High vs Low in Time-frame Decisions🕒🚀🕒 Big Timeframes: Imagine looking at a painting from a distance – that's the essence of big timeframes. Daily, weekly, and monthly charts offer a broader view of an asset's performance over extended periods. They help you identify long-term trends and major price movements.

📊 Small Timeframes: Now, picture examining a single brushstroke – that's small timeframes. Hourly and minute charts provide granular details of short-term price action. They're useful for spotting quick trading opportunities and assessing market sentiment in the moment.

💡 Investment Approach: When it comes to investing, consider your goals and risk tolerance. Big timeframes are great for long-term investors who prioritize stability and are willing to ride out market fluctuations. Small timeframes suit traders looking to capitalize on short-term price movements.

🚀 Finding Balance: There's no one-size-fits-all answer. Many investors use a combination of both big and small timeframes. Large timeframes provide context, while small timeframes offer insights into entry and exit points.

So, what's the takeaway from this timeframe comparison? 📈 It's about understanding that different timeframes offer unique insights. Whether you're a patient investor or an active trader, the key is to align your timeframe with your investment strategy.

Stay curious, stay adaptable, and remember – the art of investing involves choosing the canvas that best suits your artistic vision! 🎨🚀

Zoomout

BTC weekly timeframeWhen in doubt zoom out is a common statement in the Bitcoin community. So, let's do so by looking at the weekly timeframe.

Bitcoin formed a strong base between the blue 50% Fibonacci level at $16,350 and the 2017 high of $18,000 in the 1H203 and has gone on to touch a yearly high of $31,295. The resistance rate between the black 38.2% Fibonacci retracement level of $27,580 and $29,500 has however held its ground. Bitcoin is currently testing its 200-week MA rate of $26,450 and a break below this support rate will see it slide lower onto the 50-week MA rate of $22,245 which coincides with the black 23.6% Fibonacci retracement level and the blue 38.2% Fibonacci retracement level.

The support on the 50-week MA is crucial. A break below it will allow bears to pull Bitcoin back into the base formed in December 2022 and January 2023. If the 50-week MA holds it ground Bitcoin will however be geared to move higher and test the resistance rate between $32,945 (black Fibonacci retracement level) and $35,000 (blue 23.6% Fibonacci retracement level).

In terms of technical indicators, the weekly MACD is holding a sell signal and the RSI still has room to drift lower before hitting oversold levels. I will personally be a buyer at levels around the 50-week MA rate.

VISA - ZOOM OUTVisa is one of my favourite and most consistent stocks.

But these charts are everywhere on the stock market. Charts like this. Purely upwards.

I am just using Visa as an example.

Lacking a bear market these stocks are pure gems.

Ride the curve towards the stars.

If you want more proof check out GOOGL, MSFT even BTC

The SPY's Channel - YTDI just wanted to point out the overall ascending parallel channel the SPY has respected for the entire year. Take note of the very bullish bounces off support. Every market has ups and downs, but its the broader picture that allows us to see the bigger story. Remember, when in doubt just zoom out. Find support and resistance on the macro level and work down from there to your micro time frames. Understanding these larger trends will help guide your decision making process.

ETH BEARISH PATTERN!Ethereum is looking very bearish if this pattern plays out and it is printing a bear flag.

If ETH gets rejected at the upper resistance of the bull flag, we could see a retracement of $2500 with a wick to $2250.

Rekoctober could be in play, I think 29th 0f October from history could give us some good gains if there is no "Black Swan" event. This could last until early December or late December I do not have a crystal ball.

DYOR, safe trading.

Bitcoin on the Weekly (Zoom out)This is the Bitcoin chart on the weekly with some important information.

All the way down below you see "The bull market doors", for the ones calling out a bear market. Don't get delusional calm down, we're in a super cycle.

We just bounced of the big support area. MAJOR Support around that level

Bitcoin failing to stay above the 21 EMA, but we could see a move to the upside and that would mean we only just wicked below.

Two important resistance levels to keep an eye on.

Why i state that we're in a super cycle, is because of the institutional money flowing into bitcoin and mass adoption.

Whales are just manipulating the market, through FUD.

$LINK: Will the $30 level hold?Hey yall, it's been a minute since I posted a $LINK chart so I'll show you what I'm thinking about at the moment.

Overall market sentiment was pretty bearish for a moment there. However, I think that was a result of a massive inflow of new money via doge and scam BSC / cake swap tokens that were blowing up on tictok etc. Massive amounts of overleveraged new traders === obvious correction. In bull markets we want to see 20-30% corrections. That's weakness leaving the market and floors being established. How low will this coin go? Did it find a strong support? Or did it just keep going down like doge did from 40 cents all the way to 15 cents.

$LINK has been slowly climbing the pitchfork that I drew in the post that I linked as a related idea. We're still actually within the median and the upper 0.5 prong. Which is very solid. We're also seeing a pretty strong support being respected at the $30 dollar mark.

So trading wise? I'm accumulating more spot. I want as much $LINK as I can get before staking arrives. In lower time frames? We want to see 30 dollars respected. We also want to see the PA reclaim the middle band from the bollinger bands. And finally we want to see the 3 period Supertrend flip back to bullish. If all 3 of those things happen? I'll be entering long positions with a minimum price target of previous ATH.

I'm posting this as a neutral position for now though, because there's too much BTC volatility to really see a clear trend. Trend is your friend for trading. Long term? $LINK is the most incredibly important crypto in the entire world. It is the foundation for which all of defi is being built upon. $BTC will always be important and massive... but #DEFI will dwarf the bitcoin marketcap by orders of magnitude. $LINK will be in the center of all of that.

Zoom out and you will understand...73b for a video service????? come on get serious

1. Easy to copy paste it

2. How much money do you expect companies to spend on video service over long term?

Waiting for RSI divergences on multiple timeframes, there is a chance it will go up to 100b and then the real fun will start... with 2 hands & 2 feets i am going to short it there without a stop loss...

Setting the zoom level of chart for best fit in one viewSetting the zoom level of chart for best fit in one view

1- Alt + R or rest chart

2- Press the (zoom out) (-) button five times

in my opinion this is the best display of the chart

how do you set up?

share in comments.

test this setting and comment me if you like it.

Encourage me by pressing like button.

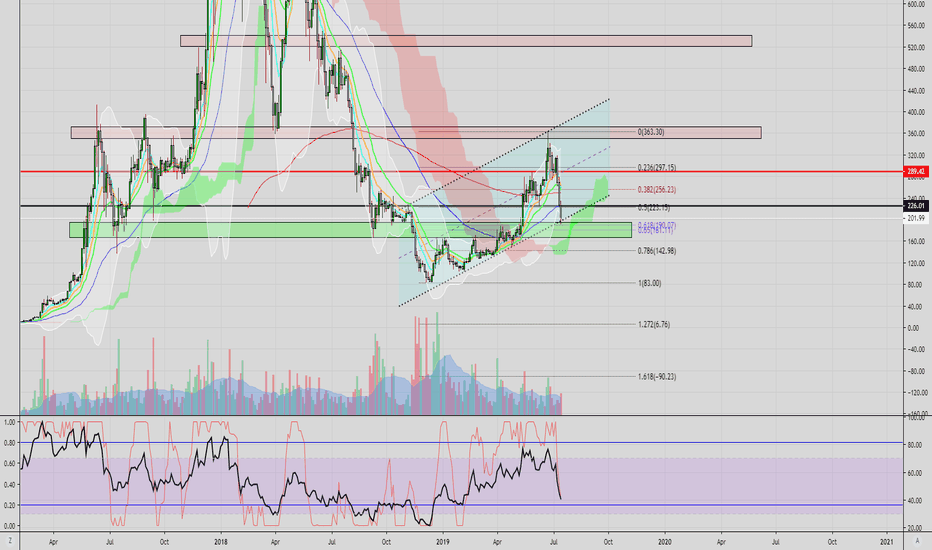

ETH Update: At support again, but will it hold?Again, we are at another strong support area. It also includes the golden pocket of fib retracement from the $83 low all the way to the $363 high. The cup and handle it scrap since the cup has retraced too far. RSI is bearish again as well. We may get some choppiness/sideways movement for as we sit closely between strong support and strong resistance. I'm probably going to make another buy in this range.