GOLD → Correction after reaching 3500. What's next?FX:XAUUSD updates high to $3,500 amid Trump's attacks on the Fed, we are still in the aggressive trend phase. North train makes a small stop which may give us a chance to trade...

Investors are fleeing to safe-haven assets amid an escalating US-China trade war and Trump's verbal attacks on Fed chief Powell.

Trump is blaming the Fed for the slowing economy and demanding immediate rate cuts, which is undermining confidence in the dollar and boosting demand for gold.

3500 is a psychologically important target and once it is reached, traders have moved to profit-taking, which could lead to a small correction...

Resistance levels: 3475, 3500

Support levels: 3441, 3408, 3385

As part of the correction, the price may test 3440, or 3410. The trend is aggressively bullish and sales should not be considered. The ideal scenario would be liquidity capture relative to 3410 and rebound or continuation of growth, as the fundamental background is on the side of gold....

Regards R. Linda!

Zigzag

POLUSDT → Rally for liquidity accumulation before the fall?BINANCE:POLUSDT.P is currently inside the trading range forming a counter-trend rally within the global downtrend. There is a rather strong liquidity zone ahead....

The distribution is formed after consolidation inside 0.1929 - 0.175. The realization phase can be stopped in the zone 0.228 - 0.2438. This will be confirmed by a stop and a false breakout.

The market is still weak, despite the local growth of bitcoin, as the flagship on the daily timeframe is still trading in the selling zone and based on the current situation we can conclude that the market is forming a collection of liquidity before the continuation of the fall.

Technically, the current rally in POL may end with a false breakout of 0.2284 or 0.2438 followed by a correction or reversal.

Resistance levels: 0.2284, 0.24388, 0.2465

Support levels: 0.2061, 0.1929.

If the price continues to approach this resistance with such speed, at some point the potential and energy may be exhausted and it will not be enough to continue the movement. In this case, we can catch a correction or even a reversal to continue the global trend.

Regards R. Linda!

GOLD → The rally continues. Waiting for correction to tradeFX:XAUUSD supported by the weakness of the dollar and increased trade tensions between the U.S. and China continues to renew highs. At the moment the market is testing 3400...

After Friday's pullback caused by profit taking, the demand for gold rose again - investors are looking for protection amid the threat of recession in the U.S. and instability in the markets. Additional pressure on the dollar is exerted by the threat to the independence of the Fed, after statements about the possible resignation of Jerome Powell.

It is not worth buying at the highs. Technically, against the background of the uptrend, the market can take a break in the form of a pullback. A bounce from support or a false breakdown of the liquidity zone may provide a good opportunity to enter the market

Resistance levels: 3400, 3410, 3430

Support levels: 3369, 3357, 3344

Undoubtedly, based on the overall fundamental situation, gold is absorbing capital as a safe haven and can continue its growth for a long time. But we should keep an eye on the situation between the US and China, as well as in Eastern Europe. Any de-escalation of the conflict may lead to a correction.

For trading now it is worth waiting for a correction to the above mentioned support levels to find a trading opportunity.

Regards R. Linda!

BITCOIN → Retest 86190. There are chances for growthBINANCE:BTCUSD is starting to show positive signs, but it is too early to talk about a change in the downtrend or a bullish rally. Strong resistance ahead....

Against the background of everything that is happening, from a fundamental point of view, bitcoin in general has withstood the blows quite well and is gradually beginning to recover, but the situation for the crypto community as a whole has not changed in any way, the promises are not yet fulfilled. Bitcoin's strengthening is most likely due to localized growth in indices and discussion of lower interest rates. But the focus is on the tariff war between China and the US, improved relations and lower tariffs could weaken bitcoin.

Technically, we see that the price is moving beyond the resistance of the descending channel. For a few days now, the price has been consolidating in front of the 86190 level, and we have chances to see a rise to the resistance of the 88800 range, from which the future prospects will already depend.

Resistance levels: 86190, 88800, 91280

Support levels: 83170, 78170

The price is slowly approaching the resistance 86190, consolidating without updating the local lows, forming a pre-breakout consolidation. There is a probability of a breakout attempt. Breakout and consolidation of the price above 86190 may give a chance to rise to 88800.

But, regarding 88800 we will have to watch the price reaction. A sharp approach with the purpose of primary testing of the level may end in a false breakout and correction....

Regards, R. Linda!

GOLD → Recovery after the FB of 0.5 fibo. What's next?FX:XAUUSD on Thursday tests 0.5 fibo, which I outlined to you on April 17, forms a false breakdown and recovers amid unstable geopolitical relations in the world. Price may continue its northward run.

The dollar continues to fall. The fundamental background depends on the relationship between the US and China as well as economic data especially after Powell's speech. The weekly session closes close to support, the decline may continue.

Gold after the shakeout is heading back north. Based on the fundamental background, the price may continue to rise. There are three days of downtime ahead as traders rest.

Fundamentally, anything can happen over the weekend, however, technically, the emphasis is on intermediate levels. The trend is still strong and bullish

Resistance levels: 3332, 3344, 3357

Support levels: 3313, 3288, 3284

If nothing supernatural happens over the weekend, gold in the Asian session may bounce off the nearest resistance and test trend support before continuing the uptrend. If there are any critical changes in the mood of countries/politicians then I will update the situation

Regards R. Linda!

NEIROUSDT → Countertrend momentum. Is the reversal close?BINANCE:NEIROUSDT.P is one of not many coins that is growing. But the only disadvantage is that the coin is at the bottom. Most likely it is forming a set of liquidity before continuing to fall.

NEIRO is strengthening and heading towards the resistance of the range while bitcoin continues its correction.

Strong resistance and liquidity zone at 0.187 is ahead. Strong gains could be stopped by a false breakout and reversal

Just because a coin is at the bottom doesn't mean it has nowhere to fall. Yes, there is.

At the moment the price is in the range on the background of a strong downtrend, within which the price does not show signs of life. The previous buyback ended with a strong sell-off.

Resistance levels: 0.000187, 0.0002045.

Support levels: 0.000169, 0.000154

In the short term, we should expect a false breakout, reversal and price drop to the support of the range.

I do not rule out a prolonged struggle in the resistance zone, within which the price may go higher and test the 0.00020 liquidity zone before continuing to fall, within which it may renew the bottom.

Regards R. Linda!

ALCHUSDT → Rally to the liquidity zone. False breakout?BINANCE:ALCHUSDT.P is one of not many coins that looks strong amid the bearish cryptocurrency market. But how long will this energy last? There is strong resistance ahead....

A local pre-breakdown consolidation relative to the intraday level is forming. In general, this is the state of the market, ready to continue its growth within the distribution.

Thus, the breakout of 0.1590 resistance will provoke the continuation of growth up to the liquidity zone at 0.177. But already at 0.177, due to the fact that it is an important and strong intermediate resistance level, we should expect a false breakout and a pullback, for example, to 0.159 or 0.5 fibo.

Resistance levels: 0.159, 0.177, 0.23

Support levels: 0.1516, 0.5 fibo

The distribution is already 53% since the breakout of the consolidation resistance. By the time the resistance is approached, it will be 77% and the market may use up all the accumulated potential, so liquidity above 0.177 is likely to stop the upward rally and turn the coin down.

Regards R. Linda!

GOLD → Correction to support. What's next?FX:XAUUSD updates a new high to 3357. A correction is forming after Powell's speech. On the background of the bullish trend it is worth looking for stronger support levels

Gold halted gains at $3,358 as traders take profits and assess the implications of Trump's tariff policy.Gold's gains on the week were driven by the escalating trade war between the US and China, fears of a US recession and a flight from risk assets. However, cautious rhetoric from Fed chief Powell and positive signals from trade talks with Japan temporarily curbed further gains in gold. But the level of risks and possible escalation of the conflict is still at a high level.

It is too early to talk about the trend change. At the moment the correction to liquidity zones is forming on the background of the bullish trend. The focus is on 3296, 0.5 fibo. The price may bounce from these levels.

Resistance levels: 3344, 3457

Support levels: 3320, 3296, 3275

The correction after Powell's speech may be quickly exhausted if the politicians from China and the US fuel the conflict. But any hints of negotiations and tariff cuts could be taken very positively by the market, which could lead to a reversal of the local trend.

Regards R. Linda!

GOLD → If you didn't catch the train, what should you do?FX:XAUUSD in a rally. Running into a train that is already in motion is prohibited due to the lack of ability to calculate risks. Ahead of the news, a correction is possible, which will allow us to find a place to trade

Gold continues to update an all-time high on the back of expectations of retail sales in the US and the speech of Fed chief Powell. Price growth was supported by strong data from China, increased demand for “protective assets” due to geopolitical tensions and trade risks between the U.S. and China. Additional support was provided by forecasts of gold price growth from ANZ to $3,600 by the end of the year

Technically, the psychological zones of interest 3325 - 3350 are ahead, from which a correction may form. The ideal scenario is to wait for a correction to local or intermediate support levels and only there look for an entry point.

Resistance levels: 3318, 3335, 3350

Support levels: 3275, 3265, 3244

On the background of a strong bull market it is worth using as a productive strategy to trade on the breakdown of resistance in order to continue growth, but in this case we need to wait for consolidation, we do not have it.

Or wait for correction, support retest and only then consider buying.

Regards R. Linda!

NZDUSD → Is there a chance for continued growth?FX:NZDUSD within the framework of the rally, which is associated with a strong decline in the dollar, is exiting the ascending channel and testing the resistance at 0.5922.

Against the backdrop of the falling dollar, which is associated with economic factors, the New Zealand has good chances to continue to grow. Consolidation of the currency pair above the level will indicate the readiness of the currency pair to continue to grow.

But! Today is quite a day full of economic news. Traders are waiting for Core retail sales & retail sales, as well as Powell's speech at 17:15 UTC. High volatility is possible!

Resistance levels: 0.5922, 0.6038

Support levels: 0.5853

A small correction may be formed from the resistance, but another retest and price consolidation above 0.5922 may be a good signal for both the bulls and us to make decisions. The currency pair has all chances to reach 0.6000

Regards R. Linda!

GBPCAD → False breakdown, where do we go from here?FX:GBPCAD is forming a false breakdown of trend support. Against the backdrop of the falling dollar, the pound sterling went into the rally phase, which is favorable for the currency pair.

The fundamental situation is in favor of GBP and CAD against the dollar, which continues its rapid decline.

As part of the correction, the currency pair forms a test of support without the opportunity to continue the downward movement. The maneuver ends with a false breakdown and consolidation above the level (inside the channel). The currency pair may continue the uptrend if the bulls hold the defense above 1.8144 - 1.823

Support levels: 1.81500, 1.79788

Resistance levels: 1.8233, 1.83796

Accordingly, based on the fact that we have an uptrend, a strong currency pair (on the background of a weak dollar) and a false breakdown of support, we can say that the price is not allowed down and it is worth considering an attempt to continue the uptrend.

Regards R. Linda!

GOLD → Consolidation before the news. What to expect?FX:XAUUSD is not going to turn around. The level of economic risks is still at a high level and the price may continue to rise, but after the end of consolidation.

Gold is back to a record $3,246 despite calm markets. Lower US bond yields and a pause in capital withdrawals are supporting demand for protective assets.

Uncertainty around Trump's tariff policy and expectations of a Fed rate cut are driving prices higher. Additional support is provided by inflows into Chinese ETFs and expectations of Chinese GDP data. Further gold movement depends on headlines on tariffs and Fed rhetoric.

Technically, the focus is on consolidation 3244 - 3187 and internal support level 3208.

Resistance levels: 3244, 3270

Support levels: 3208, 3187

The market is likely to be in consolidation until tomorrow, when important economic reports will be published. But nevertheless, there could be strong movements intraday due to various factors. I expect to see a retest of support at 3208 or 3187 before further upside. But, consolidation near 3244, breakout and consolidation above the level may give a chance for growth

Regards R. Linda!

GOLD → Countertrend correction. What to do in this case?FX:XAUUSD , after a bull run, bumps into strong limit resistance at 3244 and enters a correction phase, which is generally a logical maneuver amid strong gains.

Gold corrects from Friday's record $3,245 and moves back to $3,200 amid improving market sentiment and progress in trade talks. The price pared gains after a strong weekly rally, reacting to U.S. concessions on tariffs on Chinese electronics and China's pledges to boost economic stimulus. Additional influences come from the dialog between the US and Iran, as well as the anticipation of China's GDP and trade data for March. Despite the pullback, downside may be limited due to ongoing uncertainty.

Technically, it is worth looking at the 3187 - 3167 conglomerate of support, which can stop (temporarily or even turn the price upward) a strong and sharp decline, as the fundamental backdrop within the tariff war is still tense.

Resistance levels: 3244, 3270

Support levels: 3187, 3174, 3167

The rally is temporarily halted, but there is no talk of a trend reversal, as the tariff war fire is still burning, Trump or Xi Jinping may add to the fire....

Within the framework of counter-trend correction, the emphasis is on the support of 3187, 3174, 3167 from which we can trade a false breakdown and catch the price rebound.

Regards R. Linda!

NZDJPY → Back in range, there's a chance to strengthenFX:NZDJPY is forming a false break of the range support and within the reversal pattern confirms the break of the bearish structure

The fundamental background has been extremely unstable lately and depends on any harsh statements of politicians, mainly related to the trade war.

But, technically, the pair is returning to the range on the background of local market recovery. A false breakdown of the range support is formed.

The break of the bearish structure, the formation of the reversal pattern and the return to the trading range give chances for strengthening of the price. If the bulls hold the defense above 83.7 - 84.2, the currency pair may strengthen to 85.15 - 87.4

Resistance levels: 84.196, 86.15

Support levels: 83.79, 83.31, 82.21

Consolidation above the key support zone may allow the bulls to strengthen the price to the local zone of interest. Global trend is neutral, local trend is upward.

Regards R. Linda!

GOLD → Price is consolidating, but to what end? Growth?FX:XAUUSD continues on its way as part of a strong rally. Price is testing strong resistance and there is a good chance of a new high as the trade war escalation intensifies. Against the backdrop of the bull run, there is no need to think about selling!

Gold is trading near all-time highs above $3,200 on Friday, posting a weekly gain of about 5.5%. Rising prices are fueled by concerns over U.S. financial stability and the possible resignation of the Fed chief, adding to pressure on the dollar. Expectations of recession and Fed rate cuts are increasing amid escalating trade war with China, after the US imposed tariffs of 145% and Beijing retaliated - China raised tariffs to 125%. Inflation in March came in below expectations, reinforcing forecasts for a rate cut. Focus is on further trade talks and China's response

Resistance levels: 3219.5

Support levels: 3197, 3187, 3167

Emphasis on the local range: 3219 - 3187. Breakdown and price consolidation above the resistance will provoke rally continuation. But I do not rule out a correction to accumulate energy before the continuation of growth. In this case gold may test 3197 (0.7f), or support of 3187 range.

But we should be aware of the fact of unpredictability: If the US and China sit down for negotiations, the situation may change dramatically.

Regards R. Linda!

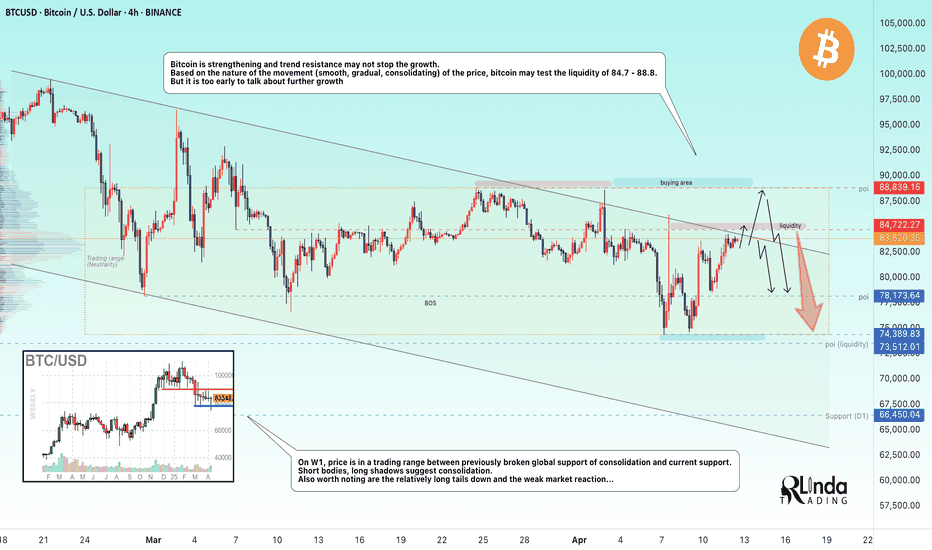

BITCOIN → Testing trend resistance. Will there be a breakout?BINANCE:BTCUSDT is approaching trend resistance and most likely it may test the liquidity zone and risk zone for sellers (liquidity hunt ?), but does the market have the potential to support the upside?

Bitcoin is strengthening and channel resistance may not stop this growth. Based on the nature of price movement (smooth, gradual, consolidating), bitcoin may test liquidity 84.7K - 88.8K. But it is too early to talk about further growth

On W1, the price is in a trading range (consolidation) between the previously broken global consolidation support and the current support. Short bodies, long shadows speak about consolidation. Also worth noting are the relatively long tails to the downside and the weak market reaction...

Fundamentally, the cryptocurrency market (community as a whole) for the past week did not get anything positive as from the very beginning of this year, the growth can be attributed to the 90-day technical break by Trump, but there are a number of nuances:

- the fire has not yet been put out

- just because they gave a 90-day break doesn't mean everything is fine. It's just a head start for the U.S. to prepare for the situation more thoroughly

- The escalating conflict between the U.S. and China has investors looking for less risky assets like gold. Cryptocurrencies are definitely not on that list.

- Rumors of a US interest rate cut are likely to provide support as well.

Resistance levels: 84700, 88800

Support levels: 78200, 73-74К, 66500

I would not hurry with conclusions about further growth. Growth could be considered if bitcoin overcomes 88800 and consolidates above this zone. But a sharp approach or a false breakout of one of the mentioned liquidity zones may provoke a reversal and fall.

Regards R. Linda!

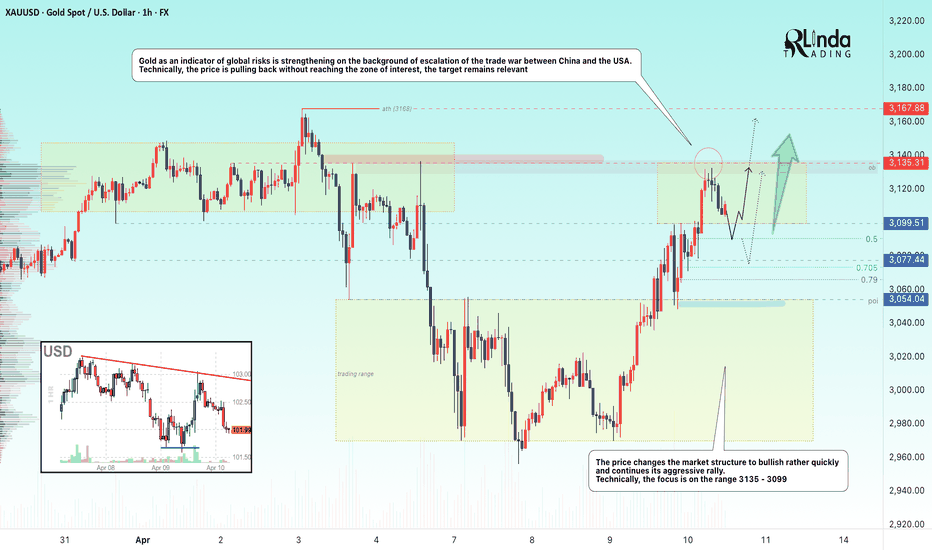

GOLD → Global economic risk indicator consolidates ahead of CPIFX:XAUUSD , rather quickly changes the market structure to bullish and continues its aggressive rally. The economic risk indicator is working perfectly. Technically, the focus is on the range 3135 - 3099

Gold is consolidating around $3,100 in anticipation of US inflation data. The escalating trade war between the US and China keeps demand for defensive assets alive despite the pause in price gains. Trump imposed 125% tariffs on Chinese goods and China retaliated with duties of 84% on U.S. imports. Increased tariff tensions are raising recession expectations and encouraging bets on a Fed interest rate cut, which supports gold. However, a rise in March CPI inflation (expected 2.6% y/y) could trigger a downward correction, although the impact could be short-lived - tariff news remains the main driver

Technically, the price failed to reach the 3135 liquidity zone and reversed, which attracted the crowd willing to sell (deceptive maneuver). But, after correction the price may return to the target quite quickly

Resistance levels: 3135, 3167

Support levels: 3100, 3090, 3077

Emphasis on the range boundaries, possible retest of 3100-3090- 3075 before continuation of growth. On the news or before the opening of the American session there may be a long squeeze before the continuation of growth.

Regards R. Linda!

DOGE → Will the market hold strength or lose it all?BINANCE:DOGEUSDT is testing the liquidity and resistance zone amid a downtrend as part of a news-induced rally. Will the market hold this trend or return to a sell-off?

The downtrend continues. As part of the correction triggered by the news backdrop, bitcoin strengthened and pulled the altcoins with it. But the market may lose all its growth quite quickly, as bearish pressure on the market is still very strong (There are no fundamental positive changes for the market). The fall of BTC may be followed by DOGE as well.

Technically, the price is forming a false break of the resistance zone 0.1622 - 0.15700, consolidation of the price below this zone will provoke the continuation of the fall to the nearest zone of interest 0.13646.

Resistance levels: 0.157, -0.1622

Support levels: 0.13646, 0.1277, 0.1154

A retest of the trend resistance is possible, but price consolidation below the key zone will be a good signal indicating the seller's strength, the decline may continue. On the weekly timeframe we have a trigger at 0.14217, break of which will open the way to 0.1277 - 0.1025.

Regards R. Linda!

GOLD → Bounce back to accumulate energy before growthFX:XAUUSD confirms interim bottom at 2970 after a false breakdown and as part of the escalating trade war, price is strengthening from support to the important medium-term level of 3054.

Further dynamics will depend on the market reaction to the minutes of the March Fed meeting and the introduction of reciprocal tariffs between the US and China. The introduction of 104% duties on Chinese goods increases trade tensions, reduces investor confidence and supports the price of gold against the background of a weakening dollar. Even with the Fed's cautious rhetoric, gold may keep rising due to the escalating trade war.

The medium-term situation depends on the Fed (namely hints or actions on rate cuts), the trade war and negotiations on the situation in Eastern Europe

Resistance levels: 3054, 3077, 3099

Support levels: 3033, 3013 (0.5f), 2995

Since the opening of the session (the price has passed the daily norm) gold has exhausted the technical potential and the 3054 area may push the price down (false breakout). As part of a technical pullback, gold may test 3033 - 3013 before looking at upside attempts again.

Additional scenario: pullback to the fvg zone (0.7 - 0.79 fibo) before further growth.

Regards R. Linda!

USDCAD → Weak dollar provokes continuation of downtrendFX:USDCAD under the pressure of a weak dollar and downtrend may renew its lows. The fundamental background for the dollar is weak, the market reacts accordingly.

The dollar continues to fall - a reaction to the tariff war. Besides, additional pressure is created by the issue of interest rates reduction.

The currency pair is under the pressure of the downtrend. After a false resistance breakout, the price is consolidating in the selling zone. The trend change is confirmed by the cascade of resistances. Emphasis on the local range 1.4245 - 1.42018. The price exit from the consolidation will provoke the continuation of the fall

Resistance levels: 1.4245, trend boundary

Support levels: 1.4202, 1.415

Possible retest of resistance before further decline. But the price exit from the current range and consolidation of the price below 1.4202 - 1.4205 will provoke the growth of sales and further fall to 1.405 (zone of interest).

Regards R. Linda!

GOLD → Rising economic risks could push the price upwardFX:XAUUSD closed inside the range 2970 - 3060 and has all chances to strengthen as the situation between the USA and China is only getting hotter, which creates additional risks.

Gold continues to rally from its recent low of $2,957, back above the $3,000 level amid a weaker dollar and a pause in rising US bond yields. The market is reacting to escalating trade tensions between the US and China, including the threat of new 50% tariffs and possible countermeasures by Beijing. Strengthening expectations of Fed rate cuts and recovering risk appetite also support gold's growth, but the instability of global trade policy keeps investors uncertain.

At the moment the price is testing resistance at 3013 and after a small correction the assault may continue, and a break and consolidation above 3013 will open the way to 3033 - 3057.

Resistance levels: 3013, 3033, 3057

Support levels: 2996, 2981

The trade war and the complex, politician-dependent fundamental backdrop allows us to strategize relative to economic risk. Technically, we are pushing off the strong levels I have outlined for you. The overall situation hints that China will not just give up and Trump will not lose face. An escalation of the conflict could send gold higher.

The price may strengthen from 0.5 fibo, or from 3013

Regards R. Linda!

ADAUSDT → Correction to the liquidity zone before the fall ↓BINANCE:ADAUSDT is in a bear market, under pressure. An exit from consolidation and a pullback with the aim of retesting the resistance (liquidity zone) before further decline is formed

The fundamental background for cryptocurrencies is extremely negative. Bitcoin on yesterday's manipulation related to the 90-day tariff break, which was later denied by the White House began to form “helicopters” and high volatility. As the market calms down, the price returns to the selling zone, which creates pressure for Cardano as well.

Technically, a false breakdown of 0.5 fibo is formed and the price is consolidating near the local support at 0.5800. The breakdown and consolidation of the price below 0.58 will provoke the continuation of the fall. A retest of the previously broken consolidation support at 0.6300 is possible.

Resistance levels: 0.63, 0.6661

Support levels: 0.581, 0.5092, 0.4564

The market structure is exclusively bearish. A False breakout of resistance or breakdown of 0.581 will provoke a further fall, but the level of 0.5092, if broken, will finally drive the coin into the zone of emptiness, which may lead the price to fall to 0.45- 0.42.

Regards R. Linda!

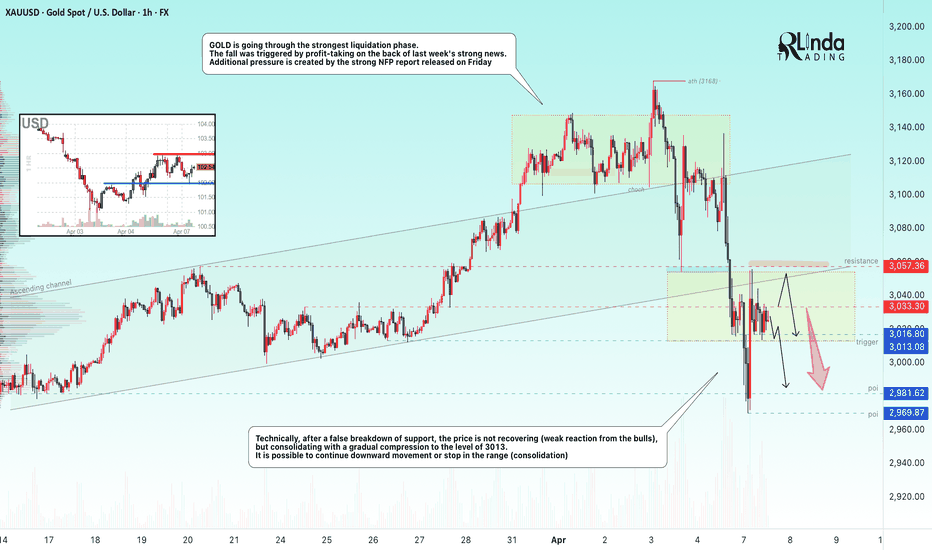

GOLD → Consolidation or continuation of the fall. 3013 triggerFX:XAUUSD is going through the strongest liquidation phase. The fall is triggered by profit-taking amid last week's strong news. Additional pressure is created by the strong NFP report released on Friday. The economic risk situation is bifurcating....

Gold prices rebounded after falling in the Asian session, consolidating the drop triggered by the intensifying trade war between the US and China. Donald Trump's comments about rejecting deals with China have heightened recession fears, raising the likelihood of a Fed rate cut.

Against this backdrop, there was increased interest in gold as a protective asset, despite the rise in the dollar and bond yields. However, further strengthening of gold is questionable due to profit taking and lack of new economic data from the US.

Technically, the price is consolidating under pressure against the support at 3017-3013. A descending triangle is forming on the local timeframe.

Resistance levels: 3033, 3057

Support levels: 3017, 3013, 2981

Based on the current situation and strong pressure on the market, we can expect two situations to develop:

1) breakdown of support 3017 - 3013, if the structure of the descending triangle on the local timeframe will be preserved. The target will be the support of 3000, 2981.

2) Or, the price will close inside the range with the target of consolidation between 3057 - 3033 - 3013 (consolidation of forces after a strong fall and liquidation)

Regards RLinda!