Louis Vuitton & Dow Jones Intermarket correlation between Dow Jones and Louis Vuitton , and the fractal correlation between Yield curve ( US 10Y - US 02 Y ) and NZD AUD shift forward 353 weeks ,this technique of moving forward is used by Larry Williams and aims to align the same Wyckoff phases of two out of phase, unrelated graphs. The Yield curve is the most powerful indicator for the stock markets, the inversion of the curve predicts the trend change, I have devised a fractal system that predicts the yield curve, moving the Nzd Aud chart forward I get a fractal correlation that has existed for 25 years, will it continue to exist? if the answer is yes then it is telling us that the yield curve will change direction, but if it changes direction it means that the dow jones will also change direction, if this "law" is maintained, if the fractality is maintained I also have the information that will change the trend for Louis Vuitton too.

Yieldcurve

What could go wrong with the yield curve ?New Fed policy will allow inflation to run above its 2% target. To achieve higher inflation the Fed is is expected to hold short-term rates very low for a long time.

A sudden steepening of the yield curve after an inversion almost always coincides with recession.

Aggressive expansion of the money supply through fiscal and Fed policy has led to concerns of rising inflation. The US government needs to fund relief packages and pump money into a weak economy. Excess supply of longer-dated Treasury supply hitting the market may put additional pressure on prices and keep long dated yields moving higher. Institutions may aim to unload expensive long-term Treasuries onto the market which could depress prices and increase yields.

Investors may soon demand higher yields on longer-term debt. But are we ready for higher back-end rates & a steeper curve?

The inflation break-even rate between 10 year Treasury Inflation Protected Securities (TIPS) and regular 10 year Treasuries hit 1.8% last month, the highest since February.

Is the relationship between the yield curve and SP500 dead?Looking at the TVC:US10Y - TVC:US03MY and the AMEX:SPY it seems that during a recession like this TVC:US10Y - TVC:US03MY should rise and AMEX:SPY should fall.

Will it be the case this time as well or is this time different?

Maybe the FED cannot allow TVC:US10Y to rise this time due to the amount of debt and will instead impose yield curve control like in Japan by printing money to buy TVC:US10 ?

The Best Yield Curve Tutorial You've Ever ReadThe two year has remained relatively flat since this week's open. However it did gap up significantly. Why is the 30 year falling (see linked article) while the two year remains consistent?

Bonds of different maturities care about different things. In particular, the shorter end of the spectrum cares less about the long term effects of inflation and the general position in the economic cycle than the long end. Why? Those effects will be felt less in two years than the short term effects of interest rate decisions or the sentiment about it.

Conversely, the 30 year has more time to price in these factors. It has to take in the considerations above, and more. Hence why the 30 year is tumbling right now, as it's more sensitive to risk sentiment and longer term factors.

Don't forget that bonds are fixed income products, meaning they pay a yield that is inversely proportional to the price. The difference between the yield at either end of the spectrum is commonly referred to as the yield curve . The yield curve could also refer to a plot of the set of all yields on treasury products of various maturities.

The difference between the two ends could narrow, or flatten . It could also steepen . Furthermore, that flattening or steepening could be driven by either end. In this case it is led by the long end. Since prices are decreasing (on account of risk on sentiment), we call this a long end led bear steepener .

If you liked this analysis, subscribe for more content. Also check us out at Ghost Squawk!

Long AUD/NZD, targeting 1.1000Recent developments

A dovish RBNZ policy announcement has been conducive to the pair's push to a six-month high. Further monetary policy of asset purchases over negative rates was largely expected.

Technical analysis

The pair has given back a bit since rallying at its fastest pace since 2014 (around 7% increase in just over a month). If it can break past previous 1.0850 key level, then there should be a chance to test 1.10 or at the very least trade up the channel with ease.

Primary drivers for a further move up

On the fundamental side, elevated risk sentiment on the backdrop of bottoming growth in markets, as well as the continued divergence between RBA and RBNZ should support the upward direction of the pair. Policymakers have remained quite dovish, which should be risk-positive as central banks have incentive to ease rather than tighten. With that being said, the RBNZ policy stance is looking more dovish than the RBA's. We can look at both policy stances and yield curves for an indication of what's to potentially come.

The RBNZ have kept the official cash rate at 25 bp, while the base of asset purchasing have been expanded to a cap of NZ$60bn. Although the market seems to be pricing in negative rates, I don't think it's likely that we will see that, given that the RBNZ effectively guided that it won't happen (at least for this year - although this could be on the cards for 2021). Why lose all credibility on forward guidance when there are other methods of easing such as bond purchasing or fixed term loans? Either way, the base case is further easing and I would look towards August and June meetings as further catalysts if financial conditions tighten.

On the contrary, the RBA has stopped purchasing bonds since early May after hitting 25 bp on the 3Y; keeping the curve at the current levels should be supportive to Australia, which remains a relatively high yielding Aaa country (despite slight rating downgrade).

Risks

Downside risk on AUD/NZD lie in 1) narrowing policy differentials, 2) risk sentiment softening, 3) and/or a more hawkish RBNZ that would lead to NZD strength, thus pushing the pair lower.

As such, targeting top end of the channel 1.1000 with a stop of 1.05985.

Prediction of next financial downturn Pt.2Dow Jones dropped over 1200 points in one day, that's the biggest downward move ever happen.

Interest rates are going down FED Watch Tool shows over 99% that FED will cut at least 25pts.

More cuts will come soon, please check www.cmegroup.com

I follow this website and 3-5 days ago there was only 10% for a single interest rate cut.

Unfortunately, due to the Coronavirus outbreak global economy suffers and the whole world will soon enter Great Depression!

YIELD CURVE IS NOT WELL UNDERSTOOD!BOND MARKETS SAVANTS CLAIM THAT THE DEEPER THE YIELD-CURVE INVERSION, THE DEEPER THE RECESSION!

HOWEVER, VISIBLE INVERSIONS HAVE BEEN INCREASINGLY SHALLOW WHILE FOLLOWING RECESSIONS HAVE BEEN INCREASINGLY SEVERE, CULMINATING IN THE 2008 GLOBAL FINANCIAL CRISIS!

BY THIS LOGIC, WILL THIS RECESSION BE MORE SEVERE THAN 2008?

Yield Curve and the SPYIf we take some of the information that past yield curve signals have shown us we can expect about 18 Months of correction. Funny enough the average bear market is about a year and a half as well so there's a bit of confluence with what the charts suggesting and what we know as good trading rules of thumb.

Based on this information i'll be letting part of my SPY Put position go into next month and look for reversals to exit and begin hunting long setups into April-May 2020. As with all trading the market can and will do anything it wants to haha so keep that in mind as well and be good about risk management ALWAYS.

More Info:

www.investopedia.com

www.investopedia.com

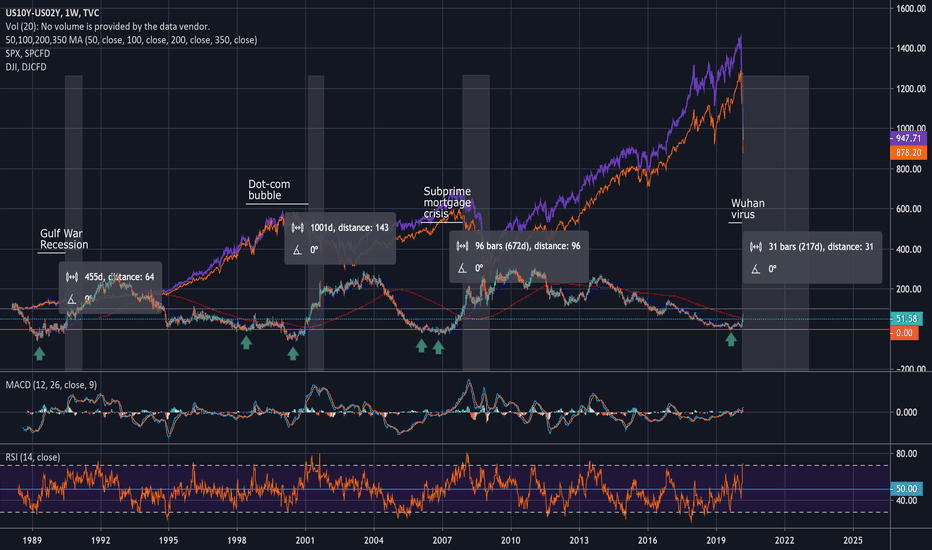

Macro Deep Dive - SPX, Initial Claims, Yield Curve and Fed FundsCharts:

- Top left = SPX

- Bottom left = Initial jobless claims (unemployment metric)

- Top right = US 10 year and US 2 year spread (Yield curve inversion metric)

- Bottom right = Fed funds rate (short-term interest rates)

It is no secret that US equities are grossly overvalued, from Warren Buffet to Stanley Druckenmiller to Ray Dalio, the smart money has made their case for why US stocks simply cannot justify their valuations indefinitely.

Yet Stocks continue higher, largely due to massive CB liquidity, spurred on from fears of a global slowdown and the ensuing economic impact this would have on such indebted nations and consumer, this coupled with the supply chain shock that the Corona-Virus is undoubtedly having on global trade is a recipe for disaster.

So what are the macro/ recession indicators saying?

They are flashing red.

The Initial claims are at record lows, which sounds fantastic, until you realize that most major recessions and even depressions are accompanied with low, not high, unemployment. Recessions strike when everyone is complacent, when they are fat and happy and when they have their blinders on.

I will be watching the initial claims and will look for the the claims to spike and reverse trend, as this is a much stronger indicator of structural weakness within the economy.

Moving over the the US10y/ US02y spread, it is well known that the yield curve briefly inverted in 2019, however, the initial inversion is not the point to sell, this is due to the yield curve inversion being a leading indicator of recession. Historically, from the point of first inversion to the inevitable decline in equities, is roughly 12 months to 18 months.

We are 7 months into the initial inversion and the yield curve looks like it is going to invert yet again.

Finally we have the Fed funds rate, the targeted overnight lending rate for the Federal Reserve.

The trend is clearly down, down, down with rates this has been rocket fuel for bonds which are now traded akin to equities for capital appreciation, rather than the interest bearing assets they were designed as.

Furthermore, and perhaps most interestingly, it is not the point where rates are raised that signal trouble for stocks, but rather once the Fed pivots and reverses course and begins easing and lowering rates, THIS, not the rate hikes is the signal to watch for.

It comes as no surprise then, that interest rate cuts have not only begun, but are in full swing, with further rate cuts this year, already being priced in.

The macro outlook looks bleak, this bubble CANNOT last forever, however i firmly believe that the Banksters will not let this bubble burst without a fight, a global slowdown, coupled with global equity markets crashing would cause widespread panic and in some places, riots.

So keep an eye out for the helicopter drop of money coupled with bail ins, bail outs and of course, more QE.

-TradingEdge