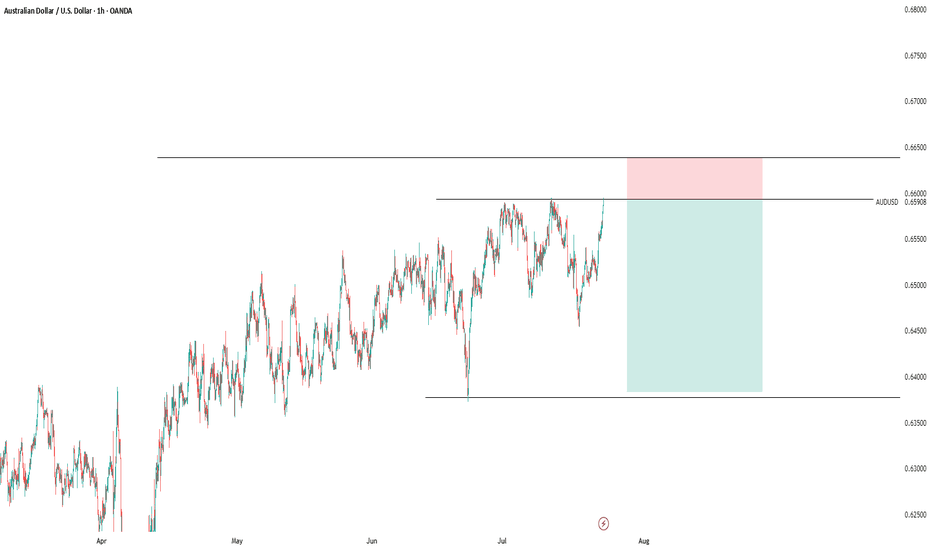

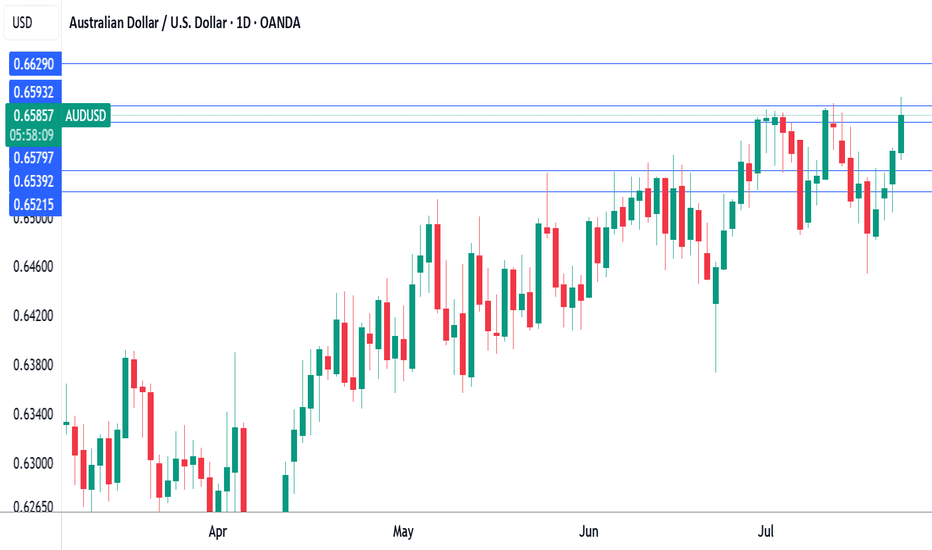

audusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Forex market

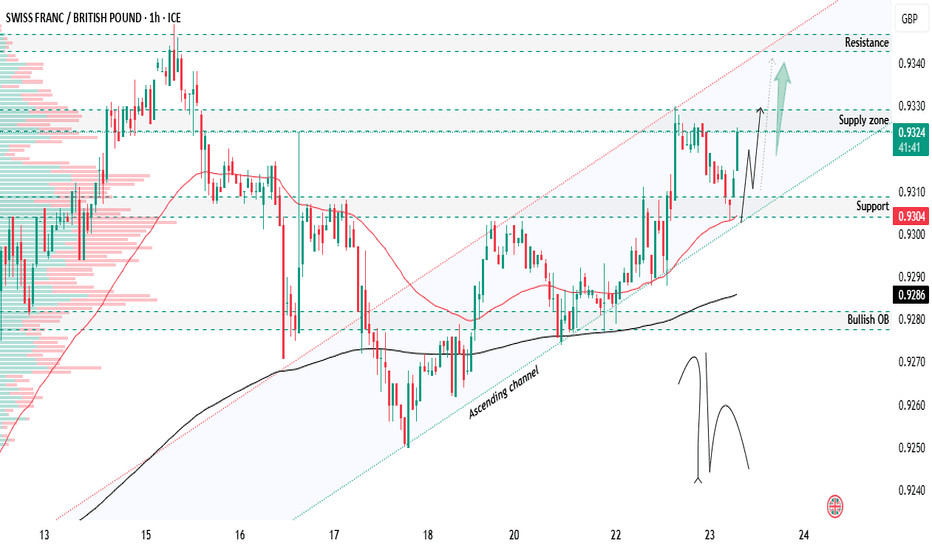

CHFGBP Ascending channel pattern bullish target📊CHFGPB Forecast – 1H Timeframe

CHFGBP is following the ascending structure, respecting trendline support with potential for a bullish continuation

📍 Key Support Zone:

Price reacting from 0.9300, showing signs of bullish interest

Long opportunity building from this zone

🛑 Stop Loss:

Placed below at 0.9270, aligned with the bullish order block (OB) for structural protection

🎯 Target Levels / Supply Zones:

🔹 0.9360 – minor resistance

🔹 0.9400 – major supply zone to watch for reaction or take-profit

🧠Staying patient — watching for confirmation to follow the trend

Are you watching CHFGBP? Share your setup below

👍 Like | 🔔 Follow | 💭 Comment for more sharp forecasts

#chfgbp

Australian dollar hits eight-month high on risk-on moodThe Australian dollar has rallied for a fourth sucessive day. In the North American session, AUD/USD is trading at 0.6588, up 0.50% on the day. The red-hot Aussie has jumped 1.6% since Thursday and hit a daily high of 0.6600 earlier, its highest level since Nov. 2024.

The financial markets are in a risk-on mood today, buoyed by the announcement that the US and Japan have reached a trade agreement. Under the deal, the US will impose 15% tariffs on Japanese products, including automobiles. As well, Japan will invest some $550 billion into the US.

Global stock markets are higher and the Australian dollar, a gauge of risk appetite, has climbed to an eight-month high.

Investors also reacted positively today to reports that negotiations between the US and China were speeding up and the US could grant an extension of the August 12 deadline to reach an agreement. The latest positive developments on the tariff front have raised hopes that the US will also sign trade deals with the European Union and South Korea.

The White House continues to put pressure on the Federal Reserve. Earlier this week, Treasury Scott Bessent called for a thorough review of the Federal Reserve. Bessent echoed President Trump's calls for the Fed to lower interest rates.

Fed Chair Jerome Powell hasn't shown any signs of plans to cut rates and has fired back that the uncertainty over Trump's trade policy has forced the Fed to adopt a wait-and-see policy. The Fed is widely expected to hold rates at the July 30 meeting but there is a 58% likelihood of a rate cut in September, according to CME's FedWatch.

AUD/USD has pushed above resistance at 0.6579 and tested resistance at 0.6593 earlier. Next, there is resistance at 0.6629

0.6539 and 0.6521 are the next support levels

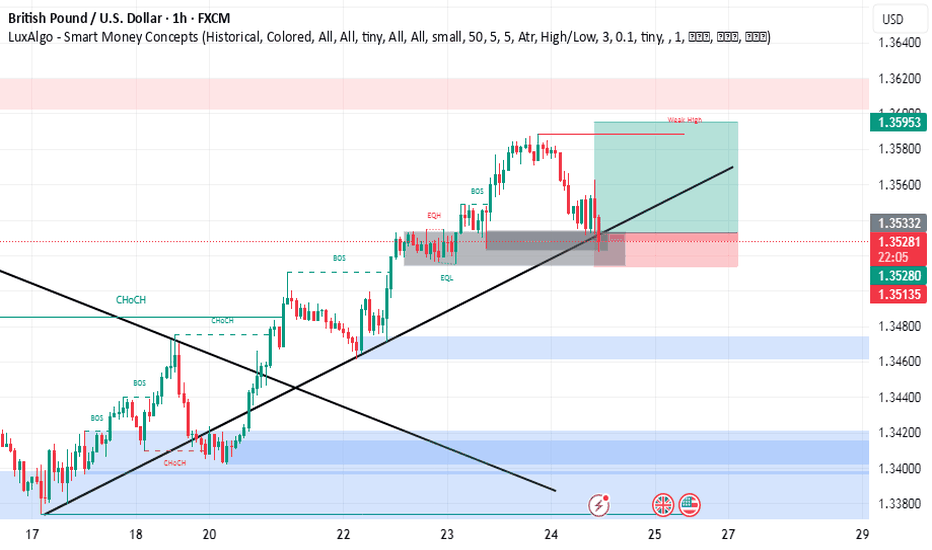

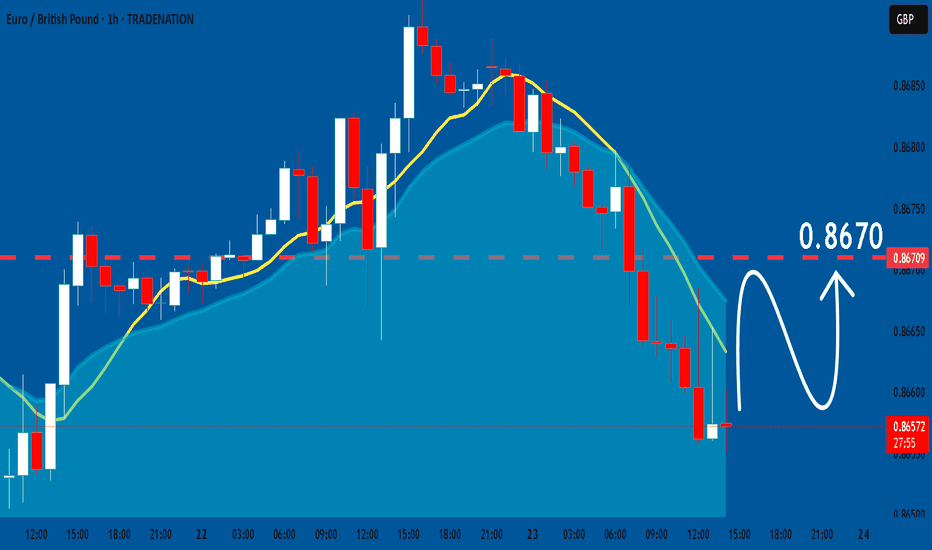

EURGBP: Will Keep Growing! Here is Why:

The recent price action on the EURGBP pair was keeping me on the fence, however, my bias is slowly but surely changing into the bullish one and I think we will see the price go up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

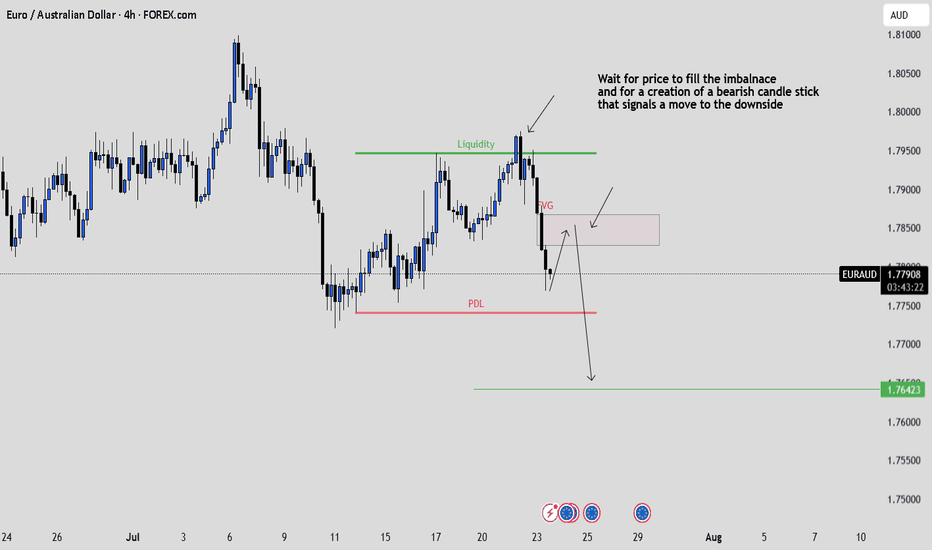

EURAUD: Waiting for the FVG Tap and Confirmation to ShortPrice ran previous liquidity and dropped aggressively, creating a clean FVG.

I’m now watching for price to retrace into that imbalance and form a strong bearish candle. If it does, I’ll be looking to short down

Clean structure. Just waiting for confirmation.

Market Analysis: AUD/USD Climbs as Dollar WeakensMarket Analysis: AUD/USD Climbs as Dollar Weakens

AUD/USD started a decent increase above the 0.6520 level.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar rebounded after forming a base above the 0.6450 level against the US Dollar.

- There is a connecting bullish trend line forming with support at 0.6540 on the hourly chart of AUD/USD.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from the 0.6450 support. The Aussie Dollar was able to clear the 0.6500 resistance to move into a positive zone against the US Dollar.

There was a close above the 0.6550 resistance and the 50-hour simple moving average. Finally, the pair tested the 0.6565 zone. A high was formed near 0.6564 and the pair recently started a consolidation phase.

On the downside, initial support is near the 0.6540 level. There is also a connecting bullish trend line forming with support at 0.6540. It is close to the 23.6% Fib retracement level of the upward move from the 0.6454 swing low to the 0.6564 high.

The next major support is near the 0.6495 zone. If there is a downside break below it, the pair could extend its decline toward the 0.6480 level. It is close to the 76.4% Fib retracement level.

Any more losses might signal a move toward 0.6450. On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6565. The first major resistance might be 0.6575. An upside break above the 0.6575 resistance might send the pair further higher.

The next major resistance is near the 0.6600 level. Any more gains could clear the path for a move toward the 0.6650 resistance zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

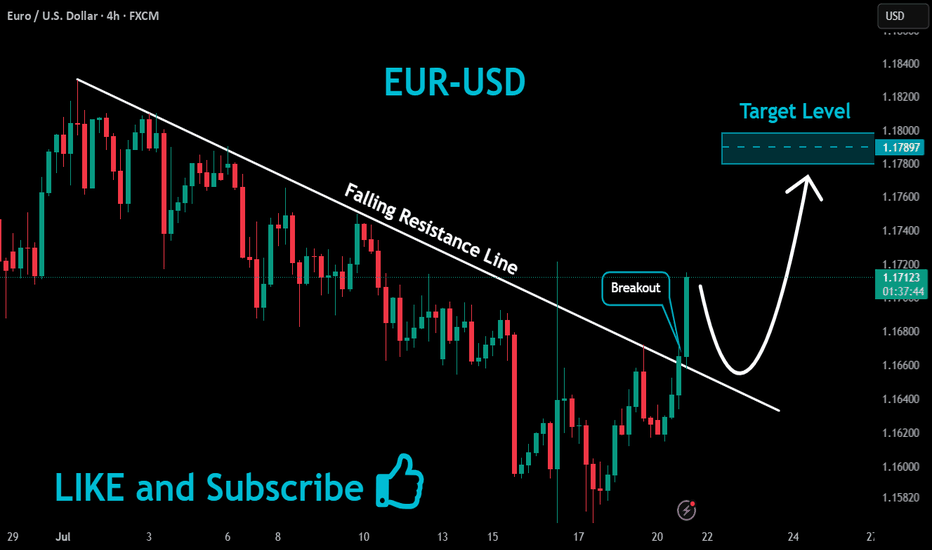

EURUSD Massive Bullish Breakout!

HI,Traders !

#EURUSD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

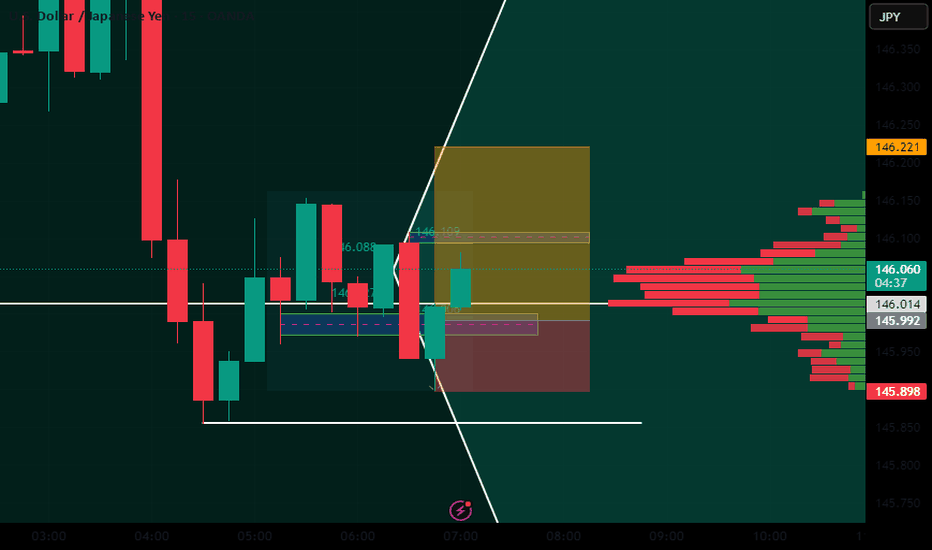

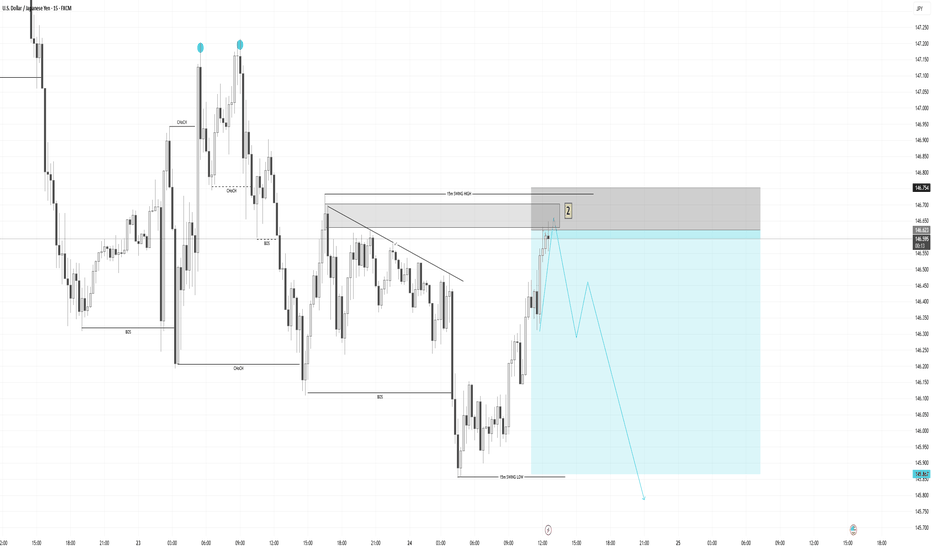

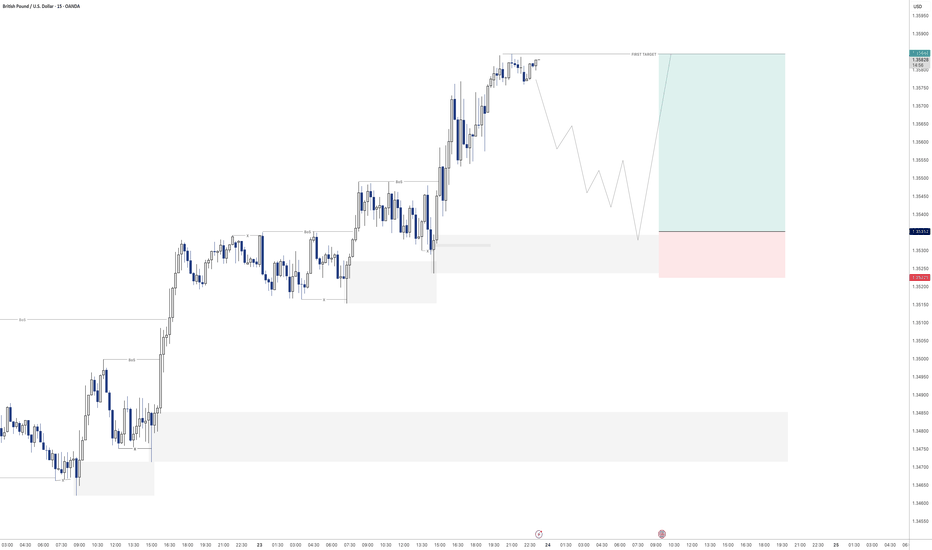

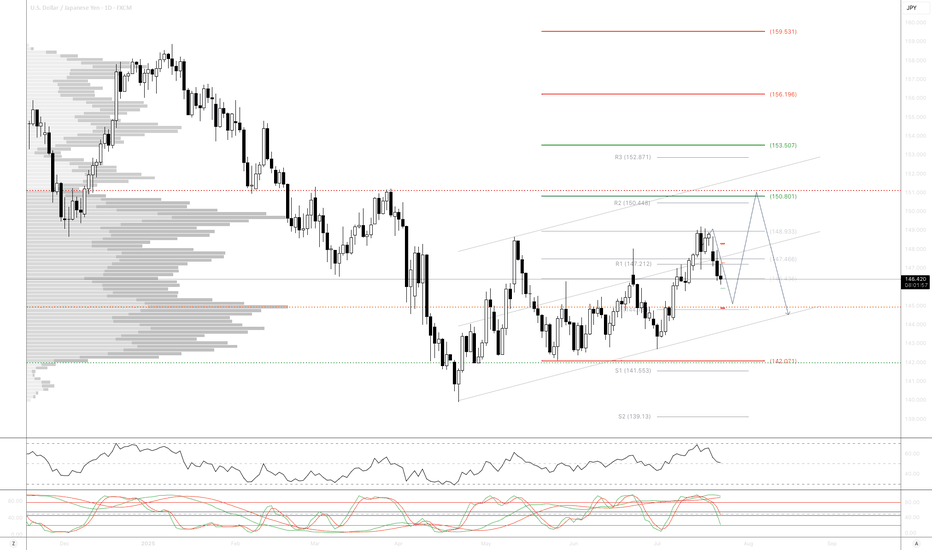

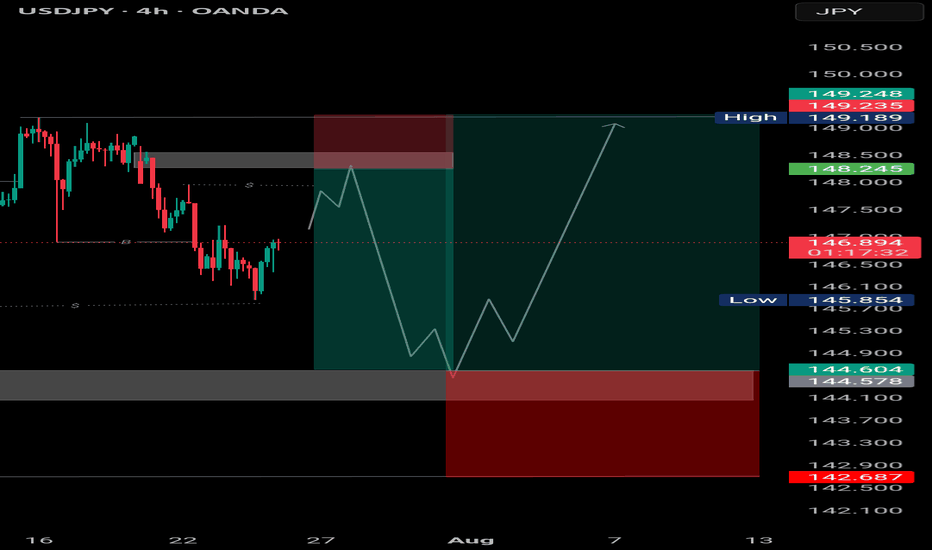

Simple SMC Short Setup on USDJPY (15min TF)Here’s a short trade idea I’m watching on USDJPY using basic Smart Money Concepts (SMC).

🔍 What I saw:

The market made a Break of Structure (BOS) to the downside.

A Change of Character (CHoCH) confirmed that the trend might be shifting.

After the drop, price retraced back to a supply zone in the premium area—right near a swing high.

I also noticed a trendline liquidity sweep, which adds more confluence that this could be a trap before a drop.

📉 Plan:

Waited for price to tap the zone and react before entering short.

Stop loss is above the swing high (to protect against fakeouts).

Targeting the recent low for a potential clean move down.

This setup uses no indicators—just price action, supply & demand, and simple structure.

Drop your thoughts or questions below—I’m always open to feedback!

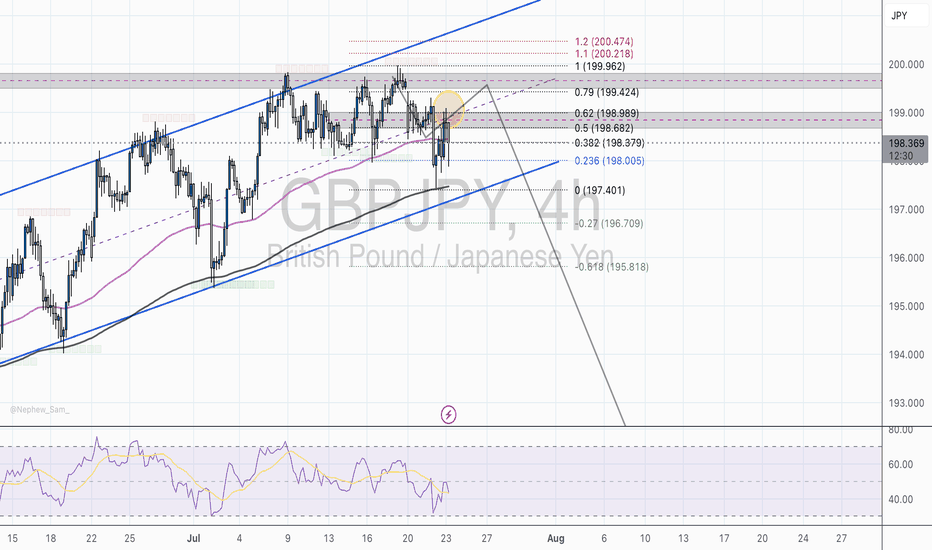

GBP/JPY 4H - Rejection from Supply Zone and Key Fib AreaOverview:

GBP/JPY is trading near 197.91, and recent price action suggests a potential short opportunity. The pair has been rejected from a key Fibonacci resistance zone, and bearish momentum appears to be building beneath a fading ascending channel. Let’s break down why this chart leans more bearish.

Market Structure Breakdown:

* Price action failed to sustain new highs above 199.90 and is now forming lower highs, a potential early sign of trend exhaustion.

* The recent bounce from 197.40 was muted and rejected near the 0.5 and 0.618 retracement levels, indicating strong supply around the 198.68–198.98 zone.

Fibonacci Confluence:

* The rejection occurred right at the 0.618 retracement of the prior downswing — a key Fibonacci level often used by institutional traders to re-enter in the direction of the trend.

* Price is now hovering below the 0.382 (198.38) and 0.5 (198.68) levels, which may now act as resistance.

* If the current rejection holds, downside targets are:

* 0.0 (197.40) – recent low

* -0.27 extension (196.70) – potential bearish continuation target

* -0.618 extension (195.81) – extended downside objective

Trendline & Channel Considerations:

* The ascending channel is losing momentum.

Moving Averages:

* Price is now below the 50 EMA, and testing the 200 EMA, which is at risk of breaking.

* A clear close below both EMAs would confirm bearish momentum.

RSI & Momentum:

* The RSI shows bearish divergence on recent highs and is struggling to break above the midline (50).

* Momentum is tilting to the downside and failing to build higher on bounces.

Key Zones:

* Resistance Zone: 198.60–198.98

* Strong Fibonacci confluence + previous supply

* Support Zone: 197.40

* Prior swing low and 0.0 Fib level

* Bearish Continuation Zone: Below 197.30

* Breakout would confirm downside acceleration toward 196.70 and 195.80

Conclusion:

GBP/JPY is showing signs of bearish pressure beneath key resistance. With the rejection from the 0.618 Fib level and weakening channel structure, the path of least resistance may be to the downside — especially if price breaks and holds below 197.40.

A confirmed breakdown opens the door toward 196.70 and possibly 195.80, as bearish continuation unfolds. Overall we can even see price hitting past historical levels at 189.50

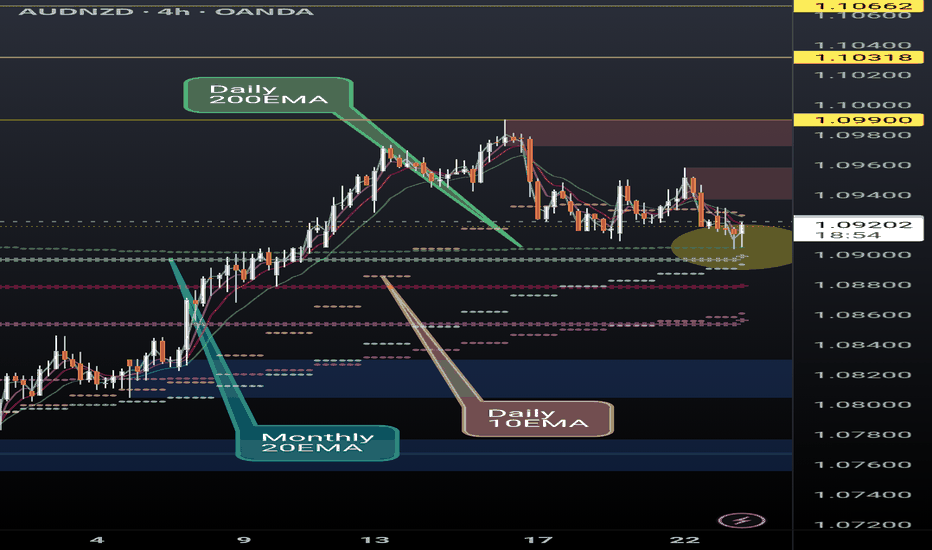

AUDNZD finding support on critical EMAsAUDNZD is finding support at the daily 200EMA (overlayed on 4H chart) and, more significantly, above the monthly 20EMA (overlayed). Break and hold the daily 10EMA (overlayed) will be key.

If the momentum continues we could see a continuation of the ongoing rally however recent AUD monetary policy meeting minutes seemed to lean dovish.

I'm a cat not a financial advisor.

Kiwi climbs on risk-on flow – chart says more to come? The New Zealand dollar strengthened to around 0.6045, its highest level in over a week, supported by improved global risk sentiment following a breakthrough U.S.–Japan trade agreement.

The agreement, which lowers tariffs and boosts bilateral investment, triggered a surge in Japanese markets. Japan’s Nikkei 225 index jumped more than 3%, hitting a one-year high.

The breakout in NZDUSD was accompanied by a series of bullish candles with little to no upper wicks, evidence of minimal rejection from sellers. The most recent candles are consolidating just below the 0.6055 zone, which aligns with minor resistance from July 4.

Rejection from this area—especially if it prints a bearish engulfing or shooting star pattern—could signal a short-term pullback. On the downside, immediate support is now at 0.6000. If broken, the next support potentially lies around 0.5980, which was the last major swing low before the breakout.

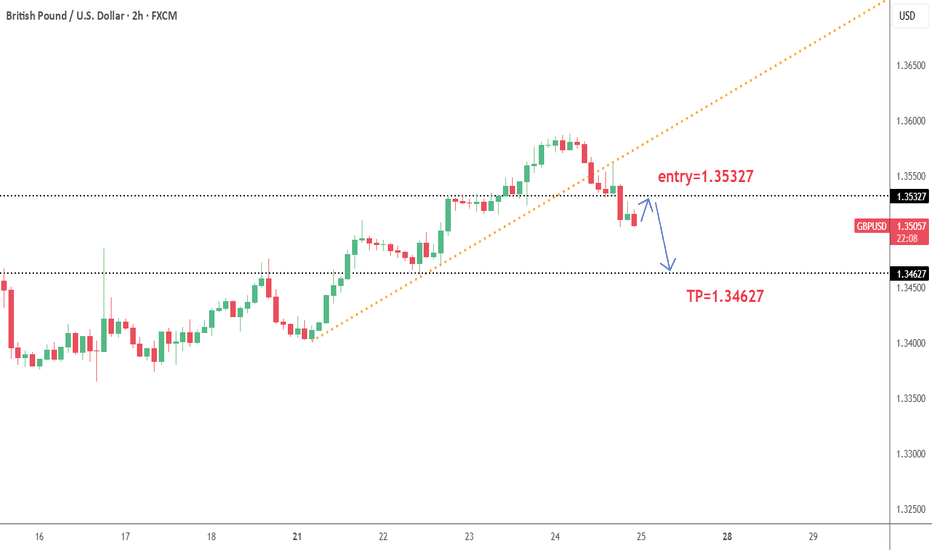

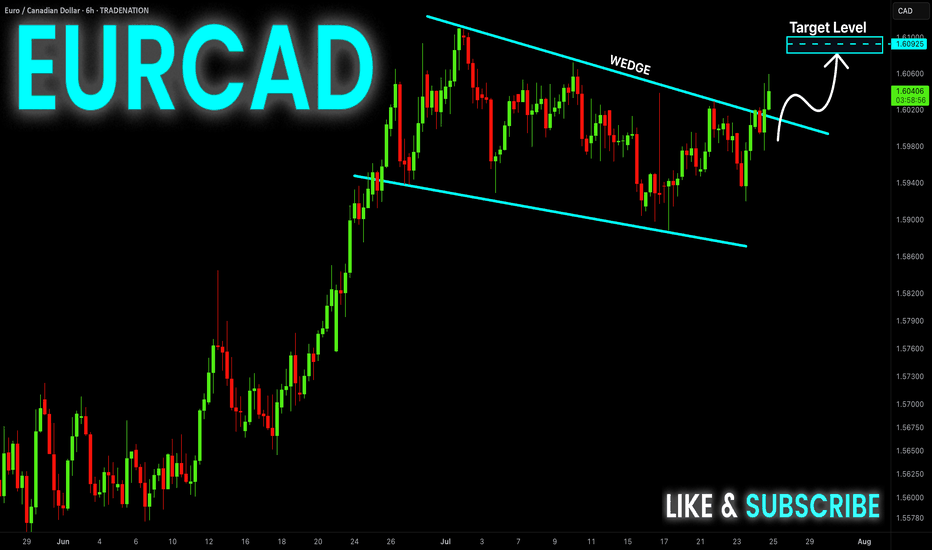

EUR-CAD Bullish Wedge! Buy!

Hello,Traders!

EUR-CAD is trading in an

Uptrend and the pair formed

A bullish wedge pattern and

Now we are seeing a bullish

Breakout from the wedge so

We are bullish biased and we

Will be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.