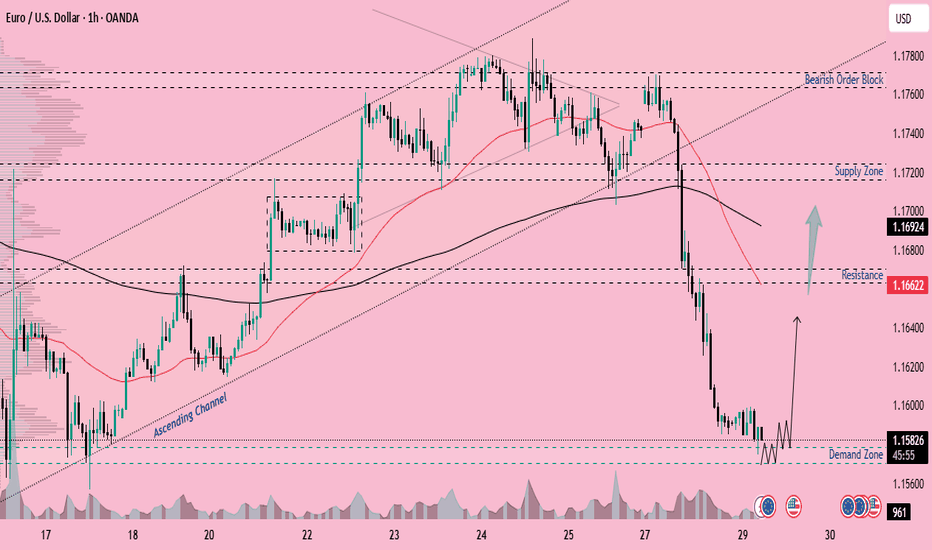

EURUSD After breakdown it get demand zone at 1.15700 buyers area📊EURUSD 1H Forecast

EURUSD is showing bullish momentum from the demand zone at 1.15700 — a clear buyers' area

Market is pushing up with strength, targeting key resistance levels ahead

📌 Target Zones:

1.16700 – Resistance Level

1.16900 – FVG (Fair Value Gap)

1.17200 – Supply Zone

1.17600 – Bearish Order Block (Watch for reaction)

🕒 Outlook:

Buyers are active from 1.15700, and we expect price to continue climbing toward the FVG and supply zones.

Caution near 1.17600 OB — may trigger profit-taking or reversal

👋Regards From Expert Team

Forex market

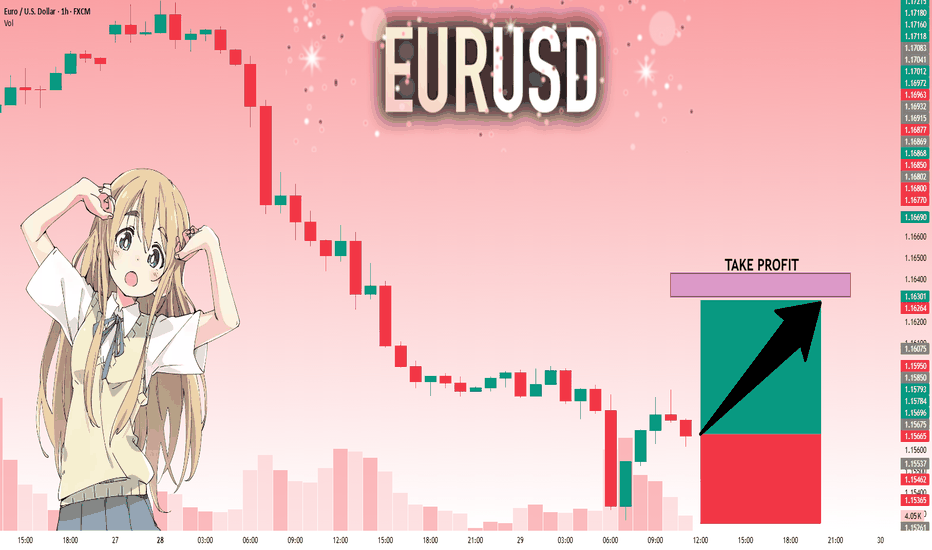

EUR/USD ADDED TO THE WATCHLISTPrice has fallen dramatically so we are on watch for a possible reversal (maybe short term) pattern to appear. Momentum is very low and looks prime to go up. We will need a hammer candle, with an engulfing confirmation candle, strong volume and in a best case scenario strong support to come off of. We will keep watching this one.

GBPUSD Bullish Retracement into NY KillzoneSetup Break above the Asian high (1.33600) leaves inverse SIBIs at:

4 h – 1.33610

1 h – 1.33440

15 m/5 m cluster – 1.33280

Entry & Stops

Primary: 1.33280–1.33320 (5 m/15 m cluster)

Alternate: 1.33440 retest (1 h SIBI)

Stop: below 1.33150 (Asian low)

Targets

1.33600 (Asian high)

1.33610 (4 h SIBI)

Trade Management

Move SL to breakeven at 1:1 R :R

Scale 20% at TP1

Trail SL beneath each lower‐timeframe SIBI

Watch for volume/VWAP confirmation into NY session

Chart markers: entry zone, SL line, TP levels, SIBI arrows. Trade your edge—let the killzone fuel it.

GBPAUD BUY OPPORTUNITY!📊 Current Market Behavior:

Price is retracing back toward the OB and FVG zone after a bullish move.

A small pullback is expected (as shown by the downward leg of the arrow) to mitigate the OB/FVG.

After mitigation, a strong bullish continuation is anticipated.

⚠️ Watch For:

Bullish confirmation inside OB (e.g., bullish engulfing, strong rejection wicks)

Reaction volume and candle strength during the London or NY session

Failure to hold OB may lead to price revisiting 2.04206

EURUSD: Will Go Up! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.15675 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1.16318.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

July 29, Forex Outlook : High-Reward Setups You Shouldn’t Miss!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

USDJPY

AUDJPY

CADJPY

EURGBP

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

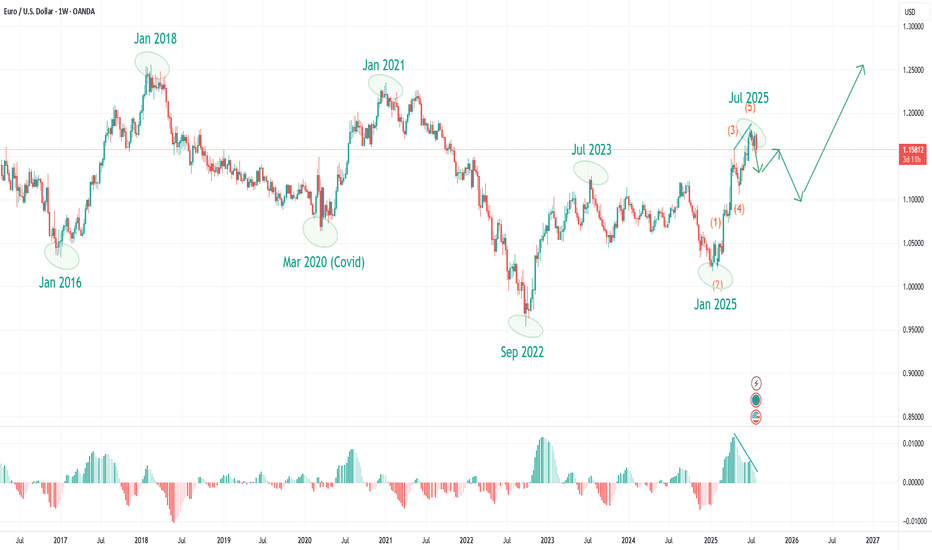

EUR/USD: Is the Next Big Correction Already Underway?EUR/USD: After 120 Days Up, Are We Entering a Year-Long Correction? What Market Cycles Reveal.

As EUR/USD traders digest the stunning 120-day, five-wave rally from the January 2025 lows to the July 2025 highs, the big question now is—what's next? The clues are right in front of us, and they suggest we may be headed into an extended corrective phase, one that could last until the very start of 2026.

What the Current Structure Shows

Motive Wave Complete: The impulsive surge just wrapped up a textbook five-wave move, with each leg unfolding cleanly and culminating in a July top. Motive waves like this are the engines of market trends—fast-moving, decisive, and packed with momentum.

Corrective Phase Incoming: But all trends eventually pause, and here the evidence points to a shift. Corrective waves—unlike their trending counterparts—are time-consuming, choppy, and have a tendency to frustrate impatient traders. The completed motive wave took just 120 days, but corrections often take much longer to play out. According to this chart, the probable timeline for this correction extends into December 2025, or possibly beyond.

Why the Count Is Labelled This Way

Wave Duration Clue: One of the most reliable Elliott Wave principles is that corrective phases outlast the sharp, high-energy motive moves that precede them. With the motive wave spanning four months, a comparable correction stretching into late 2025 makes perfect structural sense.

Cycle Awareness, Major Turning Points, and MACD Divergence:

Flip to the weekly turning points chart, and a deeper pattern emerges: Major EUR/USD direction changes consistently cluster around the start of a new year, with minor tops and bottoms often forming near mid-year. Over the last eight years, six out of seven major pivots have landed at those cycle pivots.

Notably, if you look at the weekly chart’s MACD, there’s now a clear bearish divergence—while price clocked new highs into July, the MACD failed to confirm, rolling over and diverging lower. This kind of momentum divergence at a major turning point is classic for trend exhaustion and aligns perfectly with the idea that a correction is not only likely, but perhaps overdue.

This powerful confluence—timing, price structure, and momentum—underscores just how much “cycle” and structure awareness can add to your trading playbook.

What to Watch Next (Trade Planning)

Timing the Correction: If the correction follows historical precedent, expect sideways or choppy price action well into Q4 2025, with the next big directional opportunity around the calendar turn into 2026.

Cycle-Based Strategies: Recognising these cycles lets you prepare for reversals, especially if price is diverging from the MACD at those major timing windows.

Structure > Prediction: The motive phase is where you ride the trend; cycles, structure, and momentum help you avoid exhaustion traps and see when patience is required.

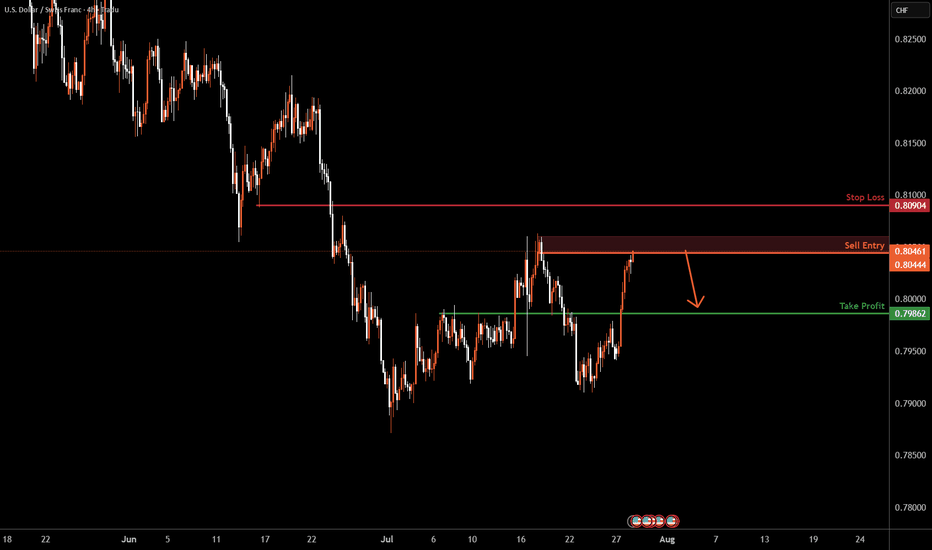

USDCHF H4 I Bearish Drop Based on the H4 chart analysis, we can see that the price is entering our sell zone of 0.8404 - 0.8061.

Our take profit will be at 0.7986, a pullback support level.

The stop loss will be placed at 0.8090, a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

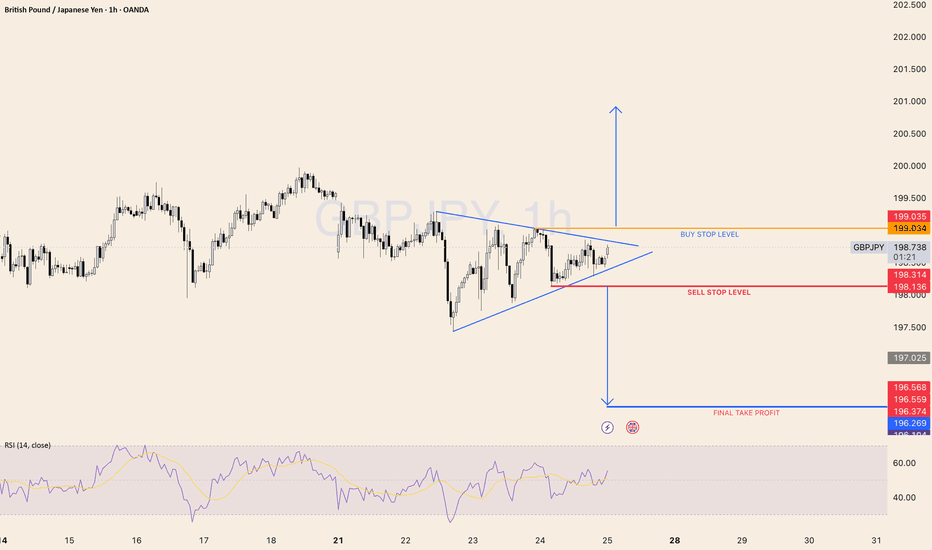

GBP/JPY SYMMETRICAL TRIANGLESYMMETRICAL TRIANGLE Completion: A potential breakout scenario for GBP/JPY involves the currency pair moving sharply out of a symmetrical triangle pattern. If the pair breaks above the upper trendline, it could signal a bullish move, with traders targeting higher resistance levels. Conversely, a break below the lower trendline may indicate a bearish trend, prompting a search for support levels.

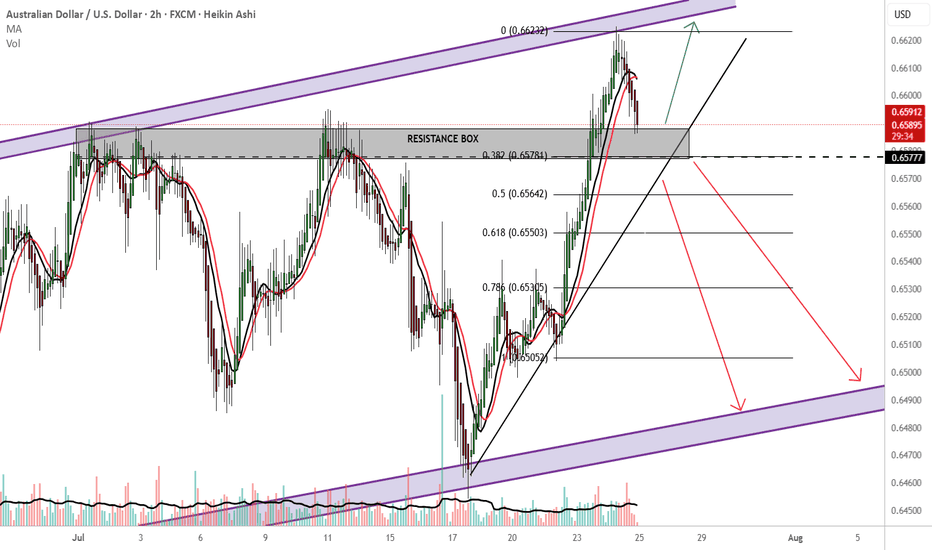

AUDUSD Still early days

20% in me:

Unless strong bullish fundamentals present themselves or the big boys with the big bucks drive a bullish push anywhere from 0.65784 or resistance, I would be looking to sell.

Buy outside the resistance box

TP:0.66600 new immediate high?

Please also consider price action as there are 2 previous rejections in the 0.65784 price area.

80% in me:

-Australia is heavily tied to China via exports

RBA rate cuts?

Falling iron ore prices...

-Perfect price action channel trade. SELL at resistance BUY at support. Bullish long term, bearish short term.

-fib 0.382 downward continuation and close below 0.65784

-Looking for a break below the upward sloping trendline HARD sell

-safer option: wait for a 0.65780 retest, below the upward sloping trendline sells and make bank.

TP: 0.6500

THOUGHTS?

EUR/USD – Potential Reversal Ahead?| Daily Timeframe | Outlook (Published July 29, 2025)

⚠️ Setup Summary:

This chart is highlighting a critical juncture for EUR/USD, where price is nearing a major decision zone. Based on price action and wave structure, there are two likely scenarios unfolding. Let’s break it down simple .

EUR/USD has seen a strong bullish rally from March to July, but current price action suggests momentum exhaustion. Now, we’re watching for signs of a reversal or deeper correction in the coming weeks.

📊 Two Probable Scenarios:

✅ Case 1 – Simple Corrective Wave (ABC Pattern)

Expected Move:

Price may spike up into the 1.186–1.199 zone (final bull trap/liquidity grab)

Followed by a sharp bearish move (impulse C wave) towards 1.10505 zone

This reflects a clean correction before possible reaccumulation

📌 This is often seen after retail traders get caught chasing highs late in a move.

---

✅ Case 2 – Complex Corrective Wave (ABCDE Flat/Running Triangle)

Expected Move:

A longer, more sideways and choppy correction into Q1 2026

Price forms a distribution pattern under resistance

After a breakout below the structure, a sharp drop to 1.10505 zone (or deeper)

📌 This is a slower bleed-out pattern before continuation lower. Often traps both buyers and sellers in the chop.

---

🎯 Current Price: 1.15756

We are in a decision zone, and watching the reaction around 1.165–1.186 will be crucial to validate either Case 1 or Case 2.

---

💡 My View:

> Wait for confirmation at the 1.186 zone.

If price rejects strongly from there, Case 1 is in play. 👈❤️

If price chops sideways and holds higher for weeks, expect Case 2 structure.

---

🚨 Reminder for Traders:

Don’t chase moves — let the market show its hand

Use proper risk management

Combine this structure with session timing, liquidity sweeps, and fundamental events

---

💬 Drop a comment if you're seeing similar setups in other majors!

🧠 Follow for real-time updates & actionable setups.

#EURUSD #ForexAnalysis #WaveTheory #SmartMoney #OrderBlock #LiquidityHunt #ForexStrategy #ElliottWave #PriceAction #FXTrader #TradingView

---

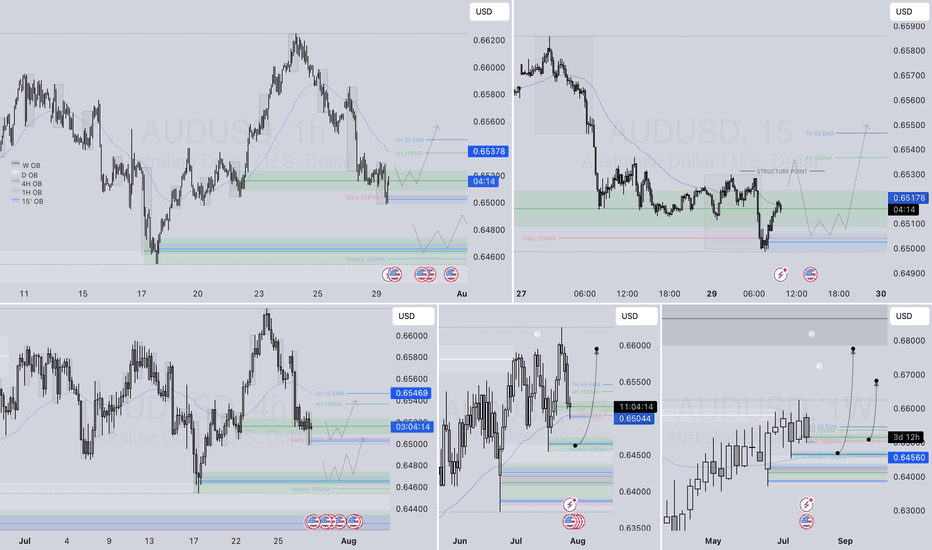

AUDUSD – DAILY FORECAST Q3 | W31 | D29 | Y25📊 AUDUSD – DAILY FORECAST

Q3 | W31 | D29 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDUSD

EURCAD 1H longEURCAD 1 H made a beatiful sharp drop, now stalling arround some good support levels.

When such a drop happens with no pullback formed yet I'm happy to buy the way down.

Because the pullback has to come soon buyers step in at the support levels.

My plan is simple I open a manual grid at the support levels I draw and aim for a 2R profit

Current grid 3 levels

1 market order

2 buy limits

Tp 2R

extra confirmation RSI is oversold

GBPCAD OUTLOOKIn this analysis we're focusing on 2H time frame for finding possible upcoming movement in price. So as per my strategy today I'm looking for a sell trade opportunity. Confirmation is very important, after confirmation we'll execute our trade. Let's see which opportunity market will give us.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is my prediction.

#GBPCAD 1H Technical Analysis Expected Move.

GBPUSDGBPUSD has taken liquidity and is heading towards the 2H ORDERBLOCK at 1.33140 once I’ve reached this zone I will take profit and go long. Taking into account jolts today so be careful of volatility and the possibility of long wicks. I can’t see anymore liquidity underneath so expecting big volume to the upside