Banks vs Utilities Holding UpUpdates coming from the previous "Banks Look Cheap vs Utilities" chart. For those who don't remember here are the flows we have been tracking:

Now it is clear US 10-year Yields are starting to withdraw again, although this time Banks vs Utilities are less affected. I have been talking with clients recently around this space and there is broadly no concern. Valuations in Banks remain supportive and as long as the trend remains in tact there is little to concern, however as we enter into a weaker than expected end of year outlook for US Equities I am updating the Outlook:

Outlooks changed from Buy to Neutral, any weakness in banks is actionable in my opinion.

As always keep the comments and questions coming, please like if the ideas are helping and any feedback is welcomed!

Thanks

XLU

OPENING (IRA): XLU JAN 17TH 52 SHORT PUT... for a .48 credit.

Notes: One of the underlyings on my IRA shopping list, pulling the trigger here on a "not a penny more"* short put at the 52 strike with a resulting cost basis of 51.52/share if assigned on the 52 shortie. The current yield is 3.06% with an annualized dividend of 1.85.

Will look to roll out "as is" at least quarterly for further cost basis reduction until assigned or that's no longer productive.

* -- See HYG "Not a Penny More" Short Put Post, Below.

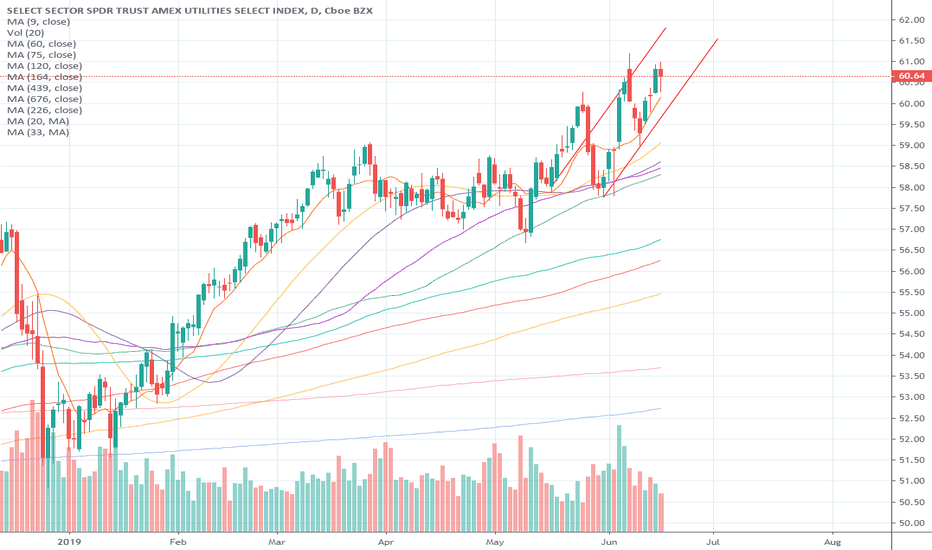

XLU - DAILY CHARTHi, today we are going to talk about XLU

We observe a D1, some important points. The details are highlighted above.

Thank you for reading and leave your comments if you like.

Join the Traders Heaven today, for more exclusive contents!

Link bellow!

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should use it as financial advice

Is XLU underperformance signaling a potential crash ahead? Business cycle is still going down (as indicated by falling steel prices) and defensive sectors are supposed to outperform SPY in this environment. Lately XLU is underperforming SPY significantly, which happened twice in last several years. In 2015 it foretold a big market crash. In early 2019, while the divergence was relatively small, it predicted the May correction. This time there is a significant divergence. I expect a significant decline in stocks in coming weeks.

US SECTOR SERIES FINALE 11/11: UTILITIES(XLU)+ESSENTIAL TA NOTESSERIES FINALE ; Episode 11/11 : US (SPX) Sectors Technical Analysis Series - 31st of July 2019 (4 Minute Read)

Since this is the Series Finale I will try to holistically summarize the whole series of 11 Episodes on all the US sectors.

The essential notes from this chart are the following(also included in the comments) :

1 . Compared to the previous expansion of 2002-2007 ; the current expansion of US Utilities has yielded a much slower growth . This can be seen from the chart as the current bullish channel is at the bottom range of the pitchfork. Despite this fact, the volume has kept growing continuously from which statement several indications can be derived. To keep it simple and as obviously as it can be, a good portion of the volume growth can be attributed to the funds flow from asset classes that are based on inflation( pension funds, real estate, fixed income securities etc etc ) into equities characterised as defensive as part of XLU, XLP, XLV .

2 . From the cycle lines it can be seen that we narrowly escaped a recession in 2015-2016 . However, I do not think that this will be the case come by the next drop in the cycle circa-2021. Fundamentally, due to the low global growth that dominated the 2015-2016 correction particularly in the emerging markets-in effect due to President Trump the cycle extended . Despite my disagreement with his absurd trade and tax policies , I have to give credit where credit is due. Now at the same time, I do not think that a cycle extension is necessarily good; in a way it means that the fundamental & structural issues that develop in the economy during an expansion continue to build up even more. The higher it tops= the lower it will bottom (% wise).

3 . Elections 2020 , US/China trade deal and Brexit will dominate the negative momentum in the upcoming months and years. Global growth has slowed down quite a bit and it's way overdue for a recession. In fact, past June 2019, we have been in the longest expansion on record, lasting more than 10 years(122 months now).

Regarding the key takeaways from the XLU chart are all labelled above: structural supports, channel supports and bullish targets . I do not see a need to continually repeat myself . Make sure to check out the comments for detailed indicator analysis.

This episode concludes the show . Hope you enjoyed it- I certainly did.

This is just a brief "free" and very detailed analysis. Perhaps in the future I might form a premium group, to whose members I will provide all the details of my research. For any use of this show for references to any corporations or individuals that get inspired from my ideas, I'd appreciate it I am being given credit for my efforts .

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up or follow is greatly appreciated !

Step_Ahead_oftheMarket-

Make sure to check all the previous episodes on the US Sectors for more holistic understanding :

EPISODE 10 : US COMMUNICATIONS ( XLC )

EPISODE 9 : US REAL ESTATE ( XLRE )

Full Disclosure: This is just an opinion, you decide what to do with your own money. For any further references- contact me through any of my channels.

THE WEEK AHEAD: GDXJ, GDX, GLD, XLU, SLVEARNINGS

FAST (41/31), PEP (19/18) and DAL (15/26) announce earnings next week, but the rank/implied metrics aren't there for me (>70 rank; >50 implied) for an earnings-related volatility contraction play.

BROAD MARKET

TLT (21/10)

IWM (12/16)

SPY (11/13)

QQQ (10/17)

EEM (7/17)

EFA (5/10)

Weak sauce.

SECTOR EXCHANGE-TRADED FUNDS

Premium selling opportunities remain in gold and the miners, with some decent background implied in the oil and gas sector and semicons:

Top 5 By Rank: GDXJ (86/37), GLD (75/15), GDX (62/32), XLU (61/14), and SLV (56/19). USO (30/36), SMH (27/25), and XOP (21/31) follow thereafter ... .

Pictured here, remarkably, is the exact same setup strike-wise that I posted last week in GDXJ in the August cycle -- the nearest the 20 delta 32/39 short strangle, paying 1.06 at the mid price with break evens at 30.94/40.06 and delta/theta metrics of 2.82/2.92.

IRA TRADES

XLU (61/14) is on my IRA shopping list with a current yield of 3.05%, but as a rate sensitive, it's ripped way higher on all this talk of cutting, cutting, cutting.* You'd think with that rank (61), it would be paying something, but the background's only at 14, so it's really no surprise that it isn't. I can either man up and sell something closer to at-the-money if I want in, and then manage the short put from there, wait for lower, sell a "Not a Penny More" at a price I'm comfortable with and then whittle away at cost basis from that point forward before taking on shares if I'm not happy with my cost basis (e.g., the Jan '20 18 delta 55),** or do something a little funkier like a 90/30 call diagonal with the long leg far out in time at a strike I'd be willing to exercise at.***

With the possibility of a no cut looming in the July cycle, I'm opting for waiting for lower. If that December "sell everything" dip is evidence of anything, it's that we'll probably have opportunities at some point going forward.

* -- So have all the other rate sensitives -- IYR, XLP, TLT, HYG.

** -- I generally do that anyways as long as it's productive.

*** -- I looked at a Jan '21 (no, that's not a typo) 50 long/Aug 16th 62 short call diagonal, but it's hard to price out in off hours with the setup being bid 7.78/ask 13.05. I'd be fine with the right to exercise at $50/share, but would need a Dick to sell me the setup for a price that results in a break even at or below where the underlying is currently trading to even consider that setup (i.e., not more 60.68 minus the 50 long strike or 10.68; the broker's saying the mid price for that setup is 10.42 with a resulting break even of 60.42 versus spot at 60.68). The additional benefit of that particular setup is that it's far more buying power efficient in a cash secured environment than short putting: the buying power effect of a 50 short put is the strike (50.00) minus any credit received with no right of exercise/assignment if the short put stays out of the money. It kind of begs the question of: "Why the hell don't I do that setup in the IRA more often as an acquisition strategy versus short putting?"

XLU stock price forecast timing analysisStock investing strategies

Read more: www.pretiming.com

Investing position about Supply-Demand(S&D) strength: In Rising section of high profit & low risk

S&D strength Trend Analysis: In the midst of an upward trend of strong upward momentum stock price flow marked by the temporary falls and strong rises.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 1.1% (HIGH) ~ -0.1% (LOW), 0.7% (CLOSE)

%AVG in case of rising: 0.8% (HIGH) ~ -0.4% (LOW), 0.6% (CLOSE)

%AVG in case of falling: 0.4% (HIGH) ~ -0.8% (LOW), -0.4% (CLOSE)

Stock Price Forecast Timing Criteria: Stock price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

Business cycle update - More outperformance of defensivesDefensives XLP, XLU, and IYR should continue to outperform

Sector rotation Cyclical to Defensive I heard some interesting commentary this week from the pros about watching for signs in the cyclical:defensive sector ratio.

I put together this chart using (XLK+XLI+XLB)/(XLP+XLU+XLV).

It is a composite of tech, industrials and materials indexes as a ratio to staples, utils and health sector indexes.

The chart ratio is about 1:1 right now.

In a late stage economy if earnings expectations plunge in the cyclicals the chart ratio should show the capital rotation into the defensive sectors.

Worth watching for a signal!

XLU rises after consolidation periodsUtilities are defensive and traditionally do well in summer, when risk stocks suffer from ‘Sell in May’. In the last six consolidations, which often start around May, the price moves up after the consolidation ends.

Overall, the ETF has followed a clear parallel channel for four years now, and it is affected much less by macro events.

Each consolidation has been followed by a rise of around 6.7% so an entry at 58 (.30 below current), with a stop of 56.50 (below the consolidation low and the lower current channel (in red, I have treated Xmas 2018 as an outlier), and a target of 62.50 (where the upper channel will be on Oct 31, traditionally the end of the summer season neatly gives a 3:1 trade to run for six months.

Not the most exciting of trades, but safer than most.

Why The Yield Curve Matters To Utilities & Other Bond ProxiesThis chart of the U.S. 10s/2s curve and the SPDR S&P Utilities Sector ETF (XLU) is interesting. A few days ago, I was reading a blurb by a well-known outlet about utilities getting "smoked" during the Q4 equity route. Like above, performance is relative to time frame. Additionally, you have to have a deeper understanding about what XLU is and what it can do.

It's not enough to just assume utilities as "defensive" thus it protects you from a broad equity sell-0ff. This also coincides with some questions I get from subscribers: why advocate holding XLU and TLT?

Yes, XLU is a bond proxy but it is not a bond. Its underlying is composed of equities. The TLT is composed of U.S. 7-10 year treasuries.

They both perform well under low interest rate environments when yields trend lower. However, keep in mind that the XLU is still equity-based and won't protect you fully.

Notice, XLU didn't blink until the 10s/2s began to steepen. It's been gung-ho since the curve flattened out. And if we went back through periods were the curve began to steepen, it effected other bond proxies much more dramatically like REITs.

Flattening of the curve isn't the issue unless you're financials. It's the massive steepening caused by the Fed cutting interest rates that kill markets.

Business cycle points to outperformance of XLP Relative performance of defensive sectors XLP, XLU and IYR vs SPY.

XLV performance did not follow a cyclical pattern

Best fit suggests outperformance of XLP vs SPY in coming months

XLU Defensive in clear channelThe XLU (Utilities ETF) is a well-known defensive (succeeds in troubled economies, you have to buy their product) and has a very clear channel. My trade enters at the bottom of the channel and so allows for further market weakness. The price only matched the previous top last time, so I am playing safe with that top as a target, rather than going to the top of the channel.

XLU (Defensive) Still in ChannelXLU, the SPDR Utility Sector is well-known, high div paying defensive, and has not broken support like SPY as a whole. Let's play safe with a 1.6:1 trade, with stop below the lower tramline and target the confluence high of the bullish and moderate cases, as shown by the regular and dotted lines. Aggressive traders could set the stop at 53.75, reflecting the 52-55% pullback last time.

German Real Estate looks attractive despite econ slowdownGerman Real Estate has been highly correlated with XLU and bonds while benefiting from flow of liquidity into equities. In previous slowdowns it has performed quite well. At least it has behaved quite predictably where buying the dips around KC and RSI o/s levels proved profitable.

Don't Be A (High) Beta, Brah! $XLI $XLUI have been a huge component of growth slowing, and the cyclical/defensive proxy of XLI/XLU is a clear indicator that the growth outlook is mixed at best.

Not only that, you might be a beta (probably the bad kind). When you see both growth and inflation slowing on a rate of change basis on the back drop of higher volatility, you must always look to long low beta, short high beta (see Don't Be A MoMo ).

From today's Parallax Weekly:

Cyclical v Defensive (XLI/XLU) is hovering around a 11-month low. This is another indicator of slowing growth as cyclical revenue and earnings are heavily reliant on economic activity. This is also a high v low beta trade. The 3-year monthly beta 1.05 v .05. Since October 1, XLI is down 11.58 percent opposed to a 3.59 percent gain for XLU over the same period.

On a relative basis, XLU has outperformed XLI by 15.17 percent. And those long Bitcoin are missing that.