Overview some vendors getting historical priceI tried to connect some vendors: IEXCloud, TD Ameritrade, Yahoo Finance, Rapid API, Alpaca, CNBC, and Tiingo I have some notes:

IEXCloud has no historical prices on timeframes: 5m, 15m, 1h, 2h, 4h but realtime this one is a good performance

TD Ameritrade limit connection by minutes and no timeframes: 1h, 2h, 4h

Yahoo Finance has timeframes but it returns fake data when there are many connections

Rapid API is very slow maybe it coved many many third-party

Cnbc delayed 2 minutes

Alpaca limit connection

Tiingo maybe is good, it has timeframes minute and hour, ex: 5m, 15m, 1h, 2h, 4h (excepting day and week)

So if you want to get price by timeframe for your application, you can choose Tiingo (paid monthly) or connected IEXCloud to get realtime

Yahoo

The best tool to follow optionsYahoo Finance is the best tool.

I like to trade options but I haven't found the best tool yet. I often follow Yahoo Options, I think this is the best tool and it is free.

Although it is delayed 15 minutes as real-time price, I can get all contracts of many expirations and based on changing price.

Steps to follow:

Search a ticker and go to the Options section

There are 2 viewing types: List and Straddle. I often look at on Straddle section to compare between CALL and PUT.

In the expiration select box, I often visible the second or third week from current, it is less losing (this is my expiriense)

Key to focus: change and open interest, it is important to trade options

However, Yahoo Options don't support comparing change along days (I will note next article)

Summary, Yahoo Options is the best free tool to follow trading options.

Yahoo Japan to Take Control of Fashion Retailer ZozoJapan’s top fashion e-retailer Zozo, reportedly, will give Yahoo Japan full control over it for a 400 billion-yen takeover amount. Converted into dollars, the famous web services company is bidding $3.70 billion to acquire Zozo.

The Tokyo-based online fashion store would enable Yahoo Japan to have a more comprehensive array of services and compete against rivals head-on. Yusaku Maezawa, the billionaire mind behind Zozo, announced his departure from his CEO post.

According to Maezawa, he will sell most of his stake as Zozo’s shares have dragged down around 60% over the year.

“I will entrust Zozo to a new president and take my own path,” Maezawa said in a Twitter post.

Yahoo Japan, if the deal closes, should be able to jumpstart its expansion into the fashion space in Japan through Zozo. Amazon and Rakuten, the main competitors of Yahoo Japan, have already tried but struggled to make progress.

Zozotown, which is the name of Zozo’s online mall, has control of roughly 50% of the Japanese fashion market.

Investors have been having uncertainties about Zozo’s growth after a previously-failed experiment and brand competition over discounting.

According to Yahoo Japan, it is looking to buy a 50.1% stake of Zozo, which saw a market-value close at 680 billion yen on Wednesday as shown by Refinitiv.

Maezawa told the public that he would sell about 30% of his stake in the company, which leaves him roughly 6% ownership over Zozo.

Among many Japanese entrepreneurs in today’s age, Maezawa stands out. He’s made a name for himself by defying skeptics from a decade-ago time. He’s now gained credit for creating a trendy and easy-use fashion website during a time when this was unheard of.

Maezawa and Zozo

Maezawa’s lifestyle enticed the public into getting to know him more. His way of living attracted attention as he flamboyantly displayed his wealthy persona.

He was the first to sign up—among a number of fellow entrepreneurs—for a trip around the moon by Elon Musk’s SpaceX program. He also paid $110 million for renowned painter Jean-Michel Basquiat’s work.

But his colorful show and tell of wealth comes with a price, even on Zozo. Maezawa has sold part of his art collection at Sotheby’s, saying he’s run out of money.

Last year, Zozo’s annual earnings started to decline primarily because of a failed made-to-measure service, which started as an experiment.

The service mainly became ineffective as it ended having few orders while having huge costs.

Several brands have also become unhappy with Zozo’s discounting methods, therefore, leaving the platform. Instead, others went on to pursue the creation of their own e-retailer services.

In March, the Japanese fashion e-retailer said it was able to secure a commitment line from banks worth around 15 billion yen.

Now, as Yahoo Japan prepares to take over Zozo, a shift in the Japanese tech sector is simultaneously occurring. Rakuten is set to launch its wireless telecom services, rivaling SoftBank’s credibility in dominating the market. However, Amazon has also started to step into the territory of fashion.

Once Maezawa leaves his post, Kotara Sawada will assume the role of leading Zozo, according to a statement from the companies.

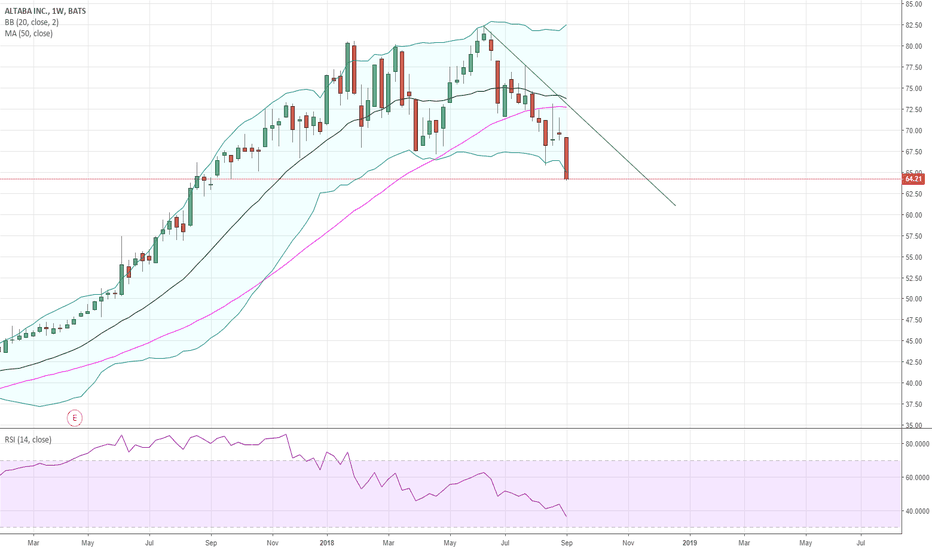

AABA weeklythis is Yahoo, they have a P/E of 2.36 YET earnings per share of ~$28... their financials are turning around... is this the def of a sleeper?... its yahoo

The Break! I was waiting for yahoo to break to start the uptrend. Bet is that the macd will signal a BUY. I would look to open a trade tomorrow morning.

Entry = tomorrow's open

S/L = 44.65

yahoo $yhoo Weekly close pretty much right at ihs neckline. I will have more confidence if we see a solid hold above the highs of the right shoulder.

YAHOO possible Bearish Shark PatternLooks like completed bearish shark pattern. Looks like uptrend loosing power. Maybe hacks steal was the trigger for down trend.

On 1H chart we broke 240 MA, made pullback. We are on top of trend line, third attempt. If it holds we could go down.

YHOO. Looks finished upIt looks like wave (c) of B finished or going to do so.

Yellow (c) already hit the 200% distance of wave (a) in white B.

Wave B in its turn has hit the 61.8% of wave A.

All conditions point to imminent drop in price.

MACD shows bearish divergence - price is up as MACD is falling.

Target for the drop = $19.6 where the C=A.

YHOO UpYahoo broke a resistance and going higher towards 46.5 area. Long entry with a little position because of low RR

YAHOO DAILY BULLISH VIEWSignals:

1-Double bottom

2-Breakout of incline resistance

3-Realisation of channel

4-Formation of flag

Buy 42.70-42.80 (breakout of top flag's line)

Stop-loss 41.72 (-1 tic flag's low price)

Target 50.00 (sizing)

Yahoo weekly bullish viewSignals:

1-Double bottom

2-Breakout of incline resistance

3-Realisation of channel

4-Formation of flag

YAHOO - MORE UPSIDE BEFORE A POSSIBLE BIG DROPYahoo has broken a corrective structure on daily, so i'm expecting more upside before a possible big drop. I'm looking for a strong breakout of this uptrend.

YAHOOAM NEUTRAL ON YAHOO, MAY SEE SOME NEW HIGHS DUE TO THE NEWS OF VERIZONE BUYING SOME ASSETS. BUT BECAREFUL. ONCE IT BREACHES THOSE GREEN LINES, IT'S A SUCKER FOR SHORT.

techcrunch.com