XLMLONG

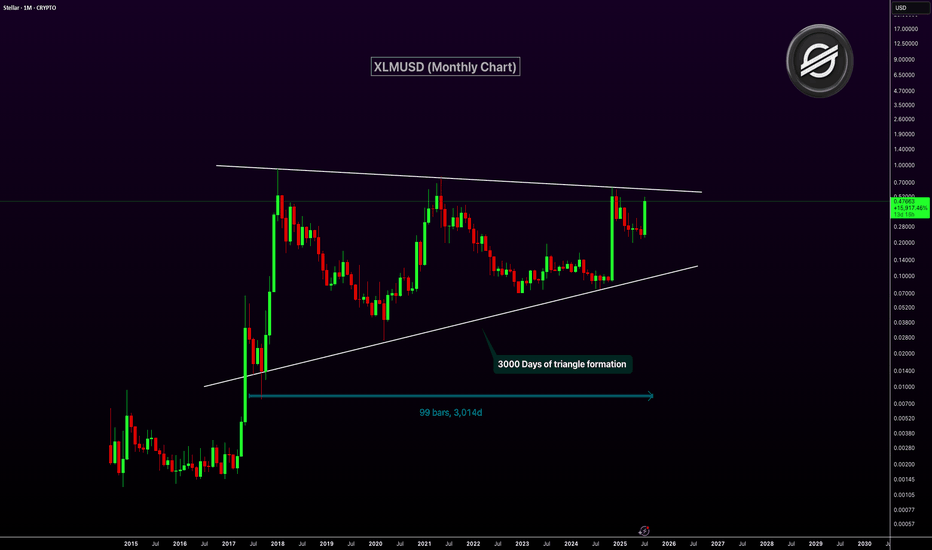

XLMUSD Nearing Breakout After 3,000-Day Triangle FormationXLM has been consolidating inside a massive symmetrical triangle for over 3,000 days. This long-term pattern on the monthly chart dates back to 2017. The price is now approaching the upper resistance trendline of the triangle. A breakout from this structure could ignite a major bullish rally.

The current monthly candle shows strong momentum with over 100% gains. A confirmed breakout above resistance could mark the start of a macro uptrend. This triangle is one of the most significant technical setups in XLM’s history.

Target 1: $1.00

Target 2: $2.50

Target 3: $5.00

XLMUSDT Eyes on $0.3109: Breakout Zone Could Ignite Rapid ClimbXLMUSDT is currently forming a bullish reversal structure on the 4-hour chart. After a prolonged downtrend, price has established a support base around the $0.2570 level. This zone has acted as a key support, rejecting downside attempts multiple times, and creating a potential accumulation floor.

The price is now pushing above short-term consolidation, hinting at a possible breakout from the recent range. This range behavior, followed by an early higher low formation, indicates that buyers may be stepping in more aggressively.

Support Zone

The support zone around $0.2570 to $0.2585 is structurally significant. Price dipped into this level twice and was strongly rejected both times. The most recent low around this zone created a long wick, suggesting liquidity grab and potential trend reversal.

This zone now serves as a clear invalidation point for the bullish setup. A break below would likely invalidate the long bias and open the door for a deeper retracement.

Resistance Levels and Take-Profit Targets

The chart identifies two major resistance levels.

The first resistance is around $0.2902, marking Take Profit 1 (TP1). This level acted as resistance multiple times in the past and should be the first area where selling pressure could return.

The second resistance, marked at $0.3109 (TP2), is a higher timeframe resistance zone. It was previously a strong ceiling before the drop in early June. If the momentum is sustained, this area becomes a logical final target for the current bullish swing.

Supertrend Confirmation

The Supertrend indicator has recently flipped green, supporting the bullish bias. The flip occurred after price reclaimed the mid-range, and the price is now consolidating just above the Supertrend baseline.

This is a classic bullish signal on the 4H chart, particularly when it aligns with a structural bottoming pattern and a clean risk-reward setup.

Risk–Reward Setup

The current setup offers a favorable risk-to-reward ratio of 2.49. Entry is positioned near $0.2723, with the stop-loss placed just below the support zone at $0.2570. This limits downside risk to approximately 5.6%.

The upside, on the other hand, stretches up to $0.3109, offering potential gains of around 14%. Even the first target at $0.2902 offers a decent 6.5% return, making this trade attractive for swing traders aiming for a mid-term move.

Momentum Shift and Potential Breakout

What strengthens the bullish case further is the price action attempting to break out of the recent lower high zone. There is a clear effort to reclaim momentum, and a successful 4H candle close above $0.2770 would signal a clean breakout and continuation.

Earlier price action shows signs of accumulation, including a liquidity sweep below $0.2570 followed by strong rejection — a common reversal pattern in crypto markets.

XLM short termHello

this time I am posting a short term idea (few days to few weeks).

After explosion in Q4 of 2024 XLM has formed a downtrending channel which can potentially turn into a bull flag.

Currently XLM price is sitting at a bottom of this channel.

Short term traders can look to purchase some XLM now and wait till it comes towards the top of the channel to sell and get some profit. If it reaches top of the channel potential is 50% price increase.

If the market turns bullish in next few days to weeks XLM might even break upwards out of this bull flag but do not count on it just yet.

This idea is somewhat risky so proceed with extreme caution and with tight stop-loss below the channel.

Good luck.

XLMUSDT Weekly LONG This is a weekly technical analysis for educational purposes on XLMUSDT. I believe that Stellar will find new higher high levels in the middle of the 2025 Bull Season.

As I mentioned before on my ALGOUSDT Weekly Analysis ;

"Considering the global economic crisis, the technical recession in the United States, the suppression of gold and other commodities, the real estate and unemployment crisis in China, and the European Union countries' struggle with inflation, I believe that market makers (the bulls) may create a false FOMO (Fear of Missing Out) during the 2024 BTC halving period, potentially driving BTC to levels of perhaps 50K+ before ending the year 2024 around the 20-25K range. When we consider the global effects, the real bull season is likely to occur between 2025 and 2026.

Reaching 100K in Bitcoin by 2024 wouldn't make much sense if most people don't have the financial means. It's important to remember that patient wealthy individuals often capitalize on the impatience of those with fewer resources. (let's say poors with high dreams) Those with limited means may not have the capital to participate in the market for couple of years.

This is not "clever riches profit from the idiot riches game". Never was. I believe.

I may be wrong, :)

Regards,

XLM Long following XRP StructureChart Comparison: XLM vs. XRP

On the left side of the chart, we have XLM/USDT, and on the right, we're comparing it with XRP/USDT. Both charts display a very similar structural pattern, with XRP showing a more advanced movement compared to XLM. It appears that XLM is currently lagging behind XRP but is likely to follow suit soon.

Given the similarity in price action and market behavior, I anticipate XLM will catch up, and I am expecting a move towards the marked target in the near future. If XLM continues to follow XRP's trajectory, we should see an upward move that aligns with the target zone.

Keep an eye on XLM for a potential breakout and move towards the target area marked in the chart.

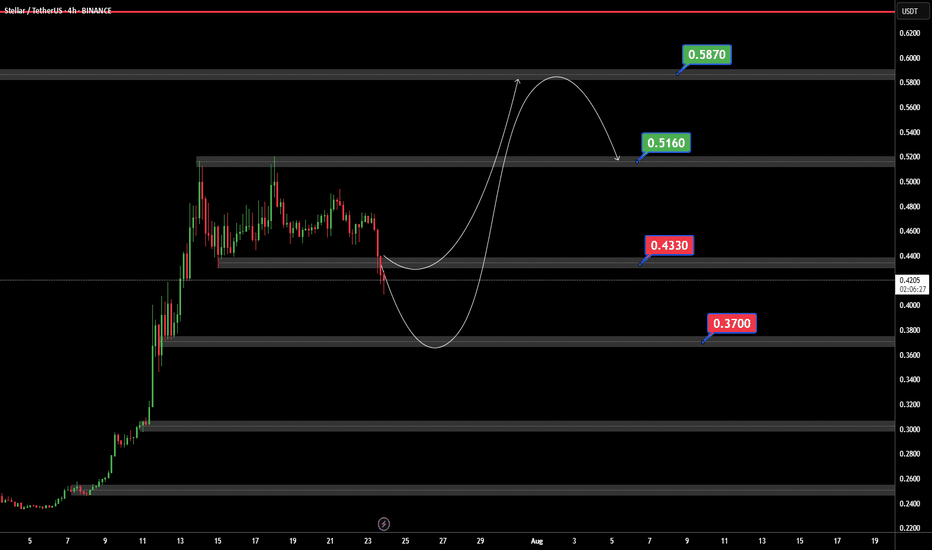

#XLM/USDT Ready to go higher#XLM

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.4300

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.4434

First target 0.4590

Second target 0.4746

Third target 0.4927

xlm long!"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Can XLM hit $1 this year? Let's find out!The Stellar price has recorded a strong bullish recovery around its $0.43 mark. By hovering close to that psychological barrier since the week started, this altcoin has formed a resistance/support level around the price range. This further makes it a crucial watch level.

Specifically, with an intraday surge of over 14% with a trading volume of $4.233 billion, the Stellar price has reclaimed the $0.50 mark. Moreover, with the recent bullish candle, this altcoin has formed a flag pattern in the 1D time frame, suggesting a significant increase in the price action.

The Relative Strength Index (RSI) continues hovering above the overbought range in the daily time frame. This highlights an increase in the buying-over-selling pressure for the altcoin in the crypto market.

Further, the EMA 50/200-day has displayed a constant uptrend after experiencing a Golden Cross earlier this month. This suggests that the altcoin may continue gaining value in the upcoming time.

If the bullish sentiment sustains, the XLM coin price will breach its important resistance level of $0.50 and head toward its upper high of $0.60. Maintaining the price above that level could set the stage for this altcoin to retest its upper high of $0.70.

Conversely, if the bears outrun the bulls, the Stellar token will retest its support trendline of the flag pattern. Furthermore, if the bears dominate the crypto space, this could result in it plunging toward its lower support level of $0.40.

Be patient with XLMUSD, it's time will comeHello everyone,

today I choose to talk about XLM.

Many consider it a dead coin, since it did not make a new ATH in 2021. But I prefer trading with verified coins that have been around for long enough to establish patterns in their charts. And I trade based on these patterns.

This is a weekly chart of XLMUSD.

It is one of the sleepiest coins. But when it wakes up, it is a rocket.

How to read my chart:

- When XLM is in bull market, it respects 21 weekly EMA -> price action above it. (arrow up)

- When XLM is in bear market, it respects 21 weekly EMA -> price action below it.

- In accumulation, price action plays with 21 weekly EMA, goes above it then below, then again above it, and below... (rectangle)

Sure, this does not help, right. How could you know if we are still playing with 21 weekly EMA or is this cross above start of parabolic rise. Well, the answer lies in RSI.

XLM goes parabolic once weekly RSI crosses above 70 (circle). We are not there yet so I do not expect fireworks tomorrow. Remember, XLM is one of the last ALTs in the bull run to wake up, that is why its bull runs are so violent. Because once it wakes up it makes up for all the sleeping in matter of few weeks.

More info on XLM:

- XLM created its base (red line). It has respected it since 2018. It has touched it in 2023 and 2024.

- People think XLM slept through 2023 bull run and hence is dead. But the fact is that the 2023 bull run is still not over and XLM will mark the end of it with its parabolic run.

I have started to slopwly accumulate XLM with the money gained from BTC and other ALTs that have already surged.

XLM potential is from 5x to 15x. You choose and determine where you want to take profit. BUT MAKE SURE TO TAKE THE PROFIT!

And remember: If you buy low, you do not need coin to break ATH to make substantial amount of money. Buying price is much more important then selling price.

Good luck.

P.S. Check my other posts. If you find value in my ideas, boost and share them.

If you want to stay notified, follow me.

#XLM/USDT#XLM

The price moves in an inverted head and shoulders pattern

The right shoulder is now complete

Wall is expected for the upper border of the shoulder

We have a higher stability moving average of 100

We have bullish momentum on the RSI and an uptrend

We have a current breakout of the channel to the upside

Entry price is 0.2500

The first target is 0.3000

The second target is 0.3500

The third goal is 0.4000

#XLM/USDT#XLM

The price is moving in a descending channel on the 1-hour frame and is holding it tightly and is about to break out to the upside

We have a bounce from the lower limit of the channel at 0.0900

We have a bearish trend of the RSI that is about to break out, which supports the upside

We have a trend to stabilize above the 100 moving average

Entry price 0.900

First target 0.0920

Second target 0.0988

Third target 0.1031

Long Position on XLMUSDT / Volume ProjectionBINANCE:XLMUSDT

COINBASE:XLMUSD

SL2 ---> Mid-risk status: 5x-8x Leverage

SL1 ---> Low-risk status: 3x-4x Leverage

👾The setup is active but expect the uncertain phase as well.

⚡️TP:

0.1045

0.1055

0.1070

0.1085

0.1100

0.01112(In Optimistic Scenario)

➡️SL:

0.0977

0.0955

🧐 The Alternate scenario:

🔴If the price stabilizes below the trigger zone, the setup will be cancelled.

XLM (Stellar) Technical Analysis and Trade Idea 📈🚀Taking a comprehensive view of XLM (Stellar) , we observe a prevailing bullish trend, particularly evident when analyzing the weekly charts. Although there was a recent minor downturn, the daily chart exhibited bearish movements. However, the overall sentiment is optimistic once again. Notably, we’ve identified bullish price action—a decisive break in market structure on the 4-hour timeframe—which could potentially shift the 4-hour trend to bearish in trhe short term before it continueds bullish. In our video, we delve into trend analysis, explore price action dynamics, dissect market structure, and introduce key technical analysis concepts. Toward the video’s conclusion, we present a trade idea. It’s essential to emphasize that this information serves educational purposes only and should not be construed as financial advice. 📈🚀📊

#XLM/USDT#XLM

The price is moving in a downward channel and sticking to its limits well

It was penetrated upwards forcefully and was stabilized above it

We have a higher stability Moving Average 100 in red

We have an uptrend on the RSI that the price is following well

Further upside is supported

Entry price is 0.1223

The first target is 0.1275

The second target is 0.1329

The third goal is 0.1388

XLMUSDT 1W LONG📈Hi all. Timeframe 1 week. Stellar is globally in an ascending channel and is currently flat at its support. A fractal repetition of growth to the upper boundary of the channel is possible. I'm considering placing on spot now, and long on breakout/retest, depending on your type of trading. Marked goals and levels on the chart.