XBTUSD BitMEX Chart Analysis December 23th

Hello.

Make it simple and make profit.

It’s BitCoinGuide.

Hope you had a nice weekend.

We are already at the end of this year.

Let’s always keep up the good work.

Don’t forget to “Follow” me and press “Likes”.

I will begin XBTUSD BitMEX Chart Analysis for December 23th

This is 30m candle chart for last week.

On Friday we had no particular movement.

The important part was the price does not go down below too much on the weekend.

Then it went over the green parallel line and 4H parallel blue resistance line successively.

It made a bit of a detour and then rose up when the cloud changed from “blue cloud” to “red cloud”.

The price went over the “smile face” line and touched the “bell” line.

This is daily candle chart.

As I explained last week, it went over the parallel resistance line.

So we newly have a daily candle chart’s parallel lines.

And now we have a converging section based on the orange mid term trend line.

As there is weekly CME Gap, the movement will be very important for 2 days.

So I brought a trading strategy quite tight for safety.

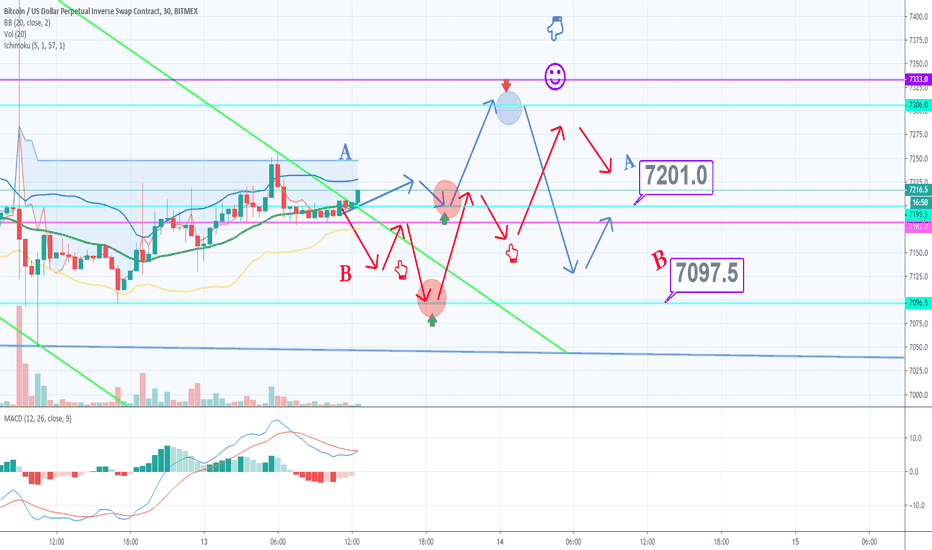

This is 30m candle chart for today.

In fact, it is very hard to measure wave pattern and trading strategy right after a drastic movement of a trend.

As a whole, I brought a long position strategy.

To briefly summarize,

1. Please check route A & B with long position entry timing and price point at the right side.

2. Route A: Please check the price does not go down below the entry point. If it does, it will end up drifting sideways.

3. Route B : Please check the final long position entry point (If it goes down below, please check out the price gap for weekly CME market.

This is it.

I’ve indicated bonus points.

Blue finger pointer for route A (short position shortly)

Red finger pointer for route B

Hope you cope well with it.

In case of Altcoins, we will have to consider the correction and weekly CME Gap. Then I will try to operate simultaneously with Bitcoin.

Hope you have a good day.

I will come back to you with FX Margin trading, overseas trading in the afternoon.

Thank you.

(Translation

Jae Ho Shin)

Zeromarketzerospread

XBTUSD BitMEX Chart Analysis December 20th

Hello.

It’s BitCoinGuide~

Don’t forget to press “Likes” and “Follow” me.

I will begin XBTUSD BitMEX Chart Analysis for December 20th

This is 30m candle chart for yesterday.

As you can see from 30m candle chart, it ended up drifting sideways between route A and B.

On YouTube Live Streaming, I opened long position at the middle line of Bollinger band with tight stop loss and made a little bit of profit.

I waited for long position at the point I’ve mentioned. But it did not come down.

But we have lots of chances for tomorrow.

So don’t be regretful.

This is 4H chart.

I believe a direction will be decided within the colored box.

Currently we are on “red cloud” with MACD Dead Cross coming soon.

I brought a strategy based on this.

This is 30m candle chart for today.

I will briefly summarize.

1. Please check route A & B with A’s long position / B’s short position entry timing and price point of $7,150.

2. Route A : Please check the price does not go down below the entry point. If it does, please refer to route B. When you have entered the position, please check the price touches the final “smile face” line. If it leaves tail with just one touch, please switch into short position. Also, if the price does not make it to the blue parallel resistance line for 4H candle chart, switch into short position.

3. Route B : Right at the short position entry point, please check if the price goes above the green parallel resistance line. If it does not make it, please enter short position.

This is it for today.

I’ve indicated bonus points with blue finger pointer for route A / red finger pointer for route B. For those who can cope with it, please take advantage of the opportunity.

If we reach the point where the bell is located, or the price seems to move upward, you can simultaneously operate major altcoins on the weekend.

I will come back to you with FX margin trading and overseas chart analysis in the afternoon.

(Sorry for yesterday as I was so tired)

Thank you.

(Translation

Jae Ho Shin)

December 20th XBTUSD Chart AnalysisHello.

It’s BitCoinGuide~

Don’t forget to press “Likes” and “Follow” me.

I will begin XBTUSD BitMEX Chart Analysis for December 20th

This is 30m candle chart for yesterday.

As you can see from 30m candle chart, it ended up drifting sideways between route A and B.

On YouTube Live Streaming, I opened long position at the middle line of Bollinger band with tight stop loss and made a little bit of profit.

I waited for long position at the point I’ve mentioned. But it did not come down.

But we have lots of chances for tomorrow.

So don’t be regretful.

This is 4H chart.

I believe a direction will be decided within the colored box.

Currently we are on “red cloud” with MACD Dead Cross coming soon.

I brought a strategy based on this.

This is 30m candle chart for today.

I will briefly summarize.

1. Please check route A & B with A’s long position / B’s short position entry timing and price point of $7,150.

2. Route A : Please check the price does not go down below the entry point. If it does, please refer to route B. When you have entered the position, please check the price touches the final “smile face” line. If it leaves tail with just one touch, please switch into short position. Also, if the price does not make it to the blue parallel resistance line for 4H candle chart, switch into short position.

3. Route B : Right at the short position entry point, please check if the price goes above the green parallel resistance line. If it does not make it, please enter short position.

This is it for today.

I’ve indicated bonus points with blue finger pointer for route A / red finger pointer for route B. For those who can cope with it, please take advantage of the opportunity.

If we reach the point where the bell is located, or the price seems to move upward, you can simultaneously operate major altcoins on the weekend.

I will come back to you with FX margin trading and overseas chart analysis in the afternoon.

(Sorry for yesterday as I was so tired)

Thank you.

(Translation

Jae Ho Shin)

XBTUSD BitMEX Chart Analysis December 19th

Hello.

It’s BitcoinGuide.

Don’t forget to press “Likes” and “Follow” me.

I will begin XBTUSD BitMEX Chart Analysis for December 19th

This is 30m candle chart for yesterday.

I’ve mentioned several times about this pattern comparing with that of December 4th

Along with route B, it first came down and made the wave pattern following the red arrow.

From the long position entry point of route B, it passed the route A.

At the blue finger pointer area, it consistently went up, filling up the gap and ended up at the final blue parallel resistance line.

It was about $1,000 profit.

Congratulations.

This is daily candle chart.

If we breakout the blue parallel resistance line, we have orange mid-term resistance line.

We have two blue parallel lines and if we breakout the first one, we will have to face the next uptrend parallel line.

We are currently at the middle line of Bollinger band.

I brought a strategy based on this.

This is today’s 30m candle chart.

I will briefly summarize,

1. Please refer to route A & B with A’s long position entry timing / B’s short position entry timing with price points.

2. Route A : Please check the price goes down below the entry point. If it does, please follow route B. If the price goes up, you should check the price touches the final “smile face” line. If it leaves a tall shadow with one touch, or without a touch, please operate short position.

3. Route B : Please check $6,945 long position entry point. If it goes down with an additional candle, please call it a day with no position. If it rebounds, please check the price goes above the green parallel resistance line. Then it would be considered switching into route A.

Please check out the blue and red finger pointers where you can take advantage of in real time basis.

Regretful to say but, today I may not be able to upload FX margin trading, overseas trading analysis.

Hope you understand and have a good day.

Thank you.

(Translation Jae Ho Shin)

December 19th XBTUSD Chart Analysis

Hello.

It’s BitcoinGuide.

Don’t forget to press “Likes” and “Follow” me.

I will begin XBTUSD BitMEX Chart Analysis for December 19th

This is 30m candle chart for yesterday.

I’ve mentioned several times about this pattern comparing with that of December 4th

Along with route B, it first came down and made the wave pattern following the red arrow.

From the long position entry point of route B, it passed the route A.

At the blue finger pointer area, it consistently went up, filling up the gap and ended up at the final blue parallel resistance line.

It was about $1,000 profit.

Congratulations.

This is daily candle chart.

If we breakout the blue parallel resistance line, we have orange mid-term resistance line.

We have two blue parallel lines and if we breakout the first one, we will have to face the next uptrend parallel line.

We are currently at the middle line of Bollinger band.

I brought a strategy based on this.

This is today’s 30m candle chart.

I will briefly summarize,

1. Please refer to route A & B with A’s long position entry timing / B’s short position entry timing with price points.

2. Route A : Please check the price goes down below the entry point. If it does, please follow route B. If the price goes up, you should check the price touches the final “smile face” line. If it leaves a tall shadow with one touch, or without a touch, please operate short position.

3. Route B : Please check $6,945 long position entry point. If it goes down with an additional candle, please call it a day with no position. If it rebounds, please check the price goes above the green parallel resistance line. Then it would be considered switching into route A.

Please check out the blue and red finger pointers where you can take advantage of in real time basis.

Regretful to say but, today I may not be able to upload FX margin trading, overseas trading analysis.

Hope you understand and have a good day.

Thank you.

(Translation Jae Ho Shin)

AUDUSD FX Chart Analysis December 18th

Hello.

It’s BitcoinGuide.

Please “Follow” me and press “Likes”.

I will begin AUDUSD Chart Analysis for December 18th

This shows 30m candle chart for EURUSD yesterday.

The trend changed from B-> A -> B

After a fall, it dropped to the indicated position.

It could have been profits for both sides.

It is $296 point profit only for long position.

It has been long time to see this much profit.

Congratulations to you all.

This is AUDUSD 30m candle chart.

I brought short position trading strategy.

To briefly summarize,

1. Please check route A & B with A long position / B short position entry timing and price points.

2. Route A : Please check the long position entry point. If it goes down below, please check route B. If you manage to get in, please see if the price goes above the final parallel resistance line. If it leaves tall shadow without reaching out, please switch into short position.

Please also refer to the blue finger pointer.

3. Route B : After a rebound, please see if the price touches the resistance line for 1H candle chart. If it touches, it could lead to route A. Please also refer to the blue finger pointer.

The price may move between the green parallel supporting and resistance line.

I hope you cope well with your trading.

This is it for today.

I will come back to you tomorrow again.

Thank you.

(Translation Jae Ho Shin)

December 18th AUDUSD FX Chart Analysis

Hello.

It’s BitcoinGuide.

Please “Follow” me and press “Likes”.

I will begin AUDUSD Chart Analysis for December 18th

This shows 30m candle chart for EURUSD yesterday.

The trend changed from B-> A -> B

After a fall, it dropped to the indicated position.

It could have been profits for both sides.

It is $296 point profit only for long position.

It has been long time to see this much profit.

Congratulations to you all.

This is AUDUSD 30m candle chart.

I brought short position trading strategy.

To briefly summarize,

1. Please check route A & B with A long position / B short position entry timing and price points.

2. Route A : Please check the long position entry point. If it goes down below, please check route B. If you manage to get in, please see if the price goes above the final parallel resistance line. If it leaves tall shadow without reaching out, please switch into short position.

Please also refer to the blue finger pointer.

3. Route B : After a rebound, please see if the price touches the resistance line for 1H candle chart. If it touches, it could lead to route A. Please also refer to the blue finger pointer.

The price may move between the green parallel supporting and resistance line.

I hope you cope well with your trading.

This is it for today.

I will come back to you tomorrow again.

Thank you.

(Translation Jae Ho Shin)

XBTUSD BitMEX Chart Analysis December 18th

Hello,

it’s BitcoinGuide.

Don’t forget to press “Likes” and “Follow” me.

I will begin XBTUSD BitMEX Chart Analysis for December 18th

This is 30m candle chart for yesterday.

I’ve deleted unnecessary lines.

It seemed like there will be a trick as it was Tuesday.

It ignored route A and B wave pattern. Rather, it newly made a wave at a delayed point.

If the price becomes very steady, ignoring the A & B wave pattern, the indicated routes are invalidated.

At A long position entry point, the cloud changed into “red” cloud in 15m candle chart.

Right after, the price drastically fell.

As I explained yesterday, price fall in the midst of cloud’s turning point tends to be severe.

According to the situation, I entered long position and coped with it in real time basis.

For those who could not participate for the live streaming, I’ll explain one more time.

After opening position, the price went over the orange trend line. Target point was $7,000 at maximum, and stop loss for $6,860.

The price went over the orange trend line, however, reached to the stop loss point(suspicious movement).

Then the price suddenly dropped precisely from the red finger point. It was about $300 fall.

The timing of creating a wave pattern via route B was delayed. By making a detour, rather the downtrend channel was reinforced.

Each route strategy was invalidated and the price heavily fell.

This is weekly candle chart.

We newly have blue parallel supporting and resistance line for daily chart. And please refer to the below red supporting line / and $6,020 price point.

Yesterday’s downtrend wave ignored the middle line of monthly candle chart and once again strongly fell.

I brought a strategy based on this fact.

Today’s strategy.

It is 30m candle chart.

To briefly summarize,

1. Please check route A & B with long position entry timing and price points

2. In case of route A, please check if the price goes down below the entry point. If it does please refer to route B.

If the price does not touch the final “smile face” line above, and shows a suspicious movement including tall shadow, please switch into short position (please check the blue finger pointer)

3. Route B : please check long position entry timing and price point.

If we see a rebound from the entry point, please refer to red finger pointer. (Recently there has been frequent downtrend pattern with this kind of a trick).

If the price goes above green parallel resistance line, please follow route A.

Also check out the converging triangle for green parallel line and blue supporting line.

There are no such uptrend and downtrend without a reason.

Especially, in case of downtrend, it firstly makes a short uptrend and creates a position. Then a heavy fall comes after, you should be careful for it.

(Long position is quite different)

Above all, the downtrend seems strong, so I hope you could operate your long position in short term basis.

This is it for today.

I will come back to you with FX margin trading in the afternoon.

Thank you.

(Translation Jae Ho Shin)

December 18th XBTUSD Chart Analysis

Hello,

it’s BitcoinGuide.

Don’t forget to press “Likes” and “Follow” me.

I will begin XBTUSD BitMEX Chart Analysis for December 18th

This is 30m candle chart for yesterday.

I’ve deleted unnecessary lines.

It seemed like there will be a trick as it was Tuesday.

It ignored route A and B wave pattern. Rather, it newly made a wave at a delayed point.

If the price becomes very steady, ignoring the A & B wave pattern, the indicated routes are invalidated.

At A long position entry point, the cloud changed into “red” cloud in 15m candle chart.

Right after, the price drastically fell.

As I explained yesterday, price fall in the midst of cloud’s turning point tends to be severe.

According to the situation, I entered long position and coped with it in real time basis.

For those who could not participate for the live streaming, I’ll explain one more time.

After opening position, the price went over the orange trend line. Target point was $7,000 at maximum, and stop loss for $6,860.

The price went over the orange trend line, however, reached to the stop loss point(suspicious movement).

Then the price suddenly dropped precisely from the red finger point. It was about $300 fall.

The timing of creating a wave pattern via route B was delayed. By making a detour, rather the downtrend channel was reinforced.

Each route strategy was invalidated and the price heavily fell.

This is weekly candle chart.

We newly have blue parallel supporting and resistance line for daily chart. And please refer to the below red supporting line / and $6,020 price point.

Yesterday’s downtrend wave ignored the middle line of monthly candle chart and once again strongly fell.

I brought a strategy based on this fact.

Today’s strategy.

It is 30m candle chart.

To briefly summarize,

1. Please check route A & B with long position entry timing and price points

2. In case of route A, please check if the price goes down below the entry point. If it does please refer to route B.

If the price does not touch the final “smile face” line above, and shows a suspicious movement including tall shadow, please switch into short position (please check the blue finger pointer)

3. Route B : please check long position entry timing and price point.

If we see a rebound from the entry point, please refer to red finger pointer. (Recently there has been frequent downtrend pattern with this kind of a trick).

If the price goes above green parallel resistance line, please follow route A.

Also check out the converging triangle for green parallel line and blue supporting line.

There are no such uptrend and downtrend without a reason.

Especially, in case of downtrend, it firstly makes a short uptrend and creates a position. Then a heavy fall comes after, you should be careful for it.

(Long position is quite different)

Above all, the downtrend seems strong, so I hope you could operate your long position in short term basis.

This is it for today.

I will come back to you with FX margin trading in the afternoon.

Thank you.

(Translation Jae Ho Shin)

EURUSD FX Chart Analysis December 17th

Hello, it’s BitcoinGuide.

Always, don’t forget to “Follow” me and press “Likes”.

I will begin EURUSD Chart Analysis for December 17th

This is USDJPY 30m candle chart for yesterday.

It was route A. First long position, and then short position switching timing.

It was an opportunity for both sides.

It seems about $500 movement. Congratulations for those who made profits.

Today we have 30m candle chart for EURUSD.

Recently, FX margin trading position seems to be in the midst of both uptrend and downtrend.

I will briefly summarize.

1. Please confirm route A & B with A’s long position entry timing / B’s short position entry timing and each price points at the right side.

2. In case of route A, please check if the price goes down below the long position entry point / Then please refer to route B. If the price rises, please check whether it touches green parallel resistance line. If it shows a suspicious movement, please switch your position according to the direction of arrows.

3. In case of route B, please see if the price goes above entry point (orange trend line with an additional candle). If it does, please refer to route A.

If the price does not go down below the final blue supporting line, please enter long position.

This is it for today.

Today is Tuesday when we see lots of tricks. So be careful.

Please wait with patience and cope with the wave pattern that you can deal with.

Based on orange trend line and 4H chart’s parallel supporting line, I’ve checked converging section, so please refer to this.

Also please refer to GBPUSD(Which have the same direction with EURUSD) and USDCHF(Which have the opposite way).

I will come back to you tomorrow.

Thank you.

(Translation Help

Jae Ho Shin)

December 17th EURUSD FX Chart Analysis

Hello, it’s BitcoinGuide.

Always, don’t forget to “Follow” me and press “Likes”.

I will begin EURUSD Chart Analysis for December 17th

This is USDJPY 30m candle chart for yesterday.

It was route A. First long position, and then short position switching timing.

It was an opportunity for both sides.

It seems about $500 movement. Congratulations for those who made profits.

Today we have 30m candle chart for EURUSD.

Recently, FX margin trading position seems to be in the midst of both uptrend and downtrend.

I will briefly summarize.

1. Please confirm route A & B with A’s long position entry timing / B’s short position entry timing and each price points at the right side.

2. In case of route A, please check if the price goes down below the long position entry point / Then please refer to route B. If the price rises, please check whether it touches green parallel resistance line. If it shows a suspicious movement, please switch your position according to the direction of arrows.

3. In case of route B, please see if the price goes above entry point (orange trend line with an additional candle). If it does, please refer to route A.

If the price does not go down below the final blue supporting line, please enter long position.

This is it for today.

Today is Tuesday when we see lots of tricks. So be careful.

Please wait with patience and cope with the wave pattern that you can deal with.

Based on orange trend line and 4H chart’s parallel supporting line, I’ve checked converging section, so please refer to this.

Also please refer to GBPUSD(Which have the same direction with EURUSD) and USDCHF(Which have the opposite way).

I will come back to you tomorrow.

Thank you.

(Translation Help

Jae Ho Shin)

December 17th XBTUSD Chart Analysis

Hello,

it’s BitcoinGuide.

Hope my analysis is helpful for you. And if it is, please don’t forget to press “Likes” and “Follow” me.

I will begin XBTUSD BitMEX Chart Analysis for December 17th

This is 30m candle chart for yesterday.

It was long -> short movement.

If you look at the left point, the price suddenly fell before the entry timing.

And it was a variable.

If the price dropped to $7,035 once again, then the wave could have a power to possibly rise until the top of weekend CME gap.

With lack of power, price dropped from the finger pointer at the right side.

(I’ve mentioned several times about entering short position, and I believe you must have made profit this time)

So congratulations for those who made profits.

This is monthly candle chart.

Unfortunately, we have reached the point where I hoped I wouldn’t see.

Please refer to the point.

I brought a strategy based on this factor.

Today’s strategy.

It is long position strategy, and we have 30m candle chart.

I will briefly summarize.

1. Please refer to route A & B with long position entry timing and price points.

2. In case of route A, please check if the price goes down below the entry point / If it does, please refer to route B. If you make it to enter long position, please check whether the price reaches green parallel resistance line and finally “smile face” line.

If the price does not make it to the resistance line, please refer to the blue arrows for your additional switching points.

3. When the price follows route B, please check long position entry timing and price points.

If the price goes down below $6,760, please call it a day with no position.

(I’ve made this point a long position because we have a strong possibility for a strong rebound)

Please look at the red finger pointer. If the price does not lose its power and supports well for this level, it would go straight up to the route A.

This is it for today.

Today is Tuesday when we frequently see a twist.

However, due to the fact that the price strongly dropped just like last week, we need some time to wait for a rebound until the weekly CME Gap point.

So, please consider there is pretty much chance of just drifting sideways. Hope you cope well with it.

I will come back to you with FX margin trading in the afternoon.

Thank you.

(Translation Help

Jae Ho shin)

USDJPY FX Chart analysis December 16th

Hello.

It’s BitcoinGuide.

If my analysis is helpful,please press “Likes” and “Follow” me.

I will begin USDJPY Chart analysis for December 16th

This is 30m candle chart for USDCHF for last Friday.

It followed route B with drastic fall, ignoring the indicated wave pattern and entry timing.

If you look at the blue finger pointer, there was a drastic fall directly to the maximum point.

When it comes to this kind of a variable, it is very important to understand the movement including drastic fall and rise.

I changed my strategy to long position and made profit.

After the rebound, it ended up with drifting sideways.

Today we have 30m candle chart for USDJPY.

It is still drifting sideways within the daily candle chart’s trend.

So I brought a strategy based on this factor.

1. Please refer to route A & B with A’s long position entry timing / B’s short position entry timing and price points.

2. In case of route A, please check the price goes down below your entry point / If it goes up, please check if it goes above the final “smile face” line. / If it does not make it to the top, please switch into short position.

3. When it follows route B, please first check out the finger pointer part where the price could directly go up / If it does, please follow route A.

4. At route B’s final long position entry point, close your position if it goes down below parallel supporting line with an additional candle.

This is it for today.

I believe the direction will be turned out within the range of green parallel line.

It may just end up with drifting sideways. So please refer to this for your safe trading.

I will come back to you tomorrow.

Thank you.

(Translation Help

Jae Ho Shin)

December 16 USDJPY FX Chart analysis

Hello.

It’s BitcoinGuide.

If my analysis is helpful,please press “Likes” and “Follow” me.

I will begin USDJPY Chart analysis for December 16th

This is 30m candle chart for USDCHF for last Friday.

It followed route B with drastic fall, ignoring the indicated wave pattern and entry timing.

If you look at the blue finger pointer, there was a drastic fall directly to the maximum point.

When it comes to this kind of a variable, it is very important to understand the movement including drastic fall and rise.

I changed my strategy to long position and made profit.

After the rebound, it ended up with drifting sideways.

Today we have 30m candle chart for USDJPY.

It is still drifting sideways within the daily candle chart’s trend.

So I brought a strategy based on this factor.

1. Please refer to route A & B with A’s long position entry timing / B’s short position entry timing and price points.

2. In case of route A, please check the price goes down below your entry point / If it goes up, please check if it goes above the final “smile face” line. / If it does not make it to the top, please switch into short position.

3. When it follows route B, please first check out the finger pointer part where the price could directly go up / If it does, please follow route A.

4. At route B’s final long position entry point, close your position if it goes down below parallel supporting line with an additional candle.

This is it for today.

I believe the direction will be turned out within the range of green parallel line.

It may just end up with drifting sideways. So please refer to this for your safe trading.

I will come back to you tomorrow.

Thank you.

(Translation Help

Jae Ho Shin)

XBTUSD Chart Analysis December 16

Hello.

“Make it simple and make profit” It’s BitcoinGuide.

If my analysis is helpful, please “Follow” me and press “Likes”.

I will begin XBTUSD BitMEX Chart Analysis for December 16.

This is 30m candle chart for last Friday.

I’ve deleted unnecessary lines.

It moved along with route A with long position and then stopped.

Based on the orange converging section that I mentioned in our private member’s room, it rose about $100.

After, it could not touch the final “smile face” line, and dropped suddenly below the orange supporting line.

I’ve mentioned several times about operating short position.

For those who remembered this could have made profits for both sides.

Congratulations.

This is weekly candle chart.

The candle is made at the bottom part of Bollinger band. And the supporting line is indicating below.

Please look at the blue supporting line(daily candle’s parallel line).

If there is a rebound, please refer to the orange resistance line.

We are at position where there could be a rebound, but still in a dangerous zone.

It is time when daily candle chart’s MACD Dead Cross should come out.

So I brought a strategy based on these factors.

Today’s strategy.

It is 30m candle chart and long position trading strategy.

To summarize,

1. Please check route A & B with long position entry timing / price points

2. In case of route A, please check whether the price goes down below $7,106 with an additional candle. If it does, please refer to route B. If the price rises and touches the “smile face” line, we will be at safe zone. If it does not make it, please enter short position.

3. If it follows route B, check if the price goes down below $7,035 long position entry point. If it does, call it a day with no position.

4. In case of route B, please refer to the finger pointers. If there is not much correction, please check if the price goes up strongly. Then it would be considered route A.

This is it for today.

If you look at the middle, there is weekly CME Gap.

For you reference, please check if there will be a rebound reaching this point.

I will come back to you with FX Margin Trading Chart Analysis in the afternoon.

Thank you.

(Translation Help

Jae Ho Shin)

December 16th XBTUSD Chart Analysis

Hello.

“Make it simple and make profit” It’s BitcoinGuide.

If my analysis is helpful, please “Follow” me and press “Likes”.

I will begin XBTUSD BitMEX Chart Analysis for December 16.

This is 30m candle chart for last Friday.

I’ve deleted unnecessary lines.

It moved along with route A with long position and then stopped.

Based on the orange converging section that I mentioned in our private member’s room, it rose about $100.

After, it could not touch the final “smile face” line, and dropped suddenly below the orange supporting line.

I’ve mentioned several times about operating short position.

For those who remembered this could have made profits for both sides.

Congratulations.

This is weekly candle chart.

The candle is made at the bottom part of Bollinger band. And the supporting line is indicating below.

Please look at the blue supporting line(daily candle’s parallel line).

If there is a rebound, please refer to the orange resistance line.

We are at position where there could be a rebound, but still in a dangerous zone.

It is time when daily candle chart’s MACD Dead Cross should come out.

So I brought a strategy based on these factors.

Today’s strategy.

It is 30m candle chart and long position trading strategy.

To summarize,

1. Please check route A & B with long position entry timing / price points

2. In case of route A, please check whether the price goes down below $7,106 with an additional candle. If it does, please refer to route B. If the price rises and touches the “smile face” line, we will be at safe zone. If it does not make it, please enter short position.

3. If it follows route B, check if the price goes down below $7,035 long position entry point. If it does, call it a day with no position.

4. In case of route B, please refer to the finger pointers. If there is not much correction, please check if the price goes up strongly. Then it would be considered route A.

This is it for today.

If you look at the middle, there is weekly CME Gap.

For you reference, please check if there will be a rebound reaching this point.

I will come back to you with FX Margin Trading Chart Analysis in the afternoon.

Thank you.

(Translation Help

Jae Ho Shin)

USDHCF Chart Analysis for December 13th

Hello.

It’s BitcoinGuide.

Today, please press “Likes” and “Follow” me.

I will begin USDHCF Chart Analysis for December 13th

This is XAUUSD Gold Chart Analysis for yesterday.

First, it followed route A and then it touched the line at $1,486.

Right after, it suddenly dropped right to the entry point of route B.

It is about $25 movement.

Congratulations for those who made profits.

Today we have USDCHF 30m candle chart.

To briefly summarize,

1. Please check route A & B with A’s long position B’s short position entry timing and each price points.

2. If the price goes down below A long position entry point, please check route B’s short position.

Please also check whether the price goes over the orange trend line / and then the next parallel resistance line.

3. When it follows route B, please check the price touches 1H candle chart’s Bollinger band resistance line twice. If it touches twice, please refer to route A. If it does not make twice and lose its power, please enter short position.

Please check the first convergence section for two orange lines.

The “sad face” line below is stacked with other supporting lines. So, if it drops below this point, it would cause a drastic fall. (Not only for today, but also you should make it clear next week)

This is it for today.

Recently, GBPUSD / EURUSD, which have opposite direction to USDCHF, are on good uptrend. Please check the movements too.

I’ll wrap up for today.

Hope you had a good week.

I will come back to you next Monday.

Thank you.

(Translation Help

Jae Ho Shin)

December 13th USDHCF Chart Analysis

Hello.

It’s BitcoinGuide.

Today, please press “Likes” and “Follow” me.

I will begin USDHCF Chart Analysis for December 13th

This is XAUUSD Gold Chart Analysis for yesterday.

First, it followed route A and then it touched the line at $1,486.

Right after, it suddenly dropped right to the entry point of route B.

It is about $25 movement.

Congratulations for those who made profits.

Today we have USDCHF 30m candle chart.

To briefly summarize,

1. Please check route A & B with A’s long position B’s short position entry timing and each price points.

2. If the price goes down below A long position entry point, please check route B’s short position.

Please also check whether the price goes over the orange trend line / and then the next parallel resistance line.

3. When it follows route B, please check the price touches 1H candle chart’s Bollinger band resistance line twice. If it touches twice, please refer to route A. If it does not make twice and lose its power, please enter short position.

Please check the first convergence section for two orange lines.

The “sad face” line below is stacked with other supporting lines. So, if it drops below this point, it would cause a drastic fall. (Not only for today, but also you should make it clear next week)

This is it for today.

Recently, GBPUSD / EURUSD, which have opposite direction to USDCHF, are on good uptrend. Please check the movements too.

I’ll wrap up for today.

Hope you had a good week.

I will come back to you next Monday.

Thank you.

(Translation Help

Jae Ho Shin)

XBTUSD Chart Analysis for December 13th

Hello.

“Make it simple and make profit” It’s BitcoinGuide.

Yesterday a worldwide renowned analyst pressed “Like”.

I feel proud of myself.

If you also feel my analysis is helpful, please “Follow” me and press “Likes”.

I will begin XBTUSD BitMEX Chart Analysis for December 13th

Above shows 30m candle chart for yesterday.

It pretended to follow route B, but followed route A eventually.

I explained you about the reason why yesterday on the YouTube.

For those who participated the live streaming must have made some profit.

I also made profit and shared with you all.

Congratulations for all of you.

Yesterday the price went over the orange resistance line, and slowly went up following the orange supporting trend line.

I’ve mentioned that a movement within the Bollinger band of 30m candle chart is consolidation.

The price did not suddenly go up and down with tall shadow. Instead, the price is steadily going up and it means a lot. Please keep in mind of this.

Today’s points that you should know.

Please refer to 4H candle chart.

Check out the candle’s current position and MACD status.

Today’s trading strategy.

This is 30m candle chart. And it’s long position trading strategy.

I will briefly summarize.

1. Check out route A & B with long position entry timing and price points.

2. In case of route A, please check whether the price goes down below the entry point.

If it does, please refer to route B.

/ If you entered, please check the price touches the above “smile face” line twice. If it does, keep your long position / If it does not manage to touch the line, and leaves tall shadow, switch into short position.

3. If the price follows route B, please check whether it goes down below $7,097. If it does, call it a day with no position.

/ If you look at the first finger pointer, please check whether the price suddenly changes its way and goes above the green parallel line.

If you look at the second finger pointer, when the price goes down below the pointer with an additional candle, switch into short position for short term.

This is it for today.

I will come back to you with FX margin trading analysis in the afternoon.

Fighting

(Translation Help

Jae Ho Shin)

December 13th XBTUSD Chart Analysis

Hello.

“Make it simple and make profit” It’s BitcoinGuide.

Yesterday a worldwide renowned analyst pressed “Like”.

I feel proud of myself.

If you also feel my analysis is helpful, please “Follow” me and press “Likes”.

I will begin XBTUSD BitMEX Chart Analysis for December 13th

Above shows 30m candle chart for yesterday.

It pretended to follow route B, but followed route A eventually.

I explained you about the reason why yesterday on the YouTube.

For those who participated the live streaming must have made some profit.

I also made profit and shared with you all.

Congratulations for all of you.

Yesterday the price went over the orange resistance line, and slowly went up following the orange supporting trend line.

I’ve mentioned that a movement within the Bollinger band of 30m candle chart is consolidation.

The price did not suddenly go up and down with tall shadow. Instead, the price is steadily going up and it means a lot. Please keep in mind of this.

Today’s points that you should know.

Please refer to 4H candle chart.

Check out the candle’s current position and MACD status.

Today’s trading strategy.

This is 30m candle chart. And it’s long position trading strategy.

I will briefly summarize.

1. Check out route A & B with long position entry timing and price points.

2. In case of route A, please check whether the price goes down below the entry point.

If it does, please refer to route B.

/ If you entered, please check the price touches the above “smile face” line twice. If it does, keep your long position / If it does not manage to touch the line, and leaves tall shadow, switch into short position.

3. If the price follows route B, please check whether it goes down below $7,097. If it does, call it a day with no position.

/ If you look at the first finger pointer, please check whether the price suddenly changes its way and goes above the green parallel line.

If you look at the second finger pointer, when the price goes down below the pointer with an additional candle, switch into short position for short term.

This is it for today.

I will come back to you with FX margin trading analysis in the afternoon.

Fighting

(Translation Help

Jae Ho Shin)

XAUUSD Gold Chart Analysis December 12th

Hello.

It’s BitcoinGuide.

Please “Follow” me and press “Likes”.

I will begin XAUUSD Gold Chart Analysis for December 12th

This shows GBPUSD 30m candle chart for yesterday.

It moved from route B to A. Stop loss was at green parallel resistance line.

So, the strategy failed yesterday.

Today we have XAUUSD Gold 30m candle chart.

Recently, we frequently see strong trend in FX market.

So, I calculated the wave a bit bigger than usual.

To summarize,

1. Please see route A & B with each entry timing and price point.

2. When you enter long position on route A, if it goes down below the entry point, please refer to route B.

3. In case of route B, when you enter long position, please carefully look at the first adjustment. When the price falls strong, close your position.

This is it.

Currently, we are at downtrend signal.

As a whole, however, the uptrend seems strong for now. So, I brought a strategy according to it.

Recently, we usually see strong trend. So please don’t be hesitant. And enter your position as you planned.

Do not forget to put stop-loss.

I will come back to you tomorrow.

Thank you.

(Translation help

Jae Ho Shin)

December 12th XAUUSD Gold Chart Analysis

Hello.

It’s BitcoinGuide.

Please “Follow” me and press “Likes”.

I will begin XAUUSD Gold Chart Analysis for December 12th

This shows GBPUSD 30m candle chart for yesterday.

It moved from route B to A. Stop loss was at green parallel resistance line.

So, the strategy failed yesterday.

Today we have XAUUSD Gold 30m candle chart.

Recently, we frequently see strong trend in FX market.

So, I calculated the wave a bit bigger than usual.

To summarize,

1. Please see route A & B with each entry timing and price point.

2. When you enter long position on route A, if it goes down below the entry point, please refer to route B.

3. In case of route B, when you enter long position, please carefully look at the first adjustment. When the price falls strong, close your position.

This is it.

Currently, we are at downtrend signal.

As a whole, however, the uptrend seems strong for now. So, I brought a strategy according to it.

Recently, we usually see strong trend. So please don’t be hesitant. And enter your position as you planned.

Do not forget to put stop-loss.

I will come back to you tomorrow.

Thank you.

(Translation Help

Jae Ho Shin)

December 12th XBTUSD BitMex Chart Analysis

Hello.

It’s BitcoinGuide.

If my words are helpful, don’t forget to “Follow” me and press “Likes”.

I will begin XBTUSD BitMex Chart Analysis for December 12th

This is 30m candle chart for yesterday.

It followed route B except the last tall shadow.

Important part was the point when the price could not touch the B long position entry point.

It was a bit delayed and when it touched the price, it suddenly went up and down.

In 30m candle chart, the movement was between the resistance and supporting line. So it was in consolidation. The wave which should have come out yesterday was delayed and came out suddenly today morning.

As you see the red finger point for short position ($7,352.5), I’ve mentioned this additional information in our private member’s room.

It precisely touched the “smile face” line once, and came back to where it belonged.

Recently, there has been too much tricks and long consolidation period.

But I also made profit for $21 movement.

Congratulations for those who earned in this difficult period.

This shows monthly candle chart.

Please refer to $6,850 that I checked for your reference.

Today’s strategy.

It is 30m candle chart.

I will briefly summarize the major information.

1. Please confirm route A & B with A’s long position entry timing / B’s short position timing with each price point.

2. In case of route A, please confirm whether the price does not go down below the entry point.

If it does, it is highly likely to go to route B / If you manage to enter route A long position, please check the price goes above the “smile face” line.

(if the price breaks the point of 30m candle chart’s parallel line and 4H candle chart’s line continuously, it would cause a huge price shooting)

3. Please confirm the first long position entry point for route B. After, check short position where the route A and B meet. (If the price does not have power to break out this point, please enter short position)

4. If it follows route B, please put limit price on $6,834 for long position. It is very likely to see a strong rebound from this point.

This is it for today.

Hope you have a good day.

I will come back to you with FX, overseas futures analysis.

Thank you.

(Translation Help

Jae Ho Shin)