X is about to take off! a 70% profit is on the way! (1D)The trigger line has been broken, we have a bullish CH on the chart, and a demand zone is visible.

Given these bullish signals and the time correction in reaching the demand zone, we are looking for buy/long positions in the demand zone.

Targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

XUSDT

#X #XUSDT #XEMPIRE #LONG #Setup #Eddy#X #XUSDT #XEMPIRE #LONG #Setup #Eddy

XUSDT.P Long Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Note : The price can go much higher than the second target, and there is a possibility of a 100% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

Warning : The stop loss is dramatic and large. Place the stop loss based on your strategy and after getting entry and confirmation on the entry point behind the last shadow that will be created.

Be successful and profitable.

I hope you enjoyed the previous analysis and signal of this currency.

Previous analysis and signal Of X Empire :

#X #XUSDT #XEMPIRE #LONG #Scalp #Scalping #Eddy#X #XUSDT #XEMPIRE #LONG #Scalp #Scalping #Eddy

XUSDT.P Scalping Long Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style. (( AMD SETUP ))

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Note: The price can go much higher than the second target, and there is a possibility of a 70% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

Be successful and profitable.

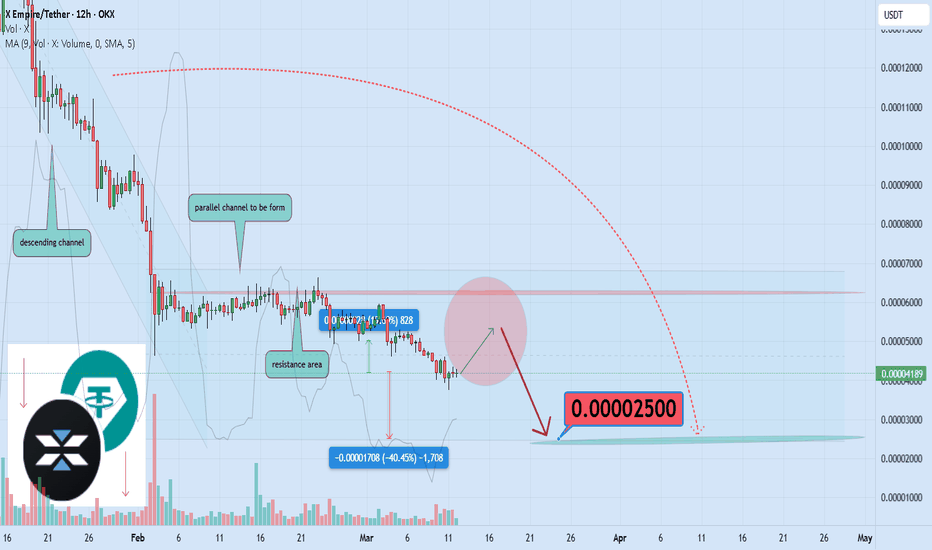

X Empire Breakdown: 40% Drop Targeting 0.000025Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for X Empire 🔍📈.

The X Empire has exhausted all its key support levels, and I project an additional decline of at least 40% moving forward. The primary target for this downturn is 0.000025. Following this, I anticipate a phase of consolidation, characterized by range-bound price action and the potential establishment of a parallel channel.📚🙌

🧨 Our team's main opinion is: 🧨

X Empire has lost all support, with a 40% decline expected to 0.000025, followed by consolidation and a possible parallel channel.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

$OKX:XUSDT OKX:XUSDT

If the green box is lost, it can drop to the price range of 0.0000145. This currency is a playground for gamblers. Friends who want to buy this currency for investment purposes should never do so. If you observe the trading volume of this currency in a single day, you will see that it is traded at least as much as the total volume of this market, indicating the activity of trading bots as well as gamblers who make trades in the short term. There are no fundamentals behind this currency, and the only reason it can rise and fall is the news coming from Elon Musk. This analysis is an update from the last analysis conducted on this currency.

xusdtSupport and press the rocket to cheer me up

Observe the ten percent loss limit

Stay away from Bitcoins

Feel free to buy and sell and post your comments

What is Tether Gold (xusdt) and Its Future in Crypto?Hello and greetings to all the crypto enthusiasts, ✌

Personal Insight on Tether Gold and Its Future Potential:

When I analyze a new project, I personally dedicate a significant amount of time to thoroughly studying its various aspects. However, this was the first time that while reviewing a particular project, I found my attention so intensely and inexplicably drawn to it. After careful consideration, I am confident that, in the near future and at the appropriate time, I will be making a personal investment in it. That being said, please take note of the disclaimer section at the bottom of each post provided by the website, this is merely my personal opinion and should not be interpreted as financial advice.

There is something truly captivating about the fusion of the ancient, physical world of gold with the innovative and rapidly evolving realm of cryptocurrency. This, in essence, is the concept behind Tether Gold, and it represents a highly compelling idea with extraordinary growth potential. In the world of cryptocurrency, it is often these unique and forward-thinking ideas that pave the way for significant market breakthroughs. What makes Tether Gold even more intriguing is that it is not just a speculative idea; it has the robust backing of a trusted entity like Tether.

Now, let’s take a closer look at this project and its key features:

What is Tether Gold (XUSDT)?

Tether Gold (XUSDT) is a digital token issued by Tether, and it is backed by physical gold. Each unit of XUSDT is pegged to one troy ounce of gold, with a purity of 99.9%. This gold is securely stored in insured vaults, ensuring both safety and transparency. Tether Gold provides a means for investors to participate in the gold market digitally, without the need for the physical handling or storage of gold.

Tether Gold combines the benefits of cryptocurrencies—such as fast and easy transfers, and decentralized security—with the timeless stability and intrinsic value of gold. This token is tradable on major blockchains, including Ethereum and Tron, and has been positioned as a secure, efficient, and transparent means for digital gold investment.

A Brief History of Tether Gold:

Tether Gold was launched by Tether in January 2020, marking a significant expansion of the company’s product offerings. Tether, which is primarily known for its stablecoin USDT, introduced Tether Gold in response to increasing demand for digital assets backed by physical commodities, particularly gold. The company recognized the growing interest in stable digital assets that combine the safety and value of gold with the flexibility and innovation of blockchain technology.

The Benefits of Investing in Tether Gold:

Investing in Tether Gold presents several key advantages, making it an attractive option for a wide range of investors. This digital asset offers an innovative way to invest in gold, providing greater convenience, flexibility, and lower costs compared to traditional methods of purchasing and storing physical gold.

Some of the most notable benefits of investing in Tether Gold include:

Security and Transparency: Each Tether Gold token is fully backed by physical gold stored in secure vaults, and this backing is regularly audited, ensuring full transparency. Investors can have peace of mind knowing their investments are securely backed by tangible assets.

Efficient Transferability: Unlike physical gold, which can be cumbersome and costly to transfer, Tether Gold can be easily transferred across the globe, quickly and at minimal cost. This opens up the opportunity for investors to access and trade gold in a way that is both convenient and cost-effective.

Accessibility: Tether Gold allows investors to gain exposure to the gold market with relatively small amounts of capital, without the need to buy, store, or insure physical gold. This makes it a highly accessible option for those who may not have the resources or desire to invest in physical gold.

Stability and Value: Gold has long been regarded as a safe-haven asset, maintaining its value even during times of economic instability. By combining the stability of gold with the technological advantages of blockchain, Tether Gold offers a powerful and stable investment vehicle.

From a technical perspective:

Tether Gold is currently positioned for potential significant growth. After experiencing several rounds of declines, it now finds itself in a strong position for an explosive upward movement. This could be an ideal time for investors to consider entering or increasing their positions in Tether Gold, as the market appears poised for a potential surge.

🧨 Our team's main opinion is: 🧨

Tether Gold (XUSDT) is a digital token backed by physical gold, offering the stability of gold with the flexibility of blockchain. It’s an easy, secure way to invest in gold digitally, and with its strong backing from Tether, it has great growth potential in the crypto market.

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

X Empire price has done something incredible !)💰 Something phenomenal has happened that hasn't been remembered for many years: NYSE:X #Empire altcoin has made +1750% in a week

Whether it was the exchange's promotional campaign, #Trump's election victory+ his colleague #muskempire and everything directly or indirectly related to him are now “in chocolate” or all together, but God grant most altcoins to grow like this.

Then we will feel the real taste of the alt-season

The #X #marketcap has grown from 20 million to the current 300 million.

We have two questions for you:

Where will the OKX:XUSDT price go next: 🐳 along the blue route by $0.0014 or 💔 along the red route by $0.00014 (the difference is only 0 or 10 times ;)

What other low-cap altcoins do you think will pump like this? You write your options in the comments, and we will analyze some of them and publishing ideas here

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

In what range should we buy "X" ?Note: Do not use this analysis for sell/short positions.

X managed to pump more than 1500% after being listed on exchanges by attracting creative attention.

But we should not be emotional to buy again and we should control our emotions and wait for X to reach the cheap price areas.

It seems that this bullish wave is over.

We have identified a support range on the chart, which will be our buy range.

The target can be the red box.

Closing a daily candle below the invalidation level will violate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

xSupport and press the rocket to cheer me up

Observe the ten percent loss limit

Stay away from Bitcoins

Feel free to buy and sell and post your comments

$X Token Gains Momentum as Binance Launches Perpetual ContractsIn an exciting development for the NYSE:X token, Binance has listed it as a trading pair in its perpetual contracts, a move that's set to drive substantial market interest. This development comes alongside Binance’s latest futures offerings, giving users access to leveraged trading up to 75x. With this listing, NYSE:X is poised for potential upside gains as traders and investors react to the expanding trading opportunities.

Technical Analysis

The NYSE:X token’s daily chart reveals a promising falling wedge pattern, often signaling a bullish reversal. Trading currently above key moving averages (MAs) and up 5.51%, the token shows resilience, holding strong even amid recent retracements. Additionally, the Relative Strength Index (RSI) is sitting at 48, suggesting balanced momentum with a potential upward shift as buyers gradually regain control. Traders are closely watching for a breakout from this pattern, as this could catalyze a rapid price surge.

Volume dynamics further emphasize this potential. In the wake of Binance’s listing announcement, NYSE:X saw a significant 102% spike in intraday trading volume. Such a surge in volume underscores heightened interest, with traders positioning themselves in anticipation of a stronger price rally. This volume uptick also supports a potential bullish continuation as demand outweighs supply.

Binance Listing Sparks Optimism

Fundamentally, Binance’s addition of NYSE:X to its futures and perpetual contract offerings opens new doors for market participation. By allowing up to 75x leverage, Binance offers traders substantial upside potential, making NYSE:X a particularly attractive asset for those with high-risk, high-reward strategies. The exchange’s user base, known for its active trading engagement, is now positioned to push demand for NYSE:X even further.

Further, Binance’s reputation for boosting assets upon listing adds to the optimism surrounding NYSE:X ’s potential. Previous tokens, such as PNUT and ACT, saw impressive price hikes following their Binance debuts. The listing also brings added credibility and visibility to NYSE:X , likely enhancing its attractiveness to a broader audience.

Future Outlook

Beyond technical signals and exchange activity, NYSE:X ’s fundamentals remain compelling. With a supportive and rapidly growing community, the token has gained traction through various initiatives aimed at increasing adoption. The combination of strong tokenomics and a passionate user base aligns with a long-term bullish outlook. As more users enter the ecosystem via Binance’s leveraged options, increased liquidity and market interest are likely to push NYSE:X to new heights.

Finding Ranging Market Before Happening! (X Empire)In the heart of ARZ Trading System, is a candle that we call it MC (Master Candle). Any time that we see a candle that matches following description, most likely we will have a ranging market, with specified range of oscillations:

1. Candle itself is in the direction of the trend

2. Body of the next candle is within high to low of this candle

3. In the next candle(s), price could retrace most of the MC candle

The main ranging area is the high to low of the MC candle. The exact size of this area, from high to upper is UTP (here $0.00062), and from low to lower is LTP (here $0.00011). This means price could fluctuate between these levels.

If market is going to continue the trend (here is uptrend), price should break the UTP level and continue strongly.

Target levels (X Empire)The ARZ method is based on Wyckoff. The base (range) is MC which you can see in the chart. After breaking of this range, if price moves in one direction and stayed in the momentum (Bullish or Bearish with acceptable retracements), we expect the movement to continue on.

Here we see price has achieved 3 of the targets which are: $0.00031, $0.00045, and $0.00059 . If movement continues, next 3 targets are: $0.00073, $0.00087, and $0.00101 . After reaching each one of these targets, we expect a retracement, and it can be strong, then no worry should come with it.

And again, whatever happens, I'm holding tight to $X!

#X New structure, new target area 📊#X New structure, new target area 🔥

🧠From a structural perspective, we have built a new long structure after breaking through the previous target area. The ideal target area for this structure is 0.00036361-0.00045236. Currently, an ascending triangle has formed near the resistance line, so we may reach the ideal target area

⚠️If we break below the long defense point, it means that this upward trend is over, and the probability of reaching the ideal target area becomes smaller. If the structure further evolves into a bearish head and shoulders structure, then after this short structure is established, you can try to place some short orders

Let's see👀

🤜If you like my analysis, please like💖 and share💬

💕 Follow me so you don't miss out on any signals and analyze 💯

BITGET:XUSDT.P

A possible Retracement (X Empire)If current candle couldn't cross and close the high of previous candle, most likely there will be a deep retracement happening afterwards.

This is a ranging market.

X Empire(X) can PUMP[+10%_+20%_30%]Today, I want to analyze the telegram game token X Empire , which has been listed in various exchanges for about 1 day , so that if you participate in the Airdrop of this telegram game , where you can sell your tokens or even profit from the increase in the price of the token X .

X token ( OKX:XUSDT ) has managed to break the Downtrend line .

I expect X Empire(X) to rise again after the pullback to the Downtrend line and attack the resistance zone , and if the resistance zone is broken, we should expect it to rise to $0.000084 & $0.000091 .

⚠️Note: Because there is not much data on token X, be sure to observe capital management in this position more than before.⚠️

⚠️ Note: If you have the X token and want to sell, the resistance zone can be a suitable zone, or if the support zone breaks, it is better to sell this token because it is more likely to fall. ⚠️

🔔Be sure to follow the updated ideas.🔔

X Empire Analyze ( XUSDT), 15-minute time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.