Xlushort

Banks vs Utilities Holding UpUpdates coming from the previous "Banks Look Cheap vs Utilities" chart. For those who don't remember here are the flows we have been tracking:

Now it is clear US 10-year Yields are starting to withdraw again, although this time Banks vs Utilities are less affected. I have been talking with clients recently around this space and there is broadly no concern. Valuations in Banks remain supportive and as long as the trend remains in tact there is little to concern, however as we enter into a weaker than expected end of year outlook for US Equities I am updating the Outlook:

Outlooks changed from Buy to Neutral, any weakness in banks is actionable in my opinion.

As always keep the comments and questions coming, please like if the ideas are helping and any feedback is welcomed!

Thanks

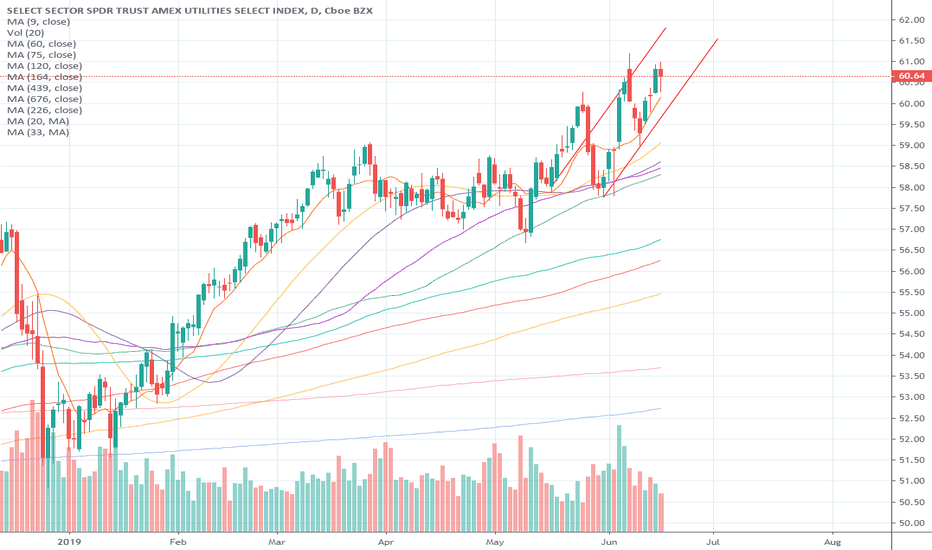

XLU stock price forecast timing analysisStock investing strategies

Read more: www.pretiming.com

Investing position about Supply-Demand(S&D) strength: In Rising section of high profit & low risk

S&D strength Trend Analysis: In the midst of an upward trend of strong upward momentum stock price flow marked by the temporary falls and strong rises.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 1.1% (HIGH) ~ -0.1% (LOW), 0.7% (CLOSE)

%AVG in case of rising: 0.8% (HIGH) ~ -0.4% (LOW), 0.6% (CLOSE)

%AVG in case of falling: 0.4% (HIGH) ~ -0.8% (LOW), -0.4% (CLOSE)

Stock Price Forecast Timing Criteria: Stock price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

XLU Bearish OutlookBear Case:

*Forming H&S

*Massive RSI Divergence

Bull Case:

*China

*** Looks like XLU might look to form a H&S, but based on how heavily the RSI has dropped, it might not even bother and just drop. In either case, Short the top of the Right Shoulder or a break of the neckline .... Let's talk about it! ***

XLU Utilities fund: Waiting for a structural breakdownXLU is a massive, highly liquid fund that only invests in utility companies that are included in the S&P 500. It is one among the cheapest and most liquid options. I am expecting a structural break down. Will only enter if the relative upward strength or the volume of the pair runs out. I have identified the same structure on RSI below. Have a look.