#ZRO/USDT#ZRO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.34.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 2.36

First target: 2.40

Second target: 2.44

Third target: 2.48

ZROZ

#ZRO/USDT#ZRO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 2.41.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 2.69

First target: 2.82

Second target: 2.98

Third target: 3.17

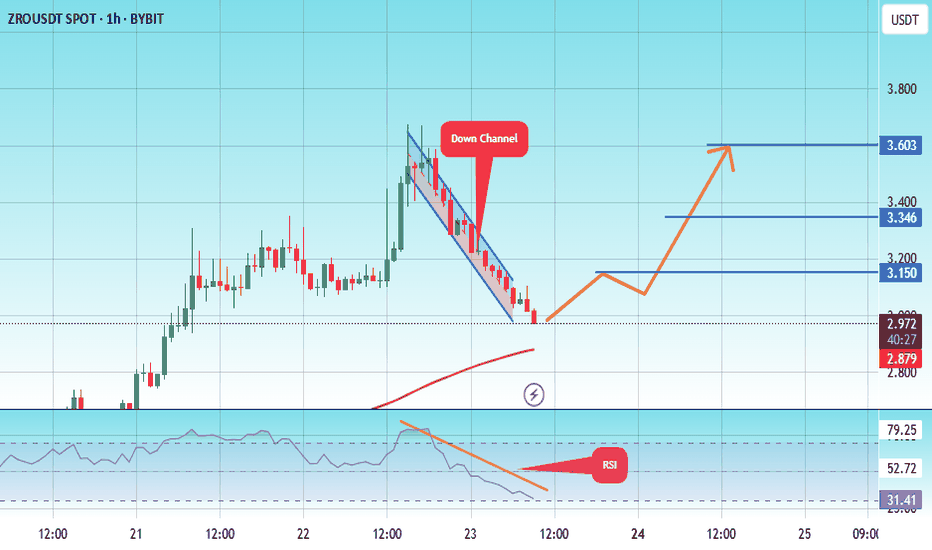

#ZRO/USDT#ZRO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 2.93.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 2.98

First target: 3.15

Second target: 3.35

Third target: 3.60

#ZRO/USDT#ZRO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.00

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 2.02

First target 2.07

Second target 2.12

Third target 2.18

#ZRO/USDT Ready to go up#ZRO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 3.43

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 3.50

First target 3.61

Second target 3.78

Third target 3.93

#ZRO/USDT Ready to go higher#ZRO

The price is moving in a descending channel on the 30-minute frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at a price of 4.58

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 4.60

First target 4.70

Second target 4.78

Third target 4.88

#ZRO/USDT Ready to go higher#ZRO

The price is moving in a descending channel on a 15-minute frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at a price of 4.88

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 5.01

First target 5.13

Second target 5.23

Third target 5.38

#ZRO/USDT Ready to go higher#ZRO

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 6.15

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 6.35

First target 6.57

Second target 6.87

Third target 7.21

#ZRO/USDT Ready to go higher#ZRO

The price is moving in an ascending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 6.70

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 6.70

First target 6.88

Second target 7.20

Third target 7.49

#ZRO/USDT Ready to go higher#ZRO

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 6.08

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 6.308

First target 6.54

Second target 6.80

Third target 7.08

#ZRO/USDT Ready to go higher#ZRO

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 5.90

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 6.05

First target 6.38

Second target 6.62

Third target 6.94

#ZRO/USDT

#ZRO

The price is moving in a descending channel on a 30-minute frame upwards and is expected to continue.

We have a trend to stabilize above the moving average 100 again.

We have a downtrend on the RSI indicator that supports the rise by breaking it upwards.

We have a support area at the lower limit of the channel at a price of

4.70

Entry price 4.84

First target 4.93

Second target 5.05

Third target 5.20

#ZRO/USDT#ZRO

The price is moving in a descending channel on the 4-hour frame upwards and is expected to continue

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 3.30

Entry price 3.38

First target 3.57

Second target 3.70

Third target 3.93

#ZRO/USDT Ready to go up#ZRO

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 3.42

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 3.55

First target 3.69

Second target 3.84

Third target 4.03

#ZRO/USDT#ZRO

The price is moving in a descending channel on the 4-hour frame

And it is sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 3.75

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 4.00

First target 4.15

Second target 4.37

Third target 4.61

#ZRO/USDT#ZRO

The price is moving in a descending channel on the 1-hour frame and is sticking to it greatly and is about to break upwards

We have a bounce from the lower limit of the channel at a price of 4.00

We have a downtrend on the RSI indicator about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 4.00

First target 4.35

Second target 4.60

Third target 5.00

#ZRO/USDT#ZRO

The price is moving in a descending channel on the 1-hour frame and we are about to break it

We have a bounce from a major support area in green at 3.80

We have a downtrend on the RSI indicator that has been broken upwards

We have a trend to stabilize above the 100 moving average, which supports the rise

Entry price 3.96

First target 4.16

Second target 4.39

Third target 4.64

#ZRO/USDT#ZRO

The price is moving within a bearish channel pattern on the 4-hour frame, which is a strong retracement pattern

We have a bounce from a major support area in green at 3.67

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum, upon which the price is based higher at the discount

Entry price is 3.75

The first goal is 4.25

Second goal 4.57

Third goal 4.91

#ZRO/USDT#ZRO

The price is moving in a downward channel and has penetrated it and is returning from it strongly

.

We have a bounce from the green support area at 2.80

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that is about to break higher and supports the rise

Entry price is 3.25

The first goal is 3.60

The second goal is 3.90

Third goal 4.20

#ZRO/USDT#ZRO

The price is moving within a descending channel pattern on the 4-hour frame, which is a retracement pattern

We have a bounce from a major support area in the color EUR at 2.55

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum and the price is based on it

Entry price is 2.60

The first goal is 2.84

Second goal 3.03

Third goal 3.31

$TLT: Keep an eye on this$TLT has reached the end of a huge weekly and monthly down trend, and made me think it could be a long lasting bottom for fixed income here. Question is: Does this low hold after the next FOMC or not?

The daily chart shows a setup where a daily uptrend is set to expire by tomorrow, which could mean the current advance is over, or, perhaps, it needs some time sideways to build for a new move to the upside over time. If you can figure out what bonds will do, you have pretty big odds of getting all the rest right overall, so I'm extremely motivated to figure out what comes next here.

Keep an eye out for the daily signal outlook here, and be on guard for a weekly scale breakout to the upside to buy or add to existing longs.

Cheers,

Ivan Labrie.