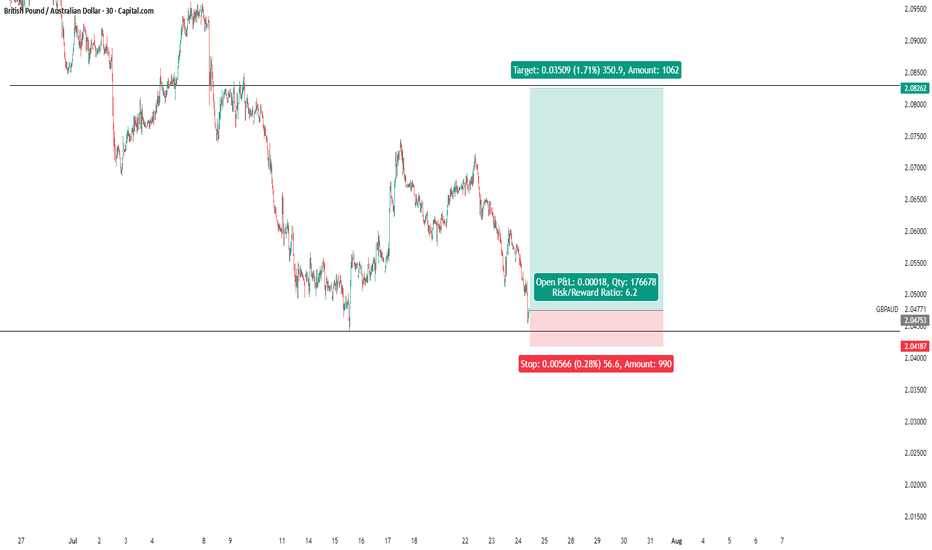

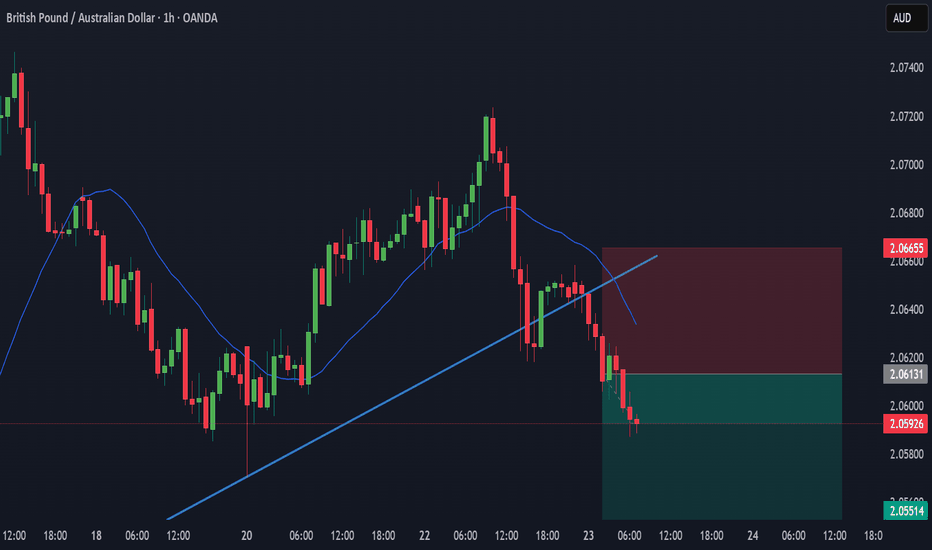

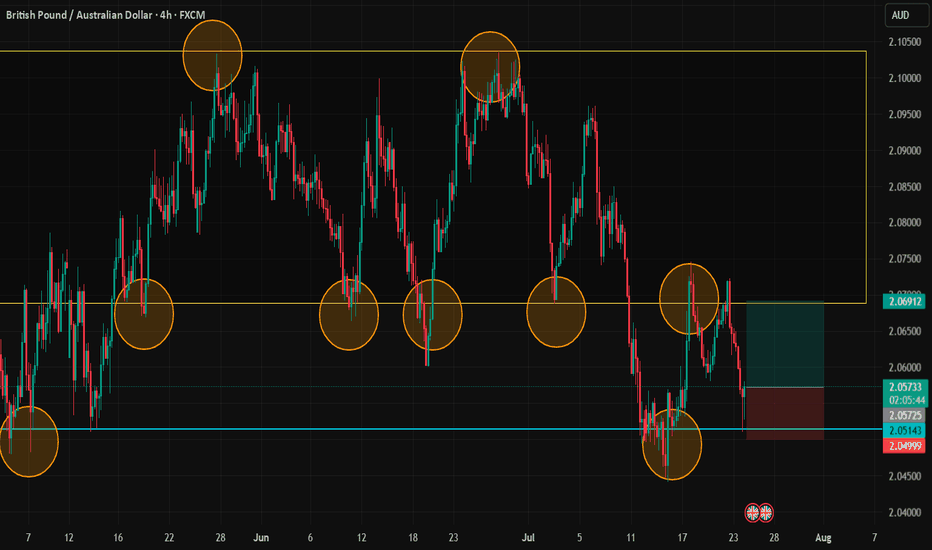

GBPAUD BUY SIGNAL. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Forex market

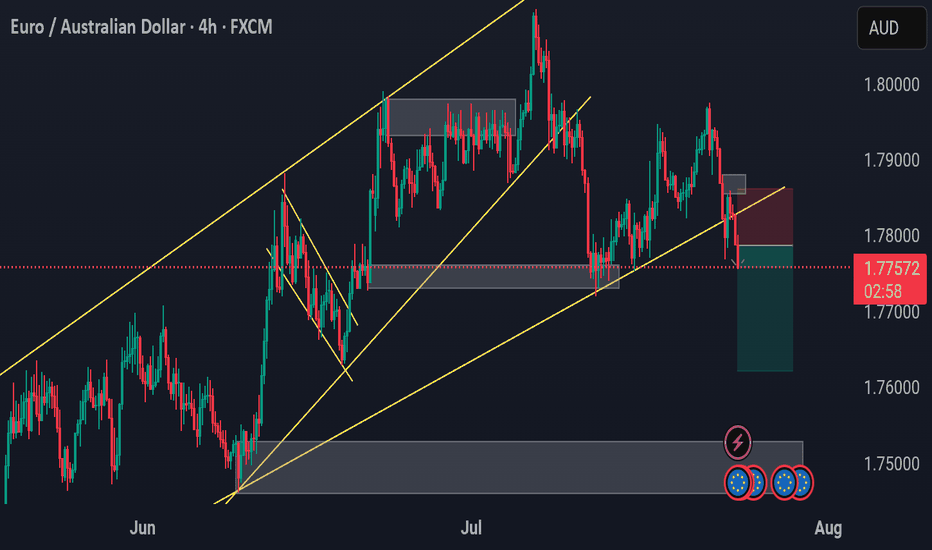

EURAUD SELL EURAUD SELL

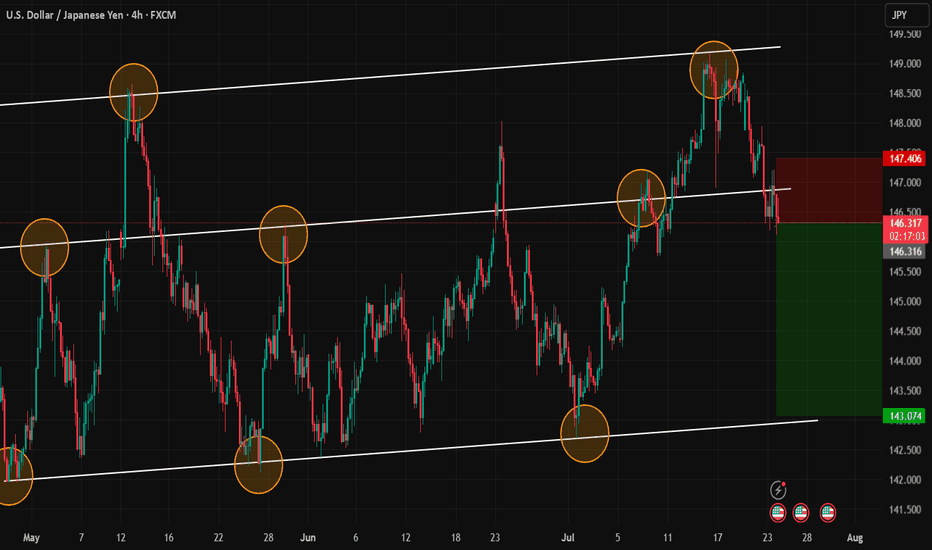

🕒 4H Chart | FXCM Feed

Price has broken out of the ascending channel and is now rejecting a key supply zone with a clean break and retest. We anticipate continued bearish movement.

🔹 Sell Entry: 1.77675

🔹 Stop Loss: 1.78500 (−82.5 pips)

🔹 Take Profit 1: 1.76500 (+117.5 pips)

🔹 Take Profit 2: 1.75500 (+217.5 pips)

🔹 Take Profit 3: 1.74500 (+317.5 pips)

📊 Risk:Reward Ratios:

TP1 ≈ 1.42R

TP2 ≈ 2.63R

TP3 ≈ 3.85R

📎 Confluences:

✔️ Ascending channel break

✔️ Bearish retest of structure

✔️ Supply zone reaction

✔️ Clean downside space into demand zone

🔔 Partial profits at TP1 or SL to BE is advised. Let runners play if price flows cleanly.

📅 Signal Date: July 24, 2025

📢 @PulseTradesFX

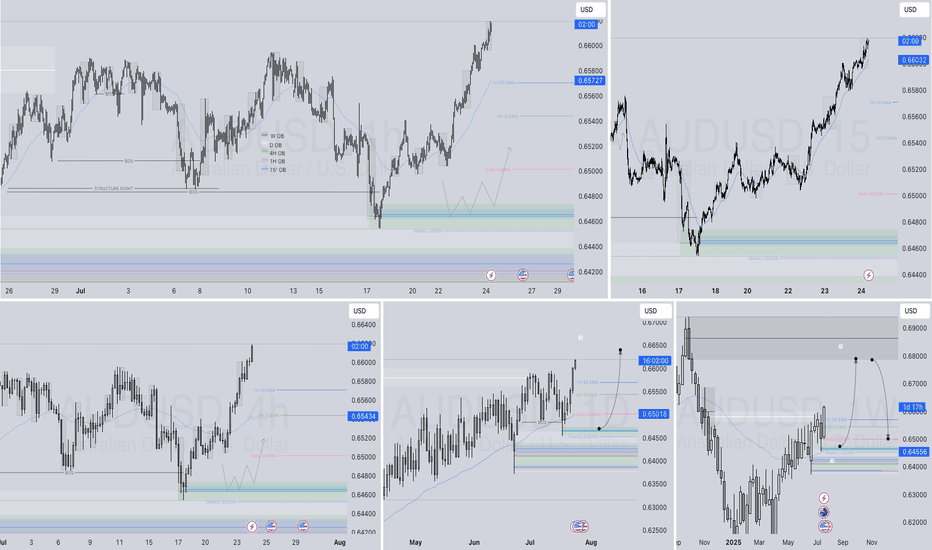

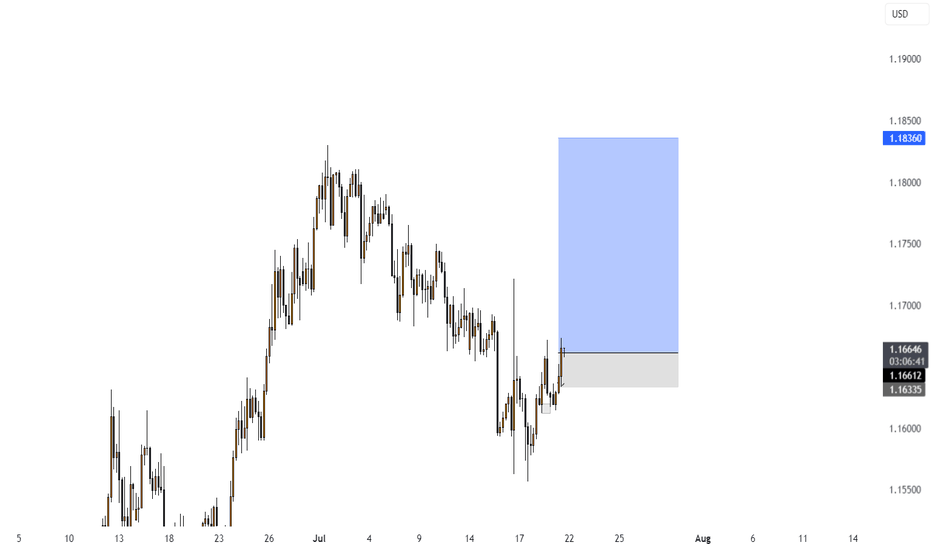

AUDUSD Q3 | D24 | W30 | Y25📊AUDUSD Q3 | D24 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

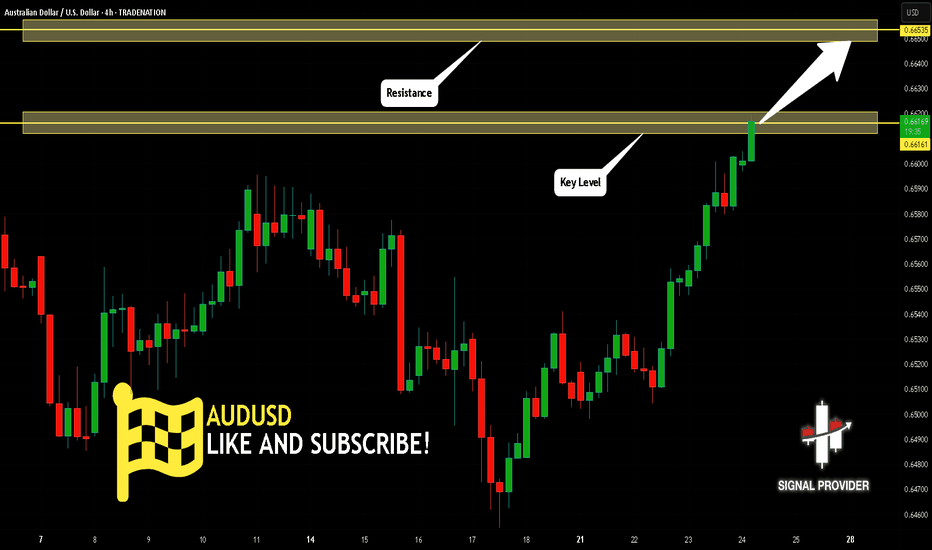

AUDUSD Will Go Up From Support! Long!

Here is our detailed technical review for AUDUSD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 0.661.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 0.665 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

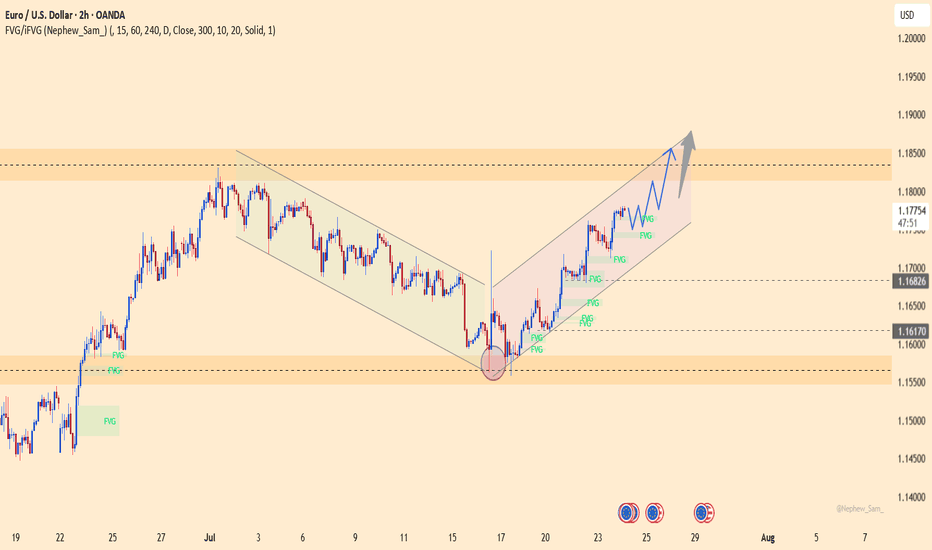

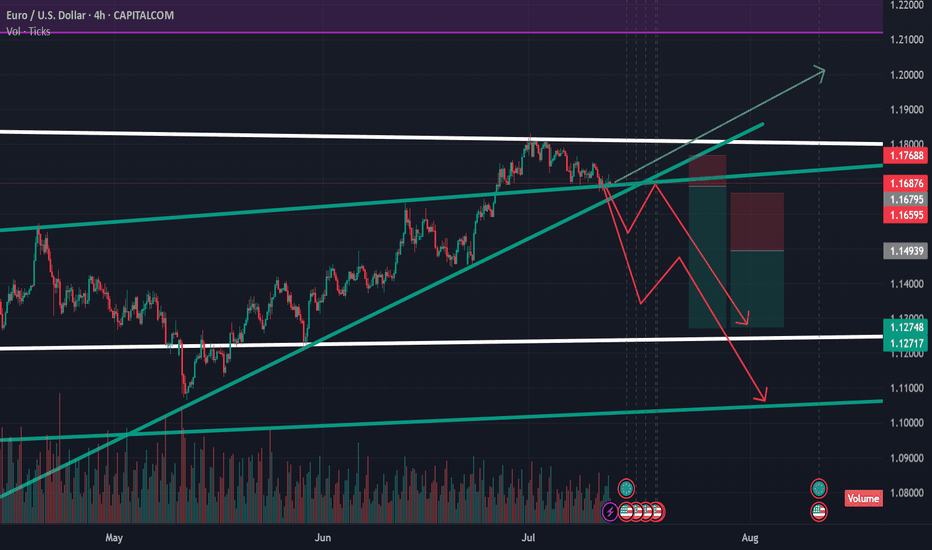

EURUSD – The Comeback is Real! After weeks trapped in a descending channel, EURUSD has broken out in style, launching into a clean bullish channel. Price is now carving a staircase of FVG zones, with momentum clearly favoring the bulls.

What’s fueling the fire?

Flash Manufacturing PMI from Europe beat forecasts

Eurozone consumer confidence improved

Markets pricing in dovish Fed as jobless claims dropped but inflation expectations stall

As long as price stays above 1.1750 and respects the ascending channel, the 1.1850 zone is well within reach.

Strategy: Buy the dips inside the bullish channel. FVGs act as stepping stones for further upside.

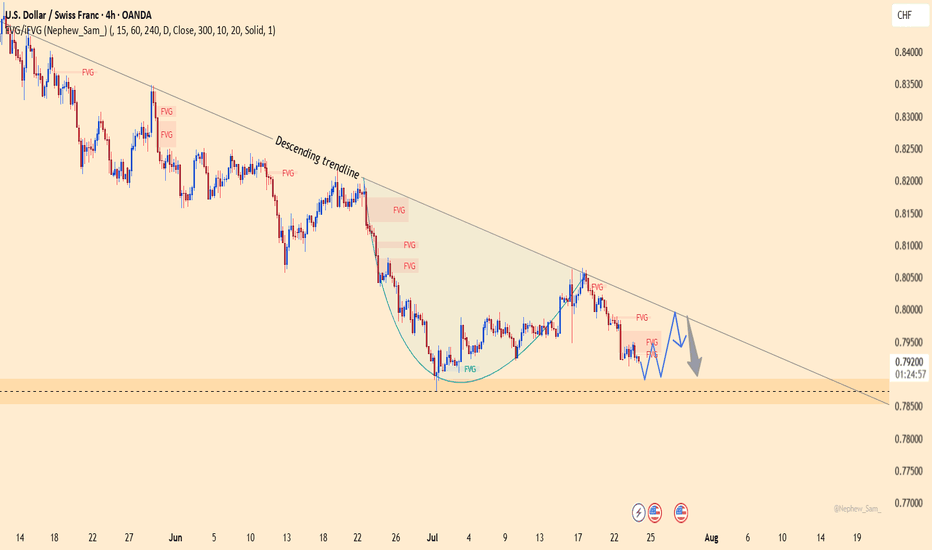

USDCHF – The Wind Still Blows South!USDCHF remains trapped below the descending trendline since June. Every bullish attempt has been sharply rejected – showing sellers are still in control.

Fresh U.S. data just released:

Jobless claims dropped → strong labor market → Fed likely to keep rates high → USD gains strength.

Manufacturing PMI beat expectations → resilient economy → more reason for a hawkish Fed.

But don’t forget: CHF is attracting safe-haven flows, adding downward pressure on USD!

If price fails to break above 0.7990 and gets rejected at the trendline, a drop toward 0.7890 is likely.

Strategy: Look to SELL around the trendline – follow the trend, not your emotions!

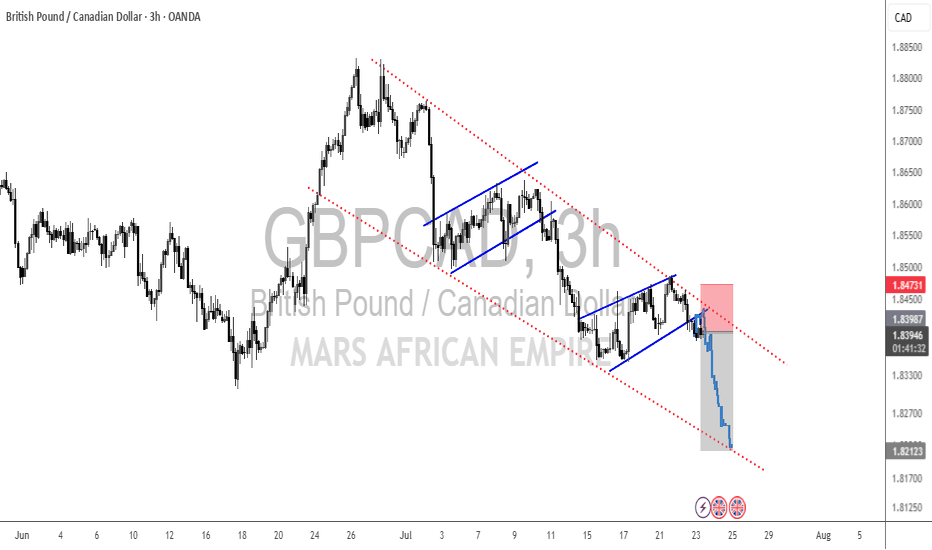

WOULD YOU TAKE THIS TRADE? GBPAUD SELLAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

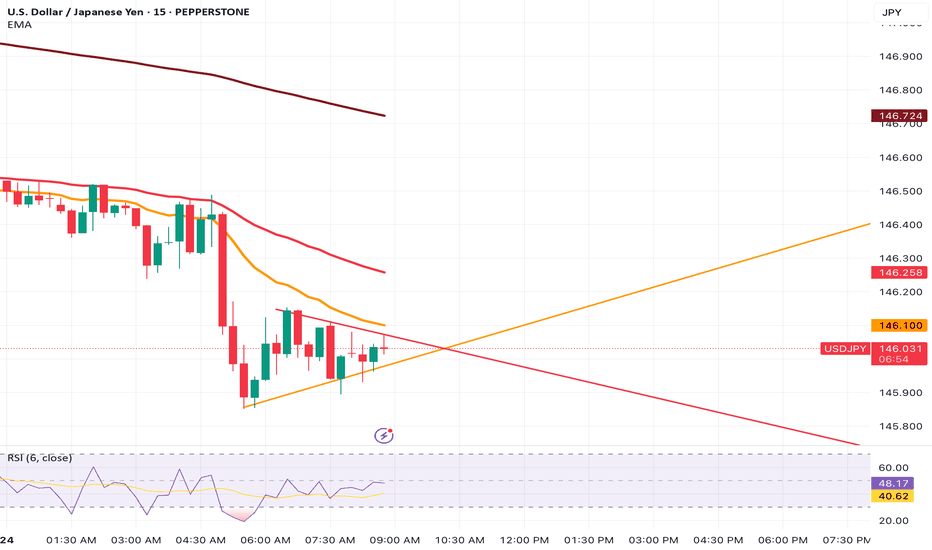

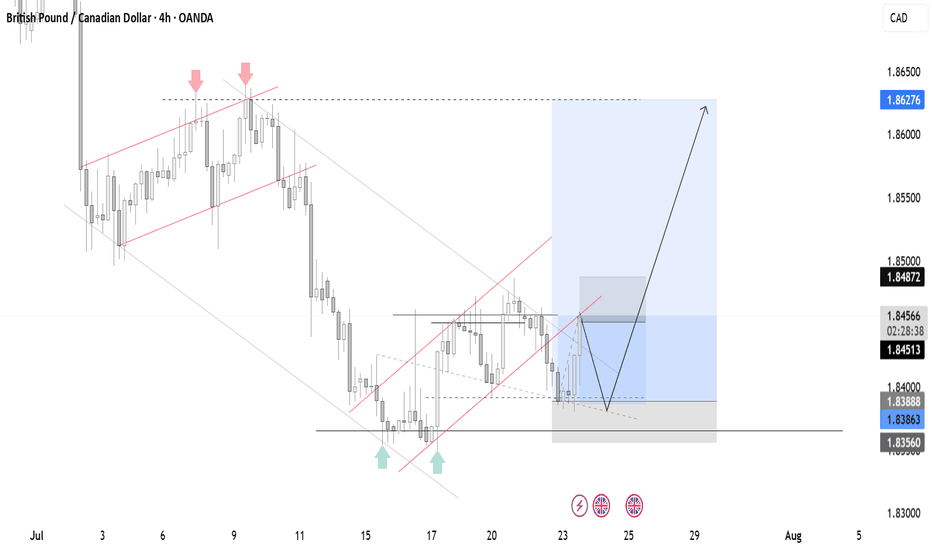

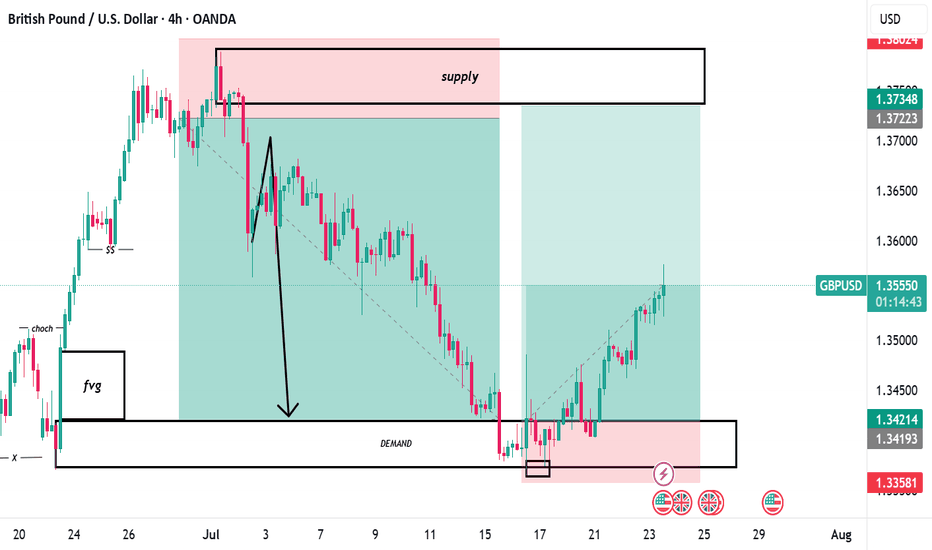

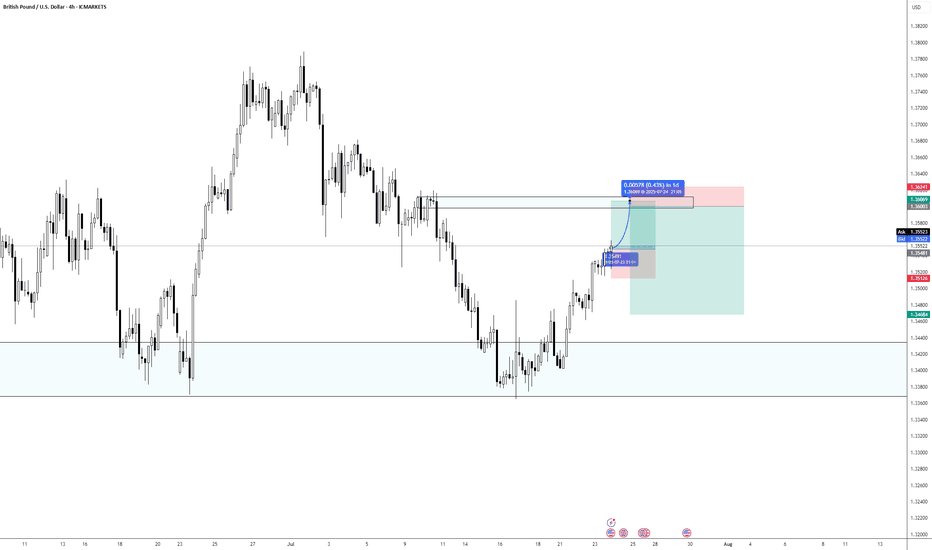

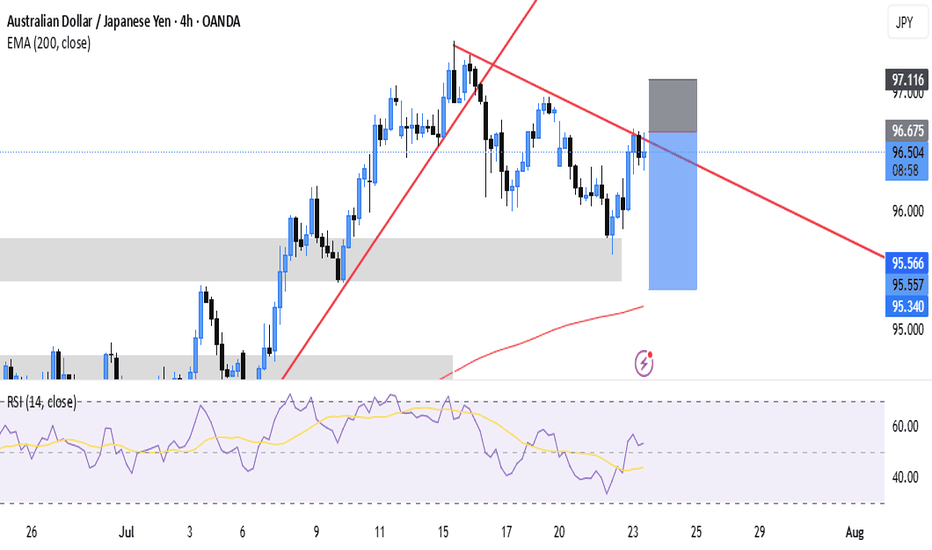

Demand to Supply MoveThis idea illustrates a potential bullish price movement from a recent demand zone toward a nearby supply zone based on structural price action and S/R dynamics.

Concept:

Price recently reacted from a clearly defined demand zone below, where strong buying pressure was previously observed.

The current structure shows a sequence of higher lows, signaling short-term bullish momentum.

Expectation:

Projecting a continuation of this bullish push toward the overhead supply zone, which also aligns with a broken support now acting as resistance.

The target area represents a liquidity zone where sellers are likely to re-enter, offering a potential reversal or reaction.

Reasoning:

Demand Zone Reaction: Price has already confirmed bullish intent with strong rejection wicks and momentum candles.

Clean Traffic to the Left: Limited resistance between current price and the target zone.

S/R Confluence: The target area corresponds to a previous consolidation and breakdown point, enhancing its validity as resistance.

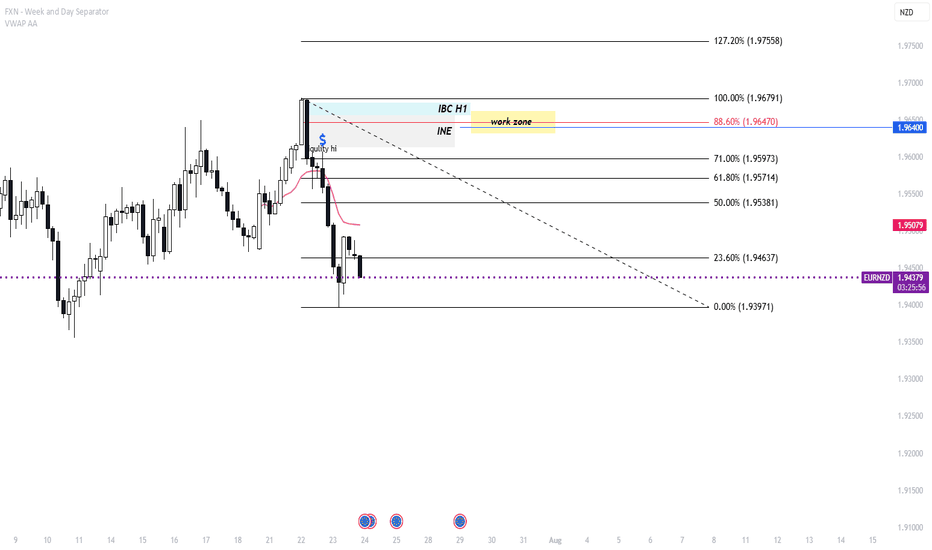

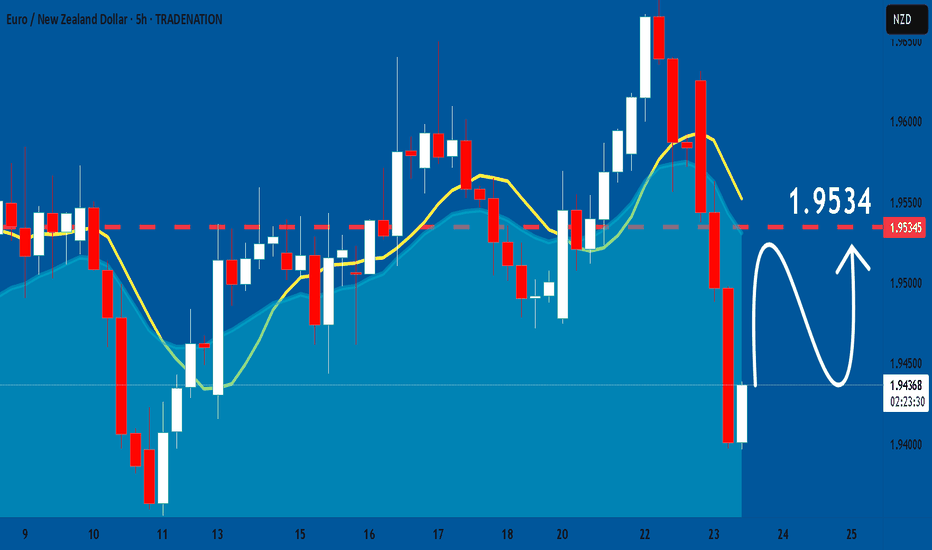

EURNZD: Bulls Will Push Higher

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy EURNZD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️