Zoomvideo

ZM Zoom Video Communications Options Ahead of EarningsIf you haven`t sold ZM before the correction:

Now analyzing the options chain and the chart patterns of ZM Zoom Video Communications prior to the earnings report this week,

I would consider purchasing the 70usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $5.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

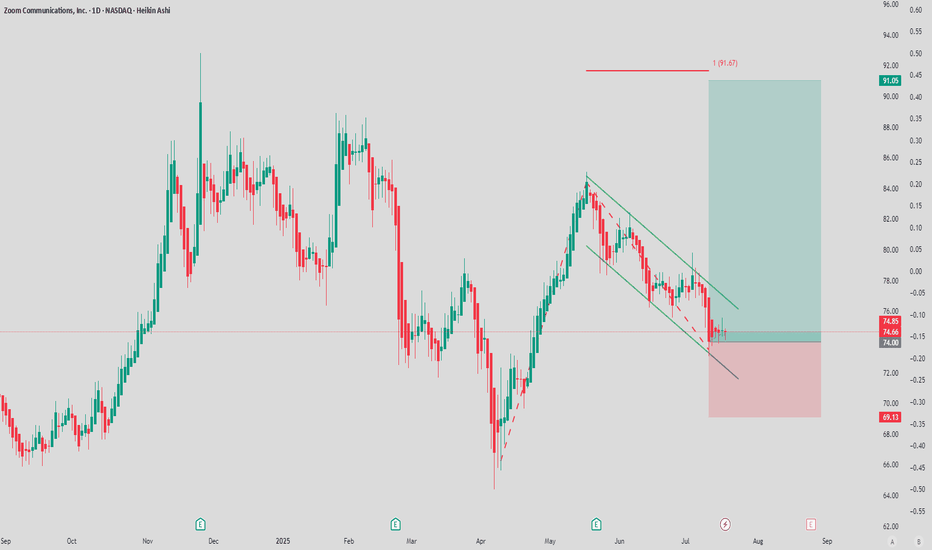

ZOOM 70 % rally comingZOOM remains bearish.

Last week we had both bearish engulfing weekly and monthly close.

We expect the downtrend to continue and retest lows from 2019.

After that if we get bullish divergences, it may be the time to accumulate zoom stock.

If we break below previous all time lows, new lows may be coming as the price will enter the discovery mode to the downside therefore it´s important to set up the stop loss.

Entry, target and stop loss are shown in the chart.

ZM Zoom Video Communications Options Ahead of EarningsIf you haven`t bought ZM before the previous earnings:

Then, after analyzing the options chain and the chart patterns of ZM Zoom Video Communications prior to the earnings report this week,

I would consider purchasing the 65usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $8.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ZM: Zoom is zooming into a black hole of disasterThere is almost noting bullish about ZM. After the huge selloff for months it's been a bear flag consolidation for weeks. With general market weakness intensifying, ZM has no chance here. Most likely in lower double digits to single digit in the next year or so. We might see a bounce first due to RSI oversold conditions, but wouldn't expect much. It will be a pump and dump scheme for investors to get out. They have no use case left as Microsoft and Apple have cornered the market for video conference. I hope google or some other big tech buy them out and put them out of their misery. I don't own or hold any stocks, so I have no skin in the game, but this is just sad to watch. I like the product better than teams or face time. But market doesn't like it and that's what counts.

Zoom (ZM) Looking to Breakout after Extended ConsolidationI really like this opportunity from ZM here. The stock is cheap on many metrics and the market is pricing in a bearish case. If ZM can post even minimal growth in 2024, the stock should rip.

We've had almost a year of consolidation in this $60-$74 range and we're attempting to break out. It's just a matter of time.

I'm targeting ~$97 to fill the gap made in August 2022. After such a long period of consolidation, a breakout should cause some short covering and bring in traders on a technical basis. If we break below the range, it would signal a failure and I would cut my losses

High probability trade

Target: $97 (+34%)

Stop Loss: $58 (-19%)

- Sultan of Chart

ZOOM - WEEKLY BULLISH DIVERGENCE - BUY NOW In September 2022 we published the trading idea where we expected more downside for ZOOM:

Now it's time for an update and more details!

ZOOM price most likely is at the bottom now or very close to the bottom.

Weekly bullish divergences are not a joke. We expect at least 75 % pump.

What about the stop loss?

You can put a stop loss below the key support, however be careful! It may just fakeout below the support to kick you out from your trade.

ZOOM is down 88 % from its ATH. It's not a time to be bearish. DCA into ZOOM and enjoy the profit soon.

ZM Zoom Video Communications Options Ahead of EarningsIf you haven`t sold ZM here:

or ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of RUM Rumble prior to the earnings report this week,

I would consider purchasing the 60usd strike price Puts with

an expiration date of 2023-11-24,

for a premium of approximately $1.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ZM Zoom Video Communications Options Ahead Of EarningsIf you haven`t entered ZM here:

Or sold here:

Then analyzing the options chain and the chart patterns of ZM Zoom Video Communications prior to the earnings report this week,

I would consider purchasing the 66usd strike price Puts with

an expiration date of 2023-8-25,

for a premium of approximately $3.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Zoom Potential Rounding Bottoming Zoom Video was a darling stock during the pandemic when office workers were sheltering in place at home and communicating via video chats. Price hit a high near $600 in Q4 of 2020 and has fallen roughly -80% to current levels where it has levelled off and appears to be forming a bottom in the $70 range.

Currently price is attempting to hold and trend above the 200ma which it hasn't done since the summer of 2021 when the previous attempt to regain the 200ma failed. Going forward we want to see price hold above the 200ma and take out short-term resistance at $75-$76.The short-term MA's are currently rising above the longer MA's which is an indication of a short-term bullish trend for price. We want to see price continue to move higher and for the short MA's to rise above the 200ma for a sign of bullish trend continuation.

The PPO indicator show the green RSI line rising above the purple signal line which is a short-term bullish momentum indication. Both lines trending above the 0 level indicates intermediate to long-term bullish momentum behind price.

The TDI indicator shows the RSI line crossing above 60 and in the upper half of the white Bollinger Bands which indicates a short-term bullish trend in price. The overall action of the green RSI line is trending between the 40-80 levels which indicates intermediate to long-term bullish price trend. Going forward we want to see the green RSI line continue to rise above the 60 level for short-term bullish bias in price which would help maintain above the 200ma.

Price gapped down in Aug of 2022 so should Zoom hold current bullish bias and take out short-term resistance levels we could see a move to fill the gap up near $95-$96.

My entry is at $73.95 with a stop loss at $68. No upper price target for now other than the gap target, will raise my stop-loss order as price moves higher and creates a series of higher highs and higher lows assuming that a breakout is coming.

ZM - 3D timeframe hints at potential MACRO shiftHi guys, this is a Technical Analysis on Zoom.

So many stocks have done well in this bull market and some not so much. My focus is to catch some potential ones that are down significantly from their blow off tops, in the process of bottoming.

Note this is a 3 Day timeframe. This analysis is to see hints in these intermediate timeframes to see whether there is potential for these findings to impact the bigger picture or MACRO trend.

Current Price action for the last 4 candles have printed support above the 50 DMA (green moving average) and 21 EMA (Yellow moving average)

Note also the 50 Green DMA is starting to flatten out, indicating a potential BOTTOMING sign, since if you look left the things been signficantly pointed down since blow off top.

Also note the 21 Yellow EMA is starting to slope up, trying to cross over the 50 DMA.

This has happened only 1 time in the history of 3D Zoom chart but when it did, a massive bull run ensued after. This is something to OBSERVE.

ANother plus point, we are above the 2 sloping trend lines that were resistance lines since July 2022 and Nov 2022.

NOw lets look at the CANDLE characteristics of the 4.

Its important to notice the UPPER WICKS forming -> this indicates selling pressure, and that we are hitting on some tough resistance, indicated by the RED rectangle.

BUT note the highlighted candle formation -> This is a Dragonfly doji, which is a BULLISH candle pattern. I wont go into the details as i am not an expert but just note its not a traditional dragonfly so the power of its impact, may vary. (Again i could be wrong, so don't hold me to this and correct me if im wrong)

Note the tail of the Doji, how it bounced off this major convergence of support between the July 2022 resistance line, and both MA. Great sign in my opinion for a bullish case.

BUT also keep your mind on the various support lines below price action, if we get rejected here which is always a possibility, look for price to test:

1. Firstly the moving averages

2. The July 2022 resistance now flipped support

3. November 2022 resistance now flipped support

4. Lastly, the RED horizontal MAJOR bottom support at around $61. WHich we have never gone below in the history of ZOOM.

Lets move onto my indicators:

1. RSI- Note the Red line, this is actually a reference to the BULLISH DIVERGENCE forming in zoom. Notice also the first white horizontal line, We have recently broken major resistance and formed a higher high in RSI. This is a good sign in my opinion. The 2nd white line above, is something that if we break would indicate MAJOR trend change, as we would break the June 2021 highs on RSI.

2. MACD -> momentum indicator -> Notice how the histogram bars have shortened and the Blue/Red lines have flattened. This in my opinion, this "quiteness", may indicate a "Calm before the storm" scenario. Also if we are crossed up where the Blue line is over the red and ABOVE the 0 level, that could be a sign for bullish momentum. Especially if the space between the 2 lines widens.

3. ADX & DI - Notice the green line is slowly moving above the White horizontal line, if we can get significantly above it, its may indicate a chance for further bullish momentum. If also the white line comes up and pierces the green line, that would add to the bullish momentum case.

*BULLISH DIVERGENCE is a bullish pattern where price action on the charts shows lower lowers but the indicators show higher lows. This pushes price to "catch up" with what the indicators are showing, since normally price action should mirror indicators & vice versa.

CONCLUSION:

Price action is currently in an interesting zone of resistance. Getting above this would be monumental for ZM for sure. We have some great support levels hanging out below us, which could make for some nice BUY zones if price gets there. But in the great scheme of things, and in my opinion, NOT Financial advise -> Zoom is extremely cheap. There are some bullish signs like the dragonfly doji, potential EMA/DMA cross, Higher high RSI and more...... COuld these be the necessary catalysts to have zoom finally start a bull run, well....... TIME WILL TELL.

THANK YOU for taking the time to tune in. Please support me by boosting, following and commenting. Feedback always helps and or expressing your thoughts would be great.

DISCLAIMER: This is NOT FINANCIAL ADVISE. I am not a financial advisor. This is strictly my opinion and for educational expression. Trade with caution, always focusing on RISK MANAGEMENT. Protect yourselfs, deploy stop losses.

ZM BUYHi, according to my Zoom video stock analysis. There is a good buying opportunity. The stock exited the downward channel. And breaking the resistance at level 70. We also notice a very strong positive green candle for the daily time frame. And there it started to form an ascending channel to the top. Good luck everyone

$ZM - ZOOM long term buys. Zoom has certainly been a hot topic in the stock market as of late, with the increasing popularity of remote work and virtual meetings. The volatility in the market makes any stock trade idea risky, but there are a few factors to consider when it comes to Zoom.

First, it's important to look at the company's financials and performance. Zoom has shown impressive growth over the past year, with revenue increasing by 355% during the second quarter of 2020. However, it's worth noting that competition in the video conferencing space is fierce, and there are no guarantees of continued growth.

Additionally, keep an eye on broader market trends and potential economic impacts. As the world continues to navigate the COVID-19 pandemic, any shifts in consumer behavior or economic policy could affect Zoom's stock price.

As always, it's crucial to do your own research and consider all factors before making any stock trades. I'm here to assist you with any information you need to make an informed decision.

Investing in Zoom stock: Will You be Profiting Long-Term?Are you on the lookout for a solid investment opportunity in the current market? Look no further than Zoom Video Communications! Although media reports or rumours about a significant change in a company’s business prospects usually cause its stock to trend and lead to an immediate price change, certain fundamental factors always drive the buy-and-hold decision.

Zoom Video Communications stock company is reacting to a very strong monthly demand level located around $70 per share. There is a lot of profit for margin for this long-term buy opportunity of Zoom Video Communications shares. There is room for this tech stock to reach $250; it will need a few months, bu

Zoom rallies to be capped.Zoom - 30d expiry - We look to Sell at 77.77 (stop at 82.43)

We are trading at oversold extremes.

There is no clear indication that the downward move is coming to an end.

The primary trend remains bearish.

The stock is currently underperforming in its sector.

20 1 week EMA is at 78.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Our profit targets will be 66.10 and 64.10

Resistance: 72.17 / 78.00 / 81.50

Support: 68.00 / 66.00 / 63.55

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Zoom approaching all time lows.Zoom - 30d expiry - We look to Sell a break of 68.68 (stop at 71.71)

Trades at the lowest level in 34months.

Price action continues to trade around the all-time lows.

We are trading at oversold extremes.

This stock fell 3 % last week.

Short term momentum is bearish.

A break of the recent low at 68.88 should result in a further move lower.

The bias is to break to the downside.

Our profit targets will be 61.11 and 60.11

Resistance: 73.00 / 77.30 / 80.00

Support: 68.88 / 65.00 / 62.00

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

ZM ( ZOOM VIDEO ) LONG 4H ( 11.23.2022)Cut its annual revenue forecast, hurt by inflation dampening the spending power of customers and by people using online video-conferencing less with the easing of pandemic restrictions. Zoom chief financial officer Kelly Steckelberg said during a post-earnings call that the company’s online business would decline nearly 8% during the year. The stock has fallen more than 60% this year, the company said it now expects annual revenue to be between $4.37 billion and $4.38 billion, compared with an earlier outlook of $4.39 billion and $4.40 billion. The company, however, raised its annual adjusted profit per share to between $3.91 and $3.94, compared with $3.66 to $3.69 forecast earlier. Revenue for the third quarter ended Oct. 31 rose 5% to $1.1 billion, on the back of a 20% increase from high-paying enterprise customers.

ZM Zoom Video Communications Options Ahead Of EarningsIf you missed my other calls on ZM:

Then you should know that looking at the ZM Zoom Video Communications options chain ahead of earnings , i would buy the $75 strike price Puts with

2022-11-25 expiration date for about

$2.80 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

Why ZM Zoom Video could go higher by Friday!! ZM Zoom Video reached our Buy Area:

As you can see in the chart, Zoom Video Communications, Inc. (ZM) reached our price target!

Friday, before the close, at 16:29:37 someone bought 20300 ZM shares at $72.29 for about $1.5Mil.

But that`s not all!

Also before the bell i saw 9K calls worth $1.4Mil, with the following characteristics:

2022-10-21 expiration date (this Friday!)

$73.10 entry price

$75 strike price

$1.55 premium paid.

In order not to expire worthless, the shock should reach $76.55!

The stock was $72.29 at the close and i think it is primed for a comeback!

ZM Zoom Video is the 2nd biggest holding of Ark Invest with $1.03Bil invested their average entry price being $274.87! the stock is now only $72.29.

ZM stock lost 87.85% from its all time high. I think this could be The bottom.

On 8/23/2022 The Goldman Sachs Group set a Price Target of $122.00 for ZM Zoom Video.

My short term Price Target is the $106 resistance.

Looking forward to read your opinion about it.