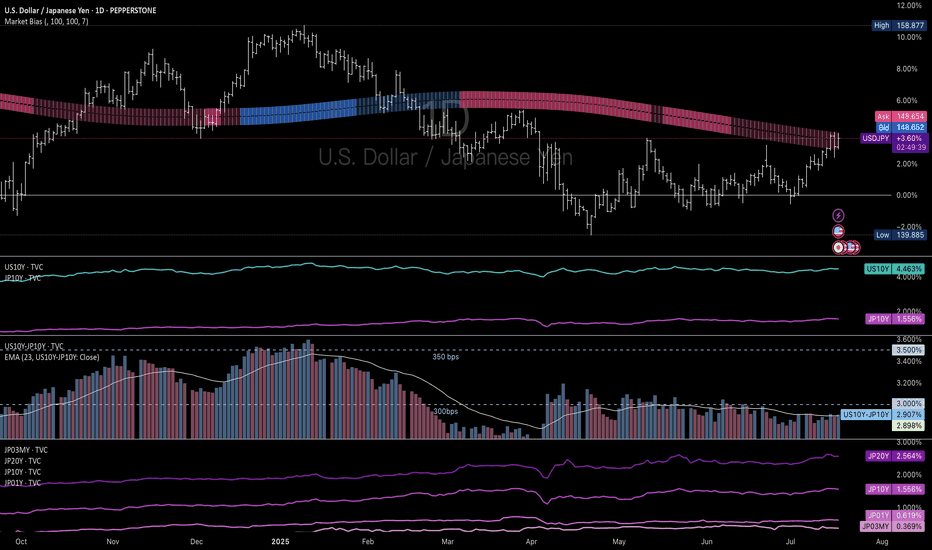

Good setup to short USDJPYRecently the risk emotions caused by the White House and inflation worries it produced drives long term US Treasury yields rising, with 20-yr yield cross up to 5% once again.

Yet, you can see that the yield difference are still at a dropping trend. Moreover, the Fed is expected to cut 125 bps in the next 15 months according to the swap market.

Combined with the techincal levels, it's a good price to get into a short position of USDJPY. I don't know about you guys. I'm in

Yieldcurve

Steepening Yields & Uncertainty: What says the Bond Markets?

CBOT:ZN1!

US Yield Curve in Image Above

Showing yields on May 27, 2024 vs May 27, 2025 . What happened in a year and how to understand this?

Looking at the image above, the yield curve was inverted on this day last year. Comparing last year’s term structure to today’s, we can see that the yield curve has steepened sharply.

What does this signify? Let’s dive deeper as we share our insights and assessment of what the bond market is doing.

At the March 16, 2022, meeting, the FED finally pivoted away from their "transitory inflation" narrative to a significant supply shocks narrative—supply-demand imbalances and Russia-Ukraine war-related uncertainty. This started a rate hike cycle, with rates peaking at 5.25%–5.50% in the July 26, 2023, meeting.

The Fed Funds rate was reduced by 100 bps, with a cut of 50 bps on September 18, 2024, and two cuts of 25 bps in the November and December 2024 meetings. The FED paused its rate cutting at the start of the year, citing—as we have all heard recently—that the inflation outlook remains tilted to the upside, and given policy uncertainty and trade tariffs, the risk to slowing growth continues to increase. Businesses are holding back spending due to this confusion and continued uncertainty. ** Refer to the image of FED rate path above.

The start of the rate hike cycle also began the FED’s balance sheet reduction program—from a peak of $8.97 trillion to the current balance of $6.69 trillion. **Refer to the image of FED's balance sheet above.

Rates remained elevated at these levels to bring down inflation, which peaked at 9.1% in June 2022. Inflation has currently eased to 2.3% as of April 2025. Refer to the CPI YoY image above.

Ray Dalio, Jamie Dimon, and most recently non-voter Kashkari (FED) highlighted stagflationary risks. FED Chair Powell noted risks to both sides of its dual mandate in its most recent meeting March 19, 2025.

In the March meeting, they also announced a slower pace of reducing Treasury securities, agency debt, and agency mortgage-backed securities. In this announcement, Treasury securities reduction slowed from $25 billion to $5 billion per month, while maintaining agency debt and agency mortgage-backed securities reduction at the same pace.

Many participants and analysts noted this as a dovish pivot. However, given the current market conditions and the supply-demand imbalance emerging within US Treasury and bond markets, we note the rising yields.

The yield curve steepening signifies that investors want better return on their bond holdings. The interesting turn of events here is that US Treasuries and bonds have not provided the safety they usually do in times of uncertainty and policy risk. The dollar has fallen in tandem with bonds, resulting in a devalued dollar and rising yields. Thirty-year yields touched the 5% level, and the DXY index traded at levels last seen in March 2022.

Looking deeper under the hood, we note that a repeat of COVID-pandemic-style stimulus measures may perhaps result in an uncontrollable inflation spiral. The ballooning twin deficits—i.e., trade and budget deficits—with the new “Big Beautiful Bill,” or as some analysts joked, noting this as a foreshadowing of the newest credit rating: “BBB.”

Any black swan event may just be the catalyst needed to tip these dominoes to start falling.

As we previously noted in some of our commentary, debt service payments are now more than defense spending.

The new bill, once passed, is going to add another $2.5 trillion to the deficit. While the deficit is an issue in the US, it is important to note that it is a global issue.

The key question here will be: in due time, will the US bond market and US dollar regain their usual haven status? Or will we continue seeing diversification into Gold, Bitcoin, and global markets?

So, to summarize these mechanics playing out in the US and global markets—in our view—sure, the US administration, one may debate, is not helping by creating this environment of uncertainty in global trade, coupled with a worsening deficit and higher-for-longer rates. The markets currently are perhaps at their most unpredictable stage, with so much going on in the US and across the world.

It is still too early to write off US exceptionalism, and there will be value in rotating back to US markets once the dust on policy uncertainty settles. We suggest that investors stay diversified, watch for any upside surprises to the inflation and do not chase yields blindly as the move may already be overstretched. It is also our view that we are past the extreme policy uncertainty having already noted Trump put when ES Futures fell over 20%.

Although note that near All-time highs or at 6000 level, we are likely to see further headline risks until trade deals are locked in. As always, be nimble, pragmatic and be ready to adjust with evolving market conditions.

Definitions

Plain-language definition: A “basis point” (bps) is 0.01%. So, a 50 bps cut = 0.50% reduction in interest rates.

Plain-language definition: A steep yield curve means long-term interest rates are much higher than short-term ones. This can reflect rising inflation expectations or increased risk.

A “black swan event”—an unpredictable crisis—could set off a chain reaction if confidence in US finances weakens further.

Trade deficit: Importing more than exports

Budget deficit: Government spending far more than it earns

The Yield Curve is NOT InvertedLately I've been seeing a lot of people incorrectly state that the Yield Curve is currently inverted.

IT IS NOT.

Easily measurable 10Y - 2Y.

Google the definition if you need to.

I laid out the impact of the yield curve inverting against the S&P 500.

In most cases, you can see SP:SPX sells off slightly after inverting.

The higher the spread, the healthier the market is.

You want funds buying longer dated securities for market stability and confidence.

S&P500 vs Unemployment vs Yield CurveI'd be surprised if that was the bottom in equities. 10yr/2yr is still coming out of inversion which historically is followed by a recession and a decline in equities, and we have unemployment remaining stubbornly low with only one direction to go from current levels. Market selloffs usually mean investors lose money while main street loses jobs so we should start to see the unemployment rate begin to rise from here assuming that the tariff war isn't over.

Trump proved today that he has no intention of relenting on the new tariffs; when China retaliated with 34% tariffs on US goods, he immediately hit them with 50% tariffs. Not sure which side will cave first, but as long as there is uncertainty around US/China trade the risk for further declines in equities remains.

The previous two times the yield curve inverted, we saw 50%+ declines in equities and rising unemployment when the curve came out of inversion. There was also a short-lived inversion in 2019 with a spike in unemployment and falling equity prices due to Covid, but the Federal Reserve lowering interest rates to 0% and printing trillions of dollars kept that bear market short and sweet.

We currently have a Federal Reserve that needs higher rates to fight inflation while at the same time we have a president who wants lower rates to stimulate growth. Catch-22 for the Fed: if they lower rates, they risk reigniting inflation. If they raise rates or keep them flat during a market decline it will speed up the decline in equities. Trump knows this which is why I don't think that the tariff war and market decline are over.

US Recession Imminent! WARNING!Bond traders are best when it comes to economics. Stock traders not so much.

As the chart shows, historically, when rates bunch up, what follows is a recession. During the recession, the economy tries to fix itself by fanning out the yield curve, marking it cheaper to borrow and boosting the economy.

The best time to be buying up stocks and going long the market is when the yield curve is uninverted and fanned out wide—not when it is bunched up like this.

My followers know this is my first warning of a recession since FEB. 2020.

WARNING! Things can get ugly from here very quickly!

US10Y: 10-Year Treasury Yield – Safe Bet or Yield Trap?(1/9)

Good morning, everyone! ☀️ US10Y: 10-Year Treasury Yield – Safe Bet or Yield Trap?

With the 10-year yield at 4.358%, is it time to lock in safety or wait for better rates? Let’s break it down! 🔍

(2/9) – YIELD PERFORMANCE 📊

• Current Yield: 4.358% as of Mar 25, 2025 💰

• Historical Context: Above pandemic lows (~1-2%), below early 2000s (5-6%), per data 📏

• Sector Trend: Inverted yield curve signals caution, per economic reports 🌟

It’s a mixed bag—let’s see what’s cooking! ⚙️

(3/9) – MARKET POSITION 📈

• Safe Haven: U.S. Treasuries are risk-free ⏰

• Income Appeal: 4.358% yield draws income seekers 🎯

• Potential Upside: If rates fall, bond prices rise 🚀

Firm in safety, with growth potential! 🏦

(4/9) – KEY DEVELOPMENTS 🔑

• Inverted Yield Curve: 2-year yield higher, hinting at slowdown, per data 🌍

• Fed Outlook: Expected rate cuts later in 2025, per posts on X 📋

• Market Reaction: Investors balancing income with economic risks 💡

Navigating through uncertainty! 💪

(5/9) – RISKS IN FOCUS ⚡

• Interest Rate Risk: If rates rise, bond prices drop 🔍

• Inflation Risk: Erodes real returns if inflation outpaces yield 📉

• Opportunity Cost: Missing higher returns from stocks ❄️

It’s a trade-off—risks are real! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Risk-Free: No default risk, backed by U.S. government 🥇

• Liquidity: Active market for trading, per data 📊

• Tax Benefits: Interest exempt from state, local taxes 🔧

Got solid foundations! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Interest rate and inflation risks, per economic reports 📉

• Opportunities: Capital gains from falling rates, diversification benefits 📈

Can it deliver both income and growth? 🤔

(8/9) – POLL TIME! 📢

US10Y at 4.358%—your take? 🗳️

• Bullish: Buy now, rates will fall soon 🐂

• Neutral: Hold, wait for more clarity ⚖️

• Bearish: Wait for higher yields or better opportunities 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

US10Y offers a steady yield with safety, but with an inverted curve, caution is advised. Gem or bust?

Yield Curve Inversion Watch Chart - Fed Has To Cut!If you’re worried about a recession, you should be watching the Yield Curve Inverting.

Historically, an inversion signals a recession, but with a lag.

We can see this on the chart whenever the yield curve hits 0%

This shows the 2Y yield higher than the 10Y which is a signal that the market expects slow economic growth.

To counter-act the inversion, the Fed cuts the EFFR, although they are always late.

One would think that the Fed would learn from history, and get ahead of the curve this time around.

Only time will tell.

I’m cautiously optimistic as Treasury Secretary Bessent has stated that he has a weekly meeting with Fed Chair Powell.

$Meta and U.S equity Bull Run Almost Finished? Was just having a little fun before bed and brainstorming on the NASDAQ:META chart. Our darling as of late. I love trying to find similarities and patterns between macro swings and cycles. Human psychology and business cycles have a way of repeating themselves pretty often. As they say, history doesn't repeat, but it rhymes.

This recent melt up reminds a lot of the price action NASDAQ:META saw in 2021-2022. RSI overbought both times, currently approaching the 2.618 fib when connecting them to major high and low points. Decreasing volume on the moves up.

There's a lot of other data to support a bear market may be on the horizon:

Weak housing data/stocks (I do see some outlier stocks in the housing sector).

The yield curve un-inversion which typically precedes major bear markets 6-12 months after un-inversion.

The dollar seems to want to keep going higher. However it has shown a lot of weakness here lately which could help fuel the rest of the bull market.

The unwinding of the Japanese Yen carry trade has seemed to play a big factor in U.S equities as of late. Every time the BOJ hikes interest rates, a lot of U.S. equities see pretty sizable bearish volatility shortly after.

Being the darling that NASDAQ:META has become, once this trend line breaks it will be a signal that everyone should be taking note of in my opinion. I think the risk of a bear market increases dramatically. Maybe we get a shallow or 2022 style bear market next year and continue to make one last lag into new highs in 2027.

Here are some ideas that could support that theory:

China seems to be coming out of a depression-style bear market and is beginning to inject liquidity into their economy. This could help give U.S. equities a little more juice to run higher for longer

chips could make a major comeback and fuel SPY/QQQ higher for longer.

Names like Google, Tesla and Amazon can continue to show strength and we could see a rotation into them.

Maybe we get some more significant quantum breakthroughs with the help of AI.

These are things to keep in mind, but I think the probabilities of this this bull market we've enjoyed since 2008 is A LOT closer to the end than the beginning.

I base most of my sentiment off the 18.6 year real estate/land cycle theory that I have been following since 2022. I also give a lot of credibility to U.S. yield curve un-inversions sending shockwaves through the global economic system.

What do you guys and gals think?

META run almost finished? Just a little fun and brainstorming with higher time frame charts. Utilizing RSI, patterns, and time cycles.

Lots of similarities between now and the 2020-2021 bull run. Not to mention a lot of good data suggesting we are close to a recession at best. (Weak housing data/stocks, yield curve uninversion)

What are your thoughts?

10-year Treasury Yield Surging ahead last FOMC in 2024After a politically charged November, bond markets have shifted their gaze back to economic fundamentals, setting the stage for a crucial Federal Reserve meeting on December 17. Recent data—including a robust jobs report and rising inflation—have reignited debates over long-term yields and the Fed’s future rate trajectory.

With the Fed’s dot plot and 2025 outlook in focus, the bond yield rallies ahead of the meeting reflects heightened anticipation of pivotal policy signals. This piece unpacks the dynamics driving Treasury yields and explores a potential trade setup deploying CME Yield futures to navigate the unfolding market environment.

MARKETS ARE FOCUSSING ON ECONOMIC DATA AGAIN

In November, U.S. Treasury yields were more influenced by political factors than by economic data. The 10-year Treasury yield remained largely unchanged after the 13/Nov CPI report, which showed headline CPI rising to 2.6% year-over-year in October, up from 2.4% in September. While the higher inflation suggested potential risks to bond yields—given that prolonged inflation could lead the Federal Reserve to slow its pace of rate cuts—Treasury yields were mostly unaffected by the data.

Instead, yields declined sharply when markets opened on November 25, following President Trump’s announcement of Scott Bessent as his pick for U.S. Treasury Secretary. Bessent, a fund manager, is anticipated to prioritize tax cuts and fiscal caution. The announcement drove the 10-year Treasury yield nearly 30 basis points lower over the next week, reaching its lowest level in over a month.

In the past two weeks, however, market focus appears to have shifted back to economic data. The non-farm payrolls report for November, released on December 6, exceeded expectations with 227,000 jobs added. Additionally, October’s dismal figure of 12,000 jobs was revised upward to 36,000, providing further support to the positive sentiment.

The improved jobs report soothed investor concerns, signalling that the state of the US economy may not be as bad as previously perceived. The jobs report eventually drove a 5-basis point recovery over the following week.

The latest CPI report for November also reaffirmed the trend that investors were focussing attention on economic data as 10Y yields surged after the report, rising nearly 19 basis points from the 09/Dec low.

10Y-2Y spreads have also surged by 8 basis points since 09/Dec. Investors can monitor the yield spreads using CME’s Treasury watch tool .

Source: CME TreasuryWatch

The tool can also be used to monitor the yield curve. Over the past month, the decline in Treasury yields has been concentrated in shorter-term tenors (2Y, 3Y, and 5Y), while the 30Y yield has remained largely unchanged. In contrast, the increase in yields over the past week has been more uniform across all tenors.

Source: CME TreasuryWatch

The November report showed inflation rising even further to 2.7%, although in-line with expectations, it suggests that inflation may be more persistent than previously perceived. This has led to expectations of a higher inflation premium for long-term treasuries which may have contributed to the rally in 10Y treasury yields.

FED DOT PLOT REMAINS THE HIGHLIGHT NEXT WEEK

Markets are almost certain of a 25-basis-point rate cut at the FOMC meeting on 17/Dec, with FedWatch indicating a 97% probability of this outcome as of 16/Dec. However, the primary focus will likely be on the Fed's guidance for the rate trajectory in the coming year. Alongside the rate decision, the Fed is expected to release its dot plot and summary of economic projections at the December meeting.

The December meeting is crucial as participants closely monitor the outlook for 2025. At last year’s December meeting, the Fed projected significant rate cuts in 2024, which triggered a substantial equity rally and a decline in bond yields.

Source: CME FedWatch

Per CME FedWatch, market participants expect an additional 50 basis points of rate cuts in 2025. However, the Fed's September dot plot indicated expectations for 100 basis points of cuts in 2025. If the December dot plot reaffirms the projection of 100 basis points, bond yields could decline sharply.

Source: Federal Reserve

BOND YIELDS HAVE RALLIED HEADING INTO THE MEETING IN THE PAST

The 10-year Treasury yields have rallied ahead of three of the last four FOMC meetings, with the increases notably concentrated in the three days leading up to the meetings. Given the recent trajectory of 10-year yields, a similar pattern may be likely this time.

The 10Y-2Y spread has shown a similar trend, increasing ahead of the last three FOMC meetings. However, following the November meeting, the 10Y-2Y spread declined. This suggests it may be prudent to position ahead of the meeting to mitigate potential post-meeting volatility.

Hypothetical Trade Setup

Market participants are nearly certain of a rate cut at the upcoming FOMC meeting, but the summary of economic projections is likely to carry greater significance. Currently, market expectations for rate cuts in 2025 are more conservative than the Fed's previous dot plot. If the Fed reaffirms expectations for more aggressive rate cuts next year, bond yields could sharply reverse their two-week rally.

While the 10-year yield outlook remains uncertain and subject to risk, the 10Y-2Y spread has a more optimistic trajectory. The spread stands to benefit from expectations of further rate cuts and its ongoing normalization trend. Additionally, historical trends suggest that positioning before the FOMC meeting may be advantageous, as the spread corrected after the last meeting.

Investors can express a view on the steepening of the 10Y-2Y yield spread using CME yield futures.

CME Yield Futures are quoted directly in yield with a 1 basis point (“bps”) change representing USD 10 in one lot of Yield Future contract. This simplifies spread calculations with a 1 bps change in spread representing profit & loss of USD 10. The individual margin requirements for 2Y and 10Y Yield futures are USD 330 and USD 320, respectively, at the time of writing. However, with CME’s 50% margin offset for the spread, the required margin drops to USD 325 as of 16/Dec, making this trade even more compelling.

The below hypothetical trade setup provides a reward to risk ratio of 1.94x:

Entry: 13.5 basis points

Target: 30 basis points

Stop Loss: 5 basis points

Profit at Target: USD 165 (16.5 basis points x USD 10)

Loss at Stop: USD 85 (8.5 basis points x USD 10)

Reward to Risk: 1.94x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Trump Presidency Ignites Bond Yields on Inflation ExpectationsThe “Make America Great Again” ethos has set the greenback on fire. Donald Trump's re-election has the US dollar surging 2%, extending its rally since early October to a total gain of 5%.

This resurgence is despite the anticipated 25 basis points (“bps”) rate cut at the November FOMC meeting. Dollar rally is driven by expectations of potential policy changes by the Trump Presidency.

HIGHER INFLATION EXPECTATIONS UNDER TRUMP 2.0

Trump’s election victory, combined with the Republican sweep of the Senate and the House of Representatives, gives the party the leverage to enact swift and substantial legislative changes.

His policies, such as corporate-friendly tax cuts & light-touch regulations, are expected to amplify corporate growth. These policies, combined with import tariff imposition, are expected to drive inflation higher. Rising inflation will curtail the pace of rate cuts by the Fed.

Rate cut expectations have eased since election. On November 6 (election day), projections pointed to rates reaching 350-375 bps on election day (6/Nov) per CME FedWatch tool. Now, they are expected to reach 375-400 bps.

Trump has previously pushed the Fed towards accommodative rate environment. Fed Chair Powell re-iterated that the Fed remains independent and data driven.

Source: CME FedWatch

Trump's proposed tariff policy will further strengthen the dollar. In August 2023, Trump announced plans for a universal 10% tariff on all U.S. imports, reiterating that tariffs on Chinese goods could be even higher, potentially reaching 60%-100%.

Such tariffs are expected to drive inflation higher. It will raise consumer prices and provoke retaliatory actions from trading partners, worsening inflation. Trump aims for these tariffs to revitalize American manufacturing and reduce reliance on imports which collectively support a stronger dollar.

STRONGER DOLLAR TRIGGER BOND YIELD SURGE

The resurgent dollar has contributed to the sharp rally in bond yields. The yield rally since October has resulted in the 10Y yield rising by 60 bps. Yields initially surged after the election result but partially reversed the following day after the FOMC meeting.

It currently stands 5 bps higher than the pre-election level.

Unlike the yield, the yield spread has remained flat since October. Higher for longer rates act to push this spread lower.

The Federal Reserve reaffirmed (at its Nov meeting) its dovish tone as Powell pointed to signs of an easing job market and slowing inflation. However, its impact on curbing bond yields was limited.

According to a JP Morgan report , while Fed Chair Powell has consistently conveyed a dovish tone over the years, the Fed's actual decisions have often skewed hawkish.

Although Powell’s dovish statements have initially brought bond yields down, the hawkish policy actions and Fed’s wait and watch approach that followed have typically led to renewed yield increases. This explains why yields continue to rise despite Powell’s dovish remarks at the November meeting.

HYPOTHETICAL TRADE SETUP

Treasury bond yields have been on the rise since October and Trump’s win has supercharged the rally. Investors are expecting higher inflation due to Republican policies which favour corporate growth.

Import tariff, if enacted, would have an even larger impact on the dollar and bond yields. However, actual policy plans remain uncertain for now.

While yields initially surged after the elections, they partially reversed shortly after as the Fed signalled a dovish stance. Despite this, the 10Y-2Y yield spread has remained unchanged.

Resurgent inflation will lead to the Fed slowing the pace of rate cuts. The recent reversal in yield spreads may be unsustainable given the expectation for slower rate cuts. When Trump administration announces policy plans, yields could surge even more strongly.

This week’s CPI release is anticipated to influence bond market movements. Analysts expect October’s YoY inflation to remain steady at 2.4%. If inflation holds at this level, it may have minimal impact, aligning with the Fed’s "watch and wait" strategy. However, a sharper-than-expected drop in inflation could reinforce expectations of quicker Fed rate cuts.

With the impact of inflation most apparent on the longer-tenor yields, investors can focus the position on the 10Y-2Y spread.

CME Yield Futures are quoted directly in yield with a 1 basis-point change representing USD 10 in one lot of Yield Future contract. This simplifies spread calculations with a 1 bps change in spread representing profit & loss of USD 10.

The individual margin requirements for 2Y and 10Y Yield futures are USD 330 and USD 320, respectively. However, with CME Group’s 50% margin offset for the spread, the required margin drops to USD 325 as of 12/Nov, making this trade even more capital efficient.

A hypothetical long position on the CME 10Y yield futures and a short position on the 2Y yield futures offers a reward to risk ratio of 1.3x is described below.

Entry: 6.2 basis points

Target: -11.5 basis points

Stop Loss: 20 basis points

Profit at Target: USD 177 ((6.2 - (-11.5)) x 10)

Loss at Stop: USD 138 ((6.2 - 20) x 10)

Reward to Risk: 1.3x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Yields USA

1. 1-Month Yield (4.596%):

- The short-term yield here is the highest, which might indicate a risk premium for investors lending to the government over such a short period. This could also reflect the Federal Reserve’s current monetary policies, which may be keeping short-term rates high to combat inflation.

2. 1-Year Yield (4.316%) and 2-Year Yield (4.252%):

- The yields for 1-year and 2-year bonds are slightly lower than the 1-month yield, which is unusual in a normal yield curve, where rates typically increase with maturity. This could indicate an inverted yield curve, often seen as a sign of an economic slowdown or potential recession. Investors may be anticipating future rate cuts due to an expected economic weakening.

3. 10-Year Yield (4.308%):

- The 10-year yield is close to the short-term rates, confirming a relatively flat or even inverted yield curve. Typically, the 10-year yield is higher in a growth environment. Here, a yield similar to short-term bonds suggests low confidence in long-term economic growth or expectations of stabilized inflation.

4. 30-Year Yield (4.473%):

- The 30-year yield remains close to short-term yields, with a slight increase compared to the 10-year but still within the same range. This configuration indicates that the market does not anticipate strong long-term economic growth or significant inflation increases. It may also signal that investors seek the safety of long-term assets despite similar yields to shorter-maturity bonds.

The yield curve appears inverted or very flat, which is often interpreted as a sign of caution or economic uncertainty. This structure reflects a potential anticipation of an economic slowdown, where the Federal Reserve might need to lower rates in the coming years if inflation is controlled and economic growth slows. Investors may be seeking protection by purchasing long-term bonds, anticipating lower rates in the future.

Bitcoin - Another sign that Fed credibility is waning.A Sick Feeling in the Belly of the Yield Curve

Another sign that Fed credibility is waning.

The socioeconomic point of view is that, as the Supercycle bear market develops, central banks will lose their mantle as being omnipotent directors of markets. Whereas in the bull market, central bankers like Alan “the Maestro” Greenspan were lauded because positive social mood was driving the stock market higher, in the bear market central bankers will be vilified as negative social mood causes a downtrend in stock prices.

Yesterday, Fed Chairman Jerome Powell sought to reassure Americans that the series of interest rate hikes that the central bank is embarking on would not tip the U.S. economy into recession. The bond market promptly ignored those soothing words and the yield curve flattened. A flattening yield curve, whereby the positive gap between short-dated bonds and long-dated bonds is narrowing, is a sign that the market is anticipating slower economic growth. When the yield curve inverts, with long-dated yields below short-dated, it has historically been a signal that an economic recession is on the horizon.

That historical relationship is most generally related to the yield spread between 2-year yields and 10-year yields, and that yield curve has been flattening over the past year from 1.50% to around 0.20% where it is currently hovering. So, not quite inverted yet, but trending in that direction.

However, in the so-called belly of the yield curve, the area between 5 and 10-year maturity, the message is already here. The chart below shows that the yield spread between 5 and 10-year U.S. Treasury yields has declined precipitously over the last year and, yesterday, turned negative. This yield curve inversion is a clue that a 2-yr /10-yr (2s 10s in industry vernacular) inversion is probably on its way.

Despite what the Fed says, a beast of a recession may be approaching.

U.S. Treasury 10-Year Yield Minus 5-Year Yield

Yield Curve Reinverts on Easing Rate Cut ExpectationsFed sets the rates. Rates guide treasury yields. Fed remains data dependent. Incoming data creates nuanced shifts in yield spreads.

The September jobs report revealed 254,000 jobs added, significantly exceeding expectations of 147,000, with August figures also revised upward. This strong report, along with the JOLTS data from earlier in the week, indicates that the job market remains strong and not as weak as previously anticipated.

Despite the strong jobs data, the yield curve has inverted once again. While Mint Finance has previously highlighted that recession risks can lead to the yield curve inverting, that is not the only reason. This time around, the inversion is being driven by delay in rate cut expectations. CME’s Yield Futures enables investors to deftly express their views on the path of rates ahead.

JOB MARKET SHOWS MIXED SIGNS OF RECOVERY

The latest JOLTS figures showed U.S. job openings rising from 7.711 million to 8.090 million in August, with the previous month's numbers revised up by 38,000. Although job openings remain near a two-year low, the increase is a positive sign.

Rise in job openings was primarily due to increase in construction jobs (+138k), which are often seasonal, and government jobs (+103k). However, the overall report paints a mixed picture. Hiring fell by 99k from the previous month, and while total separations dropped by 317,000, the largest contributor was a 159,000 contraction in quits.

With fewer hires and a large drop in quits, the data suggests the job market is not particularly strong, as workers hesitate to leave their current positions with fewer being hired into new roles.

The Non-Farm Payrolls (NFP) showed 254,000 jobs added in September, with health care, social assistance, and leisure and hospitality sectors leading the gains. As a result of these additions, the unemployment rate eased to 4.1%. Hourly earnings grew by 4% YoY, with the previous month's figures revised upward to 3.9%.

RATE CUT EXPECTATIONS TEMPER

Further rate cuts are still expected, but the anticipated pace has slowed. Before the PCE inflation report on September 27, CME FedWatch indicated a cumulative 75 basis point reduction over the next two FOMC meetings in November and December.

Source: CME FedWatch

CME FedWatch tool also indicated a high probability of 100 basis-point cuts last month. However, after the encouraging PCE report, which showed inflation easing to 2.2%—its lowest level since 2021 and close to the Fed's target—the probability of a cumulative 50 basis-point cut has steadily risen.

Following the jobs report last week, the probability of cumulative 50 basis-points cuts surged to 80%.

The trend suggests that market participants are increasingly expecting a soft landing, with inflation easing and the job market remaining strong. A soft landing reduces the urgency for aggressive rate cuts, giving the Fed more flexibility to monitor the effects of previous rate hikes and lower rates more gradually.

Source: CME FedWatch

Crucially, Fed Chair Jerome Powell has suggested a similar outlook for rate trajectory. While speaking at the National Association for Business Economics, he suggested that if the economy continues on its current trajectory, he expects two more smaller rate cuts this year, or cumulative rate cuts of 50 basis points at the next two meetings. FOMC projections also signalled a similar rate outlook for 2024 as signalled by the dot plot below.

Source: FOMC

YIELD CURVE RE-INVERTS

Bond yields have increased sharply to their highest level since August on tempered rate cut expectations.

Crucially, the increase has been much sharper for the 2-year yields indicating near-term expectations of elevated rates for longer.

The result has been a re-inversion in the yield spread with 2-year & 10-year treasury yields now on par. Notably, the yield futures spread has declined more sharply than the treasury yield spread.

HYPOTHETICAL TRADE SETUP

Recent economic data points to rising likelihood of a soft landing. Expectations of rapid rate cuts have tempered accordingly. While rates are expected to continue declining, the pace is expected to slow with a cumulative 50 basis points (“bps”) of further cuts in 2024 likely.

As rates remain elevated for an extended period, the yield curve has begun to invert again. With current inflation easing, the inflation premium on long-term treasuries has diminished.

FOMC projections suggest a gradual path toward rate normalization, suggesting a potential near-term yield curve inversion before it eventually normalizes. Investors can express views on this outlook through CME yield futures.

Further, the yield futures spread is trading at a (~5bps) premium to the treasury yield spread, as the futures contracts approaches expiry on October 31, the futures spread will converge towards the treasury yield spread which further benefits the short position.

CME Yield Futures are quoted directly in yield with a 1 basis point (“bp”) change representing USD 10 in one lot of Yield Future contract. This simplifies spread calculations with a 1 bp change in spread representing profit & loss of USD 10. The individual margin requirements for 2Y and 10Y Yield futures are USD 330 and USD 320, respectively. However, with CME’s 50% margin offset for the spread, the required margin drops to USD 325 as of October 8, making this trade even more compelling.

A hypothetical trade setup comprising of long 2Y yield October futures and short 10Y yield October futures with reward to risk ratio of 1.5x is described below.

Entry: 13.5 bps

Target: -1.5 bps

Stop Loss: 23.5 bps

Profit at Target: USD 150 (15 bps x 10)

Loss at Stop: USD 100 (10 bps x 10)

Reward/Risk: 1.5x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

US02Y/US10Y Uninversion & RecessionsThe dynamics of the US Treasury yield curve, particularly the spread between the 2-year and 10-year yields (US02Y/US10Y), have long been studied as potential indicators of economic health. One phenomenon that garners significant attention is the inversion and subsequent uninversion of this yield curve. Lets delve into what these terms mean, their historical significance concerning recessions, and how investors might interpret these signals.

What is the Yield Curve?

The yield curve is a graphical representation showing the relationship between interest rates and the maturity of US Treasury securities. Typically, longer-term bonds have higher yields than shorter-term ones due to the risks associated with time, such as inflation and uncertainty. This normal upward-sloping curve reflects investor expectations of a growing economy.

Yield Curve Inversion

An inverted yield curve occurs when short-term interest rates exceed long-term rates. Specifically, when the yield on the 2-year Treasury note surpasses that of the 10-year Treasury bond, it suggests that investors expect lower interest rates in the future, often due to anticipated economic slowdown or recession.

Historically, an inversion of the 2-year and 10-year yield curve has been a reliable predictor of upcoming recessions. Before the last several recessions, the yield curve inverted approximately 12 to 18 months prior.

An inversion indicates that investors are seeking the safety of long-term bonds, driving their prices up and yields down, due to concerns about future economic conditions.

Uninversion refers to the process where the inverted yield curve returns to a normal, upward-sloping shape. While an inversion is a warning sign, the uninversion phase can be even more critical.

In many cases, recessions have followed shortly after the uninversion of the yield curve. This occurs as the Federal Reserve may begin cutting short-term interest rates in response to economic weakness, causing short-term yields to drop below long-term yields again.

The uninversion can signal that monetary policy is shifting in response to economic stress, potentially validating the recessionary signals that the initial inversion suggested.

The uninversion of the US 2-year/10-year yield curve is a critical event that has historically preceded economic recessions. By understanding this phenomenon and considering it alongside other economic indicators, investors can make more informed decisions. It's important to approach such signals with a comprehensive analysis and a prudent investment strategy that aligns with individual financial goals and risk tolerance.

Recession Now Well Underway The yield curve is now fully inverted after reaching EXTREME levels. With that, we can conclude the recession has officially contaminated the financial sector.

Soon (likely before year end) we will see a significant selloff in equities.

Suggest: sell stocks & buy US Treasury Bonds.

Yield Curve Reversion Trade 2024The yield curve reversion is when the US10Y Treasury Yield becomes greater than the US2Y Treasury Yield and has a track record for signalling recession. I've been tracking the reversion for the past two years for any hint of sense of whether the US FED would cut FEDFUNDS rates or if bond traders would drive yields/prices towards reversion. This time, the fed's narrative is driving the reaction here.

To express this idea I've put on long CBOT_MINI:10Y1! and short CBOT_MINI:2YY1! via the futures market. I'll keep rolling the futures contracts until the yield curve starts to form a top, likely a spread value between 1.5-3.0.

FOMC Showdown Poised to Ignite a Surge in Yield SpreadsWith inflation finally cooling and the Fed signaling rate cuts, it seems relief is on the horizon—until you look at the job market. As recession risks grow and Treasury yields falter, a steepening yield curve presents a compelling opportunity.

Positioning in the yield curve ahead of the FOMC meeting offers a more measured way to navigate the uncertainty.

COOLING CPI SIGNALS GREEN LIGHT FOR RATE CUTS

This week’s inflation report showed headline CPI cooling to 2.5%, the lowest since February 2021. With this release, inflation has finally fallen decisively below the stubborn 3% mark and is now just 0.5% above the Fed’s target range. PCE inflation reflects similar levels, likely giving the Fed the signal to start cutting rates.

JOB MARKET REPRESENTS MATERIAL RECESSION RISKS

Recent job market data suggests it may be too soon to declare a soft landing. The labor market is significantly weakening, and with household savings dwindling and credit delinquencies increasing, conditions may worsen before improving.

U.S. economic data from the past week indicates that the labor market is in a precarious situation. The August JOLTS report showed job openings dropping to their lowest since early 2021, reflecting decreased labor demand, while unemployment edged up slightly.

Additionally, the August jobs report revealed a modest gain of 142,000 non-farm jobs, falling short of expectations, with downward revision for July bringing those figures down to just 89,000.

As covered by Mint Finance previously a recession is likely to lead to a sharp steepening of the yield curve.

We covered average levels of the yield spread at the start of recessions in detail previously, but in summary with the current 10Y-2Y spreads at 15 basis points, there may be up to 85 basis points of further upside in the spread.

TREASURY YIELD PERFORMANCE

Despite a short recovery following the ominous jobs report on 2/August, Treasury yields have continued to decline. Unsurprisingly, short-dated treasuries have underperformed as 2Y yields are 27 basis points lower, while 30Y yields have only declined by 12 basis points and 10Y by 15 basis points.

Overlaying yield performance with economic releases, the largest impact on yields over the last few months has been from FOMC releases and non-farm payrolls while performance around CPI releases has been mixed. Potentially suggesting traders are more concerned about recession risk than moderating inflation.

OUTLOOK FOR SEPTEMBER FOMC MEETING

Source: CME FedWatch

FedWatch currently suggests that a 25 basis point rate cut is more likely in the upcoming FOMC meeting scheduled on September 17/18. However, probabilities of a 50 basis point rate cut are also relatively high at 43%.

Source: CME FedWatch

While the odds of a 25 basis point cut have remained in majority, the 50 basis point cut has been uncertain with probability shifting over the past week.

FOMC meetings have driven a rally in yield spreads over the past year.

With FOMC meeting slated for next week, it is interesting to note that performance in yield spread prior to meetings has been more compelling than performance post-FOMC meeting. Over the last 5 meetings, pre-FOMC meetings, the 10Y-2Y spread has increased by 4 basis points.

Performance is even more compelling in the 30Y-2Y spread which has increased by an average of 13 basis points.

AUCTION DEMAND FAVORS 10Y

Recent auction for 10Y treasuries indicated strong demand with a bid/cover ratio of 2.64, which is higher than the average over the last 10 auctions of 2.45. Contrastingly, the 30Y auction was less positive with a bid/cover ratio of 2.38, below the average of 2.42. 2Y auction was sharply weaker with a bid/cover of 2.65 compared to average of 2.94.

Auction uptake suggests higher demand for 10Y treasuries than 30Y treasuries and fading demand for near-term 2Y treasuries.

HYPOTHETICAL TRADE SETUP

Recent economic data has made an upcoming rate cut nearly certain. However, the size of the cut remains unclear. CME FedWatch currently indicates a 42% probability of a larger 50-basis-point cut, driven by the recent CPI report and weak jobs data.

With rising recession risks, the Fed might opt for a larger rate cut. However, if they choose a moderate 25-basis-point cut, market sentiment could stabilize. Historically, yield spreads around FOMC meetings suggest that positioning before the meetings tends to be more advantageous than after. This is especially relevant now, as moderating sentiment from a 25-basis-point cut could trigger a temporary reversal in yield spreads.

Considering the underperformance of the 10Y-2Y spread in September and increased auction demand for 10-year Treasuries, a long position in the 10Y-2Y spread may be the most favorable strategy for gaining exposure to the steepening yield curve.

Investors can express views on the yield curve using CME Yield Futures through a long position in 10Y yield futures and a short position in 2Y yield futures.

CME Yield Futures are quoted directly in yield with a 1 basis point change representing USD 10 in one lot of Yield Future contract. This makes spread calculations trivial with a 1 basis point change in spread representing PnL of USD 10.

The individual margin requirements for 2Y and 10Y Yield futures are USD 330 and USD 320, respectively. However, with CME’s 50% margin offset for the spread, the required margin drops to USD 325 as of September 13, making this trade even more compelling.

A hypothetical trade setup offering a reward to risk ratio of 1.46x is provided below:

Entry: 14.2 basis points

Target: 35 basis points

Stop Loss: 0 basis point

Profit at Target: USD 208 (20.8 basis points x 10)

Loss at Stop: USD 142 (14.2 basis points x 10)

Reward to Risk: 1.46x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

One Chart to Rule them All ~ 10Y/2Y and 10Y/3M Yield Spreads10Y/2Y and 10Y/3M Yield Spread

One chart to rule them all. I have combined the 10Y/2Y Yield Spread (purple line) and the 10Y/3M Yield Spread (blue line) onto one chart. You can get updated readings on it at anytime on my TradingView page (link in bio above)

I have measured the historic timeframe from un-inversion to recession for both datasets. Un-inversion occurs when the yield spread rises back above the 0 level.

Given the 10Y/2Y Yield Spread has just un-inverted (moved above 0), I thought this a worthy exercise. The findings are interesting and useful.

Main Findings / Trigger Levels

The findings are based on the last 4 recessions (this as far back as the 10Y/3M Yield Spread chart will go);

▫️ Before all four recessions both yield spreads un-inverted (only one has to date);

- At present only the 10Y/2Y yield spread has un-inverted (2nd Sept 2024), thus we can watch for the next warning signal which is an un-inversion of the 10Y/3M yield spread. Without both yield spreads un-inverting the probability of recession is reduced.

▫️ The 10Y/2Y typically un-inverts first and the 10Y/3M un-inverts second.

-Historically the delay between the 10Y/2Y and the 10Y/3M un-inversion is between 3 to 10 weeks (23rd Sept – 11th Nov). This is the date window that we can watch for a 10Y/3M un-inversion (based on historic norms).

-If we move outside this window beyond the 18th Nov with no 10Y/3M un-inversion, then we are outside the historic norms and something different is happening. Nonetheless watching for the un-inversion of the 10Y/3M after this date could be consequential.

▫️ On the chart I have used the last four 10Y/2Y yield spread un-inversion timeframes to recession and created a purple area to forecast these from the recent the inversion on the 2nd Sept 2024 forward (Labelled 1 - 4). This creates a nice visual on the

chart. Based on these historic timeframes and subject to the follow up 10Y/3M un-inversion confirming in coming weeks, the potential recession dates are as follows (also marked on chart);

1.28th Oct 2024 (based on 2000 10Y/2Y un-inversion to recession timeframe)

2.03rd Feb 2025 (based on 2020 10Y/2Y un-inversion to recession timeframe)

3.12th May 2025 (based on 2007 10Y/2Y un-inversion to recession timeframe)

4.25th August 2025 (based on 1990 10Y/2Y un-inversion to recession timeframe)

✅ Remember, you can check in on this chart and press play to get updated data at any time by clicking the link in the comments below or by following me on TradingView👍

▫️ I will include a table in the comments which outlines all of the above metrics with dates. I will also share a chart with a zoomed in version of present day so that all the above trigger dates can be more closely monitored.

Finally, it’s important to recognize that these findings and trigger levels are based on the last four recessions. There is no guarantee that a recession will occur or occur within the set trigger levels. What we have is a probabilistic guide based on historic patterns. This time could play out very differently or not play out at all. Regardless, all of the above findings help us gauge the probability of a recession with historic timeframes to watch. It leaves us better armed to make the necessary risk adjustments, particularly if the 10Y/3M yield curve un-inverts.

Price is king, and at present, prices are pressing higher on most relevant market assets. From the above findings and the current positive market price action, it appears we have a little more time before being hauled into a longer-term correction or recession. I lean towards the later dates (2, 3, and 4 above) for this reason. Interestingly, many of my historic charts from months ago and last year suggested Jan/Feb 2025 (also option 2 above) as a very high-risk period. You can view these charts under the above specific chart on TradingView.

This chart is your one-stop shop for checking recession trigger levels based on historic timeframes for both yield spreads. You can update this chart data anytime on my TradingView page with just one click. Be sure to follow me there to access a range of charts that will help you assess the direction of the economy and the market. Thanks again for coming along!

Remember, you can check in on this chart and press play to get updated data at any time by clicking the link in the comments below or by following me on TradingView.

Thanks

PUKA

Lower inflation do not mean things will become cheaperLower inflation and interest rates do not necessarily mean that prices will decrease. If I annualize the inflation numbers instead of focusing on the monthly figures, the overall picture becomes much clearer.

2 and 10 Year Yield Futures

Ticker: 2YY, 10Y

Minimum fluctuation:

0.001 Index points (1/10th basis point per annum) = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com