Is Wheat ZW1 Ready for a Long Trade? Key Demand Area InsightsThe futures of Wheat ZW1! are reaching a weekly demand zone, where we observe non-commercials going long and retail traders holding short positions. This could present a potential setup for a long trade. Note: There is another demand area below, but the positions of commercials are less clear compared to non-commercials and retail traders.

Always manage your risk carefully if you agree with my analysis, and be sure to develop your own trading plan.

✅ Please share your thoughts about ZW1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Zw1

Will Dry Soil Lift Wheat's Price?Global wheat markets are currently experiencing significant attention as traders and analysts weigh various factors influencing their future price trajectory. Recent activity, particularly in key futures markets, suggests a growing consensus towards potential upward price movements. While numerous elements contribute to the complex dynamics of the grain trade, current indicators highlight specific supply-side concerns as the primary catalyst for this outlook.

A major force behind the anticipation of higher wheat prices stems from challenging agricultural conditions in significant production areas. The United States, a crucial global supplier, faces concerns regarding its winter wheat crop. Persistent dryness across key growing regions is directly impacting crop development and posing a material threat to achieving expected yields. This environmental pressure is viewed by market participants as a fundamental constraint on forthcoming supply.

Further reinforcing these concerns, official assessments of crop health have underscored the severity of the situation. Recent data from the U.S. Department of Agriculture revealed a winter wheat condition rating below both the previous year's level and average analyst expectations. This shortfall in anticipated crop health indicates a less robust supply picture than previously factored into market pricing, thereby increasing the likelihood of price appreciation as supply tightens relative to demand, even as other global factors like shifts in export prices from other regions introduce different market crosscurrents.

ZW | Wheat | InfoCBOT:ZW1!

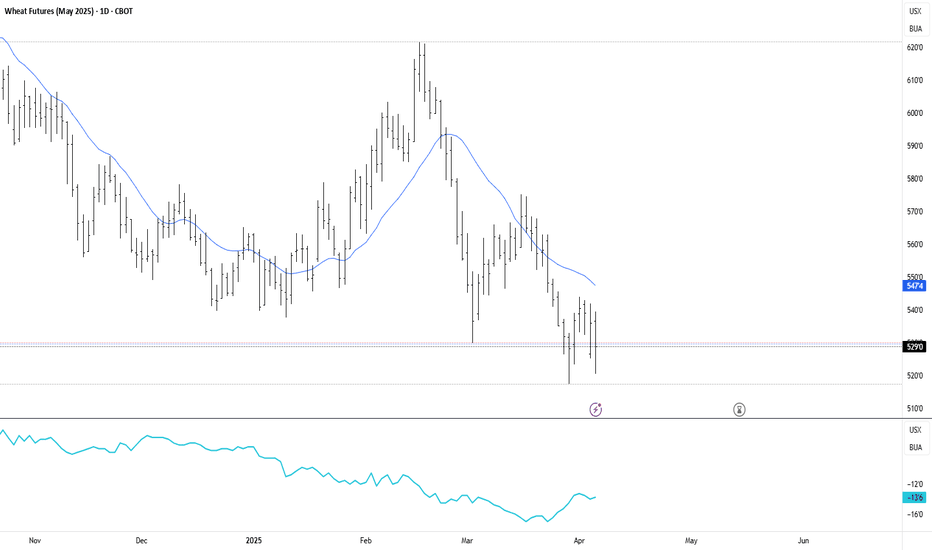

The Wheat Futures (ZW) market is currently in oversold territory across all timeframes. On the 30-minute chart, the RSI is below 10, a condition that is exceptionally rare and indicative of potential exhaustion in selling pressure.

Analysis:

Overall Trend: The overall trend remains bearish, as confirmed by the series of lower highs and lower lows visible on the chart.

Expectation: Despite the bearish trend, I anticipate the possibility of a counter-rally from the current levels. However, there is a lesser probability of the price moving further down to test the next major support, which I have identified as the extreme pain point.

Actionable Plan:

Key Levels: The chart features clearly marked Bullish (530’4) and Bearish (527’4) lines. These serve as critical breakout zones.

A break above 530’4 signals a safer entry for a long position, targeting the bullish retracement levels.

A break below 527’4 confirms further downside momentum, justifying a short position, targeting the bearish support levels.

Price Targets:

Bearish Targets: Calculated based on support zones, with the immediate levels at 520’0 and 514’2.

Bullish Targets: Based on Fibonacci retracement levels, which align precisely with key resistance areas.

Conclusion:

I recommend waiting for a confirmed breakout of either the Bullish Line (530’4) or the Bearish Line (527’4) before entering a position. This approach minimizes risk while capitalizing on the momentum toward clearly defined price targets.

Unlocking the Wheat Matrix: The Code to Dominating CommoditiesUnlocking the Wheat Matrix: The Code to Dominating Commodities

What if I told you there is a way to see the hidden signals of the market? To move not with the herd but ahead of it, where clarity reigns and profits follow. This week, we delve into Wheat (ZW) — a market where the COT strategy reveals its secrets. The choice is yours: read on and learn, or remain blind to the patterns all around you.

Decoding the Setup

Understand this: this is not an invitation to blindly leap into the market. No, we wait. Patience is the cornerstone of mastery. When the technical tools confirm the market’s strength, only then do we act. Now, let’s break down the wheat matrix:

Code 1: Commercial and Small Speculator Positioning

The Commercial COT Index, using a 26-week lookback, reveals that commercials are at an extreme in long positioning. At the same time, the Small Speculator COT Index shows small specs aligning at a similar extreme. In the wheat market, unlike others, we follow the small specs rather than fading them. A deviation from the norm—an anomaly in the matrix.

Code 2: Commercial Extremes in Net Positioning

Commercial entities are nearing their most bullish stance in three years. History whispers a truth: when commercials move like this, the market often follows.

Code 3: Contrarian Signal from Investment Advisors

The masses of investment advisors are overwhelmingly bearish. Against this backdrop, the extreme bullish positioning of commercials sends a powerful contrarian signal. The matrix is showing its hand.

Code 4: Valuation Metrics

Wheat stands undervalued against U.S. Treasuries. When value aligns with positioning, the code becomes clearer.

Code 5: Seasonal Patterns

Seasonal truths tell us that wheat’s true bottom often forms in early January. This aligns perfectly with the cyclical and technical signals currently emerging.

Additional Signs in the Matrix

Spread Divergence: Bullish spread divergence between front and next month contracts.

Accumulation Indicators: Insider Accumulation Index and Williams ProGo confirm accumulation.

Technical Tools: %R is in the buy zone, and Weekly Ultimate Oscillator Divergence further supports the bullish narrative.

Cycles: The Recurring Patterns

44-Month Cycle: A major bottom forms now.

830-Day Cycle: Signals an upward move into March.

151/154-Day Cycles: Align with a cyclical bottom occurring now, projecting strength into March.

The Red Pill of Action

With these signals converging, the urge to act immediately can feel irresistible. Don’t. The matrix requires patience. Let the market reveal its strength. When the time comes, you’ll ride the wave with confidence.

The Path to Mastery

Trading isn’t merely a series of moves; it’s a philosophy. The COT strategy is a key, but only those who seek mastery will unlock its full potential. If you’re ready to see the market for what it truly is, join Tradius Trades. Here, we don’t just navigate the matrix of commodities—we redefine it. Are you ready to free your mind?

Wheat: Bulls are Back! 🐂Wheat is once again showing its bullish side and is taking the first upward step out of the sideways movement of recent weeks. In the further course, the price should now continue the blue wave (c) and complete the superordinate wave A in turquoise. Following this, we expect a sell-off. Within the framework of our alternative scenario, however, it remains 37% likely that the price will once again fall below the support level at USX 495.25 in order to make a lower low of wave Alt. (b).

WHEAT Bearish pressure under the 1D MA50 and MA200.Wheat (ZW1!) has been trading within a long-term Channel Down pattenr since July 2022. The price is currently on a bearish sequence below both the 1D MA200 (orange trend-line) and 1D MA50 (blue trend-line). It appears that technically this is a Bearish Leg following the December 06 2023 Lower High rejection, similar to the one that started on the October 10 2022 Lower High.

That sequence reached the Channel Down bottom on the 1.786 Fibonacci extension. As a result, our long-term Target is 455'7.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WHEAT Struggling on the 1D MA200. Long-term sell opportunity.Wheat (ZW1!) has been trading within a Channel Down pattern since July 2022 and since early December has failed repeatedly to detach itself above the 1D MA200 (orange trend-line). Since it is closer to the top (Lower Highs trend-line) of the pattern and it resembles the February 14 High, we expect a strong selling sequence if the price breaks below the 1D MA50 (blue trend-line).

The previous Lower Low was priced on the 1.786 Fibonacci extension from the Lower High. That gives us a projected target of 413'0.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ZW1! Wheat LongWheat futures have broken out of a falling wedge pattern on positive divergence. The price broke out of the wedge to the upside, then it back-tested the wedge from above, and proceeded to move up aggressively today. This is an objective buy signal.

The most common investment vehicle for this trade is WEAT, an ETN backed by wheat futures.

WHEAT Short From Resistance! Sell!

Hello,Traders!

WHEAT is retesting a broken

Key horizontal level of 580'0

Which is now a resistance

And as wheat is in the

Local downtrend I am

Bearish biased so I will

Be expecting a move down

Sell!

Like, comment and subscribe to help us grow!

Check out other forecasts below too!

Wheat: Harvest time is coming soon! 🌾🚜The price of wheat is currently moving very much in line with our expectations and will soon reach our turquoise target zone between USX 560.60 and 531.10, where the low of the magenta wave (b) is expected. Then we should finally see a reversal and a broad-based rise to USX 807.25. Should the price fall below this zone, we would not change our scenario significantly, but would only expect a move further towards the magenta target zone.

ZW1! Will Grow! Buy!

Here is our detailed technical review for ZW1!.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 703'2.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 812'7 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

Wheat - Too FastNature is beautiful.

It's always balancing the underlying energy.

That's what we see here.

Wheat spurted down too fast.

The down-swing can be put in context by the Medianlines.

Here, price has reached it's balance again at the CL.

What's next? I bet for sideways to short action, until we crack the orange CIB line.

Stalking Hat on...

Wheat predictions: How winding up grain deal blows up the price The world is "not optimistic" that the grain-export corridor that has allowed it to ship more than 30 million tons of crops amid the Russia - Ukraine tensions will be extended beyond July, the country’s infrastructure minister said Wednesday.

The efficiency of the Black Sea corridor is faltering and crop volumes are declining. Even if prolonged, it won’t be as helpful in offloading the nearing 2023 harvests in its current state.

"We are doing our best in order to maintain this initiative", - Mr. Kubrakov (who signed the deal) said.

The deal — which was brokered by the United Nations and Turkey — has helped lower world food prices and maintain a sector that is vital for Ukraine’s economy.

It is next up for renewal on July 17, nearby July, 2023 CBOT:ZWN2023 Wheat Futures contract expiration.

Russian President Vladimir Putin already signaled that his nation may quit the pact, though the UN has urged all parties to press on.

There are no prerequisites for extending the grain deal, Mr. Peskov, press secretary of the Russian President said on June 21.

The deal has recently been plagued by a persistent slowdown in ship inspections, and Russia’s refusal to approve vessels headed to one of the three ports it covers.

Some 1.3 million tons of crops were shipped via the corridor in May, less than a third of the peak in October, UN figures show.

The technical picture indicates, Wheat Futures contracts are heading up for the 5th consecutive weeks in a row, second time since Q1 2022, last time due to widely known tensions between Russia and Ukraine.

With almost 30 percent gain from 2023 low near 575 cents per bushel, the price breaking up 1/2-year simple moving average, with further upside opportunities, up to 800 cents per bushel.