USDJPY Buy Setup – Breakout Confirmation & Seasonal TailwindTechnical: USDJPY has broken above a downtrend resistance line after finding support at the 61.8% Fibonacci retracement level at 146.95 . This breakout suggests the corrective phase may have ended, signaling potential for further upside. Pullbacks toward 149.70 (a retest of the broken trendline) present an attractive entry opportunity. Upside targets are 152.74 and 157.10 in the short to medium term. The setup is invalidated below 147.97 , with a break below 146.33 negating further bullish expectations.

Fundamental: Commercial selling of the Japanese Yen and renewed dollar purchases indicate a shift favoring USD over JPY, supporting the bullish technical outlook.

Seasonal: Over the past 25 years , USDJPY has risen 76% of the time between March 25 – April 8 , with an average gain of 1.04% .

Trade Idea:

Entry: On pullbacks toward 149.70

Stop Loss: 147.97 (or 146.33 for extended risk management)

Targets: 152.74 and 157.10

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Yen

Japan's Tariff Worries and BOJ Rate Hike HintsThe Japanese yen remained weak around 150.7 per dollar on Tuesday, near a three-week low, as the U.S. dollar gained strength. Trump's plan to impose tariffs on autos, pharmaceuticals, and other sectors raised concerns for Japan’s export-driven economy.

BOJ minutes from January showed officials remain open to future rate hikes depending on wage and inflation trends, with one member suggesting a possible increase to 1% in late fiscal 2025. Still, the BOJ kept rates steady at 0.5% last week, maintaining a cautious stance with global tensions.

Key resistance is at 151.70, with further levels at 152.70 and 154.00. Support stands at 147.00, followed by 145.80 and 143.00.

Yen Slips to 149 as Inflation EasesThe yen fell to around 149 per dollar on Friday, ending a two-day rally, after Japan’s core inflation eased to 3% in February from 3.2% in January, still above expectations of 2.9%. This marked the second month of stronger inflation, reinforcing the case for future rate hikes.

Earlier, the BoJ held rates at 0.5% and maintained a cautious stance, citing global uncertainties, particularly rising U.S. tariffs. The bank also reiterated its focus on monitoring currency moves. A stronger U.S. dollar further pressured the yen amid global growth and trade concerns.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

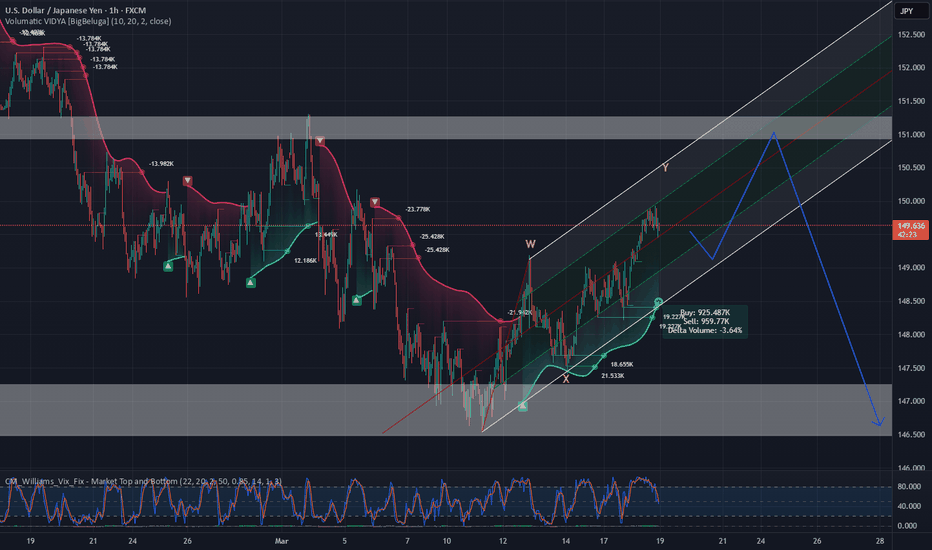

USDJPY SELL SETUP!!From a technical perspective, examining the USD/JPY chart, we might notice that prices are forming a lower high, which often indicates a potential downtrend. The price respecting Fibonacci retracement levels can also suggest that the market is reacting to key support and resistance levels. When traders see the price approaching these levels and behaving predictably, it can bolster their confidence in the direction of their trades.

Overall, the expectation is for a continuing strength in the yen, especially if the market sentiment remains focused on potential rate hikes from the Fed. This scenario might lead to more bearish moves for the USD/JPY pair, making it important to watch for any significant economic data releases or comments from central bank officials that could signal changes in monetary policy.

USD/JPY Analysis: Dollar Weakens After Fed DecisionUSD/JPY Analysis: Dollar Weakens After Fed Decision

Yesterday, the Federal Reserve announced its interest rate decision, which, as expected, remained unchanged. Fed Chair Jerome Powell emphasised that there is no rush to cut rates amid uncertainty surrounding US inflation and the tariff policies implemented by the Trump administration.

This key announcement triggered volatility in financial markets, notably:

→ US stock indices rose;

→ the US dollar weakened, which was evident in currency (and cryptocurrency) charts involving USD pairs.

The most significant movement occurred in the USD/JPY chart, as the Bank of Japan was also active yesterday. While it also left interest rates unchanged, it acknowledged growing uncertainty around Japan’s economy and added a new reference to the "changing trade environment."

Technical Analysis of USD/JPY

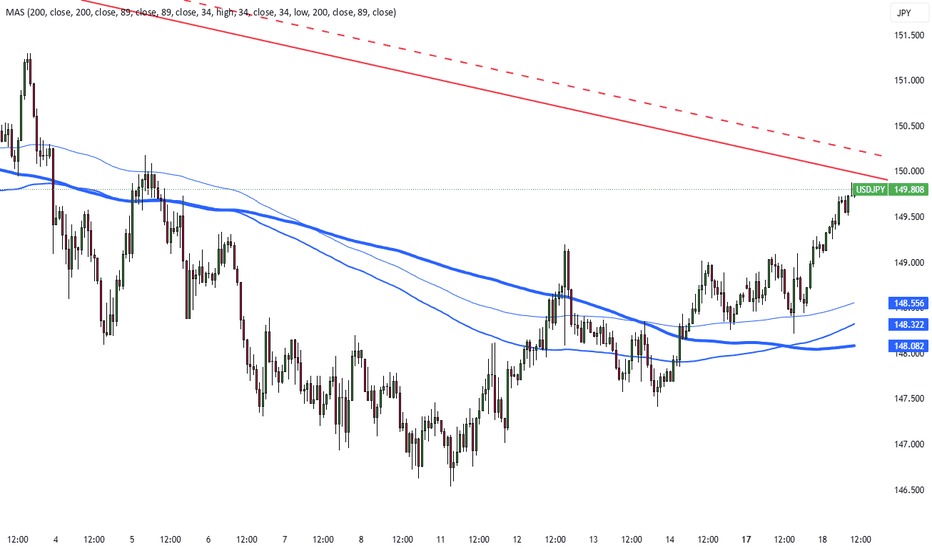

As we noted on 21 February when analysing the Japanese yen’s exchange rate against the US dollar:

→ Price fluctuations are forming a downward channel (marked in red).

→ The former support at the lower boundary of the blue channel may now act as resistance.

Since then, the price has:

→ Tested the breakout level (indicated by an arrow) before continuing to decline within the channel, confirming its relevance.

→ Reached the lower boundary of the channel and rebounded upwards from the 147 yen per dollar level.

Given that the price is closely interacting with the channel lines and is currently around its median, it suggests that supply and demand are relatively balanced under these conditions. This is further supported by the fact that neither the Fed nor the Bank of Japan introduced surprises, leaving interest rates unchanged.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Dollar Weakens Post-Fed, Lifting Yen Beyond 148.5The yen strengthened past 148.5 per dollar, rising for a second session as the dollar weakened after the Fed reaffirmed two rate cuts this year. Fed Chair Powell downplayed Trump’s tariffs as short-lived. The BoJ kept rates at 0.5% on Wednesday, adopting a cautious stance amid global risks, especially US tariffs. It also emphasized monitoring forex markets and their impact on the economy.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

EUR/JPY Market Analysis: Potential Reversal at Key Resistance LeThe EUR/JPY pair, on the 4-hour chart, exhibits a strong bullish impulse that recently peaked around 163.64 , aligning with a key Fibonacci extension level (1.618). This area marks a critical resistance zone, where price action has shown signs of rejection.

The Harmonic pattern, such as the b]Crab , suggest potential exhaustion of the uptrend. The latest leg upward reached a 2.618 extension , reinforcing the possibility of a corrective move. Support levels to monitor include ** 162.23 ** (BC) and ** 160.59 ** (T1), which could serve as downside targets if bearish momentum gains traction.

For traders, a decisive break above **163.64** could invalidate the short-term bearish bias, paving the way for further upside. Conversely, sustained rejection from this level may trigger a deeper retracement towards key Fibonacci and harmonic support zones.

Conclusion : The pair is at a critical inflection point, where price action and confirmation of rejection signals will determine the next directional move. Traders should watch for price action at resistance and key support levels to assess trade opportunities.

Japanese Yen Hits Two-Week Low Before BoJ MeetingThe yen fell past 149.5 per dollar, a two-week low, ahead of the BoJ's policy decision. The central bank is expected to hold rates at 0.5% on Wednesday while assessing U.S. policy impacts. Despite a pause, rate hikes are anticipated later this year as rising wages and inflation support policy normalization. Major firms agreed to wage hikes for the third straight year, increasing consumer spending and inflation.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

Sentiment Extreme on the Yen Could Bode Well for Commodity FXI take a closer look at the Japanese yen futures market to highlight why I think the Japanese yen has reached an important inflection point. And that could further support the bounce of yen pairs such as AUD/JPY, CAD/JPY and NZD/JPY - alongside USD/JPY should the Fed not be as dovish as many hope.

Matt Simpson, Market Analyst at City index and Forex.com

GBPJPY - Higher Probability Favors Upside ContinuationThe GBP/JPY pair is displaying strong bullish momentum as it trades near 192.25, having recently tested but failed to break through the key resistance level at 193.05. After forming a higher low structure within an ascending trendline since late February, the pair shows notable strength with buyers stepping in at each pullback. Technical analysis suggests that the higher probability move is a continuation to the upside, with price likely to break above the horizontal resistance at 193.05 after a possible minor retracement. If this bullish scenario plays out, we could see the pair extend toward the 194.50 level before potentially reaching higher targets as indicated by the upward-pointing arrow on the chart. The ascending trendline and the support zone marked by the blue box near 191.00 should provide solid foundations for this anticipated upward move, keeping the overall bullish bias intact as long as price remains above these key structural levels.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY - Bullish pattern towards descending trendlineThe USD/JPY pair appears to be forming a potential reversal pattern after reaching a low around 146.50 in early March. Having bounced from this support level, the price is now hovering near 148.60 with indications of a larger corrective move ahead. Technical analysis suggests we are expecting a bigger correction in this area, with the price likely to test higher levels before encountering significant resistance. The initial price target will be the upper boundary of the blue box area (approximately 150.50-151.00), with potential to go toward the descending trendline that has been capping price action since January.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Yen Slips Against USD as Tariff Concerns Increase the DollarThe yen fell below 148 per dollar on Friday, reversing gains as trade tensions increased the dollar. Trump reaffirmed plans for reciprocal tariffs starting April 2. Despite this drop, the yen remains near a five-month high, backed by expectations of BOJ rate hikes. Japanese firms agreed to wage increases for a third year, aiming to offset inflation and labor shortages. Higher wages may spur spending and inflation, giving the BOJ room for future hikes. While rates are expected to remain unchanged next week, policymakers may pursue hikes later this year.

Key resistance is at 149.20, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

Fundamental Market Analysis for March 12, 2025 USDJPYThe Japanese yen (JPY) continued to lose ground against its US counterpart for the second day in a row and moved away from the highest level since October, reached the previous day. Fears that US President Donald Trump may impose new tariffs against Japan have proved to be key factors undermining the safe-haven yen. Nevertheless, a significant Yen depreciation still seems unlikely amid hawkish expectations from the Bank of Japan (BoJ).

Data released today showed that Japan's annual wholesale inflation, the Producer Price Index (PPI), rose by 4.0% in February, indicating that inflationary pressures are intensifying. In addition, hopes that the sharp wage increases seen last year will continue into this year support the market's growing confidence that the Bank of Japan will raise interest rates further. This, should serve as a tailwind for the low-yielding yen and help limit losses.

In addition, lingering concerns over the possible economic consequences of Trump's trade policies and a global trade war should support the JPY. The US Dollar (USD), on the other hand, is near multi-month lows amid expectations that a tariff-induced slowdown in the US economy will force the Federal Reserve (Fed) to cut borrowing costs several times this year. This should help limit the USD/JPY pair's rise.

Trade recommendation: SELL 148.35, SL 148.95, TP 147.35

USD/JPY H4 | Heading into an overlap resistanceUSD/JPY is rising towards an overlap resistance and could potentially reverse off this level to drop lower.

Sell entry is at 148.20 which is an overlap resistance that aligns with a confluence of Fibonacci levels i.e. the 23.6% and 38.2% retracements.

Stop loss is at 149.45 which is a level that sits above the 50.0% Fibonacci retracement and a swing-high resistance.

Take profit is at 146.53 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDJPY - Bigger correction on the daily timeframeUSD/JPY's daily chart indicates we're expecting a larger correction in the near term, followed by a likely continuation of the downtrend toward the blue box target area (143.50-146.00). After reaching peaks near 162.00 in July 2024 and 158.00 in December 2024/January 2025, the pair has established a series of lower highs, creating a clear downtrend pattern. Currently trading around 148.05, the price sits at a critical juncture, with the projected path suggesting a temporary bounce (as illustrated by the zigzag line) before bearish momentum likely resumes. This outlook is supported by the consistent lower highs since mid-2024, the price's position near a historical support/resistance level, February's failed attempt to sustain prices above 150, and the overall downward momentum that has dominated since December 2024.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY Weekly FOREX Forecast: March 10 - 14th In this video, we will analyze USDJPY and JPY Futures. We'll determine the bias for the upcoming week, and look for the best potential setups.

After a long period of weakness in the YEN, the last couple of months have shown a turnaround. By several metrics, the BOJ has the country's economy finding its footing, and looking up. This is reflecting in its currency. It a time of uncertainty, the YEN will and has been outperforming the USD, as investors look to it as the safe haven of choice. This is likely to continue in the next week or so.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GBPJPY - More downside?GBP/JPY appears to be in a potentially bearish setup after recently testing resistance. The chart shows that price has formed a significant consolidation zone with clear upper and lower boundaries marked by the red horizontal lines. After making a recent high, the price seems to be struggling to break above the upper resistance zone highlighted by the pink box. The long downward-pointing red arrow marked on the chart is our highest probability move that we anticipate right now.

Given the recent price action and failure to establish new highs above resistance, the higher probability move is likely downward. This bearish outlook is supported by the apparent double top formation near the resistance zone and the pronounced selling pressure that has emerged after testing these levels. Traders should watch for a potential breakdown below recent support levels, which could accelerate the downside move toward the lower boundary of the range as indicated by the arrow's trajectory.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Yen Steady Near 149 as BOJ Hints at Possible Rate HikesThe yen held near 149 per dollar, its strongest in five months, benefiting from a weaker dollar amid a stronger euro and Trump’s tariffs. While Trump eased tariffs for some automakers, retaliatory measures pressured the dollar. BOJ Deputy Governor Uchida signaled potential rate hikes if economic forecasts hold, noting financial conditions remain loose with minimal JGB reductions.

Key resistance is at 152.00, with further levels at 154.90 and 156.00. Support stands at 148.60, followed by 147.10 and 145.80.