ZENUSDT | Triangle Breakout Setup Brewing!#ZEN is currently consolidating in a symmetrical triangle pattern on the 4-hour timeframe, following a strong bearish move. The price action has shifted to a sideways range, signaling a potential trend reversal or continuation setup in the making.

What to Watch:

We’re closely monitoring a bullish breakout from the triangle or resistance zone.

A confirmed breakout with a successful retest will trigger our long entry.

As always, proper risk management is key – wait for confirmation before entering.

Trade Plan:

✅ Wait for breakout above resistance

✅ Look for volume confirmation

✅ Enter on retest with a tight stop-loss

✅ Target recent highs for a solid R:R setup

What’s your take on #ZEN? Do you see a breakout coming or more chop ahead? Drop your thoughts in the comments!

Follow me for more real-time crypto setups and chart breakdowns!

#ZEN #CryptoTrading #PriceAction #TrianglePattern #BreakoutTrade #TechnicalAnalysis #ZENUSDT #Altcoins #TradingSetup #CryptoTA #BullishBreakout #SwingTrade #4hrChart #TradingViewIdeas

Zenusdt

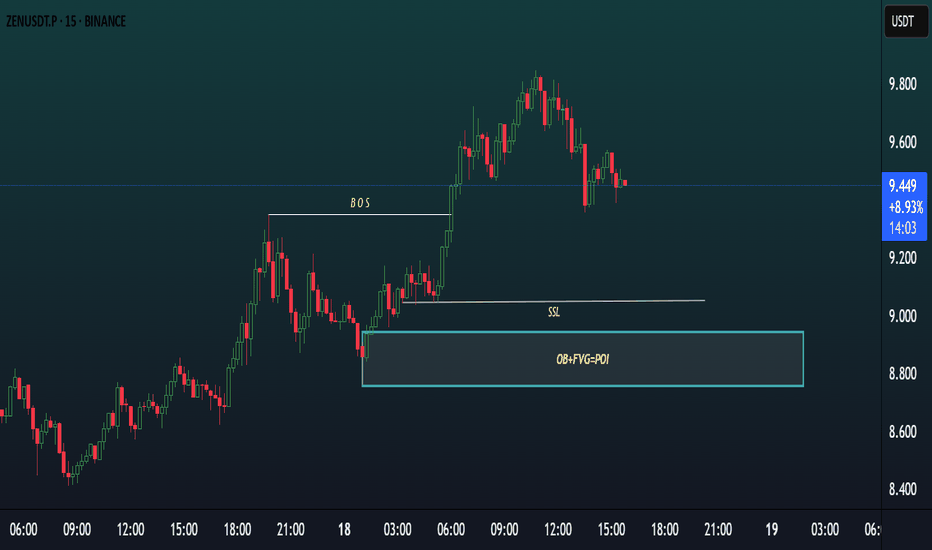

ZENUSDT TRADE IDEA.Chart Overview

Pair: ZEN/USDT Perpetual

Timeframe: 15 Minutes

Current Price: 9.472

Setup Type: Bullish SMC-based retracement entry

Strategy: Order Block + Fair Value Gap (FVG) + SSL sweep

📌

Setup Summary

A classic Smart Money Concept setup forming:

Bullish Break of Structure (BoS)

Sell-side liquidity (SSL) sweep below equal lows

Order Block (OB) + FVG convergence zone = POI (Point of Interest)

🧠

Explanation of the Setup

1.

Break of Structure (BoS)

Price broke above a key swing high, confirming bullish intent and initiating a market structure shift.

This is the first sign of institutional buying.

2.

SSL – Sell-Side Liquidity Sweep

Liquidity beneath equal lows has been swept before the bullish move, confirming that smart money grabbed sell orders to fuel buy positions.

This adds more confidence to the POI being a potential reaction zone.

3.

POI: OB + FVG Confluence

A clean bullish order block is formed at the base of the move.

A Fair Value Gap (FVG) exists in the same region — a sign of imbalance that often gets filled before continuation.

POI zone is marked between approximately 8.85–9.00 USDT.

4.

Price Action

Price is now retracing slowly, with bearish candles approaching the POI.

The expectation is a bullish reversal once the POI is tapped — targeting new highs above 9.80–10.20.

✅

Confirmation Tips

Before entering:

Look for bullish engulfing on 5m or 1m timeframe inside POI

Internal structure break (micro BoS) from the zone

Optional filters: RSI bullish divergence, volume spike, or trendline break

📌

Conclusion

This is a high-probability bullish trade setup with strong SMC logic:

Break of structure ✅

SSL sweep ✅

OB + FVG confluence ✅

POI identified ✅

It aligns perfectly with institutional trading behavior and offers a clean risk-managed entry.

ZEN/USDT Daily Chart: Accumulation Before the Big Move? Hey traders! Let’s dive into this daily ZENUSDT chart. Horizon is in a sideways accumulation phase, forming an Expanding Wedge right after a massive bullish Falling Wedge breakout.

We’re also seeing a small inverted head and shoulders at the bottom support range of $7.08-$10.08 , with the neckline at $10.08 . ZEN recently revisited this level, and a confirmed breakout could propel it toward $18.08-$28.94 , with a major target at $41.15 .

If the breakout fails, we might see a pullback to the neckline at $10.08 or the shoulder support at $8.28 .

Key Levels to Watch:

Resistance: $18.08, $28.94, $41.15

Support: $8.28

Breakout Target: $41.15

Breakdown Risk: $8.28

Is ZEN about to skyrocket, or will this breakout fail? Let’s hear your thoughts below!

ZENUSDT Forming Bullish BreakoutZENUSDT is emerging as an attractive opportunity for traders looking to capitalize on mid-term altcoin breakouts. With good trading volume backing its recent price action, this pair has been gaining traction among market participants who expect a potential gain of 50% to 60%+. The current technical structure is showing early signs of a possible trend reversal, making this a crypto asset worth keeping on the watchlist for a swing trade setup.

Horizen (ZEN) continues to strengthen its position in the blockchain ecosystem with its focus on privacy and decentralized applications. Investors appreciate the project’s robust network and innovative sidechain solutions, which enhance scalability and interoperability. These fundamentals are fueling renewed interest, as more traders look for altcoins that combine real-world utility with promising price potential.

Technically, ZENUSDT appears to be forming a strong base that could lead to a healthy rally if the crypto market sentiment remains positive. Traders should monitor key support and resistance levels, along with volume spikes that could validate a breakout move. Given the steady accumulation phase, a decisive close above nearby resistance could open the door for significant upside.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ZENUSDT Forming Bullish SwingZENUSDT is attracting a growing number of traders who are paying close attention to promising altcoins that could deliver solid gains in the coming weeks. Horizen (ZEN) continues to prove its resilience in the privacy and blockchain interoperability space, and the recent price action hints at a potential reversal from a strong support zone. With good volume building up and a stable base forming, many investors see this as a strategic accumulation level for the next bullish swing.

Horizen’s fundamental strength lies in its privacy features, sidechain solutions, and robust community backing. As blockchain adoption expands, projects with practical use cases like ZEN gain renewed interest, especially from long-term holders looking for coins with sustainable ecosystems. The expectation of a 50% to 60% gain aligns well with the current market structure, where we see buyers stepping in around the highlighted demand zone to push prices higher.

From a technical perspective, the recent chart shows that ZENUSDT is consolidating within a clear support area while maintaining good volume. This suggests that a breakout could be imminent if the price can close above nearby resistance levels. The next leg up could see ZEN retesting previous highs, providing attractive short-term opportunities for swing traders and position holders who are looking for coins with strong fundamentals and momentum potential.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ZEN/USDT Weekly Analysis: Major Accumulation Zone

🧠 Chart Analysis Overview (ZEN/USDT - 1W):

This weekly chart of Horizen (ZEN) against Tether (USDT) reveals a long-standing accumulation zone, and current price action hints at a possible bullish reversal from a critical support level. Let's break it down:

🟨 Key Technical Zone:

Support Zone (Accumulation): $5.06 – $7.06

This zone has acted as a major historical support area dating back to early 2021. Price has tested this zone multiple times and shown rejection, indicating strong buyer interest.

🔼 Bullish Scenario:

1. Price Rejection from Support:

A strong bullish wick and potential bounce from the $7.06 area signals accumulation and possible reversal.

2. Upside Targets (Resistance Levels):

$10.55

$14.71

$20.51

$30.08

$49.78

Long-Term Targets: $108.12, $144.81, $169.23

3. Pattern Indication:

The price action resembles a triple bottom formation within the accumulation zone — a classic reversal pattern. The yellow projection shows a possible V-shape recovery or rounded bottom scenario.

4. Trigger Confirmation:

A weekly close above $10.55 would be a confirmation trigger for continuation toward the next resistance levels.

🔽 Bearish Scenario:

1. Failure to Hold Support:

If ZEN fails to hold the $7.06 support zone and closes below the historical low of $5.06, the bullish structure invalidates.

2. Downside Risk:

Below $5.06, there's no significant historical support, suggesting a sharp drop is possible — potentially entering uncharted territory.

3. Bearish Breakdown Trigger:

Watch for weekly candle body close below $5.06 with volume — this could initiate further downside pressure.

📐 Pattern Summary:

Pattern Forming: Triple Bottom / Accumulation Zone

Type: Reversal Pattern

Timeframe Validity: Weekly – suitable for mid-long-term swing outlook

Volume Context: Not visible in chart, but confirmation from volume would strengthen the setup

🎯 Strategic Outlook:

Bias: Neutral-to-Bullish (While above $7.06)

Ideal Entry: Around $7.00 with tight invalidation below $5.00

Invalidation Level: Weekly close < $5.06

Take-Profit Zones: $10.55 → $14.71 → $20.51 → $30.08 → $49.78

#ZENUSDT #Horizen #CryptoReversal #AltcoinAnalysis #TripleBottom #TechnicalAnalysis #AccumulationZone #CryptoSwingTrade #SupportAndResistance #BullishSetup

Horizen: What You Need To Know About The Altcoins—Experts Only!A shakeout is a market move where the whales (exchanges) create volatility in order to rattle unprepared traders and investors.

If you use a limit stop-loss and you are clueless, the exchanges and market whales can see your orders and they use this to their advantage. Since they own all of the coins and everything basically, they can move the market. They produce a massive amount of pressure until everybody freaks out.

Those with too much leverage gets their positions liquidated. Everything lost. That's fine, it is their fault for being too greedy. Learn from your mistakes. Take the loss and move on. Nobody to blame. Just a lesson and a learning experience.

Those with a tight stop-loss limit order get to sell at a lower price and secure a small loss, sometimes between 10-30%.

Those patient, @MasterAnanda readers and followers, get to watch from a distance and even buy more when prices are low. No loss.

Let me get back into conspiracy theory mode.

So the market produced a bottom and is set to grow long-term. Very stupid and greedy people start to become very aggressive and decide to buy with 15, 18 and even 20 or more X.

We have no compassion for these people because this obviously greed, too much of it. And of course, this can never work.

The market is like a living being. Like a horse or a camel. It feels it has too much weight on top of it and if it wants to go the long ride, it has to get rid of this weight. The shakeout only lasts a few days but more than 1 billion USD was removed from the market. This is all leverage. This has nothing to do with buyers, investors or spot traders ok?

So these were literally gamblers that lost money. This is not a casino, this is a financial market. Learn to play the game or get REKT.

The way to play is to buy and hold.

The way to play is by participating, being part of the market and accumulating.

Of course, there is nothing wrong with gamblers but if you do gamble, there is a very strong risk involved.

While a gambler can lose everything in one single bet. A spot trader can hold and if prices drop, simply wait. The worst case scenario ends up being a long wait.

It is a shakeout and look at this chart, ZENUSDT. Two days later, the market is back up—full green. We have a higher low.

This is only the start. It will get harder and more complex as the bull market develops.

Please, whatever you do, do not use margin or leverage if you don't know what you are doing, the results is never anything good.

The only reason why you would use leverage is "to earn more money." "To earn more," "to earn fast." How did that go?

In the quest for fast money, big money, you ended losing hundreds of thousands in less than a month.

It can take 2-3 months to earn a sure 100-300%.

It can take 3 weeks to have your entire position liquidated.

Anyway, stay away from leverage if you can't keep it below 5X.

If you do go there, just know that you will not make it out alive. Everybody is thinking that they can beat the professionals, but the professionals are trading 24-7, you are on a phone and only check-in every few days. By the time you try to adapt, everything is gone. You are not buying from an exchange, you are competing against them and it is a losing game, they hold your money, your history, your data, your coins. They will always beat you because they know everything that you do, and you know nothing about how they work.

They'll give you a great website, lots of numbers, lots of cats and dogs and the illusion that you can make money easily without much effort. You lose money and they make billions.

If you want to win, play long-term.

Only use leverage when you have been successfully trading spot for 2-3 years, minimum. And when you do start with 3X.

By the way, if you don't have time to plan, to read, to prepare, you won't have time to get paid.

This is the most advanced game in the whole world. It is a money game. Only a very small percent are successful at it. Think before you believe you can come ahead without any effort, you are playing against us—we own the market.

Thank you for reading.

Namaste.

ZENUSDT | Strong Buyers, Strategic PatienceZENUSDT has caught my attention thanks to persistent buyer strength, even in an environment where many altcoins are struggling to hold ground. This tells us something important: smart money is interested, and that makes this chart worth watching closely.

🔹 The Blue Box – A Launchpad or a Trap?

We’re currently testing the blue box, which I believe could act as a high-probability support zone. However, I’m not jumping in blindly. What I’m waiting for is a clear breakout on the 1-hour timeframe — a decisive move that shows buyers are not just present, but in control.

This kind of breakout tells a story: liquidity is being absorbed, and momentum is shifting upward. When this happens at a known zone of interest, especially one where buyers are already active, it opens the door to low-risk, high-reward trades.

🔹 What You Should Watch For:

Breakout from the blue box area on 1H with volume

No strong rejections or fakeouts in the lower time frame

Retest of the box after breakout for safer entries

🧠 Psychological Edge:

Most traders act too early or too late. Waiting for a proper 1H breakout keeps you away from noise and closer to confirmation. This is where many miss out because they are impatient. But remember — our edge comes from discipline, not guessing.

So yes, I’m watching this pair very closely. The buyers are here. The zone is valid. And the plan is clear: wait for the market to tip its hand, then move.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Is Horizen $ZEN The Next Big Crypto Investment Opportunity?In May 2025, LSE:ZEN has reached a strong imbalance trading at $8 after a period of consolidation for a couple of months. A morning star price action candlestick pattern is being created This imbalance suggests that buying pressure is outweighing selling pressure, creating a favorable environment for potential upward momentum.

Horizen is a privacy-focused blockchain platform that combines security, scalability, and decentralization. Built with a strong emphasis on privacy and interoperability, Horizen offers a unique ecosystem that includes sidechains (called ZenApps), a decentralized treasury system, and a robust node network. The native cryptocurrency, LSE:ZEN , powers transactions, staking, and governance within the Horizen ecosystem.

Horizen: Your Altcoin ChoiceIt is very easy to see where Horizen is going. Very easy. A broadening ascending channel is present on the chart.

➖ Notice the lower boundary and the higher lows. Perfect symmetry. Growing slowly long-term. The bottom was hit June 2023.

➖ Notice the higher boundary and the higher highs. Truly perfect. A new higher high is in place and coming next.

That's it for the char pattern now let's focus on candlestick reading.

There is a strong decline starting in late December 2024. The peak session ended as a shooting star. A classic bearish candle.

The decline is very steep and now is ending as a hammer, another one. This hammer is a perfect reversal signal at this point. The week is yet to close but we know the correction is over because many pairs already moved ahead. What one does, the rest follows.

Trading volume is also really high. Volume is high on the drop and yet the market remained within a long-term higher low. This is a bullish signal. Volume is also high as the action turns to closing green from red.

These are early signals. We are looking at bottom prices, the best possible prices before the start of the next bullish phase.

Zcash and Horizen, both will grow, Bitcoin as well.

This is a great opportunity. A great choice. Your Altcoin Choice.

Thanks a lot for your continued support.

If you enjoy the content or find it useful, consider follow. It will only take a second of your time.

Namaste.

HOOKUSDT UPDATEHOOKUSDT is a cryptocurrency trading at $0.2285. Its target price is $0.4000, indicating a potential 120%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about HOOKUSDT's future performance.

ZEN’s Reversal Zone – Perfect Time to Go Long?ZEN has seen a sharp 78.65% decline from its $46.28 high, dropping over the past 40 days. With six consecutive red daily candles, we’re at a critical point to determine whether a bullish reversal is near or if further downside is ahead. Let's analyse the key support and resistance zones and establish high-probability trade setups.

Support Levels & Confluences

1️⃣ Psychological Support – $10: Price bounced off $10, aligning with the 0.886 Fib retracement.

2️⃣ Trend-Based Fib Extension 0.786 – $11.33: Indicates potential correction completion

3️⃣ Yearly Open from 2021 – $11.61: Acts as a historical support level

4️⃣ Weekly Support at $11.48 (0.618 Fib Retracement): Aligns with the weekly order block ($12.13 - $11.45)

5️⃣ Monthly 21 SMA – $10.86: Aligns with the 0.786 Fib

Long Trade Setups – Laddering Strategy

Long positions can be laddered from $11.48 (0.618 Fib) down to $10.82 (0.786 Fib) for a better cost basis.

Long Entry #1: $11.48 (0.618 Fib Retracement)

Long Entry #2: $11.00 (Mid-range level between fibs)

Long Entry #3: $10.82 (0.786 Fib Retracement)

Stop Loss: Below $10.60

Take Profit: $14 - $15

R:R: 13:1 (for 0.786 Fib entry)

This laddering approach allows for better risk management and capital allocation.

Alternative Long Entry – Confirmation-Based Trade

Entry: If price reclaims $12.11 (Daily Open & Weekly Level) and retests it as support

Stop Loss: Below $11.48

Target: $14 - $15

R:R: 3:1

Resistance Levels & Short Setup

1️⃣ Weekly Open - $14.20

2️⃣ Monthly Level - $14.85

3️⃣ Weekly Level - $15.12

4️⃣ Key Resistance - $15

5️⃣ 0.5 Fib Retracement from Downward Wave - $15.25

6️⃣ Weekly 21 SMA - $14.92

Short Setup (If Price Reaches Resistance & Shows Weakness)

Entry: Between $14.85 - $15.25

Stop Loss: Above $15.50

Take Profit: $14.2 - wOpen

Key Takeaways:

Ladder long entries from $11.48 - $10.82 to maximise R:R

Alternative long trade if price confirms $12.11 as support

Strong resistance at $14.85 - $15.25, ideal for profit-taking or a short trade setup

Multiple confluences (Fib levels, moving averages, order blocks) confirm these setups

New Free Indicator Release 🚀

I've just launched a FREE TradingView indicator – Multi Timeframe 8x MA Support & Resistance Zones. It helps visualise key support and resistance levels across different timeframes. Check it out and let me know your thoughts!

ZEN Trend Successfully ChangedZEN Detailed Analysis on 4h tf.

ZEN has successfully changed it's trend from down to the upside and re testing it as well. Also it is holding well 200EMA daily + 50EMA 3D.

I am aiming the next leg up soon towards 26$ - 29$ (Fair Value Gap Area)

Hope for the best.

#nfa #dyor #aqeelonline

Anticipated ZEN Drop Hits Target – Long Now?The anticipated drop I was watching has played out, providing excellent long setups across many coins, including ZEN. ZEN retraced perfectly to the POC at $17.07, aligning with the fib retracement 0.85

This confluence makes it an ideal long setup, offering great potential gains

Long Entry: $17.3

Target 1: $21 (R:R 2.5)

Target 2: $27 (R:R 6)

ZEN Trade Setup: Ride the Wave to +50% ProfitAfter a strong bullish impulse, ZEN completed a 5-wave structure resulting in a +72% price increase and successfully took out a key high. This marked a potential short trade opportunity at the key resistance level.

Subsequently, the price retraced significantly, forming a pullback into the golden pocket (0.618–0.65 Fibonacci retracement), a high-probability buying zone. This corrective move also completed a 5-wave structure to the downside, providing a favorable long trade opportunity with a compelling Risk-to-Reward (R:R) ratio of 3:1.

The target for this long trade is the 0.618 Fibonacci retracement level of the entire impulse wave at $35.86, representing a potential upside of nearly 50%. Additionally, the negative 0.234 Fibonacci level at $35.98 aligns closely with this target, creating a good confluence zone.

Key Levels:

Entry Zone: $23–$25

Primary Target: $35.86 (0.618 Fibonacci retracement)

Confluence Level: $35.98 (Negative 0.234 Fibonacci extension)

Stop-Loss: Below the low of $21 for downside risk mitigation, DCA

ZENUSDT: Two Blue Boxes, Two Opportunities!ZENUSDT: Two Blue Boxes, Two Opportunities! 🚀

ZENUSDT is presenting two crucial zones to watch:

First Blue Box: Perfect for a short-term upward move. A quick reaction here could bring solid gains for the nimble trader.

Second Blue Box: This is the big one! A visit here has the potential to spark new highs.

How to play this smart: Always confirm with CDV, volume profile, and lower time frame market structure breaks before jumping in.

Opportunities like this don’t wait. Be sharp, stay ready, and dominate the charts! Boost, comment, and follow for more insights. 💹

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!