Monero (XMR/USD): Navigating Momentum Toward $600 by Mid-2025Monero (XMR) is currently in a critical phase, with its momentum determining the trajectory for the coming months. The market is watching whether XMR can maintain its current bullish momentum or face a temporary slowdown before resuming its upward climb.

Scenario 1: Sustained Momentum to $600 by June–July 2025

January 2024 Target: If XMR does not lose momentum, it is likely to reach $250 by the end of January 2024.

Consolidation or Pullback: After reaching $250, XMR could enter a brief consolidation phase or experience a small pullback, allowing the market to stabilize and attract fresh buyers.

Mid-2025 Rally: This stabilization will set the stage for a rally toward $600 by June–July 2025, marking a significant price surge driven by strong fundamentals and improving market sentiment.

Scenario 2: Temporary Loss of Momentum Before Resumption

February Retest of $175–$180: If XMR loses momentum, it could fall back to retest the $175–$180 zone in February 2024.

March Recovery to $250: After this retest, XMR could regain strength and target the $250 level by March 2024.

Mid-2025 Rally: Following consolidation around $250, XMR would still have the potential to reach $600 by July–August 2025, albeit on a slightly delayed timeline.

Key Levels to Watch:

$175–$180 (critical zone if momentum is lost).

$250 (key barrier to confirm bullish continuation).

Target: $600 by mid-2025 (bullish rally culmination).

Summary:

Monero’s ability to maintain its current momentum will define its short-term trajectory.

Sustained Momentum: Reach $250 by January 2024, consolidate, and rally to $600 by June–July 2025.

Temporary Slowdown: Retest $175–$180 in February, recover to $250 in March, and achieve $600 by July–August 2025.

Both scenarios highlight Monero’s long-term bullish potential, with $600 as a realistic target for mid-2025.

Xmrdollar

Monero Playable- Well this chart will be a bit difficult to understand, so follow the graph and the famous bubbles..

- XMR i a strong privacy coin, notice the asymmetry from 2018 to 2022. stunning!

- XMR is not an FTX shitty token or a scam coin, this project is here to stay.

- Monero is comparable to Litecoin, they start always their bullish trends before the other altcoins.

- Litecoin because of his halving earlier than BTC, XMR because it's like the little brother of TheKing for the Darknet.

- So to play this trade you have to follow BTC movements, because if BTC dip more you know already what will happen to XMR..!

- Remember also that for now we could go sideway for while and it could be very boring, so be patient.

- Play like a robot don't be greedy, respect your gains and take your lose or hodl (up to your strategy).

- Always invest what you can afford to lose.

----------------------------------------------------------------

Trading Part ( Look the chart to understand more )

----------------------------------------------------------------

Now : Nothing to buy !! ZERO !

----------------------------------------------------------------

Scenario 1 : Play the Dip ( Dangerous mode )

----------------------------------------------------------------

- Buy 120$

- Rebuy 100$

- TP1 170$

- TP2 250$

- TP3 350$

- SL : 95$

----------------------------------------------------------------

Scenario 2 : Play the Breakout ( Soft mode )

----------------------------------------------------------------

- Buy 180$

- TP2 250$

- TP3 350$

- SL : 165$

----------------------------------------------------------------

- if you understood my chart, i can tell you, Bravo!

Happy Tr4Ding !

Monero XMR price is preparing for long-term growthMonero is an old-school bastion of anonymity in the crypto world that has survived and is in demand. Because its "friends in the shop" from the first generation of altcoins DASH and ZEC are hopelessly depreciating, although they were once much more popular and expensive than XMR

Sooner or later, the cryptocurrency market will be regulated, and for holders of the XMR coin, its presence will be like a breath of fresh and anonymous air of the "truth cryptan")

If we look at the global price chart of XMRUSDT on the weekly timeframe, we will see that the price has been consolidating in the form of a triangle for more than 5 years since 2017.

Now the price has hit the lower boundary.

Also, the price of XMRUSD has not updated the June 2022 low, while the price of BTC and many other altcoins have recently updated their 2022 lows.

Summing up, we believe that keeping at least 1 XMR in your long-term investment portfolio is a matter of honor and devotion to the creators of the anonymous crypto world.

Sooner or later, the time will come when you can sell your Monero for $4000+ .

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

XMRUSDT 3D How much can Monero anonymity cost?Today, on the global chart, we will consider the XMRUSDT price movement

Monero is an old crypto coin. It is popular because it is "the last of the Mohicans", which preserves the anonymity of the owner.

Quite often moves on an individual route despite the trajectory of the BTCUSDT price.

During the fall of the crypto market in June 2022, the XMRUSD price was held by a powerful mirror level in the area of $96.

XMR price is currently trying to establish itself at the top half of the descending trend channel that has been stretching since May 2021

If the price is firmly anchored at the top half of the channel, as well as a little positive in the crypto market, everything is set for continued growth.

We expect that with such a schedule, the XMRUSDT price may rise to $330 at this year.

_______________________________

Since 2016 , we have been analyzing and trading the cryptocurrency market.

We transform our knowledge, trading moods and experience into ideas. Each "like under the idea" boosts the level of our happiness by 0.05%. If we help you to be calmer and richer — help us to be happier :)

XMRUSDT Waiting for the Resistance zone Breakout!XMRUSDT Technical analysis Update

XMR/USDT currently trading at $249

Waiting for the resistance Breakout

Buy level : Above $251.00

Stop loss: $237.00

TP1: $260

TP2: $270

TP3: $281

TP4: $290

Max Leverage 2x

Always keep Stop loss

Note: please do your own research before investing. Never invest money that you can't afford to lose.

XMR Analysis of 4y Monero Price Movement and Yearly ExpectationsMonero is probably one of the few old cryptocurrencies that has retained its value in monetary terms, as well have the main old-school function of the crypt - anonymity!

Crypto anarchists who value the anonymity of the crypt, buy XMR and hold for years , and such actions allow the price of XMRUSDT to adequately keep on the global chart.

Today we will look at the XMRUSD chart on a 3D timeframe, touching the previous 4 years of trading and try to look into the future for a year)

In December 2017, the maximum value of Monero was established - $478 . After that, XMR holders had a difficult 3 years (1 year of decline + 2 years of consolidation at the bottom) + 1 year of growth. And now, after +/-1230 days. At the beginning of May 2021, the price of XMRUSDT was able to renew the maximum , setting it at a new level of $519

But literally, a few days later, it became clear that this was just a false breakout of an important level. And already on May 19, when the entire cryptocurrency market was fall, it became clearly visible on the XMRUSD chart at what price XMR investors are ready to buy this asset in addition.

The mirrored level of $115-125 has shown its importance 4 times over the past 4 years. In the fall of May, it was from there that an aggressive buyout took place. The drop of Monero was -75%, which is higher than the average in the crypto market during this period.

However, there is also a positive factor. Today, when the price of BTCUSD is again dropping towards the critical 30K$ and most of the alts are surpassing BTC in the rate of decline, and some are even preparing to renew the minimum of the last month, the price of XMRUSDT is being held with dignity, long-term investors are not selling yet.

What we saw on the chart makes us think and assume that the price of XMRUSD will most likely not fall below the critical zone of $152-162. In this case, a global pattern can be formed on the chart to continue the " Cup with a handle" trend. The upper target of such a figure, after fixing above $500 , will be around $1800 per XMR.

It is also always worth keeping in mind an alternative scenario in case the price of BTCUSDT will drop below $28,000 in the near future and continue to move down, then altcoins will not be able to resist this trend.

In this case, the global zone for buying Monero for the long-term long will be at the range of $50-80

Write in the comments which scenario of price movement you prefer, and what developments you expect.

_______________________________

Since 2016, we have been analyzing and trading the cryptocurrency market.

We transform our knowledge, trading moods and experience into ideas. Each "like under the idea" boosts the level of our happiness by 0.05%. If we help you to be calmer and richer - help us to be happier :)

XMR 1D Anonymous coin, loved and appreciatedWe drew the previous global analysis on a 3D timeframe.

But Monero stubbornly does not want to work it out, so it's time to figure out what's the matter on a smaller timeframe.

For 9 months, the price deftly moves upward in a channel, and any attempt to flow the price of an anonymous coin is skillfully bought back.

It is safe to say that Monero most worthy of all withstood the blow from the news of the delisting of the anonymous trio XMR, ZCash and Dash from the Bittrex exchange.

Now the XMRUSDT price is most likely heading to the level of $172.5, where the future vector of the price movement will be decided.

Further, the XMRUSD price from $140 within the channel, will move to update the highs of the year in the range of $200.

Or once again it will aim to test the level of $120 for strength.

_______________________________

Since 2016 , we have been analyzing and trading the cryptocurrency market.

We transform our knowledge, trading moods and experience into ideas. Each "like under the idea" boosts the level of our happiness by 0.05% . If we help you to be calmer and richer - help us to be happier :)

There is a trading opportunity to buy in XMRUSDMidterm forecast:

While the price is above the support 26.05, beginning of uptrend is expected.

We make sure when the resistance at 68.20 breaks.

If the support at 26.05 is broken, the short-term forecast -beginning of uptrend- will be invalid.

Technical analysis:

A peak is formed in daily chart at 67.79 on 05/18/2020, so more losses to support(s) 60.05, 54.05, 44.00 and minimum to Major Support (26.05) is expected.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 61.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (54.05 to 44.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (54.05)

Ending of entry zone (44.00)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 60.05

TP2= @ 68.20

TP3= @ 82.15

TP4= @ 96.50

TP5= @ 120.95

TP6= @ 137.95

TP7= @ 168.70

TP8= @ 230.10

TP9= @ 298.90

TP10= Free

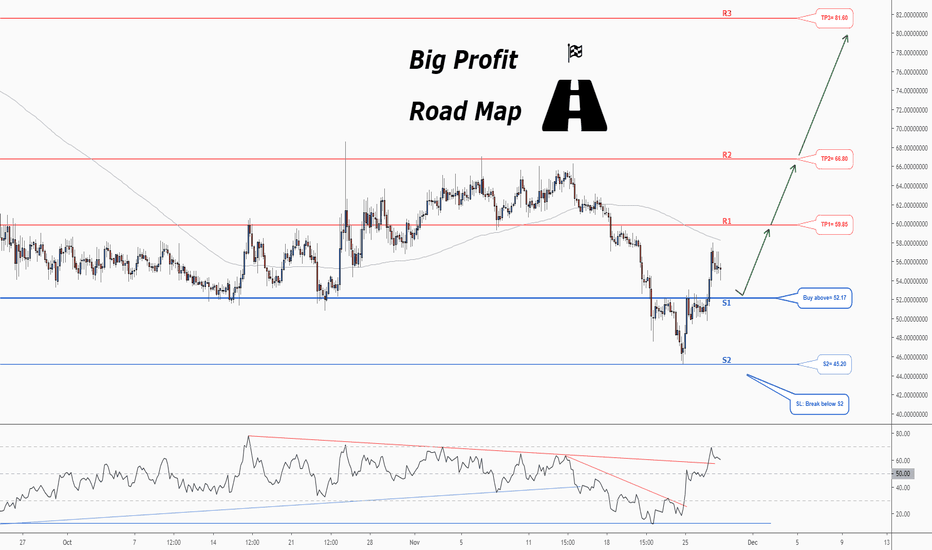

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (60.0). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 69.

Take Profits:

TP1= @ 71.70

TP2= @ 81.70

TP3= @ 96.90

SL= Break below S2

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (79.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a uptrend and the Continuation of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 58.

Take Profits:

TP1= @ 145.90

TP2= @ 120.95

TP3= @ 96.90

SL= Break below S2

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (79.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a uptrend and the Continuation of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 58.

Take Profits:

TP1= @ 145.90

TP2= @ 120.95

TP3= @ 96.90

SL= Break below S2

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (52.17). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 60.

Take Profits:

TP1= @ 59.85

TP2= @ 66.80

TP3= @ 81.60

SL= Break below S2

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (52.17). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 60.

Take Profits:

TP1= @ 59.85

TP2= @ 66.80

TP3= @ 81.60

SL= Break below S2

Don't miss the great buy opportunity in MONEROTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (86.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 45.

Take Profits:

TP1= @ 97.00

TP2= @ 106.25

TP3= @ 120.87

SL= Break below S2

Don't miss the great buy opportunity in MONEROTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (86.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 45.

Take Profits:

TP1= @ 97.00

TP2= @ 106.25

TP3= @ 120.87

SL= Break below S2

A second Chance to Buy in XMRUSDMidterm forecast:

98.50 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index ( RSI ) is 74.

New trading suggestion:

*There is still a possibility of temporary retracement to suggested support line (98.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

*If you missed our first HUNT, you have a second chance to buy above the suggested support line (98.50).

Entry signal:

Signal to enter the market occurs when the price comes to "Support line" then forms one of the reversal patterns, whether "Bullish Engulfing", "Hammer" or "Valley", in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 14 BUY trade(s) @ 49.70 based on '2-Day Hammer' entry method at 2019.03.12.

Total Profit: 74244 pip

Closed trade(s): 20380 pip Profit

Open trade(s): 53864 pip Profit

Closed Profit:

TP1 @ 56.70 touched at 2019.03.31 with 700 pip Profit.

TP2 @ 65.50 touched at 2019.04.02 with 1580 pip Profit.

TP3 @ 76.30 touched at 2019.04.02 with 2660 pip Profit.

TP4 @ 88.65 touched at 2019.05.15 with 3895 pip Profit.

TP5 @ 100.00 touched at 2019.06.19 with 5030 pip Profit.

TP6 @ 114.85 touched at 2019.06.22 with 6515 pip Profit.

700 + 1580 + 2660 + 3895 +5030 + 6515 = 20380

Open Profit:

Profit for one trade is 117.03 (current price) - 49.70 (open price) = 6733 pip

8 trade(s) still open, therefore total profit for open trade(s) is 6733 x 8 = 53864 pip

All SLs moved to Break-even point.

Take Profits:

TP7= @ 137.95

TP8= @ 149.10

TP9= @ 168.70

TP10= @ 230.10

TP11= @ 298.90

TP12= @ 372.35

TP13= @ 447.10

TP14= Free

A second Chance to Buy in XMRUSDMidterm forecast:

98.50 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index ( RSI ) is 74.

New trading suggestion:

*There is still a possibility of temporary retracement to suggested support line (98.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

*If you missed our first HUNT, you have a second chance to buy above the suggested support line (98.50).

Entry signal:

Signal to enter the market occurs when the price comes to "Support line" then forms one of the reversal patterns, whether "Bullish Engulfing", "Hammer" or "Valley", in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 14 BUY trade(s) @ 49.70 based on '2-Day Hammer' entry method at 2019.03.12.

Total Profit: 74244 pip

Closed trade(s): 20380 pip Profit

Open trade(s): 53864 pip Profit

Closed Profit:

TP1 @ 56.70 touched at 2019.03.31 with 700 pip Profit.

TP2 @ 65.50 touched at 2019.04.02 with 1580 pip Profit.

TP3 @ 76.30 touched at 2019.04.02 with 2660 pip Profit.

TP4 @ 88.65 touched at 2019.05.15 with 3895 pip Profit.

TP5 @ 100.00 touched at 2019.06.19 with 5030 pip Profit.

TP6 @ 114.85 touched at 2019.06.22 with 6515 pip Profit.

700 + 1580 + 2660 + 3895 +5030 + 6515 = 20380

Open Profit:

Profit for one trade is 117.03 (current price) - 49.70 (open price) = 6733 pip

8 trade(s) still open, therefore total profit for open trade(s) is 6733 x 8 = 53864 pip

All SLs moved to Break-even point.

Take Profits:

TP7= @ 137.95

TP8= @ 149.10

TP9= @ 168.70

TP10= @ 230.10

TP11= @ 298.90

TP12= @ 372.35

TP13= @ 447.10

TP14= Free

XMR Bear Cycle CompletedWelcome back!

Today I wanted to go over one of the large caps because they are the ones that lead the market.

XMR is a great long term cycle because it has proven itself with Bitcoins bear cycles previously.

I like this set up for a couple reasons...

First off, we have a very strong trend that went uber parabolic in the last cycle. This created a 1,3,5 Elliott Wave sequence,

and with the breakout of major descending resistance we have now made the first indications that this bear cycle is over.

From where were at now, I would expect us to continue higher to my target at $150.

I also noticed a pattern thats playing out compared to the last bear cycle that is almost exactly the same.

These cycles often repeat the same cycles in different forms but the resemblance is near exact.

Will history repeat itself? Only time will tell but, I am bullish.

There is a possibility for the beginning of an uptrend in XMRUSDMidterm forecast:

While the price is above the support 38.50, beginning of uptrend is expected.

We make sure when the resistance at 76.30 breaks.

If the support at 38.50 is broken, the short-term forecast -beginning of uptrend- will be invalid.

Technical analysis:

While the RSI uptrend #1 is not broken, bullish wave in price would continue.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 56.

Trading suggestion:

There is still a possibility of temporary retracement to suggested support zone (48.00 to 38.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (48.00)

Ending of entry zone (38.50)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Trade Setup:

We opened 14 BUY trade(s) @ 49.70 based on '2-Day Hammer' entry method at 2019.03.12.

Total Profit: 3682 pip

Closed trade(s): 0 pip Profit

Open trade(s): 3682 pip Profit

Open Profit:

Profit for one trade is 52.33 (current price) - 49.70 (open price) = 266 pip

14 trade(s) still open, therefore total profit for open trade(s) is 266 x 14 = 3682 pip

Take Profits:

TP1= @ 56.70

TP2= 65.50

TP3= 76.30

TP4= 88.65

TP5= 100.00

TP6= 114.85

TP7= 137.95

TP8= 149.10

TP9= 168.70

TP10= 230.10

TP11= 298.90

TP12= 372.35

TP13= 447.10

TP14= Free