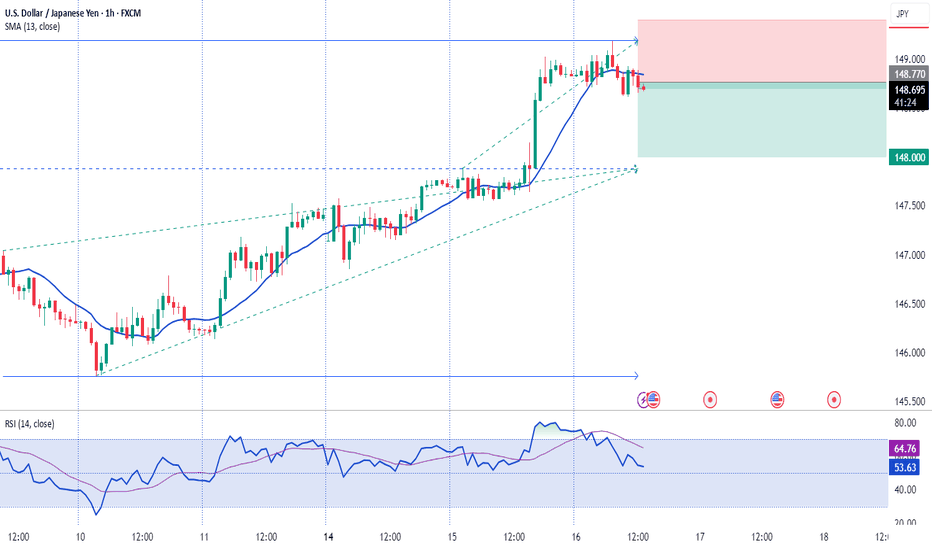

Forex market

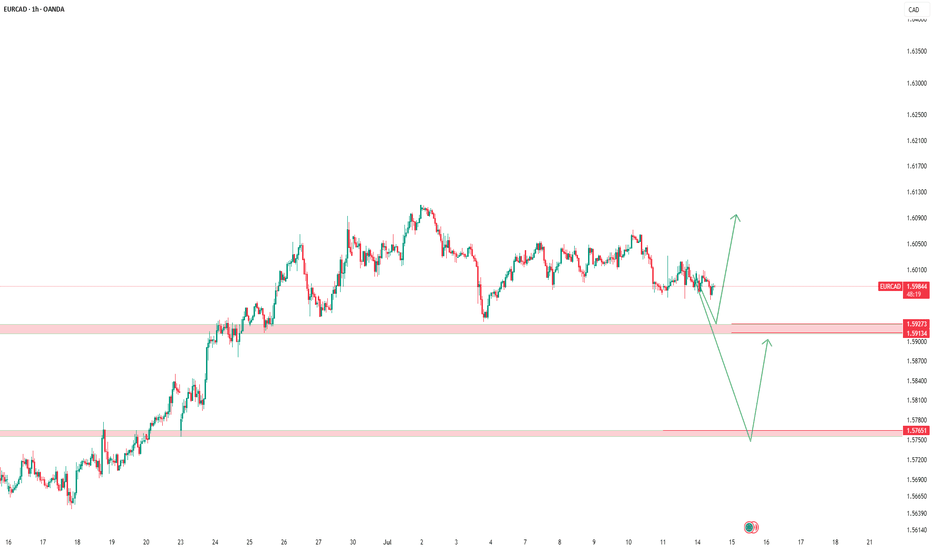

EURCAD – Two Key Levels, One Solid PlanOn this pair, we have two important levels:

🟡 The first level might act as a trap (stop hunting).

So don’t rush to buy — wait for confirmation.

🟢 The second level offers a safer buy opportunity.

As always, our plan stays firm —

we don’t tell the market what to do, we follow it.

🔻 If a clean break and valid pullback occurs on the first level,

a short trade toward the lower level is possible.

⚠️ This pullback short scenario is only valid until price reaches the lower level.

If price hits the lower level and starts moving up,

any short position becomes much riskier.

Discipline > Prediction.

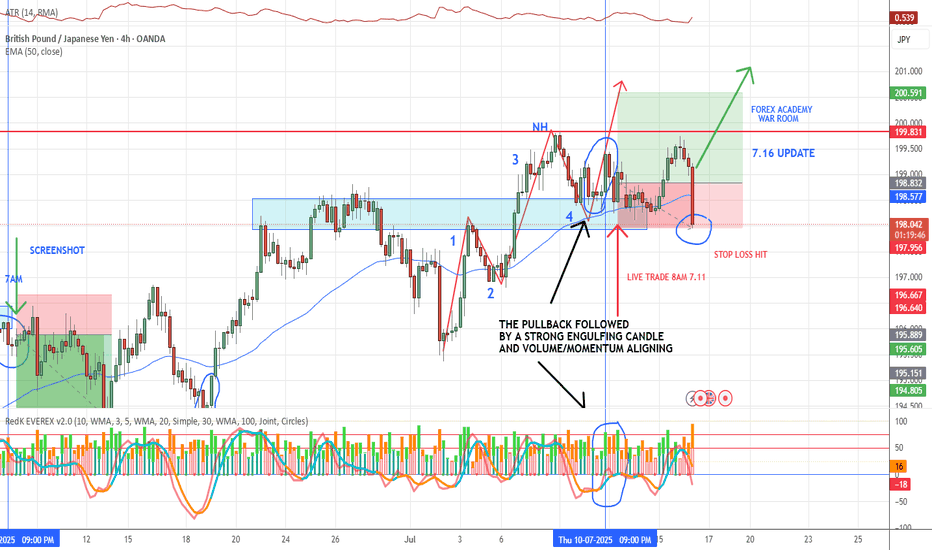

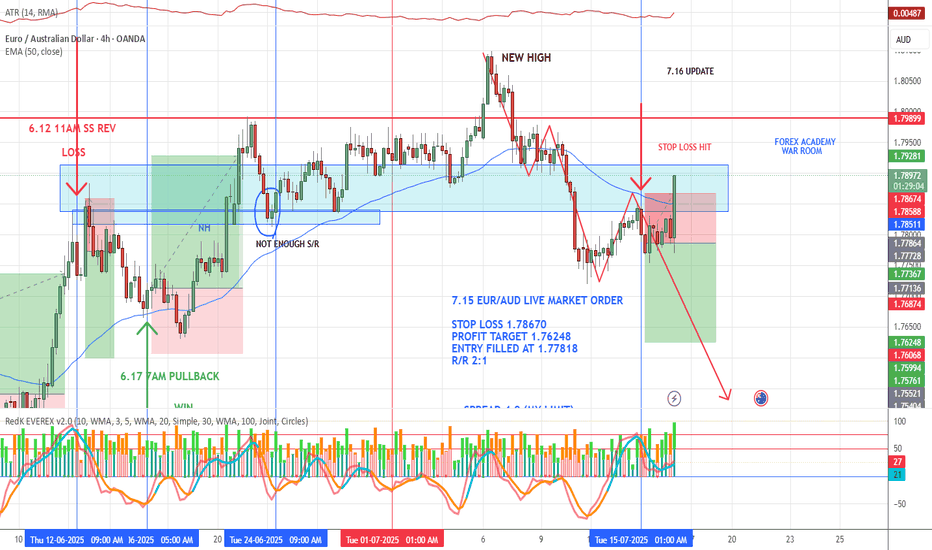

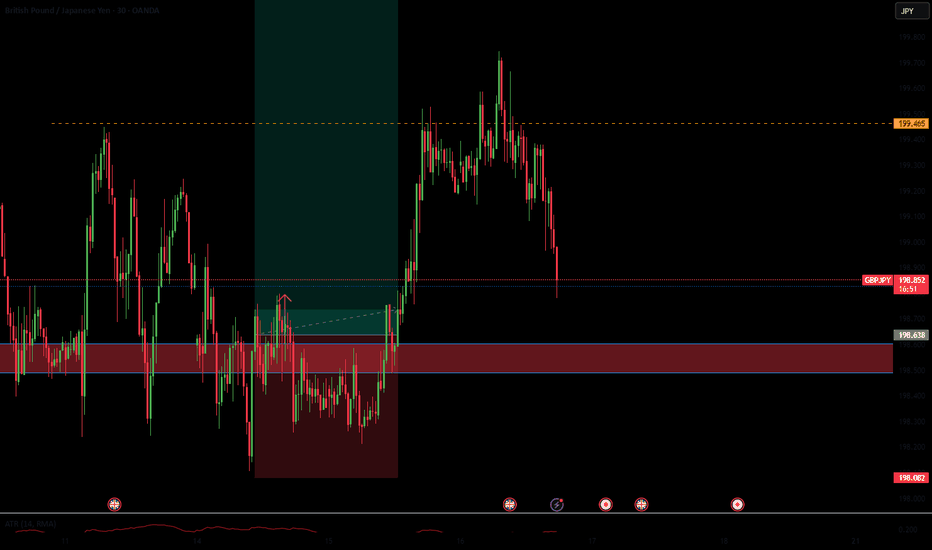

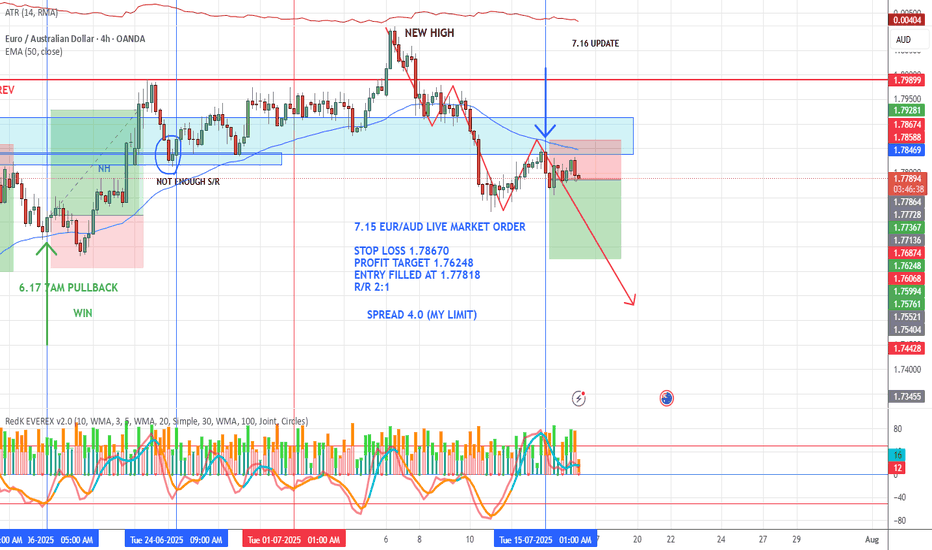

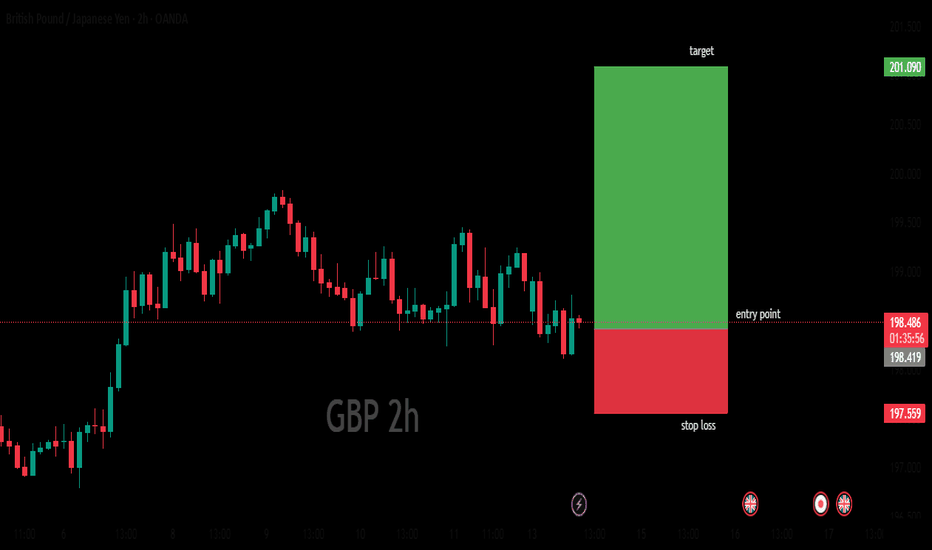

7.16 GBP/JPY LOSSSome days you go through things like this, when the markets make big moves it is great if you are on the right side and sucks if you are not. We have a limit to our exposure in the markets and ALWAYS follow our bankroll management plan. Price hit our stop on this one — no hesitation, no regrets. The setup met all the VMS criteria, but the market had other plans. This happens, and it’s built into the process. No revenge trades. No chasing. Just alignment and discipline. That’s how we grow.

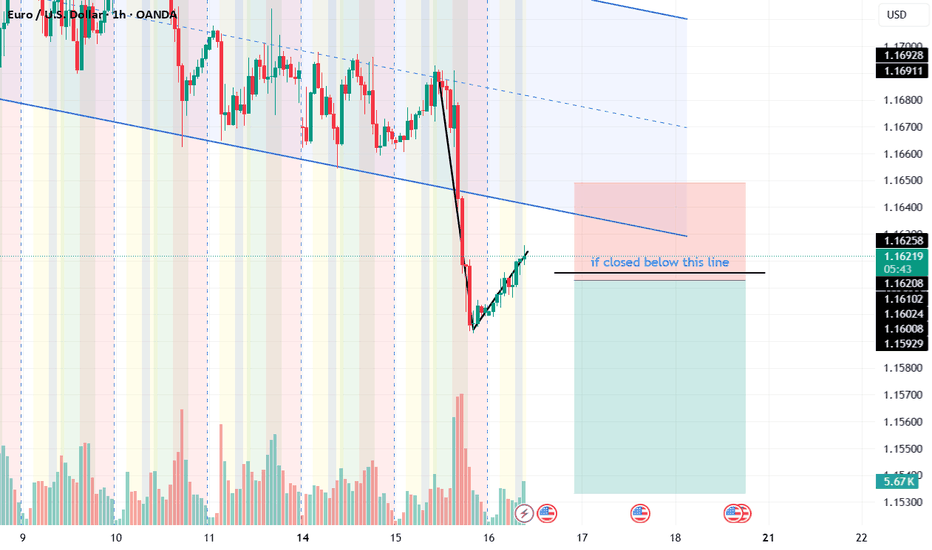

EUR USD shortThis is not my original idea. I took some advice and looked at other ideas, so I decided to come up with a short one. Let's see what happens.

Please note: This is for educational purposes only and not a trading signal. These ideas are shared purely for back testing and to exchange views. The goal is to inspire ideas and encourage discussion. If you notice anything wrong, feel free to share your thoughts. In the end, to learn is to share !

CADCHF Squeeze Between OB and Trendline – Big Move Coming?CADCHF is compressing within a descending triangle structure, showing signs of bullish intent as it continues to reject a key demand + 1H order block area.

🔹 Trade Idea:

I’m watching for a bullish breakout above 0.58380, which will also confirm a trendline breakout from the descending triangle. Until then, I remain on the sidelines.

🔹 Key Technical Factors:

- Price consolidating inside a descending triangle, squeezing between lower highs and a consistent demand zone

- Repeated rejections from the green demand zone suggest buyers are defending the level strongly

- A clean order block (1H) is aligned with the bottom of this structure, adding confluence for a bullish move

- Above 0.58380 breakout may trigger momentum toward 0.58630, near the supply zone

🔹 Trade Plan:

+ Buy above: 0.58380 (on breakout + close above trendline)

+ First Target: 0.58630 (next resistance/supply area)

* Invalid if: price breaks and holds below the demand zone

⚠️ Note: Entry is only valid on confirmed breakout. Until then, patience and watchfulness around structure edges are key.

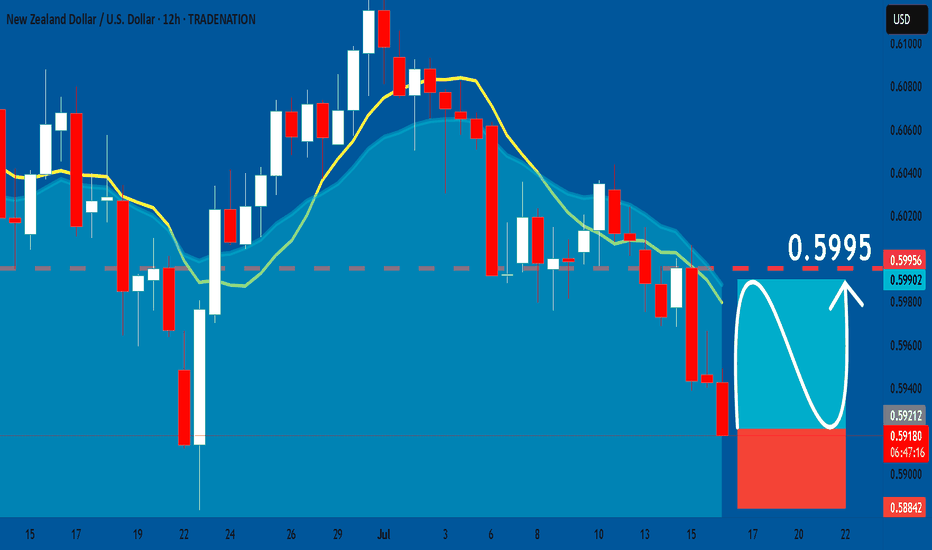

NZDUSD: Bullish Continuation & Long Signal

NZDUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NZDUSD

Entry Point - 0.5922

Stop Loss - 0.5884

Take Profit - 0.5995

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

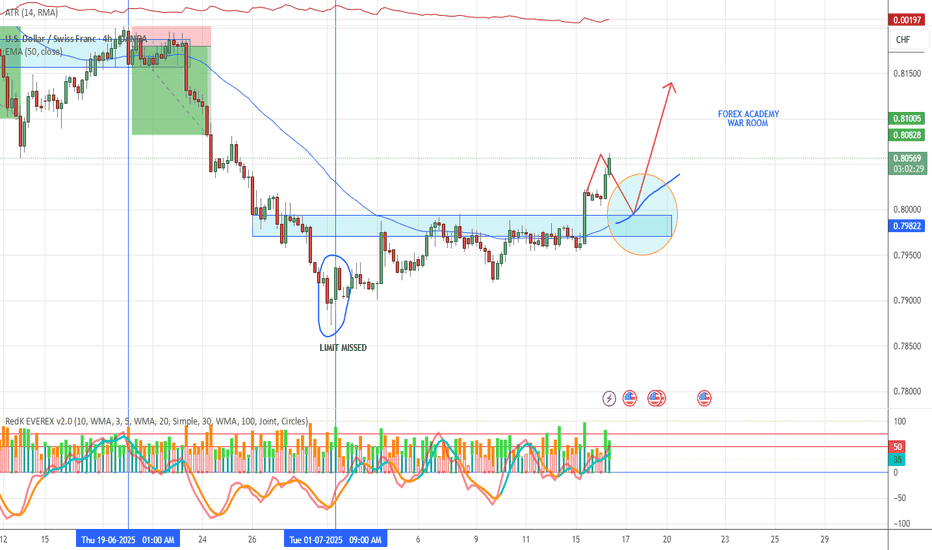

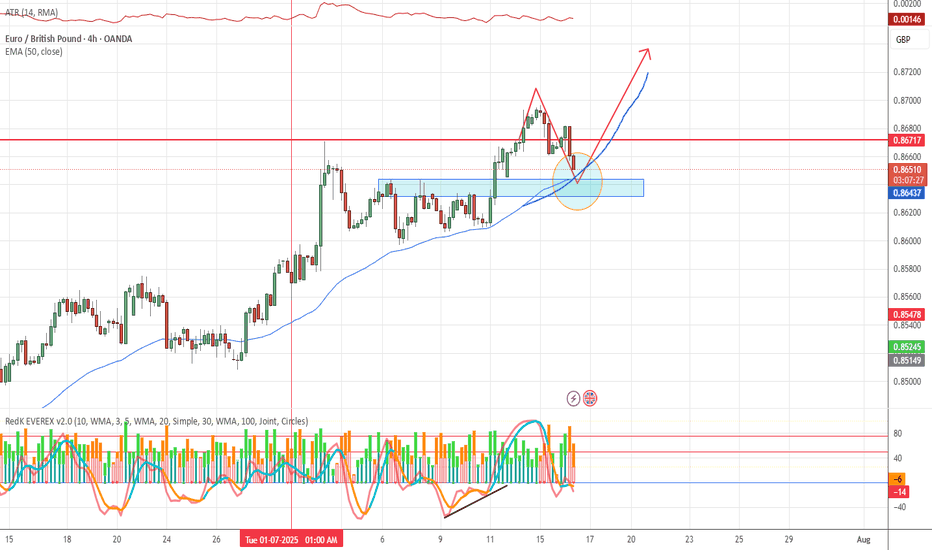

7.16 WATCHING EUR/GBP 4H CHARTThis market made a recent new high to confirm the uptrend, now we want to see it pullback into the S/R, make an engulfing candle up, momentum to be low pointing up and volume to be strong up..........also, all of this MUST happen in the morning sessions. We are watching this one.

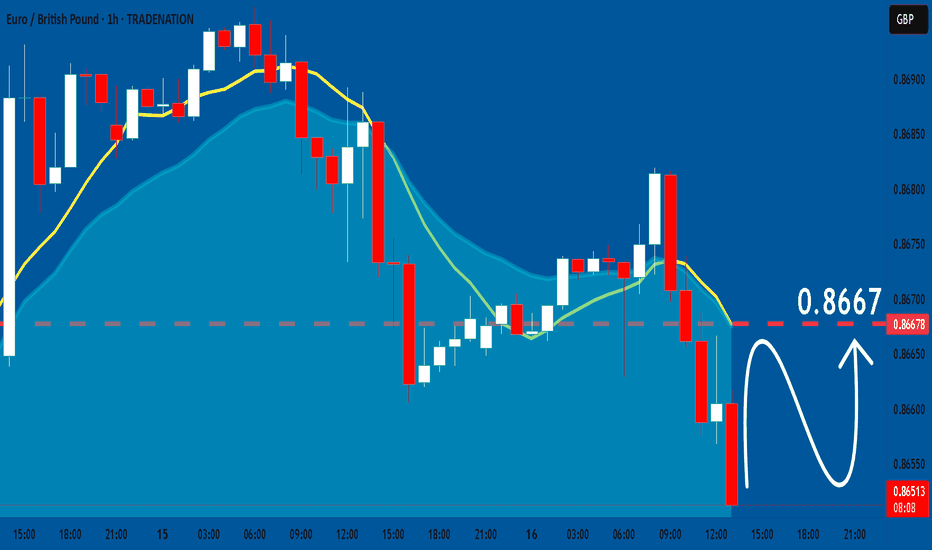

EURGBP: Expecting Bullish Movement! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the EURGBP pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 1.15850 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

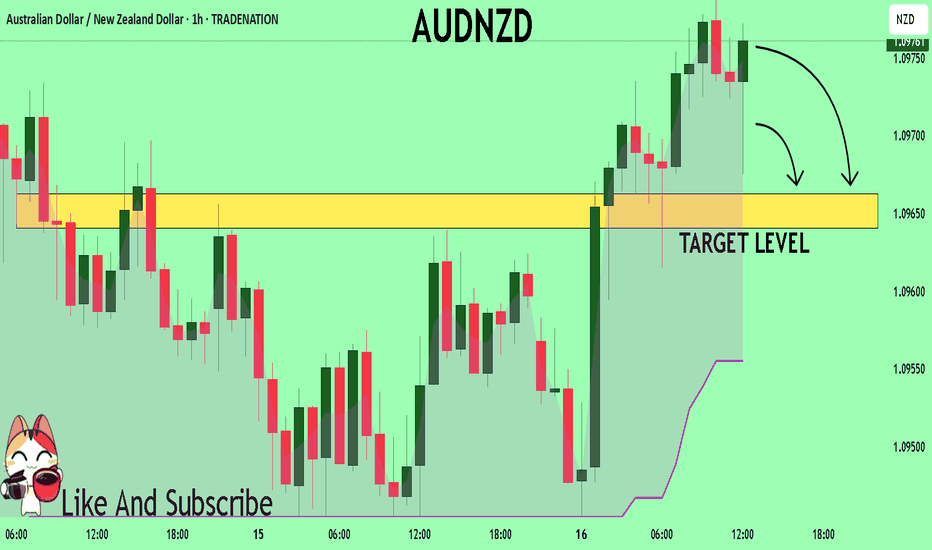

AUDNZD Under Pressure! SELL!

My dear followers,

This is my opinion on the AUDNZD next move:

The asset is approaching an important pivot point 1.0975

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.0966

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

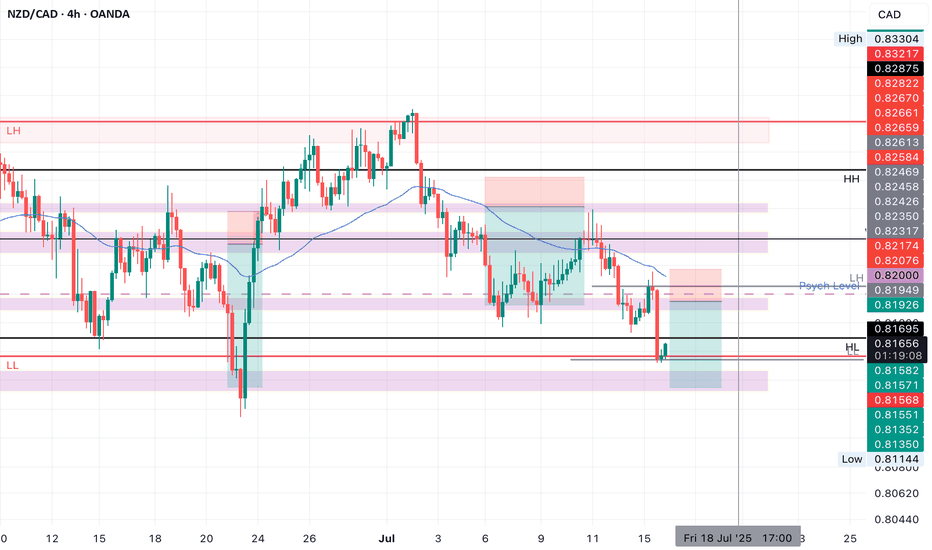

NZDCAD SHORT Market structure bearish on HTFs DH

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 0.82000

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 2.66

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

EUR/USD 4 HOURS BEARISH ANALYSISThe image depicts a computer screen displaying a trading platform, specifically the Euro/U.S. Dollar currency pair on a 4-hour chart from FXCM. The chart features a black background with a blue trend line and a blue shaded area, indicating an upward trend. The price action is represented by red and green bars, with the current price at 1.17283.

GBP/JPY 2HOURS BULISH ANALYSISThe image shows a computer screen displaying a trading platform with a candlestick chart for the GBP/USD currency pair. The chart is displayed on a black background, with pink and blue bars representing price movements. A green and pink rectangle is visible on the left side of the screen, possibly indicating a trade or order. The overall atmosphere suggests that someone is actively trading or analyzing the market using this platform.