Xrp - It all comes down to this!🚀Xrp ( CRYPTO:XRPUSD ) has to break structure:

🔎Analysis summary:

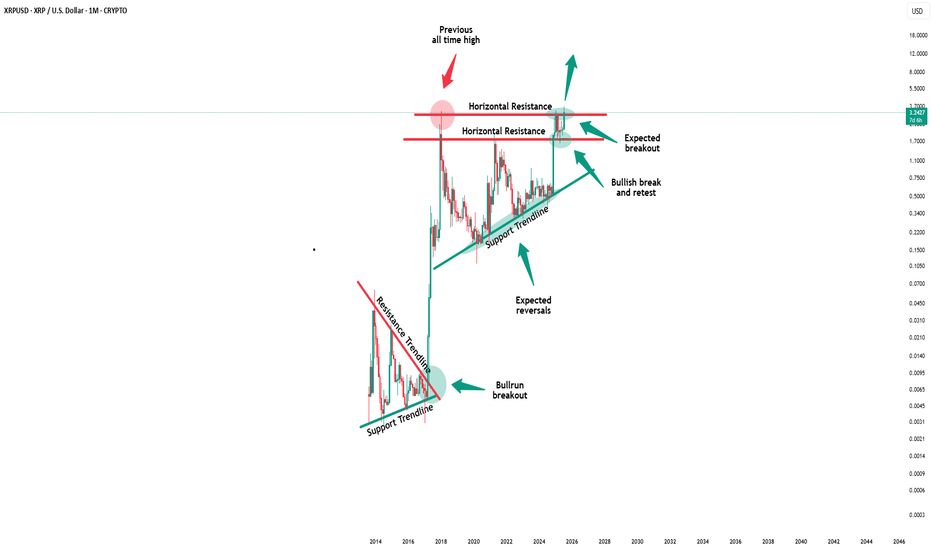

After Xrp created the previous all time high in 2018, we have been seeing a consolidation ever since. With the recent all time high retest however, Xrp is clearly showing some considerable strength. It all comes down to bulls being able to push price higher, above the massive horizontal structure.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Xrpusdsignal

Xrp - This is the bullrun breakout!🔑Xrp ( CRYPTO:XRPUSD ) breaks the triangle now:

🔎Analysis summary:

After the recent bullish break and retest, Xrp managed to already rally another +100%. This is a clear indication that bulls are still totally in control of cryptos and especially Xrp. It all just comes down to the all time breakout, which will then lead to a final parabolic rally.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

The Great XRP Escape Plan: Thief Strategy Deployed🌀 XRP/USDT – Thief Trader’s Master Heist Plan: Crack the Vault Before They Catch On! 🧠💰

🔐💸 Operation Code: Ripple Raid 3.9 - Eyes on the Prize, Hands on the Trigger 💥

🌍 Attention Global Market Robbers and Strategic Money Movers!

This ain't just another analysis—this is the Thief Trading Style Blueprint, surgically designed for the XRP/USDT Crypto Market. Whether you're a silent sniper or full-squad raider, this trade setup is your next high-voltage money heist.

🔍 Market Breakdown:

📊 Technical + Fundamental = Robbery Precision

Currently, Ripple (XRP) is showing bullish fuel—charging into our trap-the-bears zone. Volatility is tightening, resistance is trembling, and it smells like liquidity is about to get stolen.

⚠️ Warning: The market’s at a risky cross-zone – overbought with heavy consolidation – where big bears and trapped traders usually play defense. That’s exactly where we strike.

🔓 Entry Gameplan – “Wait, Trigger, Execute”

📈 Entry:

"The heist begins when the candle breaks the high and screams confirmation!"

Set Buy Stop Orders above the recent resistance (around 3.1000).

Alternatively, use Buy Limit Orders on pullbacks at key swing levels (15M or 30M timeframes).

We use a multi-layered entry strategy (aka DCA + stacking like a pro thief stacking vaults). Be surgical. Be patient.

📌 Pro Tip: Always set a chart alert at the trigger zone to avoid missing the breakout party.

🛑 Stop Loss – “Breakout First, Then Talk Safety”

🚫 NO SL BEFORE BREAKOUT. Period.

Once price breaks out, then:

🔐 SL = Nearest 4H candle wick swing low (around 2.8000).

But remember, your SL = your risk appetite.

Whether you're placing 1 big order or 10 mini traps, manage it smart.

🎯 Target – "Get Rich, Then Vanish"

🏴☠️ Primary Take Profit Zone:

Target: 3.9000

Or exit anytime you see signs of reversal.

Don't get greedy—get paid.

👀 Scalpers’ Note:

Only play the Long side.

If you're deep-pocketed, dive in straight. If not, ride with swing traders and trail your SL to protect profits.

🔥 Why This Trade is 🔐:

📈 Current price structure, liquidity zones, and momentum favor bulls.

📊 Correlated intermarket signals + on-chain activity + macro backdrop align with XRP strength.

🧠 Smart money accumulation is visible – this is your window before the big breakout.

🚨 News & Position Management Alert:

📢 Stay clear of opening trades during major news events.

Use Trailing Stop-Loss on running positions to lock gains while letting profits fly.

This is not hype. This is precision.

Thief Trader doesn’t guess – we plan, we trigger, we exit.

📌 Final Words:

Whether you're scalping seconds or swinging for days – follow the blueprint. XRP has a vault to crack, and we’re here to rob it clean.

Now go out there, set those traps, and let the market pay you like it owes you.

🧠💸🕶️ Next Heist Plan Coming Soon… Stay Sharp.

XRP Price Struggles as Key Holders’ Outflows Hit 7-Month HighBINANCE:XRPUSDT is currently priced at $2.99 , sitting just below the $2.95 resistance. The bearish market sentiment and outflows are evident, making it difficult for the altcoin to break through this resistance. A continuation of the current trend may lead to further downward pressure on the price.

BINANCE:XRPUSDT longer-term outlook is also influenced by its HODLer net position change, which has reached a seven-month low . The LTHs, who have a significant impact on the price of XRP, are seeing their positions decrease

BINANCE:XRPUSDT is likely to test the support of $2.65 in the coming days, unless investors shift their sentiment. If this support level fails to hold, XRP may experience further losses, putting additional strain on the altcoin and its investors.

To recover, BINANCE:XRPUSDT will need to reclaim $2.95 as support and break through the $3.00 mark . A successful breach of these levels could pave the way for a move towards $3.41, ultimately invalidating the current bearish outlook and offering hope for a potential recovery.

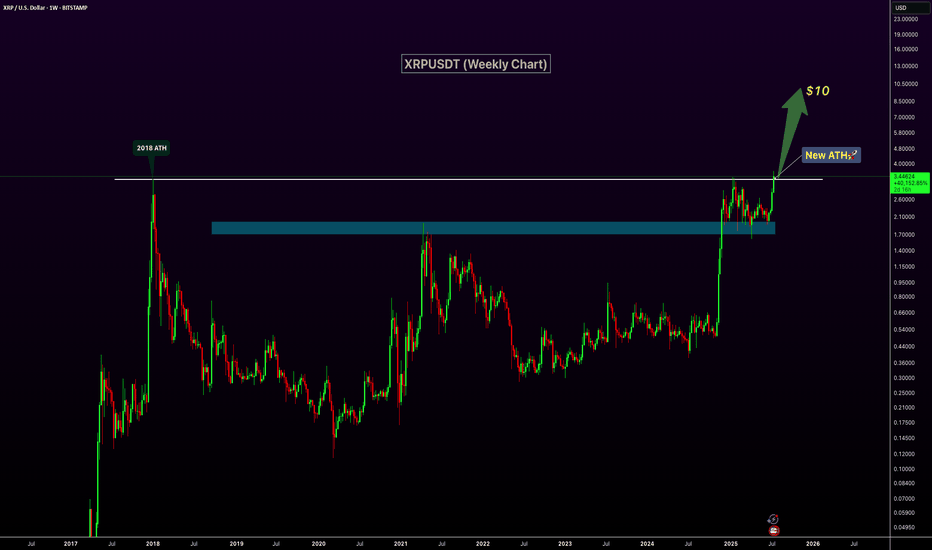

XRP Price Prediction: Is a Breakout to $15 Imminent? XRP Breakout Targets $15 — Analyst Says 'This Is Just The Start': Is XRP Set to Explode?

The cryptocurrency world is once again turning its attention to XRP, the token developed by Ripple Labs, as bullish analysts predict an imminent and explosive rally. After a strong run-up earlier in 2025, XRP has pulled back slightly and is now approaching a critical support zone. Some analysts are now calling for a $15 breakout target, even as the token hovers near $2.80, a level many see as a pivotal point for the next leg of the bull market.

Let's dive into the latest developments, technical analysis, and market sentiment surrounding XRP — and why some believe "this is just the start."

XRP Price Overview: Current Positioning

As of early August 2025, XRP is trading around the $2.85 mark, down from its recent high near $3.70. While this pullback may concern short-term traders, technical analysts argue that this retracement is healthy and necessary for the formation of a higher low, a common pattern in bullish market structures.

The key price levels to watch include a support zone between $2.80 and $2.95, resistance at $3.70, downside risk to $2.20 if $2.80 fails, and upside targets of $5 in the short term and $15 in the mid-term.

Why $2.80 Is So Important

The $2.80 support level is emerging as a make-or-break price zone. It aligns with multiple technical indicators including the 0.618 Fibonacci retracement from the previous rally, the Value Area High (VAH) from recent price accumulation zones, and Higher Time Frame (HTF) structure showing consistent support around this level in recent months.

If XRP manages to hold this level and establish a higher low, it could kick off a new bullish wave, potentially targeting $5 in the short term and beyond in the medium term.

Analysts Call for $15 XRP — Is It Possible?

Several key factors support the bull case. Institutional interest continues to grow as Ripple's partnerships with banks and financial institutions support long-term utility. Legal clarity has improved significantly after years of regulatory uncertainty, with the SEC lawsuit largely resolved, removing a major overhang. Technical indicators including bullish divergence on the RSI, MACD bullish crossover, and increasing volume all support upward momentum. Additionally, as Bitcoin stabilizes, funds are flowing into major altcoins, including XRP, as part of the typical altcoin rotation cycle.

August Rally Incoming? Bullish Divergence Signals 20% Upside

Technical analysts have identified a bullish divergence forming on the daily and 4-hour charts — a classic signal that often precedes a strong move upward. This divergence appears as the price makes lower lows while the RSI makes higher lows, suggesting momentum is shifting in favor of the bulls.

If confirmed, this divergence could catalyze a 20% rally in August, potentially pushing XRP back above $3.40 and testing the critical $3.70 resistance. A clean break above this level would likely open the floodgates for further gains.

$3.70: The Gatekeeper to Higher Highs

While there's excitement around the potential for XRP to hit $5 or even $15, the path forward must first go through $3.70. This resistance level has stalled price action multiple times in 2025 and will likely serve as a psychological and technical barrier.

Two scenarios are possible: a break above $3.70 would open the door to $5 and $7 targets quickly, while a rejection at $3.70 could lead to a pullback toward $2.20, especially if $2.80 fails.

Traders Hedge With New XRP Rival: Remittix

As XRP consolidates, some traders are diversifying their holdings into Remittix (RTX), a new cross-border payments token that promises enhanced scalability and compliance tools. RTX has gained traction recently, especially among DeFi-native traders seeking alternatives to XRP's centralized development model.

Remittix highlights include strong tokenomics with a deflationary model and staking rewards, a real-world use case targeting remittance markets in Asia and Africa, and a PayFi Wallet with beta slated for launch in Q3 2025, offering seamless integration with fiat on/off ramps.

While Remittix is gaining momentum, XRP's brand recognition, liquidity, and institutional partnerships still give it a significant edge in the payments space.

XRP Price Forecast: Short-Term and Long-Term Outlook

In the short term over the next 30 days, the bullish scenario involves holding $2.80 support, breaking $3.70, and rallying to $5. The bearish scenario would see XRP lose $2.80, drop to $2.20, and consolidate.

For the mid-term outlook in Q4 2025, if the bullish trend continues and macro conditions remain favorable, XRP could target $7 to $10 by the end of the year. In a full altseason scenario, $15 is not out of reach, according to some analysts.

Key Catalysts That Could Drive XRP Higher

Several catalysts could propel XRP higher. Institutional adoption continues to expand as Ripple's partnerships, especially in the Middle East and Asia-Pacific, lay the groundwork for long-term utility. CBDC integration presents another opportunity as Ripple works with multiple central banks on developing Central Bank Digital Currencies. Any progress here could significantly boost XRP's real-world use.

ETP listings could bring new inflows as XRP may benefit from exchange-traded products in Europe and Asia, especially if more crypto-based ETFs gain traction globally. The macro environment also favors growth, with a dovish Fed, weakening USD, and rising crypto adoption all creating a fertile environment for altcoins like XRP to thrive.

Community Sentiment: Is the XRP Army Ready?

The XRP community, also known as the XRP Army, remains one of the most passionate and active in the crypto space. Social media sentiment has turned increasingly bullish, with hashtags like #XRPToTheMoon and #XRP15 trending on X (formerly Twitter).

However, analysts caution against overexuberance, noting that market cycles can be volatile and unpredictable.

Risks to Watch

While the bullish case is compelling, it's important to consider the risks. Macro-economic shocks from a sudden shift in interest rates or recession fears could impact crypto markets broadly. Regulatory setbacks remain possible — although Ripple has gained legal clarity in the U.S., future regulations in Europe or Asia could cause volatility.

Network risks from any technical issues or security breaches could erode trust and trigger selloffs. Competition from new projects like Remittix, Stellar (XLM), and other payment-focused tokens could eat into XRP's market share.

Final Thoughts: Is XRP Set to Explode?

With XRP hovering near a critical support zone at $2.80, all eyes are on whether bulls can defend this level and push the token back into an uptrend. If successful, the next moves could be explosive, with analysts forecasting $5 in the short term and potentially $15 or higher before the end of 2025.

While risks remain, the technical setup, improving fundamentals, and renewed community optimism all point toward a bullish continuation — if key levels hold.

As always, investors should stay informed, manage risk, and avoid emotional decisions in this fast-moving market.

Summary

XRP currently trades around $2.85 with key support at $2.80 and major resistance at $3.70. Short-term targets point to $5 while mid-term projections suggest $10 to $15 is possible. Downside risk exists to $2.20 if support fails. Bullish catalysts include legal clarity, growing utility, and increasing adoption, while bearish risks encompass macro shocks, competition, and potential regulation.

Disclaimer

This article is for informational purposes only and is not financial advice. Cryptocurrency investments are highly volatile and involve significant risk. Always do your own research (DYOR) and consult with a financial advisor before making investment decisions.

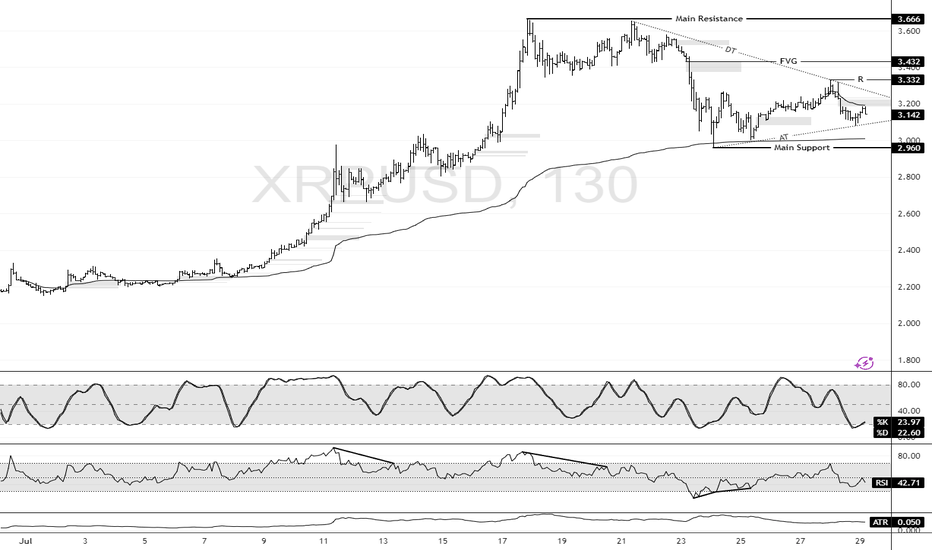

XRP: Support at $2.960 Holds the Bullish SetupFenzoFx—XRP dipped from $3.666 but stabilized near the monthly anchored VWAP at $2.960. It now trades at $3.142 above the ascending trendline.

Immediate resistance lies at $3.332, aligned with the descending trendline. A close above this level may propel XRP to $3.432. Strong buying could extend gains to the recent high of $3.666.

The bullish outlook stands while XRP/USD holds above key support at $2.960. A drop below this level would invalidate the bullish scenario.

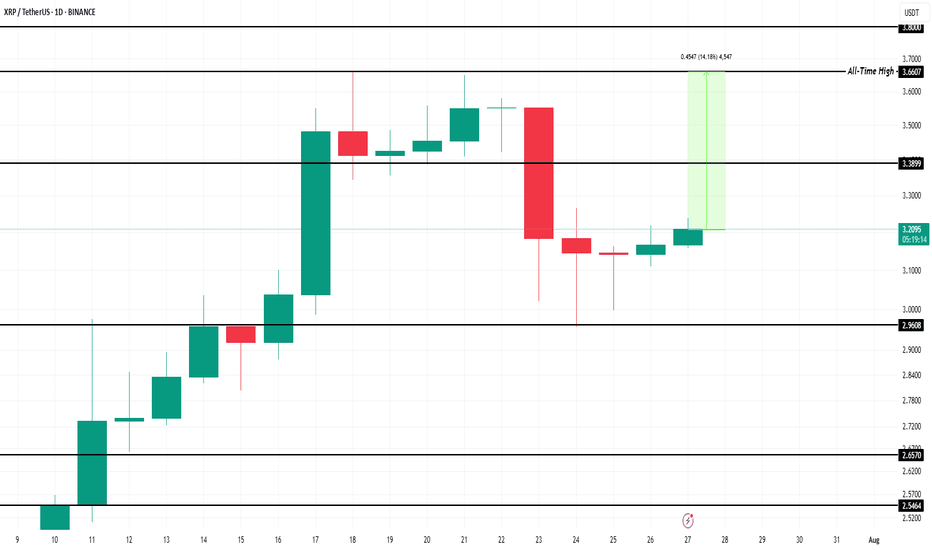

$500 Million XRP Accumulation To Drive 15% Price Rise to ATHBINANCE:XRPUSDT is currently trading at $3.20, which places it 14% away from reaching its ATH of $3.66. The support at $3.38 is crucial, and securing it could lead to further gains.

BINANCE:XRPUSDT has been seeing significant inflows in the past three days. Over 163 million XRP, worth around $519 million , have been accumulated by investors. This buying surge suggests that a wave of optimism is returning to the market, signaling that investors are positioning themselves for a potential price increase.

If BINANCE:XRPUSDT can reclaim support at $3.38 , it will be well-positioned to push past its ATH and reach new highs. This would mark a significant milestone for the altcoin, setting the stage for further price gains.

However, should the investor sentiment shift and selling pressure increase, BINANCE:XRPUSDT could face a decline. If the price falls below $3.00, it could slide to $2.96 or lower , invalidating the bullish thesis.

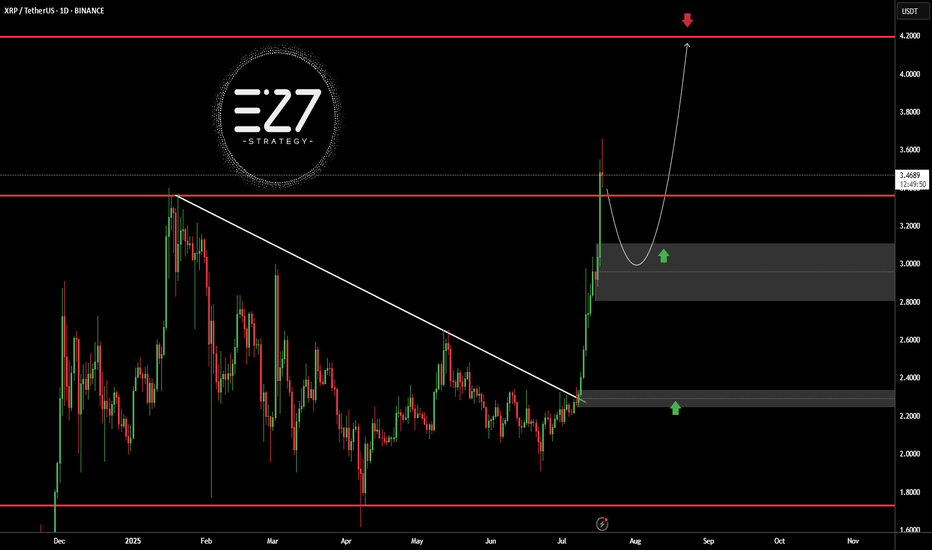

XRPUSDTBINANCE:XRPUSDT broke above its long-term downtrend line and surged to the $3.5000 resistance area, but is now undergoing a correction. The current bullish structure, with a higher high and higher low, suggests the trend remains upward. A pullback toward the $3.0000 demand zone is likely and would be a healthy retracement. Holding this area could trigger a continuation toward the key resistance at $4.2000.

Key Level Price

Main Support $2.2000

Main Resistance $4.2000

Best Buy Range $2.9500 – $3.1500

Best Sell Range $4.1000 – $4.2000

Investment Risk (Buying) Medium

⚠️Please control RISK management

XRP : Long term analysisHello friends🙌

🔊Considering the great growth that the price has had and has set a new ceiling, be careful because we are at the ceiling and when we are at the price ceiling, we should always expect a price correction...

⚠Now, given the strong upward trend we have, you can buy with risk and capital management, but our suggestion is lower prices for the possibility of a correction and the possibility of a reversal pattern.

So we have identified important support levels for you and we have also identified price targets.

🔥Follow us for more signals🔥

*Trade safely with us*

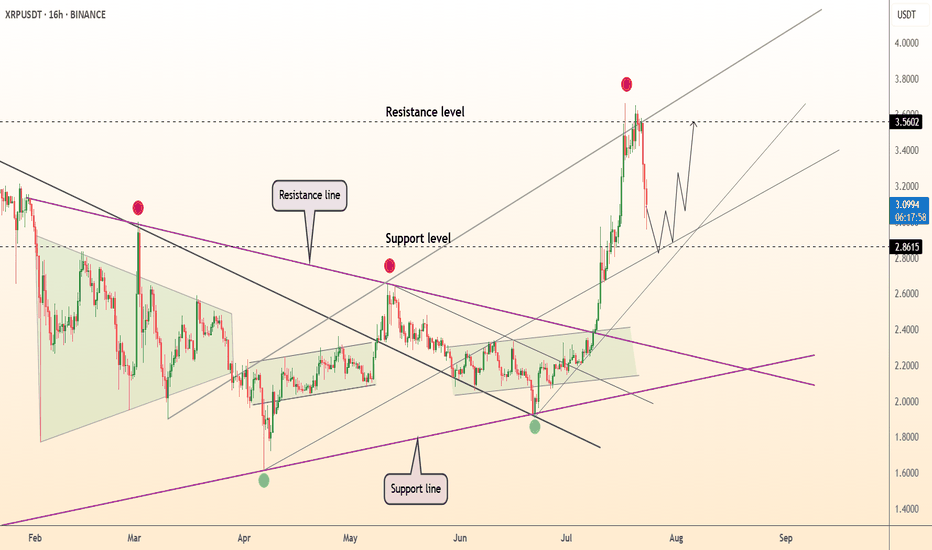

DeGRAM | XRPUSD rolls back to support📊 Technical Analysis

● After spiking to 3.56 (red dot) price slipped into a shallow bull-flag that is holding on the grey inner trend-line and the broken purple 2-year cap, converting 2.86-3.00 into firm support.

● Volatility compression inside the flag sits midway of the rising channel; a 16 h close back above 3.22 activates a 1:1 continuation toward the median-line cluster at 3.80, with the outer rail still pointing to 4.00.

💡 Fundamental Analysis

● CME’s launch of micro-XRP futures and fresh US exchange relistings lifted open-interest 18 % w/w, while Coinglass shows $12 M shorts liquidated since Monday—evidence of renewed upside pressure.

✨ Summary

Buy 3.05-3.22; breakout over 3.22 aims 3.80 → 4.00. Invalidate on a 16 h close below 2.86.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

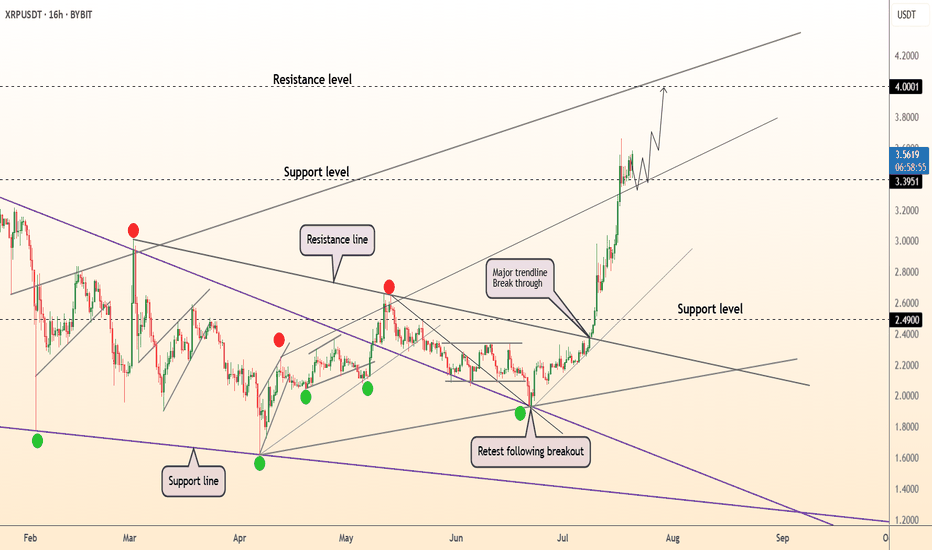

DeGRAM | XRPUSD above the support level📊 Technical Analysis

● Price is now building above the former 3.39 resistance after the purple multi-month trend-cap break; three higher closes there confirm the zone as fresh support and signal a “run-away” gap.

● July’s 0.85 USDT impulse flags to the rising-channel crest and round-number offer at 4.00, reinforced by the 1.618 Fib projection of the June-July base while the parabolic guide-line of higher lows remains intact.

💡 Fundamental Analysis

● Santiment reports the ten largest wallets added >30 M XRP this week amid media chatter of constructive SEC–Ripple status talks, underlining continued dip absorption.

✨ Summary

Long 3.40-3.50; sustained trade above 3.39 targets 3.80 → 4.00. Bias void on a 16 h close below 2.95.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

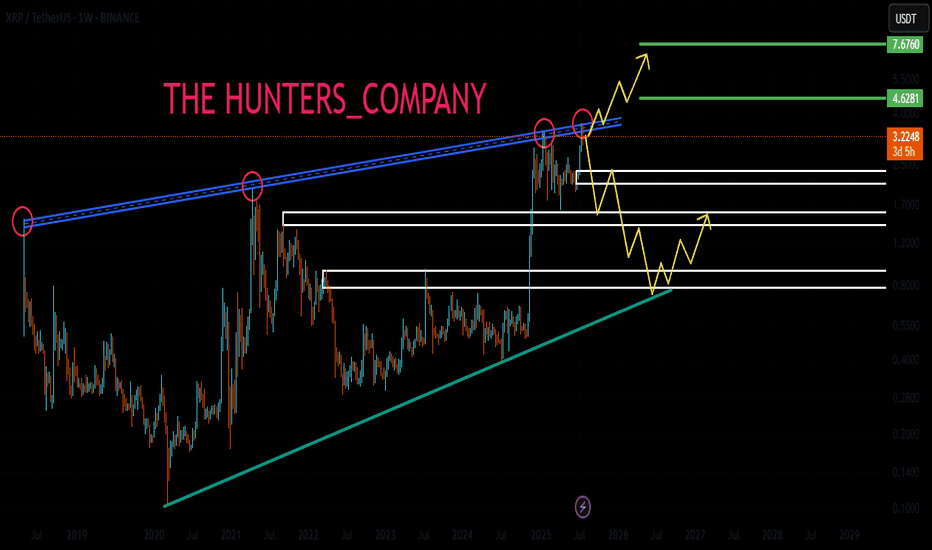

XRP Breaks 2018 High – New ATH Confirmed!XRP has officially broken above its 2018 peak, signaling a major bullish breakout and printing a new all-time high on the weekly chart. The previous resistance zone around $2.6–$3 has now flipped into strong support, confirming the strength of this move. With increasing volume and momentum behind the rally, XRP appears well-positioned for continued upside. The next key psychological target lies at $10, and current price action suggests a clear path toward that level. If bullish sentiment continues, this breakout could mark the beginning of a significant new uptrend.

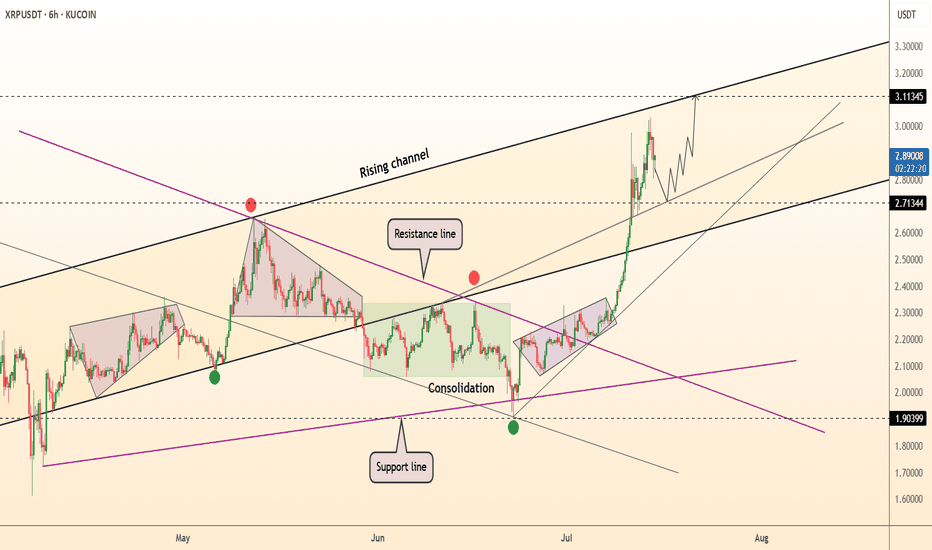

DeGRAM | XRPUSD continues to move in the channel📊 Technical Analysis

● Aggressive breakout from the 8-week green consolidation box has pierced both the purple ’23 trend-cap and inner wedge roof; pull-backs are holding above the prior 2.71 swing, confirming a fresh demand flip.

● Price is now tracking the mid-July parabolic support inside the black rising channel; the next confluence lies at the channel crest / Feb supply 3.11, implied by the 40¢ measured move of the July flag.

💡 Fundamental Analysis

● CME CF announced a cash-settled XRP reference rate for institutional derivatives, boosting open interest and signalling deeper liquidity ahead of the 23 Jul SEC status hearing.

✨ Summary

Long 2.70-2.80; hold above opens 2.88 → 3.11. Invalidate on a 6 h close below 2.60.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

"XRP/USD: Bullish Raid Alert! Ride or Escape Fast!"🚨 XRP/USD HEIST ALERT: Bullish Loot Grab Before the Escape! (Thief Trading Style) 🚨

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 Thief Trading Strategy Activated! 🔥

Based on ruthless technical + fundamental analysis, here’s how we SWIPE THE LOOT from XRP/USD (Ripple vs. Dollar). Follow the chart’s Long Entry blueprint—our target is the high-risk YELLOW ATR ZONE (overbought, consolidation, potential reversal). Beware of traps! Bears and cops lurk here, but we strike smart.

🏴☠️ ENTRY:

"Vault’s cracked—bullish loot is FREE GAME!"

Buy Limit Orders preferred (15-30 min timeframe near swing lows/highs).

Aggressive? Swipe instantly—just mind the cops (liquidity traps).

🛑 STOP LOSS (Save Your Loot!):

Swing Thieves: 4H recent wick low ($2.1500).

Risk Tactics: Adjust SL based on your trade size, orders, and guts.

🎯 TARGETS:

Main Take: $2.5400 (or escape earlier if momentum fades).

Scalpers: Longs ONLY! Trail your SL—no greedy holds!

💣 KEY DRIVERS (Why This Heist Works):

Bullish momentum brewing (check fundamentals, COT, on-chain data 👉go ahead to klick 🔗).

NEWS ALERT: Avoid fresh trades during high-impact news—protect open positions with trailing stops!

💥 BOOST THIS HEIST!

Hit 👍 LIKE, 🔔 FOLLOW, and 💬 COMMENT to fuel our next robbery plan. Together, we steal the market’s cash—EVERY. SINGLE. DAY.

📢 Final Warning: Markets shift FAST. Stay sharp, adapt, and CASH OUT BEFORE THE COPS ARRIVE.

🤑 Stay tuned—more heists incoming! 🐱👤🚀

XRP/USD: "Bandit’s Breakout" – MA Confirms the Profit Raid!🔥 XRP/USD HEIST ALERT: The Bullish Bank Robbery Plan (MA Breakout Strategy) 🔥

🌟 Attention, Market Pirates & Profit Bandits! 🌟

"The best traders are just thieves with a calculator."

🚨 Mission Brief (XRP/USD):

Based on Thief Trading tactics, we’re plotting a bullish heist on Ripple. High-risk, high-reward—police traps, fakeouts, and overbought zones be damned!

📌 ENTRY ZONE (Breakout or Pullback Heist)

"The heist begins at MA breakout!"

Buy Stop: Above 2.2200 (confirmed candle close).

Buy Limit: Near swing lows (15m/30m pullback).

🚨 Set an ALERT! Don’t miss the breakout.

🛑 STOP LOSS (Escape Route)

"No stop loss till breakout—then hide it like stolen cash!"

Thief SL: Nearest swing low (3H candle wick) ~2.1000.

Rebels adjust at own risk—your funeral, not mine. 😎

🎯 TARGETS (Profit Hideouts)

First Escape: 2.2400 (scalp & run).

Swing Bandits: Ride longer (trail SL advised).

⚡ SCALPERS’ NOTE:

Longs ONLY. Rich? Go all-in. Broke? Join swing heists.

Trailing SL = Your getaway car.

📡 MARKET CONTEXT (Why This Heist?)

Bullish momentum + consolidation breakout play.

Fundamentals? Check COT, on-chain, macro trends (check everything here 👉🔗🔗).

🚨 NEWS WARNING (Avoid Police Raids)

Avoid new trades during high-impact news.

Trailing stops = Your invisible cloak.

💥 BOOST THE HEIST!

"Like & Boost this idea—strengthen our robbery squad! More alerts = more stolen profits. 🚀💰

Next heist coming soon… Stay greedy, thieves. 😈

XRP Technical Analysis – Massive Breakout in Play!After months of tight consolidation inside a symmetrical triangle, XRP/USDT has finally broken out with strong bullish momentum on the daily timeframe.

🔹 Chart Pattern: Symmetrical Triangle

🔹 Breakout Confirmation: Daily candle closed above the descending trendline resistance

🔹 Support Zone: ~$2.00 – $2.20 (Held multiple times since April)

🔹 Breakout Level: ~$2.48 – $2.50

🔹 Next Resistance Levels:

▫️ $2.62 – Minor horizontal resistance

▫️ $3.39 – Major resistance from previous highs

▫️ $4.92 – Long-term macro target (measured move from triangle)

🧠 Why does this breakout matter?

✅ Strong Volume: Breakout happened with increased volume – a sign of genuine breakout

✅ Multi-month Base: The longer the consolidation, the stronger the breakout

✅ Support Respect: XRP respected the demand zone repeatedly, showing accumulation

✅ Momentum Building: A clean break could trigger trend-following bots and new buyers

XRPUSDT BINANCE:XRPUSDT Price broke above the downtrend line but faced resistance at 2.2770 dollars and started correcting. Key supports are at 2.1900 and 2.0800 dollars. If it bounces, resistances to watch are 2.2770, 2.3600, and 2.4620 dollars. Price is currently between key levels.

Key Levels:

Support: 2.1900 – 2.0800

Resistance: 2.2770 – 2.3600 – 2.4620

⚠️Contorl Risk management for trades.

DeGRAM | XRPUSD seeks to retest of the resistance line📊 Technical Analysis

● A third rebound from the rising purple support (green dots) printed a bullish engulfing that has already forced price back above the short-term grey down-trend, signalling a momentum shift.

● XRP is now coiling inside a contracting triangle capped by the purple resistance line near 2.40; the 18 ¢ consolidation width implies 2.45 on a break, while the April pivot at 2.65 lines up with the upper channel for the next objective.

💡 Fundamental Analysis

● Ahead of the 23 July SEC – Ripple status hearing, HSBC’s digital-asset unit announced a pilot using XRP for cross-border settlement, lifting social volume and spot bids.

✨ Summary

Buy 2.10-2.20; confirmed close above 2.40/2.45 targets 2.60-2.65. Thesis void on a 16 h close below 1.98.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

XRP Pattern Repeats—Next Move to $2.34?The XRP/USDT 1-hour chart is showing a compelling setup that may mirror a previously bullish price pattern. The left side of the chart highlights Pattern 1, which played out after a period of sideways consolidation followed by a breakout, resulting in a strong upward move. Now, price action is repeating a similar structure with nearly identical conditions forming.

In Pattern 1, XRP consolidated in a tight range, flipped the trend indicator from red to blue (suggesting a momentum shift), and then surged higher. This same transition is occurring again in the current market phase. Price has reclaimed the trend baseline, which has turned blue, hinting at growing buyer strength.

The idea here is that XRP could be preparing for another impulsive move to the upside, identical to what happened before. The setup is visually marked with a trade box showing entry, stop-loss, and target levels.

Trade Idea Based on Current Pattern

• Entry: 2.2849

• Target: 2.3436

• Stop-loss: 2.2520

• Reward-to-Risk (R:R): ≈ 1.78

• Potential Gain: 2.57%

• Potential Loss: 1.44%

The structure favors a long position, as long as the price holds above the 2.25–2.26 support range. A break below this could invalidate the setup and trigger the stop-loss. If the breakout is confirmed with volume, XRP could move rapidly toward the 2.34 level and possibly beyond.

This kind of fractal behavior, where patterns repeat themselves in similar market conditions, is common in crypto. With the trend indicator already flipping bullish and price forming higher lows, the probability of continuation looks solid—especially for short-term traders.

As always, trade with proper risk management, and be cautious of volatility that can trigger stop-hunts in tightly ranged zones.

XRP: A Trader's Gambit or an Investor's FortuneXRP at the Crossroads: A Trader's Gambit or an Investor's Fortune?

The digital asset XRP currently finds itself in a fascinating and precarious position, presenting a narrative so divided it could belong to two entirely different assets. For the short-term trader, the charts are painting a picture of tension and potential reversal, a technical puzzle where a wrong move could be costly. For the long-term investor, the horizon holds the promise of a revolutionary technology poised to disrupt a trillion-dollar industry, with price targets that seem almost unimaginable from today's standpoint. This analysis delves into this profound dichotomy, exploring the immediate bearish signals that tempt traders to short, while simultaneously mapping out the ambitious, utility-driven path that could lead XRP to astronomical new heights.

The Short-Term Squeeze: A Technical Tightrope Walk

Observing XRP's recent price action is like watching a high-stakes chess match. The token has demonstrated a textbook reaction to a critical trendline, a move that likely ensnared traders who were too quick to bet on a price collapse. By bouncing precisely where technical theory suggested it might, it "trapped" these early sellers, forcing them to reconsider their positions as the price stabilized and began to creep upward.

Following this maneuver, the price has embarked on a cautious ascent from the $2.20 support zone. As of early July, XRP has managed to climb above the $2.2320 mark and is holding its ground above the 100-hourly Simple Moving Average, both of which are constructive short-term signals. The immediate focus has now shifted to a key resistance level at $2.285. A decisive break above this ceiling could signal that the bulls have taken control, potentially triggering a new wave of buying pressure.

However, a significant hurdle lies in wait. On the hourly chart, a short-term contracting triangle has formed, with its upper boundary creating firm resistance at the $2.280 level. Such patterns are known to be harbingers of volatility; they represent a period of consolidation and coiling energy before the price makes a powerful move in one direction. While a breakout to the upside is possible, the bearish case remains equally compelling.

This bearish outlook is centered on a previously marked supply zone that the price is now approaching. A supply zone is an area on the chart where a glut of sell orders is historically clustered. If the price pushes into this zone without first building a stronger foundation of support by drawing in buying interest (grabbing liquidity) from lower levels, it risks hitting a brick wall. The selling pressure could overwhelm the buying momentum, leading to a swift and strong rejection. For traders anticipating this outcome, it presents a prime opportunity to initiate a short position, betting on a significant price decline. The level of $2.28 is therefore not just a resistance point; it's a critical battleground that will likely dictate the next major directional move.

The Long-Term Vision: The $35 Moonshot Fueled by Global Remittances

To truly understand the fervent belief held by long-term XRP holders, one must look beyond the flickering candles of the hourly charts and focus on the asset's fundamental purpose. The most powerful bullish argument for XRP is not based on technical patterns, but on its potential to fundamentally reshape the global remittance market.

The remittance industry—the process of individuals sending money across borders to their families—is a colossal and ever-growing sector of the global economy. Projections indicate that this market will swell from nearly $800 billion to over $1.06 trillion by 2029. For decades, this system has been notoriously inefficient, characterized by exorbitant fees that eat into the funds sent home and settlement times that can stretch for days, leaving families waiting for critical support.

This is the problem that Ripple, the technology company behind XRP, was designed to solve. By utilizing XRP as a neutral bridge asset, Ripple's payment network can facilitate cross-border transactions in a matter of seconds, not days. The cost of these transactions is a tiny fraction of what traditional banking intermediaries charge. This value proposition of speed and savings is not merely theoretical; Ripple has been actively forging partnerships to implement this technology in key remittance corridors, including those connecting to Mexico, the Philippines, Brazil, and nations in the Middle East.

The audacious price prediction of $35 per XRP stems from a model that quantifies this potential. The logic unfolds as follows: if XRP were to successfully capture a significant portion, say 25%, of the projected $1.06 trillion remittance market by 2029, the network's intrinsic value would be immense. Applying a valuation multiple similar to those of established payment processing giants, the network could be valued at over $500 billion. With a circulating supply of approximately 60 billion tokens, a simple calculation yields a fundamental value of around $8.90 per XRP.

However, the cryptocurrency market is driven by more than just underlying utility; it is heavily influenced by demand, speculation, and investor sentiment. The model accounts for this by applying a "demand premium." If widespread adoption and recognition of XRP's role create a surge in demand, this could act as a multiplier on its fundamental value. A 4x demand premium, a figure not uncommon during crypto bull markets, applied to the $8.90 base valuation, is what brings the target to an eye-watering $35.56. This forecast, while undeniably ambitious, is anchored in the tangible prospect of solving a multi-trillion-dollar real-world problem.

Bridging the Gap: Catalysts for a New Era

The journey from a price of around $2.22 to a potential $35 is long, and its success hinges on several critical factors. A major cloud that long hung over XRP was its legal battle in the United States, which created uncertainty and stifled institutional adoption. However, significant legal victories have provided much-needed regulatory clarity, affirming that XRP itself is not inherently a security. This has been a pivotal de-risking event, opening the doors for financial institutions to begin integrating and utilizing the asset with newfound confidence.

The next major potential catalyst on the horizon is the approval of a spot XRP Exchange-Traded Fund (ETF). Following the successful launch of ETFs for other major cryptocurrencies, many in the industry see an XRP ETF as a logical next step. Such a product would be a game-changer, providing a regulated and easily accessible bridge for a vast pool of capital from traditional finance to flow into the XRP market. It would allow pension funds, asset managers, and retail investors to gain exposure to XRP through their standard brokerage accounts, potentially triggering a massive wave of demand.

Of course, the path is not without its challenges. XRP operates in a competitive environment, with other blockchain projects and even modernizing traditional systems like SWIFT vying for a piece of the cross-border payments pie. Continued innovation, network growth, and the expansion of strategic partnerships will be paramount to securing its market position.

Conclusion: A Dichotomy of Destiny

In its current state, XRP embodies the dual nature of the cryptocurrency market. It is at once a playground for nimble traders, who see the immediate risks and rewards in its tight price consolidation, and a beacon for long-term visionaries, who see the blueprint for a future global financial standard. The bearish case for a short-term rejection from the $2.28 supply zone is technically sound and warrants caution. A failure to break through this level could easily send the price back down to retest lower supports.

Simultaneously, the long-term bullish thesis is one of the most compelling in the entire digital asset space. It is not built on hype alone, but on a clear and demonstrable utility aimed at a vast and inefficient market. The prospect of a $35 XRP is a testament to this potential.

Ultimately, the decision of whether to view XRP as a short-term trade or a long-term investment is a reflection of one's own timeline, risk tolerance, and belief in its underlying technology. XRP is at a critical inflection point, and whether it succumbs to short-term pressures or breaks free to pursue its grander ambitions will be a defining story in the continuing evolution of finance.