ZOOM

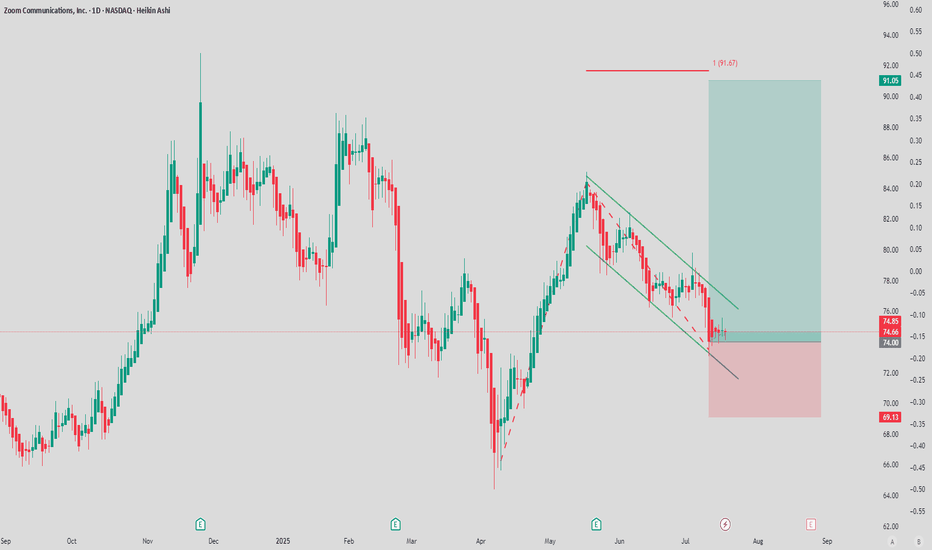

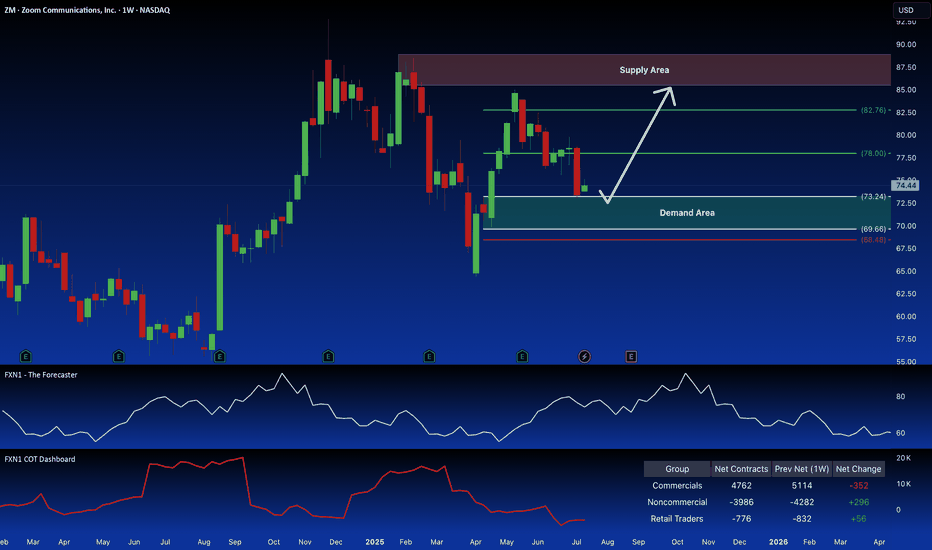

Zoom (ZM): Potential Long Setup at Demand ZoneZoom Video Communications (ZM) recently experienced a rejection at a key demand zone on its weekly chart. Non-commercial traders have increased their long positions, and forecasts suggest a potential upward trend. I'm considering a long trade setup based on a retest of that demand zone. What are your thoughts?

✅ Please share your thoughts about ZOOM in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

ZM Zoom Video Communications Potential BreakoutIf you haven`t bought ZM at the end of the giant falling wedge:

Now Zoom Video Communications (ZM) is currently showing a bullish pennant pattern, which is often a precursor to an upward breakout.

With the stock approaching the $72 level, a breakout could lead to a swift move higher, given the strong technical setup.

For speculative traders, buying the $72 strike price calls expiring this Friday at a $0.12 premium offers an appealing risk-reward ratio.

If ZM breaks above the resistance, these calls could rapidly gain value.

🔀 Bang Bang. Zoom Hit The Ground. Bang Bang. Bears Shot It DownZoom company's video-conferencing service became so ubiquitous during the Covid-19 pandemic that its corporate name became a verb describing the act of firing up a video chat to connect with coworkers online.

Zoom shares VIE:ZOOM rose seven-fold in 2020 as sales surged after millions of workers were stuck at home because of COVID-19 restrictions. By 2021, though, revenue growth slowed, and the stock plunged. The company has shed at least $100 billion in market value since then.

Meanwhile over the past two years, the stock has stagnated because Zoom's video-conferencing service is needed less as businesses continue pushing staff back to the office.

Zoom, one of the main enablers and beneficiaries of remote work, in August 2023 has asked its employees to head back to the office. The company announced that employees living within 50 miles of a Zoom office must work there at least two days a week.

"We believe that a structured hybrid approach – meaning employees that live near an office need to be onsite two days a week to interact with their teams – is most effective for Zoom," a spokesperson said in a statement. "As a company, we are in a better position to use our own technologies, continue to innovate, and support our global customers."

As pandemic Covid-19 is over, many other companies have announced return-to-office mandates, but Zoom's change of heart is surprising given the role its technology plays in remote work. The company's video-conferencing service became so ubiquitous during the pandemic that its corporate name became a verb describing the act of firing up a video chat to connect with coworkers online.

People are back to Travelling. The annual graph for NYSE:RPM , Revenue Passenger Miles for U.S. Air Carrier Domestic and International, Scheduled Passenger Flights.

Meanwhile, there're some important things to say.

Warren Buffett's 99-year-old business partner, Charlie Munger, was surprisingly embraced Zoom during the pandemic. Eric Yuan, the founder and CEO of the video-conferencing platform, celebrated the veteran investor's endorsement of his product on an earnings in 2021.

"I have fallen in love with Zoom," Munger, the vice-chairman of Berkshire Hathaway, said in a CNBC interview filmed at Berkshire's annual shareholder meeting in May, 2021.

"Zoom is here to stay. It just adds so much convenience."

• Munger added that he struck a deal in Australia using the communications tool. He trumpeted its prospects at Daily Journal's annual meeting in February, 2021 as well.

• When the pandemic is over, I don't think we're going back to just the way things were," the newspaper publisher's chairman said.

• We're going to do a lot less travel and a lot more Zooming.

Charlie loves Zoom and uses it frequently for business and to keep in touch with his family, as it's difficult for him to travel.

His business advice was to build a better product or offer a better solution, that it's all about competition, and that successful people are those with the acumen to understand life better than everyone else. He said it's up to you to work harder and better than the next person.

Charlie also said investments are better than money in the bank, and it's important to go to the office to work in person.

The main graph says, Zoom equities just hit the major all history ground support near $59 per share.

Zoom's Surges 2.47% Early Thursday on Q2 Earnings ReportZoom Video Communications, Inc. (NASDAQ: NASDAQ:ZM ) showcased its ability to navigate the post-pandemic landscape with a solid Q2 earnings report, leading to a 2.47% surge in Thursday’s premarket trading. Despite facing headwinds from decelerating growth, the company outperformed Wall Street expectations, offering a glimmer of hope for investors.

Key Financial Highlights

For the quarter ended July 31, Zoom (NASDAQ: NASDAQ:ZM ) reported adjusted earnings of $1.39 per share, a 4% increase from the previous year, and above analyst projections of $1.21 per share. Revenue rose 2% to $1.162 billion, also surpassing estimates of $1.149 billion. However, this marked the tenth consecutive quarter of slowing sales growth, reflecting the company’s ongoing transition from the explosive demand driven by the COVID-19 pandemic to a more stabilized market environment.

The enterprise segment, a key area of focus for Zoom (NASDAQ: NASDAQ:ZM ), saw revenue rise 3.5% to $683 million, beating expectations of $675 million. This growth is particularly encouraging as Zoom continues to evolve into a comprehensive communications platform, catering to business needs beyond its core video conferencing service.

Future Outlook: Revenue Re-Acceleration on the Horizon?

Zoom’s guidance for the October quarter has further bolstered investor confidence. The company expects revenue between $1.16 billion and $1.165 billion, slightly above analyst estimates of $1.157 billion. This outlook, along with an upward revision of its full-year revenue and profit forecasts, suggests that Zoom’s expanded product suite is gaining traction with enterprise customers.

Despite these positive developments, Zoom’s stock remains under pressure, having dropped nearly 18% before the earnings report and 16% year-to-date. The market has been concerned about the company’s ability to maintain growth, particularly as competition intensifies from giants like Microsoft and its Teams platform.

Strategic Shifts and Leadership Changes

Zoom’s efforts to diversify its offerings are evident in its recent moves. The company is expanding its business tools to include phone systems, contact centers, and AI-powered assistants. Additionally, the launch of a single-use webinar service capable of hosting up to 1 million attendees signals Zoom’s commitment to innovation and adaptability.

However, the announcement of CFO Kelly Steckelberg’s departure at the end of the fiscal quarter has added an element of uncertainty. While Zoom clarified that Steckelberg’s exit is not due to any internal disagreements, the search for a successor will be closely watched by investors.

Navigating the Post-Pandemic World

Zoom’s success during the pandemic was unprecedented, but the company now faces the challenge of maintaining relevance in a world that is gradually returning to in-person interactions. The ongoing decline in consumer and small business customers has been a point of concern, with sales in this segment remaining flat year-over-year. However, the company reported its lowest ever churn rate, indicating some stability in this crucial market.

CEO Eric Yuan emphasized the resilience of Zoom’s business, particularly among smaller customers, and highlighted the platform’s role in hosting significant political events, including those supporting Vice President Kamala Harris. This demonstrates Zoom’s continued importance in various sectors, even as it navigates a more competitive and less predictable environment.

Conclusion

Zoom’s Q2 earnings report may have provided a short-term boost to its stock, but the road ahead remains challenging. The company’s ability to reaccelerate growth, especially in its enterprise segment, will be critical in determining its long-term success. As Zoom continues to innovate and expand its product offerings, investors will be watching closely to see if the company can sustain its momentum in a post-pandemic world.

With the market’s focus on the bottom line and the looming leadership transition, Zoom’s next moves will be pivotal in shaping its future trajectory.

ZOOM: $66 | From Video to an Ai Assistant somehowwe all know zoom DOMINATED during the the COVID Breakout

yet when the Vaccine was rolled out by WHO and Fauci it discounted quickly to rollback to where it came from

Google Meeting is killing it Microsoft meeting is getting a piece of the pie

the ai angle in zoom iQ may take a while for ENTERPRISE players to digest

to put it simply its a business to business model

that reminds me of Business INtelligence of Msoft or

EXECUTIVE DASHBOARD appls back in 2005ish

it's a different flavor of BARD or HER that Robot Assistant movie

needs a great PACKAGER to roll this out

if this pans out.. this can be YUUUUGE!

ZOOM iQ = a glorified Executive Assistant that summarizes meetings.

ZOOM 70 % rally comingZOOM remains bearish.

Last week we had both bearish engulfing weekly and monthly close.

We expect the downtrend to continue and retest lows from 2019.

After that if we get bullish divergences, it may be the time to accumulate zoom stock.

If we break below previous all time lows, new lows may be coming as the price will enter the discovery mode to the downside therefore it´s important to set up the stop loss.

Entry, target and stop loss are shown in the chart.

Zoom (ZM): Zoom Bottoming Out? Major Accumulation Signs!A stock we previously considered "dead" and seemingly on its last legs is Zoom. Despite its current low standing, it warrants another look.

Zoom is currently trading around its lowest level ever, approximately $58 to $59. This is a stark contrast to its all-time high of $588, marking a significant sell-off following the end of the COVID-19 pandemic. Stocks like Zoom are challenging to evaluate due to the massive fluctuations in value.

Historically, Zoom has tested and held the $250 level seven times, but now, for the first time, it’s been in a prolonged sideways movement. This could indicate an accumulation phase, often seen when stocks are at their lowest, suggesting that Zoom might be finding a bottom.

Moreover, there's a trendline within this accumulation phase that has been touched three times, reinforcing the possibility that Zoom is stabilizing. This trendline might act as a support level, potentially leading to a period of growth or at least stability.

Zooming in further, we notice that during this accumulation phase, there are four notable touchpoints on the trendline. While two points dip slightly lower, this is not overly concerning given the overall price action. The trading volume within this phase is visible and consistent, with price movements often oscillating around the Point of Control (POC) at $67. Prices fluctuate above and below this level but tend to return to the POC, indicating strong trading interest at this price point.

Currently, Zoom has the potential to rise towards $72, which corresponds to the High Volume Node Edge. This movement could involve a retest of both the trendline and the POC. A successful retest and subsequent breakout from these levels could provide the necessary momentum to break out of the accumulation phase, potentially opening the door for significant upward movement.

In summary, while Zoom has faced a dramatic decline, the current price movement and trendline support could indicate a phase of accumulation, suggesting that it might not be entirely out of the game yet. While this scenario is intriguing, it is also fraught with risk. Therefore, we are opting to remain on the sidelines for now, monitoring the situation closely.

ZM: Zoom is zooming into a black hole of disasterThere is almost noting bullish about ZM. After the huge selloff for months it's been a bear flag consolidation for weeks. With general market weakness intensifying, ZM has no chance here. Most likely in lower double digits to single digit in the next year or so. We might see a bounce first due to RSI oversold conditions, but wouldn't expect much. It will be a pump and dump scheme for investors to get out. They have no use case left as Microsoft and Apple have cornered the market for video conference. I hope google or some other big tech buy them out and put them out of their misery. I don't own or hold any stocks, so I have no skin in the game, but this is just sad to watch. I like the product better than teams or face time. But market doesn't like it and that's what counts.

ZM Zoom Video Communications Options Ahead of Earnings If you haven`t sold ZM before the previous earnings:

Then analyzing the options chain and the chart patterns of ZM Zoom Video Communications prior to the earnings report this week,

I would consider purchasing the 61usd strike price in the money Calls with

an expiration date of 2024-3-1,

for a premium of approximately $3.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

🚀🚀🚀 Bitcoin is unstoppable! 🚀🚀🚀

We are witnessing history, fellow zoomers. Bitcoin will smash through 70k and it's not stopping there. This is the future of money, and we are the pioneers. 💯💯💯

Don't listen to the boomers and the fudders. They are scared of change and innovation. They don't understand the power of decentralization and cryptography. They are stuck in the past, while we are building the future. 🙌🙌🙌

Bitcoin is more than just a currency. It's a movement. It's a revolution. It's a way of life. We are not here for the short term gains. We are here for the long term vision. We are here to change the world. 🌎🌎🌎

So zoom in, zoom out, and zoom on. The moon is not the limit. The sky is not the limit. There is no limit. Bitcoin is infinite. Bitcoin is eternal. Bitcoin is everything. 🔥🔥🔥

ZOOM Backwards, minus Z, plus N equals MOON (Moon Math edition)Lines labeled.

Watch Trends.

Note Daily Time Frame.

Personally, I like 103 on a potential move to the upside.

There is a possibility of some small downside in the short term, but it's a favorable buy if you're bullish on Zoom.

Gap closes just over 100, I believe, so I'd use caution at that point.

I could see something like this if it wants to ride those short term trends upwards.

Breakout over this trend is likely to cause the higher price targets.

ZOOM OUT (lol, puns)

Weekly view.

RSI is the thing to note here. 74 vs 72 looking at a bounce, If you don't know indicators, this simply implies bullish still, it can break down pretty easily, but it needs to close the week that way.

This allows for a bigger view, which helps show how the price can justify such large swings.

Extreme lows are 14 and under.

ZOOM - WEEKLY BULLISH DIVERGENCE - BUY NOW In September 2022 we published the trading idea where we expected more downside for ZOOM:

Now it's time for an update and more details!

ZOOM price most likely is at the bottom now or very close to the bottom.

Weekly bullish divergences are not a joke. We expect at least 75 % pump.

What about the stop loss?

You can put a stop loss below the key support, however be careful! It may just fakeout below the support to kick you out from your trade.

ZOOM is down 88 % from its ATH. It's not a time to be bearish. DCA into ZOOM and enjoy the profit soon.

Zoom (NASDAQ: ZM) Video Communications Beats Q3 TargetsZoom Video Communications (NASDAQ: ZM) beat expectations for its fiscal third quarter, but offered mixed guidance for the current period. Still, ZM stock rose in extended trading.

The San Jose, Calif.-based company earned an adjusted $1.29 a share on sales of $1.14 billion in the quarter ended Oct. 31. Analysts polled by FactSet had expected Zoom earnings of $1.09 a share on sales of $1.12 billion. On a year-over-year basis, Zoom earnings rose 21% while sales increased just 3%.

For the current quarter, Zoom predicted adjusted earnings of $1.14 a share on sales of $1.13 billion. That's based on the midpoint of its guidance. Analysts had been looking for earnings of $1.09 a share on sales of $1.13 billion in the fiscal fourth quarter. In the year-earlier period, Zoom earned $1.22 a share on sales of $1.12 billion.

Zoom closed its fiscal third quarter with 219,700 enterprise customers, up 5% from the same period last year.

Also, Zoom reported 3,731 customers contributing more than $100,000 in trailing 12 months' revenue, up 13.5% year over year. Lately, Zoom has been adding more productivity and artificial intelligence tools to its business communications platform.

On Sept. 5, it introduced Zoom AI Companion, a generative AI digital assistant. As of Oct. 30, the tool had generated more than 1 million meeting summaries.

Next year, Zoom plans to release Zoom Docs, an AI-powered workspace that can be used for documentation, project tracking and management tasks.

Technical Analysist

ZM is trading near the bottom of its 52-week range and below its 200-day simple moving average.

What does this mean?

Investors have been pushing the share price lower, and the stock still appears to have downward momentum.

ZM Zoom Video Communications Options Ahead of EarningsIf you haven`t sold ZM here:

or ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of RUM Rumble prior to the earnings report this week,

I would consider purchasing the 60usd strike price Puts with

an expiration date of 2023-11-24,

for a premium of approximately $1.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ZM: Zoom has officially topped...Short it.I'm short $ZM since earlier today, I believe it has peaked here. Investors are likely to take profits now that competition has increased dramatically for them.

They thrived when the world was locked down due to the threat of COVID-19, but now that vaccines will be widely available and distributed globally very soon, holding shares has become extremely risky. I'd urge everyone holding to sell and buy something oversold with proceeds...If interested in knowing what to buy now, contact me.

A short here has very low risk, I think it can last for a long time falling, so do your own due diligence with sizing to not risk more than 1-2% if it goes against you by 3 average ranges.

Cheers,

Ivan Labrie.

Pandemic Champion Zoom will be back!In this work, I will analyze Zoom Video Communications, Inc., a leading company in the cloud communication and collaboration sector, which offers online videoconferencing, chat, telephony, webinars, among other services, for different segments and audiences. My investment thesis is that Zoom is an innovative and profitable company that has the potential to remain a leading video-based unified communications platform well into the future. To support this thesis, I will evaluate the qualitative and quantitative aspects of the company. In the qualitative part, I will describe Zoom's business model and strategy, showing how it differs from its competitors, what are its strengths and weaknesses, the opportunities and threats it faces in the global market. In the quantitative part, I will present Zoom's financial and operational data, demonstrating how it has grown in recent years, and what its projections are for the future, for a well-structured technical analysis based on Wyckoff, structures and volume delta.

_____ _____ _____

Company History

The company emerged in 2011, as a result of the vision of Eric Yuan, a former engineer at Cisco Systems, who recognized the need to create a simpler, reliable, and high-quality communication platform. The company launched its main product, Zoom Meeting, in 2013, and has since been growing rapidly in terms of customers, revenue, and profit. The company went public on the NASDAQ stock exchange in April 2019, with an initial public offering (IPO) of $36 per share. In June 2019, the company became part of the Russell 2000 index, which comprises smaller-cap companies in the United States. In April 2020, the company was promoted to the Russell 1000 index, which includes larger-cap companies in the United States. In august 2020, the company surpassed a market value of $100 billion, becoming one of the most valuable technology companies in the world.

Company's Sector of Operation

The company operates in the software as a service (SaaS) sector, which is a business model that provides information technology solutions over the internet, without the need for customers to install or maintain hardware or software. The SaaS sector is a growing and competitive industry, benefiting from digitization, mobility, and cloud trends. Within the SaaS sector, the company excels in the cloud communication and collaboration (CCaaS) segment, which offers online services to facilitate remote work, distance education, and social interactions. The CCaaS segment is dynamic and innovative, adapting to technological changes and consumer demands. It is also a challenging and regulated segment, facing competition from major market players like Microsoft Teams, Google Meet, Cisco Webex, and Skype.

Diversification and Innovation Strategy

The company's strategy is to diversify and innovate its products and services to meet customer needs and differentiate itself from competitors. The company aims to become an open and flexible platform that integrates various cloud communication and collaboration solutions. Some examples of products and services that the company has launched or acquired in recent years include:

Zoom Phone: a cloud telephony system that allows users to make and receive calls using the same Zoom Meeting application.

Zoom Rooms: an integrated system that transforms any physical space into a virtual meeting room with video, audio, and screen sharing.

Zoom Webinar: an online service that enables users to host virtual events with up to 50,000 participants and 100 speakers.

Zoom Chat: an online service that allows users to exchange instant messages with other Zoom users or external contacts.

OnZoom: an online platform that allows users to create, host, and monetize interactive virtual events, such as classes, shows, workshops.

Kites: a startup specialized in real-time automatic translation for video conferences.

SWOT Analysis

It is an essential tool for evaluating a company to invest in, as it offers a broad and organized view of the company's current situation. It consists of identifying the Strengths, Weaknesses, Opportunities, and threats that affect the company's performance. This is a qualitative analysis and does not replace technical or fundamental analysis.

The company's SWOT analysis is as follows:

Strong points:

Freemium model: Zoom offers a free basic plan that allows up to 100 participants and unlimited sessions of up to 40 minutes, attracting those looking for an affordable and quality solution for online communication. Ease of use: It is known for its simple and intuitive interface, which allows participants to start and join sessions with just a few clicks. The company also offers features such as virtual backgrounds and video retouching to enhance the look and feel of those involved during sessions. Global Usage: The platform has a global presence, with more than 300 million daily session participants and more than 213,000 enterprise customers worldwide. It also supports multiple languages and currencies, meeting the needs of diverse audiences. Financial strength: The company has experienced significant revenue and profit growth in recent years, driven by the high demand for online communication during the COVID-19 pandemic. Zoom's total revenue for fiscal 2023 was $4,393 billion, up 7% year-over-year. Business revenue was US$2.409 billion, an increase of 24% compared to the previous year. Brand name: The solution has become a household name and synonymous with online communication, thanks to its popularity and recognition among consumers. Zoom has also received several awards and recognition for its quality and innovation, such as the Webby Award for Best Mobile App in 2020.

Weak points:

Security issues: The company has faced many security and privacy issues in the past, such as “zoom bombing”, which is the unauthorized invasion of sessions by malicious people who interrupt or share inappropriate content. It has also been criticized for sharing consumer data with third parties without proper consent. They don't offer end-to-end encryption: Despite claiming to offer end-to-end encryption, the platform actually uses a type of encryption that allows the company to access session data if it wants to. This raises concerns about the confidentiality and integrity of participant communications. Zoom Rooms: Zoom rooms are a feature that allows stakeholders to create dedicated physical spaces for online communication using specialized Zoom or partner hardware. However, this feature is expensive and requires an additional monthly subscription, which may limit its adoption among customers.

Opportunities:

Growing demand: Demand for online communication is set to continue to grow in the future as more people embrace remote work and hybrid work models. The company can capitalize on this opportunity by expanding its customer base and offering customized solutions for different industries and needs. Up-selling: It can increase its revenue by encouraging basic plan consumers to upgrade to paid plans, which offer more features and benefits, such as longer sessions, more participants, recording and cloud storage, Zoom Phone and Zoom Rooms. Diversification: The platform can diversify its offer of products and services, exploring new markets and segments, such as health, education, entertainment, and e-commerce. The company can also develop new technologies and features, such as augmented reality, artificial intelligence and machine translation, to improve the user experience and differentiate itself from the competition.

Threats:

Intense competition: The company faces strong competition from other players in the online communication market, such as Microsoft Teams, Google Meet, Cisco Webex, Skype, and Facebook Messenger. These competitors have greater financial, technological and marketing resources than it does and can offer integrated and competitive solutions to customers. Regulatory changes: The platform is subject to various laws and regulations in different countries and regions, which may affect its operations and revenues. For example, it may face restrictions or bans from operating in certain markets due to national security, data privacy or human rights concerns. The company may also face fines or penalties for violating these laws and regulations. Dependence on network infrastructure: The quality and performance of Zoom services depend on the availability and reliability of network infrastructure, such as bandwidth, internet speed and stability. Any interruption or degradation of these factors could negatively impact the user experience and the reputation of the solution.

Final qualitative analysis opinion

ZM benefits from its freemium model, ease of use, global usage, financial strength and brand name. But, it also faces challenges such as security issues, lack of end-to-end encryption, cost of Zoom rooms, intense competition, regulatory changes and dependence on network infrastructure. The company can take advantage of videoconferencing demand growth, up-selling and diversification opportunities to overcome its weaknesses and threats. The platform must invest in improving its security and privacy, innovating its products and services and expanding its presence in new markets and segments. Zoom has the potential to remain one of the leading video-based unified communications solutions in the future.

_____ _____ _____

Fundamental Analysis:

We will introduce fundamental analysis, focusing on the company's financial health and performance. For this, we will use financial data from the second quarter of the fiscal year 2024 (ended on July 31, 2023). The financial indicators we will consider are: EBITDA, CFO, ROE, ROIC, Gross Margin, and Operating Margin.

Description of fundamentals:

Source: Yahoo Finance

The company has good liquidity, as it has a high ratio of liquid assets in relation to liquid liabilities, which indicates a low default rate on its basic obligations and low default rates. Furthermore, the company has a large loss in relation to equity and this further reduces its potential market value.

Source: Yahoo Finance

The company has excellent financial health and strong performance. The company demonstrates high operating profit (EBITDA), good cash generation (CFO), good return on equity (ROE) and invested capital (ROIC), and good gross and operating margins. These results show that the company is efficient, profitable, sustainable, and competitive in the video conferencing and online collaboration market.

Other Fundamentals indicators

We will address other economic indicators that are not as necessary but can be incorporated into our fundamental analysis.

Source: Yahoo Finance

The data in this table shows that the company has a good financial performance, but also faces some problems. For one, Zoom Meeting has a high P/E Ratio, which indicates that investors expect future earnings growth from the company. Zoom Meeting also has a high Enterprise Value, which represents the company's total value in the market. These indicators suggest that Zoom Meeting is a successful and innovative company, offering a high-quality and in-demand communication service. On the other hand, Zoom Meeting has a low P/B Ratio and a low PSR, which indicate that the company is trading at a price well above its book value and sales. This could mean that Zoom Meeting is overvalued or faces strong competition in its industry. Furthermore, Zoom Meeting does not pay dividends to its shareholders, which may discourage some investors looking for a stable and secure income. These indicators propose that Zoom Meeting is a risky and volatile company that depends heavily on market expectations and industry trends.

Final opinion of fundamental analysis

It has significant potential for growth and generating value for shareholders, especially in a scenario of increased demand for digital solutions, but it needs to face the threats mentioned previously in the company's SWOT analysis. .

Technical Analysis

To begin the study, first, we observe that the stock was launched in April 2019, and in January 2020, there was a significant increase, as we can see in the weekly chart. With this, we will divide this technical analysis into three parts. In this chart, we have the presence of three volume profiles. It calculates volume by price level based on the Gaussian curve and is excellent for measuring long-term position buildups, especially in a weekly chart like this.

Analysis of the first profile:

ZM Weekly Chart

Note that, since the IPO process, the stock appreciated by 671.09%, which is quite substantial. Many companies were negatively affected during the pandemic, but this one inadvertently benefited from the COVID-19 pandemic. In this first profile, we see the largest position buildup right at the range of 68.75 to 76.95. You can already see 2 candles of aggression, as shown in the second graph, causing significant drops.

Analysis of the second profile:

ZM Weekly Chart

Observing the second profile, we see a lack of demand from buyers and a position buildup on the selling side, unlike what we observed at the beginning.

Analysis of the third profile:

ZM Daily Chart

Upon examining the last profile, we see that despite the market coming from a downtrend channel, we can observe a drastic increase in volume per price level, which is a characteristic of a position buildup. As we gradually see, the seller has been reducing their position, and furthermore, the stock is in a downtrend channel that if it surpasses 78.50, combining it with the fundamentals, we could potentially have an upward trend.

Macroeconomics and Technical Analysis

Surprisingly, Zoom is not the only one that experienced a drop that significantly devalued its stock. Several companies listed on the Nasdaq Composite, including the Nasdaq Composite itself, suffered from a drop that impacted the United States economy.

E-mini Nasdaq Weekly

This was motivated by high inflation, which reached around 9%, which is indeed a very concerning figure for the US economy. By February, inflation had already reached 7.5%, which was already a very high percentage, as technology companies react poorly to inflation. This explains the poor performance of these stocks.

February table

Source: Tradingview Economic Calendar

These data explain the drop in assets listed on the Nasdaq, but surprisingly, Zoom was affected much more than the other companies. Later, when the price started to increase slightly;

And the year 2022 contributed even further to the devaluation of ZM shares. But as we can see, the asset was already in the process of falling long before:

ZM Daily Chart

There was the beginning of a bearish rally there.

Even if the current data are not so favorable, the deflation process that occurred in the United States, together with the artificial intelligence race, could also be a detail that will greatly help in the ZM valuation process.

September table updated

Source: Tradingview Economic Calendar

September's data clearly reveals a drop in inflation, but with several very significant drops, in addition to some negative points such as the reduction in job creation and economic development. Look at the table below:

Source: Tradingview Economic Calendar

Based on this table, Zoom Communications could have a positive result as the company recorded a drop in inflation in September, implying that the costs of products and services decreased. This can benefit consumers and businesses that use the Zoom Service.

Conclusion

Zoom Video Communications Inc. is a company with good financial and market performance, despite the broad devaluation it suffered in 2021/2022. It demonstrates good fundamental analysis with strong revenue and profit growth, a high net margin, low debt and a good market value.

The company also presents good technical analysis. It is undervalued, having been at an all-time low since its IPO, building a position for a likely long-term upward trend. Although the macroeconomy does not favor the variable income market due to a high interest rate of 5.5% (possible readjustment to 5.75% in September), it can also benefit from the ongoing economic deflation, which should stabilize in the end of 2024.

It also has the potential to recover from the decline it has experienced and stand out in the technology market, especially in the videoconferencing segment, which has been less and less in demand post-pandemic and in times of remote work. Demonstrating its ability to innovate and adapt to changes in the economic and social panorama, offering quality and safe solutions to its customers. Therefore, it is believed that Zoom is a good investment option for those seeking long-term profitability and growth.

I hope you enjoyed this article and found it helpful. Thank you for your attention, and until next time!