stretches up to $0.3109, offering potential gains of around 14%. Even the first target at $0.2902 offers a decent 6.5% return, making this trade attractive for swing traders aiming for a mid-term move.

Momentum Shift and Potential Breakout

What strengthens the bullish case further is the price action attempting to break out of the recent lower high zone. There is a clear effort to reclaim momentum, and a successful 4H candle close above $0.2770 would signal a clean breakout and continuation.

Earlier price action shows signs of accumulation, including a liquidity sweep below $0.2570 followed by strong rejection — a common reversal pattern in crypto markets.

XLM/USDT Breakdown: Structure Shift & Bearish Retracement Setup🚀 XLM/USDT Trade Outlook 🔎

I've been reviewing the XLM/USDT pair, and it's showing a very familiar setup compared to other majors. 🔁 On the daily timeframe, we've seen a notable shift in structure, with a clear break to the downside. 🧱📉 Dropping into the 4-hour chart, that structural break is even more apparent, adding confidence to a bearish bias. 🔍

Currently, the pair is extended away from value—and I’m anticipating a pullback into the fair value zone, where I’ll be watching closely for a potential short setup. 📐💼

🎯 In the breakdown video, we cover:

The prevailing trend context 🌊

How market structure is unfolding across timeframes 🔂

Price action cues to validate the setup 🎥📈

Key support and resistance areas for both entry and target planning 🎯

For risk management, I’m positioning the stop above the retracement high, using roughly 2x ATR for calculated protection 🛑⚙️. A potential reward could extend to 5–6x ATR, depending on how price reacts around prior structure levels on the left. ⬅️📊

As always, I’m cross-checking with my Fibonacci levels for extra confluence—and the alignment here is looking solid. 🔢🧲

Remember, this is not financial advice. Always do your own due diligence. ⚠️💡📉

XLMUSDT Weekly LONG This is a weekly technical analysis for educational purposes on XLMUSDT. I believe that Stellar will find new higher high levels in the middle of the 2025 Bull Season.

As I mentioned before on my ALGOUSDT Weekly Analysis ;

"Considering the global economic crisis, the technical recession in the United States, the suppression of gold and other commodities, the real estate and unemployment crisis in China, and the European Union countries' struggle with inflation, I believe that market makers (the bulls) may create a false FOMO (Fear of Missing Out) during the 2024 BTC halving period, potentially driving BTC to levels of perhaps 50K+ before ending the year 2024 around the 20-25K range. When we consider the global effects, the real bull season is likely to occur between 2025 and 2026.

Reaching 100K in Bitcoin by 2024 wouldn't make much sense if most people don't have the financial means. It's important to remember that patient wealthy individuals often capitalize on the impatience of those with fewer resources. (let's say poors with high dreams) Those with limited means may not have the capital to participate in the market for couple of years.

This is not "clever riches profit from the idiot riches game". Never was. I believe.

I may be wrong, :)

Regards,

Be patient with XLMUSD, it's time will comeHello everyone,

today I choose to talk about XLM.

Many consider it a dead coin, since it did not make a new ATH in 2021. But I prefer trading with verified coins that have been around for long enough to establish patterns in their charts. And I trade based on these patterns.

This is a weekly chart of XLMUSD.

It is one of the sleepiest coins. But when it wakes up, it is a rocket.

How to read my chart:

- When XLM is in bull market, it respects 21 weekly EMA -> price action above it. (arrow up)

- When XLM is in bear market, it respects 21 weekly EMA -> price action below it.

- In accumulation, price action plays with 21 weekly EMA, goes above it then below, then again above it, and below... (rectangle)

Sure, this does not help, right. How could you know if we are still playing with 21 weekly EMA or is this cross above start of parabolic rise. Well, the answer lies in RSI.

XLM goes parabolic once weekly RSI crosses above 70 (circle). We are not there yet so I do not expect fireworks tomorrow. Remember, XLM is one of the last ALTs in the bull run to wake up, that is why its bull runs are so violent. Because once it wakes up it makes up for all the sleeping in matter of few weeks.

More info on XLM:

- XLM created its base (red line). It has respected it since 2018. It has touched it in 2023 and 2024.

- People think XLM slept through 2023 bull run and hence is dead. But the fact is that the 2023 bull run is still not over and XLM will mark the end of it with its parabolic run.

I have started to slopwly accumulate XLM with the money gained from BTC and other ALTs that have already surged.

XLM potential is from 5x to 15x. You choose and determine where you want to take profit. BUT MAKE SURE TO TAKE THE PROFIT!

And remember: If you buy low, you do not need coin to break ATH to make substantial amount of money. Buying price is much more important then selling price.

Good luck.

P.S. Check my other posts. If you find value in my ideas, boost and share them.

If you want to stay notified, follow me.

#Stellar Finds Support, will XLM Break $0.130?Past Performance of Stellar

Stellar prices were in green in September when most assets, including Bitcoin, posted losses versus a strong USD. At spot rates, XLM is under pressure, dropping in a bear breakout formation, as evident in the daily chart. Despite the rejection of lower prices on October 13, the coin is still down 13 percent from September highs. Bulls appear to be struggling against a strong wave of liquidation.

#Stellar Technical Analysis

XLM prices reversed from $0.107, finding support from the 78.6 percent Fibonacci retracement level of the September 2022 trade range. As the broader crypto market finds relief, optimistic traders may buy the dips above $0.107, targeting $0.130, which is this week's high, expecting XLM primary trend established in September 2022 to continue. This forecast will be valid if XLM prices rally from spot rates above $0.130. If not, any drop below $0.107 will continue the liquidation of early October, possibly forcing the coin towards 2022 lows at $0.100, a critical support level.

What to Expect from #XLM?

The crypto market is finding support, and XLM may rise with the tide. However, traders can wait for a clearer trend definition above this week's highs. This will cancel out doubts about the strength of the uptrend and resume the primary trend from mid-September 2022.

Resistance level to watch out for: $0.130

Support level to watch out for: $0.100

Disclaimer: Opinions expressed are not investment advice. Do your research.

Stellar Bulls Surging, XLM Prices May Retest $0.13Past Performance of Stellar Lumens

Stellar Lumens prices are rallying and syncing with the broader market. The coin is stable on the last trading day but trending above a multi-month resistance trend line traced to April 2022. As the XLM prices bottom up, traders may find opportunities to ramp up in lower time frames.

#Stellar Lumens Technical Analysis

XLM prices plunged 88 percent after peaking at $0.75 in May 2021. Currently, the coin is up 16 percent from 2022 lows, and buyers are in control, reading from the candlestick arrangement in the daily chart. As price action takes shape to favor buyers and prices break higher above the critical resistance level, traders may search for entries on dips, targeting $0.13 in the medium term. This preview, however, is only valid if prices are steady above $0.10. Any breach below this reaction point may force XLM towards $0.09 or worse in a bear continuation formation.

What to Expect from #XLM?

The bounce to spot rates is refreshing for token holders and may find the base for another leg up towards $0.17 and Q1 2022 lows. Still, the rapidity of the uptrend will highly depend on if there is confirmation of July 18 gains and the level of trader participation. Any expansion in trading volumes with rising prices could signal strength and buyers taking charge after months of lower lows.

Resistance level to watch out for: $0.13

Support level to watch out for: $0.10

Disclaimer: Opinions expressed are not investment advice. Do your research.

#Stellar Lumens Bearish, XLM Primary Support at $0.10Past Performance of Stellar Lumens

Like the rest of the crypto market, Stellar Lumens remains within a bear trend. Despite recent gains, there are clear lower lows in the daily chart. At spot rates, XLM is down roughly five percent as bears reverse last week's gains.

#Stellar Lumens Technical Analysis

The XLM coin is bearish at spot rates, with upsides limited at $0.13, last week's highs. Notably, prices are below the June 23 and 24 trade range with rising trading volumes over the past few days suggesting increasing liquidation pressure. Still, XLM bulls are optimistic about recovery if prices are above $0.10, June's 2022 lows. Risk-averse traders can wait for a clean, high volume breakout above $0.13 to load on dips targeting $0.15. Conversely, deep losses below $0.10 may see XLM slide deeper towards $0.09, a February 2020 reaction point.

What to Expect from #XLM?

At spot rates, XLM is retesting Q3 2022 highs, and price action is skewed for sellers. If bears take charge, further losses below $0.10 may see the coin slip to print multi-month lows.

Resistance level to watch out for: $0.13

Support level to watch out for: $0.10

Disclaimer: Opinions expressed are not investment advice. Do your research.

XLM TO $0.03 (£0.025)- XLM is in a downtrend as you can see.

- It will most likely reach £0.025

- The first target where I will personally take some small profits is at the 4.618 level at $4 (£3.30) - 132 X RETURN

- MY second target would be around $30 (£24) - 960 x RETURN

- So if you was to invest £1,000 at £0.025 you could turn that into £132,000

- If you was to invest £1,000 at £0.0.25 you could turn that into £960,000 this could take around 5-8 years!

- NOT FINANCIAL ADVICE!!!

#XLM/USDT 30M CHART UPDATE !!Welcome to this quick XLM/USDT analysis.

I have tried my best to bring the best possible outcome in this chart.

Reason for trade:- XLM is trying to break the major resistance of the $0.15-$0.155 area. The support is $0.140-$0.142 area and we see a retest of this area. You can try to add some XLM near the support area with tight stop loss.

Remember:-This is not a piece of financial advice. All investment made by me is at my own risk and I am held responsible for my own profit and losses. So, do your own research before investing in this trade.

Sorry for my English it is not my native language.

Do hit the like button if you like it and share your charts in the comments section.

Thank you...

#XLM/USDT BEST ENTRY GREEN ZONE AND 35% PUMP AND STF !! !Welcome to this quick XLM/USDT analysis.

I have tried my best to bring the best possible outcome in this chart.

Reason of trade:-XLM/USDT symmetrical triangle pattern conforms and break the upper trend line and retest buy the green zone.

Entry:-$0.13280,$0.13575

Traget:- 35%

Stoploss:- $0.12830

with laverage 5x to 10x

Remember:-This is not a piece of financial advice. All investment made by me is at my own risk and I am held responsible for my own profit and losses. So, do your own research before investing in this trade.

Sorry for my English it is not my native language.

Do hit the like button if you like it and share your charts in the comments section.

Thank you...

#XLM/USDT 1DAY UPDATE BY CRYPTOSANDERS !Welcome to this quick XLM/USDT analysis.

I have tried my best to bring the best possible outcome in this chart.

Reason of trade:- XLM//USDT PARALLEL CHANNEL brake the green and trandline and buy the retest green zone. PARALLEL CHANNEL green zone. (SPOT CALL)

Entry:-$0.11000,$0.12745

Traget:- 70%

Stoploss:- $0.09924

Remember:-This is not a piece of financial advice. All investment made by me is at my own risk and I am held responsible for my own profit and losses. So, do your own research before investing in this trade.

Sorry for my English it is not my native language.

Do hit the like button if you like it and share your charts in the comments section.

Thank you...

XLM (Stellar) Coin Analysis 19/03/2021we have analyzed it earlier and capitalize on this coin twice earlier:

4H Time Frame:

Day Time Frame:

Fundamentals:

Stellar is an open network that allows money to be moved and stored. When it was released in July 2014, one of its goals was boosting financial inclusion by reaching the world’s unbanked — but soon afterwards, its priorities shifted to helping financial firms connect with one another through blockchain technology.

The network’s native token, lumens, serves as a bridge that makes it less expensive to trade assets across borders. All of this aims to challenge existing payment providers, who often charge high fees for a similar service.

If all of this sounds familiar, it is worth noting that Stellar was originally based on the Ripple Labs protocol. The blockchain was created as a result of hard fork, and the code was subsequently rewritten.

Fees are a sticking point for many. However, high costs when making cross-border payments aren’t just exclusive to fiat-based payments solutions such as PayPal — transaction fees have also been known to go through the roof on the Bitcoin and Ethereum blockchains because of congestion.

Stellar is unique because every transaction costs just 0.00001 XLM. Given how one unit of this cryptocurrency only costs a few cents at the time of writing, this helps ensure that users keep more of their money.

Few blockchain projects have managed to secure partnerships with big-brand technology companies and fintech firms. A few years ago, Stellar and IBM teamed up to launch World Wire, a project that allowed large financial institutions to submit transactions to the Stellar network and transact using bridge assets such as stablecoins.

Although other blockchains have community funds, meaning that grants can be given to projects that help further the ecosystem, Stellar allows its users to vote on which ventures should be given this support.

Jed McCaleb founded Stellar with the lawyer Joyce Kim after leaving Ripple in 2013 over disagreements about the company’s future direction.

In explaining the rationale behind Stellar in September 2020, McCaleb told CoinMarketCap: “The whole original design of Stellar is that you can have fiat currencies and other kinds of forms of value run in parallel with each other and with crypto assets. This is super important to drive this stuff mainstream.”

McCaleb’s goal is to ensure that Stellar can give people a way of moving their fiat into crypto — and eliminate the friction that people normally experience when they are sending money around the world.

He currently serves as the CTO of Stellar, as well as the co-founder of the Stellar Development Foundation. This not-for-profit organization aims to “unlock the world’s economic potential by making money more fluid, markets more open, and people more empowered.”

Current Fundamental:

The live Stellar price today is $0.402482 USD with a 24-hour trading volume of $832,342,993 USD. Stellar is up 2.85% in the last 24 hours. The current CoinMarketCap ranking is #13, with a live market cap of $9,109,323,999 USD. It has a circulating supply of 22,632,881,017 XLM coins and a max. supply of 50,001,806,812 XLM coins.

The top exchanges for trading in Stellar are currently Binance, Huobi Global, OKEx, BitZ, and Upbit. You can find others listed on our crypto exchanges page.

Technical Analysis:

the coin is currently in a retracement from the Past Impulsive wave and is now on the Reaccumulation Phase for another Impulsive wave and Rally.

As you can see there is Hidden Bullish Divergence of Price and MACD, which is the sign of Bullish trend continuation.

we have specified 3 New Targets with Fibonacci Projection of the previews Impulsive Cycle, where as the 3 TP gets its conformation as the price Triggers the 2TP followed by the price Correction and some distributions.

Stellar (XLMUSD) SHORT TO $0.07-$0.06 Stellar (XLMUSD) is going through an A-B-C correction. The correction looks like a Zig-zag correction which is a 5-3-5 wave design

Wave A - Went from $0.8 to $0.19

Wave B - Went from $0.19 to $0.44

Wave C - it's a 5 wave series and I think it will end up at $0.07-$0.06 zone before reversal

Stellar (XLMUSD) going to retrace to 88.6% or 94.1% correction TO $0.07-$0.06. We are presently at 78.6% FIB retracement, so the next best points are 88.6% and 94.1% and they are derived by the following formulae:

88.6% price level is derived by squaring (or multiplying by itself) from the Golden Ratio, 0.618:

0.618 x 0.618 = 0.786 (78.6%)

0.786 x 0.786 = 0.886 (88.6%)

0.886 x 0.886 = 0.941 (94.1%)

88.6% retracement price is $0.11

94.1% retracement price is $0.07

I believe Stellar (XLMUSD) will still be shorted and may find the reversal at that 94.1% zone because that's also a junction point where retracement of the whole five-wave series and the extension of the A-B-C meet

Please like and comment for feedback

XLM moving in an Ascending Bear Triangle. Huge DIP comingXLM is moving in an ascending triangle and the pattern looks bearish to me.

I has already touched point D of ABCDE pattern and I think it should meet point E at around 0.31 zone. Post this there should be a major DIP.

How far it can drop we need to wait and watch.

If you like my analysis then do drop a LIKE and a COMMENT. Also do SHARE it with your friends.

Also don't forget to smash that FOLLOW button to get daily analysis of multiple crypto currencies and sometime ASX stocks.

Note - These are my personal notes and in no way a financial advice. Do your own research and Trade wisely