Opening (Margin): DIA Aug 18th 348/Sept 15th 351/2 x 359... Covered Zebra.

Comments: A variation on one of the bearish assumption setups I described over the weekend. (See Post Below).

Here, the September 15th 351/2 x 359 is the Zebra aspect, which functions as synthetic short stock. This is, in turn, "covered" by an additional short put so the entire setup has the delta metrics of a covered put (short stock, plus a short put).

Put on for an 11.10 debit, I'll look to take profit starting for around 10% of what I put in on for.

Zebra

Trade Idea: Defined Risk Options Setups to Short the DIAmondsWith the DIA at fairly long-term overhead resistance, I thought I'd set out how I'd potentially take a bearish assumption directional shot using a defined risk options setup where the max loss is known from the outset. There are several ways to go about this:

1. Short Call Vertical

Buy the September 15th 351 call and sell the September 15th 346 call, resulting in a five wide spread for a 2.70 ($270) credit. Max profit is realized on a finish below the short call strike at 346; max loss, on a finish above 351.

Metrics:

Max Loss: 2.30 ($230)

Max Profit: The width of the spread (5.00) minus the credit received (2.30) or 2.70 ($270).

Break Even: 348.70

Probability of Profit: 55%

ROC %: 117% at max; 58.7% at 50% max.

Delta/Theta: -12.03 delta, .79 theta

Variations:

1) Go farther out-of-the-money with your spread, giving yourself more room to be wrong, with the trade-off being a smaller credit received and a lower ROC %-age. Example: September 15th 356/361 short call vertical, 1.09 ($109) credit on buying power effect of 3.91 ($391) (which is also your max loss). 27.9% at 50% max; 13.9% at 50% max; -10.02 delta, 1.14 theta. Max loss is realized on a finish below the short option leg of the setup (i.e., 356).

2) Widen the at-the-money spread, but to not more than a risk one/make one setup. Example: September 15th 346/354 Short Call Vertical, 3.95 credit on buying power effect of 4.05 ($405) (which is your max loss). 97.5% ROC at max; 48.8% at 50% max. -19.54 delta, 1.42 theta. Here, you're risking 4.05 to make 3.95, which is about as close to a risk one/make one setup as you can get.

If you look at the delta metrics of each as an indicator of how bearish your assumption is, the out-of-the-money spread has the lowest of the bearish assumptions at -10.02 delta; the risk/one make one 8-wide 346/354, the greatest at -19.54. Generally speaking, the setup should match your assumption somewhat, so if you're presumably less confident of a retreat from this level, then you should probably go with the out-of-the money spread; more confident, with the wider, at-the-money spread.

2. Long Put Vertical

Buy the September 15th 349 put and sell the September 15th 343 put, resulting in a 6-wide spread for which you pay a 2.50 debit (which is your max loss). Max profit is realized on a finish below 343; max loss on a finish above 349.

Metrics:

Max Loss: 2.50 ($250)

Max Profit: 3.50 ($350)

Break Even: 346.50

Probability of Profit: 50%

ROC %-age: 140% at max; 70% at 50% max

Delta/Theta: -17.95/.72

Variations:

As with the short call vertical, you can naturally widen the spread, with my preference being to keep the ROC %-age metrics around a risk one to make one.

3. Long Put Diagonal

Buy the September 15th -90 delta 369 put and sell the +30 delta August 18th 339 for a 21.75 ($2175) debit, resulting in a 30-wide calendarized* spread.

Max Loss: 21.75 ($2175)

Max Profit: 8.25 ($825)

Break Even: 347.25

Probability of Profit: 54%

ROC %-age: 37.9% at max; 19.0% at 50% max.

Delta/Theta: -60.65/2.99

A couple of things stand out about this setup. First, look at the short delta; it's bigly at -60+. Second, look at the price tag; it's also bigly relative to the other setups. That being said, the max profit potential is also greater than the other setups, but would require a finish below the short leg at 369. It does, however, have one additional advantageous element, and that is its calendarization which allows you to roll out the short option leg for additional credit should the setup not work out immediately. This results in a reduction in cost basis for the setup, improves your break even and therefore your profit potential.

On a more practical level, I personally don't look to get max profit out of this type of setup. I look to take profit at 10% of what I put it on for and then move on. Here, that would be around $220 or so; given the setup's delta, that would require a move of around 4 handles or so to the downside, which wouldn't be much to ask given price action in the underlying.

4. Zebra**/Put Ratio Spread

Buy 2 x the September 15th -75 delta 375 puts (for a total of -150 delta) and sell 1 x the +50 delta put at the 345 for a 13.65 ($1365) debit. Max loss is realized on a finish above 375; max profit isn't defined.

Metrics:

Max Loss: 13.65 ($1365)

Max Profit: Undefined***

Break Even: 347.35

Probability of Profit: 53%

Delta/Theta: -101.19/-1.23

As with the long put diagonal, the short delta is bigly -- the biggest of all the setups at -100, so if the underlying moves down one handle, the setup will be in profit by 1.00 ($100). Conversely, if it moves 1.00 to the upside, it will be in the red by 1.00, at least at the outset, when its dynamic delta remains at -100.

Since this setup does not reach a "max," taking profit is somewhat subjective. As with the long put diagonal, I generally take profit at 10% of what I put it on for and move on. $136 in profit isn't particularly compelling here, so I could see looking to take profit on movement toward the most recent swing low at 337, which would result in 8 handles or so of -100 delta profit ($800). An added disadvantage to hanging out in this setup for too long for "moar" is that there is some degree of assignment risk if the short put goes deep in-the-money, particularly if it does that toward expiry.

5. High Probability of Touch Long Put

Buy the September 15th 342 Long Put for a 4.55 ($455) debit

Metrics:

Max Loss: 4.55 ($455)

Max Profit: Undefined

Probability of Profit: 32%

Break Even: 337.45

Delta/Theta: -40.72/-4.52

I generally don't do standalone longs for a number of reasons I won't get into here, but thought I'd set out some kind of common sense approach that utilizes one of the metrics most traders that seem inclined to use this approach don't discuss (or aren't aware of) and its "Probability of Touch" -- the likelihood that price will "touch" the strike at some point during the life of the contract.

The general rule of thumb is that POT is about 2 times the delta of the strike. Given the fact that this is a -40 delta strike, the POT is around 80%, implying that the options market is pricing in about an 80% probability that price will touch the 342 strike at some point during the life of the contract.

* -- It's "calendarized" because one leg is in a different expiry than the other, as compared to the short call and long put verticals, above, where both legs are in the same expiry.

** -- A "Zebra" is a "zero extrinsic back ratio" spread with the short option legs paying for all of the extrinsic in the longs, resulting in an at-the-money break even.

*** -- It's technically 347.35 ($34,735), but that assumes DIA goes to zero, which (just taking a stab here) probably isn't going to happen.

ZBRA Short-Term LongWe just finished 1-5 Elliot wave and waiting to complete ABC correction we forecast that finish of ABC correction will be around 356 zone, since there is a strong demand zone and we can see institutional candle in a lower time frames.

Entry: 356

Invalidation: 330

Target: 470

Ratio: 4.38

Trade Idea: USO July 15th 2 x 72/62 Put Ratio SpreadWTI is the highest it's been in a very long time ... . You can naturally play /CL directly or use USO Here, I would buy 2 x the 72's in July and sell the 62, with the result being a break even where the stock is currently trading. I would go longer-dated in this particular case to allow shale to get back in the game, U.S. production to increase somewhat toward pre-pandemic levels, and stockpiles to build.

Metrics:

Max Loss: 19.91 ($1991)

Max Profit: 62.09 ($6209) (That assumes that the underlying could go to zero, which it naturally won't)

Break Even: 62.05 relative to today's closing price of 61.68

Delta/Theta: -88.19/-1.57

Trade Idea (Hedge): SPY July 16th 416/2 x 432 Put Ratio/ZebraPictured here is a July 16th 416/432 Put Ratio with twice the number of contracts on the long side as on the short which I can either do as a standalone directional shot or (in this particular case) a hedge against a portfolio that is longer than the net delta of this particular setup.

Here's how it's constructed:

Start out by (a) looking to buy 2 x (or some multiple thereof) the 75 delta long put in the expiry in which you want to erect your hedge and selling the at the money put, which should be around 50 long delta.

The initial result of this setup from a delta standpoint should be: (2 x -75 delta) - 50 delta = 100 short delta.

You can proceed to fiddle with which strikes you want to buy such that your break even is at or slightly above where the underlying is currently trading. This is to ensure that you're not paying more than you have to, as well as to ensure that the extrinsic in the short put pays for all of the extrinsic in the longs -- hence, the clever nickname for this ssetup: the Zero Extrinsic Back RAtio or "Zebra."

The end result:

Max Loss: 29.71

Max Profit (Theoretical): 418.29 (Assuming the Underlying Goes to Zero)

Delta: -89.52 Dynamic

Break Even: 417.15 versus 416.74 Spot

Ordinarily, I look at ratios in two pieces, the first being the long put vertical consisting of the short put and one contract of the long; the second, the "extra" long. Max profit is realized in the long put vertical aspect on a finish below the short put strike. From a trade management standpoint, I generally opt to take this aspect off at or near max, which in this case would be something a little short of 16.00 (the width of the spread) and then either (a) allow the remaining long put to ride; or (b) sell another at-the-money short put, converting the ratio into a static, standalone spread to protect myself against a whipsaw back up into the remaining long put strike. There is, after all, little point in keeping the long put vertical aspect on after it has converged on max because you won't can't make anything more on it (but can naturally still lose money on it).

THE WEEK AHEAD: 3 POTENTIAL BRAZILIAN ZEBRAS -- ITUB, PBR, EWZEver seen a "Brazilian Zebra"?

Pictured here is an ITUB (35/76) Zero Extrinsic Back Ratio Spread (hence the colorful acronym, "ZEBRA") in the Brazilian financial, ITUB. Since Zebras are high delta directional plays, they're seen as synthetic stock substitutes and can be deployed both on the call side (long), as well as on the put side (short), with the general advantages being their buying power effect relative to being in a one lot, as well as their being defined risk with max loss limited to the debit paid for putting the play on.

Here's how I set these up:

1. Start out by looking at selling a front month at-the-money short call (around the 50 delta).

2. Look at buying two times the number of long calls such that the front month short pays for all the extrinsic in the longs, which should result in a break even that is or near where the underlying is currently trading.

Here, the July 4 short call is paying .45, with the two December longs costing 2.17 each or 4.34 in total. The setup consequently costs a 3.89 debit (4.34 - .45) to put on. Since the long calls are doubled up, one-half 3.89 equals 1.945, so your break even is that amount plus the long call strike at 2.00 or 3.945 versus 4.08, which is where the stock finished on Friday. Put another way, the credit you collect for the 4 short call exceeds all of the extrinsic in the longs by about .13 (4.08 - 3.95 = .13).

From a trade management standpoint, I view these setups in two separate parts: (1) An in the money long call at the 2.00 strike; and (2) A December/July 2/4 long call diagonal.

Assuming favorable movement, I look at taking the long call diagonal off at or near max (here, the width of the spread or 2.00), and then letting the remaining long call "ride," taking it off in profit or, alternatively, selling call against, depending on how it goes. Consequently, the max profit is "undefined," since -- theoretically -- the extra long call can go to infinity. Conversely, I will look to roll the short call out to reduce cost basis further in the event the stock doesn't move or goes down.

Two other candidates for this type of setup: PBR (26/69) and EWZ (36/55) -- both options liquid and at the low end of their 52-week ranges.

In the case of the former, the PBR October/July 5/7 Zebra costs 4.06 to put on with a break even of 7.03 versus 7.06 spot (so you get into a play for 57.5% of what you'd pay to buy and cover a one lot at market); the latter: the EWZ September/July 19/25, 10.97 with a break even of 24.48 versus 24.66 spot and delta of 120.33 (you get into a play for 44.5% of the cost of getting into a one lot at 24.66).

OPENING: VXX 14/15 JANUARY 17TH ZEBRAWith VIX hovering around 2019 lows, re-upping with another "Zebra" ... .

Metrics:

Max Profit: Undefined

Max Loss: $221/setup

Break Even: 15.23

Delta/Theta: 85.16/-1.07

Notes: There are several different ways to look at this trade: (a) as a long call vertical + an additional long call; (b) long calls, the cost of which is cut by selling a short against; or (c) a synthetic long stock position (at least on setup, since its delta is dynamic). In any event, looking for a pop between now and expiry. Take profit on these is subjective, since it's awfully hard to tell when VIX has topped out and max profit in the setup is "theoretically infinite" due to the additional long call present in the spread.

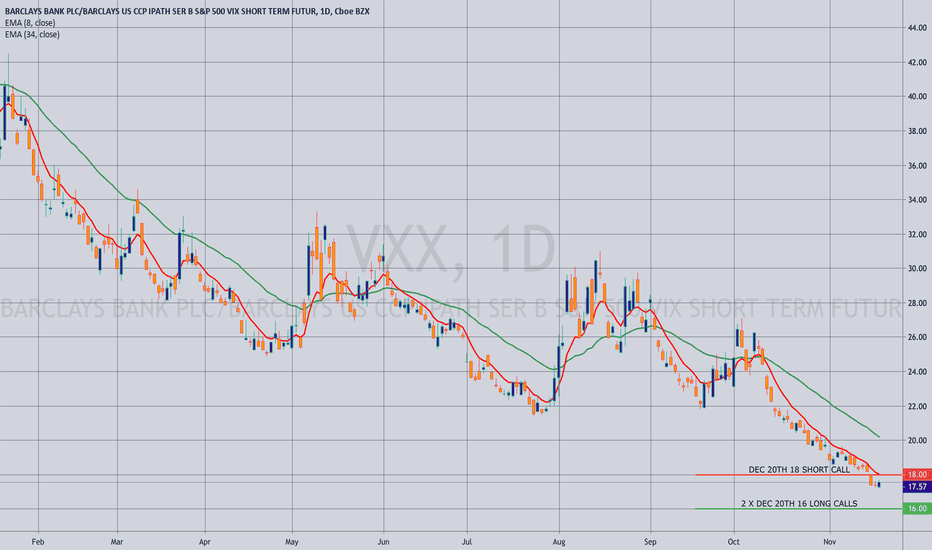

OPENING: VXX DEC 20TH 16/18 "ZEBRA"I've dicked around long enough waiting to put something on at or near VIX lows, and I like this particular setup here, although I obviously didn't catch things at VIX lows.

Metrics:

Max Profit: Undefined/Infinite

Max Loss: 3.03 ($303)

Break Even: 17.51 versus 17.57 spot

Delta: 98.9

Theta: -.83

Notes: With the classic "Zebra", you're looking for a setup in which the short option "pays for" all of the extrinsic in the longs, resulting in a break even at or below where the underlying is currently trading. Given the delta metric, you're basically in synthetic long stock. The max profit is "theoretically infinite," with the long call vertical aspect of the setup converging on max at >18 and the additional long call converging on an instrinsic value where the underlying is trading.

Naturally, a monstrous pop would be nice, but will probably money, take, run at the earliest opportunity. From a trade management standpoint, this is basically "unmanaged" -- i.e., it works or it doesn't ... .