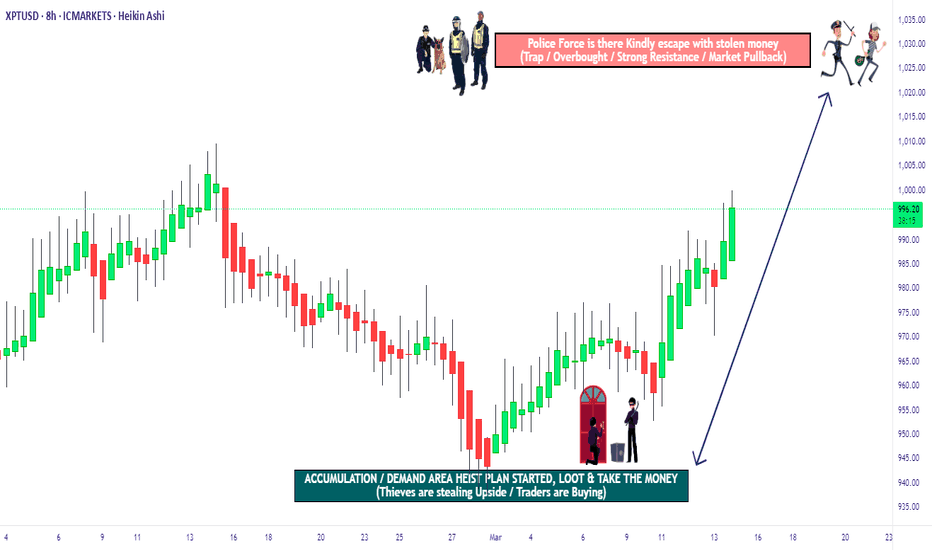

Platinum Breakout Stalk: Thief Entry Only After Confirmed🧠 Thief's Heist Plan Activated!

Asset: XTI/USD (PLATINUM) 💎

Strategy: Bullish Pullback + Breakout Play 💥

🔍 We stalking platinum's neutral zone… waiting for that clean breakout!

No early entries, no premature SLs. Discipline = Profits. 🎯

🎯 Entry: After breakout confirmed. Use multiple DCA limit orders to layer in like a ghost.

🔐 Stop Loss: ONLY after breakout – Place at 1280.00 🛡️

💎 Target: 1560.00 – Vault unlock point! 💰

📵 DO NOT place SL or orders before breakout – patience is the thief’s edge. 🧘♂️

This isn’t gambling... this is precision trading. Breakout = green light 🚦

Get ready to raid the platinum vault!

#ThiefTrader #BreakoutStrategy #PlatinumHeist #XTIUSD #BullishSetup #SmartMoneyMoves

XPTUSD

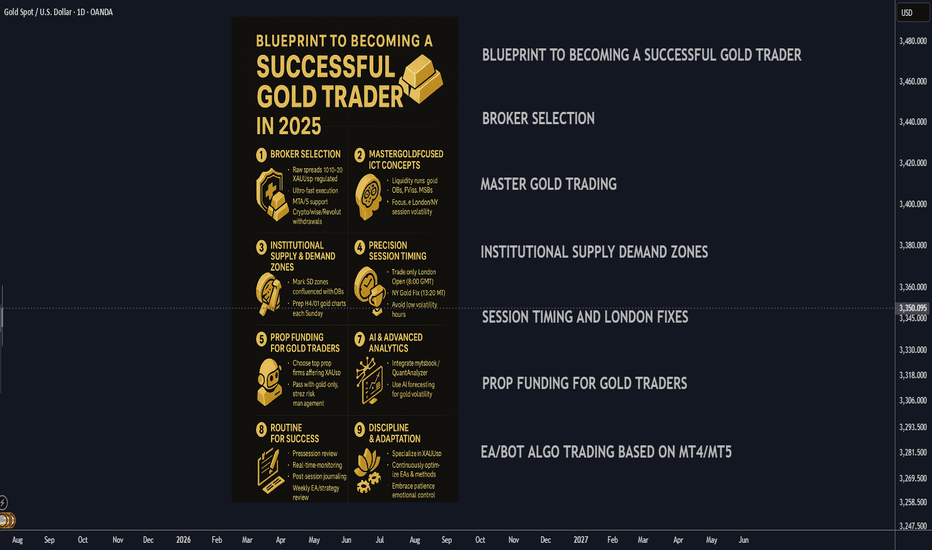

Blueprint to Becoming a Successful Gold Trader in 2025🚀 Blueprint to Becoming a Successful Gold Trader in 2025

A strategic, step-by-step plan to master gold trading by combining institutional concepts, cutting-edge automation, and the best prop funding opportunities for XAUUSD.

________________________________________

🏦 Broker Selection (Gold-Specific)

• 🔍 Choose Brokers Offering Raw Spread XAUUSD Accounts:

Seek brokers with raw/zero spread gold trading or tight gold spreads (0.10-0.30 average) with deep liquidity.

• ⚡ Prioritize Ultra-Fast Execution for Metals:

Confirm broker servers are in NY4/LD4 and latency is optimized for gold volatility spikes.

• 🛡️ Verify Regulation & Execution:

ASIC, FCA, FSCA preferred; check for proof of XAUUSD execution quality (Myfxbook/FXBlue verified).

• 📊 MetaTrader 4/5 Gold Support:

Ensure MT4/5 platform offers tick-chart precision for gold and supports custom EAs/indicators.

• 💳 Flexible Withdrawals/Payouts:

Crypto, Wise, and Revolut compatibility for fast, secure funding.

________________________________________

🎯 Gold Trading Strategy (ICT + Supply/Demand Zones)

• 🧠 Master Gold-Adapted ICT Concepts:

o Liquidity runs and stops at London/NY session highs/lows

o XAUUSD-specific Order Blocks (OBs), FVGs, and Market Structure Breaks (MSB)

• 📍 Map Institutional Supply-Demand Zones:

Gold reacts violently to these—align SD zones with ICT Order Blocks for best confluence.

• 📐 Precision Entries:

Only enter after liquidity sweeps at key XAUUSD levels (H4/D1), avoiding choppy retail entries.

• 📈 Time & Price for XAUUSD:

Focus exclusively on London Open (8:00 GMT) and NY Open/Gold Fixing (13:20 GMT)—peak volatility windows.

• 📆 Weekly Preparation:

Annotate D1/H4 gold charts every Sunday with clear OBs, liquidity points, and SD zones for the week.

________________________________________

💰 Prop Funding for Gold Trading

• 🥇 Select Firms Offering XAUUSD with Tight Rules:

Choose FTMO, The Funded Trader, MyFundedFX, or similar with high leverage and XAUUSD trading enabled.

• 📑 Pass Evaluation with Gold-Only Strategy:

Use high-probability, low-frequency XAUUSD trades—1-3 setups per week, strict risk parameters.

• 🎯 Risk Management:

Max 1% risk/trade, stop trading after 2 consecutive losses—protect account and pass evaluations.

• 📊 Analytics Monitoring:

Use prop dashboards (FTMO Metrics, FundedNext stats) to review XAUUSD trade stats and adjust.

• 📚 Diversify Funded Accounts:

Split funded capital among multiple firms to hedge against firm-specific risk and maximize payouts.

________________________________________

⚙️ Automating Gold Trading (MT4/5 EAs & Bots)

• 🛠️ Hire MQL4/5 Developers for XAUUSD EAs:

Code bots focused on gold-specific ICT (OBs, FVGs, London/NY volatility).

• 🤖 Develop EAs for Gold:

o OB/FVG/Market Structure detection on XAUUSD

o Supply/Demand zone algo entries

o Gold breakout EAs for session openings

• 📌 Trade Management Automation:

o Entry, stop loss, partial TP, BE, trailing for gold’s high volatility

o Dynamic lot-sizing by daily ATR

• 📡 VPS Hosting Near Broker’s Gold Server:

Use NY4/LD4 VPS for lowest latency (ForexVPS, Beeks).

• 📈 Quarterly Forward-Testing:

Optimize EAs in demo before live trading, retest on every major gold volatility shift (FOMC, CPI).

________________________________________

📲 Leveraging Bots & AI in 2025

• 📊 Integrate with MT4/5 Analytics Tools:

Use myfxbook, QuantAnalyzer for detailed gold trade breakdowns.

• 🔮 AI-Based Gold Forecasting:

Layer in machine learning models (e.g., TensorTrade, TradingView AI) to anticipate session volatility and direction.

• 🔔 Real-Time Alert Bots:

Set up Telegram/Discord bots for instant notification of ICT-based XAUUSD signals.

• 🧑💻 Manual Oversight:

Always review high-impact news (NFP, CPI, FOMC) and override automation when macro risk spikes.

• 🔄 Continuous Bot Updates:

Retrain your EAs monthly on latest XAUUSD price action to maintain edge.

________________________________________

🗓️ Daily Gold Trader Routine

• 🌅 Pre-Session (30 mins):

Review annotated gold charts, key session highs/lows, OB/FVG/SD levels, and upcoming news.

• 💻 During Session:

Monitor bot execution, validate setups manually, manage risk during NY/London overlap.

• 📝 Post-Session (15 mins):

Journal gold trades, note reasoning for entry/exit, emotional state, and lessons learned.

• 📆 Weekly Review:

Assess overall gold trading stats and EA performance, adjust strategy as needed.

• 📚 Continuous Learning:

Stay updated on ICT, gold market fundamentals, and new trading tech.

________________________________________

📌 Final Success Advice for 2025

• 🔍 Specialize in XAUUSD/Gold—Don’t Diversify Randomly:

Depth > Breadth—become a true gold trading expert.

• 🚩 Keep Adapting Your Gold Trading EAs:

Markets change—so must your bots and playbooks.

• 🧘 Stay Patient, Disciplined, and Selective:

Gold rewards precision and patience, not overtrading.

• 💡 Embrace AI & Automation:

Leverage every tool: AI, analytics, and custom EAs for a real 2025 trading edge.

Gold Market Update and Recommended Strategy bulls/bears📉 Gold Holds Steady ~$3,354/oz

Moderate USD strength and tariff-driven safe‑haven buying have kept gold anchored in the $3,330–$3,360 zone.

🤝 Trade & Tariff Influence

Tariff headlines—from Canada’s 35% rate to broader threats—have supported gold by boosting safe‑haven demand heading into U.S. CPI.

📊 Technical Watch

Testing resistance at $3,360; full breakout above $3,342–$3,360 opens path to $3,400–$3,500.

Support sits at $3,330–$3,322 (20‑day EMA); breach risks pickup in short‑term bearish momentum.

💼 U.S. Macro & Fed Cues

Inflation data (June CPI due July 15) and Fedspeak ahead of the July blackout window are set to define next directional moves.

🌍 Central Bank Insight

World central banks are stockpiling gold at record rates, creating a bullish backdrop.

⚖ Range‑Bound Outlook

Expect gold to drift between $3,330–$3,360 near‑term, with upside if tariff/CPI triggers materialize.

📉 Short‑Term Bias

Neutral‑to‑bullish; momentum indicators are calm but could shift quickly on macro surprises.

📈 Med‑Term Outlook Bullish

Ongoing central bank demand, trade dynamics, and macro fundamentals still favor a gradual move toward $3,500+.

⭐ Updated Strategy Recommendations

Accumulate on dips near $3,330–$3,320.

Watch resistance at $3,360–$3,400 for profit‑taking or breakout buying opportunities.

Bears may focus on selling rallies near the upper range.

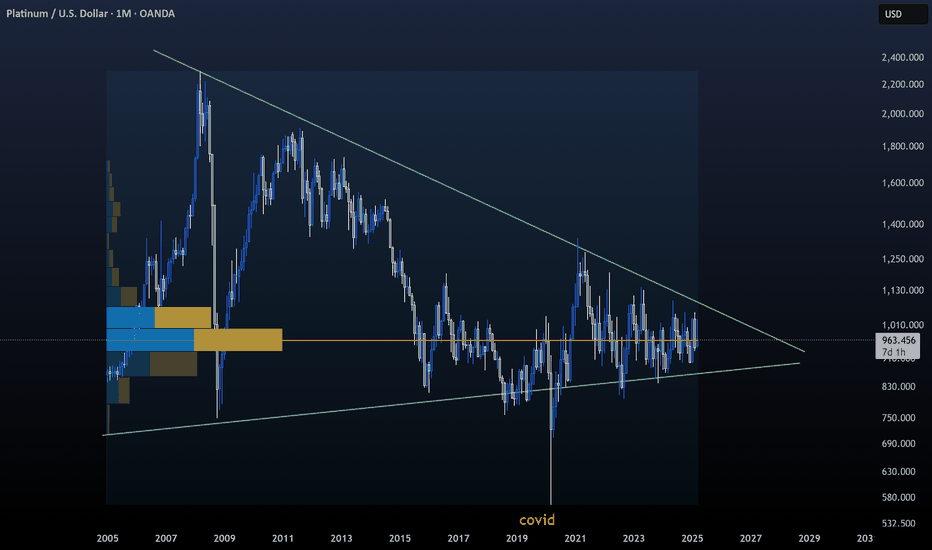

XPTUSD 1W:While Everyone Watches Gold, Platinum Quietly Wakes UpGold gets the headlines — but platinum just broke two years of silence with a clean, high-volume breakout from a symmetrical triangle on the weekly chart. And this isn’t noise — this is the structural shift traders wait for.

Price has been coiled inside a compressing wedge since early 2022. Equal highs. Equal lows. Stop hunts both ways. The classic “shake out before take off.” Now? The breakout is in. And the weekly candle closed above resistance with volume confirmation. Oh, and while we're at it — the 50MA just crossed above the 200MA, signaling a long-term trend reversal.

Target? Measure the triangle height: ~398 points. That projects a breakout target of 1440 USD, which aligns perfectly with previous institutional rejection zones.

But this isn’t just about the chart.

🔹 South Africa, the top global supplier, is struggling with energy and production cuts;

🔹 The Fed is pausing rate hikes — the dollar weakens, metals rally;

🔹 Demand from hydrogen tech, clean energy, and industrial catalysts is on the rise.

Translation? Smart money has been accumulating. The move from 965–1070 was just the ignition. The drive hasn’t started yet.

So while everyone fights over gold highs, platinum sits at the base of a move no one's prepared for — except those who know how accumulation ends.

🧭 Key support: 965–985

📍 Resistance zone: 1150–1180

🎯 Measured target: 1440+

Gold Market Update: Bulls Will target 3750 USD after 3500 USD🏆 Gold Market Mid-Term Update (June 19, 2025)

📊 Price & Technical Outlook

Current Spot Price: ~$3,365

Technical Setup

Inverted H&S pattern forming/completed on higher timeframes — confirms bullish reversal structure.

Reload (buy) zone: $3,250–$3,275 (ideal accumulation range for bulls if price pulls back).

Swing trade setup: Entry: $3,250–$3,275 (reload zone)

Take Profit (TP): $3,750

Support: Major at $3,250–$3,275 (break below = reassess bullish bias).

Resistance: $3,450–$3,500 ; next major resistance: $3,600, then $3,750.

Price consolidating above $3,250–$3,350 is technically healthy — maintaining bullish structure.

🏆 Bull Market Overview

The pullback appears complete; uptrend resumes amid strong macro/geopolitical drivers (inflation, rates, safe haven flows).

Key Levels: $3,000 (macro support), $3,250 (bulls must defend), $3,500 (breakout zone), $3,750 (swing TP).

Short-term dips = buying opportunities — “Buy the Dip” remains favored as long as support holds. Upside targets: Immediate: $3,600 Swing target: $3,750

Summary:

Gold remains in a bullish mid-term structure, with the inverted H&S pattern pointing to higher prices ahead. Bulls look to reload at $3,250–$3,275, targeting $3,750 for swing trades. As long as $3,180–$3,200 holds, buying dips is the play. A sustained breakout above $3,400–$3,600 opens the door for new all-time highs.

GOLD H4 Update: Bulls will target 3600/3750 USD Market Update🏆 Gold Market Mid-Term Update (June 16, 2025)

📊 Price & Technical Outlook

Current Spot Price: around $3,414

Technical Setup

* Gold consolidating above major support at \~\$3,180–3,200

* Testing resistance at \~\$3,380–3,400; breakout could push toward \$3,600

* Recent price action considered a healthy consolidation with upside potential

🏆 Bull Market Overview

* Pullback likely complete; supported by strong geopolitical and macro tailwinds

* Key price levels: \$3,000 / \$3,200 / \$3,400 (resistance near \$3,400)

* Bullish target: \$3,600, with further upside possible if momentum holds

* Short-term dips remain buying opportunities—“buy the dip” remains favored

⭐ Recommended Strategy

BUY/HOLD: Continue to accumulate on dips, using \$3,200–3,300 as entry zones

Target: Maintain bull target at \$3,600, with breakout opportunity above \$3,400

🏦 Macro & Market Drivers

Fed & Central Bank Outlook

* Investors positioning for possible Fed rate cuts later this year, likely totaling around 75 bps by end of 2025

* Ongoing dollar weakness supports gold

Geopolitical Tensions

* Middle East unrest, U.S.–Iran dynamics, and global evacuations are fueling safe-haven demand for gold

* Continued volatility in global hotspots likely to keep gold elevated

Risk Appetite & Market Behavior

* Both stocks and gold are climbing—an unusual “optimism + fear” scenario

* Central banks, especially in China, India, and Turkey, have been strong gold buyers in 2025

* Speculative positions in gold futures remain high

U.S.–China & Trade Tariffs

* Unresolved U.S.–China tariffs and tensions continue to support gold

* Any easing in trade friction could temper gold’s advance

📰 Latest Market Sentiment

* Wall Street remains bullish on gold for the upcoming week, though some caution persists ahead of the upcoming Fed meeting

* Macro environment is seen as supportive for gold and other precious metals

* Gold’s rally is positively influencing the broader precious metals market

🌏 Demand Themes

* **Asian Buyers**: China may relax gold import quotas to manage currency, while India demand remains strong though can be seasonally slower

* **Central Banks**: Over 240 tonnes of gold added in Q1 by central banks, with China and India as top buyers

⚠️ Risks & Watchpoints

* Fed surprises: A more hawkish tone at the next meeting could push gold back toward \$3,200–3,300

* Geopolitical breakthroughs: Any stable resolutions could reduce safe-haven demand

* Large speculative position unwinds could create short-term volatility

🔎 Mid-Term Outlook Summary

| Scenario | Support | Resistance | Catalysts |

| --------- | ------------- | ---------- | ----------------------------------- |

| Base case | \$3,200–3,300 | \$3,400 | Rate cut expectations + geopolitics |

| Bull case | Above \$3,400 | \$3,600+ | Escalating risk, dovish Fed |

| Bear case | Below \$3,200 | — | Hawkish Fed, easing global tensions |

✔️ Final Take

* Technical and fundamental momentum supports a continued bull phase with key target at \$3,600

* Best strategy: accumulate on dips between \$3,200–3,300

* Key factors to watch: Fed’s next move (June 17), Middle East developments, U.S.–China trade actions, central bank buying

Intraday Gold Trading System with Neural Networks: Step-by-Step________________________________________

🏆 Intraday Gold Trading System with Neural Networks: Step-by-Step Practical Guide

________________________________________

📌 Step 1: Overview and Goal

The goal is to build a neural network system to predict intraday short-term gold price movements—typically forecasting the next 15 to 30 minutes.

________________________________________

📈 Step 2: Choosing Indicators (TradingView Equivalents)

Key indicators for intraday gold trading:

• 📊 Moving Averages (EMA, SMA)

• 📏 Relative Strength Index (RSI)

• 🌀 Moving Average Convergence Divergence (MACD)

• 📉 Bollinger Bands

• 📦 Volume Weighted Average Price (VWAP)

• ⚡ Average True Range (ATR)

________________________________________

🗃 Step 3: Data Acquisition (Vectors and Matrices)

Use Python's yfinance to fetch intraday gold data:

import yfinance as yf

import pandas as pd

data = yf.download('GC=F', period='30d', interval='15m')

________________________________________

🔧 Step 4: Technical Indicator Calculation

Use Python’s pandas_ta library to generate all required indicators:

import pandas_ta as ta

data = ta.ema(data , length=20)

data = ta.ema(data , length=50)

data = ta.rsi(data , length=14)

macd = ta.macd(data )

data = macd

data = macd

bbands = ta.bbands(data , length=20)

data = bbands

data = bbands

data = bbands

data = ta.atr(data , data , data , length=14)

data.dropna(inplace=True)

________________________________________

🧹 Step 5: Data Preprocessing and Matrix Creation

Standardize your features and shape data for neural networks:

from sklearn.preprocessing import StandardScaler

import numpy as np

features =

scaler = StandardScaler()

data_scaled = scaler.fit_transform(data )

def create_matrix(data_scaled, window_size=10):

X, y = ,

for i in range(len(data_scaled) - window_size - 1):

X.append(data_scaled )

y.append(data .iloc )

return np.array(X), np.array(y)

X, y = create_matrix(data_scaled, window_size=10)

________________________________________

🤖 Step 6: Neural Network Construction with TensorFlow

Use LSTM neural networks for sequential, time-series prediction:

import tensorflow as tf

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import LSTM, Dense, Dropout

model = Sequential( , X.shape )),

Dropout(0.2),

LSTM(32, activation='relu'),

Dense(1)

])

model.compile(optimizer='adam', loss='mse')

________________________________________

🎯 Step 7: Training the Neural Network

history = model.fit(X, y, epochs=50, batch_size=32, validation_split=0.2)

________________________________________

📊 Step 8: Evaluating Model Performance

Visualize actual vs. predicted prices:

import matplotlib.pyplot as plt

predictions = model.predict(X)

plt.plot(y, label='Actual Price')

plt.plot(predictions, label='Predicted Price')

plt.xlabel('Time Steps')

plt.ylabel('Gold Price')

plt.legend()

plt.show()

________________________________________

🚦 Step 9: Developing a Trading Strategy

Translate predictions into trading signals:

def trade_logic(predicted, current, threshold=0.3):

diff = predicted - current

if diff > threshold:

return "Buy"

elif diff < -threshold:

return "Sell"

else:

return "Hold"

latest_data = X .reshape(1, X.shape , X.shape )

predicted_price = model.predict(latest_data)

current_price = data .iloc

decision = trade_logic(predicted_price, current_price)

print("Trading Decision:", decision)

________________________________________

⚙️ Step 10: Real-Time Deployment

Automate the model for live trading via broker APIs (pseudocode):

while market_open:

live_data = fetch_live_gold_data()

live_data_processed = preprocess(live_data)

prediction = model.predict(live_data_processed)

decision = trade_logic(prediction, live_data )

execute_order(decision)

________________________________________

📅 Step 11: Backtesting

Use frameworks like Backtrader or Zipline to validate your strategy:

import backtrader as bt

class NNStrategy(bt.Strategy):

def next(self):

if self.data.predicted > self.data.close + threshold:

self.buy()

elif self.data.predicted < self.data.close - threshold:

self.sell()

cerebro = bt.Cerebro()

cerebro.addstrategy(NNStrategy)

# Add data feeds and run cerebro

cerebro.run()

________________________________________

🔍 Practical Use-Cases

• ⚡ Momentum Trading: EMA crossovers, validated by neural network.

• 🔄 Mean Reversion: Trade at Bollinger Band extremes, validated with neural network predictions.

• 🌩️ Volatility-based: Use ATR plus neural net for optimal entry/exit timing.

________________________________________

🛠 Additional Recommendations

• Frameworks: TensorFlow/Keras, PyTorch, scikit-learn

• Real-time monitoring and risk management are crucial—use volatility indicators!

________________________________________

📚 Final Thoughts

This practical guide arms you to build, deploy, and manage a neural network-based intraday gold trading system—from data acquisition through backtesting—ensuring you have the tools for robust, data-driven, and risk-managed trading strategies.

________________________________________

Update of the Bullish/Bearish Catalysts for Gold prices________________________________________

⚡️ Gold’s Pullback: A Reset, Not the End

After peaking above $3,500/oz in April, gold’s slide back toward $3,210 marks a sharp—but not unusual—correction. What’s changed in the gold narrative? The rapid unwinding of panic bids as the Fed stays hawkish, the dollar flexes, and risk appetite returns. But beneath the surface, multiple structural drivers—old and new—are shaping gold’s next act.

________________________________________

1. Fed “Higher for Longer” Policy Bias (9/10)

Still the #1 driver.

With inflation sticky and the U.S. labor market robust, the Federal Reserve’s reluctance to cut rates (4.25–4.50%) is pinning real yields near multi-year highs. This erodes the appeal of non-yielding assets like gold, particularly for Western investors.

🦅 Watch for any dovish shift—a single Fed pivot could reignite gold fast.

________________________________________

2. U.S. Dollar Resilience (8.5/10)

The DXY recently surged above 101, buoyed by relative U.S. growth outperformance and ongoing EM weakness. Since gold is dollar-priced, a strong greenback makes gold more expensive for non-dollar buyers, crimping global demand.

💵 Sustained dollar strength could push gold closer to $3,100 unless countered by inflation or new geopolitical stress.

________________________________________

3. Central Bank Buying & “De-Dollarization” Flows (8/10)

This is the new wild card.

Countries like China, India, Turkey, and Russia are accelerating gold reserves accumulation—partly to hedge against dollar-centric sanctions and diversify away from U.S. Treasuries. Q2 2025 data shows a 35% jump in net central bank purchases year-on-year.

🏦 This bid underpins the gold market even when ETFs and retail are sellers.

________________________________________

4. U.S.–China Trade Normalization (7.5/10)

The May 2025 Geneva agreement was a big de-risking event. While tariffs haven’t vanished, steady progress on tech and agriculture reduces tail risk for global trade, putting downward pressure on gold’s safe-haven premium.

🌏 Any breakdown or tariff surprise could quickly reverse this.

________________________________________

5. Algorithmic & Quant Trading Flows (7/10)

Gold’s volatility is now heavily influenced by systematic funds. CTA (commodity trading advisor) and quant-driven selling accelerated the recent drop once $3,300 was breached. This non-fundamental selling creates overshoots—but also sharp reversals on technical bounces.

🤖 Expect snapbacks when positioning reaches extremes.

________________________________________

6. U.S.–U.K. & EU Trade Deals (6.5/10)

Both deals have reduced the global uncertainty premium. While the economic impact is moderate, improved global relations have pushed capital into equities and away from gold.

🇬🇧 Keep an eye on political risk, especially if new tariffs or Brexit-related shocks re-emerge.

________________________________________

7. India–Pakistan and Middle East Geopolitical Risks (6.5/10)

Tensions have cooled, but remain a latent driver. The India–Pakistan border saw restraint in May; Iran–U.S. talks are “cautiously positive.” Any surprise flare-up, especially involving oil, can quickly restore gold’s safe-haven bid.

🕊️ Event-driven spikes likely, but not sustained unless escalation persists.

________________________________________

8. ETF Flows, Retail & Institutional Demand (6/10)

ETF inflows have slowed sharply in 2025, but central bank and Asian buying partly offset this. U.S. retail interest has faded due to higher Treasury yields, but any sign of real rates rolling over could spark new inflows.

📈 ETF demand is now more a symptom than a cause of price moves.

________________________________________

9. Technological Demand & Jewelry Trends (5.5/10)

Longer-term, gold’s use in electronics, EVs, and green tech is rising modestly (up ~3% YoY). Indian and Chinese jewelry demand—seasonally soft now—could rebound late 2025 if income and sentiment recover.

📿 Not a short-term driver, but a steady tailwind in the background.

________________________________________

10. Fiscal Risk & U.S. Debt Sustainability (5.5/10)

Rising concerns about the U.S. debt trajectory, especially if deficits widen or the U.S. nears a shutdown or downgrade, can trigger flight-to-quality bids for gold. This is not the main driver now, but is a key “black swan” risk if Treasury auctions stumble.

💣 Could move up the list rapidly on negative headlines.

________________________________________

🌐 Other Catalysts to Watch:

• Israel – Iran tensions in the Middle East – limited impact on gold prices.

• Crypto Market Volatility (5/10): Periods of sharp crypto drawdowns have triggered some rotation into gold, but the correlation is inconsistent.

• Chinese Real Estate Stress (5/10): Signs of further slowdown or crisis (e.g., major developer defaults) could boost gold as a defensive play in Asia.

• Physical Supply Disruptions (4/10): Mine strikes, export restrictions, or transport bottlenecks can create localized price spikes, but rarely move the global market for long.

________________________________________

🏆 2025 Gold Catalyst Rankings (with Impact Scores)

Rank Catalyst Strength/10 Current Impact Direction Notes

1 Fed “Higher for Longer” Policy 9.0 Very High Bearish Key yield driver

2 U.S. Dollar Resilience 8.5 Very High Bearish Hurts non-USD demand

3 Central Bank & “De-Dollarization” Buying 8.0 High Bullish Structural support

4 U.S.–China Trade Normalization 7.5 High Bearish De-risks global trade

5 Algorithmic/Quant Trading Flows 7.0 High Bearish Magnifies volatility

6 U.S.–U.K./EU Trade Deals 6.5 Moderate Bearish Risk appetite rising

7 India–Pakistan/Mideast Geopolitics 6.5 Moderate Neutral Event risk

8 ETF, Retail & Institutional Flows 6.0 Moderate Bearish Trend follower

9 Tech/Jewelry Physical Demand 5.5 Low Bullish Seasonal uptick possible

10 U.S. Debt/Fiscal Sustainability 5.5 Low Bullish Potential tail risk

11 Crypto Market Volatility 5.0 Low Bullish Risk-off flows (sometimes)

12 China Property Crisis 5.0 Low Bullish Asian safe-haven buying

13 Physical Supply Disruptions 4.0 Very Low Bullish Rare but possible

________________________________________

🚦Where Next for Gold?

• Current price: ~$3,210/oz

• Key support: $3,150/oz

• Key upside triggers: A dovish Fed surprise, sharp dollar reversal, sudden geopolitical event, or central bank “buying spree.”

• Risks: Extended strong dollar, yield spike, no escalation of global risks.

________________________________________

Summary Table: 2025 Gold Price Catalysts Comparison

Catalyst 2024 Score 2025 Score Change Impact Direction (2025) Commentary

Fed Rate Policy 9 9 – Bearish Unchanged, still dominant

U.S. Dollar 8 8.5 ↑ Bearish Gained in strength

Central Bank Buying 7 8 ↑ Bullish Grown in importance, especially in Asia

U.S.-China Trade 7.5 7.5 – Bearish Still relevant, deal holding for now

Algorithmic/Quant Flows 6 7 ↑ Bearish Systematic trading influence is rising

Geopolitics (excl. Russia/Ukraine) 6 6.5 ↑ Neutral Slight increase, mostly latent risks

ETF/Institutional Flows 5 6 ↑ Bearish Slower, but still influential

Jewelry/Tech Demand 4.5 5.5 ↑ Bullish Tech/jewelry more important now

U.S. Debt/Fiscal Risk 5 5.5 ↑ Bullish Gaining attention with deficit concerns

Crypto Market Volatility 4 5 ↑ Bullish Correlation growing, but inconsistent

China Property Risk N/A 5 NEW Bullish Added due to emerging Asian risk

Physical Supply Disruption 3.5 4 ↑ Bullish Minor, only spikes on rare events

________________________________________

🥇 Bottom Line:

Gold’s retreat reflects a rebalancing of risk and yield, but the stage is set for sudden moves—especially if the Fed blinks, the dollar falters, or new shocks emerge. The top three catalysts (Fed, Dollar, Central Bank buying) are especially worth watching as we head into the second half of 2025.

Platinum 10 years accumulation 2 000 USD Overview of Catalysts

Here’s a detailed look at the top 10 key catalysts influencing platinum prices—and how they stack up on a 0–10 impact scale 🎯.

1. Supply Deficits (Mining Shortfalls) ⛏️

Trend: Persistent structural deficits—the largest since 2013—with a projected deficit of \~598 koz in 2024.

Drivers: Declining output in South Africa and Russia, underinvestment, and aging mines.

Impact Score: 10/10 – Direct upward pressure on price.

2. Industrial Demand & Green-Energy Growth 🏭

Trend: Industrial consumption is booming, with strong growth in sectors like wind turbines, glass, and electronics.

Support: This broad demand fuels a large part of the supply deficit, and goes well beyond automotive use.

Impact Score: 9/10 – Strong structural support.

3. Auto Catalyst Substitution (Pd → Pt) 🔄

Trend: Cost-effective substitution as platinum approaches price parity with palladium; significant volume was substituted in 2023, with more projected for 2024.

Significance: Boosts automotive demand in an area previously dominated by palladium.

Impact Score: 8/10.

4. Electric Vehicle Adoption (EVs) ⚡

Trend: EVs don’t use platinum in catalytic converters, which is a structural hit to demand as EV growth continues.

Significance: Long-term downside pressure.

Impact Score: 7/10.

5. Hydrogen Fuel Cell Demand 💧

Trend: Hydrogen vehicles use platinum, with projected demand growth toward 2030.

Limitations: Growth remains slower than battery EVs.

Impact Score: 6/10.

6. Recycling Constraints 🔄

Trend: Recycling, which provides about a quarter of supply, is falling due to fewer end-of-life vehicles and glass, reducing the supply buffer.

Market Effect: This amplifies supply tightness.

Impact Score: 6/10.

7. Chinese Emission Policies 🏭

Trend: China’s tightening emissions regulations are supporting demand, with end uses well protected against a slowdown.

Importance: China is the largest platinum user; policy gives stability.

Impact Score: 7/10.

8. Jewellery & Investment Trends 💍

Trend: Jewellery demand remains steady, and investment demand is rising.

Note: This is a smaller demand segment, but it is supportive.

Impact Score: 5/10.

9. Macroeconomic & Auto Production Outlook 📉

Trend: Weak global auto production is lowering platinum use, but recovery in auto could lift demand.

Aftermath: Economic rebound could support prices.

Impact Score:** 5/10.

10. Speculative Sentiment & Positioning 📈

Trend: Inventories are depleted; investors are waiting for a breakout.

Tipping Point: A price surge could spark momentum-driven demand.

Impact Score:** 4/10.

| Rank | Catalyst | Score (/10) |

| ---- | ---------------------------------- | ----------- |

| 1 | Supply Deficit | 10 |

| 2 | Industrial / Green-Energy Demand | 9 |

| 3 | Auto Catalyst Pd → Pt Substitution | 8 |

| 4 | EV Adoption (Negative Impact) | 7 |

| 5 | Chinese Emission Policies | 7 |

| 6 | Hydrogen Fuel Cell Growth | 6 |

| 7 | Recycling Constraints | 6 |

| 8 | Jewellery & Investment Demand | 5 |

| 9 | Macro Slowdowns / Auto Production | 5 |

| 10 | Speculative Positioning | 4 |

📌 Key Insights & Outlook

* Tight supply and diversified demand—especially from green energy and industrial sectors—are the strongest bullish forces for platinum.

* Auto-driven substitution offers further upside, while EV growth and recycling limitations act as constraints.

* Chinese regulations add resilience; hydrogen offers potential if growth accelerates.

* Jewellery and investment flows remain minor but supportive.

* Much depends on auto sector recovery and investor psychology—momentum effects could amplify gains if technical levels break.

🔮 Final Take

Platinum remains positioned for medium-term strength, thanks to severe supply tightness and robust non-auto demand drivers. For investors, key areas to watch are further deficits, industrial trends, and catalytic substitution. Be mindful of potential headwinds from EV adoption and macroeconomic softness, but the structural case remains compelling.

Platinum's Quiet Ascent: What Drives Its New Value?Platinum, often operating in the shadow of gold, has recently experienced a significant surge in value, reaching multi-year highs and capturing considerable investor attention. This resurgence is not arbitrary; it stems from a complex interplay of industrial demand, tightening supply, evolving geopolitical dynamics, and a notable shift in investment sentiment. Understanding these underlying forces becomes crucial for investors seeking to decipher the trajectory of this vital industrial precious metal.

A primary catalyst for platinum's price rally is its strong industrial utility, particularly within the automotive sector, where it remains indispensable for catalytic converters. While the rise of battery electric vehicles presents a long-term shift, the robust growth in hybrid vehicle production continues to sustain demand. Critically, the market faces persistent physical deficits, with supply consistently falling short of demand for the past two years, a trend projected to continue into 2025. Mine output struggles due to disruptions in key producing regions, such as South Africa and Zimbabwe, and secondary supply from recycling has proven insufficient to bridge the growing gap.

Geopolitics and strategic investment further amplify platinum's upward trajectory. China has emerged as a pivotal market, with a sharp rebound in demand as consumers increasingly favor platinum for both jewelry and investment amidst record gold prices. This strategic pivot by the world's largest consumer market is reshaping global platinum price discovery, supported by China's initiatives to develop new trading ecosystems and futures contracts. Concurrently, renewed investor confidence is evident in growing inflows into platinum Exchange-Traded Funds (ETFs) and robust physical buying, with anticipated lower borrowing costs also enhancing its appeal.

In essence, platinum's current rally reflects a powerful combination of tightening supply and resilient industrial demand, underscored by strategic shifts in major consumer markets and renewed investor interest. As above-ground stocks gradually deplete and the market anticipates continued deficits, platinum is poised for a sustained period of relevance, offering compelling prospects for those who recognize its multifaceted value proposition.

SHORT ON XPT/USD PLATINUMXPT/USD Platinum has given us a choc (change of character) to the downside from a recent push up.

It has currently completed the pullback of that new change to the downside and I expect it to fall from the supply area/zone to the next level of demand.

Lost of imbalance to the downside making this trade a nice setup.

XPT/USD "The Platinum" Metals Market Bull Heist Plan (DAY Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "The Platinum" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (935.000) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1015.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XPT/USD "The Platinum" Metals Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👆👆👆

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Supply and Demand Factors, Future trend targets with Overall outlook score... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Mid-Week Market Forecast: GOLD, SILVER, COPPER & PLATINUMIn this video, we'll present analysis and best setups for Wednesday, April 22nd to the end of the week.

Gold is still a buy.

Silver may present a sell opportunity at current levels.

Copper looks like it is setting up for a valid sell.

Platinum has showed weakness early this week. We'll watch for continuation.

Be patient, and wait for confirmations!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XPT/USD "The Platinum" Metals Market Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "The Platinum" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (975.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (945.000) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1004.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XPT/USD "The Platinum" Metals Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Long Term BUY PlatinumThis is a long-term accumulation and trade for Platinum. In the short term, we can continue to see the range price action.

The previous cycle lasted approximately 3100 days (8.5 years)

I believe we will see a Platinum price of $4000-5000 by 2037.

The next platinum cycle is around the corner. A trendline break will spark the next platinum bull market. For now, I will be accumulating as much platinum as possible. This opportunity can lead to a 4-5x.

If you believe in the fundamentals and idea of this setup, feel free to use and follow it.

Not financial advice.

PLATINUM Strong Triangle buy opportunityLast time we looked at Platinum (XPTUSD) was more than 2 months ago (January 30, see chart below) getting our expected rise and hitting the 999.50 Target:

This time the price is at the bottom (Support Zone) of the 11-month Descending Triangle pattern, which is a technical buy opportunity. The last Bullish Leg hit the 0.618 Fibonacci retracement level, while the one before the 0.786.

As a result we have a minimum 985.00 Target on this emerging Bullish Leg.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Platinum Portfolios: A Bullish Signal for Future Gains!Yesterday, as markets slept, a shadow flickered across Platinum’s charts. Portfolios materialized like cryptic clues—hours before prices erupted in a 3% vertical rally. But here’s the twist: the official CME report won’t land until tomorrow. By the time most traders react, the first wave will already be history.

The Setup: Why This Move Matters

1️⃣ "The Insiders Always Whisper First"

Last times, a similar pattern in Platinum’s options market foreshadowed a 150$ surge. History doesn’t repeat, but it rhymes.

These portfolios? They’re not random. They’re telegraphs from players who trade with one eye on the horizon.

The Bottom Line

This isn’t just about Platinum. It’s about trade pattern recognition. The market rewards those who connect dots before they’re obvious.

So, ask yourself:

Are you watching the right data?

Will you be ready when the next domino falls?

Stay sharp. Stay curious. And never underestimate the whispers. 🧠💥

Bullish winds are blowing. Will you sail with them? 🌪️🚀

Do your own research or follow along with us! Two minds are preferable to one!

Platinum- While everyone is chasing Gold’s rally, I’ve got my eyes on Platinum.

- That doesn’t mean Gold is a bad investment, it just means it’s already had its moment.

- Platinum feels “delayed,” but its time is coming.

- Observe closely, this simple graph reveals a tightening triangle.

Remember my first rule: Buy the blood, not the moon.

Stay sharp. Diversify. Never go all in.

Happy Tr4Ding

XPT/USD "The Platinum" Metals Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "The Platinum" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (970.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1025.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XPT/USD "The Platinum" Metals Market is currently experiencing a bullish trend,., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GOLD SILVER PLATINUM COPPER: Metals Are Bullish! Wait For Buys!This is a FUTURES market outlook for the Metals, for the week of March 24-28th.

In this video, we will analyze the following markets:

GC | Gold

SIL | Silver

PL | Platinum

HG | Copper

The USD continues its bearish ways this upcoming weak. It's currency counterparts will likely see some upside this week. Especially the JPY.

Patience and an ear to the news will be the best way to approach the equity markets. The same would also apply to news sensitive commodity markets like US OIL, Gold and Silver.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Platinum at Key Support Zone – Will Buyers Step In?OANDA:XPTUSD is approaching a significant support zone, marked by prior price reactions and strong buying interest. This area has previously acted as a key demand zone, increasing the likelihood of a bullish bounce if buyers step in.

If the price confirms support within this zone through bullish price action—such as long lower wicks or bullish engulfing candles—we could see a reversal toward 978.700, a logical target based on previous market structure and price behavior.

However, if the price breaks below this support zone and sustains, the bullish outlook would be invalidated, potentially leading to further downside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

XPT/USD "Platinum vs US Dollar" Metals Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "Platinum vs US Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most re cent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 4H timeframe,

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1070.000 (or) Escape Before the Target

🔵Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XPT/USD "Platinum vs US Dollar" Metals Market is currently experiencing a Bullish trend., driven by several key factors.

🟢Fundamental Analysis

Demand and Supply

- Demand for Platinum is increasing due to its use in catalytic converters and investment appeal.

- Supply disruptions in South Africa, a major Platinum producer, may impact global supply.

Market News

- Platinum prices rose 1.5% yesterday due to increased demand and supply concerns.

- The US dollar index is down 0.2% today, supporting precious metal prices.

⚪Macro Economics

- Global Economic Outlook

The global economy is expected to grow at a slower pace in 2025, with a forecast of 3.0% global GDP growth rate.

- Interest Rates

The US Federal Reserve is expected to keep interest rates on hold in the near term, while the European Central Bank is expected to maintain its accommodative monetary policy stance.

- Inflation

Inflation expectations are muted, with the US Consumer Price Index (CPI) expected to rise by 2.0% in 2025.

- Geopolitics

Geopolitical tensions between the US and China remain a concern, with the potential to impact global trade and economic growth.

🔴Trader Positioning

Institutional Traders

52% short, 48% long

Retail Traders

55% long, 45% short

Hedge Funds

50% short, 50% long

COT Report

Non-Commercials (Speculators)

net long 5,500 contracts

Commercials (Hedgers)

net short 3,500 contracts

🟠Market Sentiment

Retail Sentiment

Bullish (55% of retail traders are long)

Institutional Sentiment

Bearish (52% of institutional traders are short)

Hedge Fund Sentiment

Neutral (50% of hedge funds are short, 50% are long)

🟡Overall Outlook

Based on the analysis, the overall outlook for XPT/USD is bullish in the short term, driven by increasing demand, supply concerns, and a bullish market sentiment. However, the pair may experience a short-term correction due to the bearish sentiment among institutional traders.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩