Monero: The Ultimate Financial Survivor or a Digital Illusion?Introduction: The Search for an Unbreakable Asset

In an age marked by escalating global tensions, fragile supply chains, and unprecedented monetary policies, the question of where to store wealth for the long term has taken on a new urgency. The traditional playbook of stocks, bonds, and real estate feels increasingly vulnerable, tied as it is to the very systems that appear to be under strain. For centuries, physical gold was the undisputed answer—a tangible, scarce, and universally accepted store of value, independent of any government or corporation.

However, the digital revolution has introduced a new class of assets, and with it, a radical new thesis. This argument posits that in a true societal collapse—a scenario of hyperinflation, widespread conflict, or the rise of an oppressive surveillance state—only one form of value would prove truly resilient, functional, and safe: the cryptocurrency Monero. The claim is audacious: that when the world as we know it ceases to function, Monero will not just survive but will become the only viable medium of exchange. This report delves into the powerful arguments underpinning this belief, examining the unique technology that sets Monero apart, the perceived failures of all other asset classes in a crisis, and the significant, practical challenges that confront this "doomsday investment" theory.

The core of the argument rests on a return to first principles. In a world without stable governments or trusted institutions, the essential properties of money—privacy, fungibility, security, portability, and decentralization—become paramount. Proponents contend that while other assets, including the cryptocurrency pioneer Bitcoin, compromise on one or more of these critical features, Monero’s fundamental design makes it uniquely suited for the ultimate test of survival.

The Architecture of Anonymity: What Makes Monero a Digital Ghost

To grasp the Monero thesis, one must first understand the cryptographic innovations that make it the undisputed leader in financial privacy. Unlike transparent cryptocurrencies where every transaction is a public entry on a permanent ledger, Monero was engineered with mandatory, unbreakable privacy as its default setting. This is not an optional feature; it is the very fabric of the network, woven from a combination of three core technologies.

1. Ring Signatures: Erasing the Sender. When a user sends Monero, their transaction is not signed with a single, identifiable digital signature. Instead, the protocol automatically gathers a number of past transaction outputs from the blockchain to act as decoys. The sender’s true signature is mixed into this group, creating a "ring" of plausible signers. To an outside observer, any one of the participants in the ring could be the actual sender, making it computationally impossible to prove which one it was. This provides powerful plausible deniability, effectively severing the link between an individual and their specific expenditures.

2. Stealth Addresses: Shielding the Recipient. Monero ensures the privacy of the receiver through the use of stealth addresses. In most cryptocurrencies, a user has a public wallet address that can be reused, allowing anyone to see all the payments sent to that address. This creates a public history of one's income. Monero eliminates this. For every single transaction, a new, unique, one-time address is generated on behalf of the recipient. This address cannot be publicly linked back to the recipient's main wallet or to any other transaction they have received. Only the sender and receiver, using their private keys, can make the connection. This prevents the mapping of a user’s financial network and the calculation of their total wealth.

3. Ring Confidential Transactions (RingCT): Concealing the Amount. The final piece of the privacy puzzle is the concealment of the transaction amount itself. Through a cryptographic proof system, Monero is able to validate that a transaction is legitimate—ensuring no new currency is created out of thin air—without ever revealing the actual numbers involved. The amounts are encrypted on the public ledger. This prevents financial surveillance, where large or unusual transactions could draw unwanted attention from hostile actors, be they desperate governments or opportunistic criminals.

These three pillars work in concert to create a truly opaque financial system. When combined with network-level obfuscation techniques that hide the IP address of a transaction's origin, the result is a system that is not merely pseudonymous, but anonymous. This leads to its most critical economic property in a crisis: true fungibility. Fungibility is the quality of an asset where every unit is identical and interchangeable with every other unit. A dollar bill is fungible, but a diamond is not. In transparent cryptocurrencies, coins can become "tainted" by their history; if they were previously used in a crime, they can be blacklisted by exchanges or vendors. With Monero, this is impossible. Since no coin has a traceable history, every Monero is clean, equal, and freely exchangeable, just like cash.

A World in Flames: Why Other Havens Fail

The case for Monero is built as much on the inherent weaknesses of its competitors as on its own strengths. In a true systemic breakdown, every other major asset class reveals a fatal flaw.

• Fiat Currencies, Stocks, and Bonds: These are the first casualties. They are not assets in themselves, but rather claims on the health and stability of governments and corporations. In a hyperinflationary depression or a civil war, the paper promises of a failed state or a defunct company become worthless. Their value is entirely dependent on a complex legal and financial infrastructure that would no longer exist.

• Real Estate: Property is tangible, but it is also immobile and illiquid. In a lawless environment, property rights are only as strong as one’s ability to physically defend them. A house or a plot of land can be seized, destroyed, or rendered inaccessible, making it a liability rather than an asset. One cannot flee a collapsing city with a building in their pocket.

• Gold and Precious Metals: Gold is the timeless hedge against chaos. It is physical, carries no counterparty risk, and has been valued for millennia. However, it suffers from severe practical limitations in a modern collapse. It is heavy and difficult to transport securely. It is not easily divisible for small, everyday purchases. Verifying its authenticity requires specialized tools and knowledge, making transactions slow and risky. Storing it safely makes you a target.

• Bitcoin: As the original cryptocurrency, Bitcoin offers portability, divisibility, and digital scarcity. It is often called "digital gold." However, its transparent ledger is a catastrophic vulnerability in a world of turmoil. A desperate government or a sophisticated criminal organization could use blockchain analysis to identify large holders, track their every transaction, and target them for expropriation or violence. Having a permanent, public, and unchangeable record of your entire financial history is the opposite of what one would want when trying to maintain a low profile and survive.

• Stablecoins: These digital tokens are pegged to fiat currencies like the U.S. dollar. They are designed for price stability within the current system, not for surviving its demise. They are centrally issued and controlled, requiring complete trust in the entity holding the reserves. In a scenario where the dollar itself is collapsing, a stablecoin is merely a digital reflection of that failure.

Monero, its advocates claim, elegantly solves these dilemmas. It combines the portability and divisibility of Bitcoin with the privacy and fungibility of untraceable cash. It is more easily secured and transported than gold. And it exists entirely outside the control of the failing institutions that underpin all traditional financial assets.

The Sobering Reality: Counterarguments to the Digital Savior

Despite the compelling logic, the theory of Monero as the ultimate doomsday asset faces a series of harsh, practical realities that may prove to be its undoing. These challenges question the very foundation of its utility when the lights go out.

1. The Paradox of Infrastructure. The greatest challenge to any digital currency is its absolute dependence on modern technology. Monero transactions require electricity to power devices and a functioning internet to connect to the network. In a true "world blows up" scenario—characterized by a grid-down event, an electromagnetic pulse (EMP), or the destruction of core internet infrastructure—the Monero network would become fragmented at best, and completely inaccessible at worst. While niche solutions like satellite uplinks, radio broadcasts, and local mesh networks are theoretically possible, they are far from being robust, widespread, or easy to use. For the average person, their digital wealth would be trapped behind an insurmountable wall of dead technology.

2. The Human Factor and the Usability Gap. Even under normal conditions, securely managing cryptocurrency is a complex and unforgiving task. It requires a significant degree of technical literacy to handle private keys, seed phrases, wallet software, and cold storage protocols. Now, imagine trying to do this in a high-stress, post-collapse environment while concerned with finding food, water, and shelter. The cognitive burden would be immense. The risk of making a single, irreversible error—losing a seed phrase, sending funds to the wrong address, or having a device compromised—is extraordinarily high. The operational security required to safely manage digital assets is simply beyond the reach of the vast majority of the population, especially in a crisis.

3. The Last Mile Problem. An asset’s value is ultimately determined by its ability to be exchanged for essential goods and services. While a small, dedicated community of users may transact purely in Monero, this is a microscopic niche. In a widespread crisis, the fundamental challenge would be converting digital value into physical necessities. One must find a counterparty—a farmer, a doctor, a mechanic—who not only possesses the required goods but is also willing and able to accept a purely digital currency. In the immediate aftermath of a collapse, the primal logic of barter would likely take precedence. A can of beans or a box of ammunition would hold more immediate, tangible value than a string of encrypted code.

4. The Specter of Security Flaws. While Monero's cryptographic foundations are widely considered to be state-of-the-art, no system is perfect. The network is a constant target for researchers and adversaries seeking to break its privacy guarantees. Theoretical attacks have been proposed that, while complex and difficult to execute, suggest that under certain conditions, a highly sophisticated and well-funded adversary could potentially de-anonymize some users. Furthermore, the health of the network itself is a concern. In a global crisis, a significant drop in the number of people running nodes and mining could make the network more susceptible to disruption or a "51% attack," where a malicious actor could gain control of the ledger.

Conclusion: An Imperfect Hedge for an Uncertain Future

The proposition that Monero would emerge as the sole functioning investment from the ashes of a global catastrophe is a fascinating and powerful thought experiment. It correctly identifies the profound fragility of our current financial system and even exposes the critical privacy flaws in mainstream cryptocurrencies like Bitcoin. Monero’s technological design offers a truly remarkable and unparalleled combination of privacy, security, and fungibility in the digital world. It is the closest humanity has come to creating a weightless, borderless, and untraceable form of cash.

However, the thesis ultimately overreaches, mistaking technological elegance for practical invincibility. The absolute reliance on a functioning technological infrastructure is a fatal flaw in any true doomsday scenario. The immense complexity of its use creates a barrier that would exclude the majority of people precisely when they would need a safe haven the most. The fundamental challenge of exchanging digital code for physical survival goods remains largely unsolved.

Therefore, while Monero is an exceptionally powerful tool for preserving wealth and privacy in an era of increasing surveillance and financial instability, it is not a silver bullet. To declare it the only viable investment in a total collapse is to succumb to a form of digital idealism that ignores the messy, physical realities of survival. A more prudent approach to preparing for such a future would involve diversification across asset classes that address different failure points. Such a strategy might combine the digital privacy of Monero with the timeless, tangible security of physical precious metals, the practical necessity of storable goods, and, most importantly, the acquisition of real-world skills. Monero may well be the digital ghost that survives the crash of the global machine, but its utility would be severely limited in a world where the machine itself has been unplugged.

XMRBTC

Is XMRUSDT About to Explode? Key Levels to WatchYello, Paradisers! The recent ABC correction on #XMR has officially wrapped up, ending with a textbook Ending Diagonal pattern. And you know what that usually means: a reversal is cooking, and the bulls might just be sharpening their horns for a comeback.

💎The current resistance zone sits between $325 and $330, and this level will be the first real test for the bulls. If momentum is strong enough, price could see an immediate breakout. However, there’s also a high chance this area forms a classic inverse head and shoulders pattern first, a setup that would give us an even stronger confirmation of reversal once the neckline breaks above $330. This is where smart money will be watching closely.

💎Once #XMRUSDT manages to break through $330 with convincing volume, the next upside target becomes $360 to $370. This isn’t just another resistance level, it aligns with the 50% and 61.8% Fibonacci retracement, making it a high-confluence zone. Expect strong profit-taking activity here, which could trigger volatility or short-term pullbacks

💎On the downside, moderate support exists between $300 and $305, which should act as a buffer against short-term pressure. It’s likely to hold unless broader market sentiment shifts sharply.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

Case for Monero ContinuesTL;DR:

Monero is used as a currency giving it a relatively stable value during all seasons

There has been and will continue to be large transfers of Bitcoin to Monero creating supply shocks and XMRUSD RIPs

I have been heavily focused on sharing my bull case for Monero for over two years now. That made for a very disturbing morning on February 4th, 2024 when I woke up to see KRAKEN:XMRUSD down more than -30%. My first thought was, "oh no... someone cracked its privacy!" Then I read the details; it had been delisted from Binance for "being impossible for government to track and therefor banned in many countries." So... Monero was actually "working as intended." Buy!

There are only 3-4 cryptocurrencies that matters to me: Bitcoin, Monero, and which wins between Ethereum/Solana. These cryptocurrencies represent the established use cases thus far respectively in Store of Value, Currency, and Smart Contracts. I have been writing about Monero for several years now relating my observations about its uses, price performance, and future predictions. Recent events have proven my thesis to be accurate and I am confident will continue to be.

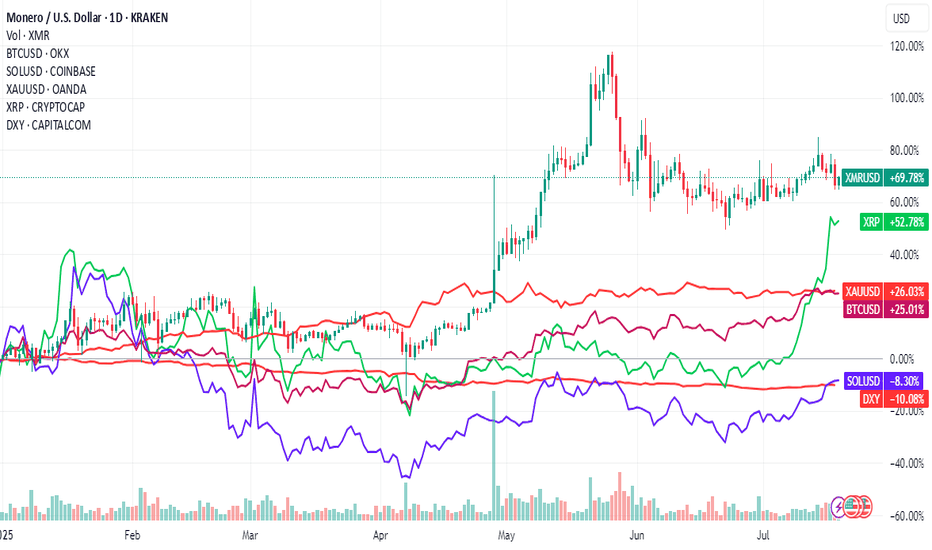

Performance versus Bitcoin:

One criticism of observing recent or past outperformance of BITFINEX:XMRBTC is "zoom out bro" where the full decade plus price trend it noted. This is undeniable. However, one should remember the investing adage: "past performance is not indicative of future results." One should also not be ignorant of the facts leading to extended periods of outperformance and what they mean for future market conditions.

During the crypto winter of 2022 Monero outperformed Bitcoin as a product of Monero holding its value, presumably because of its continued use as a medium of exchange (currency), while Bitcoin fell precipitously.

The same outperformance happened again when Bitcoin had a less dramatic decline in value during 2024. Again, Monero maintained a relatively stable valuation.

Year to Date as a product of Monero's prior stability and the catalyst event (I will talk about later) have driven a period of outperformance yet again.

Store of Value

Bitcoin's use case as a Store of Value is well established. Prior to the last Halvening event Bitcoin was actually MORE inflationary than Monero. Now the inflation rate for Bitcoin and Monero is 0.83% and 1.7% respectively. Monero has an inflation rate known as a "tail emission." The inflation rate actually declines over time as the amount of new Monero being added (432,000 annually) is fixed. There will actually be a point where they are close again around late 2027 when the rates will be 0.83% and 0.82% respectively. As Bitcoin rewards continue to decrease there will never be a point where Monero's inflation is less than Bitcoin's.

However, being inflationary or deflationary alone does not grant or guarantee value. Bitcoin will always hold the title of "most deflationary" between the two. Having limited supply and being scarce is not enough to give something value. Intrinsic value is derived from many potential factors and one that is common between both of them is: use as a medium of exchange. Monero is actually proving to be more used as a medium of exchange.

"Monero is what people think Bitcoin is."

I have been observing over the last two years a shift on the Darknet markets that there are two primary currencies: Bitcoin and Monero. What is interesting is that some Darknet markets have ceased transacting in Bitcoin entirely and rely exclusively on Monero. This is one of the reasons that Monero has maintained its value over this time. The reason is Monero's primary use case: private money. Monero is built upon privacy by default. This is originally what Bitcoin was perceived to be. Now, the public nature of Bitcoin is seen as a value proposition for state and corporate adoption to the benefit of NGU (Number Go Up) but it provides no security for those that value privacy.

"What about Zcash?"

There are other privacy coins, sure. Often times when I talk about Monero these competing coins are brought up in the context of "interesting technology." Tech matters less to use. You can have amazing tech that is worthless if no one uses it. This is analogous to the platform war between Betamax and VHS. Betamax arguably had better technology but the consumer market chose VHS and that became the standard.

As long as Monero "has privacy" then any other cryptocurrency that "has privacy" has only equal use case. What matters then is the market; the consumer. And the market and consumers have already decided to use Monero. The network effect has already taken over. It will be incredibly unlikely that any other privacy coin can reach the same network effect and supplant Monero.

Bitcoin is worthless without state approval

In 2023 and 2024 hackers that had somehow broken into the Darknet market of Silk Road and the Cryptocurrency exchange Bitfinex were captured, prosecuted, deprived of freedom, and forced to surrender their Bitcoin many years after their crimes were committed. We are talking billions of USD worth of Bitcoin that were rendered worthless to their ill gotten owners. What should have been realized then was that all Bitcoin, despite being permissionless, is worthless to its owner without full state approval. You can hold it, send it, and trade it but if government does not approve it will find you and take your freedom. That is, of course, unless you hand it over to them and they might give you some of that freedom back.

So it became rather obvious that should a hacker acquire copious amounts of Bitcoin they would invariable seek to privatize these gains. Just such an event happened in April. Allegedly, a hacker gained access to a very old Bitcoin private key containing nearly $330 million worth of Bitcoin and then proceeded to convert it to Monero irrespective of transaction costs and liquidity. This created an acute supply shock leading to a huge RIP. Many smaller exchanges "ran out" of Monero exacerbating the supply shock and leading to further appreciation.

This is a catalyst that is founded upon rational actions albeit not ethical. We can presume that such catalysts will continue to happen into the future.

Technical Analysis

Monero has been very hard to trade using my standard methods. Because of its normal stability of value it lacks clear and robust trends to play pullbacks. However, there is a definite recent trend to look at now. I am very interested to see where and if Monero establishes a new trading range because then I can look at the lows of this range to accumulate more. The potential 50% Retracement level of the present price action is 292.

Conclusion

During all seasons both bullish and bearish Monero will continue to be used as a medium of exchange and maintain its Store of Value. Monero has already reached adoption level in the use case of privacy which establishes a moat of competitive advantage versus any other privacy coins. As long as humans use cryptocurrency they will value the privacy advantage of Monero versus Bitcoin and periodically and unexpectedly convert between the two leading to huge supply and price shocks.

Privacy Coins Surge: Monero & Zcash Lead $10B Rally In the ever-dynamic and often boisterous world of cryptocurrency, where hype cycles can inflate and deflate valuations with breathtaking speed, a particular sector has been making significant strides, albeit with less fanfare than its more mainstream counterparts. Privacy coins, designed with the core tenet of offering users enhanced anonymity and transaction confidentiality, have been steadily gaining traction. Recently, this burgeoning niche has quietly crossed a significant milestone: a collective market capitalization exceeding $10 billion. Spearheading this charge are two of the most established and technologically distinct players in the privacy space: Monero (XMR) and Zcash (ZEC), both of which have recently shown notable activity on price charts, signaling growing investor interest and a potential re-evaluation of their intrinsic value.

The concept of financial privacy is hardly new, yet its application in the digital realm, particularly on inherently transparent blockchains like Bitcoin’s, presents unique challenges. While Bitcoin transactions are pseudonymous (linked to addresses, not directly to real-world identities), the public nature of the ledger means that with enough analytical effort, transactions can often be traced and linked. Privacy coins aim to solve this by employing sophisticated cryptographic techniques to obscure sender and receiver identities, transaction amounts, and other metadata that could compromise user anonymity.

Monero (XMR): The Standard-Bearer for Obligatory Privacy

Monero, launched in 2014, has long been considered one of the most robust and uncompromising privacy coins. Its core philosophy revolves around the principle that privacy should be default and mandatory for all users and transactions. This is achieved through a multi-layered approach to obfuscation:

1. Ring Signatures: This technique allows a sender to sign a transaction amongst a group of other possible signers (decoys pulled from the blockchain), making it computationally infeasible to determine which member of the group actually authorized the transaction. The size of this "ring" enhances the ambiguity.

2. Stealth Addresses: For every transaction, a unique, one-time public address is generated for the recipient. This prevents linking multiple payments to the same recipient address, a common method for deanonymizing users on transparent blockchains.

3. Ring Confidential Transactions (RingCT): Implemented in 2017, RingCT obscures the amounts being transacted. While the network can cryptographically verify that no new coins are being created out of thin air (i.e., inputs equal outputs), the actual values remain hidden from public view.

This combination ensures that Monero transactions offer a high degree of unlinkability (difficulty in proving two transactions are related) and untraceability (difficulty in determining the sender/receiver). This commitment to always-on privacy has made Monero a favorite among those who prioritize true financial anonymity, believing it essential for fungibility – the property where each unit of a currency is interchangeable with any other unit. If some coins can be "tainted" by their transaction history (as can happen on transparent ledgers), true fungibility is compromised.

The recent positive performance of Monero on the charts could be attributed to several factors. There's a persistent underlying demand from users who genuinely require its privacy features. Furthermore, in an environment of increasing discussion around Central Bank Digital Currencies (CBDCs) and heightened digital surveillance, assets that offer an alternative path to financial confidentiality may be seeing renewed interest.

Zcash (ZEC): Optional Privacy with Cutting-Edge Cryptography

Zcash, launched in 2016, takes a different approach to privacy, offering it as an option rather than a default setting. It utilizes a groundbreaking cryptographic technique known as zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge). This allows one party (the prover) to prove to another party (the verifier) that a statement is true, without revealing any information beyond the validity of the statement itself.

In Zcash, this translates to the ability to conduct fully "shielded" transactions. When a transaction moves from one shielded address (a "z-addr") to another, the sender, receiver, and amount are all encrypted on the blockchain, yet zk-SNARKs are used to prove that the transaction is valid according to the network's consensus rules (e.g., the sender had the funds, no double-spending occurred).

Zcash also supports "transparent" addresses (t-addrs), which function similarly to Bitcoin addresses, with all transaction details publicly visible. Users can choose to transact transparently, from transparent to shielded, from shielded to transparent, or fully shielded. This optionality aims to provide flexibility and potentially cater to a broader range of users and regulatory environments, allowing for auditable transparency when desired, while still offering robust privacy when needed.

The recent chart activity for Zcash might reflect growing appreciation for its sophisticated technology and its unique positioning. The development and improvement of zk-SNARKs are at the forefront of cryptographic research, and Zcash is a prime example of their real-world application. As the crypto space matures, there may be an increasing demand for solutions that can offer strong privacy while also providing pathways for selective disclosure or compliance, a balance Zcash aims to strike.

Why the Quiet Surge to $10 Billion?

The collective rise of privacy coins to a $10 billion market capitalization, while "quiet" relative to mainstream crypto narratives, is significant. Several undercurrents could be contributing to this growth:

1. Growing Awareness of Blockchain Transparency: As more individuals and institutions interact with cryptocurrencies, the implications of permanently public ledgers are becoming better understood. High-profile cases of blockchain analysis being used to track funds (for both legitimate and questionable purposes) highlight the lack of inherent privacy in many popular cryptocurrencies.

2. Desire for Financial Sovereignty: For some, the ability to transact privately is a fundamental aspect of financial freedom and sovereignty, akin to using physical cash. Privacy coins offer a digital equivalent.

3. Concerns Over Digital Surveillance: The increasing digitization of finance, coupled with discussions around government-issued digital currencies, has raised concerns about potential mass financial surveillance. This may drive some users towards privacy-preserving alternatives.

4. Maturation of Privacy Technology: The cryptographic techniques underpinning coins like Monero and Zcash have been developed, battle-tested, and refined over several years, increasing confidence in their efficacy.

5. Niche Use Cases: While sometimes controversial, privacy coins serve legitimate niche use cases, such as individuals in oppressive regimes needing to protect their financial activities, or businesses wanting to keep sensitive commercial transactions confidential from competitors.

6. Market Diversification: As the overall crypto market grows, investors may look to diversify into sub-sectors like privacy coins, especially if they perceive them as undervalued relative to their utility or technological innovation.

The "Quiet" Aspect and Lingering Challenges

Despite their technological sophistication and growing market cap, privacy coins operate in a somewhat contentious space, which contributes to their "quiet" ascent.

1. Regulatory Scrutiny: The primary challenge comes from regulators worldwide. Concerns that privacy coins can be used to facilitate illicit activities like money laundering or terrorist financing have led to increased scrutiny. Several exchanges have delisted privacy coins in certain jurisdictions to comply with KYC/AML (Know Your Customer/Anti-Money Laundering) regulations. This regulatory pressure can stifle adoption and create uncertainty.

2. Perception Issues: The association, whether fair or not, with illicit activities has created a perception challenge for the sector. While proponents argue that any financial tool can be misused and that privacy is a fundamental right, this narrative can be difficult to overcome.

3. Complexity: The advanced cryptography involved can make these coins less accessible to the average user compared to simpler cryptocurrencies. Explaining the nuances of ring signatures or zk-SNARKs is more challenging than explaining Bitcoin.

4. Development and Governance: Like all crypto projects, ongoing development, robust governance, and maintaining network security are crucial and require significant resources and community effort.

The Significance of the $10 Billion Milestone

Reaching a $10 billion collective market capitalization is a testament to the resilience and perceived value of the privacy coin sector. It indicates that despite regulatory headwinds and perception challenges, there is a substantial and growing demand for financial privacy in the digital age. While still a relatively small fraction of the total cryptocurrency market, it's a clear signal that a significant number of users and investors believe in the importance of these tools. This milestone provides a degree of validation for the developers, communities, and users who have championed the cause of digital financial privacy.

Future Outlook

The path forward for privacy coins like Monero and Zcash will likely remain complex. They will continue to navigate a challenging regulatory environment, engaging in an ongoing dialogue about the balance between privacy and law enforcement. Technological innovation will be key, not only in enhancing privacy features but also in improving user experience and potentially developing solutions that can address regulatory concerns without compromising core principles (as Zcash attempts with its optional transparency).

Education will also play a vital role – helping the public and policymakers understand the legitimate needs for financial privacy and the capabilities and limitations of these technologies. The debate over financial privacy is far from over, but as Monero and Zcash move up and the sector surpasses the $10 billion mark, it's clear that the demand for confidential transactions is a persistent and growing force in the digital economy. The quiet surge may be a prelude to a louder conversation about the future of money and the fundamental right to privacy in an increasingly interconnected world.

XMR LOOKS SUPER BULLISH (1W)Before anything else, pay attention to the timeframe of the analysis; it’s weekly.

It seems that wave C of the weekly triangle has ended, and the price has entered wave D.

Wave D could progress up to the ATH or even slightly exceed it.

For wave E, we will have a rejection, and then the main upward move will form.

On the chart, we have marked a green line as our KEY LEVEL. As long as the price stays above this line, XMR is super bullish.

A weekly candle closing below the invalidation level will invalidate the analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Monero: What is the "Fair Value"?Crypto investors need to be aware of Monero and its historic performance tendencies especially on a day like today. It has become the only cryptocurrency in which I think has actual USEFUL value in terms of being used as an '"currency".

KRAKEN:XMRUSD for the last several years has functioned much like a stablecoin albeit with a lot of volatility. It trades within a range but one that has been steadily increasing over time. The old range used to present a fair value of around 156 within the middle of the range. The new bottom of the range sits at 196. As this bear cycle continues I will look to these supports to hold $KRAKEN:XMRUSD.

I do not promise that one should expect the 10x, 100x, etc. from investing in $KRAKEN:XMRUSD. That is not what the cryptocurrency is for. Its value is in its privacy by default. Those values are; resistance against surveillance, true sovereign money, and the actual ideals of being a tool for human freedom that began cryptocurrency over a decade ago. Monero today has actually replaced Bitcoin as the currency of choice on the Dark Web... that was what gave Bitcoin its value in the early days.

Besides the afore mentioned fundamental value of Monero it is important to understand what recent price history has shown about Monero versus Bitcoin during the bull/bear price cycles:

Cryptocurrency Cycles

The relative performance of Monero to Bitcoin (which is, basically, the crypto market) at different points over the last few years can be charted using KRAKEN:XMRBTC

Since November 16, 2024 XMRBTC has performed +64%. This has happened while the price of Bitcoin has mostly stagnated by Monero has steadily appreciated in value.

The period prior was from April 2024 through September 2024, again when the price of Bitcoin stagnated by Monero held and increased in value.

The most important period to study for now, when Bitcoin has likely entered its bearish cycle phase, is the period between December 2021 and January 2023; the last Bitcoin bear cycle. XMRBTC outperformed by about 150% as Bitcoin went down but Monero depreciated less. This period ended when the recent Bitcoin bull cycle began.

Critics will rightly point out though that "Bitcoin over time has outperformed" and they would be correct, historically. Within this truth though crypto investors need to look for a correlation that works anywhere close to this; where when Bitcoin goes down that cryptocurrency consistently holds its value against Bitcoin. There is no other major cryptocurrency that behaves this way. Knowing the cycles can provide investors with a "safe haven" potentially.

Trade wisely!

Monero's 'Basing Pattern' Breakout Points to Price Gains AheadMonero (XMR), the leading privacy-focused cryptocurrency, has recently shown signs of renewed strength, breaking above the $200 mark and confirming a bullish shift in market trend.1 This upward movement is particularly significant as it follows a prolonged period of consolidation, during which XMR formed a classic "basing pattern."2 This article will delve into the details of this technical pattern, explore the factors contributing to Monero's current momentum, and analyze the potential for further price gains in the near future.

Understanding the Basing Pattern

In technical analysis, a basing pattern, also known as a consolidation pattern, represents a period of price stabilization after a downtrend or a significant price drop.3 During this phase, the price trades within a relatively narrow range, forming a base for a potential future breakout.4 This pattern typically indicates that selling pressure is weakening, and buyers are beginning to accumulate the asset.5

Key characteristics of a basing pattern include:

• Consolidation Range: The price trades within a defined range, bounded by support and resistance levels.6

• Decreasing Volatility: Price swings become less pronounced as the pattern develops.7

• Increased Volume on Breakout: A breakout above the resistance level is often accompanied by a significant increase in trading volume, confirming the strength of the new uptrend.8

Monero's recent price action has exhibited these characteristics. After a period of decline, XMR's price consolidated within a range, demonstrating decreasing volatility. The recent break above $200, accompanied by increased trading volume, signals a potential breakout from this basing pattern, suggesting a shift towards bullish momentum.9

Factors Contributing to Monero's Momentum

Several factors could be contributing to Monero's current positive trajectory:

• Increased Demand for Privacy: In an increasingly surveilled world, the demand for privacy-preserving technologies is growing.10 Monero, with its strong focus on anonymity and untraceable transactions, is well-positioned to benefit from this trend.11

• Technological Developments: Ongoing development and improvements to the Monero protocol, such as advancements in its privacy features and scalability solutions, enhance its value proposition and attract users.

• Growing Adoption: While adoption of privacy coins is still relatively niche compared to mainstream cryptocurrencies, Monero has a dedicated community and sees usage in various applications where privacy is paramount.

• Broader Market Sentiment: The overall cryptocurrency market has shown signs of recovery recently.12 A positive market sentiment can have a ripple effect on various cryptocurrencies, including Monero.

The Significance of the $200 Breakout

The break above the $200 resistance level is a crucial technical development for Monero. This level has acted as a significant barrier in the past, and breaking above it suggests a strong shift in market sentiment. This breakout confirms the potential validity of the basing pattern and opens the door for further price appreciation.

Potential for Further Price Gains

With the breakout confirmed, several potential price targets can be identified using technical analysis. Common methods include:

• Measuring the Height of the Basing Pattern: The height of the consolidation range can be projected upwards from the breakout point to estimate a potential price target.

• Identifying Fibonacci Retracement Levels: Fibonacci retracement levels can be used to identify potential resistance levels and price targets based on previous price movements.13

• Analyzing Long-Term Trends: Examining long-term charts can provide insights into potential long-term price targets.

Based on these methods, potential price targets for Monero could be significantly higher than current levels. However, it's crucial to remember that these are just potential targets, and market conditions can change rapidly.

Challenges and Risks

While the current outlook for Monero appears positive, it's essential to acknowledge potential challenges and risks:

• Regulatory Scrutiny: Privacy coins like Monero face increased regulatory scrutiny due to their potential use in illicit activities.14 Increased regulation could negatively impact their price and adoption.

• Competition: Other privacy-focused cryptocurrencies and privacy-enhancing technologies are emerging, posing competition to Monero.

• Market Volatility: The cryptocurrency market is inherently volatile, and even with positive technical indicators, price corrections and unexpected events can occur.15

Conclusion

Monero's recent breakout above $200, following a well-defined basing pattern, suggests a potential shift towards bullish momentum.16 Factors such as increased demand for privacy, technological developments, and positive market sentiment contribute to this positive outlook. While potential price targets can be identified using technical analysis, it's essential to acknowledge the inherent risks and challenges associated with the cryptocurrency market. As always, thorough research and caution are advised when making investment decisions. The confirmation of the basing pattern and the break of the $200 resistance level does provide a strong signal for those interested in the privacy coin space.

Monero (XMR/USD): Navigating Momentum Toward $600 by Mid-2025Monero (XMR) is currently in a critical phase, with its momentum determining the trajectory for the coming months. The market is watching whether XMR can maintain its current bullish momentum or face a temporary slowdown before resuming its upward climb.

Scenario 1: Sustained Momentum to $600 by June–July 2025

January 2024 Target: If XMR does not lose momentum, it is likely to reach $250 by the end of January 2024.

Consolidation or Pullback: After reaching $250, XMR could enter a brief consolidation phase or experience a small pullback, allowing the market to stabilize and attract fresh buyers.

Mid-2025 Rally: This stabilization will set the stage for a rally toward $600 by June–July 2025, marking a significant price surge driven by strong fundamentals and improving market sentiment.

Scenario 2: Temporary Loss of Momentum Before Resumption

February Retest of $175–$180: If XMR loses momentum, it could fall back to retest the $175–$180 zone in February 2024.

March Recovery to $250: After this retest, XMR could regain strength and target the $250 level by March 2024.

Mid-2025 Rally: Following consolidation around $250, XMR would still have the potential to reach $600 by July–August 2025, albeit on a slightly delayed timeline.

Key Levels to Watch:

$175–$180 (critical zone if momentum is lost).

$250 (key barrier to confirm bullish continuation).

Target: $600 by mid-2025 (bullish rally culmination).

Summary:

Monero’s ability to maintain its current momentum will define its short-term trajectory.

Sustained Momentum: Reach $250 by January 2024, consolidate, and rally to $600 by June–July 2025.

Temporary Slowdown: Retest $175–$180 in February, recover to $250 in March, and achieve $600 by July–August 2025.

Both scenarios highlight Monero’s long-term bullish potential, with $600 as a realistic target for mid-2025.

XMR/USD Poised for a Major Bullish Phase**XMR/USD Poised for a Major Bullish Phase**

Monero (XMR/USD) has officially broken out of a prolonged **accumulation phase**, signaling the start of a powerful bullish cycle. After successfully breaching the key resistance zone between **$180-$210**—the upper limit of the previous major rally—XMR is now primed for a sustained upward trajectory. This breakout marks a critical turning point, underscoring growing investor confidence and heightened demand for privacy-focused digital assets.

With strong technical momentum and supportive macroeconomic conditions, XMR is expected to embark on a **significant rally**. The next few years could see progressive gains, culminating in a **new all-time high (ATH) of $600** by **May-June 2026**. This projection is fueled by increasing adoption of privacy coins, enhanced network upgrades, and broader market bullishness.

Investors should watch for consolidation phases along the way, but the overall trend points toward **long-term growth**. As Monero continues to carve out its position in the crypto market, this rally could establish a new price floor well above previous highs, reinforcing its strength and utility in a growing decentralized economy.

XMR/BTC Monthly - I Always Thought Satoshi Was Gov - This is a response post to a theory proposed by a Nom_de_Guerre

Please refer to post here :

I will be also doing the same if BTC loses 11k support. Which at this point in time, I do not think will happen. I still am Long BTC as I believe the testing phase has not yet completed, and 100k or higher targets are still in play until my TA is invalidated.

This is a long term position which according to my analysis will play out sometime between 2025/2030. I have always hated XRP as it is a Banker's coin, centralized. After some further discussion and research into this, I will be holding my XMR bags and accumulating more. Furthermore, I will be purchasing XRP (something I said I would never do). Never say Never. The 589 meme is only a meme until true. Will be posting XRP Monthly chart next. If the TA fits, you must acquit.

Monero Outperforms Bitcoin. What does it mean?I have been pointing out on my social media and Livestreams that Monero has been outperforming Bitcoin since April 2024. This inversion in the KRAKEN:XMRBTC cross pair is interesting in itself considering most cryptocurrencies remain in high correlation to Bitcoin INDEX:BTCUSD but there is more that can be inferred by this relationship. First, we will look at the key data point in the past that could be happening and then I will offer a possible explanation for this phenomenon.

Bitcoin Maxis will point out that over the last 2 years Bitcoin overall has outperformed Monero by 25%. That's not the point. It is not that Monero is a "better" long term investment. Bitcoin has far more bullish history. The point is that the last time Monero outperformed Bitcoin was through the whole 2022 bear cycle. The outperformance did not end until January of 2023 when the Bitcoin bull trend started.

If history is a guide then Monero outperformance, especially sustained over many months, is an indicator itself that a bearish cycle of Bitcoin is confirmed. It also could be argued that Monero could become the "flight to safety" during bear cycles. We only have one sure data point but are currently witnessing a second.

How can Monero do this? The best possible explanation is the Dark Web. On-chain transaction on Bitcoin have become prohibitively expensive. The alternative of using Lightning network, by having to setup and join nodes, negates the privacy that the Dark Web runs on. Monero has over the last few years become more dominant to the point that now it is the only cryptocurrency used on many Dark Web sites. Monero is the clear winner in the privacy use case for cryptocurrency.

XMR - Monero is gonna explode soon#XMR/USDT #Analysis

Description

---------------------------------------------------------------

+ The price has hit the resistance level and appears to be rejected from it (confirmation will come once the candle closes).

+ We can consider entering a long trade once the price retraces.

+ There is good potential in the bull run if the price bounces back after reaching the support zone.

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 170.1 - 152.88

Stop Loss: 95.96

------------------------------

Target 1: 183.27

Target 2: 240.56

Target 3: 295.61

Target 4: 370.83

Target 5: 469.02

------------------------------

Timeframe: 1M

Capital Risk: 1-2% of trading amount

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights.

Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

XMR IS VERY BEARISHHi, dear traders. how are you ? Today we have a viewpoint to SELL/SHORT the XMR symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Monero (XMR) or Moonero?Greetings citizens of the world

Monero price today is $145 with a 24 hour trading volume of 100 million dollar. XMR price is up 0.7% in the last 24 hours and 7% since last week

Monero is the top privacy centric cryptocurrency based on the CryptoNote protocol, a secure, private and untraceable currency system and after what happened to Tornado cash more "people" use XMR.

100-110$ is the most important support level for monero so if you were long from that level take some profit because at 160 we can have a little correction but if we break 160$ then 165,170 and 179 are next targets. If you want to buy monero for long term hold, 100-120$ are good dip zone for loading some coins.

as you see XMR repeat its pattern in downtrend so there is no reason for FOMO or any crazy leverages

MONERO (XMR) showing a MASSIVE bullish divergence on the 1hr.MONERO is showing one of the largest bullish divergence gaps I've seen in a long, long time, after dropping about 40% in a day. This was obviously a coordinated attack to manipulate the price of XMR, as it is hated by the power's that be, because it can not be tracked, traced or controlled by their corrupt ring of criminal governments. Their pathetic attempt is now backfiring, as all they did was give XMR investor's the opportunity of a lifetime to buy even more XMR at the best discounted price they've probably seen in years.

If you trade this, trade with caution, as they could do it again.

Good luck and always use a stop loss.

"Monero Roars: Bull Run Signals Potential Multi-Year Rally!"Monero (XMR): Chart Analysis Indicates Multi-Year Bull Cycle Amid Privacy Focus

Monero (XMR), a leading privacy-focused cryptocurrency, is captivating the attention of traders and investors not only for its unique attributes but also for the compelling price setup that suggests a potential multi-year bull cycle ahead.

Privacy at Its Core:

Monero isn't just another cryptocurrency; it's a digital asset engineered for privacy and anonymity. Utilizing cutting-edge cryptographic techniques such as ring signatures, stealth addresses, and confidential transactions, Monero ensures that users' financial activities remain shielded from prying eyes. In an age of increasing surveillance and censorship, Monero stands as a beacon of financial sovereignty, offering individuals the ability to transact freely and privately, without fear of surveillance or censorship.

Community-Driven Development:

Monero's development is steered by a passionate and decentralized community committed to advancing the principles of privacy, security, and decentralization. Unlike many cryptocurrencies, Monero has no pre-mine or founder's reward, ensuring a fair and equitable distribution of coins from the outset. This grassroots approach to development fosters innovation and ensures that Monero remains true to its core principles.

The Price Setup:

Against the backdrop of Monero's privacy features and community-driven ethos, its price chart reveals a compelling setup that hints at a potential multi-year bull cycle. Technical analysts have identified what appears to be a six-year cup and handle pattern—a bullish formation that typically precedes prolonged periods of price appreciation. The cup formation, which began around 2018, showcases a gradual accumulation phase followed by a consolidation period characterized by relatively stable price action. In recent months, Monero has shown signs of breaking out from the handle formation, with price movements suggesting a potential upward trend continuation.

Implications for Investors:

For investors seeking exposure to a cryptocurrency with strong fundamentals and growth potential, Monero presents an enticing opportunity. If the cup and handle pattern indeed materializes into a multi-year bull cycle, investors could stand to benefit from significant gains over the long term. However, it's essential to approach investment decisions with caution and conduct thorough research, considering factors such as market volatility, regulatory developments, and macroeconomic trends.

Conclusion:

In conclusion, Monero embodies the principles of privacy, security, and decentralization in the digital asset space. As its price chart suggests the potential for a multi-year bull cycle, investors are presented with an opportunity to participate in the growth of a cryptocurrency that prioritizes privacy and financial sovereignty. While the outcome remains uncertain, Monero's fundamentals and technical setup offer compelling reasons to believe in its long-term potential.

XMR bullrun is nearIt is one of the symbols that is moving above 500 days in a limited RANGE. This symbol appears to be completing a very large diametric.

The green area is the strong bottom. Now it seems that we are in the last correction wave, that is, G from G.

The last corrective branch i.e. wave g of G is expected to be completed and the bullish wave will begin in the form of a large D wave

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

XMR bullrun is nearIt is one of the symbols that is moving above 500 days in a limited RANGE. This symbol appears to be completing a very large diametric.

The green area is the strong bottom. Now it seems that we are in the last correction wave, that is, G from G.

The last corrective branch i.e. wave g of G is expected to be completed and the bullish wave will begin in the form of a large D wave

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

XMRUSDT ( don't panic ... )hello dear investor and traders

don't open sell position for some news

XMR The price is well supported on the supportzone …

long time ago: President Trump gave a reward for tracking Monero transactions... but Monero continues to work strongly and has the most secure blockchain…

don't panic : The mafia is waiting to get bigger to collect Monroe

good luck

has monero bottomed on btc and usd pair?xmr has touched the bottom channel and find supports on the 50 moving average.

looking at my other xmr charts and and an area of resistance i previously highlighted in both has proven difficult to break past.

the btc pair now looks to be breaking that resistance and that alongside the usd pair in its position im bullish and ask are we going to see a merry xmas $800 xmr?

XMR can go upBy examining the chart, it seems that we have a symmetrical one, and its final branch, i.e., looks like a triangle.

It can go up by keeping the green area. The red box can be the target of this upward movement

This is an update to the analysis linked in the relevant section

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You