XMR/BTC TA Update (Bullish Inverse Head & Shoulder Pattern?)XMR/BTC

Monero is at the edge of completing the Right Shoulder of the Inverse H & S pattern. If price can break above 7660 sats,

Expect further upside movement as the market structure will turn from bearish to a bullish uptrend.

Xmrusd

Why volume is not always an indicator of valueAs you can see in XMRBTC the volume has been increasing steadily over the years, (possibly fake volume), this leads people to the conclusion that a lot of buyers are present when in reality price is steadily declining and care should be taken when choosing to invest. My conclusion is that volume has little to no correlation to price action, and analysis should be made using various other TI (linear regression, Fibonacci zones for example). First educational post feedback is nice.

Is it the beginning of the end or the end of the beginning? #10Bear markets create strong cryptocurrencies.

Strong cryptocurrencies create bull markets.

Bull markets create shit coins.

And, shit coins create bear markets...

Since January 2018, It has been almost 2 years bear market! I know so many people has been keeping their zombie bags from 2017. Is there any hope? Yes, but not for most of them.

If you are still really thinking that You can get quick rich by only learning trading methodology, buying all the altcoins, You will be regret here. There is no easy money in crypto…

it’s all about working hard and trading smart. Knowing your win-rate is also the key!

What about BitMonero or Monero?

Due to its privacy features, Monero experienced rapid growth in market capitalization and transaction volume during the year 2016, faster and bigger than any other cryptocurrency that year. This growth was driven by its uptake in the darknet market,

In the first half of 2018, Monero was used in 44% of cryptocurrency ransomware attacks!

2019 - 2020 ?

I am not a Fundamental Analysis ( FA ) expert but I can easily say that It looks awful on technical analysis ( TA )

Strongly believe that I can find many coins on better risk & reward ratio. As long as XMR is below 0.01 BTC , it is not worth to keep for a long term.

In the meantime, I already put over 14 $BTC buy order on alt-coins ( You already know it if you are following me on twitter . If you haven't yet, You should do it right away to catch great tips to make so much crypto profit ) . It has been the best time to accumulate right coins! It reminds me between Nov 2016 - February 2017.

( Around 0.005 BTC, i put my first buy order for it tho - At that time, I will be watching closely)

PROTIP:

Let me tell you the secret of crypto !!!

If you want to get a lambo, trading/holding is not the only way! Not happy with results, Change your mindset!

So,what should you do?

-Be a part of coin projects

-Be a part of exchange projects

-Give crypto workshops

-Follow me on twitter

-Run a BTC ATM

Monero Price Analysis: Sustainable RecoveryMonero has posted double-digit gains following a strong bullish reversal from $45.00. The cryptocurrency is now attempting to recover from an eight-month trading low.

The XMR/USD pair had declined by over 30 percent since the start of November and is currently trading around 58 percent below current 2019 trading high.

Technical analysis shows that the XMR/USD pair is still technically bearish over the short and medium-term, however, signs are emerging that the recent recovery could be sustainable.

The four-hour time frame shows that a small inverted head and shoulders pattern has recently been triggered, with the $65.00 level the overall upside objective of the bullish pattern target.

A rally towards $65.00 would also help to create a much larger reversal pattern that could eventually send the XMR/USD pair towards the $85.00 level.

The daily time frame shows that sellers tested the top of a falling wedge pattern during the recent decline, with buyers successfully defending the technical test.

The daily time frame shows that the XMR/USD pair will be in a prime position if buyers can accelerate the recent recovery towards the $78.00. This would help Monero recover above its 200-day moving average and reclaim its technically bullish status.

The Relative Strength Index on the daily time frame shows that the recent recovery is pulling the coin away from oversold positions.

According to the latest sentiment data from The TIE, the short-term sentiment towards Monero is neutral at 56.50 percent, while the overall long-term sentiment towards the cryptocurrency is neutral at 33 percent.

XMR/USD H4 Chart by TradingView

Upside Potential

A break above the $91.00 level would have the August 8 swing-high at $98.00 as the strongest form of technical resistance. The daily time frame currently shows four lower price highs, making a break above the most recent swing-high, at $91.00, technically very important.

The daily time frame highlights that the XMR / USD is trading below the 50-day moving average, at $87.00, but above its 200-day moving average, which is found at the $74.50 level.

Downside Potential

The four-hour time frame is showing that the XMR/USD pair has strong medium-term technical support around the $52.00 and $48.00 levels.

Critical long-term technical support for the XMR/USD pair is located at the $45.00 level.

Summary

Monero has staged a strong recovery from an eight-month trading low owing to the broader cryptocurrency market.

A sustained rally above the $65.00 level would help encourage traders to continue to buy the XMR/USD pair, with the $85.00 level the medium-term upside objective.

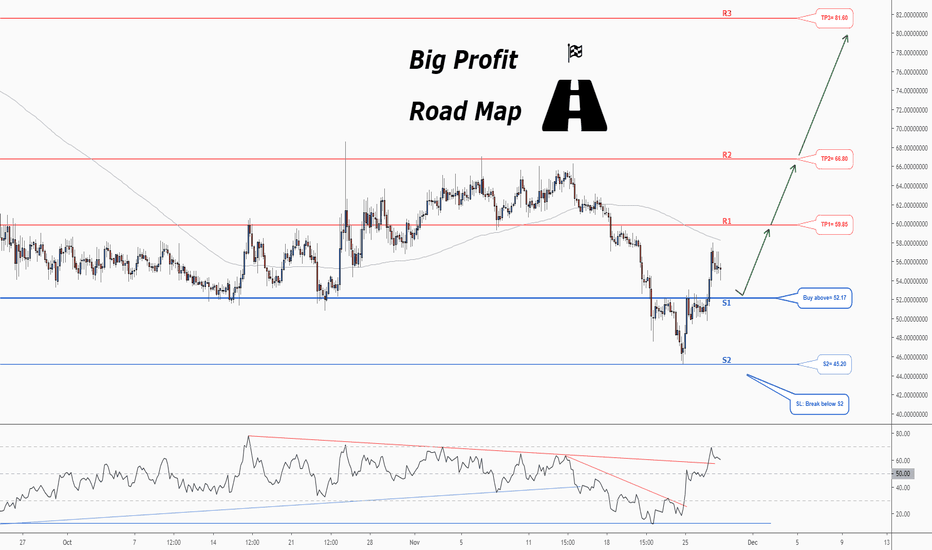

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (52.17). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 60.

Take Profits:

TP1= @ 59.85

TP2= @ 66.80

TP3= @ 81.60

SL= Break below S2

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (52.17). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 60.

Take Profits:

TP1= @ 59.85

TP2= @ 66.80

TP3= @ 81.60

SL= Break below S2

XMR and XMRBTC various views

A turn in XMR seems to be in. Both the XMRUSD and XMRBTC are signalling a bottom.

Multi year support seems to be holding. (fake break below got bought up)

Tapped low end of VPVR. Movign back to 1.09B High volume node, and has unfinished business up until 1.5b mark.

Has been following fractal since early sept perfectly.

DeMark 1D: Perfected 9 and S13 triggered.

More DeMark analysis folllowing in posts below

DeMark on 2W timeframe XMRUSD:

2W Perfected 9 buy signal (the perfect 9 sell worked beautifully 18 weeks ago).

DeMark on 2W timeframe XMRBTC

Cluster of A13, C13, and S13.

DeMark on 1W timeframe XMRBTC

Perfected 9 triggered, on green 4 out of 9 currently.

Also really clean break and retest out of falling wedge. (see daily as well)

DeMark on 1D timeframe XMRBTC

Cluster of A, C and S13's triggered and active.

Move to 0.008 High volume node likely. Break and convert that, move to 0.011 next.

XMRUSD formed bullish Shark | A good buying opportunity21 minutes ago

Priceline of Monero / US Dollar cryptocurrency has formed bullish Shark pattern and entered the potential reversal zone.

This PRZ area should be used as stop loss point in case of complete candle stick closes below this zone.

I have used Fibonacci sequence to set the targets:

Buy between: 62.106 to 61.143

Sell between: 63.099 to 65.151

Regards,

Atif Akbar (moon333)

XMR/USD BUY SIGNALMonero bouncing off the support while ZCASH already showed a buy signals. Seems like these two are going up big time

XMR UpdateLines and connections have been averaged on step-line over log for higher precision. Formation is confirmed (in blue) by multiple points, especially on the 'monthly' interval. The red trend line is unfortunately invalid, as the first peak created too much empty space, which is usually the number one cause for a formation to bust at the end. I used to like Monero until it busted a key support area (see previous chart) and so it's generally speaking a clear short until further notice . Technically there is some headroom for a retest towards 65 but ultimately you'll see another drop by the end of this month to the low 40's. So I'm dropping this ticker off my watchlist for a while as I will be focusing more on high-volume crypto tradables.

(XMR) Monero could be a good Call!Hi, Traders ! Monfex is on the air !

BTSE, a UAE-licensed cryptocurrency derivatives exchange, announced the launch of Monero (XMR) futures trading on its platform.

* The exchange is considered to be the only one supporting XMR futures trading. It also announced that XMR Futures would provide investors with various payment options, while traders could also use it as collateral.

* In general terms, Monero is regarded as a privacy coin because of its untraceable and private nature. A prompt comparison among the privacy featured coins shows that XMR takes the first place by market cap, total fees, and GitHub activity.

* In terms of pricing, Monero is far off (down appox. 90%) from its ATH of $500, registered in December 2017.

* XMR's market cap is now estimated at $965 million, while its trading volume averages at around $26 million, which ranks XMR 14th on the Brave New Coin market cap table.

* Technically, Monero stays within a wedge and is currently closer to its upper band. At the same time, XMR's price is located between the two Fibonacci time zones, so we expect to see a significant (local) top (or bottom) by the end of the year.

* Directionally, we incline more toward a Long shot with the price target area at $85 - $95 level.

Mid-term trade signal

Buy @ $50 - $60.

Target: $85 - $95.

Stop-loss: $48.

Watch for our Updates to get real-time superior signals!

GOOD LUCK AND LOTS OF PROFITS !!

Disclaimer

This report is for information purposes only and should not be considered a solicitation to buy or sell any cryptocurrency or cryptocurrency product. Monfex accepts no responsibility for any consequences resulting from the use of this material. Any person acting on this trade idea does so entirely at their own risk.

(XMR) Monero could be a good Call!Hi, Traders ! Monfex is on the air !

BTSE, a UAE-licensed cryptocurrency derivatives exchange, announced the launch of Monero (XMR) futures trading on its platform.

* The exchange is considered to be the only one supporting XMR futures trading. It also announced that XMR Futures would provide investors with various payment options, while traders could also use it as collateral.

* In general terms, Monero is regarded as a privacy coin because of its untraceable and private nature. A prompt comparison among the privacy featured coins shows that XMR takes the first place by market cap, total fees, and GitHub activity.

* In terms of pricing, Monero is far off (down appox. 90%) from its ATH of $500, registered in December 2017.

* XMR's market cap is now estimated at $965 million, while its trading volume averages at around $26 million, which ranks XMR 14th on the Brave New Coin market cap table.

* Technically, Monero stays within a wedge and is currently closer to its upper band. At the same time, XMR's price is located between the two Fibonacci time zones, so we expect to see a significant (local) top (or bottom) by the end of the year.

* Directionally, we incline more toward a Long shot with the price target area at $85 - $95 level.

Mid-term trade signal

Buy @ $50 - $60.

Target: $85 - $95.

Stop-loss: $48.

Watch for our Updates to get real-time superior signals!

GOOD LUCK AND LOTS OF PROFITS !!

Disclaimer

This report is for information purposes only and should not be considered a solicitation to buy or sell any cryptocurrency or cryptocurrency product. Monfex accepts no responsibility for any consequences resulting from the use of this material. Any person acting on this trade idea does so entirely at their own risk.

Monero Technical Analysis - XMRUSD - 31%-404% Profit ExpectedMonero - XMRUSD - Technical Analysis - 31%-404% Profit Expected

Don't Miss This Profitable Opportunity ... 4x - 5x Gains Expected.

Based on AB=CD pattern , Time Ratio & Gann Analysis, It's a potential long position with great returns :)

In a lower time-frame (4hrs) this long position has also been confirmed.

Target Profit Range - 51 - 169

(31%-404% Profit Expected)

TP - 1 - 51

TP - 2 - 74

TP - 3 - 100

TP - 4 - 124

TP - 5 - 147

TP - 6 - 169

Buying Zone! Long Position

Early Entry Trigger Point - 36 - 39

Ideal Entry Trigger Point - 32 - 35

***If you want to get in this trade from this point 60 you can still make 23% profit till TP2 is reached, however, there is a very high probability that price may continue to move down towards my ideal entry point., It is recommended to enter with a smaller lot size if you want to go long right away & manage your stop loss accordingly.

Good Luck.!

Disclaimer - This is not financial advice. This is my personal view and analysis of this chart.

If you follow this idea please plan your trade according to your lot size and account equity.

Don't forget to like, comment & follow , If you agree with my analysis :)