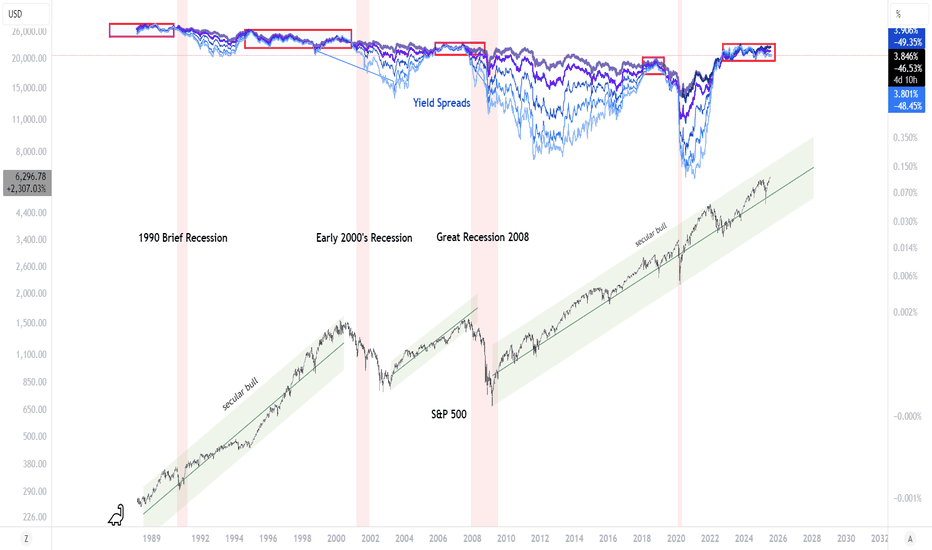

Yield Spreads Warning About the Secular Bull MarketAre we in the final innings of the current secular bull market that emerged from the robust injection of liquidity in response to the 2008 Financial Crisis? Yield spreads are giving us a warning and one that should not be dismissed. Yield spreads show (shorter to longer in lighter blue to darker blue) a spread that has been shrinking, for quite some time. The yield curve has been inverted for a while too. As we tread these dangerous waters, one has to wonder, when and where will the next event to cause a credit contraction come from? Is it a bubble? Can it be AI, Credit, geopolitics, currency based? Something will distress the credit markets and, as long as the yield spread remains shrunken, this event will almost certainly cause a recession. TVC:US02Y PYTH:US10Y TVC:US30Y SP:SPX

Government bonds

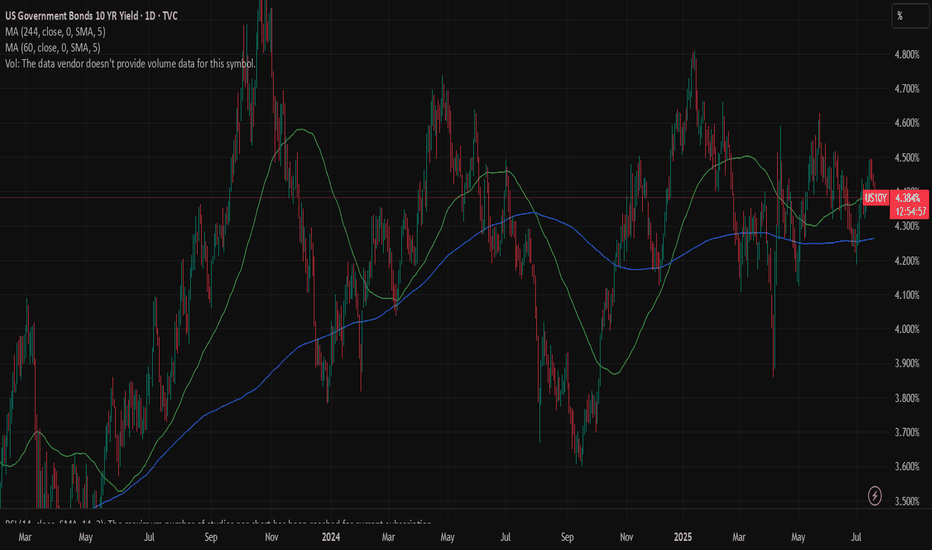

US 10Y TREASURY: June data cools rate cut hopesThe US inflation and jobs data shaped investors sentiment during the previous week, where 10Y US Treasury yields eased as of the end of the week. The US inflation remains relatively steady and in line with expectations, with 0,3% increase in June or 2,7% y/y. The producers price Index was holding at 0% in June, while the University of Michigan inflation expectations also eased to 4,4% for the year and 3,6% for a five years inflation expectations. June Retail Sales surprised the market with a 0,6% increase for the month.

At the start of the week, 10Y yields reached their highest weekly level at 4,49%, and took a downturn during the second part of the week. The lowest weekly level reached was 4,41% on Friday. As US macro data remains relatively robust, the current market expectations for a rate cut in July are almost diminished. Traders now expect any rate cuts to be delayed to September or later. As per CME FedWatch Tool, odds for September rate cut slipped from 70% down to current 50%. As the week ahead does not bring any currently significant macro data, it could be expected that also 10Y Treasury yields could have a relatively calmer week. It will be used for digesting current macro data and to gear up for the last week of July, when the next FOMC meeting is scheduled.

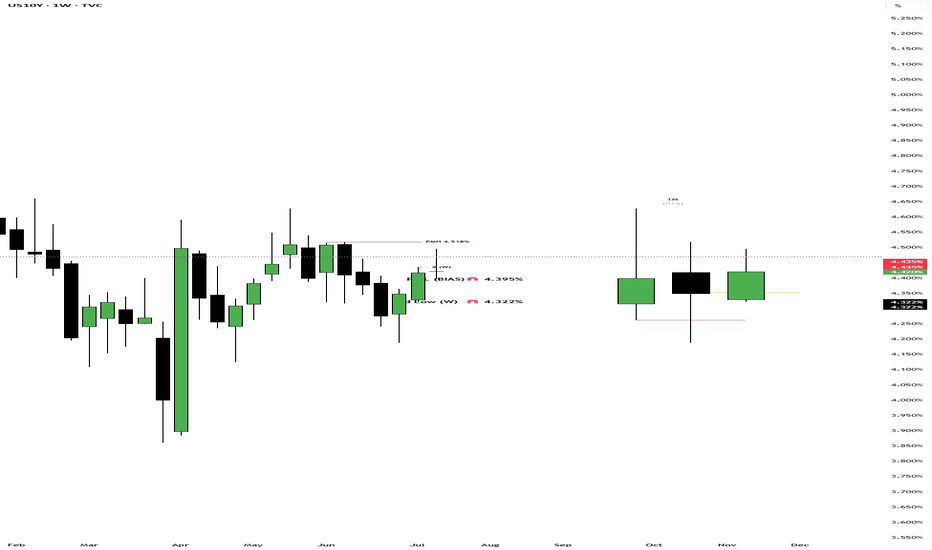

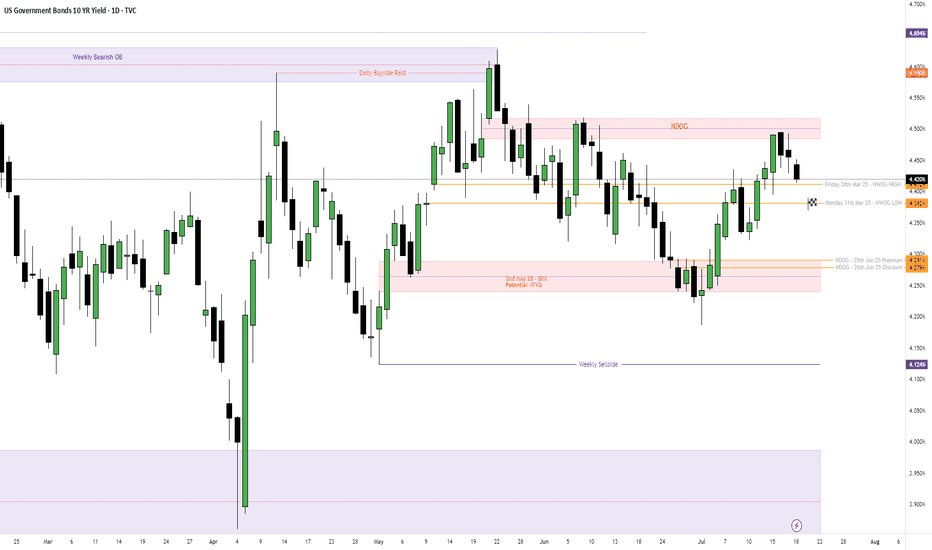

UST 10Y Technical Outlook for the week July 21-25 (updated dailyUS Treasury 10Y Technical Outlook for the week July 21-25 (updated daily)

Overnight

On Friday, the yield on the US 10-year Treasury note slightly declined to 4.44%, driven by investor reactions to the latest University of Michigan Consumer Sentiment data and remarks from Federal Reserve Governor Christopher Waller. The consumer sentiment index rose in July, accompanied by lower inflation expectations for both short- and long-term horizons. Waller expressed support for a potential rate cut in July, indicating he might dissent if the Federal Open Market Committee chooses to maintain current rates. However, market expectations remain focused on no rate changes this month, with two quarter-point cuts anticipated in September and December. Earlier data highlighted robust consumer spending through strong retail sales, alongside softer-than-expected core CPI and PPI figures.

Economic Release for the Week www.myfxbook.com

Weekly Bias

For the week I am expecting last weeks low of 4.395% to be mitigated to previous old low of 4.322%. I am basing this assumption based on the price action last week and how the weekly candle closed weekly (pin bar). Will start the analysis on daily bias on Tuesday.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

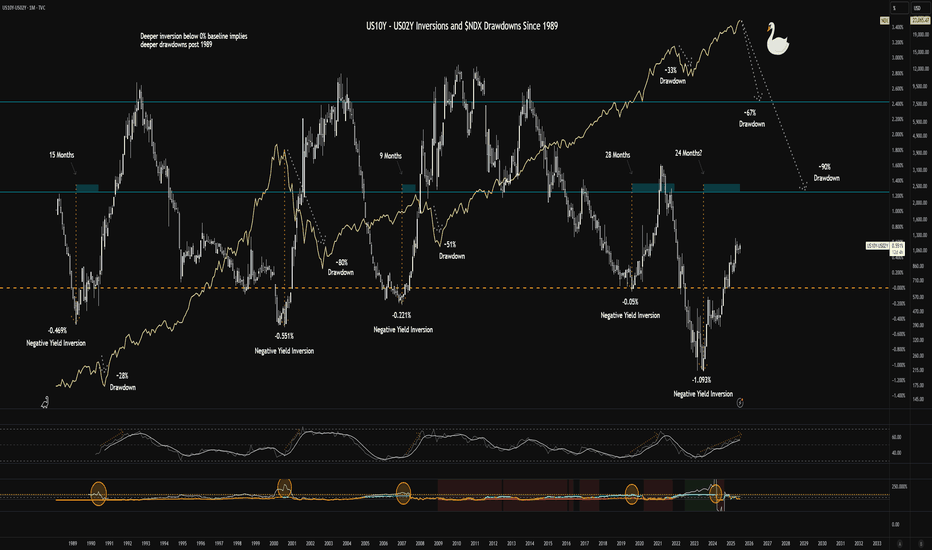

$US10Y - $US02Y Inversion and $NDX Drawdowns Since 1989I cleaned the chart a bit for readability.

The chart shows historical inversions in the TVC:US10Y and TVC:US02Y and the drawdowns in the NASDAQ:NDX that followed. The implication is that we should expect to see a >50% drawdown within 4 months. I'm not calling the "why" but only drawing parallels to historical price action following bond market environments.

My current interpretation is that we're headed for stagflation - interest rates will be stickier than consensus takes driven by market uncertainty and increasing energy prices. The Trump administration seems to be pushing for policies that would alleviate pain from stagflation. The next revolution in technology promises massive productivity gains with respect to efficiencies in money transfers and back-end business operations in general. Unemployment will continue to rise as automation begins to increase.

The market will take time to find its bearings (upskilling and learning curves for employees and employers).

The Ai boom requires energy - more than we currently have capacity for. Companies will have to finance this build-out with vast sums of money. The reward will take time to harvest. Pain in the real economy will dampen consumption for a while.

Price action in Ai and technology companies has outpaced realized gains - we are at the front-end of this curve, much like the dotcom bubble.

Speculative bubbles like BITSTAMP:BTCUSD represent a direct threat to control over monetary policy for the reserve currency and hegemony. I am still very long USA (Dollar Milkshake). CRYPTOCAP:BTC has real value for struggling economies eclipsed by the majors, but for holders of this asset in the western world, large gains in CRYPTOCAP:BTC would necessarily depend on the collapse of civilization as we know it, implying a logical paradox for people that expect outsized returns. CRYPTOCAP:BTC.D demonstrates the loss of share of market cap well.

I invite comments with legitimate rational criticism as I'm always looking to improve my thinking about this topic.

Long ideas (comment additional tickers):

Utility-driven tokens enabling this new paradigm - BITSTAMP:XRPUSD COINBASE:XLMUSD COINBASE:ICPUSD COINBASE:LINKUSD BITFINEX:XDCUSD COINBASE:HBARUSD etc.

Inelastic staples - NYSE:LLY NYSE:BUD NYSE:PM

Energy and Ai infra - NASDAQ:ABAT AMEX:WWR NASDAQ:ENVX NASDAQ:PLUG NYSE:LAC AMEX:LEU NYSE:SMR NYSE:CHPT NYSE:KMI NYSE:QS NASDAQ:ITRI NASDAQ:ENPH NASDAQ:FSLR NASDAQ:CLSK NASDAQ:TSLA KRAKEN:EWTUSD

Disruption Beneficiaries - NYSE:WU AMEX:UPW NASDAQ:OPEN BOATS:PYPL NYSE:FIS NYSE:XYZ NASDAQ:FIVN NASDAQ:BGM

Short ideas:

NASDAQ:MSTR NASDAQ:PLTR NASDAQ:META NYSE:ED NYSE:EIX NYSE:PCG BOATS:XOM NYSE:CVX

I am employing long-expiry, OTM verticals to improve costs of trades or synthetic longs on moonshot names if not holding shares outright.

Share your comments. Good luck to all!

$NDX Black Swan Correlation of Variance from 0% of $US10Y $US02YIt appears that since 1989, deeper inversions of the yield curve have led to deeper drawdowns in the $NDX. Relative strength always appears to be in a steeper move upward coupled with fuzzy signals in volatility before the drawdown. Based on the previous market crashes, anything from a 60% to 90% drawdown appears to be plausible.

Currently buying long-expiry OTM put verticals across tech meme names (think NASDAQ:PLTR ) and potentially on some stalwart Mag7 tickers (maybe NASDAQ:META ) for pennies for potentially massive risk/reward paydays. Nothing more than a few grand, but I'm also long exposure to battery materials, hydrogen, and other energy plays. NASDAQ:ABAT NASDAQ:PLUG AMEX:WWR NYSE:LAC NASDAQ:ENVX NYSE:CHPT AMEX:LEU NYSE:SMR

Best of luck.

US10Y UNITED STATES GOVERNMENT 10 YEAR BOND YIELD .US 10-Year Treasury Yield Reaction to July 15, 2025 Economic Data

Key Economic Data (July 15, 2025)

Indicator Actual Forecast Previous

Core CPI m/m 0.2% 0.3% 0.1%

CPI m/m 0.3% 0.3% 0.1%

CPI y/y 2.7% 2.6% 2.4%

Empire State Mfg Index 5.5 — -8.3

Market Reaction: US 10-Year Treasury Yield

Yield Movement:

The US 10-year Treasury yield rose sharply to 4.495% on July 15, 2025, up from 4.43% the previous market day—a gain of 7 basis points.

Immediate Cause:

This jump occurred as the inflation data, while showing softer core CPI than forecast, delivered a higher-than-expected annual CPI (2.7% y/y vs. 2.6% forecast) and robust CPI m/m. Additionally, the Empire State Manufacturing Index rebounded strongly, further supporting concerns over persistent price pressures and economic momentum.

Market Interpretation:

Investors increasingly scaled back expectations for near-term Federal Reserve rate cuts, causing a sell-off in Treasuries and pushing yields higher.

Persistent inflation—especially with annual CPI running above consensus—suggests the Fed may need to keep rates higher for longer, amplifying bond market volatility.

The improved manufacturing sentiment also fueled the belief that the US economy remains resilient, reinforcing the hawkish read on interest rates.

Summary Table: US 10-Year Yield

Date Yield Daily Change

July 15, 2025 4.495% +0.07%

July 14, 2025 4.43% —

Key Takeaways

US10Y jumped by 7 bps to its highest level in five weeks after the mixed inflation report and strong manufacturing data.

Investor sentiment shifted toward fewer and later Fed rate cuts as inflation proved more stubborn than forecast.

The yield reaction underscores ongoing sensitivity to inflation surprises and economic resilience in 2025.

The bond market’s move highlights that even minor upsets to the inflation outlook can quickly ripple through rates, especially when compounded by positive growth signals.

#US10Y

US30Y Bullish ideaThis is a potential idea of the 30 year bond yield potentially having movement to the upside. We have already reached into a daily volume imbalance and weekly volume imbalance. We also have a monthly order block that is acting as support combined with our volume imbalance levels. We also have relative strength with the US30Y against the US10Y and US5Y. Could be a potential idea to look for bullish ideas with the the fact that we are in a potential point were we could have a Quarterly shift.

*Targeting

A move to the upside were we have buyside liquidity and the 4H fair value gap.

US Treasury 10Y Technical Outlook July 14-18 (updated daily)US Treasury 10Y Technical Outlook for the week July 14-18 (updated daily)

Overnight

On Friday, the US 10-year Treasury note yield increased by nearly 4 basis points to approximately 4.39%, driven by market concerns over new tariff threats from President Trump. These include a proposed 35% tariff on Canadian imports starting August 1, 2025, and planned 15-20% tariffs on most other trading partners, up from the current 10%. Additional tariffs include 50% duties on Brazilian imports and copper, alongside formal notices to other key trading partners, intensifying trade tensions. Despite these developments, the US Treasury reported strong demand for its recent auctions, with $22 billion in 30-year bonds and $39 billion in 10-year notes. On monetary policy, markets anticipate the Federal Reserve will maintain current interest rates at its next meeting, with expectations of two 25-basis-point rate cuts by the end of 2025. Source: TradingView News (Trading Economics)

Economic News for the week www.myfxbook.com

Daily Technical Outlook

With the strong bearish (in price) close on Friday and the week, there’s a chance market will target 4.435% and for the week 4.462%. With the strong influence by fundamental please continue to watch the tariff updates and policy adjustments as this are the strong drivers of market moves the past week. This week will be inflation rate week due on Tuesday.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

US 10Y TREASURY: tariff tensions rattle bonds During the previous week there has not been important US macro data scheduled for a release, however, news regarding tariffs has been the ones which shaped investors sentiment and also, US bond yields. It was indeed a no-clear-direction trading week when it comes to 10Y Treasury benchmark yields. The week started with a strong move to the upside, from 4,32% up to 4,39, then there was a push back, while yields ended the week at 4,41%. News regarding tariffs were the ones that shaped Friday's sentiment on the market.

Saturday brought news that the US Administration is implementing tariffs of 30% on goods imports from Europe and Mexico. This information is still not reflected in market yields, but will certainly be with the start of the trading week on Monday. Aside from tariffs news, the week ahead brings some important US macro data, like June inflation, PPI and University of Michigan Consumer Sentiment on Friday, implying that another volatile week is ahead.

GB10Y UK GOVERNMENT 10 YEAR BOND YIELD

The current Governor of the Bank of England is Andrew Bailey.

Appointment: Andrew Bailey has served as Governor since March 16, 2020, and his term runs until March 15, 2028.

Role: As Governor, he chairs the Monetary Policy Committee, Financial Policy Committee, and Prudential Regulation Committee.

Background: Prior to his appointment as Governor, Bailey was Chief Executive Officer of the Financial Conduct Authority (FCA) and has held several senior roles within the Bank of England, including Deputy Governor for Prudential Regulation.

Recent Activity: He remains active in shaping UK monetary policy and financial stability, and was recently nominated as the next Chair of the Financial Stability Board, beginning July 2025.

Andrew Bailey continues to lead the Bank of England through significant economic and financial developments.

Upcoming UK Economic Reports (July 13–17, 2025)

Below is a schedule of major UK economic releases and events for the coming week, with local times (BST):

Date Time (BST) Event

July 13, Sun 06:00 AM Core Inflation Rate MoM

July 13, Sun 06:00 AM Retail Price Index MoM

July 13, Sun 06:00 AM Retail Price Index YoY

July 14, Mon 12:00 PM NIESR Monthly GDP Tracker

July 14, Mon 11:01 PM BRC Retail Sales Monitor YoY

July 15, Tue 09:00 AM Treasury Stock 2032 Auction

July 15, Tue 08:00 PM BoE Governor Andrew Bailey Speech

July 16, Wed 06:00 AM Inflation Rate YoY

July 16, Wed 06:00 AM Core Inflation Rate YoY

July 16, Wed 06:00 AM Inflation Rate MoM

July 16, Wed 06:00 AM Core Inflation Rate MoM

July 16, Wed 06:00 AM Retail Price Index MoM

July 16, Wed 06:00 AM Retail Price Index YoY

July 16, Wed 09:00 AM Treasury Gilt 2034 Auction

July 17, Thu 06:00 AM Unemployment Rate

July 17, Thu 06:00 AM Average Earnings incl. Bonus (3Mo/Yr)

July 17, Thu 06:00 AM Employment Change

July 17, Thu 06:00 AM Average Earnings excl. Bonus (3Mo/Yr)

July 17, Thu 06:00 AM HMRC Payrolls Change

July 17, Thu 06:00 AM Claimant Count Change

July 17, Thu 09:00 AM Treasury Gilt 2030 Auction

Note: All times are in British Summer Time (BST). These events are subject to change based on official updates.

Key releases include inflation data, labor market statistics, retail sales, and several government bond auctions. The Bank of England Governor's speech is also a major event for markets with price volatility .

the UK 10-year gilt yield (UK10Y) is approximately 4.63%, having edged up 0.03 percentage points from the previous session. Over the past month, it has risen about 0.15 points and is 0.52 points higher than a year ago, reflecting persistent inflation concerns and expectations about Bank of England (BoE) monetary policy.

Correlation Between UK10Y, UK10, and GBP Strength

UK10Y Yield and GBP:

The 10-year gilt yield is a key indicator of UK long-term borrowing costs and investor sentiment. Higher yields typically attract foreign capital seeking better returns, which tends to strengthen the British pound (GBP). Conversely, expectations of BoE rate cuts or economic weakness can pressure yields lower and weaken GBP.

Recent Dynamics:

Despite inflation remaining above 3%, the UK economy has shown signs of contraction (GDP shrinking 0.1% in May), prompting markets to price in an 80% chance of a BoE rate cut in August. This has led to some volatility in yields and GBP strength.

The BoE’s policy rate has already been reduced from 5.25% to 4.25% over the past year, and further easing is anticipated, which can weigh on the GBP.

UK10 (Shorter-Term Yields) vs. UK10Y:

Shorter-term gilt yields (e.g., 2-year or 5-year) tend to be more sensitive to immediate BoE policy moves, while the 10-year yield reflects longer-term inflation and growth expectations. A steepening yield curve (rising long-term yields relative to short-term) can indicate confidence in economic recovery and support GBP. A flattening or inverted curve may signal caution and pressure GBP.

GBP Strength Mixed; supported by higher yields but pressured by economic slowdown and easing expectations

Yield Curve Moderately steep, reflecting growth/inflation expectations

In essence: The UK 10-year gilt yield at 4.63% supports GBP strength by attracting yield-seeking capital, but the expected BoE rate cut and economic weakness introduce downside risks. The interplay between short- and long-term yields and BoE policy guidance will continue to influence GBP’s trade directional bias .

UK GOVERNMENT 10 YEAR BOND PRICE GB10Relationship Between GB10 Price and GBP Strength

Inverse Relationship:

Bond prices and yields move inversely. When gilt yields rise (due to inflation concerns or expectations of tighter monetary policy), gilt prices fall. Conversely, if yields fall, prices rise.

Impact on GBP:

Higher UK gilt yields, reflecting higher interest rates or inflation expectations, tend to attract foreign capital seeking better returns. This supports demand for the British pound (GBP), strengthening the currency.

However, if yields rise due to inflation fears without confidence in economic growth, or if rate cuts are expected, GBP strength may be limited.

Current Market Context:

The UK economy has shown signs of contraction, and markets are pricing in an 80% chance of a Bank of England rate cut in August 2025. This dynamic creates some volatility:

Yields remain elevated (4.63%), supporting GBP.

Expectations of easing may cap GBP gains and pressure gilt prices higher (yields lower).

GBP Strength Supported by higher yields but tempered by expected BoE easing

Market Drivers Inflation, economic contraction, BoE rate expectations

Conclusion

The current UK 10-year gilt price near 99.0 and yield around 4.63% reflect a market balancing inflation risks and economic slowdown. Elevated yields help support GBP strength by attracting yield-seeking investors, but the prospect of Bank of England rate cuts and economic weakness limit upside for the pound.

#GBP #GB10 #GB10Y

UNITED STATE GOVERNMENT 10 YEAR BOND YIELD US10Y1. US 10-Year Treasury Yield (US10Y)

The 10-year Treasury yield is approximately 4.39%, up about 0.04 percentage points from the previous session (July 10, 2025).

Over the past month, the yield has edged up slightly by around 0.02 points and is about 0.20 points higher than a year ago.

Market expectations project the 10-year yield to average around 4.28% by the end of Q3 2025, with a gradual decline to about 4.06% in 12 months.

The yield increase reflects ongoing market pricing of Fed rate policy, inflation expectations, and economic growth prospects.

2. US Dollar Index (DXY)

The DXY is trading near 97.758, reflecting a modest decline over the year.

The index is influenced by Fed policy expectations, global risk sentiment, and interest rate differentials.

A stronger 10-year yield tends to support the dollar, but recent tariff uncertainties and geopolitical risks have contributed to some volatility.

3. Bond Prices and PIMCO Active Bond ETF (BOND)

Bond prices move inversely to yields; with yields rising slightly, bond prices have shown minor declines.

The PIMCO Active Bond Exchange-Traded Fund (BOND) is trading around $91.50, essentially flat on the day, reflecting a diversified portfolio of fixed income instruments.

This ETF invests mainly in investment-grade debt but can hold up to 30% in high-yield securities, providing exposure to a broad range of bonds.

4. Federal Reserve Chairman

The current Chairman of the Federal Reserve is Jerome H. Powell, serving since February 2018 and reappointed in 2022 for a term through 2026.

Powell’s leadership continues to focus on balancing inflation control with economic growth, navigating trade uncertainties, and signaling a cautious but data-driven approach to future rate changes.

Summary Table

Metric Latest Data (July 2025) Notes

US 10-Year Treasury Yield 4.39% Slight increase; reflects Fed policy pricing

US Dollar Index (DXY) 97.75 Modest decline YTD; sensitive to yields and tariffs

PIMCO Active Bond ETF (BOND) $91.50 Stable; diversified fixed income exposure

Fed Chairman Jerome H. Powell Leading Fed policy since 2018, reappointed 2022

Market Context

The modest rise in the 10-year Treasury yield signals market confidence in the US economy but also reflects inflation concerns and Fed policy expectations.

The DXY’s relative stability amid tariff uncertainty suggests balanced market sentiment toward the dollar.

Bond investors remain cautious, with diversified funds like PIMCO’s BOND ETF offering a buffer against volatility.

Fed Chair Powell’s guidance continues to emphasize data dependency, with markets watching closely for signals on rate adjustments.

#FEDS #DOLLAR

CANADIAN GOVERNMENT 10 YEAR BOND YIELD CA10YCanada 10-Year Bond Yield CA10Y

The Canadian 10-year government bond yield is 3.43-3.419%% as of July 10, 2025, slightly up from the previous session and close to its level a year ago.

Trend: The yield has edged up by about 0.06 percentage points over the past month, but remains below its long-term average of 4.25%.

Economic Outlook

Growth Forecast: GDP growth for 2025 is now expected at 1.0%–1.25%, revised down from earlier forecasts due to trade tensions and a cooling labor market.

Risks: The outlook is tilted to the downside, with rising unemployment (7% in May, projected to reach 7.5% by year-end) and weakened consumer/business sentiment.

Monetary Policy: The Bank of Canada has held its policy rate at 2.75%, with expectations of a rate cut to 2.25% by year-end as growth headwinds persist.

Regional Performance: Some provinces, like Newfoundland and Labrador, are seeing upgrades due to resource production, but overall national performance is subdued.

Upcoming Economic News

July 15: New Motor Vehicle Sales (May data) and Monthly Survey of Manufacturing.

July 16: 30-Year Bond Auction.

July 17: CFIB Business Barometer, Foreign Securities Purchases.

July 21: Producer Price Index (PPI) MoM release.

Ongoing: Industrial production and retail sales data will provide further insight into growth trends.

US Tariff Effect

New Tariffs: The US announced a 35% tariff on Canadian imports effective August 1, 2025, escalating trade tensions.

Economic Impact:

These tariffs are expected to weigh heavily on Canadian exports, business investment, and employment, given Canada’s high trade exposure to the US.

The Canadian dollar fell in response to the tariff announcement, reflecting market concern over the impact on Canada’s export-dependent economy.

Sectoral Risks: Manufacturing and auto sectors are particularly vulnerable, with job losses already concentrated in trade-exposed regions.

Policy Response: The Bank of Canada has cited trade uncertainty as a key reason for maintaining a cautious monetary stance, with further easing likely if conditions deteriorate.

Summary Table

Indicator Latest Value / Outlook Notes

10-Year Bond Yield 3.43% Slightly up, below long-term average

GDP Growth (2025) 1.0%–1.25% Downgraded due to trade/labor headwinds

Unemployment Rate 7% (May), 7.5% (year-end est.) Rising, especially in trade-exposed sectors

BoC Policy Rate 2.75% (cut to 2.25% expected) Cautious, possible further easing

US Tariffs 35% from Aug 1, 2025 Significant downside risk

Key Economic News July 15–21: Sales, PPI, auctions Manufacturing, trade, and price data

In summary:

Canada’s 10-year bond yield remains stable but below historical averages. The economic outlook is subdued, with downside risks from rising US tariffs, a softening labor market, and weak business sentiment. Upcoming economic releases will be closely watched for further signs of stress, especially as new US tariffs threaten to further dampen growth and confidence.

#CA10Y #BOND #BONDYIELD

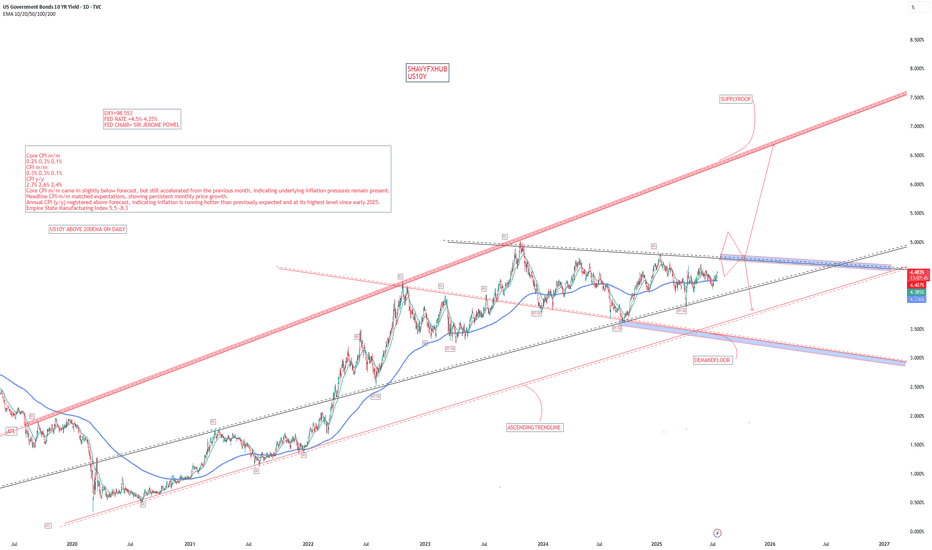

US10Y: New Multi Decade Highs are coming for Treasury Yields!📈 US10Y: Treasury Yields Are About to Explode Higher

Longing bonds was the consensus trade heading into 2025. Everyone expected a “flight to safety” as equities tanked, but guess what? Bonds have been a massive disappointment. Instead, Bitcoin and Gold have stolen that narrative—who saw that coming?

But here’s the real kicker…

The 10-Year Treasury Yield is now forming a textbook Wyckoff Distribution Schematic #2, and we’re entering Phase B with a potential Upthrust (UT) forming. That means yields could be gearing up for a massive breakout, putting serious pressure on leveraged bond bulls.

My projection?

We’re heading to the 2.272–2.414 Trend-Based Fib Extension, targeting 5.53% to 6.42%. That’s a multi-decade high in yields.

If you’re holding bonds with leverage...

🔥 You might want to sleep with one eye open.

And no—this isn’t about the Fed, or politics, or CPI print tea leaves. Fundamentals don’t lead—technicals do.

UNITED STATES 10 YEAR GOVERNMENT BOND YIELD US10YMarket Context

The yield reflects investor expectations for Federal Reserve policy, inflation trends, and US fiscal conditions.

Markets are pricing in potential Fed rate cuts later in 2025, but persistent inflation and fiscal concerns are keeping yields and pending a clear directional bias .

The US 10-year yield is a key benchmark for borrowing costs and is closely watched as a “risk-free” rate for global financial markets.

Summary

US10Y is currently at 4.35%-4.332%,

The yield awaiting further economic data and central bank signals.

US 10Y TREASURY: September rate cut?Jobs data posted during the previous week shaped investors sentiment. The JOLTs job openings in May reached the level of 7.769M, higher from market forecast of 7,3M. The main impact on the market came from the NFP data for June, with 147K new jobs, above market expectations of 110K. At the same time, unemployment fell to 4,1% in June. Strong jobs data significantly decreased market expectations that the Fed might potentially cut interest rates at July's FOMC meeting. Current odds still hold for September's cut.

A “higher for longer” is again wording used by market participants. The 10Y Treasury yields adjusted to that expectation by increasing yields from 4,2% toward 4,33% as of the end of the week. In a week ahead, there are no currently significant US macro data scheduled for a release. In this sense, it could be expected a short relaxation of the 10Y yields, where levels between 4,3% and 4,8% could be shortly tested.

UST 10Y Technical Outlook for the week July 7-11 (UPDATED DAILY)US Treasury 10Y Technical Outlook for the week July 7-July 11 (updated daily)

Overnight

The US 10-year Treasury yield increased by 6 basis points to 4.34%. A stronger-than-expected jobs report triggered the rise. Nonfarm payrolls reached 147,000 in June. April and May payroll figures were revised higher. The unemployment rate dropped to 4.1%. Wage growth slowed to 0.2%. Investors eliminated expectations for a July Federal Reserve rate cut. The probability of a September rate cut fell to approximately 80%. Fed Chair Powell advocated a cautious approach. A significant bill advanced through Congress.

Source: TradingView News (Trading Economics)

Economic Release week July 7-11 www.myfxbook.com

Technical Outlook

Monthly Chart, I am expecting a support (in px) at 4.37%, the 50% fib level of previous month. If it continuous to punch through then I would expect a target of previous month high of 4.518% is in play. Weekly Chart, following a sweep of previous week low with strong rejection, I am expecting market to target previous week high (PWH) of 4.407%. It is also worth to note that the week is closing above 50% range of last week with no signs of rejection. Daily chart, , yesterday I mentioned “ wich leads me to expect a continuation to target yesterday’s high of 4.308%” the lvl was reached and market closed through the previous day’s high which leads me to expect the next daily target will be

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.