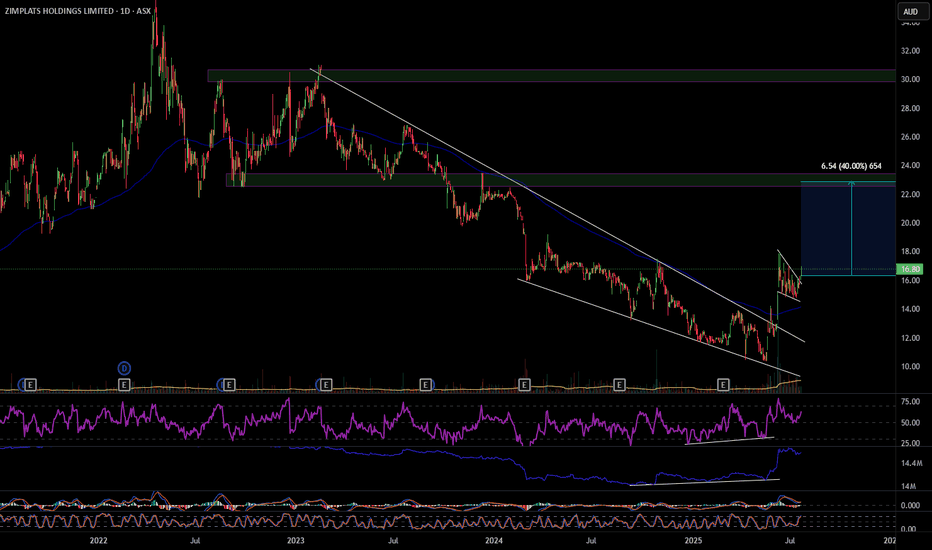

ZIM 40% move up

ZIM has broken out of a descending wedge with bullish RSI and OBV divergence, also multiple divergences on smaller time frames. On the hourly it's had a pull back and formed a bull flag that it has also broken out of. ZIM looks to have formed a change of structure forming higher highs and higher lows, my first target will be $22.90 a move of 40%. Definitely one to consider. Good luck and happy trading 🍀

ZIM

Quantum's ZIM Trading Guide 4/8/25

NYSE:ZIM

(ZIM Integrated Shipping Services Ltd.) - Sector: Industrials (Shipping)

Sentiment:

--Bearish (slight softening). Pre-market put volume softened, RSI likely ~35 (down from ~38 with a -2.8% drop from $12.9608 to $12.591), X posts overnight mixed—tariff fears dominate, but LNG fleet news (10 new 11,500 TEU vessels announced April 8) offers faint hope, suggesting a less aggressive sell-off than March’s lows.

Tariff Impact:

--Severe. 10% universal tariffs raise fuel and container costs, with 46% Vietnam tariffs threatening Asia-U.S. routes (70%+ revenue). Sentiment overshadows fundamentals, though LNG fleet modernization and freight rate resilience provide a slight buffer.

News/Catalysts:

--Consumer Credit (April 8) could signal trade demand—weak data may deepen ZIM’s slide; X posts on the $2.3B LNG charter deal (announced April 8) and potential freight rate stabilization (e.g., Red Sea tensions) might spark a relief rally today.

Technical Setup:

--Weekly Chart:

---HVN near $15 as resistance (March 25 high: $15.2512), weekly low ~$12.4106 as support

---Downtrend (8-week EMA < 13-week < 48-week, reflecting $12–$20 range since March).

---RSI ~35 (weakening, near oversold),

---MACD below signal (histogram narrowing),

---Bollinger Bands at lower band,

---Donchian Channels below midline,

---Williams %R -80 (oversold).

-One-Hour Chart:

---Support at $12.81 (April 7 prev. close proxy), resistance at $13.547 (April 7 high), weekly confluence.

---RSI ~37, MACD below signal (histogram less negative),

---Bollinger Bands at lower band,

--- Donchian Channels below midline,

---Williams %R -78 (easing from oversold).

-10-Minute Chart:

---Pre-market drop to $12.591, 8/13/48 EMAs down, RSI ~35, MACD flat near zero.

Options Data:

--GEX: Bearish (softening)—pinning near $12.9608 eases pre-market, dealers less aggressive.

--DEX: Bearish—put delta leads but with reduced intensity.

--IV: High—~55–60% vs. norm 45–50%, reflecting tariff-driven volatility.

--OI: Put-heavy—OI concentrated below $13, capping upside momentum.

Directional Bias: Bearish (softening). GEX’s fading pinning reduces downside lock, DEX’s put delta sustains selling but softens, high IV supports volatility without sharp drops, and put-heavy OI anchors lower—bearish with less conviction.

Sympathy Plays:

--SBLK (Star Bulk Carriers): Falls if ZIM dumps (shipping correlation), rises if ZIM rebounds.

--MATX (Matson, Inc.): Drops with ZIM downside, gains if ZIM recovers.

--Opposite Mover: ZIM dumps → defensives like KO rally; ZIM rallies → SBLK/MATX surge.

Sector Positioning with RRG:

--Sector: Industrials (Shipping)

---RRG Position: Lagging Quadrant (slight improvement). ZIM’s pre-market softening from $12.9608 eases its lag vs. XLI, buoyed by LNG news.

Targets: Bullish +4% ($13.50, hourly resistance); Bearish -5% ($12.00, near April low).

is this Max Fear for Zim? zones to watch but i Bought in $14.78ZIM’s current daily chart indicates that the stock is testing critical support around the $14.80 level after a recent bearish price action, down approximately 4.33% at the last close. The JP Momentum Stochastic DeMark indicator (bottom pane) clearly illustrates deeply oversold conditions, with multiple blue triangles signalling potential short-term trend exhaustion and a probable bounce or consolidation from current levels.

However, the current ADX reading at 21.1 remains weak, - and this is what worries me - suggesting limited momentum and no strong directional trend strength yet.

Combining this with broader research, ZIM faces macroeconomic headwinds such as anticipated oversupply in container shipping capacity, tariff-driven uncertainty, and lower projected earnings for 2025. These fundamental factors provide context to recent bearish technical action and caution traders against expecting aggressive or prolonged upward moves without positive macro or industry catalysts.

My Short, Near, and Long-Term Outlook - this is why you're here.

Short-term (1-2 weeks): Technically oversold conditions strongly favour a bounce or consolidation in the immediate term. A rebound target around $16.00–$16.50 (recent breakdown area and initial resistance) is plausible.

Confidence: 7/10 (moderate-high, due to clear oversold signals on stochastic indicators).

Near-term (1-3 months): Expect sideways volatility within a range between current support at $14.50–$15.00 and resistance at $17.50–$18.50. Persistent bearish bias (DMI Bearish, 20.1% trend strength) limits upside potential without supportive fundamental shifts.

Confidence: 6/10 (moderate; macro headwinds temper confidence).

Long-term (6-12 months): Potential gradual recovery towards $19–$22, contingent upon improving global macroeconomic conditions, stabilisation in shipping demand/supply dynamics, and resolution or easing of trade tensions.

Confidence: 5/10 (moderate-low, due to macroeconomic uncertainties and tariff risk exposure).

ZIM dips into Oversold 3H - Pivot for a Ride up or more Down?Key Technical Levels and Indicators

Current Price Range: Mid– SWB:16S

Immediate Support: $14.80–$15.20

Deeper Support: $12–$13

Near‐Term Resistance: $18–$19 (coinciding with short‐term moving averages)

Higher Resistance: $20–$22 (major zone from recent swings)

On the daily timeframe, ZIM has:

1. Broken below its short‐term moving averages.

2. Momentum turning mildly bearish on oscillators (including StochDeMarker).

3. A downward price swing from the FWB:20S into the mid‐teens, suggesting near‐term pressure.

Bearish Breakdown

• Scenario: ZIM fails to hold support around $15 and decisively closes below $14.80. This opens a path to retest $12–$13 or potentially lower if market sentiment worsens.

• Catalysts: Continued weakness in shipping rates, soft earnings or guidance, general market downturn.

• Probability: ~45%

• Time Horizon: 2–8 weeks (if the downward momentum continues)

or...

Range/Consolidation

• Scenario: ZIM finds some buying interest around $15, stabilizes, and oscillates between $15 and $18. The market awaits clearer signals from macro data or shipping fundamentals.

• Catalysts: Mixed or neutral container freight data, no major negative surprises on earnings, overall sideways movement in equities.

• Probability: ~35%

• Time Horizon: Could persist for a few weeks to a couple of months if no strong catalyst appears

Bullish Reversal/Bounce

• Scenario: ZIM stages a sharp rebound off the $15 region and pushes through $18–$19. A reclaim of $20 or more signals a short‐term uptrend.

• Catalysts: Positive shipping rate surprises, strong earnings beat, bullish macro sentiment (e.g., dovish Fed hints or positive global trade data).

• Probability: ~20%

• Time Horizon: Could happen swiftly (days to a few weeks) if a strong catalyst appears, but less likely given current downside momentum

ZIM - What is the next move? Is it in Dip?Hello Everyone,

Looks like ZIM has in down trend for a while and now again it reach to support level again yesterday. This is the 3rd touch of this level.

Now there is a 2 option for it: follow to A or B.

If support works then first target is 19,90 - 20.00 $

If not then main target level is 8.00- 8,25 $ for me.

I am keeping positive. Lets monitor for today and next week.

Have a lovely weekend to all.

Tolga

$ZIM has 50-100% Upside from $20- This is a shipping company in Israel whose fundamentals are getting stronger.

- It has 3500+ employees as per linkedin.

- It's trading at P/E of 1.82

- Stock based compensation isn't the issue has outstanding shares have remained stable for last 4 years.

- Trump in office will lead to stability in the middle east and high probability of negotiation and ceasefire.

- There are lot of tailwinds to push this company's stock higher.

- Discounted cash flow analysis estimates a fair value of $66.11, indicating the stock may be undervalued.

- Using Peter Lynch's valuation method, calculates a fair value of $298.57, implying significant undervaluation.

ZIM Stock Soars 16% on Strong Q2 Results and Raised GuidanceZim Integrated Shipping Services Ltd. (NYSE: NYSE:ZIM ) made headlines with a significant surge in its stock price, jumping over 16% in premarket trading following an impressive fiscal second-quarter performance. The Israel-based shipping giant not only surpassed Wall Street expectations but also raised its full-year guidance, signaling continued confidence in its strategic direction despite broader economic concerns.

Strong Q2 Performance Fuels Investor Confidence

In its Q2 earnings report, ZIM posted a net income of $373 million on revenue of $1.93 billion. This translates to earnings per share (EPS) of $3.08, which significantly outperformed analysts’ estimates of $1.92 per share on $1.78 billion in revenue. The strong results were primarily driven by an 11% year-over-year growth in volume, a positive indicator for the company amidst global economic challenges.

ZIM’s quarterly net income of $373 million is particularly noteworthy, considering the company reported a net loss of $213 million in the same quarter last year. This dramatic turnaround highlights the effectiveness of ZIM's strategic initiatives, including cost structure improvements and capacity expansion.

Raised Full-Year Guidance: A Vote of Confidence

One of the key drivers behind ZIM’s stock rally is the company’s decision to raise its full-year guidance. NYSE:ZIM now expects its adjusted EBITDA for 2024 to range between $2.6 billion and $3.0 billion, up from its previous forecast. This upward revision reflects management’s confidence in the company’s market position and strategic execution.

CEO Eli Glickman attributed the success to “outstanding strategic execution,” emphasizing the importance of improving cost structures and expanding capacity. Glickman also highlighted positive demand trends and ongoing supply pressures stemming from geopolitical issues, such as the Red Sea crisis, which are expected to bolster the company’s performance in the second half of the year.

Adding to investor optimism, NYSE:ZIM announced a dividend of 93 cents per share, representing a 48% year-over-year increase in revenue. This move underscores the company’s commitment to returning capital to shareholders.

Technical Analysis: Momentum and Caution

ZIM's stock has gained significant momentum, with the recent earnings report serving as a catalyst for a sharp price increase. Prior to the earnings release, ZIM’s stock had dropped 8% from its year-to-date high, but strong Q2 results have rekindled investor interest. Currently, ZIM stock is up 19% and has a bullish Relative Strength Index (RSI) of 69.68, nearing overbought territory.

The daily price chart shows a gap-up pattern that may be filled in upcoming trading sessions.

The stock's 50-day moving average price is currently at $1.30, while the 200-day moving average stands at $1.49. The stock’s recent surge has pushed it above both moving averages, a bullish signal that indicates potential for further upside.

However, it’s important to note that ZIM's stock remains volatile, with significant swings in response to market news. While the stock’s RSI (Relative Strength Index) is not yet in overbought territory, investors should remain cautious as the stock approaches key resistance levels. The current beta of 1.78 also suggests that the stock is more volatile than the broader market, making it susceptible to larger-than-average price movements.

Is It Too Late to Invest in ZIM?

Despite the recent rally, the investment community remains divided on ZIM’s long-term prospects. Before the earnings release, Wall Street had a consensus “hold” rating on the stock, with an average price target just above $18, indicating a potential downside of nearly 17% from current levels. However, with the stock now trading at $23.77, some analysts see room for further gains, particularly if the company continues to execute its strategic initiatives effectively.

ZIM's raised guidance and strong Q2 performance have certainly reinvigorated investor confidence. However, with economic uncertainties still looming, potential investors should carefully weigh the risks before jumping in.

Conclusion: A Promising but Volatile Investment

ZIM Integrated Shipping Services Ltd. has delivered a strong second quarter, highlighted by impressive earnings, raised guidance, and strategic execution. While the stock’s recent surge is promising, it also reflects the inherent volatility and risks associated with the shipping industry and the broader market. Investors should consider both the technical indicators and fundamental strengths before making any investment decisions.

ZIM Integrated Shipping Services Options Ahead of EarningsIf you haven`t sold ZIM before the previous earnings:

Then analyzing the options chain and the chart patterns of ZIM Integrated Shipping Service prior to the earnings report this week,

I would consider purchasing the 17.5usd strike price in the money Calls with

an expiration date of 2024-10-18,

for a premium of approximately $3.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ZIM Integrated Shipping Services Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ZIM Integrated Shipping Services prior to the earnings report this week,

I would consider purchasing the 12usd strike price Puts with

an expiration date of 2024-3-15,

for a premium of approximately $1.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

What is fueling ZIM Stock's Run?Zim Integrated Shipping Services (NYSE: ZIM) is gaining momentum with ZIM stock rising 43% since mid-December. However, it is still down 90% on the year.

However, this low float stock has caught the attention of investors due to a number of factors including its short squeeze potential and its position to benefit from ongoing Houthi attacks on commercial ships passing through the Red Sea.

With management announcing plans to address the company's underlying issues, ZIM stock could be poised for a huge recovery in 2024 if the container shipping industry continues to benefit from these geopolitical tensions.

ZIM Stock Background

Zim Integrated Shipping Services, together with its subsidiaries, is an Israeli company that provides container shipping and related services in Israel and internationally. It provides door-to-door and port-to-port transportation services for various types of customers, including end-users, consolidators, and freight forwarders. The company also offers ZIMonitor, a premium reefer cargo tracking service.

Zim achieved a great deal of success during the pandemic thanks to global lockdowns which drove consumers to online shopping. Americans alone spent $1.7 trillion online from 2020 to 2022. That’s a massive $609 billion more than the two years before Covid-19, representing a 55% increase in online spending.

This online shopping spree drove demand for shipping, increasing the cost of transporting containers globally. Thanks to increased shipping demand, ZIM delivered 2.5 years of great financial results from mid-2020 through 2022, including net income of nearly $10 billion.

ZIM also offered high dividends of around $2.00 to $2.50 per share in 2021. Retail investors were obviously drawn to ZIM's high dividends and ZIM stock surged 830% from February 2021 to March 2022.

Post-Pandemic

ZIM stock came crashing down when lockdowns were lifted in most countries and people started making up for lost time during the pandemic. Consumer behavior changed drastically as people started spending more money on services rather than goods. As a result, Americans spent $11.6 trillion on services, compared to $5.9 trillion on goods in 2022.

For Zim, this meant lower freight rates as well as declining volume. If you look at Zim’s 2022 Q3 results and check the company’s revised 2022 full-year guidance, you’d see that the company was projecting a decline in freight rates, softer demand, and flatter volume compared to 2021.

As a result, ZIM stock dropped by more than 70% in 2022, and its net income in Q4 2022 was $417 million, compared to $1.71 billion in Q4 2021.

The company attempted to salvage the situation in April then August of 2022, when it raised its dividend yield to near 20% and 40% respectively. However, Zim was forced to pause its dividends after it recorded a loss of $58 million in Q1 2023. The second quarter of 2023 also saw a loss of $213 million, while the third quarter’s loss equaled a massive $2.27 billion. Now, Zim’s forward dividend is equal to zero.

The Houthi Attacks

A new conflict started between Israel and Hamas in October of this year, and since Zim is an Israeli company operating in the region it has had exposure to the conflict. ZIM stock fell roughly 30% since the attack happened until the end of November.

As the conflict progressed through November and December, the Shia Islamist Houthi group in Yemen started attacking commercial ships passing through the Red Sea. These strikes are meant to cause economic pain on Israel’s allies that pass through the Red Sea for trade, and force them to put pressure on Israel to allow aid into Gaza and end the war.

It was during this time that major shipping companies, including Maersk (CPH: MAERSK-B), Hapag-Lloyd (OTCMKTS: HPGLY), and Evergreen (NASDAQ: EVGR), announced that they would pause shipping through the Red Sea amid fears of Houthi attacks. Additionally, the oil company BP (NYSE: BP) said that it would do the same, a move that caused oil and gas prices to surge.

Following these companies, Zim has also announced that it will be taking measures to ensure the safety of its crews, vessels, and customers' cargo by rerouting some of its vessels. As a result, ZIM stock, as well as the stocks of many other shipping companies, surged on the news.

Hapag-Lloyd stock advanced 16% in Frankfurt trading, while Maersk rose 7.9% in Copenhagen. On the other hand, ZIM stock increased more than 35% in early December.

Investors' sentiment reversed since shipping companies are being forced to take the much longer route around Africa instead of through the Suez Canal. Taking this much longer route will no doubt increase costs significantly, however, these increased costs can be passed on to consumers as shipping companies raise prices. Raising costs due to the security risks and longer route could result in higher profits for shipping companies which is why public shipping companies like ZIM are seeing some momentum.

A Potential Short Squeeze?

Besides this catalyst, ZIM stock has increased as much as 75% in December, marking its strongest monthly performance in more than 2 years.

Yet, ZIM's short interest has reached 24% which is near the highest level in at least 3 years. This level of short interest and momentum from retail traders which own 59% of the roughly 95 million float could force shorts to cover their short positions.

Notably, short sellers have made over $100 million so far this year in ZIM stock, but they have lost $63 million in December. This combination of factors could make ZIM stock ripe for a short squeeze.

Technical Analysis

Looking at the hourly timeframe for ZIM stock, we can see that it's been trading in a downwards channel for some time. The stock increased on higher than average trading volume and tested the resistance at $12.01 before pulling back.

When looking at the indicators, ZIM stock is trading above the 200 MA but recently dropped below the the 50 MA. The 50 and 200 MAs recently crossed over forming a golden cross which could signal a bullish shift in trend. After becoming overbought, the RSI recalibrated on the pullback and is neutral at 47.26.

With ZIM stock trading just below the 50 MA, it could either successfully break out above it or drop lower after failing to break through. Traders bullish on ZIM stock should wait for a successful breakout above and retest of the 50 MA before taking a position. Whereas, bears can go short if the break out fails and short ZIM stock based on its bearish fundamentals.

Is ZIM Stock a Good Investment?

While in the short term, ZIM stock could continue to rally, in the long term its outlook is quite different. During the Q3 earnings call, Zim’s management team made it clear that the company is following strategic plans with a strong focus on the long-term to help Zim return to profitability.

One of these plans is returning some of its vessels. Zim is classified as a light-assets company, meaning that it doesn’t own all of its vessels, but just rents them. By the end of 2022, Zim had 150 vessels in its fleet, of which 9 were owned by the company and 141 were rented.

Some of Zim’s leases on these vessels are expiring in 2024 and 2025. As is, the company plans on not renewing them to reduce its capacity and costs thereby strengthening revenues and profitability. While this will be a slow process, with roughly 2 years before the leases expire, it’s still a move in the right direction.

Another thing management did was use the profits earned during the pandemic - around $10 billion of net income - to pay off a lot of debt. Additionally, this period of profitability led to a significant cash balance of over $3 billion in Q3. This means that the company has a healthy balance sheet and isn’t facing the risk of running out of money anytime soon.

Zim’s long-term plans also include a fleet renewal program secured through a series of charter agreements. The company invested in 46 newly built container ships, of which 28 are powered by liquified natural gas, which is natural gas that has been cooled into a liquid form and faces no risk of exploding if there is any sort of leak or spill. It is also considered a cleaner source of energy than oil and coal. This allows Zim to have a younger, more fuel and cost efficient fleet by 2025, ultimately reducing its costs and increasing its competitiveness.

In order to achieve this, Zim entered a strategic supply agreement with Shell in order to secure liquified natural gas at competitive prices. The company also bought almost $1 billion worth of containers with a particular focus on reefer propositions. According to CEO Eli Glickman, the company now owns the youngest reefer fleet in the industry, which will allow it to compete for high-value cargo.

Zim’s management has also tried to reassure investors by sharing that Israel accounts for only 10% of the company’s volume. Even though Zim isn’t stopping its operations in Israel or near it, investors will be relieved to know that 90% of the company’s business isn’t in an area of war.

ZIM Stock Forecast

When looking at Zim’s 2023 full-year guidance, we can see that the company projects an adjusted EBIT loss of $400 million to $600 million, expects a continued weakness in freight rates with no recovery from current levels, a slight decline in the company’s YoY, and higher than previously projected bunker costs.

While it’s unlikely that Zim’s new plans will help it achieve profitability anytime soon, but they could help reduce costs and return the company to efficiency and a better cash flow.

Speaking of cash flow, it’s important to note that despite losing money Zim is still achieving positive cash flow from operations, totaling $338 million in Q3. This is a good sign for the company, since its losses can be reduced after it reduces its long-term assets like the vessels, and therefore reduce non-cash expenses like depreciation.

In the income statement, you have to record non-cash expenses such as depreciation for long-term assets, but it’s not necessarily a cash outflow. So, even though Zim is losing money, it’s still generating cash inflow which is a good thing.

Overall, the company’s management team is competent and its plans to return to profitability are solid, but the company faces geopolitical risks and the impact of changing consumer behavior. The latter is still a persisting problem, one which Zim’s management admitted they had expected it to reverse sooner.

In light of these factors, ZIM stock appears to be a high risk investment, at least in the short-term. But if its management's plans come to fruition, it could see a strong recovery once consumer behavior returns to its normal balance.

ZIM Integrated Shipping Services Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ZIM Integrated Shipping Services prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2023-9-15,

for a premium of approximately $0.78.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ZIM Long IdeaZIM and the shipping industry has just come out of a massive bubble and all shipping lines are finding their feet. ZIM made earnings last quarter which was one of the roughest yet.. the recent GRI of around $600/FEU Trans-Pac should put carriers back into the green and they will try their best to hold rates around this level via blank sailings and volume control. This is a dangerous game but ZIM fundamentals (ship / space leasing) have proven extremely successful as volume dried up and carriers bringing in massive container ships are baring the brunt of the blow.

TA looks like a bull div on LTF (4hr) and sitting at the lows for a double bottom. If buying low selling high is a thing.... any lower than this and ZIM sinks so clear S/R level.

Long term looking for 238 fib level but this feels like a good entry depending on macro

ZIM a contrarian playZIM has run through a perfect tailwind momentum, increasing its revenues from roughly 3B to around 10B due to the supply chain disruption and energy situation in Europe / Asia.

Assuming its revenues will drop back to 4B, the company might still be profitable and the valuations could look attractive.

If the company manages a better than expected EPS and better outlook (than estimated), then this stock could be a double bagger.

Risk is limited to a potential 5:1 Reward, which makes it a very interesting proposition.

#notfinacialadvise. Size your position accordingly.

Will ZIM Ship Up?Will ZIM Ship Up?

ZIM has a falling wedge pattern on the daily timeframe!

A cup was also identified inside of the falling wedge pattern. The stock looks prime for a move to the upside after we form a handle to the cup that formed just under the daily resistance line. I expect a handle to form in confluence with price rejection at the trendline.

The daily chart as of 4 February 2023 shows that we have too many buyers at the line of resistance. Therefore, I expect a selloff (creation of the handle) and in turn less buyers (which is what we want) before the break of the line of resistance. After the line breaks, we will see more buyers step in to then push us up above the handle and line of resistance (daily trendline).

However, it's understood that price could push through the line of resistance and hold above it. If it price holds above the line, then the stock will be inside of a gap that has not filled.

ZIM has a gap between 23-25.42. The stock gapped down on 28 November 2022.

ZIM closed at 22.85 on 3 February 2023.

*This is not financial advice.

Akili,

MrALtrades00

ZIM: NEUTRAL with one Eye on China.During the last part of the year already passed, we saw a downward trend of this stock.

Many factors can associate with this downward trend, such as the decrease in demand for the transport of goods between Europe, USA, and China, and the news of the coming recession had led to the bear trend of this stock and its fall. Now the interest on this stock seems to be reducing and the movement of the price is no longer the same as before. We can see from the body of the candles, that is starting to be small, and the drop in the price is no longer intense as before.

Now the price is pressed in the area between the levels 18.68 and 16.64, which is in the phase of accumulation that can lead to a new trend, which is not possible to determine.

From my side the last level that the price can hit before the uptrend is 11.94, however, good attention to the news from the government of Beijing can be determined the future of transportation in the coming months and not only that.

Ranks promised - Ranks did 💪🏼ZIM Integrated Shipping Services Ltd - provides comprehensive logistics services, the main business is container shipping

TOTAL RANKS SCORE - 74 %

🟢 Fundamentally, at the moment, the stock looks more interesting than 74% of similar companies. Let's figure out what's what. ⁉️

RANKS FINANCE SCORE - 97 %

📍Return on invested capital is 74%, Net Profit margin is 36%

📍Equity is greater than total debt, and EBITDA for the year can cover the entire net debt with might and main

📍Free cash flow return is about 200% (the company is definitely doing well financially) 💰

RANKS VALUATION SCORE - 100 %

📍 All cost multipliers are much lower than the industry average

📍 Revenue and profit are in tremendous growth, but capitalization is small

📍 However ❗ the forecast P/E screams - SELL TILL YOU CAN ❗️ 👀

WHAT'S THE CATCH?

🔴 The consensus forecast for the company's earnings is depressing 📉

RANKS FORECAST SCORE - 11 %

📍 After a rapid COVID growth in freight costs in 2020 and 2021, the market is cooling down

📍 The peak rates of container transportation ended in 2021, the entire 2022 rate is falling

📍 Most likely, the rate will come to the level of "normal" 2019, and it will not end soon

RANKS RECOMENDATIONS

🟡 If you are already a stockholder, we recommend you to keep the stock. If you are only considering buying, we recommend abstaining if you do not want to wait more than a year.

📍 The company (#ZIM) is one of the largest players in the market and has a good financial safety cushion on its balance sheet.

📍 The current dynamics of stock quotes and the macroeconomic situation contribute to the continuation of the price drop.

📍 Nevertheless, in our opinion, the company's shares can become a good asset for the future, but not in the next 12 months.

$ZIM last chance to shine$ZIM is in for a long 3 quarters with global freight rates in the gutter but after a 75% move down and a really nice reaction to the last major level ($18-19) the major HTF bull div has a shot at playing out. Specifically with wall-street running away as the massive dividend is likely to be cut in Q1 (who cares)

The main thing to consider is if this is a hold or a swing trade and with the current macro environment I think it needs to be a swing trade OR long long term hold. For the long term hold you need to examine freight rates and what ZIM was doing in 2019 (exclude bubble data from 2020-2022) DYOR and see what you think. Worth a look IMO.

The main thing is the S/R level could not be more clear... above $18 upside potential is pretty good and below $18 downside is price discovery...

ZIM - a stock to hold foreverZIM is a logistics company, one of the top global carriers.

Given the fundamentals and insane dividends I would hold this stock forever, or at least till when it reaches 5x of today's value.

If nothing changes, I am doing exactly this.

Market cap - 7.9B

Revenue - 10.73B

Income - 4.64B

Assets - 9.84B

Operating cash flow - 5.81B

ZIM bounceNYSE:ZIM

I see ZIM stock fallowing Baltic Dry Index with a lag. As we observe a bounce in BDI we can expect the same in ZIM stock price.

From a technical point of view the same thing.

We are now in wave 5 of an impulse wave down. which could also be done.

So from wave analysis point of view we can expect a correction up, most likely to the minor wave 4 extreme. in the region of $34.

And financially the company is rock solid.

Disclaimer: This is my analysis and does not constitute financial advice.

8/31/22 ZIMZIM Integrated Shipping Services Ltd. ( NYSE:ZIM )

Sector: Transportation (Marine Shipping)

Market Capitalization: 4.408B

Current Price: $36.09

Breakdown Price: $33.90

Sell Zone (Top/Bottom Range): $40.75-$51.80

Price Target: $19.50-$15.80

Estimated Duration to Target: 86-91d

Contract of Interest: $ZIM 12/16/22 30p

Trade price as of publish date: $2.50/contract

ZIM Short TradeBA is breaking down and setting up for a powerful move lower. Biden has essentially declared war on shipping companies for hiking prices post-COVID and has threatened to lower prices by executive order. This was all the bulls needed to head for the exits and take their profits after a strong run in 2022.

Relative strength has broken down over the last 2 weeks as the stock fell more aggressively than the overall market. ZIM now trades near the crucial $48 level which served as resistance before the last breakout and support on several re-tests of this area. It is also sitting on the 200-day moving average which is the line in the sand for long-term holders. If ZIM breaks this area, which I believe it will, expect to see the stock fall fast and hard.

Several days of aggressive selling over the last two weeks point to heavy institutional selling and the beginning of Stage 3 (see Wyckoff Market Cycles). Don't be surprised if ZIM falls another 50% or more from today's level. Look for a move below $47.50 on above-average volume. That will be trigger to go short ZIM.

ZIM short tradeZIM is breaking down and likely heading much lower. The stock has been a market leader in 2022 along with other shipping stocks. Profits are up triple digits after shippers realized they could 10X their rates to transport cargo containers after the pandemic.

The White House has essentially declared war on these companies and institutional investors are heading for the exits.

After a strong Stage 2 (markup phase), ZIM is in Stage 3 (distribution phase) and quickly head for Stage 4 (markdown/capitulation).

Relative strength is breaking down and the RS line is trending aggressively lower.

The 50-day moving average is rolling over and the 200-day line has now been broken (big no-no).

You can also see institutional selling in the volume footprint. Traders may consider selling ZIM short here with a stop above the pivot high near $53.