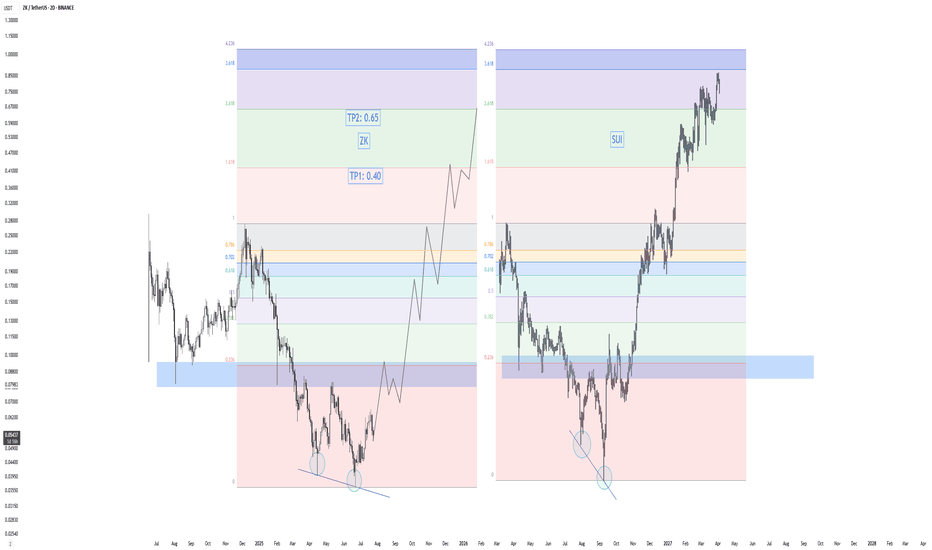

ZK - Golden opportunity? 0.40? Hello everyone, here’s my new analysis on ZK.

Recently, the price surged nearly 80%, followed by an 18% pullback over the last two days. From its all-time high, ZK is currently down about 80%, which in my opinion presents a golden opportunity.

Based on my research, the peaks of altseasons often occur between December–January or April–May. After analyzing the Others Market Cap dominance chart, I believe we’re setting up for a strong altseason in the next 5 months. Over the last few years, BTC has significantly outperformed altcoins—but recently, I’ve noticed a major shift in market dynamics, indicating that capital might be rotating back into alts.

On the chart, ZK is showing a classic crypto crash-recovery pattern. For example, SUI dropped around 80–85% before rallying over 1000% in just 4 months. I see a strong structural similarity between the bottoming pattern of SUI and the current structure of ZK.

If ZK breaks the resistance zone at 0.080–0.095, I expect a rapid move up toward 0.22–0.26. After that, a healthy correction around the previous ATH would be expected—before potentially heading to 0.40 as Take Profit 1 (TP1).

Zksync

Need to be careful.A new downward wave may occur. Need to pay attention.

The market is very enthusiastic about Ethereum, we need to be cautious in these exciting moments.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

ZK Secondary trend.-82% Wedge. Reversal zones. 01 05 2025Logarithm. Time frame 3 days. Decrease from listing about -82%. For cryptocurrencies of such liquidity and capitalization, this is not the maximum decrease (-90-96%). But sometimes from such values as now (-82-85%), taking into account the news hype during the listing "whales $ 458 million", a reversal and strong pumping can occur under the market as a whole. For example, like another hype project of "hanging noodles" - Flare (distributed to XRP holders). Decrease by -82% and then pumping slightly above the listing price under the next alt season of the cycle + 560%.

This does not necessarily mean that this will happen, this is an example of what happens from such values of decline with such liquidity and hype. In some ways, not only in the structure of the TA formation, but in the hype and disappointment of "investors", the projects are identical.

Main trend , and the previously shown zone, in which the price is now.

ZkSync Main trend. L2 for ETH. $458 million funds 21 02 2025

Main trend now in the moment (full trading history).

There is no need to guess the minimums and maximums. It is important to know these zones and have an acceptable average price, from the position of the trend and its potential. It is regulated by the distributed entry volume (in advance) at potential reversal zones.

Is ZkSync ZK The Next OM and LUNA?Hello, Skyrexians!

Recently coins started to scam, like we have seen 90% for OM, 2 days ago there were bad news from $BINANCE:ZKUSDT. Why these news are good and this is not the same story we will try to cover today.

Since ZK has been listed it moves technically despite the low capitalization. On the daily time frame we can see the global Elliott waves picture - the irregular correction ABC. Now price is printing wave C which consists of 5 waves. Awesome oscillator gives us an idea where waves 3 and 4 have been finished and now we are in wave 5. We suppose this correction is over because we have the confirmed bullish reversal bar and we had the negative news next to the bottom. We suppose that crowd has been sold their coins into others and now rocket can be really empty.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

#ZK/USDT#ZK

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.0676

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.0729

First target 0.0792

Second target 0.0838

Third target 0.0896

zkSync Fresh L2 coin for ETH. 458 million $ investment by fundsLogarithm. Time frame 1 day. Since the coin is fresh (people sell freebies), and it was recently listed, if the market will be dominated by a downtrend until October, a downtrend channel will be formed in case of a break of the key support.

_____________________________________

Most importantly:

1️⃣ There was aerdrop manipulation , the community got a very small % of the promised coins, which is in the hands of developers and crypto funds (after shaking out now, there will be full control over the price).

2️⃣ It is worth noting that crypto funds “invested” (with speculative interest) 458 million dollars in the asset. Which is an absolute record.

The first and second are extremely positive for the maximum prices of the asset in the cycle in the future. Consequently, the asset is interesting for investment and position trading, and it does not matter what will happen now locally for a couple of months. Work from the average buy/sell price.

____________________________________

The chart shows the key resistance levels for the first significant pumping after the trend break, as well as the maximum distribution zone targets of this cycle.

The price potential will be “unlocked” similarly naturally not now, but when the solution will be implemented, there will be media PR, smart money will partially “exit” from the asset. The potential is naturally great, it is shown, who is attentive.

Let me remind you, L2 is a solution for scaling the ETH network. When this is implemented and PR'd and ETH is in its first distribution zone, then pump in similar small capitalization assets.

__________________________________

Work from the average price of purchases , so in the future sales and no minimums and maximums (even if you are sure that you know and understand how “exactly” it will be, I note that most people who do everything by reverse think so), as this is the fate of true hamsters. At the same time, you need to understand the zones where it is cheap and where it is expensive, and what the general trend in the market is developing.

⏰ Profit from the local game (not necessarily to work this way) is not big (you “spin the volume” part of the allocated money to a certain zone of the asset - work). But, such local work gives you to overcome fear, because you always have money to increase coins.

⚠️ Do not abuse stop loss , where it is not necessary, because everything will be taken away on the “flat place”.

⚠️ Prefer spot trading , which forgives elementary mistakes, if you are not a very good trader. With margin and futures, your risk must be justified. If you are a ludomaniac (most sick people won't admit it, maybe you are one/one of them) then leave this high risk trading.

🐹 Psychology . If, you feel that you, like everyone else, will do, when not necessary under psychological pressure and news some not logical bullshit, it is better not to trade at all, and invest. “Hold” coins for a couple months, dividing the amount of the entry into 2-3 parts. When the market is distributed, you will sell with a big profit. Maximum targets (not necessarily, as depends on a lot of factors), is the zone 0,6 - 1 dollar.

ZK Updaterode this one back to the entry (even after the trendline from 5th Aug was broken)

in-detailed explanation in the USDT.D chart (give it a read if you want to find out how to spot strong reversal areas)

I've explained in detail what I'm expecting in this year. Please refer to the previous posts for in-depth analysis and thoughts. Too tired to write anything now :)

TLDR for the lazy ones: Late Feb-April, I'm expecting a massive rally. 100% loaded here personally!

Public trade #7 - #ZK price analysis ( zkSync )#ZK price is moving quite interestingly

It seems that the levels and channel we suggested on the chart can be used in trading the OKX:ZKUSDT pair.

Therefore, if the price of #zkSync is kept above $0.16 in the near future, this asset can be bought into the investment portfolio.

1️⃣ The minimum growth target is x2 to $0.35

2️⃣ Longer-term and more ambitious targets are $0.70 and $0.87

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Is ZkSync ZK ready to fly?Hello, Skyrexians!

Let's continue analyze layer 2. Today we have BINANCE:ZKUSDT on our plate. This is the new coin which has been listed in summer 2024. This asset is very interesting because it's fresh and there are not that much people to create the selling pressure. At the same time it has no clear long term targets and can easily dump because absence of history can increase the risk of investment in such crypto. Anyway today we prepared for you the potential high probability short term scenario which show us the potential take off for ZK!

Let's take a look at the daily time frame. Like many other crypto after listing's pump it dropped to the listing price. We can count the first pump as the larger wave 1. The crash to $0.08 can be interpreted as the corrective wave 2 in the shape of ABC. Notice, that at the end of wave B Bullish/Bearish Reversal Bar Indicator has printed the red dot, the strong bearish signal. After that we saw crash in wave C which has been ended with the green dot, the bullish sign.

From this point in our opinion large wave 3 started. First of all it has printed the wave 1 which is followed by the wave 2 in shape of flat correction. The strong uptrend continuation signal was the green dot inside the 0.618 Fibonacci retracement level. If our analysis is right price now is in wave 3 which is going to reach the zone between $0.21 and $0.27. Let's also pay attention that couple of days ago was a dangerous situation. Indicator printed red dot, but it has been already invalidated which even enhanced the potential bullish formation.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

zkSync $ZK researchZKsync is an Ethereum network scaling solution that utilizes Zero-Knowledge (ZK) Rollup technology. This makes it part of the second layer (Layer 2) of solutions aimed at reducing transaction fees and increasing bandwidth on the Ethereum network.ZK Rollups allow transactions to be conducted off-chain, which significantly reduces the load on the Ethereum network and thus gas fees. Only evidence of the correctness of these transactions is published on the main chain, which provides a high degree of security and scalability. Thanks to ZK Rollups, zkSync can process thousands of transactions per second, which significantly exceeds the capacity of the main Ethereum network.

TVL

zkSync's TVL was reported to be around $86.79 million, showing a minor decline of 2.15%. This figure indicates a relatively stable ecosystem despite fluctuations, suggesting ongoing user engagement and trust in the platform. Despite a decrease in TVL, zkSync still holds a position as a leading Layer 2 solution, although it lags behind competitors like Arbitrum or Optimism in terms of TVL. This could be due to various factors including less aggressive marketing or airdrop strategies compared to others.

Fundraising

Over the years, ZKsync has attracted significant investment through various fundraising rounds, reflecting investor confidence in its potential to solve Ethereum's scalability challenges.

Funding Rounds:

1. Seed Round - 23 September 2019:

Amount Raised: $2.00M

Lead Investor: Placeholder Ventures

Other Investors: DragonFly Capital, 1kx, Hashed Fund, Dekrypt Capital.

2. Series A - 1 October 2021:

Amount Raised: $6.00M

Lead Investor: Andreessen Horowitz (a16z)

Other Investors: DragonFly Capital, 1kx, Union Square Ventures, Placeholder Ventures.

3. Series B - 8 November 2021:

Amount Raised: $50.00M

Lead Investor: Andreessen Horowitz (a16z)

Other Investors: DragonFly Capital, ConsenSys, 1kx, OKX Ventures, Alchemy, among others.

4. Undisclosed Funding - 27 January 2022:

Amount Raised: $200.00M

Investor: BitDAO

5. Series C - 16 November 2022:

Amount Raised: $200.00M

Lead Investors: Blockchain Capital, DragonFly Capital

Other Investors: Andreessen Horowitz (a16z), Lightspeed Venture Partners, Variant.

The gradual increase in funding and the participation of prominent investors such as Andreessen Horowitz, DragonFly Capital and Blockchain Capital emphasize the market's confidence in ZKsync's technology and its potential to address Ethereum's scalability challenges. Recent rounds have given ZKsync the resources to explore and innovate further, including integrating with broader blockchain functionality or developing new tools for developers and users.

Tokenomics

Maximum offer: ZK 21.00 billion

Token distribution:

Token Assembly - 29.3%

This allocation is for participants and platform creators who make significant contributions to the ecosystem. Their contributions may include development, protocol improvements, or integration of new services.

Ecosystem Initiatives - 19.9%

These tokens are allocated to support initiatives aimed at the growth and development of the ZK ecosystem. This may include project funding, developer grants, network usage incentive programs, and marketing campaigns.

Investors - 17.2%

Investors who have invested in a project receive this share of tokens. This can include investments at various stages, from seed rounds to later investments. These tokens can be locked for a certain period to prevent immediate sale after unlocking.

Team - 16.1%

Project team members receive tokens for their work in creating and developing the project. These tokens are usually also vested to incentivize long-term team participation in the project.

Airdrop (Users) - 15.6%

This portion of tokens is distributed to users, possibly as part of an airdrop or other incentive programs to attract and retain users in the ecosystem. The tokens are allocated and already unlocked, allowing users to use or trade them immediately.

Airdrop (Contributors) - 1.93%

Vesting

Investors and Team:

Initial Unlock (TGE - Token Generation Event): 17.2% of the tokens allocated to investors and 16.1% to the team are set to be unlocked.

Cliff: There is a one-year cliff period. This means that no tokens will be unlocked until one year after the initial unlock date.

Unlocking Schedule:

Date of First Unlock: June 17, 2025

First Unlock Amount: 11% of their allocation becomes available.

Post-Cliff Vesting: After the cliff, tokens vest at a rate of 2.47% per month from July 17, 2025, to June 17, 2028.

End of Vesting: The vesting period concludes on June 17, 2028, with all tokens fully vested by this date.

Airdrop (Users):

Initial Unlock: 100% of the tokens allocated for users' airdrop are unlocked at Token Generation Event (TGE).

Unlock Date: June 17, 2024

Airdrop (Contributors):

Initial Unlock: 100% of the tokens allocated for contributors' airdrop are also unlocked at TGE.

Unlock Date: June 24, 2024

Untracked Tokens:

Represents a large portion (49.2%) of the total supply where the vesting details are not available or disclosed. These tokens could potentially be unlocked at any time, which might affect market dynamics.

Summary:

Total Unlocked: At the time described, 17.5% of the total token supply is unlocked, with 33.3% still locked.

Vesting Strategy: The strategy for investors and the team involves a significant cliff to ensure long-term commitment and align interests with the project's success over time. The immediate vesting for airdrop participants encourages community engagement right from the start.

This vesting schedule aims to balance immediate liquidity with long-term token distribution, ensuring stability and incentivizing sustained involvement from different stakeholders in the zkSync ecosystem.

Conclusion

The project has good funding and everything to pump up the price going forward. There is no point in writing about airdrop, as it was weak and the developers distributed tokens to themselves. This only confirms the further pumping of the asset after accumulation. Now it is not a bad project to buy in the medium term with the target indicated on the chart. TVL shows that not everything is not so bad compared to other L2s, only Scroll is better statistically.... Not the kind of project to invest in for “technology” or idea, but definitely for capital appreciation in a year is not a bad option.

Horban Brothers!

ZKUSDT Bullish Cup and handle PatternZKUSDT technical analysis update

ZKUSDT price has formed a cup and handle pattern on the 4H chart and is currently forming the handle. Once the price breaks the cup and handle neckline, we can expect a strong bullish move.

Buy Level: after breakout confirmation 4H chart, above $0.155

Stop Loss: $0.140

Regards

Hexa

ZK/USDT Breakout Alert: Bullish Setup with 100%+ Gain Potential!Hey everyone!

If you’re finding value in this analysis, don’t forget to hit that 👍 and follow for more updates!

ZK is showing strong momentum right now! It recently broke out of a descending triangle and is currently in a retest phase. This could be a perfect opportunity to buy and accumulate on dips, with the potential for 100-130% gains ahead!

Entry Range: Current price and add more up to $0.132

Target: 100-130%

Stop-Loss: $0.111

What are your thoughts on ZK’s price action? I’m seeing a solid bullish setup here! Share your analysis and insights in the comments below!

ZKSync: Poised for a Major Breakout in the Coming Cycle!ZKSync is rapidly positioning itself as one of the top Layer 2 solutions for Ethereum, offering scalability, lower fees, and faster transactions key ingredients for the next wave of blockchain adoption. As Ethereum’s congestion issues persist, Layer 2 protocols like ZKSync are becoming essential, and with its zero-knowledge rollups and strong utility, it is set to outperform many major coins.

In the coming cycle, I believe ZKSync has the potential for significant growth. With its solid technicals and increasing adoption, ZKSync is well-positioned to experience a breakout. Keep your eyes on this one it could be a top performer in the next market phase.