Forex market

USDCAD Update: Don’t Sleep on This Uptrend’s First LegYo traders, Skeptic from Skeptic Lab here! 🚀 USDCAD’s serving a hot long trigger for pattern traders chasing the first leg of a big uptrend! We’ve got an ascending triangle breakout on the daily, with bullish candles stacking up, hinting at a return to the weekly bullish trend. Too early to confirm, but the momentum’s fire.

📈 Today’s FOMC meeting’s got everyone buzzing—will Powell cut, hold, or drop resignation hints? Check the full setup in the video, but with crazy news like Federal Funds Rate

, s tick to high-probability trades, keep risk low, and no FOMO or revenge trading! Drop your thoughts, boost if it vibes <3

EURUSD ahead of the FEDEURUSD remains below the 1,1600 level following the trade agreement between the US and the European Union.

Today, all eyes are on the FED’s decision regarding interest rates.

Watch for a reaction around the support zone, as it may present an opportunity for the trend to continue.

However, it's advisable to reduce risk and hold off on new entries until after the news is released.

GBP/USD – Bullish Liquidity Grab Setup | 1H Chart AnalysisPrice is currently consolidating after a strong bearish move and has shown signs of a potential reversal. Here's the breakdown:

🔹 MSS (Market Structure Shift) has occurred, indicating a possible trend reversal

🔹 Price is forming higher lows with internal liquidity build-up beneath BSL (Buy Side Liquidity)

🔹 Expecting a short-term liquidity grab below BSL, followed by a bullish push into the Pullback Zone

🔹 Key Zones to Watch:

• Bullish Reaction Zone: 1.3335–1.3345

• Pullback Target: 1.3400–1.3420

• Full Take Profit: 1.3440+ (Order Block Zone)

🧠 Scenarios:

1️⃣ If price respects current minor demand zone, it may sweep BSL and head to Pullback Zone

2️⃣ Failure to hold may revisit Day Low (1.33075) for deeper liquidity grab before a bounce

Bias: Bullish (after liquidity sweep)

Invalidation: Break below Weak Low

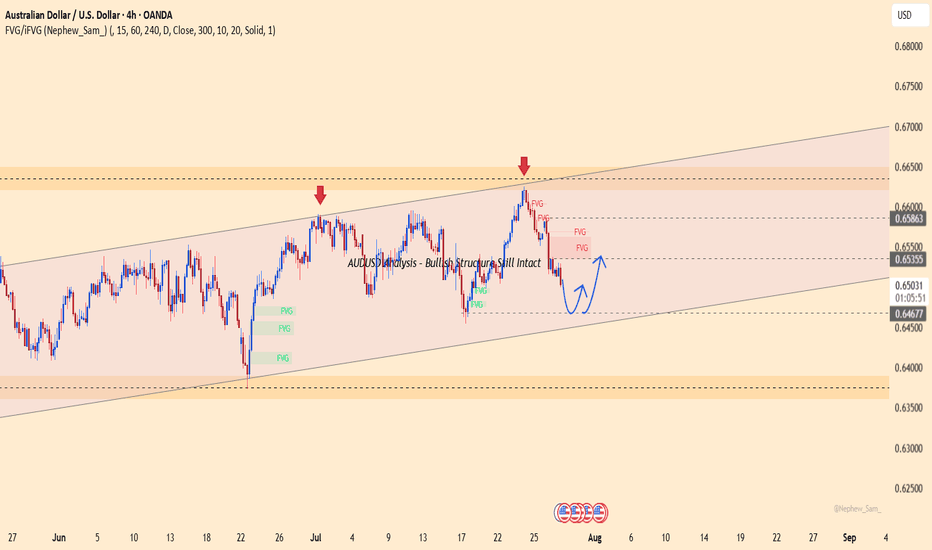

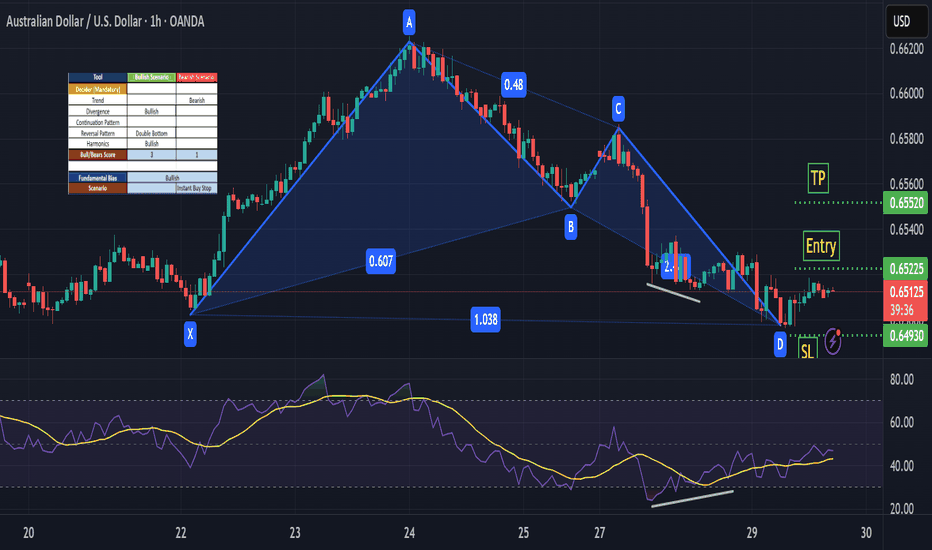

AUDUSD Analysis – Bullish Structure Still IntactAUDUSD is trading within a clear ascending channel on the H4 chart. After dropping from the FVG zone around 0.65800, price has reacted well to the lower boundary support near 0.64650.

Currently, price action suggests the potential formation of a short-term bottom. If this level holds and the pair rebounds, the next target could be the red FVG zone near 0.65400.

Recent Supporting News:

U.S. consumer confidence slightly weakened, causing the dollar to cool off — offering technical rebound support for AUD.

Trading Strategy:

Prefer short-term Buys near 0.64650 if a confirmed bounce appears, with target around 0.65400. Be cautious if price breaks below the ascending channel.

Do you think AUD will continue to rise within this bullish channel?

GBPJPY – Bearish pressure returns near ascending channel supportGBPJPY is trading close to the lower trendline of the ascending channel, with the 197.400 zone acting as a key support. A breakdown below this level could trigger stronger bearish momentum.

On the news front, Japan’s CPI remains solid, strengthening the yen. Meanwhile, the British pound is under pressure after recent consumer spending data showed signs of weakness, raising concerns over the UK’s economic outlook.

Strategy: If the price breaks below 197.400 and fails to bounce back, consider SELL setups in line with the bearish trend. If it rebounds, watch the reaction around the 199.100 zone for signs of recovery confirmation.

USD/CAD(20250730)Today's AnalysisMarket News:

According to a Reuters/Ipsos poll, Trump's approval rating has fallen to 40%, the lowest level since his second term.

Technical Analysis:

Today's Buy/Sell Levels:

1.3762

Support and Resistance Levels:

1.3820

1.3798

1.3784

1.3739

1.3725

1.3704

Trading Strategy:

If the price breaks above 1.3784, consider a buy entry, with the first target price at 1.3798. If the price breaks below 1.3762, consider a sell entry, with the first target price at 1.3739.

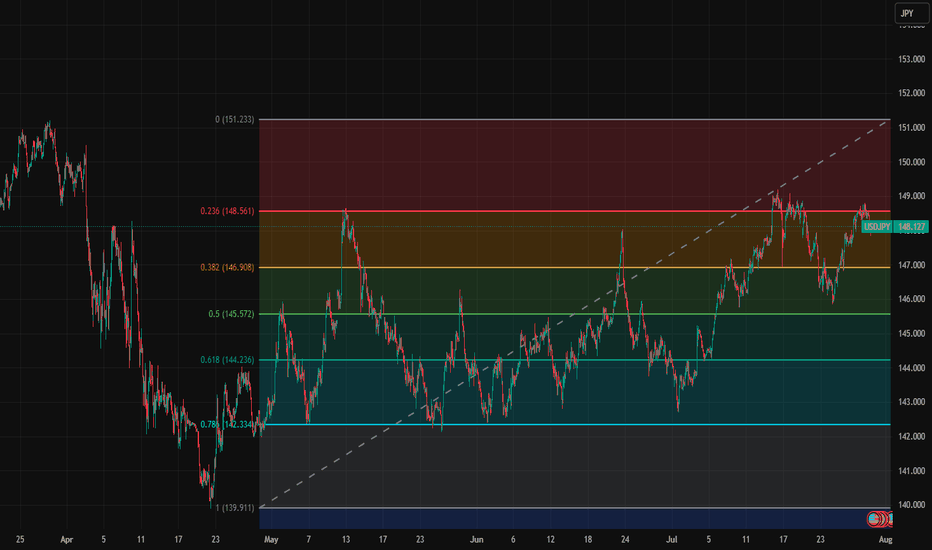

USD/JPY Technical Analysis – Bearish Outlook from Key Supply ZonThe USD/JPY pair is currently presenting a strong bearish opportunity and price action structure. As of the latest 4H chart analysis, the price has reached a well-defined supply zone around the 148.80–149.70 area. This zone aligns with a previous institutional level where price showed significant reaction, marking it as a valid area of interest for sellers.

Liquidity Grab & Rejection

The market structure remains bearish overall. Recently, price took out a cluster of liquidity above the previous highs. This liquidity sweep suggests that smart money may have accumulated short positions, preparing for a move lower.

High-Probability Sell Zone

The price is currently reacting to a premium zone near the 0% Fibonacci retracement level, drawn from the recent swing high to swing low. This zone also coincides with a previous area of imbalance and supply, reinforcing the bearish setup.

Key Bearish Targets

First Target: 145.89 — this aligns with the 50% Fibonacci retracement level and a previous structural support.

Second Target: 142.56 — this deeper target sits near the 89% Fibonacci level, close to an old demand zone where price may look to rebalance.

Summary

With trend direction biased to the downside, the pair is showing strong signs of rejection from a key supply zone after sweeping liquidity. If momentum continues, we expect USD/JPY to drop toward 145.89 initially, with an extended move possibly reaching 142.56.

Traders should monitor price action closely for further confirmations and maintain proper risk management, especially with upcoming economic catalysts that may affect the JPY.

BIASOne thing i will tell you for free is that, you should stop worrying about entries, and always focus on the market direction, of the current leg of price that you find yourself paired with the HTF perspective, that way even if your entry is wrong, you can always find another entry and join in the given direction.