what's next after historic plunged? what's next after historic plunged?

HSI needs to claw its way back - resistance now takes the spotlight!

🚨🚨🚨

🔎🎯 Always ask before you open a position, what's your time frame!?

Follow this principle for your trade for entry and exit so you will not lost on that particular trade. Happy trading everyone! 💰

From previous posts:-

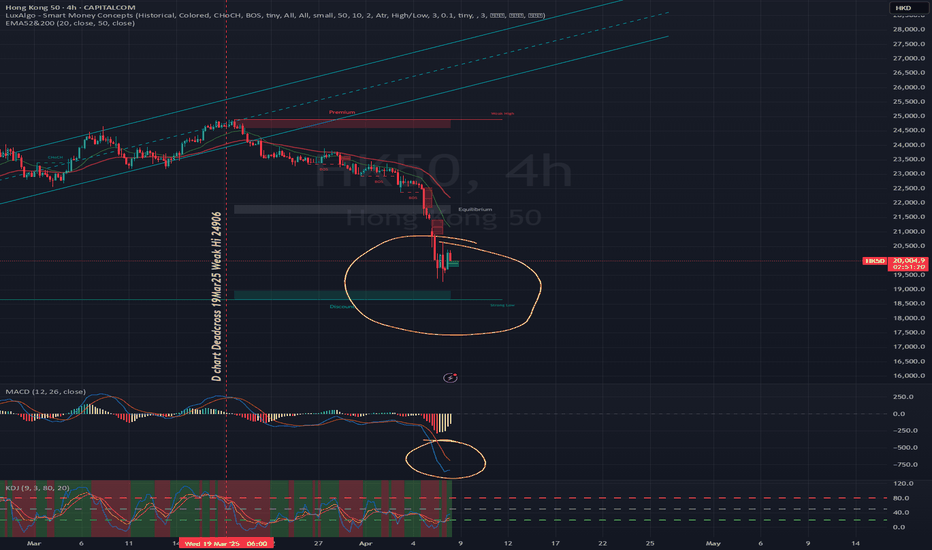

MACD - Deadcross formed 20/3/2025 on D Chart.

4H chart:

at point of writing ✍️: the Index uptrend mode is broken where we have been reviewing the movement of the Index.

For this week trade plan: Most likely short the index for days to few weeks until get confirmation of reversal back to uptrend.

For swing trade: Buy into support Sell at resistance.

Set your TP/SL & protect your capital.

PEPPERSTONE:HK50

On 7Apr25 - special Monday, HSI dropped 13.22% ; 3021.51pts to close at 19828.30. The Index below its 20MA@22814 (currently); 50MA@22509 (currently)

This is the historic largest single day plunge since 1997 Asian Financial Crisis.

Historically, the HSI has experienced significant single-day drops during major financial crises. For instance, that was on October 28, 2008, amid the global financial crisis, the HSI fell by 12.7%, marking its biggest single-day percentage drop since 1997.

Well, human beings shape history. While it may not repeat the same way, but often returns in similar forms and familiar contexts. We are the innovative and creativity creatures on this earth, hence we are free to craft the stories eventually become history.

PEPPERSTONE:HK50

currently the 20MA:22581; 50MA:22423

🚨 as of ✍️ :

🗝️ Resistance : 20632

Resistance Level : 20143 20266

Support Level : 18830 19450

🗝️ Support : 18751

W Chart:- HSI continues its Bullish mode with strong pullback! Recovery could expected to see in end Jun - early Jul'25.

17Mar2025 -

24Mar2025 -

7Apr2025 -

For current markets condition, the CHN & HKG can be volatile with the continuing noise from tariff.

🎯 Reminder: For long term (6-18 months) continue to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets. If you don't know how or where, you may ask Deepseek/Chatgpt for most reputable Trading courses nearest to you.

Let's follow our own zentradingstrategy , continue to trade and zen with 📙 and 🍵 for profits.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage trading and investment buddies.

Zentradingstrategy

HSI testing resistance levels —will it break through or bounced?25/03/2025

🚨🚨🚨

HSI resistance is being tested for short-term!

Investors tend to take profit towards quarter end.

HSI:HSI

MACD - Deadcross formed 20/3/2025.Resistance 24750-24600 level.

4H chart: PEPPERSTONE:HK50

at point of writing ✍️: the Index uptrend mode is paused and moving out of bound from the uptrend channel.

MACD : moving below zero line - Bearish mode.

KDJ: below 30 level in the bearish zone. Hopefully the divergence cycle completing soon for a strong reversal.

BB - ranging at lower BB; mid-line:23986 (this is your 🗝️ level for your long/short TP/SL level)

Set your TP/SL and let the markets works.

For this week trade plan: Most likely short the index for days to few weeks until get confirmation of trendline back to uptrend channel. Buy into support Sell at resistance. Set your TP/SL.

🚨 as of ✍️ :

Support/Resistance Levels :

22979

23030

23242(23374)

23526

23997

24385

24586

24648

24945

🗝️🗝️🗝️Level: 23526-23620

HSI continues its Bullish mode.

W Chart:-

17Mar2025 -

24Mar2025 -

📰 another -ve news, but this might be distraction. 🚨

www.tradingview.com

Shares in Hong Kong slumped 487 points or 2.0% to 23,417 on Tuesday morning, reversing gains from the prior session amid concerns over U.S. recession risks and China’s deflation threat.

www.tradingview.com

** Hong Kong's benchmark Hang Seng Index declined 2.2%, and the Hang Seng Tech Index

HSTECH lost 3.5%.

For current markets condition, the CHN & HKG can be volatile with the continuing noise from tariff.

🎯 Reminder: For long term (6-18 months) continue to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets. If you don't know how or where, you may ask Deepseek/Chatgpt for most reputable Trading courses nearest to you.

Let's follow our own strategy and zen with 📙 and 🍵 for profits.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies.

HSI charging forward, but watch that resistance!Helloy everyone,

Yesterday the Index performed quite well; bullish.

Trying to go back to the uptrend channel.

PEPPERSTONE:HK50

at point of writing ✍️:

MACD - Deadcross formed. Sell/Short at resistance level 24730-24650

BB - 23953(lower BB) mid-line:24350 (this is your 🗝️ level for your long/short TP/SL level)

Quote from 17/3/2025 post

For this week trade plan: Buy into support Sell at resistance. Set your TP/SL.

🚨 as of ✍️ :

🗝️ Level : 22979-23242(23374)- 23997- 24385 - 24586 - 24648 - 24945

To retest 24385 again.

Set your TP/SL, let the market do its thing, and ride the trend with confidence! Manage your risk/reward (r/r).

HSI continues its Bullish mode.

HSI:HSI

W Chart:-

📰 another +ve news, but this might be distraction. 🚨

www.tradingview.com

🎯 Reminder: Continue to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets. If you don't know how or where, you may ask Deepseek/Chatgpt for most reputable Trading courses nearest to you.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies.

While wait for the markets cook, you may zen with 📙 and 🍵because stress won’t make the candles move! 🚶

Happy Trading!

The game plan is clear: DCA,accumulate, and let the market work!HKEX:2800

Breakthrough downtrend channel on last Sept2024 and W-Chart formed MACD Goldencross for bullish mode.

If enter now at 24.50

Target Profit 1 Level at : 30.70 (~25.3%)

Target Profit 2 @33.50; another ~9% (cumulative + ~36%)

Target Profit 3 : ATH

Continue to DCA and accumulate; you may wait for slight retracement to add position. 24.26

Time frame : 9-24months

It created higher hi recently for W chart.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

Follow your trade plan then zen with 📙 and 🍵 while waiting for profits to be reazlied.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies.

Was the break over? HSI bulls are back on the field and ready?Hello everyone, happy Monday!

Last week movement, HSI retraced consecutive 4 trading days and slight recover on Friday yet closed with loss 271pts; -1.12% for the week of 10 Mar 2025. However, YTD it has logged an increased of +4216.69pts; +21.02%. HSI:HSI

MACD - Goldencross was marked in Green (5Mar25; 14Mar25)

BB - Currently trading within upper BB channel.the Mid-line 4H chart at 23789 at point of writing ✍️.

For this week trade plan:

Buy into support Sell at resistance. Set your TP/SL.

🚨 as of ✍️ :

🗝️ Level : 22979-23242(23374)- 23997- 24385 - 24586 - 24648 - 24945

To retest 24385 again.

The Index continues its Bullish mode.

With some catalyst news to support Long call.

www.tradingview.com

🎯 Reminder: Continue to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets. If you don't know how or where, you may ask Deepseek/Chatgpt for most reputable Trading courses nearest to you.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies

The Index seems hits the ceiling ;trade cautiously!Hello everyone, is Friday! Last trading of the week! This week has been a challenging one.

Hope everyone stick to the trading plan.

Trade plan is the same, buy into support and sell at resistance based on your trade tf.

4H Chart PEPPERSTONE:HK50

This morning the MACD seems has reversal sign although the GoldenCross form below zero line ,at least showing the end of the bear, monitor to confirm it's not a fake reversal. 🚨

As the D chart showed the Index still out of uptrend channel again as mentioned from previous post, as long as the Index out of the upper trend channel then the pullback is inevitable for the next wave.

However longer tf, it's still bullish which created higher high for thr W Chart. HSI:HSI

it would be great if this week could close 24669(last week Hi). But unlikely, what do you think?

Happy trading everyone.

** Please Boost 🚀/LIKE 👍,FOLLOW 🔔 SHARE 🔁 and COMMENT ✍️ if you enjoy this idea! Share your trading journey toencourage the trading buddies.

What's next for HSI? Hello everyone, how was the Monday strong pullback?

my short break did not stop the participation of the index slope down ski 😂 😂 😂

Hope everyone stick to the trading plan.

Trade plan is the same, buy into suppysel at resistance based on your trade tf.

4H Chart

Today probably a reversal happens but it could still in retracement mode., trade cautiously.🚨

As the D chart showed after the Monday 477pts plunged pushed the Index out of uptrend channel again as mentioned from previous post, as long as the Index out of the upper trend channel then the pullback is inevitable for the next wave.

However longer tf, it's still bullish which created higher high for thr W Chart.

it would be great if this week could close 24669(last week Hi)

Happy trading everyone and zen with 📚 and 🍵 once your SL/TP set.

** Please Boost 🚀/LIKE 👍,FOLLOW 🔔 SHARE 🔁 and COMMENT ✍️ if you enjoy this idea! Share your trading journey toencourage the trading buddies.

oh wow, seems the Index has the wheel to run!Hello everyone! Happy Friday!

News📰 : anticipate more positive news to come (of course mixed with some -ve for retracement) 🔮

Look at the HSI D Chart

- posted 28Feb2025

- posted 3Mar2025

- 7March2025 at point of writing; the index trading above the support level of 23500 (the 28Feb2025 Hi); it tried to go back to uptrend channel and staying above! (broke on 28Feb2025).

Monitor the Trading volume: finance.yahoo.com

Avg past 3 months : 77.909Bn (+19.18% for the past avg vol); this imply the fund flow is abundance, hopefully this continues! Although the vol is slightly less than the last Oct 2024.

Look at the 4H chart

PEPPERSTONE:HK50

The HSI last Dec 2021 Hi @ 24385 is being tested again today!

Now, what's next? 25147, btw now and then Next level that we are looking at to break (oh wow! we need to add in past Higher Hi):

22840-22900

23241-23275-23314- 23471 (need to break above this level to change back to uptrend movement, else probably is gonna be sideways, continue to monitor and confirm)

23952-24101

24385

24586

24747

24800

25147

🚨 as of ✍️ :

Resistance : 24385 - 24586 - 24800. Let's monitor; this level is now being tested and see if breaks and staying above.

🗝️ support level

22750 -23535 (this level being tested few times; it's now became strong support level). Don't think this can easily broke down.

MACD - Goldencross was marked in Green (5Mar25)

KDJ - Remained at Bullish green zone since 4Mar25, the CFD is now in a short bullrun cycle.

BB - Still within lower BB channel and gap up trading at upper BB channel/

the Mid-line 4H chart at 22960-975 was corrected from 23320.

Trade Plan : 23477-24385 - 24751

Buy into support & Sell at resistance

the 1H showing it's now bullrun on the 2nd half of today. Ride on the waves and locked in your profits.

🚨🚨🚨 Locked your profits and watch out for reversal for retracement!

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵 for profits.

Happy Trading everyone!

🎯 Start to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

HKEX:2800 - 22.90-22.82 if it happens to retrace back to this level, otherwise anytime NOW is entry point! It's confirmed by the 200MA (above in W chart) ; also the W chart MACD GoldenCross. Cross-check it; if need helps let us know.

HKEX:2823 - 13.17-14.75 can start to open position and start accumulate, is allowed to wait for confirmation once it breaks 14.75 level. But you will be getting at higher cost...

HKEX:2801 - open position at price : 23.73-23.80 or anytime NOW! if ever retraced back to 23.36-23.66 accumulate more.

HKEX:3067 - open position now, add position when it retraced to 11.63,,11.33 or below. If you have missed, you may tk position still good to start at 11.85,11.99,12.15

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies

GPS recalculating, HSI is finding its way back to the bull routePEPPERSTONE:HK50

D chart : it tries to returning into uptrend channel.

HSI:HSI

D Chart

We look forward to see it at 24192, 24385! Let's continue to monitor.

W Chart PEPPERSTONE:HK50

in 1H 4H chart mentioned the Index is intact and in the Bullish runway!

Look at longer term and trade zen-ly!

Cultivating and nurturing your trading mindset:

Pay attention to your trading strategy becoming a great trader but not profits from one trade.

Happy Trading Everyone.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies *

is the Trumph speech boost the Index? n is Wednesday the humpdayHello everyone! How was yesterday trade? Hope everyone stick to the strategy set the SL/TP for your day trade.

News📰 : as expected and anticipate more positive news this week 🔮

www.tradingview.com

**China shares waver, HK bounces as Beijing vows more support for consumption, AI**

HSI +1.30% at this news published.😂

Look at the HSI D Chart

- posted 28Feb2025

at point of writing; the index closed below key support level of 22900-23000 (the strong level of 23000 which is the 10MA level, the uptrend is broken 28Feb25); as mentioned this level has been retest 3 times, let's continue to monitor.

However, today the Index open Hi. So trade ⚠ cautiously. Don't chase Hi.

Trading volume: finance.yahoo.com

Date Volume

Mar 3,2025 4,338,200,000

Feb 28, 2025 6,578,300,000

Feb 27, 2025 6,257,000,000

Feb 26, 2025 5,138,100,000

Feb 25, 2025 4,449,800,000

Monthly

Mar 1 2025 - 4,338,200,000 (as of todate)

Feb 1 2025 - 93,960,700,000 (+7.53% from prev month)_correction

Jan 1 2025 - 52,385,800,000

Dec 1 2024 - 56,349,200,000

Avg past 3 months : 77.909Bn (+19.18% for the past avg vol); this imply the fund flow is abundance, hopefully this continues! Although the vol is slightly less than the last Oct 2024.

Look at the 4H chart

PEPPERSTONE:HK50

The HSI last Oct Hi @ 23241 has been broken, this level could be the resistance level for the Index to break the next level Hi. The HK50 last Oct Hi @ 23258.

Now, what's next?

As updated:-

Next level that we are looking at to break:

20985

21336-21350

22020-22535, 22840-22900

23241-23275-23314- 23471 (need to break above this level to change back to uptrend movement, else probably is gonna be sideways)

23952-24101

24385

🚨 as of ✍️ :

it stays above 22535(retest 3 times and this might formed very strong support level).

🗝️ support level :

22990 broken :22340-22750 (this level being tested 3 times 17,20Feb & 4Mar; last tested at 22535.3)

MACD - Deadcross was marked in Green, continue to curving down (4h Chart)

KDJ - Reverse to Bullish green zone on 4Mar25; the CFD continue to trading the upwards trend till now.

BB - Still within lower BB channel and gap up trading at upper BB channel/

the Mid-line 4H chart at 22960-975 was corrected from 23320.

Trade Plan: might pullback to 23020 to fill the gap. Range : 23025-23258

Buy into support : 22880-22960(confirm with indicators)

Sell at resistance : 23150, 23190, 23372/400, 23454,23512(it soared to hit ,this morning)

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵 for profits.

Happy Trading everyone!

🎯 Start to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

HKEX:2800 - 22.90-22.82 if it happens to retrace back to this level, otherwise anytime NOW is entry point! It's confirmed by the 200MA (above in W chart) ; also the W chart MACD GoldenCross. Cross-check it; if need helps let us know.

HKEX:2823 - 13.17-14.75 can start to open position and start accumulate, is allowed to wait for confirmation once it breaks 14.75 level. But you will be getting at higher cost...

HKEX:2801 - open position at price : 23.73-23.80 or anytime NOW! if ever retraced back to 23.36-23.66 accumulate more.

HKEX:3067 - open position now, add position when it retraced to 11.63,,11.33 or below. If you have missed, you may tk position still good to start at 11.85,11.99,12.15

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea or need help! *

Looks like HSI got a morning energy boost is not a Weakday!3/3/2025

Hello everyone! Happy Monday today is not a Weakday but a wonderful weekday start of the week 🫰 🫶

News📰 : this was from 28Feb2025

www.tradingview.com

N this is this morning 3Mar2025 - what do you think? I suspect more good news will come this week. 🔎🔮

www.tradingview.com

Look at the HSI D Chart

- posted 25Feb2025

- posted 26Feb2025

- posted 27Feb2025

- posted 28Feb2025

at point of ✍️; the index closed near the key support level of 22900-23000 (the strong level of 23000 which is the 10MA level); as mentioned this level has been retest 3 times, let's continue to monitor.

Trading volume: finance.yahoo.com

Date Volume

Feb 28, 2025 6,578,300,000

Feb 27, 2025 6,257,000,000

Feb 26, 2025 5,138,100,000

Feb 25, 2025 4,449,800,000

Feb 24, 2025 5,264,600,000

Monthly

Mar 1 2025 - 93,960,700,000 (+7.53% from prev month)

Feb 1 2025 - 87,382,400,000

Jan 1 2025 - 52,385,800,000

Dec 1 2024 - 56,349,200,000

Avg past 3 months : 77.909Bn (+19.18% for the past avg vol); this imply the fund flow is abundance, hopefully this continues! Although the vol is slightl less than the last Oct 2024.

Look at the 4H chart

PEPPERSTONE:HK50

The last Oct Hi @ 23241 has been broken, this level could be the resistance level for the Index to stay above for the next level.

Now, what's next?

As updated:-

Next level that we are looking at to break:23330, 23525, 23990, 24101, 24385.

🚨 as of ✍️ :it seems it stay above the key support level of 22990.

🗝️ support level : 23500 (broken) , 23175 (broken), 22990 (testing), 22741

MACD - last marked WAS deadcross and curving down as marked in YELLOW. After 8 bars-it reversed as marked in GREEN. and NOW it formed Deadcross again (as marked in YELLOW)

KDJ - Remained in bearish red zone with chance that it could reverse upwards.

BB - Still within lower BB channel and testing to break the BB mid-line for 4H chart at 23330.

Today Trade Plan: 22785-23504

Buy into support : 22900 ,23,005, 23169,23283 (confirm with the indicator if it's on the bullish zone)

Sell at resistance : 23400, 23353, 23335 (short/TP with shorter timeframe bearish zone, cross-check and wait for confirmation.)

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

🎯 Start to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

HKEX:2800 - 22.90-22.82 if it happens to retrace back to this level, otherwise anytime NOW is entry point! It's confirmed by the 200MA (above in W chart) ; also the W chart MACD GoldenCross. Cross-check it; if need helps let us know.

HKEX:2823 - 13.17-14.75 can start to open position and start accumulate, is allowed to wait for confirmation once it breaks 14.75 level. But you will be getting at higher cost...

HKEX:2801 - open position at price : 23.73-23.80 or anytime NOW! if ever retraced back to 23.36-23.66 accumulate more.

HKEX:3067 - open position now, add position when it retraced to 11.63,,11.33 or below. If you have missed, you may tk position still good to start at 11.85,11.99,12.15

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea or need help! *

HSI clocked out early, TP sit back and relax wait for next move!

Hello everyone! Today one of the web hot topic - all the 7 stars align and there must be something happen!

What do you think?

"Bulls took profits, bears took chances—HSI took a nap before the next round!" 😴📈📉

Here you go...now come with this news 📰

www.tradingview.com

**Shares in Hong Kong plunged 309 points or 1.3% to 23,415 on the last trading day of February, marking a second session of losses.

The Hang Seng fell further from its highest in over three years, set earlier in the week, and was on track for its first weekly drop in seven weeks, with all sectors posting sharp losses.

Still, markets were on course for solid monthly gains, up around 15% so far, marking a third month of rises as hopes mounted that China’s 2025 Two Sessions meeting next week will outline key policy priorities, including potential support measures for the economy.**

Look at the HSI D Chart

- posted 25Feb2025

- posted 26Feb2025

- posted 27Feb2025

- posted 28Feb2025 at point of writing; the index broke the key support level of 22900-23000 (the strong level of 23000 which is the 10MA level; let's monitor closely next week the new start for the month and see this level can be maintained. (this level has been retest 3 times)

Trading volume: finance.yahoo.com

Date Volume

Feb 27, 2025 6,257,000,000

Feb 26, 2025 5,138,100,000

Feb 25, 2025 4,449,800,000

Feb 24, 2025 5,264,600,000

Monthly

Feb 1 2025 - 87,382,400,000

Jan 1 2025 - 52,385,800,000

Dec 1 2024 - 56,349,200,000

Avg past 3 months : 65.3Bn ; current as of todate / month volume > past 3 mnths avg (i.e 57.98bn)

Look at the 4H chart (main chart)

PEPPERSTONE:HK50

The last Oct Hi @ 23241 has been broken hence retracement is not a surprised!

With the month closing today, the strong pullback is inevitable for institute and whale to take profit.

Please trade cautiously today! 🚨 🚨 🚨

Now, what's next?

As updated:-

Next level that we are looking at to break and steadily staying above this level - 23525, 23990, 24101, 24385

🚨 as of ✍️ it seems break the first support level this morning- and let's see if it could rebound today else it will go down ⬇ 👇 to 23175-22990 level, then 22741.

🗝️ support level : 23500 (broken) , 23175 (broken), 22990 (testing), 22741

MACD - last marked WAS deadcross and curving down as marked in YELLOW. After 8 bars-it reversed as marked in GREEN. and NOW it formed Deadcross again (as marked in YELLOW)

KDJ - Now reversed turned into bearish red zone. It remained in bearish zone.

BB - It is now entered lower BB channel and testing to break the lower BB and create new Lo.

Today Trade Plan: 23000-23504

Buy into support : 22795- 22900 (confirm with the indicator if its on reversal mode otherwise stayaway)

Sell at resistance : 24040,23454,23250 (short and TP within shorter timeframe, cross-check and wait for confirmation)

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

🎯 Start to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

HKEX:2800 - 22.90-22.82 if it happens to retrace back to this level, otherwise anytime NOW is entry point! It's confirmed by the 200MA (above in W chart) ; also the W chart MACD GoldenCross. Cross-check it; if need helps let us know.

HKEX:2823 - 13.17-14.75 can start to open position and start accumulate, is allowed to wait for confirmation once it breaks 14.75 level. But you will be getting at higher cost...

HKEX:2801 - open position at price : 23.73-23.80 or anytime NOW! if ever retraced back to 23.36-23.66 accumulate more.

HKEX:3067

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea or need help! *

Not every run is a marathon— it needs pit stop! Hello everyone!

Here you go...now come with this news 📰

Market Chatter: China Plans 400-Billion-Yuan Capital Injection for Banks -- 💰💰💰?

www.tradingview.com

Look at the HSI D Chart

- posted 25Feb2025

- posted 26Feb2025

- posted 27Feb2025 at point of writing; the index seems doing quite well since open this morning,

trying to stay above the support level 💣💣💣23500 (and strong level of 23000 which is the 10MA level, if break below this level the Index bullrun end, but it's unlikely as it has been retest 3 times)

Trading volume: finance.yahoo.com

Date Volume

Feb 27, 2025

Feb 26, 2025 5,138,100,000

Feb 25, 2025 4,449,800,000

Feb 24, 2025 5,264,600,000

Monthly

Feb 1 2025 - 81,125,400,000

Jan 1 2025 - 52,385,800,000

Dec 1 2024 - 56,349,200,000

Avg past 3 months : 63.28Bn ; current month Feb volume > 3 mnths avg

Look at the 4H chart

PEPPERSTONE:HK50

The last Oct Hi @ 23241 has been broken hence retracement is not a surprised!

Now, what's next? This is tough question 🙋 - Next level that we are looking at to break and steadily staying above this level - 23525, 23990, 24101, 24385

🚨if it breaks below 23454-23500 (& not rebound) it could go down ⬇ 👇 to 23250-23175

🗝️ support level : 23500, 23175, 22741 t

MACD - last marked WAS deadcross and curving down as marked in YELLOW. After 8 bars-it reversed as marked in GREEN.

KDJ - Now reversed turned into bearish red zone.

BB - continue moving above the mid line of BB, this morning touches the mid-line; so be cautious 🚨🚨🚨

Today Trade Plan: 23454-24050

Buy into support : 23454 -23550 (TP :23600-23775)

Sell at resistance : 23800-24050 (TP : 23525-23454)

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

🎯: start to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

HKEX:2800 - 22.90-22.82 if it happens to retrace back to this level, otherwise anytime NOW is entry point! It's confirmed by the 200MA (above in W chart) ; also the W chart MACD GoldenCross. Cross-check it; if need helps let us know.

HKEX:2823 - 13.17-14.75 can start to open position and start accumulate, is allowed to wait for confirmation once it breaks 14.75 level. But you will be getting at higher cost...

HKEX:2801 - open position at price : 23.73-23.80 or anytime NOW! if ever retraced back to 23.36-23.66 accumulate more.

HKEX:3067

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea or need help! *

Rebound lik a champ, monitor the vol c if the guests left early?Hello everyone! How was your zentradingstrategy? Hope everyone embrace with the retracement.

Sell on news? or Buy the dip?

What did we noticed on yesterday news? pfft..Distraction, distraction...

but here you go for today 😂😂😂: www.tradingview.com

**Shares in Hong Kong surged 520 points or 2.3% to 23,555 on Wednesday, shifting from a weak session the day before amid robust gains across all sectors.**

Look at the HSI D Chart

- posted 25Feb2025

- 26Feb2025 at point of writing; the index seems doing quite well since open this morning, trying to stay above the support level 22990.

Yesterday trading volume: finance.yahoo.com

Date Volume

Feb 26, 2025

Feb 25, 2025 4,449,800,000

Feb 24, 2025 5,264,600,000

Look at the 4H chart

PEPPERSTONE:HK50

The last Oct Hi @ 23241 has been broken hence retracement is not a surprised!

MACD - last marked WAS deadcross and curving down as marked in YELLOW. After 8 bars-it reversed as marked in GREEN.

KDJ - WAS at bearish zone curving down; and now reversed and turned bullish in green zone.

BB - now moving above the mid line of BB from yesterday ranging within the mid-line.

22990 resistance level now reversed as SUPPORT level. Hopefully the retracement is completed. Let's monitor especially the volume see if this is just a rehearsal.

Today Trade Plan: 23150-23670 (ahemmm...trust you can do the math 😂)

Buy into support : 23150 -23175 (TP :23600-23630)

Sell at resistance : 23465-23670 (TP : 23450-23500)

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

Reminder : start to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

HKEX:2800 - 22.90-22.82 if it happens to retrace back to this level, otherwise anytime NOW is entry point! It's confirmed by the 200MA (above in W chart) ; also the W chart MACD GoldenCross. Cross-check it; if need helps let us know.

HKEX:2823 - 13.17-14.75 can start to open position and start accumulate, is allowed to wait for confirmation once it breaks 14.75 level. But you will be getting at higher cost...

HKEX:2801 HKEX:3067

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea or need help! 😍 **

A little dip? Just the market testing if the game still on!Hello everyone!

Sell on news?

www.tradingview.com

**Hong Kong stocks fell 315 points or 1.4% to 23,030 in Tuesday morning trade, marking the second session of sharp losses amid broad sector falls, notably consumers and tech.Traders retreated from riskier assets after the US intensified curbs on Chinese investments and proceeded with tariffs on Canada and Mexico.**

Is this piece of sh *** news helps in trading? 🤐 🤐 🤐

#sticktoyourplan

#trustwhatyoutrust

#followyourowntradingplan

Build your own #zentradingstrategy news can be distraction to your judgements!

Look at the HSI D Chart

Look at the 4H chart

PEPPERSTONE:HK50

The last Oct Hi @ 23241 has been broken hence retracement is not a surprised!

MACD - formed deadcross and curving down as marked in yellow circle.

KDJ - at bearish zone curving down.

BB - it broke down uptrende channel trading in lower BB channel

22990 support level turned resistance level now. If it able to break and stay above this level this week then this is a healthy pull back. Let's monitor.

Today Trade Plan: 22500-23250 (~830pts)

Buy into support : 22600 -22900 (TP :22950-23130)

Sell at resistance : 23000-23100 (TP: 22900-22930)

PEPPERSTONE:HK50

1h Chart

Check MACD & KDJ - wait for the reversal confirmation before taking your swing long position.

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

Reminder : start to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

HKEX:2800 - 22.90-22.82 add position

HKEX:2823 HKEX:2801 HKEX:3067

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!**

HSI took off like a rocket...confirmed bullish24/02/2025

HSI took off like a rocket… then remembered it forgot its wallet and came back for a quick retrace!" 🚀📉

Next target : 24385

HSI 1W Chart

Look at that! ignore the news, the movement and volume

finance.yahoo.com

Goldencross for the week of 3Feb2025 - with trading volume jumped from 3.69bn to 15.12bn.

And the subsequent week volume keeping at >20bn level (for the week of 10Feb & 17Feb)

Let's monitor if this week keeping the same level of volume for the 3rd week.

finance.yahoo.com

we noticed the trading volume increased from 4.42Bn to 6.1673bn last Friday 21Feb25

www.tradingview.com

** The Hang Seng Composite Index on information technology firms and the Hang Seng Tech Index slip 0.5% and 0.1% respectively, while Hang Seng Index adds 0.4%

** Stock up 76.9% YTD

HSI:HSI

The last Oct Hi @ 23241 has been broken today!

MACD, KDJ and BB remained at bullish zone.

Key support level: 22990,22668,22446

Key resistance level : 23675,24167,24385

Look at the 1h chart - posted

PEPPERSTONE:HK50

Today Trade Plan:

Buy into support : 23300-23500

Sell at resistance : 23650-23700 (TP:23630)

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

Reminder : start to accumulate China & HKG for the potential upside for the year! Today retracement is a good entry point.

HKEX:2800 HKEX:2823 HKEX:2801 HKEX:3067

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!**

will the movement has memory to follow its old path?20Feb25 ** Hong Kong's benchmark Hang Seng Index (HSI) declined 1.6%, dragged by a sharp correction in technology stocks.

HSI:HSI

20Feb25 - (4H)

21Feb25 (4H)

⏰ ⏰ ⏰

Trade with cautious.

Since the goldencross formed week of 3Feb25 - the index had soared 908pts, +4.49%

The following week; week of 10Feb2025 - another +1486pts +7.04%

For the past two weeks the index had a small bull run of 2543pts; 12.7%

If history repeat, then HSI need a break after consecutive two weeks of climbing. If you see what I see.

The next strong resistance will be the last Oct2024 Hi at 23241. Let's see if today the volume and market sentiment able to break this then is likely to retrace back.

KDJ - The D chart - at overbought and red zone and now turning to red bearish zone.

Look at the 4H chart

PEPPERSTONE:HK50

Overnight the HK50 had touched and broke 23241 and retrace back.

Let's monitor if today there is chance for HSI to break the last Oct Hi.

MACD - above zero level - Bullish zone reversal from deadcross formed earlier and now with light red inverted histogram.

KDJ - Turned Bullish

BB - returning to upper BB channel

Today Trade Plan:

Buy into support : 22850 - 23000 (TP/SL at 22580)

Sell at resistance : 23250 - 23300 (TP/SL at 23200)

Look at the 1H chart.

Be cautious and pay attention. KDJ still ranging bearish zone although the MACD is within Bullish level but with light histo i.e low volume.

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

Reminder : start to accumulate China & HKG for the potential upside for the year! Today retracement is a good entry point.

HKEX:2800 HKEX:2823 HKEX:2801 HKEX:3067

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!**

aiyerr...indeed acrophobia!www.tradingview.com

Hello everyone! the 'sesame door' seems did not fully open 🔓

😂 😂 😂

⏰⏰⏰Cautious!! it open Lo and sellers volume overpower buyers.

HSI:HSI

D chart on HSI

The next strong resistance will be the last Oct2024 Hi at 23241. - It's seems need more booster to reach.

How far to reach the ATH from today? from previous post as predicted it's not that far! - So close yet so far.

We definitely be there this week! --- never time the market we react according to how it moves. This seems unlikely to happen this week unless the sesame door open! 😂

From the soar early this week, today seems facing strong selling for profit taking.

KDJ - is at overbought and red zone and now turning to red bearish zone.

PEPPERSTONE:HK50

Look at the 4H chart

MACD - above zero level - Bullish zone but deadcross formed and curving down.

KDJ - Bearish mode continues.

BB - entering lower BB channel and ranging at lower BB.

Today Trade Plan:

Buy into support : 22310 - 22450

Sell at resistance : 22677-22700

Look at the 1H chart.

⏰ Be cautious and pay attention to the reversal to enter for higher chance winning trade!

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

Reminder : start to accumulate China & HKG for the potential upside for the year! Today retracement is a good entry point.

HKEX:2800 HKEX:2823 HKEX:2801 HKEX:3067

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!**

Is the handshake with magic lantern signal the 'open sesame'?Hello everyone have you found your magic🏮 yet?

😂 😂 😂

Retracement is healthy for continuous bullish mode.

HSI:HSI

D chart on HSI

As mentioned before :-The next strong resistance will be the last Oct2024 Hi at 23241.

How far to reach the ATH from today? from previous post as predicted it's not that far!

We definitely be there this week!

From the soar early this week, today expecting a pullback in order to retest the Hi.

KDJ - is at overbought and red zone.

Look at the 4H chart

PEPPERSTONE:HK50

MACD - bullish zone

KDJ - now at overbought and retracement mode (bearish mode)

BB - Index continue trading above BB midline and stay within upper BB channel. Be cautious and it could retrace to lower BB range.

Today Trade Plan:

Buy into support : 22550 - 22665 (key support level for 1H Chart)

Sell at resistance : 22800 -22890

Look at the 1H chart.

MACD : it is still at bullish zone but cautious if its not above stay above the support level and might break below zero line and turned bearish.

KDJ : retraced completed and reversal from oversold zone turning into green.

BB : start coming down trade range at lower BB range. Potential for accumulation and easy win when it hit the bottom of lower BB.

Lower BB : Today support level should be at 22475- 22570 (to continue bullish it needs to stay above this level)

Resistance : 22900-23000

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

Hope you found your magic🏮, rub it and whisper your own "open sesame" phrase and boom!

www.straitstimes.com

Reminder : still early and start to accumulate China & HKG for the potential upside for the year!

HKEX:2800 HKEX:2823 HKEX:2801 HKEX:3067

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!**

Acrophobia? or climbing higher?Are you acrophobia?

Hello everyone, the blossom of HSI is around the corner

HSI:HSI

D chart on HSI

As mentioned before :-The next strong resistance will be the last Oct2024 Hi at 23241.

How far to reach the ATH from today? from previous post as predicted it's not that far!

We definitely be there this week!

Look at the 4H chart

PEPPERSTONE:HK50

MACD - bullish zone

KDJ - Bullish

BB - Index continue trading above BB midline and stay at upper BB channel.

Today Trade Plan:

Buy into support : 22500-22600

Sell at resistance : 23100 -23300 (the last Oct 2024 Hi - 23241)

Look at the 1H chart.

MACD formed GoldenCross again!

KDJ also is at bullish green zone and at bullish level.

BB : above upper BB 22630 - 22950

Lower BB : Today support level should be at 22500 (to continue the rally needs to stay above this level)

Resistance : 23100-23300

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

Start to accumulate China & HKG for the potential upside for the year!

HKEX:2801 HKEX:2800 HKEX:2823

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!**

keep climbing after a short rest!TGIF everyone & Happy V day! HSI continue sending love 📦 & 💷 to who pay attention to it!

HSI:HSI

D chart on HSI

The next strong resistance will be the last Oct2024 Hi at 23241.

How far to reach the ATH from today? Estimated : 1061pts to go (~4.79%); is not that far!

Expecting and allow some retreat a healthy pullback these two weeks.

Look at the 4H chart

PEPPERSTONE:HK50

MACD - now at bullish zone with inverted red histogram.

KDJ - Bearish zone and likely to reverse.

BB - Index continue trading above BB midline and stay at upper BB channel.

Today Trade Plan:

Buy into support : 21090-22000

Sell at resistance : 22230-22300

(trade range : 301pts; ~1.37%)

Look at the 1H chart.

MACD formed GoldenCross this morning.

KDJ also is at bullish green zone and at bullish level (after yesterday pullback and reverse from oversold zone)

BB : above upper BB 21930 - 22300

Lower BB : 21910 ( today support level should be at 21600)

Resistance : 22200 (if breaks then to retest the next resistance at 22545 then 22770)

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

Wishing everyone a good weekend ahead.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!**

HSI continue to roars, bull take charge ahead! PEPPERSTONE:HK50

HSI:HSI

Hello everyone good am! hope you made enough winning trades for the upcoming weekend.

D chart on HSI

MACD & KDJ both are at bullish zone.

The next strong resistance will be the last Oct2024 Hi at 23241.

with the positive news, this is likely to touch soon.

www.tradingview.com

Look at the 4H chart

MACD - still on the bullish zone and supported with bullish green histogram.

KDJ - Bullish zone , overbought zone. Cautious for a short pullback.

BB - Moving above BB midline and ranging at upper BB channel and continue to arching up.

Look at the 1H chart.

MACD continue staying at bullish level (above zero line)

KDJ - cautious for pullback (ranging between red and green zone but at overbought level)

BB : above upper BB 21900-22200

Lower BB : 21530 ( today support level should be at 21800)

Resistance : 22200 (if breaks then to retest the next resistance at 22500 and 22770)

Today Trade Plan:

Buy into support : 21800-21950

Sell at resistance : 22200

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

Wishing everyone a good weekend ahead.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!**

continue to rise with news! PEPPERSTONE:HK50

HSI:HSI

Hello everyone how was your trade yesterday?

It was a healthy pullback and hope you managed to short it and make some profit.

D chart on HSI

The bullish continues, yesterday was a healthy pullback with 227pts -1.06%

KDJ is now back to bullish zone.

Correction : MACD already crossed above zero level.

Look at the 4H chart

MACD - still on the bullish zone but with reduced volume with inverted red histogram. Cautious for the pullback.

KDJ - Bullish zone.

BB - Ranging at upper BB channel and continue to arching up.

Today Trade Plan:

Buy into support : 21520-21550

Sell at resistance : 21815 (TP : 21758)

253 range for day trade is suffice to gain some pocket money.

Look at the 1H chart.

MACD is arching to bullish.

KDJ also back into bullish green zone at overbought level (cautious for pullback)

BB : above upper BB 21500-21750

Lower BB : 21259 (support level)

Resistance : 21850 (if breaks then to retest the next resistance at 21975)

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

Wishing everyone a good day with many winning trades !

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!**