Xvg

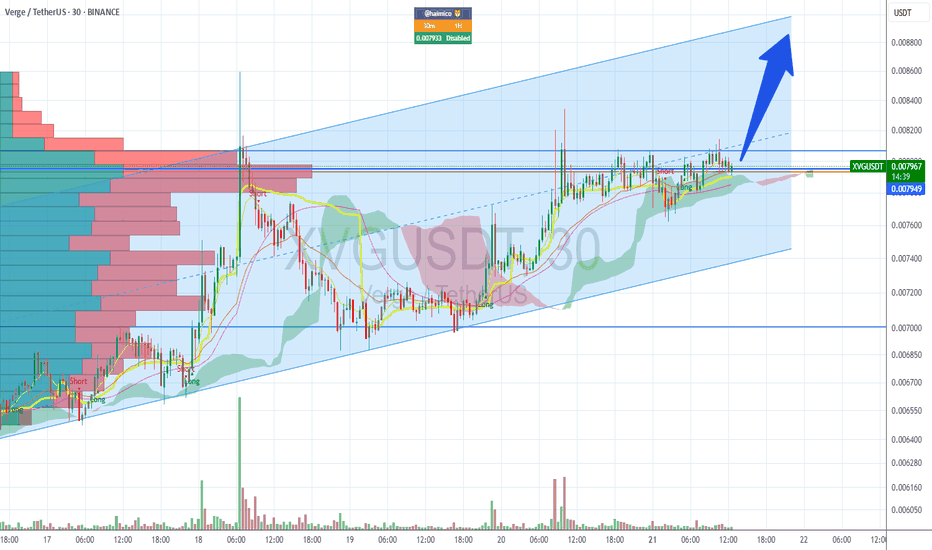

XVGUSDT Forming Potential BreakoutXVGUSDT is shaping up with an interesting technical setup that could catch the eye of both short-term traders and long-term crypto investors. The chart currently suggests that Verge (XVG) is forming a potential breakout pattern after a period of consolidation within a descending channel. This pattern often signals that sellers are losing momentum, paving the way for an upward price reversal if a breakout above resistance occurs. With strong volume backing this move, XVGUSDT could deliver a solid gain in the 90% to 100%+ range if the bullish scenario plays out.

Verge has long held a spot among privacy-focused cryptocurrencies, known for its focus on anonymity and secure transactions. As crypto investors continue to diversify into projects with strong use cases, Verge’s established community and real-world applications add credibility to its potential upside. This renewed buying interest reflects growing optimism about Verge’s future, especially as it continues to improve its network and form new partnerships.

Traders should pay close attention to price action near the top trendline of this descending channel. A clear breakout with sustained volume could attract even more buyers, sparking a rally towards key resistance levels. Historically, Verge has seen sharp moves following similar technical setups, making this an appealing chart for swing traders aiming to capture high-percentage gains.

Keep XVGUSDT on your watchlist as we look for confirmation of this breakout in the days ahead. A decisive close above resistance could be the catalyst for the next major uptrend in this privacy coin’s journey.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

XVG - Privacy is Important!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈XVG has been overall bullish trading within the rising channel marked in blue and it is currently retesting the lower bound of the channel.

Moreover, the red zone is a strong structure.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XVG approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

XRP vs XVG 8 Year Triangle Fractal Comparison 05 2025Logarithm. Time frame 1 month. Linear chart for clarity. Two cryptocurrencies of the super hype of altcoins in 2017 (the final alt season of the cycle before last). XRP is ahead of XVG. The structures are similar, but if XVG breaks through the triangle upwards like on XRP, then work with the first target, observing risk management. You can leave 5-10% of the position for the second target, but this is not necessary. As for XRP, everything is as before... local update in the XRP idea.

XVG Secondary trend (part) Resolution of the triangle 8 years 05 2025

XRP/USD Main trend 28 07 2022

XVG Secondary Trend (Part) Triangle Resolution 8 years 05 2025Logarithm. Time frame 3 days. Linear instead of candlestick specifically for clarity. This is the longest chart history on tradingview that could be found. It does not display everything as is. Where this cryptocurrency was previously traded, the exchanges deleted the entire trading history. Listing on new exchanges does not display the whole picture. I described and showed everything on the chart. More in the channel, screenshots and comparison with XRP, here the site does not provide an opportunity to make such a comparison, as there are simply no charts of such history.

Verge (XVG) like XRP identical chart of the main trend, and the same 8-year triangle after the pumping of 2017. The only difference is that XRP came out of its triangle half a year ago, in alt season #2 of this cycle, and this cryptocurrency is still in the canvas of its triangle. But the price is gradually being driven into a corner. In alt season #3, most likely, the denouement of this story lasting 8 years will occur. More up than down (at the beginning).

Verge (XVG), like XRP, is an asset of the super pump of 2017 and the price retention is -96-98% from the super pump by hundreds of thousands of percent (I am not mistaken exactly so), which forms a huge triangle on XXX (8 years). This is all inherent in the assets of the hype of 2017: XVG XRP NEM XLM ZEC XMR DASH LTC and so on ... Some of them, over the past 2 years, have become on the path of hype (XRP XLM), and some on the path of scam (I do not want to make anti-advertisement).

Most likely, everything will repeat on XVG, as on XRP, but only at the right time, in the final alt season of this cycle. "XVG captains" do not have as much money and a powerful state behind them as XRP, to go against the market and the general trend, therefore, they need the market hype to distribute "a little higher". And so with most of these altcoins. Do not forget to get rid of them on the pump. Remember, the more down-to-earth goals, the more likely you are to earn over the long term. Observe risk and money management.

Remember, there is a big alt season ahead, provided that you are an adequate person and your goals are appropriate.

Verge: Highest Volume EverOn the 19th of February XVGUSDT produced the highest volume ever on the daily timeframe.

See chart below:

This occurrence can signal the start of a new market phase.

Good afternoon my fellow trader....

Here we can see a consolidation channel that is more than two years long. Each time this channel is violated it happens on the upper boundary, resistance, support remains unchallenged as Verge has been producing long-term higher lows.

These are bullish signals. Now we have a very strong weekly volume bar after a mild corrective phase. We are looking at the start of a new bullish market phase.

This is just a friendly reminder. Verge (XVGUSDT) is about to blow-up.

Thank you for reading.

Namaste.

XVG - on the "VERGE" of breaking out!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 XVG has been in a correction phase trading within the falling blue channels.

🏹As XVG approaches the lower bound of the channels, which lines up perfectly with the demand zone marked in red, it would be an attractive zone (at least for me) to look for longs.

🏹On the other hand, for the bulls to take over long-term, a break above the last major high marked in blue around $0.015 is needed.

For now, we wait! ⏱️

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

XVG Looks bearish (4H)From where we entered "Start" on the chart, XVG correction seems to have started. This correction seems to be a diametric. By maintaining the red area, it can move towards the green box.

The low risk range for sell/short positions is the red box.

Closing a daily candle above the invalidation level will violate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

XVG Is Bullish And On FireI privately traded this token, SGX:XVG yesterday. Where I analyzed and draw the pattern seen on this chart below, I shared the idea in the chatroom, before it shoot up.

Sorry I did not publish it then. I am seeing another setup building up on the Daily TF , so i want to share it publicly before it began.

Verge (XVG) is a decentralized, open-source cryptocurrency that prioritizes user privacy and anonymity . Originally launched as DogeCoinDark in 2014, it was rebranded as Verge in 2016. Verge uses the TOR network to obfuscate IP addresses, ensuring that transactions are private and secure.

I have spotted another bull flag developing on the daily level, I am heavy on SGX:XVG , it is one of the most cheapest privacy coin at this time. HODLers are still early to the game .The bull flag is clearly identified on that chart, with recent support and resistance levels.

There's a wall of support around 0.012794 - 0.011997 , this offers a likely good entry price. A major Support level is seen at 0.009683 . The micro levels are already overbought, may be gearing up for pull-back soon.

👍 Like if you agree. Comment if you disagree.

XVG {Read the caption}hello friends

After a heavy fall, this coin was able to enter an ascending channel and hit a higher ceiling and floor, which we showed you in the picture.

Now, after hitting the roof for the third time, we have seen a correction.

Now the best option is to buy a staircase, one step here and in case of deeper modification, the next steps that we specified for you...

Its target is its initial price, which means we expect it to reach its supply price, and if it breaks and hits a new ceiling, we will give you a new update.

If you like, support us with like and comment.

OG is trying to return to the trendTo date, the market has consolidated in anticipation of passing the middle of the month and determining the direction for the end of the year. The decision on the US interest rate may have a big impact. But for now, there is still an opportunity for the growth of individual coins with technical signals. TROY is showing itself well, aiming for a breakout of 0.0075. But in this article I want to consider OG, which from the second bottom at the key support of $ 5 can give a trend and catch up with TROY in dynamics. With a successful exit above the previously formed trend line, the nearest target will be a test of the 7.5-9 range. With a successful opening of the second half of the month above 7.5, you can expect the trend to consolidate and further overshoot. For now, the pressure of the unprocessed targets of the bears at 3000-3100 on the ether and 75-85k on the cue ball remains, in connection with which a new wave of sales at the change of the week may be deeper, with a payback after the decision on the US interest rate, in case the dollar weakens. In this negative scenario, OG can test $3.5-$4 where it will be possible to make a top-up, as it was possible to do with TROY. In the medium term, both TROY and OG are good tools with probable.

VIB also gave a new opportunity to re-buy profitably, which, in an optimistic scenario, can turn a weekly candle into a bullish one in order to continue the trend by 0.15 due to the opening of the week above 0.1.

#XVGUSDT LONGAh, SGX:XVG , the mysterious Verge, a coin that's been around longer than the last Earth Mark II project! Here's what i think...

Short Term (The Next Few Weeks - What we in the biz call "A Galactic Minute"):

- Current Trend: Looks like SGX:XVG has been showing some signs of life, much like a petunias thinking about the nature of existence right before it hits the ground. If it can maintain above the recent support levels, we might see a bit of a bounce back.

- Potential Move: There's a shimmer of hope, or perhaps just my screen reflecting light. If SGX:XVG can break through the resistance at around $0.021, we could see a move towards $0.025ish. Not a meteoric rise, but enough to make you feel like you've found the answer to life, the universe, and everything (which, by the way, is 42, but let's keep that between us).

Wait for that neck line break! #XVG at the 15min. Target $.0257. Why is this so significant? Because that will break our 6 year accumulation triangle!! $.03 is my target to start the breaking point!! I expect major news announcement or positive news to hit the

I opened LONG from 0.0174. I will fix profit at 0.021 and will wait breaking resistance at 0.021

XVG going parabolic upon 1day golden crossYet another shining example of apparently hall all boats rise thanks to the golden cross. Right when golden cross occurred Verge goes parabolic. It has now broken confidently above this inverse head and shoulders pattern and still would make 54% gains from its current spot to hit the full breakout target of the inverse head and shoulders pattern. Though Verge has long been considered a dead coin, I do recall talk that it may possibly one of the few cryptos that is currently ISO20022 compliant right now so that is indeed an advantage it has going for it right now. Possibly not so dead afterall, but this could also be a case of “All boats rise” with the current parabolic market conditions. Also wanna give a proper shoutout to my friend Saeid for believing in this one. Saeid focuses more on elliot waves and harmonic chart patterns and is a solid analyst himself, and he believed in XVGs potential to do something lke this much mroe than I did. *not financial advice*

XVG showing a very impressive investment opportunityHi Everyone;

today we have one of the best risk to reward Investment opportunity

it is more than 4100 times the risk and the chart is look very promising.

I expect breaking the previous bear market key point will clear the way to the final target

Verge (XVG)Verge is a project based on the Bitcoin source code that is focused on privacy and stealth transactions. Anyway, XVG has been in a downtrend almost since the beginning. As can be seen, when XVG broke the second downtrend line, a strong upward wave started. Now, Verge is oscillating in a sideways channel. Let's see when XVG breaks this area upward.

XVG/USDT PlanXVG/USDT Plan

XVG/USDT is approaching a key resistance level, and the chart is shaping up for a potential breakout. The price is gradually gaining momentum 📈, and this setup looks promising for a bullish move if confirmed.

Keep an eye on the following:

- The current resistance zone needs to be broken. A successful breakout could lead to a strong move upward 🔑.

- Watch for increased trading volume during the breakout to confirm buyer strength 🔥.

- Momentum indicators like RSI and MACD are turning bullish, signaling potential upside ⚡.

Tips:

- Wait for a clear 4H or daily candle close above the resistance before entering the trade 📍.

- A retest of the broken resistance as a support zone provides a safer entry point ✅.

- Manage your risk carefully with a tight stop-loss below the resistance level 🔒.

Targets:

- First target:

- Second target:

Always trade responsibly and DYOR 🔍. Let’s see how this plays out! 🚀