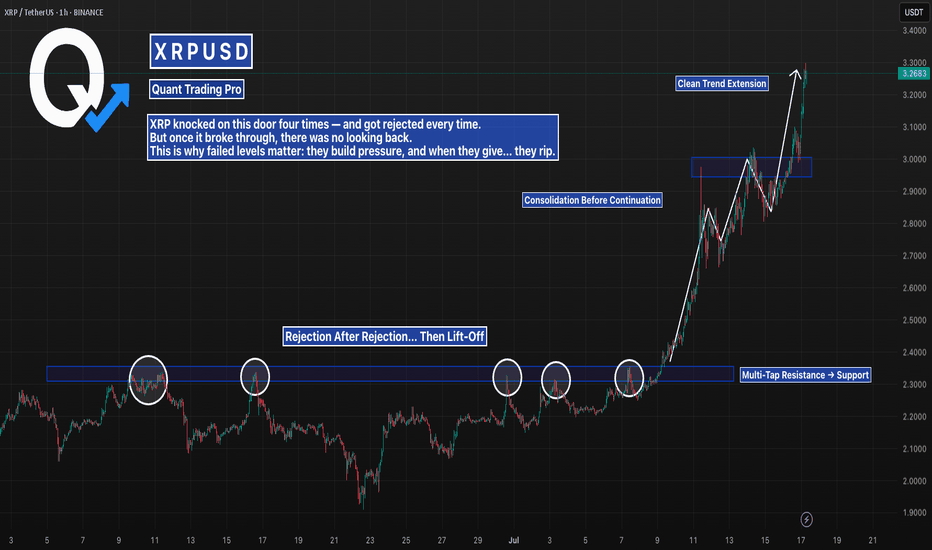

Four Failed Breakouts… Then the Real One HitThe $2.22 level stopped XRP dead in its tracks four times.

Each failed breakout built more pressure — and when it finally cleared, price exploded.

Now it’s trending clean, breaking structure after structure.

This is what a proper breakout looks like.

#XRP #XRPUSD #BreakoutTrading #ChartPatterns #FailedBreakout #CryptoSetup #BacktestEverything #TradingView #QuantTradingPro

Xrpusdlong

Xrp:The fate of Ripple in the long termhello friends👋

After a good price growth that we had, you can see that the buyers gradually exited and a triangle pattern was formed.

Now, according to the specified support, it should be seen whether buyers support Ripple or not...

You have to wait and nothing can be said until the failure of the pattern, but we suggest that you buy step by step with capital and risk management in the identified areas that are very good supports and move to the set goals.

And in the end, we must say that don't forget that we are in a strong upward trend, that the probability of the continuation of the Bister trend is the possibility of a fall...

🔥Follow us for more signals🔥

*Trade safely with us*

XRP – Dual Trends Active, Ready to Outperform - $7 Incoming

Two active trends on CRYPTOCAP:XRP right now—monthly and weekly confirmations are in, which significantly boosts the probability of hitting the first target.

Honestly, I see this outperforming CRYPTOCAP:ETH , though both are worth holding.

With both timeframes aligned, I’m expecting a strong move.

Targeting $7 on CRYPTOCAP:XRP and over $7k on $ETH.

XRP/USDT – Long-Term Breakout Setup FormingXRP has broken out of a multi-month falling channel and is showing early signs of a macro bullish shift. However, price has printed a series of strong green candles, so waiting for a clean retest before entry is advised.

Key Levels:

Support Zones: 2.5384 | 2.00 | 1.8675

Resistance Zones: 2.8340 | 4.2963 | 7.5311 | 11.9874 | 18.7488

Breakout Level: 2.5384 (channel breakout and current structure retest area)

Setup Strategy:

Entry (Ideal): On retest near 2.53–2.60 support zone

Stop Loss: Below 2.00 (or tighter depending on risk appetite)

Target 1: 4.2963

Target 2: 7.5311

Target 3: 11.9874

Target 4 (Final): 18.7488

Upside Potential: Over 600% if the structure plays out fully

Structure Insight:

Multi-month falling channel breakout confirmed

Continuous green candles suggest short-term overextension

Safer entry lies in retest and hold of the breakout zone

Long-term accumulation zone forming between 2.53–2.83

This setup favors long-term investors and swing traders waiting for a macro move. Let the price come to you — avoid chasing.

DYOR | Not Financial Advice

#XRP #Ripple

XRP Technical Analysis – Massive Breakout in Play!After months of tight consolidation inside a symmetrical triangle, XRP/USDT has finally broken out with strong bullish momentum on the daily timeframe.

🔹 Chart Pattern: Symmetrical Triangle

🔹 Breakout Confirmation: Daily candle closed above the descending trendline resistance

🔹 Support Zone: ~$2.00 – $2.20 (Held multiple times since April)

🔹 Breakout Level: ~$2.48 – $2.50

🔹 Next Resistance Levels:

▫️ $2.62 – Minor horizontal resistance

▫️ $3.39 – Major resistance from previous highs

▫️ $4.92 – Long-term macro target (measured move from triangle)

🧠 Why does this breakout matter?

✅ Strong Volume: Breakout happened with increased volume – a sign of genuine breakout

✅ Multi-month Base: The longer the consolidation, the stronger the breakout

✅ Support Respect: XRP respected the demand zone repeatedly, showing accumulation

✅ Momentum Building: A clean break could trigger trend-following bots and new buyers

XRPUSDT BINANCE:XRPUSDT Price broke above the downtrend line but faced resistance at 2.2770 dollars and started correcting. Key supports are at 2.1900 and 2.0800 dollars. If it bounces, resistances to watch are 2.2770, 2.3600, and 2.4620 dollars. Price is currently between key levels.

Key Levels:

Support: 2.1900 – 2.0800

Resistance: 2.2770 – 2.3600 – 2.4620

⚠️Contorl Risk management for trades.

XRP Pattern Repeats—Next Move to $2.34?The XRP/USDT 1-hour chart is showing a compelling setup that may mirror a previously bullish price pattern. The left side of the chart highlights Pattern 1, which played out after a period of sideways consolidation followed by a breakout, resulting in a strong upward move. Now, price action is repeating a similar structure with nearly identical conditions forming.

In Pattern 1, XRP consolidated in a tight range, flipped the trend indicator from red to blue (suggesting a momentum shift), and then surged higher. This same transition is occurring again in the current market phase. Price has reclaimed the trend baseline, which has turned blue, hinting at growing buyer strength.

The idea here is that XRP could be preparing for another impulsive move to the upside, identical to what happened before. The setup is visually marked with a trade box showing entry, stop-loss, and target levels.

Trade Idea Based on Current Pattern

• Entry: 2.2849

• Target: 2.3436

• Stop-loss: 2.2520

• Reward-to-Risk (R:R): ≈ 1.78

• Potential Gain: 2.57%

• Potential Loss: 1.44%

The structure favors a long position, as long as the price holds above the 2.25–2.26 support range. A break below this could invalidate the setup and trigger the stop-loss. If the breakout is confirmed with volume, XRP could move rapidly toward the 2.34 level and possibly beyond.

This kind of fractal behavior, where patterns repeat themselves in similar market conditions, is common in crypto. With the trend indicator already flipping bullish and price forming higher lows, the probability of continuation looks solid—especially for short-term traders.

As always, trade with proper risk management, and be cautious of volatility that can trigger stop-hunts in tightly ranged zones.

#XRP/USDT#XRP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.11.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 2.16

First target: 2.20

Second target: 2.24

Third target: 2.28

XRP Alert: $3 Bets Dominate as Massive "Wedge" Pattern SignalThe Anatomy of a Sleeper Awakened: Analyzing the $3 XRP Bet and the Decisive XRP/BTC Technical Pattern

In the relentless and often forgetful cycle of the cryptocurrency market, assets can fall into long periods of dormancy. They become laggards, overshadowed by newer, faster-growing projects, their communities tested, and their price action a flat line of disappointment on a chart full of parabolic curves. For years, XRP has been the quintessential example of such an asset. Plagued by a protracted legal battle with the U.S. Securities and Exchange Commission (SEC) and consistently underperforming its large-cap peers, it became the subject of both unwavering belief from its dedicated "XRP Army" and derision from the wider market.

However, the quietest corners of the market often hide the most tension. Beneath the surface of sideways price action, a confluence of powerful forces is beginning to emerge, suggesting that this slumbering giant may be on the verge of a violent awakening. This shift is not signaled by mainstream headlines or celebrity endorsements, but by the sophisticated and often predictive language of derivatives markets and inter-market technical analysis.

Two specific, potent signals have captured the attention of astute market observers. The first is a stunning development in the XRP options market, where call options with a $3 strike price are inexplicably dominating trading volumes. This is not a modest bet on a 20% gain; it is an audacious, seemingly irrational wager on a 500-600% price explosion. The second is a multi-year technical pattern on the XRP/BTC chart—a massive falling wedge that suggests XRP is coiling for a major rally, not just in dollar terms, but against the market's undisputed king, Bitcoin.

This analysis will conduct a deep dive into these two phenomena. We will dissect the implications of the $3 options bet, exploring the psychology and mechanics behind such speculative fervor. We will then meticulously break down the XRP/BTC wedge pattern, explaining its significance as a measure of relative strength and its potential to unleash a powerful wave of capital rotation. Finally, we will connect these market signals to the underlying fundamental drivers—the aftermath of the SEC lawsuit, Ripple's ongoing business development, and the broader market cycle dynamics—to construct a holistic thesis. While the road ahead is fraught with risk and uncertainty, the evidence suggests that the narrative surrounding XRP is undergoing a seismic shift, moving from a story of legal battles and stagnation to one of profound, speculative optimism.

________________________________________

Part 1: Decoding the Options Market Frenzy - The Audacity of the $3 Bet

To the uninitiated, the options market can seem like an esoteric and complex casino. In reality, it is a sophisticated mechanism for hedging risk and placing directional bets, and the data it generates provides an invaluable window into the collective mind of the market. The current activity in the XRP options market is not just a flicker of interest; it is a roaring fire of speculative conviction centered around a single, audacious number: $3.

Understanding the Language of Options

Before dissecting the significance of this event, it is crucial to understand the basic mechanics at play. A call option gives the buyer the right, but not the obligation, to purchase an asset at a predetermined price (the strike price) on or before a specific date (the expiration date).

For example, a trader buying an XRP call option with a $3 strike price is betting that the price of XRP will rise significantly above $3 before the option expires. If XRP were to reach, say, $4, the trader could exercise their option to buy XRP at $3 and immediately sell it for $4, pocketing the difference.

The key takeaway is that these options are leveraged instruments. A trader can control a large amount of XRP for a small upfront cost (the premium). However, if the price of XRP does not exceed the strike price by the expiration date, the option expires worthless, and the trader loses their entire premium. This makes buying far out-of-the-money (OTM) call options—where the strike price is significantly higher than the current market price—an extremely high-risk, high-reward strategy.

The Significance of the $3 Strike Price

The current market price of XRP hovers around $0.50 to $0.60. A $3 strike price, therefore, is not a bet on incremental gains. It is a bet on a monumental, life-changing rally of approximately 500%. This is what makes the situation so extraordinary. The fact that this specific strike price is the most traded in terms of volume indicates a massive concentration of speculative interest.

This phenomenon can be interpreted in several ways:

1. Extreme Bullish Conviction: The most straightforward interpretation is that a significant number of traders, from retail speculators to potentially larger funds, harbor a deep-seated belief that a major catalyst is on the horizon. This could be related to a final, favorable resolution in the SEC case, a major partnership announcement by Ripple, or the anticipated effects of a full-blown crypto bull market lifting all boats, with XRP expected to be a primary beneficiary. They are willing to risk a small premium for a chance at an exponential payout.

2. "Lottery Ticket" Mentality: A more skeptical view is that these are akin to lottery tickets. The premiums on these far OTM options are relatively cheap. A trader might spend a few hundred dollars on $3 calls, fully accepting that they will likely expire worthless. However, in the infinitesimally small chance that XRP does experience a black swan event to the upside, that small investment could turn into tens of thousands of dollars. It is a bet on volatility and a low-probability, high-impact event, rather than a nuanced analysis of fair value.

3. Potential for a Gamma Squeeze: This is a more complex but critical possibility. When a large number of call options are purchased, the market makers who sell these options are left with a short position. To hedge their risk, they must buy the underlying asset (XRP). As the price of XRP begins to rise and approach the strike price, the market makers' risk increases exponentially, forcing them to buy more and more XRP to remain hedged. This reflexive loop—rising prices forcing more buying, which in turn pushes prices even higher—is known as a gamma squeeze. The massive open interest at the $3 strike, while currently far away, builds a foundation of potential explosive fuel. If a rally were to gain serious momentum and push past $1, then $1.50, the hedging pressure on market makers would begin to mount, potentially turning a strong rally into a parabolic one.

4.

Analyzing the Volume and Open Interest

"Dominating trading volumes" means that more contracts for the $3 strike are changing hands daily than for any other strike price, whether it's a more conservative $0.75 or $1.00 call. This indicates active, ongoing betting. Open interest, on the other hand, refers to the total number of outstanding contracts that have not been settled. High open interest at the $3 strike signifies that a large number of participants are holding these positions, not just day-trading them. They are maintaining their bet over time, waiting for the anticipated price move.

The sheer concentration of both volume and open interest at such a high strike price is a powerful sentiment indicator. It tells us that the "smart money" or, at the very least, the most aggressive speculative capital, is not positioning for a minor recovery. It is positioning for a complete and total repricing of the asset. While this does not guarantee the outcome, it creates a self-fulfilling prophecy dynamic. The knowledge that this much speculative interest exists can itself attract more buyers, who want to front-run the potential squeeze.

________________________________________

Part 2: The Technical Tale of the Tape - XRP/BTC's Coiled Spring

While the options market provides a glimpse into the speculative sentiment surrounding XRP's dollar value, a far more profound story is being told on the XRP/BTC chart. This trading pair is arguably one of the most important long-term indicators for any altcoin, as it measures its performance not against a fiat currency, but against the crypto market's center of gravity: Bitcoin.

The Crucial Importance of the XRP/BTC Pair

When XRP/USD rises, it can simply mean the entire crypto market, led by Bitcoin, is in an uptrend. However, when XRP/BTC rises, it signifies something much more powerful: XRP is outperforming Bitcoin. This means that capital is actively rotating out of the market leader and into XRP, seeking higher returns. A sustained uptrend in the XRP/BTC pair is the hallmark of a true "altcoin season" for that specific asset and is often the precursor to the most explosive, parabolic moves in its USD valuation.

For the past several years, the XRP/BTC chart has been a painful sight for XRP holders. It has been in a brutal, grinding downtrend, meaning that even when XRP's dollar price rose, holding Bitcoin would have been a more profitable strategy. This long period of underperformance, however, has forged one of the most powerful bullish reversal patterns in technical analysis: a falling wedge.

Anatomy of the Falling Wedge

A falling wedge is a technical pattern that forms when an asset's price makes a series of lower highs and lower lows, with the two trendlines converging. The key characteristic is that the lower trendline (support) is less steep than the upper trendline (resistance).

• Psychology Behind the Pattern: The pattern represents a battle between buyers and sellers where the sellers are gradually losing their momentum. Each new push lower by the bears is met with more resilience from the bulls, and the price fails to fall as far as it did previously. The contracting range signifies that volatility is decreasing and energy is being stored. It is a period of consolidation that often precedes a major trend reversal. The bears are getting exhausted, and the market is coiling like a spring.

• The Breakout: The bullish signal is triggered when the price breaks decisively above the upper trendline (resistance) of the wedge. This breakout indicates that the balance of power has finally shifted from the sellers to the buyers. A valid breakout is typically accompanied by a significant increase in volume, confirming the conviction behind the move.

• Price Target: Technical analysts often measure the potential price target of a wedge breakout by taking the height of the wedge at its widest point and adding it to the breakout point. Given that the XRP/BTC wedge has been forming for several years, its height is substantial, suggesting that a successful breakout could lead to a rally of 200-300% or more against Bitcoin.

Analyzing the XRP/BTC Chart

The multi-year falling wedge on the XRP/BTC weekly and monthly charts is a textbook example of this pattern. It encapsulates the entire bear market and period of underperformance since the previous cycle's peak. The price has been tightening into the apex of this wedge for months, signaling that a resolution is imminent.

A breakout from this pattern would be a technical event of immense significance. It would signal the end of a multi-year bear market against Bitcoin and the beginning of a new cycle of outperformance. Traders and algorithms that monitor these patterns would interpret it as a major "buy" signal, potentially triggering a flood of new capital into XRP.

This technical setup provides a logical foundation for the seemingly irrational optimism seen in the options market. The traders betting on $3 XRP are likely looking at the XRP/BTC chart and seeing the same thing: the potential for a violent and sustained reversal. A 200% rally in XRP/BTC, combined with a rising Bitcoin price in a bull market, could easily provide the momentum needed to propel XRP's dollar valuation into the multi-dollar range. The two signals are not independent; they are two sides of the same coin, reflecting a deep and growing belief in an impending, historic rally.

________________________________________

Part 3: The Fundamental Undercurrents - The 'Why' Behind the 'What'

The explosive options activity and the powerful technical pattern are the "what." They are the observable phenomena. But to build a robust thesis, we must understand the "why." What fundamental shifts are occurring to justify this renewed optimism? The answer lies in a combination of legal clarity, steady business development, and predictable market cycle dynamics.

The Aftermath of the Ripple vs. SEC Lawsuit

The single greatest cloud hanging over XRP for years has been the SEC lawsuit, filed in December 2020, which alleged that XRP was an unregistered security. This created massive regulatory uncertainty, leading to its delisting from major U.S. exchanges and causing institutional capital to shun the asset.

In July 2023, a landmark summary judgment was delivered by Judge Analisa Torres. The key takeaways were:

1. Programmatic Sales of XRP on exchanges do not constitute securities transactions. This was a monumental victory for Ripple and the XRP community. It provided the legal clarity that exchanges needed to relist XRP, and it affirmed that for the average retail buyer, XRP is not a security. This removed the primary existential threat to the asset.

2. Institutional Sales of XRP were deemed securities transactions. This was a partial victory for the SEC, but it was confined to Ripple's direct sales to institutional clients in the past.

While the case is not fully over—with final remedies and penalties for institutional sales still being determined—the market has correctly interpreted the main ruling as a decisive win. The risk of XRP being declared a security across the board has been neutralized. This clarity is the single most important fundamental catalyst. It allows exchanges, investors, and partners to engage with XRP with a level of confidence that was impossible just a few years ago. The market is now looking past the remaining legal wrangling and focusing on the future.

Ripple's Unwavering Business Development

Throughout the entire legal battle, Ripple, the company, never stopped building. Its core mission is to use blockchain technology to improve cross-border payments, a multi-trillion dollar industry ripe for disruption. XRP, the digital asset, is central to its flagship product, Ripple Payments (formerly On-Demand Liquidity or ODL). This service uses XRP as a bridge currency to enable instant, low-cost international payments without the need for pre-funded nostro/vostro accounts.

Ripple has been steadily expanding its payment corridors, securing licenses in key jurisdictions like Singapore, Dubai, and Ireland, and forging partnerships with financial institutions around the globe. Furthermore, the company is actively involved in the development of Central Bank Digital Currencies (CBDCs), piloting its technology with several nations.

The recent announcement of a Ripple-issued stablecoin pegged to the U.S. dollar further expands its ecosystem. This move positions Ripple to compete in the massive and growing stablecoin market, leveraging the XRP Ledger's speed and efficiency.

This steady, behind-the-scenes progress provides a fundamental anchor to the speculative bets being placed. Unlike many crypto projects that are built on hype alone, Ripple has a real-world use case, a functioning business, and a clear strategy for capturing a share of the global payments market. The resolution of the SEC case allows this fundamental value proposition to finally come to the forefront.

The Inevitable Laggard Rotation

Finally, the optimism surrounding XRP can be explained by classic crypto market cycle dynamics. A typical bull market cycle follows a predictable pattern of capital rotation:

1. Bitcoin Leads: Capital first flows into Bitcoin, the market's most established and trusted asset.

2. Rotation to Ethereum: As Bitcoin's gains begin to slow, profits are rotated into Ethereum, the leading smart contract platform.

3. Large-Cap Altcoins: Capital then flows from Ethereum into other large-cap altcoins.

4. The Laggard Rally: Finally, in the latter stages of a bull run, traders seek out assets that have underperformed, or "lagged," the market. These laggards, often older coins with strong communities, can experience explosive catch-up rallies as a flood of speculative capital seeks the next big move.

XRP is the archetypal laggard. It has massively underperformed both Bitcoin and Ethereum for years. The bets being placed now—both in the options market and on the XRP/BTC chart—are a clear anticipation of this final, powerful stage of the market cycle. Traders are positioning themselves to front-run the great capital rotation into one of the market's most well-known but long-neglected assets.

________________________________________

Part 4: A Sobering Perspective - Risks and Counterarguments

No analysis would be complete without a balanced look at the potential risks that could invalidate the bullish thesis. While the confluence of signals is powerful, success is far from guaranteed.

1. The Options Trap: The most obvious risk is that the $3 call options are simply a mirage. The vast majority of far out-of-the-money options expire worthless. This could be nothing more than a wave of irrational exuberance from retail traders that ultimately amounts to nothing, leaving a trail of lost premiums.

2. The False Breakout: Technical patterns can fail. The XRP/BTC wedge could experience a "fakeout," where the price briefly breaks above the resistance line only to be aggressively sold back down, trapping hopeful buyers and resuming the downtrend.

3. Lingering Legal Headwinds: While the main ruling was a victory, the final penalty in the SEC case could be larger than anticipated, generating negative headlines and creating short-term selling pressure. Any future regulatory actions targeting other aspects of the crypto space could also have a chilling effect.

4. Adoption and Competition: Ripple's success is not preordained. The cross-border payments space is fiercely competitive, with traditional players like SWIFT innovating and other blockchain projects vying for market share. The ultimate success of Ripple's business model—and by extension, the utility-driven demand for XRP—is still a long-term question.

5. Centralization and Supply Concerns: A long-standing criticism of XRP is the centralized nature of its ledger and the large portion of the total XRP supply held in escrow by Ripple Labs. While Ripple has a predictable schedule for releasing this escrow, it represents a potential source of selling pressure and a point of concern for those who prioritize decentralization above all else.

Conclusion: The Convergence of Evidence

The case for a significant XRP rally is a tapestry woven from multiple, converging threads of evidence. It is not based on a single indicator but on a powerful confluence of speculative sentiment, technical structure, and fundamental catalysts.

The frenzied buying of $3 call options is the market screaming its ambition, a raw and unfiltered signal of extreme bullishness. It is a bet not just on recovery, but on a complete paradigm shift in the valuation of XRP. This audacious sentiment finds its technical justification in the multi-year falling wedge on the XRP/BTC chart—a coiled spring of potential energy that, if released, would signal a historic rotation of capital into the long-suffering asset.

Underpinning these market signals is a strengthening fundamental picture. The crucial legal clarity from the SEC lawsuit has removed the single greatest obstacle to XRP's progress, allowing the market to finally price in the steady, persistent work Ripple has done in building a global payments network. Combined with the predictable dynamics of a crypto bull cycle, where laggards eventually have their day in the sun, the stage appears to be set.

The journey to $3—and beyond—is still a marathon, not a sprint. It is fraught with the risks of failed patterns, expiring options, and the inherent volatility of the crypto market. However, for the first time in years, the narrative is not one of defense but of offense. The signals are clear: the market is no longer asking if the sleeper will awaken, but is now placing massive, leveraged bets on the magnitude of the roar it will make when it does. The current moment represents the starting gun, and for traders and investors who have been watching from the sidelines, the race for XRP's repricing may have just begun.

XRP - calm before the stormWe've got our bullish reversal sitting at the Golden Ratio price of $2.20. Fed Chairman Jerome Powell speaks today with many speculating that this will be the meeting that sends the markets soaring.

With over 17 ETFs, SWIFT update, Banks offering crypto services, BIS, XRPL EVM side chain, and many more catalyst. This could be the beginning to the largest bull run witnessed in our lifetime.

Have profits targets, an exit strategy, and plan for long-term reinvestments that will continue to make you money.

LOCK IN 🔐

$XRP ALERTCRYPTOCAP:XRP price is pushing toward breakout resistance!

Don't FOMO in yet — confirmation comes above the red zone!

Break and hold above signals bullish continuation

Rejection could lead to a pullback to the demand zone!

Resistance zone: $2.35- $2.63

Support zone: $1.92 - $2.07

Patience brings profits!

XRP/USDT Poised for Breakout from Symmetrical Triangle!Pattern Identified: Symmetrical Triangle

The symmetrical triangle is a consolidation pattern formed by a series of lower highs and higher lows, converging into a triangle shape. It reflects market indecision and often precedes a significant breakout, either upward or downward, depending on momentum and volume.

🔍 Pattern Description:

Upper Resistance Line (Descending): Connecting the lower highs since February 2025.

Lower Support Line (Ascending): Connecting the higher lows since December 2024.

Consolidation Zone: Price has been moving sideways within the triangle, indicating accumulation.

Critical Breakout Level: Around $2.23 — the price is currently testing this resistance.

📈 Bullish Scenario:

If the price successfully breaks above the upper triangle resistance with strong volume:

Target 1: $2.5855 (previous minor resistance)

Target 2: $2.9534 (key historical resistance)

Target 3: $3.2781

Maximum Target: $3.40 (local previous high and psychological level)

Breakout Confirmation: A daily candle close above $2.30 with significant volume could signal a long entry.

📉 Bearish Scenario:

If the price fails to break out and instead breaks down below the lower trendline:

Support 1: $2.00 (psychological & horizontal support)

Support 2: $1.85

Major Support: $1.55 (strong historical demand zone)

Breakdown Confirmation: A daily close below the lower triangle boundary with high volume would signal further downside.

📌 Summary:

XRP is nearing the apex of a symmetrical triangle — a major move is imminent.

A confirmed breakout could trigger a rally towards $3.40.

A breakdown may lead to a drop toward $1.55.

Recommendation: Wait for confirmation before entering long or short positions.

#XRP #XRPUSDT #CryptoBreakout #SymmetricalTriangle #XRPAnalysis #Altcoins #TradingView #TechnicalAnalysis #BullishCrypto #CryptoSignal

XRP/USD – Bearish Rejection from Resistance Zone Targets 2.0686XRP/USD Bearish Reversal Setup – H1 Chart 🕐

Analysis:

Entry Point: Price entered a short zone near 2.21828, which aligns with a previous resistance zone.

Bearish Rejection: The price formed a rejection wick and bearish candle at the resistance, signaling a potential reversal.

EMA Confluence: The price is testing below the red 50 EMA, and the 200 EMA (blue) is acting as dynamic support.

Support Zone Retest: The recent price pullback suggests a possible retest of the small support zone around 2.19106.

Target: The projected downside target is 2.06869, aligned with the prior demand zone.

Stop Loss: Positioned above resistance at 2.21828, just outside the upper rejection area.

📌 Summary:

Trend Bias: Bearish

Entry: Around 2.21828

Target: 2.06869 (≈ -6.67%)

Stop Loss: Above 2.21828

XRP/USDT Bullish Breakout Anticipation XRP/USDT Bullish Breakout Anticipation 🚀

Technical Analysis:

The chart illustrates a potential bullish setup for XRP/USDT based on price structure, support/resistance levels, and harmonic movements.

🔍 Key Observations:

Rejection From Major Support Zone (1.95 - 2.00):

Price previously tested a strong demand zone (marked as “SUPPORT”) and showed significant rejection with bullish candlestick momentum.

Series of Higher Lows ✅:

The price structure shows consecutive higher lows (green arrows), indicating rising buying pressure and bullish intent.

Break of Intermediate Resistance (2.15 - 2.18):

A breakout from the neckline area confirms bullish continuation. Price is currently retesting this level, turning resistance into support.

Target Zone at 2.35 - 2.36 🟦:

A clean target area marked by historical resistance and previous high (red arrow).

Projection indicates a possible move toward 2.3512 USDT, aligning with the measured move from the breakout structure.

Bullish Harmonic Pattern Completion 🔼:

The chart also displays a harmonic pattern completion near the recent low, suggesting a reversal point aligning with market reaction.

🎯 Trading Plan:

Entry Zone: Current retest around 2.15 - 2.18 is favorable.

Target: 2.3512 (as per projection and prior resistance zone).

Invalidation: Break below 2.10 and especially under the key support (2.00) would invalidate the setup.

📌 XRP/USDT is showing bullish strength as long as it holds above the breakout level. A sustained move could trigger momentum towards the 2.35 target zone. 💪📊

XRP to $3? Searches Surge as Whale Activity Hints at Price Boom

XRP, the cryptocurrency developed by Ripple Labs, has long been a subject of intense speculation and debate within the crypto community. Despite facing regulatory hurdles and market volatility, XRP has maintained a dedicated following, fueled by its potential to revolutionize cross-border payments. Recently, searches for "XRP to $3" have surged, reflecting renewed optimism among investors as the token exhibits signs of increased whale activity, institutional buying, and rising retail interest.

This article delves into the factors driving the renewed interest in XRP, examining the recent price movements, whale activity, and technical indicators that suggest a potential surge to $3. We will analyze the significance of the breakout above $2.20, the consolidation phase below this level, and the potential for XRP to reach $3.40. Furthermore, we will explore the factors that could either support or hinder XRP's ascent, providing a nuanced perspective on the potential for this cryptocurrency to reach new heights. By synthesizing these insights, we aim to offer a comprehensive overview of the factors that could shape XRP's price trajectory in the coming months.

Whale Activity and Institutional Buying: A Bullish Signal?

One of the key factors driving the renewed interest in XRP is the observed increase in whale activity. Whales, defined as individuals or entities holding large amounts of a particular cryptocurrency, can have a significant impact on market prices due to their ability to execute large buy or sell orders.

Recent data suggests that whales have been accumulating XRP, with whale-to-exchange transfers dropping to zero. This indicates that whales are not selling their XRP holdings, but rather holding onto them or even buying more. This accumulation by whales is often seen as a bullish signal, as it suggests that they believe the price of XRP is likely to increase in the future.

In addition to whale activity, there are also signs of increasing institutional buying of XRP. Institutional investors, such as hedge funds, asset managers, and corporations, are increasingly allocating capital to cryptocurrencies, including XRP. This increased institutional adoption can drive up the price of XRP and provide a more stable foundation for its long-term growth.

Breakout Above $2.20: A New Support Level

Another factor driving the renewed interest in XRP is the recent breakout above $2.20. This breakout is significant because it confirms a new support level for XRP. A support level is a price level at which buyers are likely to step in and prevent the price from falling further.

The breakout above $2.20 suggests that there is strong buying pressure for XRP at this level. This buying pressure could be driven by a combination of factors, including whale activity, institutional buying, and rising retail interest.

Consolidation Below $2.20: A Pause Before the Next Rally?

After breaking out above $2.20, XRP has entered a period of consolidation below this level. This consolidation phase is a normal part of the market cycle, allowing the market to digest the recent gains and prepare for the next leg up.

During the consolidation phase, the price of XRP is likely to fluctuate within a narrow range. This fluctuation can create opportunities for traders to buy low and sell high, but it can also be a period of uncertainty for investors.

The key question is whether the consolidation phase is a temporary pause before another rally or a sign that the breakout above $2.20 was a false signal. If the price can hold above $2.20 and eventually break out above the upper resistance levels, it would confirm the validity of the breakout and increase the likelihood of XRP reaching $3.

Potential for XRP to Reach $3.40: A Technical Target

Several analysts have suggested that XRP could potentially reach $3.40 in the near future. This target price is based on technical analysis, which involves studying price charts and other market data to identify patterns and predict future price movements.

One of the technical indicators that suggests a potential rally to $3.40 is the bull flag pattern. The bull flag is a bullish continuation pattern that signals a continuation of an existing uptrend. If XRP can break out above the upper trendline of the bull flag, it could potentially reach $3.40.

Another technical indicator that suggests a potential rally to $3.40 is the Fibonacci retracement levels. Fibonacci retracement levels are horizontal lines that are drawn on a price chart to identify potential support and resistance levels. If XRP can break above the Fibonacci retracement levels, it could potentially reach $3.40.

Technical Indicators: CMF and MACD Show Bullish Momentum

In addition to the bull flag pattern and Fibonacci retracement levels, other technical indicators also suggest that XRP is poised for a potential rally.

The Chaikin Money Flow (CMF) is a technical indicator that measures the amount of money flowing into or out of an asset. A positive CMF value indicates that money is flowing into the asset, which is a bullish signal. The CMF for XRP is currently positive, suggesting that there is strong buying pressure for the cryptocurrency.

The Moving Average Convergence Divergence (MACD) is a technical indicator that shows the relationship between two moving averages of an asset's price. A bullish MACD crossover occurs when the MACD line crosses above the signal line, which is a bullish signal. The MACD for XRP is currently showing a bullish crossover, suggesting that the cryptocurrency is poised for a potential rally.

Factors Hindering XRP's Ascent

While there are several factors that suggest XRP could reach $3 or even $3.40, it is important to acknowledge that there are also factors that could hinder its ascent.

• Regulatory Uncertainty: XRP has faced regulatory challenges in the past, and ongoing regulatory uncertainty could dampen investor sentiment and prevent the cryptocurrency from reaching its full potential. The lawsuit filed by the Securities and Exchange Commission (SEC) against Ripple Labs continues to cast a shadow over XRP's future.

• Market Volatility: The cryptocurrency market is known for its volatility, and sudden price swings could wipe out gains and deter investors.

• Competition: XRP faces competition from other cryptocurrencies and traditional payment systems.

• Demand Fades: If demand for XRP fades, the price could fall back to previous support levels, such as $1.54.

XRP Bulls On Alert: 'This Trendline Is Everything'

Despite the potential challenges, XRP bulls remain optimistic about the cryptocurrency's future. Many analysts have emphasized the importance of a key trendline, stating that "this trendline is everything." This trendline represents a critical support level that must be maintained for XRP to continue its upward trajectory.

If XRP can hold above this trendline, it would signal that the bullish momentum remains intact and that the cryptocurrency is on track to reach its potential targets. However, if the price breaks below this trendline, it could indicate that the bullish momentum is fading and that a further correction is likely.

XRP Price Prediction: Possible Bullish Moves Ahead

Based on the current market conditions, technical indicators, and whale activity, there are signs that suggest possible bullish moves ahead for XRP. However, it is important to remember that the cryptocurrency market is inherently unpredictable, and there is no guarantee that XRP will reach $3 or $3.40.

Investors should carefully consider the risks involved and conduct thorough research before making any investment decisions. It is also important to diversify your portfolio and avoid putting all of your eggs in one basket.

Conclusion

Searches for "XRP to $3" have surged, reflecting renewed optimism among investors as the token exhibits signs of increased whale activity, institutional buying, and rising retail interest. The breakout above $2.20, the consolidation phase below this level, and the potential for XRP to reach $3.40 are all factors that have contributed to this renewed interest.

However, it is important to acknowledge that there are also factors that could hinder XRP's ascent, such as regulatory uncertainty, market volatility, and competition. Investors should carefully consider the risks involved and conduct thorough research before making any investment decisions.

Ultimately, the future of XRP's price will depend on a complex interplay of technical factors, market sentiment, and fundamental developments. By staying informed and using proper risk management techniques, investors can position themselves to potentially profit from XRP's continued growth and success. As always, remember to consult with a qualified financial advisor before making any investment decisions. The potential for XRP to reach $3 offers a tantalizing glimpse of potential gains, but prudent analysis and risk mitigation are essential for navigating the volatile world of cryptocurrency.

XRP Price Soars Past $2.15: Next Stop $2.38? XRP Price Prediction: What’s Next After Breaking $2.15 Resistance?

Ripple’s XRP has been making waves in the cryptocurrency market, recently breaking above the critical $2.15 resistance level and surging nearly 8% in the last 24 hours to trade at $2.18. With a further 9% climb in recent sessions and open interest jumping to $3.77 billion, the coin is showing strong bullish momentum. Analysts are now eyeing targets of $2.33 and even $2.38 in the near term. But what lies ahead for XRP after this breakout? Is this the start of a sustained rally, or could resistance at higher levels cap the gains?

________________________________________

XRP Price Action: Breaking Key Resistance at $2.15

XRP’s recent price surge has caught the attention of traders and investors alike. After trading in a consolidation range for weeks, the cryptocurrency initiated a fresh increase from the $1.92 zone, gaining momentum as it approached the $2.00 level. A significant development came when XRP broke above a key bearish trend line with resistance at $2.00 on the hourly chart of the XRP/USD pair (data sourced from Kraken). This breakout was followed by a decisive move past the $2.15 resistance, a level that had previously capped upward movements.

Currently, XRP trades above $2.18, sitting comfortably above the 100-hourly Simple Moving Average (SMA), a widely watched indicator of short-term trend direction. The price action over the last 24 hours shows an 8.2% increase, with some sessions recording gains as high as 14%, particularly following geopolitical developments like the Iran-Israel ceasefire, which boosted risk assets across markets. This recovery from the $1.90 low demonstrates strong buying interest and renewed confidence in XRP’s potential.

The immediate question for traders is whether XRP can sustain this momentum. The next resistance zone lies between $2.20 and $2.33, with some analysts even targeting $2.38 based on rising open interest and market volume. A close above $2.18 in the coming hours could signal the start of another leg up, while failure to hold this level might see a pullback toward $2.10 or lower.

________________________________________

Technical Analysis: Bullish Indicators and Key Levels to Watch

To understand XRP’s potential trajectory, let’s dive into the technical indicators and key levels shaping its price action.

Support and Resistance Levels

• Support: The $2.10 level, previously a resistance, now acts as a near-term support alongside the 100-hourly SMA. A break below this could see XRP test the $2.05 zone, with further downside potential to $1.92 if bearish pressure mounts.

• Resistance: The immediate hurdle lies at $2.20, a psychological barrier that has historically posed challenges. Beyond this, $2.33 emerges as a critical target, as breaking this level could confirm a short-term bullish continuation. Analysts also highlight $2.38 as a feasible target if momentum persists.

Moving Averages and Trend Indicators

XRP’s position above the 100-hourly SMA is a bullish sign, indicating that buyers are in control of the short-term trend. Additionally, the price recently crossed above the 50-hourly SMA during its 14% surge, further reinforcing the bullish outlook. The convergence of these moving averages suggests that a golden cross—a bullish signal where a shorter-term average crosses above a longer-term average—could be forming on lower timeframes, potentially attracting more buyers.

Relative Strength Index (RSI)

The RSI on the hourly chart currently sits around 65, indicating that XRP is approaching overbought territory but still has room to run before reaching extreme levels (above 70). This suggests that the current rally could extend further, provided no major negative catalysts emerge.

Volume and Open Interest

One of the most encouraging signs for XRP bulls is the surge in trading volume and open interest. Open interest in XRP futures has jumped to $3.77 billion, reflecting growing speculative interest and confidence in further price gains. High volume accompanying the breakout above $2.15 adds credibility to the move, as it indicates genuine market participation rather than a low-liquidity pump.

Symmetrical Triangle Pattern

On the longer-term charts, XRP has been forming a 334-day symmetrical triangle, a consolidation pattern often preceding major breakouts. Analysts predict that this pattern could resolve between July and September 2025, with potential targets ranging from $2 to $5 depending on the direction of the breakout. The recent move above $2.15 could be an early indication of bullish intent, though confirmation of a full breakout from the triangle remains months away.

________________________________________

XRP Price Prediction: Short-Term Outlook (Next 24-48 Hours)

Given the current momentum, XRP appears poised for further gains in the immediate term. Analysts predict a potential 7% move toward $2.33 within the next 24 hours if the price maintains its position above $2.18. This target aligns with the upper boundary of the recent trading range and represents a key Fibonacci retracement level from the prior downtrend.

However, traders should remain cautious of the $2.20 resistance zone, where selling pressure could emerge. A failure to close above this level on the hourly or 4-hour charts might trigger profit-taking, leading to a pullback toward $2.10 or $2.05. On the flip side, a decisive break above $2.20 with strong volume could pave the way for a test of $2.33 and potentially $2.38 in the coming days.

________________________________________

What XRP Users Are Talking About This Week: Rumors, Predictions, and Debates

The XRP community has been abuzz with discussions this week, fueled by the coin’s impressive price action and broader market developments. Here are some of the key topics dominating conversations on platforms like Twitter, Reddit, and crypto forums:

1. Geopolitical Impact on XRP: The recent Iran-Israel ceasefire has been credited with boosting risk-on sentiment across markets, including cryptocurrencies. Many XRP holders believe this event contributed to the 14% surge that saw the price reclaim $2.00, with some speculating that further de-escalation could drive additional gains.

2. Regulatory Clarity for Ripple: Ongoing debates about Ripple’s legal battle with the U.S. Securities and Exchange Commission (SEC) continue to influence sentiment. While a resolution seems closer than ever, with rumors of a potential settlement circulating, uncertainty remains a key concern. A favorable outcome could act as a major catalyst for XRP, potentially pushing it toward new highs.

3. Adoption and Utility: XRP users are excited about Ripple’s continued partnerships with financial institutions for cross-border payments. Recent announcements of pilot programs in new regions have fueled speculation that increased adoption could drive organic demand for XRP, supporting long-term price appreciation.

4. Price Predictions: Community predictions range from conservative targets of $2.50 in the near term to more ambitious forecasts of $5 or higher by the end of 2025. Much of this optimism hinges on the symmetrical triangle breakout expected next year, as well as broader market trends like the Bitcoin halving in 2024.

These discussions highlight the mix of optimism and caution within the XRP community. While the recent breakout has bolstered confidence, many users remain wary of external factors like regulatory developments and macroeconomic conditions that could impact the coin’s trajectory.

________________________________________

XRP Climbs 9% as Open Interest Jumps to $3.77B: Eyes $2.38 Target

XRP’s 9% climb in a recent session, coupled with open interest soaring to $3.77 billion, underscores the growing interest from both retail and institutional traders. Open interest represents the total value of outstanding derivative contracts, and its sharp increase suggests that market participants are betting on continued price movement—likely to the upside given the current trend.

This surge in open interest aligns with XRP’s break above $2.15, reinforcing the notion that the rally has strong backing. Analysts now eye a $2.38 target, which corresponds to the 61.8% Fibonacci retracement level from the previous major swing high to low. Achieving this target would require sustained buying pressure and a break above the $2.33 resistance, but the current market dynamics suggest it’s within reach if no major sell-offs occur.

However, high open interest also introduces the risk of volatility. If the price fails to break higher and sentiment shifts, a wave of liquidations could amplify downside moves. Traders should monitor funding rates on futures platforms to gauge whether speculative positions are becoming overly leveraged, as this could signal an impending correction.

________________________________________

Ceasefire Boosts XRP Recovery: Bullish Continuation

Above $2.33?

The geopolitical landscape has played a surprising role in XRP’s recent recovery. Following a low of $1.90 amid broader market uncertainty, the announcement of a ceasefire between Iran and Israel injected optimism into risk assets, including cryptocurrencies. XRP responded with a 14% jump to reclaim the $2.00 level, a move that has since solidified with the break above $2.15.

This recovery highlights XRP’s sensitivity to external catalysts. While technical factors like resistance levels and chart patterns drive day-to-day price action, macro events can act as significant tailwinds or headwinds. If the ceasefire holds and global markets remain stable, XRP could see continued buying interest from investors seeking exposure to high-growth assets.

The key level to watch now is $2.33. A break above this resistance with strong volume could confirm a short-term bullish continuation, potentially targeting $2.38 or higher. Conversely, if geopolitical tensions resurface or broader market sentiment sours, XRP might struggle to maintain its gains, with $2.10 acting as the first line of defense.

________________________________________

When Will XRP Price Hit All-Time High? Timeline Revealed

XRP’s all-time high (ATH) of $3.84, reached during the 2017-2018 bull run, remains a distant target for many holders. However, recent technical developments and market trends provide clues about when the coin might approach or surpass this level.

Symmetrical Triangle Breakout: July–September 2025

As mentioned earlier, XRP has been forming a 334-day symmetrical triangle on the weekly chart, a pattern characterized by converging trendlines as price swings narrow over time. Such patterns often precede significant breakouts, with the direction determined by market sentiment at the time of resolution. Analysts predict that this triangle could break between July and September 2025, offering a window for a major price move.

If the breakout is bullish, targets range from $2 (a conservative estimate based on prior resistance) to $5 (a more optimistic projection based on the triangle’s height). A $5 target would represent a new ATH, surpassing the 2018 peak by over 30%. This scenario assumes favorable market conditions, including a broader crypto bull run potentially triggered by the Bitcoin halving in 2024.

Factors Influencing an ATH

Several factors could influence whether XRP reaches a new ATH within this timeline:

• Regulatory Resolution: A positive outcome in Ripple’s SEC lawsuit could remove a major overhang, unlocking significant upside potential.

• Market Cycles: Crypto markets often follow cyclical patterns, with bull runs occurring every 3-4 years. If 2025 aligns with the next cycle peak, XRP could ride the wave to new highs.

• Adoption Growth: Increased use of XRP for cross-border payments through RippleNet could drive organic demand, supporting a higher price floor.

• Macro Environment: Favorable economic conditions, such as low interest rates or stimulus measures, could boost risk assets like XRP.

While predicting an exact date for an ATH is impossible, the July–September 2025 window provides a reasonable timeframe for a potential breakout. Investors should remain attentive to technical confirmation and external catalysts as this period approaches.

________________________________________

XRP Price Reclaims Key Resistance: Are More Gains on the Horizon?

XRP’s reclaiming of the $2.10 and $2.15 levels marks a significant milestone in its recovery from the $1.92 low. This move above key resistance zones suggests that bullish momentum is building, with the potential for further gains if higher levels are breached.

The price is now trading above $2.18, and a close above $2.20 could signal the start of a fresh increase. However, the $2.20-$2.33 range remains a critical battleground. Bulls will need to defend recent gains while pushing for a decisive break above these levels to confirm the next leg up. If successful, targets of $2.38 and beyond come into play, aligning with analyst predictions and Fibonacci extensions.

On the downside, a failure to hold $2.10 could see XRP retest lower supports at $2.05 or $1.92. Such a pullback would not necessarily invalidate the bullish trend but could delay the anticipated rally toward higher targets. Traders should use stop-loss orders and monitor volume trends to manage risk during this volatile period.

________________________________________

Long-Term XRP Price Prediction: $2 to $5 by 2025?

Looking beyond the immediate term, XRP’s long-term outlook remains optimistic, contingent on several key developments. The symmetrical triangle pattern, if resolved bullishly, could propel XRP toward $2-$5 by the end of 2025. This range accounts for both conservative and aggressive scenarios, with the higher end assuming a full market cycle peak and positive catalysts like regulatory clarity.

Even in a more cautious scenario, XRP appears well-positioned to reclaim its prior highs above $3 if adoption continues to grow and broader crypto sentiment remains favorable. Key drivers include Ripple’s expansion into new markets, potential listings on major exchanges post-SEC resolution, and technological upgrades to the XRP Ledger that enhance scalability and utility.

However, risks remain. Regulatory setbacks, competition from other payment-focused cryptocurrencies, and macroeconomic downturns could cap XRP’s upside. Investors with a long-term horizon should diversify their portfolios and remain adaptable to changing market conditions.

________________________________________

Conclusion: XRP’s Path Forward After $2.15 Breakout

XRP’s recent breakout above the $2.15 resistance has ignited optimism among traders and investors, with the coin now trading at $2.18 after an 8.2% surge in 24 hours. Technical indicators like the 100-hourly SMA and rising open interest of $3.77 billion support a bullish near-term outlook, with targets of $2.33 and $2.38 in sight if momentum holds. The geopolitical boost from the Iran-Israel ceasefire and ongoing community discussions about adoption and regulation further fuel the narrative of potential gains.

In the short term, XRP must overcome resistance at $2.20 to confirm the next leg up, while holding support at $2.10 to avoid a pullback. Looking further ahead, the symmetrical triangle pattern suggests a major breakout window between July and September 2025, with price targets ranging from $2 to $5—potentially marking a new all-time high if conditions align.

While challenges like regulatory uncertainty and market volatility persist, XRP’s current trajectory indicates that more gains could be on the horizon. Traders and investors should stay vigilant, monitoring key levels, volume trends, and external catalysts to capitalize on this evolving opportunity. Whether XRP sustains its rally or faces a correction, one thing is clear: the cryptocurrency remains a focal point of excitement and speculation in the ever-dynamic crypto market.

XRP Still in Buy Zone – Eyes on $2.50+our chart clearly marks that XRP has bounced off a strong buy zone (around the $2.10–$2.15 range), aligning well with a classic setup: price hitting support, creating a small base, and starting an upward rotation. 👇

Support area respected – The highlighted circle shows XRP revisiting the demand zone and quickly rebounding, very bullish behavior.

Lower wicks & volume spike – Indicate absorption of selling pressure and possible institutional interest.

Green arrow projection – Suggests a break above the immediate resistance (~$2.17 EMA/Ichimoku levels) could trigger a rally toward the next resistances around $2.22, $2.47, and potentially $2.63.

“Still in buy zone” annotation – Absolutely valid: as long as XRP stays above that key base ($≈$2.10), the bullish case holds.

🔍 Market Context

Range consolidation between ~$2.10–$2.30 has been the dominant theme, awaiting a breakout catalyst (e.g., ETF approvals or legal clarity)

thecryptobasic.com

+14

fxempire.com

+14

crypto.news

+14

.

Analysts highlight a falling wedge and support zone between $2.00–$2.20—if price holds, a move toward $3–$4 is plausible .

A range-bound weekly outlook anticipates a push toward $2.50 resistance before exploring higher targets .

✔️ Summary

Buy zone holding: Bullish pattern confirmed with rebound from support.

Key resistance levels: Watch for a breakout above $2.17/EMA and then $2.22–$2.30/$2.50.

Ideal strategy: Maintain position above support; add on breakout, targeting $2.50–$3.00.

Risk points: A drop below $2.10 could test $2.00 or even $1.85 support.

#XRP/USDT#XRP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.21.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading for stability above the 100 Moving Average.

Entry price: 2.24

First target: 2.27

Second target: 2.30

Third target: 2.35